Copy trading platforms help you replicate the trading strategies of successful traders to enhance your understanding of the market and improve your profitability. The global copy-trading market is projected to reach $4 billion by 2030, showing that more people are getting interested in copy-trading.

That’s why we’ve done our in-depth research at WR Trading to present the 10 best copy trading platforms. We evaluated these copy trading brokers based on factors like regulation, minimum deposit allowed, and mobile trading availability, so that you can make the choice that best suits your trading needs. Let’s dive in together:

Broker:

Copy Trading:

Advantages:

Account:

Yes

- High Leverage up to 1:1000

- RAW ECN Spreads from 0.0 pips

- Fastest execution

- Attractive Bonus Programs

- Copy Trading

- MT4 / MT5

- Personal support 24/7

Yes (CopyFX)

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- MT4/MT5/RTrader/CopyFX

Yes (V-Social)

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

Yes

- $50 Minimum Deposit

- Zero commission for real stocks and ETF trades, 1% on cryptos

- 5,000+ Markets

- eToro investing platform and app

- Multiple regulations (FCA, CySEC, & more)

Yes

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

Yes

- Leverage Up To 125x

- Fast Deposits / Withdrawals

- Easy Sign-Up Process

- More Than 1,000 Cryptos

- Trading Bots, Copy Trading, Staking & more

- 24/7 Customer Support

Yes

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

Yes

- More than 1,000 markets

- Leverage up to 1:1000

- $250 Minimum Deposit

- NAGA Web app, iOS app, Android app, MT4/MT5

Yes (AvaSocial)

- Multiple Regulations

- Leverage up to 1:400

- Minimum Deposit $100

- 1,260+ Assets

- Copy Trading available

- MT4, MT5, and own platforms

Yes

- Mauritius-regulated broker

- High Leverage up to 1:1000

- Multiple account types

- More than 850 trading instruments

- MT4, MT5, PU Prime App

#1 StarTrader

StarTrader offers copy trading with a user-friendly interface in its integrated “STAR Copy” app. The platform provides transparency with detailed statistics on “STAR Masters” and is a member of the Financial Commission for client protection.

With StarTrader, investors can diversify across over 1000 products, including CFDs on various assets, with no extra fees for copying trades unless the signal provider profits. The platform has a low minimum deposit of $50 for copying trades and allows copy signal providers to earn income. For these reasons, StarTrader is our top copy trading platform.

Key Facts About StarTrader

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | Star copy app, MT4/MT5 platforms |

| Regulation | ASIC, FCA, FSCA, FSC, SCA and FSA |

| Minimum Deposit | $50 |

| Demo Account | Yes |

| Spreads and Commissions | From 0.0 pips, depending on account type, profit-sharing fee (0%-50%) |

| Mobile Trading | Yes |

| Customer Support | Provides 24/6 multilingual customer support via email and live chat |

#2 RoboForex (CopyFX)

Our third choice at WR Trading is RoboForex because it is a dynamic and reputable brokerage firm. CopyFX offers a seamless experience for investors seeking to replicate the strategies of successful traders.

RoboForex CopyFX simplifies trading by enabling users to automatically replicate the trades of strategy managers, known as signal providers. RoboForex has a special brokerage license that allows it to operate under Belize’s Financial Services Commission (FSC) regulation.

Not all Signal Providers on CopyFX charge fees. We found some that offer their strategies without commissions, allowing investors to copy their trades at no extra cost. CopyFX offers three primary copying modes to make this process easier for different trading levels:

- Proportional Mode: This mode adjusts the trade size based on how much money you have compared to the trader. If you have less money, you’ll buy/sell smaller amounts than the trader.

- Classic Mode: In this mode, you set a specific amount (e.g., number of shares or currency units) to trade whenever the trader does, regardless of their trade size or account balance.

- Fixed Mode: Here, you, the investor, copy the trader’s exact trades into your account, regardless of size or balance.

Key Facts About RoboForex CopyFX

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | CopyFX is integrated into MT4, MT5, and R StocksTrader |

| Regulation | FSC |

| Minimum Deposit | $10, $100, or more for copy trading (depending on signal provider) |

| Demo Account | Yes |

| Spreads and Commissions | From 0.0 pips, depending on account type Signal providers may charge a Performance Fee |

| Mobile Trading | Yes |

#3 Vantage

While Vantage lacks some of the social features of other competitors, it remains a top platform for copy trading. Vantage’s copy trading service is worth considering for beginners interested in a low-cost and straightforward way to copy forex trades, especially given its focus on regulation and transparency.

Vantage operates under four entities, each regulated in various jurisdictions. It is a member of The Financial Commission, an independent dispute resolution body that provides traders with an extra layer of protection.

Currently, Vantage’s copy trading focuses primarily on forex. So those interested in copy trades in stocks, ETFs, or other asset classes should consider other platforms.

