A DMA (Direct Market Access) broker enables traders to place buy or sell orders directly onto an exchange’s order book without broker intervention. This provides enhanced control, faster execution, and more transparent pricing—ideal for active traders in markets like forex and stocks.

At WR Trading, we personally reviewed and evaluated a range of top DMA brokers. Our team tested their platforms, order execution speed, market coverage, and overall reliability to help you choose a broker that fits your trading style and performance needs.

These are our top 5 DMA brokers:

Broker:

Execution:

Advantages:

Account:

DMA

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

DMA

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

DMA

- No Minimum Deposit

- Access to 1,000,000+ Assets

- Low Commissions from 0.008$/Share

- Leverage up to 1:5

- Stock IPO Access

- EU & US Regulated

DMA

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

DMA

- No Minimum Deposit

- Spreads from 0.6 Pips

- Access to 17,000+ Markets

- Leverage up to 1:200

- Low Commissions from $3 per trade

- Regulated by Tier-1 Authorities (FCA, ASIC, MAS)

List of the 5 Best DMA Brokers in 2025:

#1. BlackBull Markets

In our exploration of various top brokers, BlackBull Markets made it to our list as the top choice for DMA enthusiasts. BlackBull Markets has established a global presence with offices in New York, Jakarta, and London. This expansion reflects their growing reputation and dedication to serving traders worldwide

Like Vantage Markets, BlackBull Markets doesn’t offer pure DMA across all instruments. The broker’s ECN model, tight spreads, and support for popular platforms like MT4, MT5, and cTrader provide a robust environment for executing DMA strategies. While the FIX API for even more direct access is limited to institutional accounts, the standard offerings cater well to most DMA traders.

The broker has partnered with several top-tier institutions, such as Bank of America and JP Morgan, which helps guarantee deep market liquidity and tight spreads, as low as 0.1 pips.

BlackBull Markets is a certified Financial Services Provider in New Zealand, adhering to strict regulations and Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) policies. Client funds are held securely in segregated accounts at ANZ Bank, a reputable financial institution.

Key Features of BlackBull Markets

| Info | Black Bull Markets |

|---|---|

| Location | New Zealand |

| Regulation | Financial Markets Authority (FMA) New Zealand, Financial Services Authority (FSA) Seychelles |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, BlackBull Invest, BlackBull CopyTrader |

| Trading Instruments | Forex, Commodities, Indices, Metals, Energies |

| Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Account Offerings | Standard Account, Prime Account, Institutional Account |

| Minimum Deposit | $0 |

| Payout Fee | $5 |

| Payment Methods | Visa, Mastercard, Neteller, Skrill, Astropay, PaymentAsia, Local bank transfer |

| Demo account | Available |

#2. FP Markets (FX & CFD DMA)

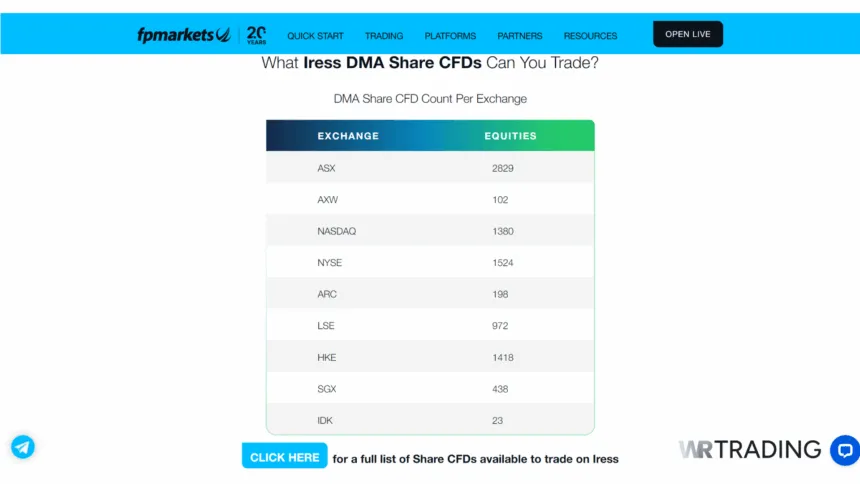

We reviewed FP Markets and found them among our top choices for traders seeking a top-tier DMA broker. Our testing focused on the key features necessary for DMA traders, and FP Markets impressed us in several areas.

