Forex Brokers accepting US clients are a rare case due to regulatory hurdles, but a few stand out for offering excellent services while remaining fully compliant with United States laws. In this review, we will cover five of the best brokers that US traders can trust. We’ll disclose their fees, trading platforms available, and forex pair variety.

Here’s a quick rundown of the five best Forex brokers that accept US clients, with one key benefit highlighted for each:

Broker:

Availability:

Advantages:

Account:

Available in the US

Deposit Currencies: USD

- CFTC & NFA regulated

- Spreads from 0.8 Pips

- More than 80 FX pairs

- Leverage up to 1:50

- No Commission

- TastyFX Web Platform, TastyFX Mobile App, MT4, ProRealTime

Available in the US

Deposit Currencies: USD

- CFTC & NFA regulated

- Spreads from 0.0 Pips

- More than 68 FX pairs

- Leverage up to 1:50

- Demo account available

- Oanda Mobile, Oanda Web, MT4, TradingView

Available in the US

Deposit Currencies: USD

- Multiple regulations

- Spreads from 0.0 Pips

- Commission: fixed $5 per $100k USD traded on FX

- More than 80 FX pairs

- Leverage up to 1:50

- Forex.com App, Forex.com Web Trader, MT5

Available in the US

Deposit Currencies: USD

- No Minimum Deposit

- FCA regulated

- Options contracts starting at $0.65

- No Platform Fees

- Demo Account available

- IBKR GlobalTrader, IBKR Desktop, Trader Workstation (TWS), & more

Available in the US

Deposit Currencies: USD

- Multiple regulations

- Leverage up to 1:50

- Demo account available

- More than 100 FX pairs

- No Commission

- Plus500 WebTrader, Plus500 App

List of the Best Forex Brokers in the USA for US Clients:

In this section, we’ll briefly review each broker, focusing on key features, regulatory compliance, and suitability for US clients. Here is a breakdown of the top 5 forex brokers in the USA.

1. TastyFX

TastyFX is our first choice at WR Trading as a great broker for US traders who want low spreads and a straightforward, cost-effective trading experience. With no commissions and spreads starting from 0.8 pips, TastyFX is perfect for minimizing trading costs. Its user-friendly web platform and mobile app allow quick and seamless trade execution. TastyFX also supports MetaTrader 4 and ProRealTime for traders who prefer more advanced charting and automation features.

What makes TastyFX ideal for US clients is its regulatory compliance, being registered with both the CFTC and NFA, ensuring a safe trading environment. USA traders can benefit from leverage up to 50:1, the maximum allowed by United States regulations while accessing over 80 currency pairs. If you’re a new trader looking to try the broker or someone with more experience who needs to backtest strategies, TastyFX offers a demo account.

| Feature | Information |

|---|---|

| Eligible for USA Traders? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.8 pips Commission – No commission |

| Trading Platforms | TastyFX Web Platform, TastFX Mobile App, MetaTrader 4, and ProRealTime. |

| Asset Types | Forex |

| Forex Pairs Available | Over 80 |

| Leverage | 50:1 |

| Customer Support | Email and phone support. |

| Demo Account | Yes |

| Educational Content | Trading guides and tutorials. |

| Regulation | CFTC and NFA |

2. Oanda

Oanda is a great fit for US traders who value technical analysis, making it our second choice. This broker is known for its powerful TradingView and MetaTrader 4 integrations, offering cutting-edge charting and analysis tools that appeal to serious traders. Oanda also offers a Technical Analysis feature that is easy to install via the trading platform. It provides intraday market scanning, volatility analysis, performance statistics, and customizable daily market reports.