Key Facts about Vantage

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | Vantage app and web platform |

| Regulation | ASIC, CySEC, FSP, FCA, FSCA, FSC, SIBL, and CIMA |

| Minimum Deposit | $50. Signal providers require $500 |

| Demo Account | Yes |

| Spreads and Commissions | From 0.0 pips, depending on account type |

| Mobile Trading | Yes |

| Customer Support | Provides 24/7 customer support via chat and other channels |

#4 eToro

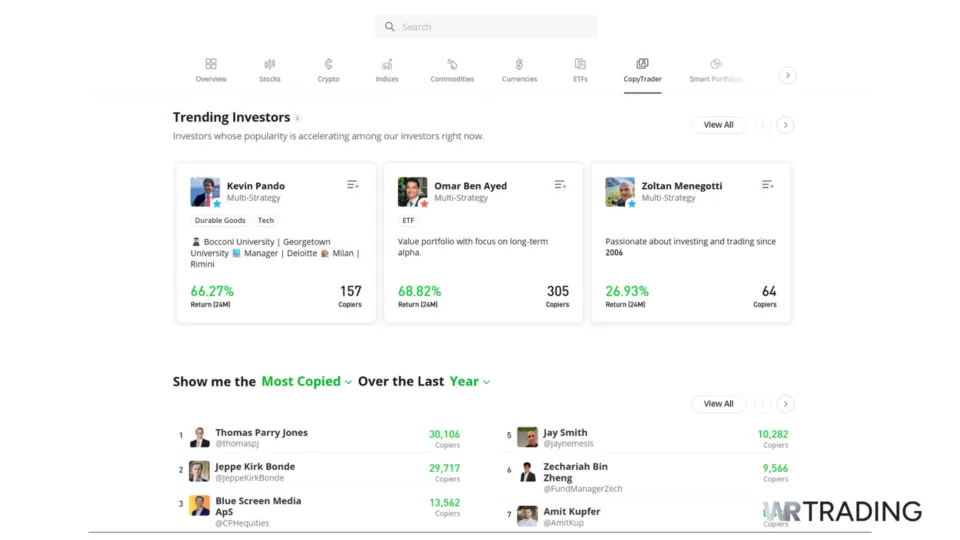

eToro has become one of the best brokers available and has taken our number one spot as the best platform for copy trading. When we tested eToro, it became evident that the platform provides a comprehensive and versatile trading experience, offering over 3,000 tradeable symbols, including forex pairs, exchange-traded securities, and CFDs.

Despite its slightly higher cost, eToro’s robust feature set and regulatory backing make it a highly reliable option for traders. With a minimum deposit from $50 to $10,000, eToro accommodates casual and serious investors.

Our WR Trading experts found that eToro is regulated in up to three Tier-1 jurisdictions. The platform offers indemnity insurance up to EUR 1 million per client in the EU, the U.K., and Australia, adding an extra layer of security for users. Moreover, eToro’s recent SEC approval to offer spot Bitcoin ETFs will appeal to users who fancy more market offerings.

Key Facts About eToro

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | eToro web platform and mobile app |

| Regulation | ASIC, CySEC, FCA, FSA (Seychelles), FSRA |

| Minimum Deposit | $200 |

| Demo Account | Yes |

| Spreads and Commissions | Spreads from 0.0 pips, commissions vary based on accounts |

| Mobile Trading | Yes |

| Customer Support | Offers support via email and phone |

#5 Moneta Markets

At WR Trading, we found the Moneta CopyTrader App to be a powerful and user-friendly platform for anyone looking to explore copy trading. What stood out to us was how traders can follow and automatically copy the trades of over 6,000 expert strategy signal providers all in real time, and with just one tap.

We liked how the app brings the trading community together, offering traders a platform to interact, share their thoughts, and learn from experienced individuals. Moneta Markets provides access to more than 1,000 instruments, including Forex, stocks, commodities, and indices.

To get started with copy trading, you need at least $100 to invest with a strategy provider (though the general minimum deposit for an account varies). The platform offers Negative Balance Protection, but terms and conditions apply. Though this protection may not cover all circumstances, such as trading abuse or extreme market conditions.

Moneta Markets operates under multiple regulations, including the Financial Sector Conduct Authority (FSCA) in South Africa. We rank this broker as the fifth-best copy trading platform.

Key Facts About Moneta Markets

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | CopyTrader App, MT4, and MT5 platforms |

| Regulation | FSCA, FSC (Mauritius) |

| Minimum Deposit | $50. $100 for copy trading |

| Demo Account | Yes |

| Spreads and Commissions | Spreads vary by account type; ECN accounts feature tight spreads (from 0.0 pips) with commissions STP accounts are commission-free but have higher spreads (from 1.2 pips) |

| Mobile Trading | Yes |

| Customer Support | Offers 24/5 multilingual support via live chat, email, and telephone |

#6 Bitget

Serving over 120 million users worldwide, Bitget impressed us with its user-friendly design and robust features. Bitget started with advanced crypto products in 2020 and expanded its copy trading services to the regular spot market in 2023, solidifying its position as a social trading innovator.

