PAMM (Percentage Allocation Management Module) accounts enable investors to earn returns from forex trading without needing to trade directly. We’ve carefully ranked the top five PAMM Forex brokers based on their performance, customer service, and financial benefits.

Our rankings are the result of thorough research and careful analysis, focusing on what matters most to investors and traders. Here’s a quick overview of our top picks and their key benefits:

Broker:

PAMM Account:

Advantages:

Account:

Yes, available

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

Yes, available

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

Yes, available

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

Yes, available

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

Yes, available

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

The 5 best PAMM Forex Brokers in Detail

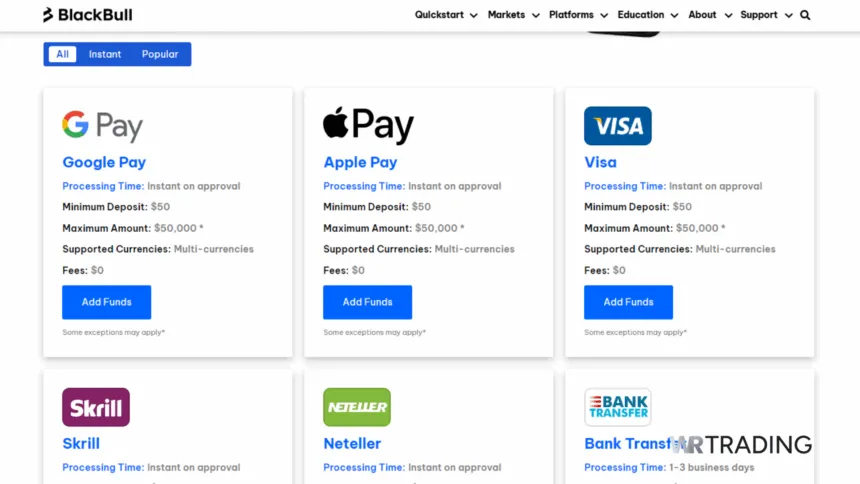

#1 BlackBull Markets

BlackBull Markets is a New Zealand-based PAMM Forex broker that has quickly gained recognition for its high-quality trading services and exceptional customer support. At WR Trading, we appreciate BlackBull Markets’ commitment to providing a professional trading environment with competitive spreads and fast execution speeds.

BlackBull Markets offers a range of account types, including ECN accounts with raw spreads, catering to different trading needs and preferences. Their PAMM accounts are designed to provide investors with maximum flexibility and transparency, enabling them to allocate their funds to skilled money managers with confidence.

BlackBull Markets is regulated by the Financial Services Authority (FSA) in Seychelles, ensuring a high level of trust and security for our clients at WR Trading.

| Broker | BlackBull Markets |

|---|---|

| Min. Deposit | $0 (PAMM account) |

| Regulation | FSA |

| Trading Instruments | Forex, Commodities, Indices (PAMM account) |

| Max. Leverage | 1:500 (PAMM account) |

| Trading Fees | Offers instant, fee-free deposits via bank transfers, cards, and e-wallets; withdrawals have varying times and potential fe.es |

| Trading Platforms | MT4, MT5, WebTrader, cTrader, TradingView |

| PAMM Account Platform | MT4 |

| Deposits & Withdrawals | BlackBull Markets does not accept clients from the United States, the UK, the the EU, Canada, or any non-resident of New Zealand. |

| Customer Support | Live chat, phone, email |

| Regional Restrictions | BlackBull Markets does not accept clients from the United States, UK, the the EU, Canada, or any non-resident of New Zealand. |