Oanda also offers its own proprietary award-winning trading platform, which includes a suite of forex tools, over 68 forex pairs, and leverage up to 50:1. The competitive pricing structure is great, with spreads starting from 0.0 pips and a flexible commission model that scales based on trade size. Also, it’s a US regulated forex broker with licenses from CFTC and NFA.

| Feature | Information |

|---|---|

| Eligible for USA Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.0 pips Commission – Varies based on trade size |

| Trading Platforms | Oanda Mobile, Oanda Web, MetaTrader 4, and TradingView. |

| Asset Types | Forex, indices, commodities, cryptocurrencies, and bonds. |

| Forex Pairs Available | Over 68 |

| Leverage | 50:1 |

| Customer Support | Email and phone support. |

| Demo Account | Yes |

| Educational Content | Technical Analysis and Oanda Learn |

| Regulation | CFTC and NFA |

3. Forex.com

Forex.com takes our 3rd spot because it offers US traders an all-in-one solution that is hard to beat. It delivers a comprehensive trading package with its range of tools, over 80 forex pairs, and leverage up to 50:1. The platform’s integration with MetaTrader 5 offers traders access to advanced charting tools, automated strategies, and a large range of assets.

Moreover, Forex.com also provides its own web-based platform, which is user-friendly and perfect for traders who prefer simplicity. It comes with advanced charts, which are a must-have for technical traders. Currently, the platform supports over 80 indicators, 50 drawing tools, and 14 time intervals. Also, the Market 360 feature discloses information about selected currency pairs, such as news, trading hours, charts, and more. It’s excellent and convenient for gaining insights into the market all in one place.

| Feature | Information |

|---|---|

| Eligible for USA Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.0 pips Commission – Fixed $5 per $100k USD traded on forex |

| Trading Platforms | Forex.com App, Forex.com Web Trader, and MetaTrader 5. |

| Asset Types | Forex, indices, stocks, cryptocurrency, and commodities. |

| Forex Pairs Available | Over 80 |

| Leverage | 50:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Academy, guides, and webinars. |

| Regulation | CFTC, NFA, CIRO, CySEC, FCA, SFC, FSA, MAS, and ASIC. |

4. Interactive Brokers

Interactive Brokers is a premium broker for US traders who seek professional-grade tools and access to a wide range of markets. Known for its Trader Workstation (TWS) platform, Interactive Brokers offers an extensive suite of advanced analytics, real-time data, and customization options, making it a favorite for experienced traders. Its ability to integrate with various assets, including stocks, options, and futures, gives traders unparalleled flexibility in building their portfolios alongside forex.

While offering leverage up to 50:1 and spreads from 0.1 pips, Interactive Brokers sets itself apart with its tiered commission structure, which benefits high-volume traders with progressively lower fees based on monthly trade activity. However, to get started, a minimum deposit of $10,000 is required, making Interactive Brokers for more serious traders. Nevertheless, if you’re a beginner, you can still sign up with IB and access the Trader’s Academy to get started.

| Feature | Information |

|---|---|

| Eligible for USA Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.1 pips Commission – Tired system based on monthly trade volume. |

| Trading Platforms | Trader Workstation and IBKR Desktop. |

| Asset Types | Forex, indices, stocks, cryptocurrency, options, futures, ETFs, bonds, and commodities. |

| Forex Pairs Available | Over 100 |

| Leverage | 50:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Trader’s Academy, podcasts, and webinars. |

| Regulation | CFTC, NFA, SEC, FINRA |

5. Plus500

Plus500 is ideal for US forex traders who want a streamlined, no-fuss trading experience. The broker’s trading platform Plus500 WebTrader provides a clean design that makes navigation simple, allowing users to quickly access over 100 currency pairs without the clutter of overly complex features. With Plus500, there are no commissions to worry about, making it appealing for cost-conscious traders who prefer transparent fees. The spreads may vary depending on the pair, but overall, Plus500 ensures competitive pricing across its currency pairs.

Although leverage is capped at 50:1, most traders will find this amount sufficient for making good profit while minimizing risk. Traders can easily execute forex trades on the go, with the Plus500 app providing a smooth, responsive experience. Moreover, Plus500 offers futures on forex, commodities, cryptocurrencies, and indices. For those who value a reliable and straightforward approach to forex, Plus500 offers just the right balance of simplicity and functionality, making it one of our top choices at WR Trading.

| Feature | Information |

|---|---|

| Eligible for USA Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – varies based on currency pair Commission – none |

| Trading Platforms | Plus500 WebTrader and Plus500 App. |

| Asset Types | Forex, indices, cryptocurrency, commodities, stock, options, and ETFs. |

| Forex Pairs Available | Over 100 |

| Leverage | 50:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Trading Academy and market insights. |

| Regulation | CFTC, NFA, FCA, CySEC, ASIC, FSAS, MAS, and DFSA. |

Is Forex Trading Legal in the USA?