We liked the flexibility Bitget offers through multiple copy trading modes. It features an extensive list of top traders and automated bots, with key performance statistics like ROI, total profit and loss, and follower count to guide selection.

The platform supports copy trading for over 800 assets, though it does not offer trading or copy trading for fiat forex pairs. A demo account is available, primarily for futures trading, using virtual funds to allow users to practice without financial risk.

The minimum deposit for copy trading is 50 USDT for features like Smart Copy, though the overall minimum deposit depends on the cryptocurrency used. For fees, elite traders typically receive a 10–20% performance fee, while standard trading fees (0.1% for spot, 0.02% maker, and 0.06% taker for futures) are applied. Customer support is provided via a help center, email, and live chat, with dedicated channels for its TraderPro participants.

Key Facts About Bitget

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | Bitget web platform and mobile app for iOS and Android |

| Regulation | None |

| Minimum Deposit | 50 USDT |

| Demo Account | Yes |

| Spreads and Commissions | Performance fee (typically 10-20%) Standard trading fees (spot: 0.1%, futures: maker 0.02%, taker 0.06%) |

| Mobile Trading | Yes |

| Customer Support | Provides customer support via a help center, email, and live chat Offers dedicated support channels through Telegram for its TraderPro participants |

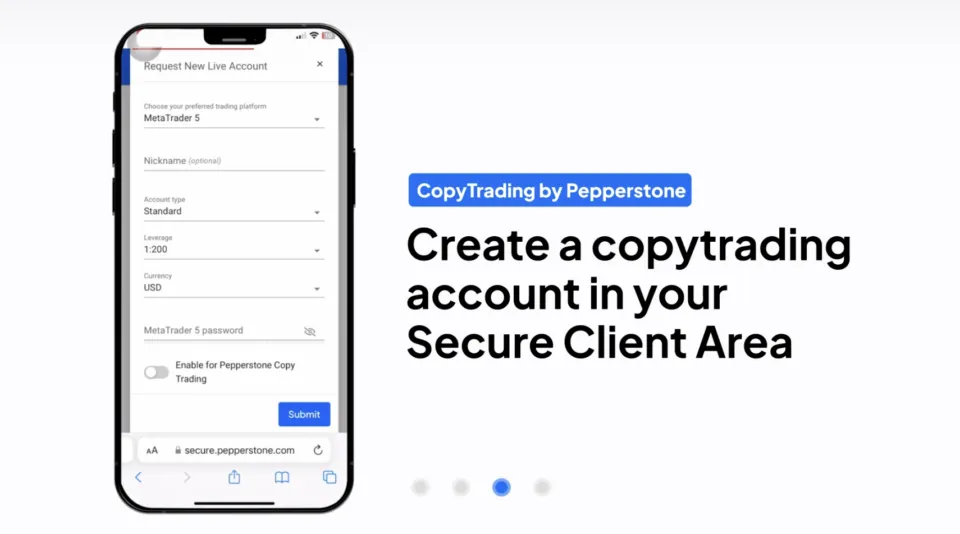

#7 Pepperstone

Pepperstone takes 7th place on our list as a solid choice for copy traders, especially beginners. It has a dedicated mobile app that makes it easy to browse through a wide selection of experienced traders and automatically copy their trades with just a few taps. The platform also integrates with a variety of third-party copy trading services, giving users more flexibility and choice.

While traders can open a regular trading account with Pepperstone without any minimum amount, they need to deposit at least $200 to begin copy trading.

Key Facts About Pepperstone

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | Pepperstone’s proprietary Copy Trading app, Signal Start, and cTrader |

| Regulation | ASIC, FCA, SCB, DFSA |

| Minimum Deposit | $0 minimum deposit. $200 recommended for copy trading |

| Demo Account | Yes |

| Spreads and Commissions | Standard accounts: spreads from 1.0 pips with no commission Razor accounts: spreads from 0.0 pips with commissions ($7 per standard lot round turn) |

| Mobile Trading | Yes |

| Customer Support | Offers support via email and potentially live chat Support email address is support@pepperstone.com |

#8 NAGA

As our second choice, NAGA stands out as a dynamic and multifaceted trading platform, especially noted for its unique blend of social networking and copy trading features. Our WR Trading review focused on specific aspects such as pricing, regulation, and overall functionality to provide a thorough analysis.

A key aspect that caught our attention was the platform’s fee schedule. NAGA provides special commissions for copying trades. For CFDs on shares, the commission is 0.2% per lot, and for CFDs on ETFs, it is 0.1% per lot. The platform, however, maintains standard account commissions for those trading various other instruments, depending on your account type.

