Corporate forex trading requires reliable brokers that offer specialized services, competitive spreads, and powerful trading platforms. Our team at WR Trading tested and reviewed several brokers to bring you the best options for corporate accounts. In this article, we will highlight the top 5 forex brokers suitable for corporate accounts, detailing their key benefits, features, and how they stand out in the competitive forex market.

To help you quickly identify the best forex brokers for your corporate trading needs, we have compiled a short list of the top 5 brokers. Each broker on this list has been chosen based on their exceptional services, user-friendly platforms, and support for corporate clients.

Broker:

Corporate Account:

Advantages:

Account:

Yes

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

Yes

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

Yes

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

Yes

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

Yes

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

List of the Best 5 Forex Brokers for Corporate Account

In this section, we provide a detailed review of each broker, highlighting their strengths and key features. This should help you make an informed decision about which broker best suits your corporate trading requirements.

BlackBull Markets

BlackBull Markets excels with its advanced trading tools and comprehensive market analytics, making it ideal for corporate traders who rely on detailed market insights. Our review revealed that BlackBull Markets offers competitive spreads starting at 0.0 pips and deep liquidity, essential for executing large trades without significant slippage.

BlackBull Markets provides over 70 forex pairs, ensuring traders have extensive options for currency trading. The leverage goes up to 500:1, allowing traders to amplify their positions. Their proprietary platform, BlackBull Trader, along with MetaTrader 4, MetaTrader 5, MetaTrader Web Trader, cTrader, and TradingView, offers a great trading environment with sophisticated charting tools and indicators.

We found BlackBull Markets’ customer support to be exceptional, providing timely and professional assistance. The broker’s strong focus on research and education is evident in the high-quality market reports and webinars they offer. This commitment to trader education and support makes BlackBull Markets a top choice for corporate accounts looking for a comprehensive trading solution.

| Feature | Information |

|---|---|

| Has a Corporate Account? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $6 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, MetaTrader Web Trader, cTrader, TradingView, and BlackBull Trade. |

| Asset Types | Forex, commodities, indices, cryptocurrencies, futures, and stock. |

| Tradable Assets | Over 26,000 |

| Currency Pairs | Over 70 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Webinars, tutorials, education hub, |

| Regulation | Financial Services Authority in Seychelles |

Vantage Markets

Vantage Markets is a broker that truly understands the needs of corporate traders. From our experience at WR Trading, their competitive spreads starting from 0.0 pips are a game-changer, significantly reducing trading costs, especially for high-volume trades. With access to over 40 forex pairs, corporate traders can diversify their portfolios and tailor their strategies to market conditions effectively.

One of the key advantages of Vantage Markets is their leverage options, which go up to 500:1. This high leverage is perfect for corporate traders looking to maximize their potential returns. The Vantage App, MetaTrader 4, MetaTrader 5, and ProTrader platforms are top-notch, providing advanced charting tools and technical indicators.

Customer service at Vantage Markets is top-tier. We found their support team knowledgeable, which is essential for corporate accounts requiring reliable assistance. The platform’s user-friendly interface, combined with its powerful features, ensures a smooth trading experience, whether you’re managing a single account or multiple portfolios.

| Feature | Information |

|---|---|

| Has a Corporate Account? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From $3 per lot |

| Trading Platforms | Vantage App, MetaTrader 4, MetaTrader 5, and ProTrader. |

| Asset Types | Forex, stocks, indices, commodities, bonds, and ETFs. |

| Tradable Assets | Over 1,000 |

| Currency Pairs | Over 40 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Courses, webinars, and ebooks. |

| Regulation | Australian Securities and Investments Commission |

FP Markets

FP Markets stands out as a versatile broker with a broad range of trading instruments, including forex, stocks, commodities, indices, ETFs, and cryptocurrencies. This makes it an excellent choice for corporate traders looking to diversify their trading activities. We were happy to find that the competitive spreads started at 0.0 pips, keeping trading costs low and enhancing overall profitability.

FP Markets offers up to 60 forex pairs, providing a wide array of major, minor, and exotic currencies. With leverage up to 500:1, this broker offers the flexibility needed to execute various trading strategies. Their MetaTrader 4, MetaTrader 5, cTrader, TradingView, IRESS, and WebTrader platforms are equipped with advanced trading tools and analytics, facilitating informed decision-making for traders.