Yes, forex trading is legal in the USA, but it is subject to some of the strictest regulations in the world. This tight regulation is designed to protect traders and ensure the integrity of the financial markets. The key regulatory bodies responsible for overseeing forex trading in the USA are the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Both agencies play an important role in making the US forex market one of the safest and most secure environments for traders globally.

The legal framework governing forex trading in the United States focuses on three primary areas:

- Broker Licensing and Regulation: Brokers who want to offer forex services to US clients must be licensed and registered with the CFTC and become members of the NFA. This ensures that they meet specific financial requirements, including maintaining sufficient capital reserves, following ethical trading practices, and being subject to regular audits.

- Leverage Limits: The United States regulations impose strict limits on the amount of leverage that brokers can offer to retail clients. The maximum leverage allowed is 50:1 for major currency pairs and 20:1 for minor currency pairs. This is far more conservative compared to brokers in other regions, such as Asia, where leverage can go as high as 500:1. These limits are set to reduce the risk of significant financial losses for traders.

- Client Fund Protection: US forex brokers are required to keep client funds in segregated accounts, meaning they are kept separate from the broker’s operational funds. This ensures that your money is protected even if the broker faces financial trouble. Also, brokers must comply with strict regulations around financial stability, reporting, and risk management to ensure the safety of client funds.

Regulation and Security of US Forex Brokers & FX Market

US forex brokers must follow key regulatory requirements, which protect traders and outline specific security measures to ensure a safe trading environment. We’ll explain how these rules protect traders, as well as specific rules US forex brokers must adhere to.

Investors Deposit Protection

In the United States, there is no dedicated deposit insurance for forex traders, like the FSCS, which covers deposits up to a specific amount in the event of broker insolvency. While banks in the US are covered by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, this does not extend to forex brokers or their clients. This means that USA forex traders do not have a guaranteed compensation scheme if a broker fails.

However, US regulators provide multiple security measures to ensure that brokers operating in the US meet high standards of financial stability and ethical practice. Below, we explore the key regulations and how they protect Forex traders in the US.

Key Regulatory Bodies:

- Commodity Futures Trading Commission (CFTC): The CFTC is a federal regulatory agency that oversees all forms of futures and options markets in the USA, including forex. It enforces laws that ensure fair and transparent practices and has the authority to take action against brokers or firms that violate its regulations. The CFTC has the power to issue fines and penalties or suspend the operations of non-compliant brokers.

- National Futures Association (NFA): The NFA is an independent regulatory body that ensures compliance with ethical trading practices in the futures and forex markets. Brokers that wish to offer services to US clients must be members of the NFA. The NFA enforces a range of rules aimed at protecting investors, including mandating that brokers have sufficient capital reserves and follow reporting requirements. It also maintains a public registry of regulated firms, which traders can easily check to verify a broker’s status.

Strict Licensing Requirements

Before a forex broker can legally accept US clients, it must be registered with both the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). The licensing process involves extensive background checks, financial reviews, and the establishment of operational practices that protect client interests.

For example, brokers must prove they have enough capital to support their clients’ trading activities and withstand financial difficulties. This ensures that only financially stable and ethical brokers can operate in the United States market, greatly reducing the likelihood of fraud or insolvency.

Capital Requirements

USA brokers are required to maintain a high level of capital reserves to protect the broker from market volatility and unforeseen losses. The NFA mandates that forex brokers must hold at least $20 million in capital to ensure they can cover their liabilities, including clients’ withdrawal requests. These high capital standards reduce the risk of brokers running out of money and prevent over-leveraging.

This capital requirement is one of the highest in the world, which explains why only a limited number of brokers operate legally in the US. It ensures that only well-capitalized and financially sound firms can serve USA forex traders.