When we tested the “Autocopy” feature, we were impressed by its simplicity and effectiveness. Users can automatically replicate the trades of top investors, and the platform provides detailed performance metrics and risk profiles for these traders.

Key Facts About NAGA

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | The NAGA Web and mobile app platforms. MT4 and MT5 |

| Regulation | CySEC |

| Minimum Deposit | $10 |

| Demo Account | Yes |

| Spreads and Commissions | €0.99 per copied trade. 5% performance fee on profits over €10 Standard account commissions: €2.50 flat fee (stock CFDs), 0.10% commission (ETF CFDs) |

| Mobile Trading | Yes |

| Customer Support | Provides 24/5 customer support via email and live chat Phone support is also available during business hours |

#9 AvaTrade

AvaTrade is another well-established online broker offering a variety of financial instruments, including forex, stocks, ETFs, CFDs, and even cryptocurrencies. The platform caters to copy traders with a platform called AvaSocial.

During our testing, we found that AvaSocial provides access to a solid pool of signal providers for traders to copy. Each profile displays performance metrics, risk tolerance indicators, and trading strategies. While the selection might not be the most extensive compared to giants like eToro, it offers various risk appetites and investment goals.

AvaTrade charges standard trading commissions/spreads depending on the asset we’re trading. However, there are no additional fees specifically for copy trading. The minimum deposit requirement to start copy trading on AvaTrade is $100, which is lower than some competitors’ minimum deposits

Key Facts About AvaTrade

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | AvaSocial, DupliTrade, ZuluTrade, and MQL5 |

| Regulation | CySEC, FFAJ, ASIC, BVIFSC, CBI, FSCA, ADGM/FRSA, SFC |

| Minimum Deposit | $100 |

| Demo Account | Yes |

| Spreads and Commissions | Signal provider’s profit share. Standard spreads and trading commissions apply to the underlying trades |

| Mobile Trading | Yes |

| Customer Support | Provides 24/5 customer support via email and live chat, with phone support also available during business hours |

#10 PU Prime

PU Prime has its own copy trading mobile app, known as “PU Social Trading”. The app allows for easy management and provides clear information about your copied trades, enabling you to monitor them live as they happen. This makes it possible to track performance and stay updated in real time.

You can start copy trading on PU Prime with a minimum deposit of just $50, making it an accessible option for new traders. The broker is regulated by ASIC in Australia and FSC in Mauritius, providing robust oversight to ensure it follows rules. Additionally, PU Prime is a member of the Financial Commission, which offers a third-party dispute resolution service and provides a compensation fund to eligible clients of up to €20,000.

Key Facts About PU Prime

| Feature | Information |

|---|---|

| Copy Trading | Yes |

| Copy Trading Software | PU Prime’s proprietary mobile app and web-based trading platform. MT4/MT5 |

| Regulation | ASIC, FSC, and FSA. Member of The Financial Commission |

| Minimum Deposit | $50 |

| Demo Account | Yes |

| Spreads and Commissions | Profit share. Standard account (variable spread), Prime accounts (from 0.0 pips with commission) |

| Mobile Trading | Yes |

| Customer Support | Provides 24/5 customer support via email, phone, and live chat |

How We Tested the Best Copy Trading Platforms

In our quest to identify the best options, we left no stone unturned, employing a multi-layered testing process that assesses functionality, user experience, and real-world usability. Here’s a breakdown of our methodology:

- Account Funding

- Copy Trading Mechanics

- Profit Share and Management

- Pricing and Fees

- Markets and Instruments

- Educational Features

Account Creation and Funding

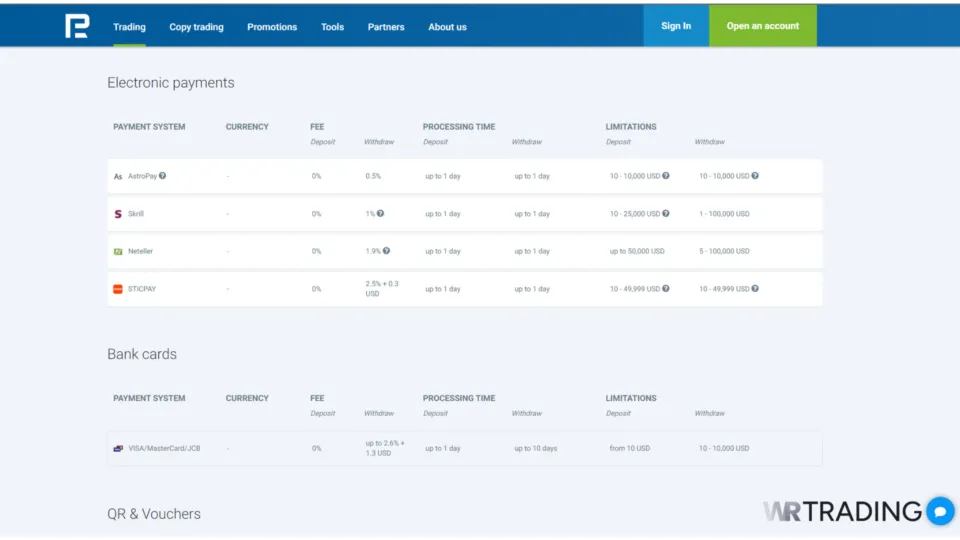

We analyzed these various copy trading platforms as end-users, experiencing each platform’s account opening and funding process. This involved evaluating signup speed, required documentation, the minimum deposit required for copy trading, and the variety of funding methods offered. Frictionless account creation and a range of funding options ensure a smooth entry point for investors.