We were impressed by the sheer number of tradable instruments FP Markets offers, exceeding 10,000 markets. This includes a massive selection of CFDs on stocks, exceeding 10,000 individual shares from major global markets. Beyond stocks, they provide CFDs on ETFs, forex pairs, indices, and even cryptocurrencies.

Their ECN pricing model further complements this extensive selection. FP Markets bypasses the traditional spread mark-up by connecting traders directly with liquidity providers. Our testing revealed the possibility of raw spreads as low as zero pips with FP Markets, though commissions may apply, making it a cost-effective option for experienced DMA traders.

FP Markets boasts a wider platform selection than most brokers we reviewed. They offer the industry-standard MetaTrader 4 and 5, the advanced cTrader platform, and even the IRESS platform for serious traders. The availability of DMA functionality makes these platforms particularly valuable for traders seeking direct market access.

| Info | FP Markets |

|---|---|

| Location | Visa, Mastercard, PayPal, Skrill, Neteller, Perfect Money, Cryptocurrency, Google Pay, and Apple Pay |

| Regulation | ASIC, ESMA, CySEC, FSCA, FSA, FSC |

| Trading Platforms | MT4, MT5, IRESS, cTrader, & TradingView |

| Trading Instruments (DMA) | FX, CFD Equities and Futures. |

| Leverage | 1:500 |

| Spreads | From 0.0 pips |

| Account Offerings (DMA) | STP, DMA, ECN |

| Minimum deposit | $100 |

| Payout Fee | None |

| Payment Methods | Visa, Mastercard, PayPal, Skrill, Netell, Perfect Money, Cryptocurrency, Google Pay, and Apple Pay |

#3. Freedom24 (Stocks, ETFs, Options DMA)

Our search for the best DMA brokers led us to Freedom24, which emerged as the third-best DMA platform on our list. This platform is particularly suitable for those who value a user-friendly experience alongside DMA capabilities. While FP Markets is top for its sheer depth of features, Freedom24 offers a streamlined and accessible DMA trading experience.

Unlike some brokers, which offer ECN models or limited DMA options, Freedom24 shines because of its commitment to pure DMA.

You get direct access to the order book, allowing you to see the real depth of liquidity and prevailing bid-ask spreads. This translates to maximum control and transparency over your order execution.

While Freedom24 boasts a wide range of tradable instruments across 15 exchanges, the broker still offers pure DMA on Stock, ETF, and Options trading. If these are your preferred instruments and pure DMA is your top goal, Freedom24 is a good option to consider. Freedom24 operates under the Cyprus Securities and Exchange Commission (CySEC license and regulations).

| Info | Freedom24 |

|---|---|

| Location | ETFs, Stocks, Indices, Stock Options and Futures |

| Regulation | CySEC, ESMA, FCA, BaFin |

| Trading Platforms | Freedom24 Mobile App |

| Trading Instruments (DMA) | Credit/debit cards, bank transfers, ApplePay and Google Pay. |

| Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Account Offerings/Types | Standard account, ECN account |

| Minimum deposit | $0 |

| Withdrawal Fee | $7 |

| Payment Methods | Credit/debit cards, bankApple Payrs, ApplePay and Google Pay. |

| Demo account | Available |

#4. Vantage Markets (Forex & CFD DMA)

Moving on, Vantage Markets is the fourth-best choice broker for Direct Market Access (DMA) trading. During our test at WR Trading, we discovered that Vantage Markets doesn’t offer pure DMA across all instruments. However, their Electronic Communication Network (ECN) pricing model is a compelling alternative for many DMA traders.

ECN execution closely resembles DMA by connecting you directly with other market participants, leading to exceptionally tight spreads. Pure DMA offers absolute control and transparency but comes at a slightly higher cost due to exchange fees. ECN pricing offered by Vantage Markets bridges the gap, providing near-DMA execution with potentially tighter spreads than standard broker models.

Vantage Markets offers several account types to suit different trading needs, including Standard STP, Raw ECN, and Pro ECN accounts. We analysed the fee structures and found them competitive, especially the Raw ECN account, which offers low spreads and commissions. This makes it an attractive option for high-frequency traders.

