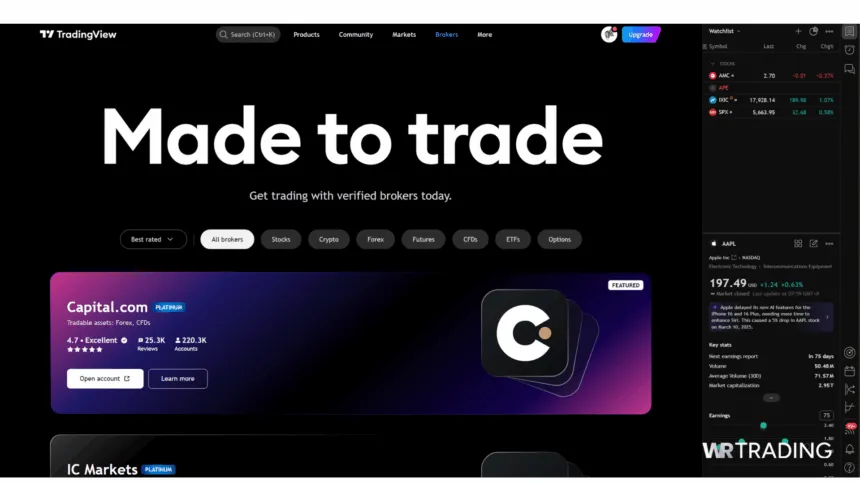

Although TradingView has comparatively limited supported brokerages, it has found favour with stock, ETF, cryptocurrency, and forex traders. Here, we’ll dissect which brokers offer the best TradingView experience and explain how and why we rate them.

These are the best 5 TradingView brokers due to our comparison in 2025:

Broker:

Platform:

Advantages:

Account:

TradingView

(+ Promo: You Can Get The Pro Versions For Free)

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1Lott

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

TradingView

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1Lott

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

TradingView

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1Lott

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

TradingView

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1Lott

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

TradingView

- Low-latency execution

- No Minimum Deposit

- Spreads from 0.9 Pips

- Leverage up to 1:1000

- High liquidity and fast execution

- TradingView, MT4, MT5

See our full video review of the top 5 TradingView Brokers here:

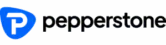

1. BlackBull Markets

BlackBull Markets is one of the more prominent supported brokers, known for its strong customer support and competitive trading conditions.

With a user-friendly platform, transparent fee structure, and integration with TradingView, BlackBull is our top pick among the brokers listed here.

It appeals to both novice and experienced traders. It offers a wide range of forex pairs, crypto assets, and many other instruments, making it a logical choice if you want to benefit from TradingView’s advanced charting tools.

Indeed, the BlackBull site promotes the TradingView platform, celebrating the collaboration as something that can “take your trading to the next level.”

Key Facts about the TradingView Broker BlackBull Markets:

| Feature | Information |

|---|---|

| Key features | Great balance of dynamic trading tools and environment for novices and pros alike, with excellent Support services |

| Minimum deposit | $0 |

| App download | Forex, stocks, commodities, CFDS, indices, crypto over 26,000 instruments |

| Trading costs | Forex, stocks, commodities, CFDS, indices, crypto, over 26,000 instruments |

| Assets to trade | Forex, stocks, commodities, CFDS, indices, crypto over 26,000 instruments |

| Broker execution speed | BlackBull’s average execution speed is > 75 milliseconds, which compares favorably to the industry average of 130 milliseconds |

| Regulation | The Seychelles Financial Services Authority (FSA) |

| Inbuilt copy & algo trading | No |

| Is TradingView free at the brokerage? | Yes, TradingView Essential (aka Basic), TradingView Plus & TradingView Premium with sufficient trading volume |

| Other apps available | cTrader, MetaTrader 4/5, BlackBull Invest, BlackBull CopyTrader |

| Support | Industry-leading Support on hand 24/7 |

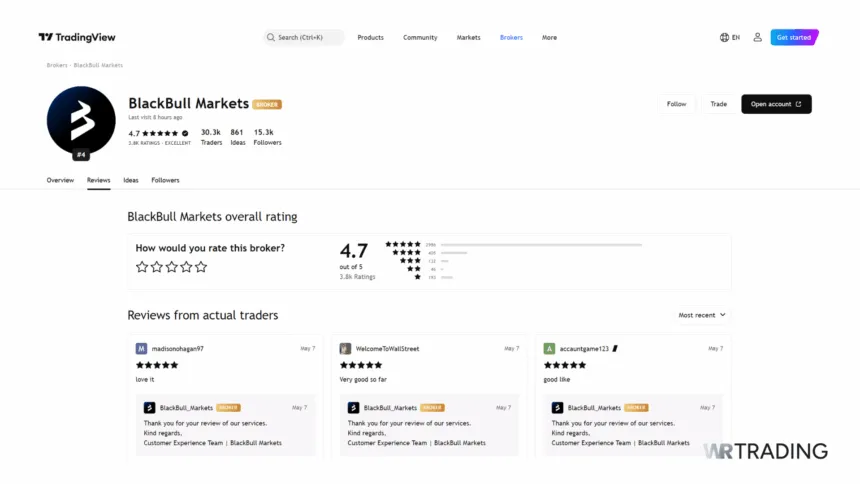

2. FP Markets

FP Markets stands out as a TradingView-supported broker with a solid reputation for low-latency execution and always competitive spreads.