Copy Trading Mechanics

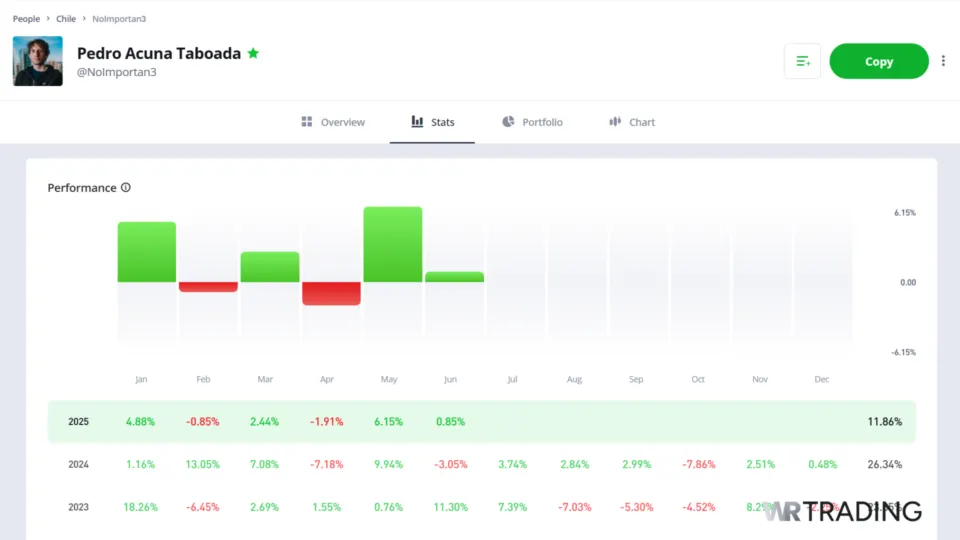

At WR Trading, we carefully examined how each platform facilitates copy trading. We focus on investigating testing features like browsing detailed trader profiles, analysing performance metrics, and initiating the copy trade process efficiently.

We assessed the flexibility of copying entire portfolios or specific trades.

Profit Share and Management

Signal providers typically earn a percentage of the generated profits for copy trades they provide. In our analysis, we considered whether signal providers earn a percentage on all trades they provide (whether profitable or not), or whether they only earn a percentage on profitable trades, aligning the interests of both parties.

We also highly considered the number of signal providers each broker offers, and if enough tools are provided to traders to manage the trades they copy.

Pricing and Fees

We scrutinised platforms’ transaction fees, management fees (if applicable), and spread structures. We aimed to identify platforms with competitive pricing and transparent fee structures, ensuring you know exactly what you’re paying for.

Range of Markets and Instruments

Diversity in tradable assets allows for better portfolio diversification in copy trading. This is why we evaluated the various instruments available on each platform, including forex, stocks, indices, commodities, and cryptocurrencies. Platforms offering a broad range of assets received higher ratings. We considered the availability and flexibility of leverage options.

Social and Educational Features

We didn’t leave out social and educational resources. We examined features like following other traders, interacting through forums or chat functionalities, and accessing educational resources related to copy trading.

We assessed the availability and quality of educational materials, such as webinars, tutorials, and market analysis, that can help users improve their trading skills.

What is the Best Copy Trading Platform for Beginners?

eToro is widely accepted as the best choice for beginners due to its excellent design and social trading features. The platform’s CopyTrader function allows users to automatically mirror the trades of Popular Investors, without needing to master market analysis. This helps beginners focus on mastering how to trade professionally.

eToro’s social feed also helps beginners gain valuable experience. The social feed is a large, active community where users can interact, share insights, and discuss strategies. Here, all sorts of detailed performance statistics like risk scores and trading histories are openly displayed for every Popular Investor, allowing new users to make informed decisions when choosing who to copy.

Additionally, eToro offers the “Copy Stop Loss” feature, which helps protect beginners’ capital by exiting a copying position if a certain amount of loss is incurred. New traders can also create a free $100,000 virtual portfolio to practice and test the copy trading feature before depositing real funds.

What is the Best Copy Trading Platform for Earning Profit Share?