Segregation of Client Funds

Another important regulation in place is the requirement that brokers hold client funds in segregated accounts. This rule ensures that a client’s deposit is not mixed with the broker’s own operating capital, preventing the broker from using client funds for its business activities or speculative trading. In the event of broker insolvency, these segregated funds remain protected, and clients should be able to recover their money because these funds are not part of the broker’s assets.

Leverage Restrictions

To prevent traders from taking on too much risk, US regulations have strict limits on the leverage brokers can offer to retail clients. The maximum leverage allowed is 50:1 for major currency pairs and 20:1 for minor pairs. The conservative leverage limits help prevent traders from experiencing devastating losses due to high-risk trading practices and ensure that brokers do not promote overly risky strategies.

Regular Auditing and Reporting

Brokers in the United States are subject to frequent audits by both the CFTC and NFA, ensuring that they are in full compliance with all regulatory requirements. Brokers must submit regular financial reports to the regulators, demonstrating that they are meeting capital requirements and segregating client funds appropriately.

These audits help regulators monitor brokers’ financial health and ensure they are not engaging in fraudulent activities or risky practices that could harm their clients.

Enforcement of Anti-Fraud Measures

The NFA and CFTC actively work to protect US traders from fraud, manipulation, and unethical practices. Brokers are required to maintain anti-fraud rules, which prevent activities such as price manipulation, deceptive marketing, or hidden fees. Regulators closely monitor brokers to ensure that clients are getting fair and accurate pricing, and any unfair practices can result in significant penalties.

The CFTC and NFA also maintain a public record of broker violations, allowing traders to check a broker’s compliance history before opening an account. This transparency is a key tool for traders to avoid dealing with brokers who have a history of misconduct.

Customer Protection Mechanisms

Brokers must implement clear customer protection policies, including complaint-handling procedures. Traders must have access to a formal process for lodging complaints if they believe they have been wronged by a broker. The NFA’s arbitration process allows traders to resolve disputes efficiently and fairly, often without needing to go through costly and time-consuming legal processes.

Cybersecurity Regulations

In addition to the financial and operational regulations, USA brokers must comply with strict cybersecurity standards to protect sensitive client information. The NFA Cybersecurity Interpretive Notice requires brokers to have effective safeguards in place to prevent data breaches and unauthorized access to client accounts.

Brokers are required to regularly assess and update their cybersecurity protocols, including encryption measures, firewall protections, and intrusion detection systems. They must also establish procedures for quickly detecting and responding to cyber threats.

These regulations are crucial in today’s digital environment, where cyberattacks on financial institutions are increasingly common.

Regulatory Surveillance and Monitoring

The CFTC and NFA maintain extensive surveillance programs that continuously monitor broker activities and trading patterns to detect irregular or suspicious behavior. This proactive monitoring helps regulators identify potential issues before they become serious problems for traders.

For example, if a broker begins to engage in excessive risk-taking or fails to meet its financial obligations, the CFTC or NFA can step in to enforce corrective actions or penalties. This continuous oversight is an important safeguard that ensures brokers remain compliant and reduces the risk of sudden broker failures or fraudulent practices.

Why Do Only a Few Forex Brokers Accept US Clients?

The primary reason only a few forex brokers accept US clients is the challenging and resource-intensive process of becoming compliant with United States regulations. These brokers must meet the requirements set by the CFTC and NFA, which involve high operational costs and place significant restrictions on how they can conduct business.

Many brokers find the extensive application process, constant monitoring, and compliance audits too demanding to justify the relatively small pool of US retail traders. Therefore, only a few forex brokers are available to USA forex traders.

Why Are Not Many Forex Brokers Regulated in the USA?

The US forex market is one of the most tightly regulated in the world, which is why only a small number of brokers choose to seek regulation there. Below are five reasons why forex brokers avoid the US market.

- High Regulatory Requirements: Brokers must comply with strict rules from the CFTC and NFA, such as having capital reserves, segregated client funds, and leverage limits. These rules are more conservative than in many other countries, making it too costly and complex for brokers to operate in the US market.