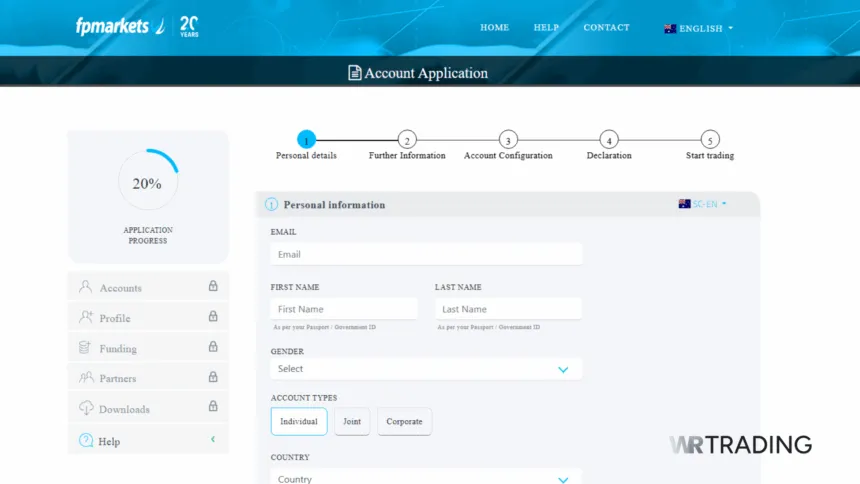

#2 FP Markets

FP Markets stands out as one of the most reliable and efficient PAMM Forex brokers in the market. At WR Trading, we appreciate FP Markets’ extensive range of trading instruments, including forex, commodities, indices, and cryptocurrencies. Their PAMM accounts offer flexible and transparent management, allowing investors to allocate their funds efficiently to skilled money managers.

FP Markets prides itself on offering competitive spreads and fast execution speeds, which are crucial for successful trading. Their user-friendly interface and comprehensive educational resources make it easy for novice and experienced traders to navigate the complexities of forex trading.

Moreover, FP Markets is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a high level of trust and security for our clients.

| Broker | FP Markets |

|---|---|

| Min. Deposit | $20,000 (PAMM account) – Exclusive Deal |

| Regulation | ASIC, CySEC, FSCA, FSA, FSC, ESMA |

| Trading Instruments | Forex, Commodities, Indices, Cryptocurrencies (PAMM account) |

| Max. Leverage | 1:500 (PAMM account) |

| Trading Fees | From 0.0 pips + $3 per lot (PAMM Raw account), From 1.0 pips (PAMM Standard account) |

| Trading Platforms | MT4, MT5, cTrader, TradingView, Mobile Trading App, WebTrader |

| PAMM Account Platform | MT4 |

| Deposits & Withdrawals | FP Markets does not accept clients from the United States, Iraq, Iran, North Korea, Syria, Afghanistan, Cuba, Liberia, Libya, Myanmar, Russia, Sudan, Yemen, Somalia, Palestine, or jurisdictions on the FATF and EU/UN sanctions list. |

| Customer Support | Live chat, phone, email |

| Regional Restrictions | FP Markets does not accept clients from the United States, Iraq, Iran, North Korea, Syri, Afghanistan, Cuba, Liberia, Libya, Myanmar, Russia, Sudan, Yemen, Somalia, Palestine, or jurisdictions on the FATF and EU/UN sanctions list. |

#3 Vantage Markets

Vantage Markets is another top contender among PAMM Forex brokers, known for its robust trading platform and exceptional customer service. At WR Trading, we have found that Vantage Markets offers a seamless trading experience through its MetaTrader 4 and MetaTrader 5 platforms, which are equipped with advanced charting tools and automated trading options.

One of Vantage Markets’ key advantages is its low-latency trading environment, which ensures rapid order execution. This feature is particularly beneficial for PAMM accounts, where timely trade execution can significantly impact overall performance.

Vantage Markets also offers a variety of account types, including ECN accounts with raw spreads, catering to different trading styles and preferences. With its robust regulatory framework, including the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA), and the Cayman Islands Monetary Authority (CIMA), Vantage Markets is a trusted choice for PAMM investors at WR Trading.

| Broker | Vantage Markets |

|---|---|

| Min. Deposit | $50 (PAMM account) |

| Regulation | ASIC, CIMA, SIBL, FSCA |

| Trading Instruments | Forex, Commodities, Indices (PAMM account) |

| Max. Leverage | 1:500 (PAMM account) |

| Trading Fees | Offers fee-free deposits through cards, bank transfers, and e-wallets, which are processed instantly. Withdrawals, however, incur fees and vary in processing time.s |

| Trading Platforms | MT4, MT5, WebTrader, Vantage App, TradingView, ProTrader |

| PAMM Account Platform | MT4 |

| Deposits & Withdrawals | Offers fee-free deposits via bank transfers and e-wallets, whic h are processed instantly. Withdrawals incur fees and vary in processing time.s |

| Customer Support | Live chat, phone, email |

| Regional Restrictions | Vantage Markets is not available to residents of the United States, Canada, China, Romania, Singapore, and jurisdictions on the FAFT and EU/UN sanctions list. |

#4 Moneta Markets

Moneta Markets has gained a reputation for its innovative forex trading approach and user-centric PAMM account offerings. At WR Trading, we have been impressed by Moneta Markets’ commitment to providing a secure trading environment and ensuring market transparency. Their PAMM accounts are designed to offer maximum flexibility, allowing investors to diversify their portfolios by allocating funds to multiple money managers.