For traders looking to earn a profit share from having their trades copied, the best platforms from our analysis are StarTrader, CopyFX, and Vantage. These platforms offer different benefits depending on the trader’s preferred compensation model.

Both StarTrader and Vantage offer the potential for a high profit-sharing ratio, allowing signal providers to earn up to 50% of the profits from their followers’ successful trades. Vantage is notable for offering providers a greater ability to develop multiple strategies for different asset classes and provides multiple payout frequency options, including daily, weekly, and monthly settlements.

CopyFX by RoboForex, in contrast, offers customizability. A provider can choose between a Performance Fee, which is a percentage of the total profit, or a Volume Fee, a fixed commission per profitable trade. For new signal providers, CopyFX also includes a “Trader Without Commission” option, which can help them build a reputation and attract followers by offering their strategies at no cost.

Vantage is the most suitable option for a provider seeking a high potential profit share and good platform tools for multiple strategies. If a trader wants compensation models and is potentially newer to the scene, CopyFX provides more flexibility.

Is Copy Trading Legal?

Yes, Copy trading is legal in countries like Australia, South Africa, and the UK, especially when you use a broker that is approved and follows the local trading rules. However, some places may have limits or may not allow it at all. So, it is very important that you look up the rules for your own country before you start copy trading.

Note that copy trading is not money management (in the sense that investors give their money to expert traders) in expectation of a certain return on investment. This is illegal in some Countries. Also note that signal providers have no obligation to be licensed. So always pick a broker that is officially licensed to operate where you live, who is likely to be compliant with the law of your jurisdiction.

Where is Copy Trading not Legal?

Copy trading is not legal in the following Countries:

- Japan, for instance, requires specific investment advisory licenses for copy trading to be legit, making its widespread practice challenging and often illegal without the proper authorization.

- Similarly, China enforces strict capital controls and government regulations that restrict or prohibit copy trading activities.

- South Korea has also implemented bans on copy trading under various conditions.

- Also, some international platforms do not offer copy trading services to residents of Cuba, Iran, North Korea, Crimea, Syria, Bangladesh, Bolivia, and Malta.

- In the USA, copy trading, especially for retail forex, is not straightforward due to stringent regulations from the CFTC and NFA. While not an absolute ban, the regulation reduces the number of compliant brokers.

On the other hand, copy trading is permitted in the UK, provided that the brokers are authorized by the Financial Conduct Authority (FCA). Australia also allows copy trading, regulating such financial activities through ASIC. Lastly, copy trading is allowed in the EU and South Africa.

Pros and Cons of Using Copy Trading Brokers

Copy trading has become a popular investment strategy, allowing novice traders to mimic the trades of experienced investors. However, like any investment approach, it has advantages and disadvantages. Here’s an in-depth look at the pros and cons of using copy trading brokers.

Pros

- Beginner-Friendly

- Convenience and Time-Saving

- Diversification Potential

- Learning Opportunity

Cons

- Blind Trust, Uncertain Results

- Limited Control

Pros of Copy Trading

Copy trading eliminates the need for in-depth market research and analysis. New investors can benefit from the experience of seasoned traders, potentially achieving returns without the initial learning curve. Copying trades automates the process, freeing up your time for other pursuits. You can monitor your portfolio performance without actively managing every trade.

You can diversify your portfolio by copying multiple traders with different strategies and potentially mitigate risk. This approach helps spread your eggs across different baskets. Observing the trades of successful investors can be a valuable learning experience. You can gain insights into their strategies and risk management techniques.

Earning more money as a signal Provider: Most brokers have a profit share system where signal providers get a percentage of the profit that their followers make from copying their trades. This offers a way for expert traders to make more money.

Cons of Copy Trading

You’re trusting someone else’s trading decisions. Past performance doesn’t guarantee future success, and there’s always a risk of losses. You relinquish control over your investment decisions. The chosen trader’s strategy may not align with your risk tolerance or investment goals.

Performance Fees: Performance fees (fees that signal providers charge for the copy trades they provide) can sometimes go up to 50% of the profit traders (followers) earn while copying trades. This significantly reduces the profitability of followers who still have to deal with spreads and commissions from their broker, or other fees from 3rd party services.

How To Copy A Trade

To copy a trade, you must choose a suitable platform, open and fund your account, find and select your preferred signals provider, initiate, and manage your copy trades. Let’s take a closer look:

Step 1: Choose Your Platform

The first step is to select a reputable copy trading platform. We’ve already done our due diligence by narrowing down some of this guide’s best platforms.

Each platform has unique features and functionalities, so research and choose one that meets your needs.

Step 2: Open and Fund Your Account

Once you’ve chosen your platform, follow the steps to open a trading account. This typically involves providing basic personal information and completing verification procedures. Once your account is open, deposit funds using one of the available methods (e.g., bank transfer or credit card).