Key features of Vantage Markets

| Info | Vantage Markets |

|---|---|

| Location | South Africa, Vanuatu, and Australia |

| Regulation | Financial Markets Authority (FMA) of New Zealand, Financial Conduct Authority (FCA) |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Trading Instruments | Bank wire transfer, credit/debit cards,and electronic wallets |

| Leverage | 1:100 up to 1:500 |

| Spreads | From 0.1 pips |

| Account Offerings | Standard STP, Raw ECN, Pro ECN |

| Minimum Deposit | $50 |

| Payout Fee | No withdrawal fees |

| Payment Methods | Bank wire transfer, credit/debit cards, electronic wallets |

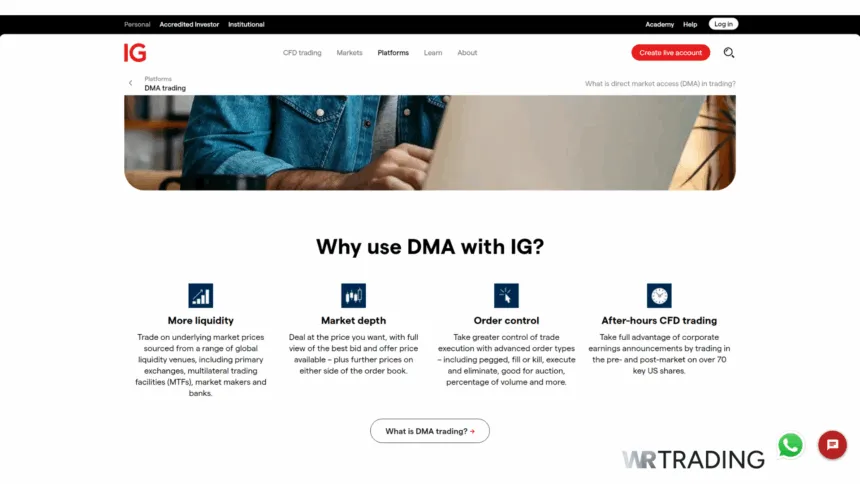

#5. IG

IG deserves a mention for its unique approach. Its L2 Dealer service provides a solid DMA alternative, earning the platform the fifth position in this comparison.

New traders benefit from a clear layout, ample educational resources, and technical analysis tools. In contrast, experienced traders enjoy deep liquidity, a broad market range, and DMA execution through the L2 Dealer platform.

We also tested the IG mobile app and were impressed by its DMA functionality. In our tests, users can receive trading signals from Autochartist and PIA directly within the app, complete with entry, exit, and stop-loss levels displayed alongside the order ticket.

The broker allows you to explore its platform for free by offering over 17,000 spread betting and CFD markets with a virtual £10,000 balance. Unlike some demo accounts, IG’s demo has no expiry date. You can practice spread betting and CFD trading for as long as you need to feel confident.

Key Features of IG

| Info | IG |

|---|---|

| Location | Melbourne, Australia, Bermuda, the United Kingdom, and the Netherlands |

| Regulation | FCA, ASIC, BaFin, FSA, MAS, DFSA, FSCA |

| Trading Platforms | MetaTrader 4 platform, L2 Dealer DMA and ProRealTime |

| Trading Instruments (DMA) | CFDs, investing, spread betting, DMA |

| Leverage | Up to 1:500 |

| Spreads (DMA) | 0.2 pips |

| Account offerings | $50 (bank cards, PayPal ,$0 (bank transfer) |

| Minimum deposit | VIP discount, educational resources, and content |

| Payout Fee | $0 |

| Payment Methods | Paypal, Bank transfer, Visa, Mastercard |

| Additional Offers | VIP discount, educational resources, and contents |

| Demo account | Available |

| Minimum withdrawal | $200 |

What is Direct Market Access?

Direct Market Access (DMA) signifies a sophisticated electronic trading method that grants investors direct interaction with the order books of financial exchanges. Traditionally, retail investors relied on intermediaries such as brokers or market makers to execute trades. These intermediaries often quoted prices based on their own inventory or market analysis, potentially introducing a layer of inefficiency.

DMA disrupts this traditional model by empowering investors to bypass intermediaries and submit orders directly into the exchange order book. This order book is a centralised registry that showcases various market participants’ buy and sell orders. By accessing the order book, DMA users gain real-time visibility into the depth of liquidity and prevailing bid-ask spreads for their desired instruments.

DMA vs OTC Trading

Investors have various avenues for executing trades. Aside from Direct Market Access (DMA), several traders use Over-the-Counter (OTC) markets as their go-to approach.

What is OTC Trading?

Over-The-Counter (OTC) Trading: OTC trading involves trading financial instruments directly between two parties without using a centralised exchange. OTC markets are decentralised and include a network of dealers and brokers who negotiate prices and execute trades. This method trades derivatives, bonds, and specific equities not listed on major exchanges.