Moneta Markets offers an intuitive web-based trading platform that is accessible from any device, making it convenient for traders on the go. Their competitive spreads and low commission rates make Moneta Markets an attractive option for investors and money managers.

Additionally, Moneta Markets is regulated by the Financial Sector Conduct Authority (FSCA), adding an extra layer of credibility and trust for our clients at WR Trading.

| Broker | Moneta Markets |

|---|---|

| Min. Deposit | $50 (PAMM account) |

| Regulation | FSCA, SLIBC |

| Trading Instruments | Forex, Commodities, Indices (PAMM account) |

| Max. Leverage | 1: 1000 (PAMM account) |

| Trading Fees | Accepts instant deposits via bank transfers, cards, and e-wallets; withdrawals use the same methods, with varying times and potential fee.s |

| Trading Platforms | MT4, MT5, WebTrader, Moneta App, ProTrader, AppTrader |

| PAMM Account Platform | MT4 |

| Deposits & Withdrawals | Accepts instant deposits via bank transfers, cards, and e-wallets; withdrawals use the same methods, with varying times and potential fees.s |

| Customer Support | Live chat, phone, email |

| Regional Restrictions | Moneta Markets restricts clients from the United States, Canada, Hong Kong, and any client in any country or jurisdiction where its use would be contrary to local law or regulation. |

#5 RoboForex

RoboForex is a well-established PAMM Forex broker known for its extensive range of trading instruments and innovative trading solutions. At WR Trading, we value RoboForex’s commitment to offering a diverse range of trading options, including forex, stocks, indices, commodities, and cryptocurrencies.

Their PAMM accounts offer a high degree of flexibility, allowing investors to choose from a wide variety of money managers based on their performance and trading strategies. RoboForex offers multiple trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, each with unique features designed to enhance the trading experience.

Their competitive spreads, low minimum deposit requirements, and robust educational resources make RoboForex an excellent choice for both new and experienced traders. RoboForex is regulated by the Financial Services Commission (FSC) of Belize, ensuring a secure and transparent trading environment for our clients at WR Trading.

| Broker | RoboForex |

|---|---|

| Min. Deposit | $10 (PAMM account) |

| Regulation | FSC |

| Trading Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies (PAMM account) |

| Max. Leverage | 1:2000 (PAMM account) |

| Trading Fees | From 0.0 pips (Prime account) From 1.3 pips (Pro account) |

| Trading Platforms | MT4, MT5, cTrader, R Trader |

| PAMM Account Platform | MT4 |

| Deposits & Withdrawals | Provides instant, fee-free deposits via bank transfers, cards, and e-wallets; withdrawals have varying processing times and may incur fees. |

| Customer Support | Live chat, phone, email |

| Regional Restrictions | RoboForex restricts clients from the United States, Turkey, Guinea-Bissau, Micronesia, Canada, Japan, Australia, Russia, Sint Eustatius, Tahiti, Northern Mariana Islands, Svalbard and Jan Mayen, Bonaire, Brazil, Curaçao, East Timor, Indonesia, Iran, Liberia, Saipan, South Sudan, and other restricted countries. |

What is a PAMM Trading Account?

PAMM accounts enable fund managers to oversee multiple trading accounts from a single platform, without the need to establish a separate investment fund. The profits and losses generated by the PAMM account manager are proportionally shared among the linked accounts.

In a PAMM setup, investors allocate their funds to a trader using the same broker, allowing a single trader to manage investments from numerous clients. This system enables traders to utilise their expertise to generate additional income.

Traders who are confident in their strategies can create their own PAMM fund to monetize their trading skills. Investors pay a fee based on the trader’s profits, providing a financial incentive for successful management.

Requirements for PAMM Accounts

PAMM account requirements differ based on the broker and the type of account. Some brokers require a trading history and a high minimum deposit to open a PAMM account. For example, FP Markets requires a six-month trading history and a high minimum deposit of $20,000.

However, a minimum investment amount, often around $100 or €100, is generally required. If the account balance drops below a certain level due to withdrawals, it may be automatically closed.

Initial deposits and withdrawals usually have a minimum amount set by the manager, and subsequent transactions also have minimum limits.