Furthermore, with FP Markets, you can access a daily news feed and an economic calendar. Also, you can utilize the Alarm Manager, which provides alerts and can carry out automated actions like closing positions. The broker’s transparent fee structure and strong regulatory framework further enhance its appeal, making FP Markets a reliable choice for corporate forex trading.

| Feature | Information |

|---|---|

| Has a Corporate Account? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, IRESS, and WebTrader. |

| Asset Types | Forex, stocks, indices, commodities, cryptocurrency, and ETFs. |

| Currency Pairs | Over 60 |

| Tradable Assets | Over 10,000 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Video tutorials and trading glossary. |

| Regulation | ASIC, FSCA, FSA, FSC, and CySEC. |

Moneta Markets

Moneta Markets is highly praised for its user-friendly platform and excellent support services, making it one of our top options. During our review, we found that Moneta Markets offers competitive spreads starting at 0.0 and a wide range of trading instruments, including over 45 forex pairs. The platform’s ease of use is a significant advantage for corporate traders who need to manage multiple accounts efficiently.

Leverage at Moneta Markets can go up to 1000:1, providing the flexibility needed for various trading strategies. The broker’s MT4 WebTrader platform is user-friendly, with intuitive navigation and a suite of advanced trading tools. Additionally, the MetaTrader 5 platform is available for those who prefer a more traditional trading experience.

Customer service at Moneta Markets is outstanding, with 24/5 support through various channels. We found their support team to be responsive and knowledgeable, ensuring that corporate clients receive the assistance they need fast. Moneta Markets’ strong emphasis on market analysis resources and educational materials makes it a solid choice for corporate traders aiming to stay well-informed.

| Feature | Information |

|---|---|

| Has a Corporate Account? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – from no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Pro Trader, and MT4 WebTrader. |

| Asset Types | Forex, commodities, indices, ETFs, bonds, and stocks. |

| Tradable Assets | Over 1,000 |

| Currency Pairs | Over 45 |

| Leverage | 1000:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Blogs and guides. |

| Regulation | Cayman Islands Monetary Authority and Financial Sector Conduct Authority. |

Pepperstone

Pepperstone is one of the best options for its low trading fees and lightning-fast execution speeds, making it an excellent choice for high-frequency traders. We experienced some of the fastest execution speeds in the industry, which is needed for taking advantage of market opportunities. The spreads are also highly competitive starting at 0.0, contributing to lower trading costs.

Pepperstone offers over 90 forex pairs, providing a broad spectrum of trading options. With leverage up to 500:1, traders can maximize their market exposure. The broker supports several trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, all of which offer advanced features and customizable interfaces to suit different trading styles.

The customer support at Pepperstone is exceptional, with 24/5 availability through live chat, phone, and email. Pepperstone’s strong regulatory standing and commitment to providing a secure trading environment further enhance its reputation as a top broker for corporate accounts.

| Feature | Information |

|---|---|

| Has a Corporate Account? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, and TradingView |

| Asset Types | Forex, commodities, indices, cryptocurrency, stocks, and ETFs. |

| Tradable Assets | Over 1,200 |

| Currency Pairs | Over 90 |

| Leverage | 500:1 |

| Customer Support | Email and phone support. |

| Demo Account | Yes |

| Educational Content | Webinars, educational videos, and trading guides. |

| Regulation | FCA, CySEC, ASIC, BaFin, CMA, and DFSA. |

How We Tested the Best Forex Brokers for Corporate Accounts

Selecting the best forex brokers for corporate accounts required a thorough and detailed evaluation process. Our approach at WR Trading was designed to ensure that each broker meets the specific needs and high standards of corporate traders. Here’s an in-depth look at how we conducted our tests and what we focused on:

Trading Conditions and Costs

To begin with, we examined the trading conditions provided by each broker. Corporate accounts typically involve large trading volumes, so we paid attention to the spreads and commissions. We executed numerous trades across different market conditions to observe real-time spreads and ensure there were no hidden fees. Lower trading costs are critical for corporate traders as they directly affect profitability.

Range of Instruments and Leverage

A diverse range of trading instruments is essential for corporate traders who often employ complex and varied trading strategies. We evaluated each broker based on various forex pairs offered, including major, minor, and exotic currencies. Furthermore, we looked at other asset classes, such as commodities, indices, and cryptocurrencies, to ensure comprehensive trading opportunities. We also assessed the leverage options available, with a focus on how high the leverage can be.