- Limited Leverage: US regulations cap Leverage at 50:1 on major currency pairs, which is significantly lower compared to other regions. This makes the US market less appealing for brokers that offer higher leverage to attract traders.

- Cost of Compliance: Operating in the US requires substantial investment in legal and compliance teams. These costs make it financially challenging for many brokers to enter or stay in the US forex market.

- Preferences for Offshore Markets: Many brokers prefer to operate in markets with fewer regulations and restrictions on their services, such as leverage, lower capital requirements, and more. Offshore markets allow brokers to maximize profitability without the costs of strict regulatory compliance.

- Strict Enforcement of Penalties: The CFTC and NFA give heavy fines and penalties for non-compliance, such as permanent bans from the market. The risk of these severe penalties deters many brokers from entering the US market.

Is It Possible for You to Trade With Forex Brokers Outside the USA as a US Trader?

Yes, it’s technically possible for US traders to open accounts with offshore brokers, but it is highly discouraged and has risks. Many offshore brokers are not legally allowed to accept US clients because they do not comply with the strict regulations of the CFTC and NFA. If these brokers are caught accepting US clients, they could face penalties from United States authorities, resulting in the broker ceasing operations, freezing accounts, and getting fined.

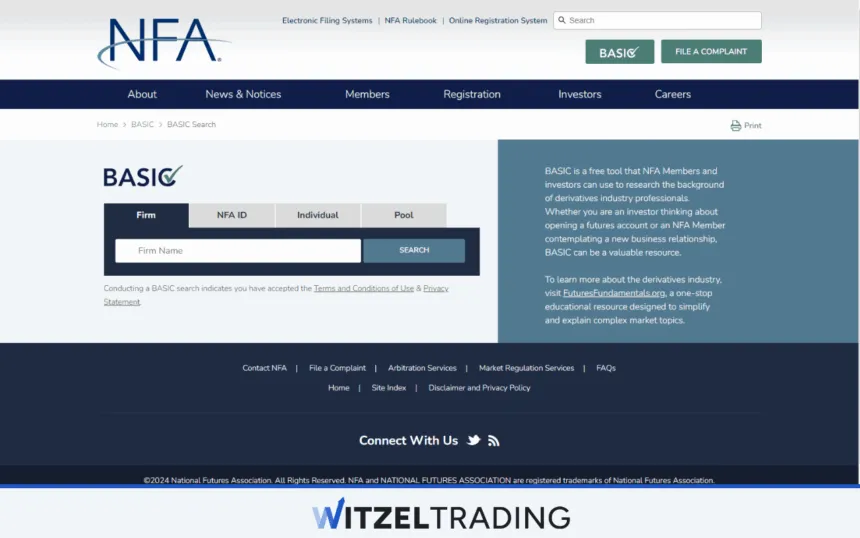

How to Check if Your Forex Broker Is Regulated in the USA

Before signing up to one of our recommended brokers, doing your own due diligence is a safe and important practice. You can start by verifying the regulation status of the broker yourself by visiting the NFA and CFTC websites. Here are easy-to-follow guides on how to check if your forex broker is regulated in the USA.

How to Check NFA Regulation:

- Visit the NFA Website: Go to the NFA website to access the NFA’s public database of registered brokers.

- Use the NFA BASIC Tool: Locate the NFA BASIC search tool on the website’s homepage. This tool allows you to search for any broker by name or NFA ID number.

- Enter the Broker’s NFA ID: If you have the broker’s NFA ID, enter it into the search tool. If you don’t have it, you can search by the broker’s name.

- Check Registration Status: After searching, verify that the broker is registered with the NFA and that they have no outstanding violations or disciplinary actions.

- Review the Broker’s History: Use the BASIC tool to view any disciplinary history, such as fines or warnings, to ensure the broker has a clean record.

How to Check CFTC Regulation:

- Visit the CFTC Website: Go to the CFTC website and click “Learn & Protect”. Then press the tab for “Check Registration & Disciplinary History”. This page will display a link to the NFA BASIC database.

- Cross-Check NFA Results: Since US brokers must also be registered with the CFTC, you can confirm their status using the information found on the NFA website. The NFA BASIC tool often provides CFTC registration details alongside NFA data.