So, with that in mind, we decided to compare how these approaches stack against each other. Here’s what separates the two methods:

| Feature | DMA | OTC |

|---|---|---|

| Execution Venue | Exchange order books | Directly between counterparties |

| More complex, requires market microstructure and order type knowledge | High – Order book reveals liquidity depth and spreads | Lower – Price discovery can be opaque |

| Spreads | Potentially tighter | It can be wider due to market maker involvement |

| Control | Greater control over order execution | Limited control; relies on market maker quotes |

| Complexity | The investor bears full responsibility | Generally simpler |

| Risk Management | Varies depending on the exchange and instrument | Counterparty risk exists |

| Minimum Investment | Varies depending on exchange and instrument | It may be lower than exchange-listed instruments |

| Suitability | Experienced investors seeking control, lower costs, and transparency | Beginners are attracted to the convenience and lower entry barriers |

Payment for Orderflow vs DMA

Our experts at WR Trading compared Payment for Order Flow (PFOF) and Direct Market Access (DMA) in our comprehensive review and testing of various trading methodologies. These two trading approaches offer distinct benefits and drawbacks. Here, we present our findings on PFOF versus DMA based on our thorough analysis and practical testing.

What is Payment for Order Flow (PFOF)?

Payment for Order Flow (PFOF) is a practice in which brokerage firms receive compensation from market makers for directing trade orders to them. We observed that PFOF is common among discount brokers, enabling them to offer commission-free trading to their clients. The process works as follows: when a trader places an order, the broker routes it to a market maker, who executes the trade and pays the broker a fee for the order flow.

| Feature | Payment for Order Flow (PFOF) | Direct Market Access (DMA) |

|---|---|---|

| Order Routing | Broker routes orders to market makers or HFT firms for execution (receives compensation) | Orders are routed directly to the exchange order book |

| Transparency | Clients may not see the best execution price | More complex, requires market microstructure and order type knowledge |

| Spreads | Potentially wider due to intermediary markup | Potentially tighter; eliminates intermediary markup |

| Control | Clients rely on broker routing decisions | Brokers define order parameters with precision |

| Complexity | Simpler | The investor bears full responsibility |

| Risk Management | The broker manages some risk | Beginners are attracted to the convenience and potentially lower entry barriers. |

| Commissions | Often commission-free | May have commissions |

| Suitability | Beginners are attracted to the convenience and potentially lower entry barriers | Experienced investors seeking control, lower costs, and transparency |

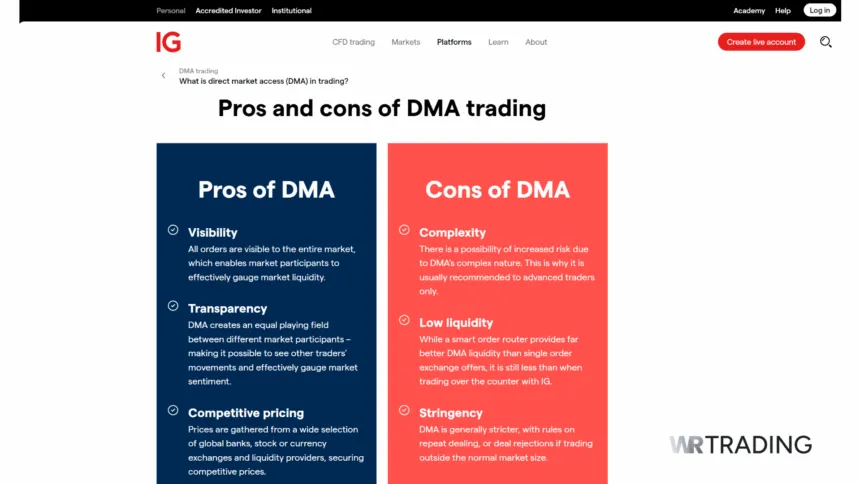

Pros / Cons of DMA

We’ve extensively reviewed and tested Direct Market Access (DMA) platforms, allowing us to distil their key advantages and disadvantages. Here’s a breakdown to help you decide if DMA aligns with your trading goals:

- Enhanced Control

- Better Transparency

- Cost Efficient

- Speed of Execution

- Increased Complexity

- Elevated Risk Management Requirements

Pros

- Enhanced Control: DMA allows traders to define order parameters more precisely, allowing you to tailor your execution strategies to specific market conditions.