Trading Platforms and Tools

The trading platform’s functionality and reliability are important for corporate accounts. We tested each broker’s platforms, including proprietary options and popular platforms like MetaTrader 4, MetaTrader 5, and cTrader. Our evaluation covered the ease of use, customization capabilities, and the availability of advanced trading tools such as charting software, technical indicators, and automated trading features.

Fast execution speeds and platform stability were also key factors, as corporate traders need to execute large volumes of trades efficiently.

Customer Support and Account Management

For corporate accounts, having responsive and knowledgeable customer support is vital. We tested the customer support services of each broker by contacting them through various channels, including live chat, phone, and email. We assessed their response times and the quality of the support provided. We looked into the availability of dedicated account managers who can offer tailored support and insights to corporate clients, ensuring their specific needs are met.

Regulatory Compliance and Security

Regulatory compliance is a fundamental aspect of our evaluation process. We ensured that each broker is regulated by reputable financial authorities such as the FCA, ASIC, or CySEC. This regulation provides an additional layer of security and trust for corporate clients. We also examined the security measures in place, including encryption protocols and data protection practices, to ensure that sensitive information and funds are securely managed.

Additional Services and Features

We also considered any additional services and features that could benefit corporate traders. This included educational resources such as webinars, tutorials, and detailed market analysis reports. Access to high-quality market insights and research tools can be incredibly valuable for corporate accounts. Furthermore, we looked at the overall user experience, including the ease of managing multiple accounts and the availability of integrated solutions for efficient trading and account management.

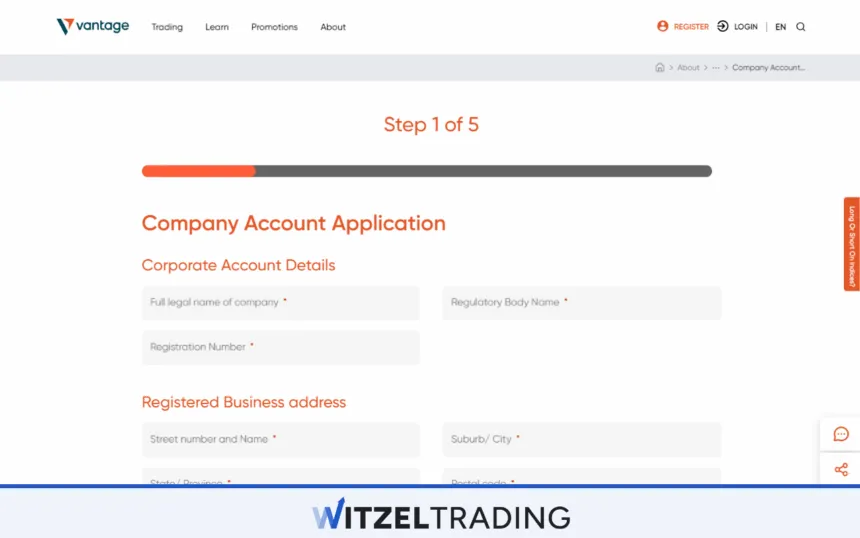

How to Open a Corporate Forex Trading Account

Opening a corporate forex trading account involves several steps, each designed to ensure that the account is set up correctly and complies with regulatory requirements. Here’s a step-by-step guide on how to open a corporate forex trading account:

Step 1: Choose a Broker

The first step is to select a forex broker that meets your corporate trading needs. Consider factors such as the range of trading instruments, leverage options, trading platforms, customer support, and regulatory compliance. Ensure the broker offers competitive spreads and robust security measures.

Step 2: Complete the Application Form

Once you’ve chosen a broker, you will need to complete their corporate account application form. This form requires detailed information about your company, including the company name, registration number, registered address, and contact details. Ensure that all information provided is accurate and up-to-date.

Step 3: Submit Required Documents

The broker will require several documents to verify your corporate account. Commonly required documents include:

- Certificate of Incorporation

- Memorandum and Articles of Association

- Proof of the company’s registered address (e.g., utility bill or bank statement)

- Identification documents for company directors and authorized signatories (e.g., passports or national ID cards)

- Proof of address for company directors and authorized signatories

- Board resolution authorizing the opening of the forex trading account and specifying the authorized signatories

Ensure all documents are certified copies and comply with the broker’s requirements.