- Review Broker: Check the regulatory standing of the broker after searching for it in the NFA database. It should display their current license and any disciplinary actions that have been taken against the broker.

Key Things We Looked at for the Best Us Forex Broker (How We Tested)

At WR Trading, we only want to provide our readers with the best forex brokers, so we ensure our review process is extremely diligent. The criteria below helped us determine whether a broker meets the high standards expected in the US market or not.

Regulation and Security

The first and most important factor was ensuring that the broker is fully regulated by the CFTC and NFA. We made sure that each broker complies with United States regulations, meets capital requirements, maintains segregated client funds, and submits to regular audits. Brokers that did not meet these regulatory standards were excluded from our list.

Trading Platforms

We tested the brokers’ trading platforms to assess their usability, functionality, and range of tools. For US traders, access to platforms like MetaTrader 4/5, proprietary software, or advanced charting tools like TradingView is required. We checked the ease of use, execution speed, and reliability of these platforms to ensure they offer premium services for traders.

Fees and Spreads

We want to recommend cost-effective brokers, so we checked each broker’s fees and spreads. Only brokers with competitive spreads were selected. We also took into account any additional fees such as commission, inactivity fees, and withdrawal charges to ensure there are no hidden costs that could impact long-term profitability.

Leverage and Risk Management

Given the leverage restrictions in the US (maximum 50:1 for majors, 20:1 for minors), we assessed how well brokers manage these limits and the tools they provide for responsible risk management. We looked for margin call policies, stop-loss features, and other tools that help traders operate safely within US leverage caps.

Deposit and Withdrawal Methods

We reviewed the ease and security of depositing and withdrawing funds. US clients need access to reliable methods such as ACH bank transfers, credit/debit cards, and wire transfers. We also considered the speed and transparency of withdrawals, ensuring brokers deliver fast access to funds without delays or excessive fees.

How to Sign up With a Forex Broker as a US Citizen:

As a US citizen, signing up with a trading broker involves a few straightforward steps. Below is a simple guide on how to get started:

- Choose a Regulated Broker: First, make sure the broker is legally authorized to accept US clients. Check the broker’s regulatory status through the NFA BASIC search tool to verify that it is properly licensed and compliant with US regulations. You can use any of our recommended brokers as we have vetted them to ensure they are regulated by the proper authorities.

- Complete the Online Application: Once you’ve selected a broker, visit their website and start the registration process. The broker will require you to fill out an online application form with personal details such as your name, address, date of birth, and social security number. This information is necessary to comply with KYC (Know Your Customer) regulations.

- Submit Identification Documents: You’ll need to provide proof of identity and address. This requires uploading a government-issued ID (like a passport or driver’s license) and a recent utility bill or bank statement showing your current address.

- Fund Your Account and Trade: After your account is verified, you can fund it using one of the available methods, such as ACH transfer, credit/debit card, or wire transfer. Be sure to review the broker’s deposit methods and any associated fees. Once your account is funded, you can start trading.

Deposit / Withdrawal Methods for US Traders:

USA forex brokers offer a variety of payment methods to make transactions as smooth as possible. Below are the most common deposit and withdrawal methods for US traders.

ACH Bank Transfers

ACH transfers are a widely used method for US traders, allowing direct transfers between your bank account and your trading account. Examples of this include connecting with traditional banks like Wells Fargo or Bank of America for secure transfers. While ACH transfers are usually free and reliable, they can take 1-3 business days to process, making it a slower option compared to others.

Credit/Debit Cards

Credit and debit cards are another popular option for US traders, with cards like Visa, MasterCard, and American Express commonly accepted for deposits and withdrawals. Deposits made using credit or debit cards are processed almost instantly, allowing traders to fund their accounts quickly. Withdrawals, however, may take 1-3 business days, depending on the processing time and policies of the card issuer.

There might be fees associated with using certain cards, especially for international transactions.