- Better Transparency: By directly accessing the exchange order book, traders can gain real-time visibility into the depth of liquidity and prevailing bid-ask spreads.

- Cost Efficient: While DMA typically involves paying a commission, our analysis showed that tighter spreads and better execution prices often offset these costs. B.

- Speed of Execution: Our testing revealed that DMA offers significantly faster trade execution than traditional trading methods. Since there are no intermediaries, orders are placed directly on the exchange’s order book, producing near-instantaneous execution.

Cons

- Increased Complexity: DMA demands a deeper understanding of market microstructure and order types than traditional methods.

- Elevated Risk Management Requirements: With direct access to the exchange, the DMA user is entirely responsible for managing risk. Robust risk management strategies are crucial to mitigate potential losses.

How do you find out if a broker gives DMA?

After reviewing several brokerage services, our expert team at WR Trading identified several key methods for determining whether a trading broker offers Direct Market Access (DMA). Based on our testing and analysis, these steps will help traders and investors identify DMA brokers and assess their suitability for direct market trading.

Step 1: Research the Broker’s Offerings

Start by visiting the broker’s official website and reviewing their product offerings. DMA brokers typically prominently highlight their DMA services, as this feature attracts advanced traders. Look for specific mentions of DMA in sections detailing trading platforms, execution methods, and trading tools.

Step 2: Analyse the Trading Platforms

DMA brokers often provide advanced trading platforms that cater to experienced traders. During our review, we noted that platforms like MetaTrader 5, TradeStation, and Interactive Brokers’ Trader Workstation (TWS) are commonly associated with DMA. Examine the platform’s capabilities, looking for features like direct access to order books, real-time market data, and advanced order types.

Step 3: Check the Broker’s Fee Structure

Our testing showed that DMA brokers usually have a distinct fee structure compared to traditional brokers. Look for commission-based pricing, tiered fee structures, or per-share pricing models. These fee structures indicate DMA services, as they typically reflect the costs associated with direct market access.

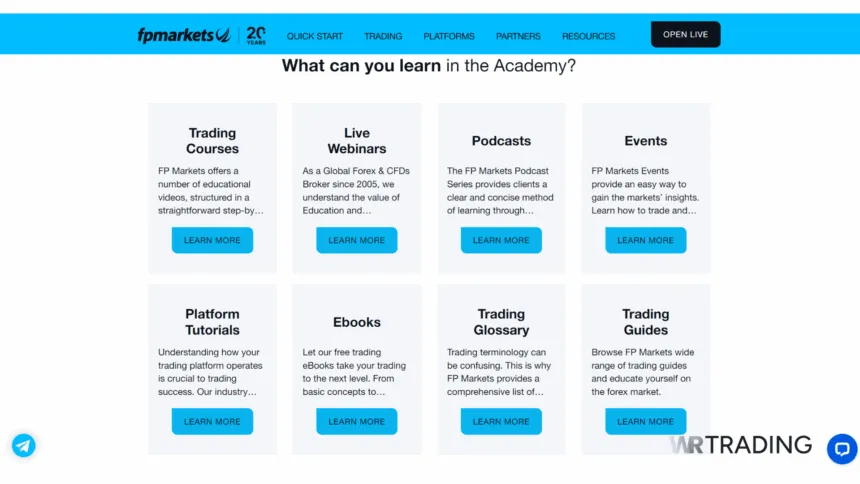

Step 4: Review the Broker’s Educational Resources

Many DMA brokers provide extensive educational resources to help traders understand and utilise DMA. Check for webinars, tutorials, articles, and guides focused on DMA trading. Our review found that brokers committed to DMA often invest in educating their clients about its benefits and usage.

Step 5: Examine the Order Execution Policy

A broker’s order execution policy can provide significant insights into whether they offer DMA. Look for detailed descriptions of how orders are routed and executed. Brokers offering DMA will explicitly mention direct routing to exchanges and the ability to interact directly with the market’s order book.

This information can be found in the broker’s terms of service, FAQs, or dedicated sections on their website.

Step 6: Contact Customer Support

In cases where the information is not readily available on the broker’s website, contacting customer support can be an effective way to confirm if a broker offers DMA. Prepare specific questions about order routing, access to market depth, and trading platform capabilities.

Our analysis highlighted that knowledgeable customer support representatives can provide clear answers and additional details about their DMA services.