Step 4: Account Verification

After submitting the application form and required documents, the broker will verify your information. This process may take a few days, depending on the broker and the completeness of your documentation. The broker may contact you for additional information or clarification during this verification process.

Step 5: Fund the Account

Once your corporate account is verified and approved, the next step is to fund the account. Brokers offer various funding methods, including bank transfers, credit/debit cards, and electronic payment systems. Choose the most convenient method for your company and ensure that the funds are transferred securely.

Step 6: Set Up the Trading Platform

After funding your account, set up your trading platform. Download and install the broker’s trading software, such as MetaTrader 4, MetaTrader 5, or any proprietary platform they offer. Configure the platform according to your trading preferences and ensure that it is functioning correctly.

Step 7: Start Trading

With your corporate forex trading account funded and the trading platform set up, you are now ready to start trading. Begin by familiarizing yourself with the platform’s features and tools. Develop and implement your trading strategies, leveraging the broker’s resources and support services to optimize your trading performance.

Are There Additional Fees for Corporate Trading Accounts?

Yes, compared to regular trading accounts, corporate trading accounts may incur additional fees. Here are some specific fees that could be unique or more prevalent in corporate trading accounts:

- Account Maintenance Fees: Corporate trading accounts often have higher maintenance fees compared to individual accounts. These fees cover the additional resources and support provided to corporate clients, such as dedicated account managers and enhanced reporting tools.

- Administrative and Legal Fees: Corporate accounts might also include administrative fees related to the verification and maintenance of corporate documents, such as certificates of incorporation and board resolutions. These fees can be charged for the initial setup as well as for ongoing compliance checks.

- Premium Service Fees: Corporate accounts often come with access to premium services, such as advanced trading platforms, in-depth market analysis, and priority customer support. While these services provide significant benefits, they may come at an additional cost that is not typically charged to regular trading accounts.

- Customized Solutions and Integration Fees: Corporate clients may require customized trading solutions or integration with their existing financial systems. Brokers may charge for these services and integrations, which are not usually necessary for individual traders.

- Higher Minimum Deposit Requirements: Although not a fee per se, corporate trading accounts often require higher minimum deposits compared to individual accounts. This higher capital requirement can be considered an additional financial burden specific to corporate accounts.

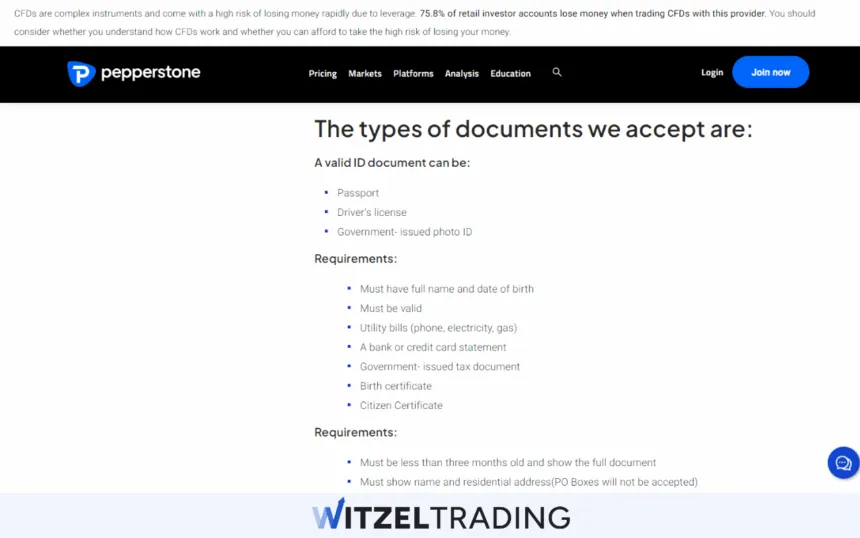

Which Documents Are Needed for Opening a Forex Trading Corporate Account

Opening a corporate forex trading account requires submitting various documents to verify the identity and legitimacy of your business. Here’s a comprehensive list of the essential documents typically required by brokers:

Certificate of Incorporation

This document is essential as it proves the legal existence of your company. It includes important details such as the company name, registration number, and date of incorporation. Ensure this document is up-to-date and certified.