Wire Transfers

For larger transactions, wire transfers are a secure and reliable method. This option is often used by traders who prefer to transfer substantial sums from their accounts via services such as SWIFT or domestic bank wires. However, wire transfers generally take longer to process, typically between 2 and 7 business days, depending on the banks involved, unless it’s the same financial institution, which can take less than 24 hours to transfer.

E-Wallets

E-wallets like PayPal, Skrill, or Neteller are available for US traders as a fast and convenient payment option. These platforms offer quick processing times, usually within 24 hours, for deposits and withdrawals. Although e-wallets provide a more flexible and speedy solution, not all US brokers support this option due to regulatory restrictions.

Platforms / Software of US Forex Brokers

United States-regulated brokers focus on offering secure, reliable, and feature-rich platforms to comply with strict regulatory standards. Below are the most commonly used platforms and software available through US forex brokers.

MetaTrader 4 (MT4)

MetaTrader 4 remains a go-to platform offered by many US forex brokers due to its balance of simplicity and functionality. It’s popular among beginner and intermediate traders in the US for its user-friendly interface, strong charting tools, and support for automated trading strategies. US brokers offering MT4 ensure compliance with regulations by tailoring account types and leverage limits to United States standards.

MetaTrader 5 (MT5)

Many US brokers also offer MetaTrader 5, the more advanced version of MT4. MT5 provides US traders with enhanced analytical tools, additional timeframes, and market depth features, appealing to more experienced traders looking for versatility.

TradingView

Some US brokers integrate TradingView, a web-based platform with powerful charting capabilities and a large library of technical indicators. It’s often used by traders who need access to in-depth technical analysis tools in a flexible, browser-based environment.

Proprietary Platforms

Several USA brokers have developed their own proprietary trading platforms designed specifically for their US client base, such as Interactive Brokers with their Trader Workstation (TWS) platform. These platforms often feature advanced security measures, quick order execution, and tools tailored to US regulatory standards. Proprietary platforms may offer enhanced integration with other financial services with the broker, providing US traders with a better trading experience.

Conclusion

When choosing a forex broker as a US trader, options like TastyFX, Oanda, Forex.com, Interactive Brokers, and Plus500 offer access to diverse platforms and top-tier trading features. Whether you need low-cost trading, advanced analytical tools, or a straightforward mobile experience, these brokers provide solid options for USA traders while ensuring compliance with regulatory standards. If you’re unsure which broker to sign up with, consider testing their demo accounts to get a feel for their services.

Quick Overview of Top 5 Forex Brokers for US Clients:

- TastyFX – Low spreads with 0% commission

- Oanda – Best for technical analysis

- Forex.com – Provides the best trading tools

- Interactive Brokers – Offers a comprehensive trading service for professional forex traders

- Plus500 – Best for Trading Forex Futures

Frequently Asked Questions on Forex Brokers in the USA:

What Should I Look for in a Forex Broker That Accepts US Traders?

When choosing a forex broker, make sure they are fully regulated by the CFTC and NFA to ensure compliance with US law. Look for brokers that offer competitive fees, reliable platforms, and secure deposit/withdrawal methods. It’s also important to consider the forex pairs available and leverage limits.

Why Are There So Few Forex Brokers in the USA?

The strict regulations by the CFTC and NFA make it difficult and expensive for many brokers to operate in the US. The high capital requirements and leverage limits deter many international brokers from entering the US market. As a result, only a handful of brokers meet the regulatory standards necessary to accept United States clients.

Do US Brokers Offer Demo Accounts?

Yes, our recommended US brokers provide demo accounts for new traders to practice without risking real money. These accounts allow you to familiarize yourself with the trading platform and test strategies in real market conditions.

What Are the Best Forex Brokers for US Clients?

The best US forex brokers are TastyFX, Oanda, Forex.com, Interactive Brokers, and Plus500. These brokers are fully regulated in the United States, offer advanced trading tools, multiple asset pairs, and various trading software.

Are US Forex Brokers Safe to Trade With?

Yes, US-regulated brokers are considered very safe because they must adhere to strict regulatory standards. They are monitored closely by both the CFTC and NFA, ensuring they maintain adequate capital reserves and keep client funds segregated.