Transparency is also crucial, with top PAMM accounts often required to provide real-time reporting on performance, transactions, and any changes to trading strategies or management decisions. Additionally, brokers implement anti-money laundering (AML) procedures to prevent illegal activities.

How Does a PAMM Account Work in Detail?

In a PAMM trading account, investors combine their funds into a single account managed by a professional trader, the PAMM Account Manager. This manager is responsible for making all trading decisions and executing trades on behalf of the investors.

Each investor’s share of the pooled capital is calculated as a percentage of the total account balance. Profits and losses from trading activities are distributed proportionately based on each investor’s contribution. PAMM accounts offer investors access to the financial markets, allowing them to leverage the expertise of experienced traders without requiring personal trade management.

For the traders managing these accounts, acting as a PAMM Account Manager offers the opportunity to trade with a larger capital base, potentially enhancing profit opportunities. Additionally, managers often charge a performance fee based on the profits generated, which aligns their interests with those of the investors and motivates them to achieve positive results.

Here’s a detailed guide from experts at WR Trading to how PAMM accounts work:

Sign Up For a PAMM Account

To get started, you need to open a PAMM account with an online forex broker. Many brokers offer PAMM accounts, so the first step is to sign up with one of them.

Deposit Funds

After setting up your account, you deposit your funds into the PAMM account. The minimum deposit amount varies by broker, but many brokers set low minimums to make these accounts accessible to a broader range of investors.

Select a Trader

After depositing funds, you choose a trader or team of traders, known as Account Managers, to handle your investments. It is essential to review the available traders’ performance history, strategies, and fees.

Align with Your Goals

Ensure the trader’s track record and approach match your investment goals and risk tolerance. This will ensure that your investment meets your needs.

Trader Manages the Investment

Once chosen, the Investment Manager makes all the trading decisions on your behalf. Multiple investors can select the same PAMM Manager, who can also manage several PAMM accounts for different strategies.

Pooling Funds

Funds from various investors are combined to trade in the foreign exchange (forex) market, aiming to generate profits. The Investment Manager charges a performance fee, usually a percentage of the profits.

Profit and Loss Distribution

Profits and losses are distributed among investors in proportion to their contributions. The Investment Manager earns a performance fee from the profits and their share. If there are losses, they are distributed proportionately among investors, and no performance fee is charged.

Trading Rounds

Profits or losses are distributed at the end of each trading round, which can last days to months, depending on the strategy. The Investment Manager then starts the next round of trading.

PAMM vs MAM Accounts

MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) accounts are managed forex accounts where a money manager trades on behalf of investors. Still, they differ in terms of fund allocation and control.

PAMM Account

In a PAMM account, the money manager executes trades on a master account, which is proportionately mirrored in the investors’ sub-accounts. Profits and losses are distributed based on each investor’s share of the total pooled funds. This method offers transparency but limits the manager’s ability to manage risk and allocate trades individually.

MAM Account

A MAM account, which is also used in conjunction with a master account and sub-accounts, provides the manager with greater customisation. The manager can manually adjust each investor’s allocation of profits, losses, and trades. This enables better risk management and customisation tailored to individual investor profiles.

| MAM Account | PAMM Account | |

|---|---|---|

| Trade allocation | It can be customized for each investor | Fixed according to each investor’s share of the total pool |

| Profit/Loss distribution | Adjustable for each investor | Proportional to each investor’s stake in the total fund |

| Risk management | Tailored for each investor | Same for all investors, proportional to their share |

| Flexibility for money manager | High | Moderate to low |

Pros and Cons

A Percentage Allocation Management Module (PAMM) account is a type of investment structure in which investors allocate their funds to a skilled trader, who manages accounts across multiple accounts. This setup presents both unique advantages and disadvantages that potential investors should carefully consider.

- Centralized Management

- Profit Sharing

- Controlled Access

- Ease of Investment

- Accountability

- Significant losses

- Not very transparent

- Drawbacks

Pros:

- Centralized Management: Brokers can manage multiple investors’ funds on a single platform, with the software handling all calculations and no limit on the number of clients.

- Profit Sharing: A successful trader earns profits from their investments and their clients.

- Controlled Access: The PAMM manager does not have direct access to the investors’ accounts, providing a layer of security for investors.

- Ease of Investment: Investors can efficiently allocate their capital to various PAMM managers by depositing funds once and distributing them accordingly.

- Accountability: Since the manager’s capital is also at risk, it ensures they act in the best interest of all investors, as any mismanagement also affects their funds.