Step 3: Find Your Trading Heroes

Most platforms offer a directory of traders you can potentially copy. These directories often include information on the trader’s performance history, risk tolerance, and investment strategy.

Here’s an example: Let’s say you’re on a platform like eToro. You can search for traders by filtering them based on their risk level (defensive, moderate, aggressive), asset class (stocks, forex, crypto), and location.

Step 4: Analyse Wisely

Here are some key factors to consider:

- Performance History: Look at their historical returns, but remember past performance doesn’t guarantee future success.

- Risk Tolerance: Choose a trader whose risk tolerance aligns with your own. Aggressive traders might not be suitable if you’re risk-averse.

- Investment Strategy: Understand the trader’s investment strategy. Does it match your investment goals?

- Attention: Don’t unthinkingly copy every trader you see. You should diligently research their profiles.

Step 5: Initiate The Copy Trade

Once you’ve identified a Signal Provider that aligns with your goals, it’s time to copy their trades. The steps might vary slightly depending on the platform, but generally, you’ll find a “Copy” button on the Signal Provider’s profile. Clicking this button will initiate the copy trading process.

Here’s an example: Let’s say you’re on a platform like RoboForex CopyFX. You’ve found a trader you want to copy and have $1000 to allocate. You decide to copy all their existing trades and new trades going forward. You would then click “Copy” on their profile, enter $1000 as your investment amount, and choose the “Copy All Trades” option.

Step 6: Monitor and Manage

Copy trading doesn’t mean setting it and forgetting it. You have a role to play by regularly monitoring your portfolio performance and the performance of the traders you’re copying. If a trader’s strategy significantly underperforms or no longer aligns with your goals, you can stop copying them anytime.

How to Get Copied on A Copy Trading Platform?

You can get copied on copy trading platforms by becoming a signal provider on a copy trading platform. Simply follow these steps:

- Selecting a platform

- Meet the specific requirements for the account type and minimum deposit

- Apply to be a lead trader

- Set up a transparent profile detailing your strategy and risk parameters.

- Trade consistently and manage risk effectively

- Engage with potential followers to build trust.

By following these steps, you can earn additional money as an expert trader.

How Much Money Do You Need to Start Copy Trading?

Some platforms, like RoboForex and PU Prime, allow you to open an account and start copying trades with a minimum deposit as low as $100 and $50, respectively. Bitget requires a minimum of 50 USDT to begin copying. Other platforms, such as StarTrader, set their minimum deposit for copying at $50.

However, these minimums often represent the platform’s overall requirement to start, and individual lead traders may have their own minimum amounts needed to effectively copy their strategy. For instance, eToro’s minimum amount to invest in a single trader is $200. On other platforms, some signal providers request as high as $5,000 in capital to copy their trades.

Do you have to Pay Tax on Copy Trading?

Yes, in most jurisdictions, any profits you make from copy trading are subject to taxation. Copy trading is considered a form of investment or trading activity, and as such, the income generated from it is typically treated as taxable income or capital gains, depending on local tax laws and how long you hold your positions.

Copy Trading vs Learning Trading Yourself

Several beginners who begin their trading journey are likely to stumble on challenges. Copy trading offers a tempting shortcut: mirror the trades of experienced investors and potentially reap the rewards. But is it the right path for you? Consider the comparison table below:

| Feature | Copy Trading | Learning Trading Yourself |

| Time and Convenience | Highly time-efficient and convenient. | Requires significant time and dedication to study market trends, analyze charts, and research investments. |

| Learning Process | Learn by observing the strategies, decisions, and risk management techniques of skilled traders. | Learn through self-study, practice, and gaining hands-on experience, often through trial and error. |

| Emotional Impact | Reduces the emotional impact by detaching your decisions from individual trades. | Can be an emotionally turbulent journey. |

| Diversification | Easily diversify your portfolio by copying multiple traders with different strategies. | Requires conscious effort and extensive knowledge to manually diversify your investments. |

| Risk Mitigation | Mitigates risk by following traders with a proven track record. | Involves a higher risk initially due to limited knowledge and experience, with losses being a part of the learning curve. |

Managing Risk on Copy Trading Platforms

Copy trading platforms do offer a tempting entry point for new investors. However, the convenience of this approach shouldn’t overshadow the importance of risk management. Our experts at WR Trading have devised ways to manage risks effectively when using copy trading platforms.

Selecting the Right Signal Provider

The foundation of your copy trading journey hinges on selecting the right signal provider which is the trader whose strategies you’ll be following. Treat this selection process as if you’re picking a financial guide. You need to learn to look beyond just impressive returns.

While past performance isn’t a guarantee of future success, a consistent track record over a reasonable timeframe is a good sign. Ensure the trader’s strategy aligns with your risk tolerance and investment goals. An aggressive, high-risk strategy might not be suitable if you’re risk-averse.