Step 7: Read Independent Reviews and Forums

Independent reviews and trading forums are valuable resources for understanding a broker’s capabilities. In our testing, our Witzel trading experts found that reviews from reputable financial websites and discussions in trading forums often include user experiences and insights about whether a broker provides DMA. Pay attention to feedback regarding order execution quality, platform performance, and fee structures.

Step 8: Look for Regulatory Disclosures

Regulatory bodies often require brokers to disclose specific details about their trading services. Review the broker’s regulatory filings and disclosures, usually found on their website or the regulatory authority overseeing them. These documents may include information about DMA offerings and execution policies.

Regulation of DMA Trading

The complexity and potential risks associated with DMA necessitate robust regulatory oversight. As such, we do not take for granted the importance of regulatory disclosures when selecting a DMA broker. Understanding the regulatory framework governing DMA trading is crucial for ensuring transparency, fairness, and security in trading activities.

Finding Regulatory Disclosure

Consider regulatory disclosures as you check out various broker websites and account options for DMA access. All reputable brokers, as well as the ones we’ve highlighted, clearly outline their compliance with relevant regulations governing DMA trading. Here’s what to look for:

- Membership in Regulated Exchanges: Ensure the broker is a member of a reputable and well-regulated exchange, such as the US Financial Industry Regulatory Authority (FINRA) or the UK’s Financial Conduct Authority (FCA). Membership signifies adherence to strict exchange rules and investor protection measures.

- Regulatory Compliance Statements: Look for clear statements on the broker’s website or account information pages explicitly mentioning their compliance with DMA trading regulations. This demonstrates transparency and accountability.

Exploring Regulatory Resources

Don’t solely rely on information provided by brokers. Take the initiative to explore resources from regulatory bodies themselves. Here are some starting points:

- Financial Industry Regulatory Authority (FINRA): For US-based investors, FINRA offers a wealth of information on DMA trading, including regulatory guidelines and investor protection measures. Explore their website for relevant resources.

- Securities and Exchange Commission (SEC): The SEC regulates US securities markets. Its official website provides insights into regulations relevant to DMA trading.

- Financial Conduct Authority (FCA): The FCA website offers information on DMA regulations and investor protection measures for UK investors.

Don’t hesitate to contact the relevant regulatory body if you have any questions or require further clarification regarding DMA trading regulations.

Conclusion

We hope that comparing the best DMA brokers correctly highlights each broker’s diverse offerings and strengths. Whether you prioritise low costs, regulatory compliance, advanced trading tools, or comprehensive support, this guide can help you navigate the complexities of DMA trading.

Using the right DMA trading platforms can help you achieve your goal of becoming a successful trader. So look at these offerings, consider your objectives, and select the perfect fit for your trading style.

Once again, here are our top 5 DMA brokers:

- BlackBull Markets — Tight spreads and compatibility with multiple trading platforms like MT4, MT5, cTrader, TradingView, BlackBull Invest, and BlackBull CopyTrader.

- FP Markets (FX & CFD DMA) — One of the best DMA brokers with tradeable instruments exceeding 10,000 markets.

- Freedom24 (Stocks, ETFs, Options DMA) — Regulated by respected bodies in the Forex industry.

- Vantage Markets (Forex & CFD DMA) — Exceptionally tight spreads.

- IG — Ample educational resources and technical analysis tools.

Frequently Asked Questions on DMA Brokers:

Are there Alternatives to Pure DMA?

Yes! Some brokers offer ECN (Electronic Communication Network) pricing. ECN closely resembles DMA by connecting you directly with other market participants, leading to tight spreads similar to pure DMA. This can be a cost-effective alternative for many investors.

How does DMA differ from traditional brokerage models?

Traditional Brokerage Models rely on brokers to execute trades on behalf of clients, often involving delays and higher costs. DMA provides direct connectivity to financial markets, enabling quicker transactions and reducing the reliance on intermediaries.

Where Can I Learn More About DMA Trading?

Many DMA brokers offer educational resources on their websites. Regulatory bodies like the SEC (US) and FCA (UK) also provide information on DMA trading.

Are DMA brokers for beginners?

DMA Brokers are generally unsuitable for beginners due to their complexity and advanced technical knowledge. To avoid significant losses, DMA trading requires understanding complex order types, market mechanics, and risk management strategies.

Does FP Markets offer DMA trading?

Yes, but with a strategic twist. They provide a compelling alternative for many traders who value a balance between affordability and market access, with the option for pure DMA in specific scenarios.