Cons:

- Investors can face significant losses if the broker doesn’t let the managing trader set a maximum loss limit.

- PAMM accounts are typically not very transparent, making it difficult to understand the management strategy.

- A significant drawback is that all traders in a PAMM account must use the same Forex broker, limiting flexibility.

Risks

The risks associated with MAM/PAMM accounts are mainly similar to those of standard trading accounts. These include the potential for trade losses, price slippage during significant news events, and issues with the broker.

One particular concern with MAM/PAMM accounts is the varying account balances of sub-accounts. Sub-accounts with substantial capital can engage in more trades. In contrast, those with smaller balances might be unable to participate in all the trader’s transactions due to regulatory leverage constraints.

This discrepancy can result in different performance outcomes for each sub-account. It’s essential to consider your frequency and capital to ensure all sub-accounts have sufficient funds to fund margin requirements.

How We Tested the Best PAMM Forex Brokers

At WR Trading, we employed a meticulous testing and analysis methodology to evaluate the top PAMM forex brokers. Our process began by verifying the regulatory status and financial security of each broker.

We assessed account types, minimum deposit requirements, and the functionality of trading platforms. We also thoroughly examined trading costs, including spreads and fees. We analysed the responsiveness of customer support and the efficiency of deposit and withdrawal processes.

The performance and transparency of PAMM accounts were analyzed through historical data and risk management strategies.

Additionally, we reviewed educational resources and gathered user feedback to understand each broker’s reputation. This rigorous, unbiased evaluation ensures that our recommendations are based on reliable and comprehensive data.

How to Set Up a PAMM Account

At WR Trading, we’ve put together an easy guide to help you open a PAMM account:

Step 1: Pick a PAMM Broker

First, choose the right broker. There are many options, so compare features, fees, and regulations to find the best fit for you.

Step 2: Open a Trading Account

After picking your broker, you’ll need to open a trading account. This typically involves completing an online form with your personal and financial information. Some brokers may require a minimum deposit before you can begin trading.

Step 3: Select a PAMM Manager

Next, choose a PAMM manager to handle your funds. Evaluate their past performance, risk management strategies, and trading methods to make an informed decision.

Step 4: Fund Your Account

Once you’ve chosen a PAMM manager, it’s time to fund your account. You can do this via bank transfer or credit/debit card.

Step 5: Keep an Eye on Your Investments

Finally, regularly monitor your investments to ensure they are on track. You can view your account details and performance reports online and make adjustments to your portfolio as needed.

Conclusion

Choosing the right PAMM Forex broker is crucial for success in the forex market. At WR Trading, we have thoroughly tested and analyzed these five brokers – FP Markets, Vantage Markets, Moneta Markets, RoboForex, and BlackBull Markets – to bring you the best options available.

Each of these brokers offers unique features and benefits, making them suitable for different trading styles and preferences. By partnering with a reliable PAMM Forex broker, you can enhance your trading experience and maximize your investment potential.

List of 5 Best PAMM Forex Brokers:

- BlackBull Markets: Best overall PAMM broker with competitive spreads.

- FP Markets: High-quality trading services with excellent customer service.

- Vantage Markets: Exceptional customer service with multi-social trading platforms.

- Moneta Markets: Flexible PAMM accounts and a global CFD broker with low trading fees.

- RoboForex: Diverse trading options with a wide range of tradeable assets.

Frequently Asked Questions on PAMM Forex Brokers

What is The Minimum Deposit Required For A PAMM Account?

The minimum deposit varies by broker. For example, FP Markets requires a minimum deposit of $20,000

Are PAMM Accounts Regulated?

Yes, reputable brokers offering PAMM accounts are regulated by financial authorities such as ASIC, the FCA, the FSCA, the FSC, and the FSA.

Can I Choose My Money Manager In a PAMM Account?

Yes, investors can select their money manager based on performance and strategy.

How Are Profits And Losses Distributed In a PAMM Account?

In a PAMM account, profits and losses are distributed based on each investor’s share of the total investment pool. If an investor contributes 10% of the pool, they receive 10% of the profits or bear 10% of the losses. This ensures returns are proportional to each investor’s contribution.

How Do I Withdraw From My PAMM Account?

Withdrawing from a PAMM account is generally easy. Log in, go to the withdrawal section, and submit your request. Some brokers may request additional information or documents for security purposes, so it’s a good idea to review their specific requirements first.