Setting Boundaries

Even with a qualified Signal Provider, limiting your potential losses is wise. Don’t allocate all your capital to a single trader. Instead, spread your investment across multiple Signal Providers, creating a diversified portfolio. This approach mitigates the impact if one strategy underperforms.

Some copy trading platforms offer additional tools to manage your exposure. Look for options to set allocation limits, specifying a fixed percentage of your capital for each copied trader.

Active Monitoring

Copy trading doesn’t mean autopilot. You still need to schedule regular reviews of the performance of the traders you copy and your overall portfolio. So, don’t be afraid to adjust allocations or stop copying altogether if a trader’s strategy consistently underperforms or no longer aligns with your goals.

Remember that economic news and broader market trends can influence individual trades. So, always stay informed to make informed decisions to avoid significant losses.

Automated Trading Vs Copy Trading: What is the Difference?

Both automated trading and copy trading help people trade without having to place every single order by hand. The main difference is in who or what makes the trading choices.

Automated trading uses a computer program, often called a “bot,” that you set up with your own rules. Once you start it, the bot will automatically open and close trades for you based on those rules, with no need for you to do anything.

On the other hand, copy trading works differently. Instead of following a computer program, you choose a real person to follow. When that experienced trader places a trade, their action is automatically copied into your own account. In this case, the trading decisions are made by a human, and you simply mirror what they do.

| Feature | Automated Trading (Trading Bots) | Copy Trading |

| Decision Maker | Pre-programmed algorithms/software (trading bot) | Human “Signal Provider” or “Lead Trader” |

| Decision Basis | Algorithmic rules, technical indicators, pre-set parameters | Human discretion, experience, and market analysis |

| Setup | Requires setting up/coding/configuring the bot’s strategy | Requires selecting a human trader to follow |

| Flexibility | Limited to the bot’s programmed rules, adaptation requires reprogramming | Inherits the flexibility/adaptability of the human trader |

| Learning Curve | Can be hard to program/configure effectively | Can be low for beginners, focus on selecting good traders |

| Control | Full control over the bot’s parameters/strategy | Control over which trader to follow, allocation, and stop-loss |

| Risk | Relies on the algorithm’s effectiveness; potential for system errors | Relies on the human trader’s skill; inherits human biases & errors |

| Transparency | Strategy logic can be fully understood if programmed by the user | Performance metrics are visible, but the underlying strategy logic may not be fully disclosed |

Conclusion

We’ve explored 10 leading copy trading platforms. Each platform from StarTrader, RoboForex, Vantage Markets, eToro, to Moneta Markets caters to a specific set of needs, with some offering a wider range of tradable assets while others emphasize social interaction or user-friendliness.

Remember that copy trading is about mirroring on your account the trades of a professional. While there is a potential for education and profit, there is an equal chance of losing funds; moreover, experienced traders may feel stifled by the conservative approach of some providers.

So, as a trader looking to make a profit, ensure to use these platforms as a tool to learn and participate in the market while conducting your research and maintaining an active role in your investment journey.

Once again, these are the Top 10 Copy Trading Platforms:

- StarTrader: Best overall broker for copy trading, best for UK traders

- RoboForex (CopyFX): Security measures for investments, including Civil Liability Insurance and two-step authentication

- Vantage: Equipped with filtering options, a user-friendly design, and doesn’t request high additional fees

- eToro: Over 3,000 tradeable symbols, including forex pairs, exchange-traded securities, and CFDs

- Moneta Markets: Best for traders in South Africa

- Bitget: Best for Crypto

- Pepperstone: Best for Australia

- NAGA: Offers a blend of social networking and copy trading features

- AvaTrade: Its copytrader platform, AvaSocial, details performance metrics, risk tolerance, and other trading strategies

- PU Prime: Best for High Leverage

Frequently Asked Questions on Copy Trading Platforms

Do all Copy Trading Platforms Offer Crypto Options?

No. While not all platforms offer cryptocurrency assets for copy trading, there’s a growing selection. Look for platforms like eToro, AvaTrade, and Vantage that mention cryptocurrencies as tradable assets.

Can I Copy Trade Stocks And Forex on The Same Platform?

Yes! Many copy trading platforms allow you to copy trades across various asset classes, including stocks, forex, ETFs, and CFDs (depending on regulations). This diversification can help spread your risk across different markets.

Can I Set My Risk Parameters When Using A Copy Trading Platform?

Yes, most copy trading platforms allow investors to set their risk parameters. These can include stop-loss limits, maximum investment per trader, and the ability to diversify across multiple traders.

Resources

- https://www.investor.gov/introduction-investing/investing-basics/glossary/copy-trading

- https://asic.gov.au/about-asic/news-centre/find-a-media-release/2018-releases/18-183mr-asic-accepts-court-enforceable-undertaking-from-vantage-global-prime-to-address-systems-and-controls-inadequacies-within-its-cfd-business/

- https://nagamarkets.com/legal-documentation?lang=en&=1