Memorandum and Articles of Association

These documents outline the company’s purpose and the rules governing its operations. They detail the company’s structure, including the roles and responsibilities of its directors and shareholders. Brokers use these to understand the corporate governance of your business.

Proof of Registered Address

You will need to provide proof of your company’s registered address. Acceptable documents typically include recent utility bills, bank statements, or official government correspondence. These documents should be no older than three months.

Identification Documents for Directors and Authorized Signatories

Brokers require identification documents for all company directors and any individuals authorized to trade on behalf of the company. Acceptable forms of identification include passports or national ID cards. Some brokers may also require proof of address for these individuals.

Board Resolution

A board resolution authorizing the opening of the forex trading account is necessary. This document should specify the names of the individuals who are authorized to operate the account.

It needs to be signed by the company’s directors and should reflect a formal decision by the company’s board.

Corporate Bank Account Details

Brokers may require details of the corporate bank account that will be used for funding the trading account. This includes the bank name, account number, and SWIFT/BIC code. Having a dedicated corporate bank account ensures clear separation of personal and business funds.

Tax Identification Number (TIN)

Providing the company’s Tax Identification Number is often required for regulatory and compliance purposes. This helps the broker ensure that the company complies with tax regulations and anti-money laundering laws.

Financial Statements

Some brokers might request recent financial statements of the company. These documents provide insight into the financial health and stability of the business, which can be an important factor in the account approval process.

Additional Regulatory Documents

Depending on the broker and jurisdiction, additional documents might be required to comply with local regulations. This can include anti-money laundering declarations, risk disclosure statements, and other compliance-related forms.

See our related article on how to open a forex account as a private trader.

Conclusion

In summary, selecting the right forex broker for your corporate trading account is essential for a smooth and effective trading experience. The trading brokers we’ve reviewed – Vantage Markets, FP Markets, BlackBull Markets, Moneta Markets, and Pepperstone – are among the best options available, each offering unique benefits tailored to corporate needs. They provide competitive spreads, high liquidity, advanced trading tools, user-friendly platforms, and exceptional customer support.

When opening a corporate forex trading account, be aware of additional fees such as account maintenance and higher commissions, and ensure you have all necessary documentation like the Certificate of Incorporation and identification for directors. By considering these factors, you can choose the broker that best aligns with your corporate trading objectives and manage your trading activities with confidence.

Overview of the Top Forex Brokers for Corporate Accounts:

- BlackBull Markets – Advanced trading tools and analytics

- Vantage Markets – Competitive spreads and high liquidity

- FP Markets – Wide range of trading instruments

- Moneta Markets – User-friendly platform with excellent support

- Pepperstone – Low trading fees and fast execution

Frequently Asked Questions:

What Features Should I Look for in a Forex Broker for Corporate Accounts?

When selecting a forex broker for corporate accounts, look for features such as competitive spreads, high-leverage options, advanced trading platforms, and excellent customer support. Access to dedicated account managers and comprehensive market analysis tools is also beneficial.

Are There Any Specific Brokers Recommended for Corporate Forex Trading?

Yes, brokers such as Vantage Markets, FP Markets, BlackBull Markets, Moneta Markets, and Pepperstone are highly recommended for corporate forex trading. These brokers are known for their competitive spreads, advanced trading platforms, and services for corporate clients. Each offers unique benefits suited to different trading strategies and needs.

Can Corporate Accounts Access Advanced Trading Tools and Platforms?

Yes, most brokers offering corporate accounts provide access to advanced trading tools and platforms such as MetaTrader 4 and MetaTrader 5. These platforms offer sophisticated charting tools, technical indicators, and the ability to automate trading strategies. Some brokers also offer proprietary platforms with enhanced features tailored for corporate trading.

Do Forex Brokers Provide Market Analysis and Research for Corporate Accounts?

Yes, reputable forex brokers offer comprehensive market analysis and research tools for corporate accounts. These resources can include daily market reports, economic calendars, webinars, and access to professional analytics. Such tools help corporate traders make informed decisions and stay updated on market trends.

Is It Possible to Open Multiple Corporate Accounts With the Same Broker?

Yes, many brokers allow businesses to open multiple corporate accounts, enabling them to manage different trading strategies or business units separately. Each account might require individual documentation and approval processes. This flexibility helps businesses optimize their trading operations and manage risk more effectively.