This broker offers a wide selection of trading instruments, including various forex pairs, cryptocurrencies, and many CFDS.

The combination of fast execution speeds and a diverse range of instruments makes FP Markets a good choice if you combine TradingView’s excellent charting and standard risk and reward tool with a broker’s low-latency dynamism.

Key Facts about the TradingView Broker FP Markets:

| Feature | Information |

|---|---|

| Key features | Low latency execution, low fees, 10,000+ CFD products, |

| Minimum deposit | $50 |

| App download | Spreads on FP Markets are known to be low, from 0.0 pips, and commissions on RAW accounts are $3 per lot per side. |

| Trading costs | You can download their Android or ios app for free |

| Assets to trade | Forex, stocks, bonds, indices, metals, commodities, crypto-10,000+ CFD products |

| Broker execution speed | Spreads on FP Markets are known to be low, from 0.0 pips, and commissions on RAW accounts are $3 per lot per side. |

| Regulation | The average execution on FP Markets has been documented as > 12 milliseconds, thrashing the industry average of 130 milliseconds, thanks to their focus on execution speed as policy, with supporting infrastructure. |

| Inbuilt copy & algo trading | No |

| Is TradingView free at the brokerage? | Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA) of The Seychelles, Cyprus Securities and Exchange Commission (Cysec) |

| Other apps available | cTrader, MetaTrader 4/5, cTrader, Iress, Mottai, Webtrader |

| Support | cTrader, MetaTrader 4/5, Iress, Mottai, Webtrader |

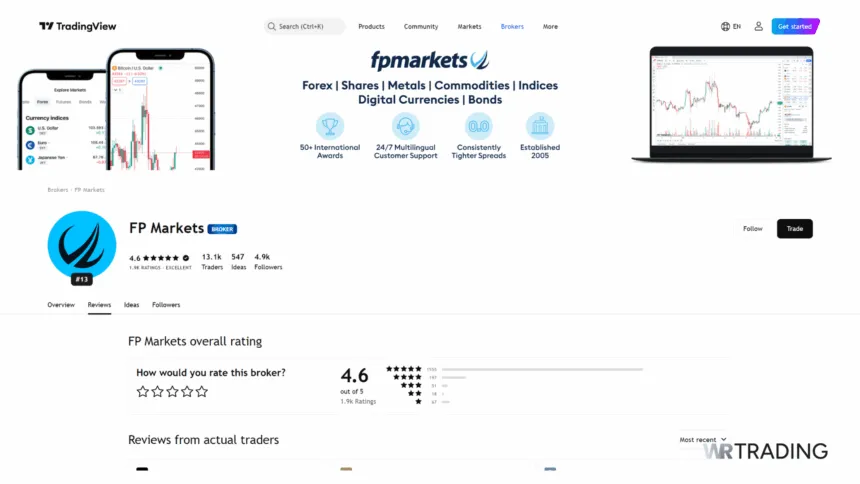

3. Vantage Markets

Vantage Markets is favoured as one of TradingView’s supported brokers, and it will spoil you with its robust trading infrastructure and educational resources.

It offers various trading instruments, including forex and cryptocurrency CFDS, and is known for its strong customer support and comprehensive trading guides.

This broker is ideal if you want to combine TradingView’s excellent charting capabilities with a supportive environment that boasts advanced trading features.

Key Facts about the TradingView Broker Vantage Markets:

| Feature | Information |

|---|---|

| Key features | Advanced trading tools, competitive spreads, transparent pricing structures, CFD brokerage par excellence |

| Minimum deposit | $50 |

| App download | Spreads start at 0.0 pip for RAW ECN accounts (1.0 pip for Standard STP accounts) and $3 per round turn. |

| Trading costs | Yes, free TradingView Basic, and free TradingView Pro, Pro+, or TradingView Premium plan with a $500 deposit and notional $1 million trading volume |

| Assets to trade | Forex, shares, metals, indices, commodities, 34 crypto CFDs |

| Broker execution speed | An average execution speed of between 100 – 250 milliseconds, against the industry average of 130 milliseconds |

| Regulation | Australian Securities and Investment Commission (ASIC), Financial Sector Conduct Authority (FSCA) of South Africa, Financial Conduct Authority (FCA) UK, and Vanuatu Financial Services Commission (VFSC) |

| Inbuilt copy & algo trading | No |

| Is TradingView free at the brokerage? | Yes, free TradingView Basic, and free TradingView Pro, Pro+, or TradingView Premium plan with $500 deposit and notional $1 million trading volume |

| Other apps available | MetaTrader 4/5, Webtrader |

| Support | Good, 24/7 support |

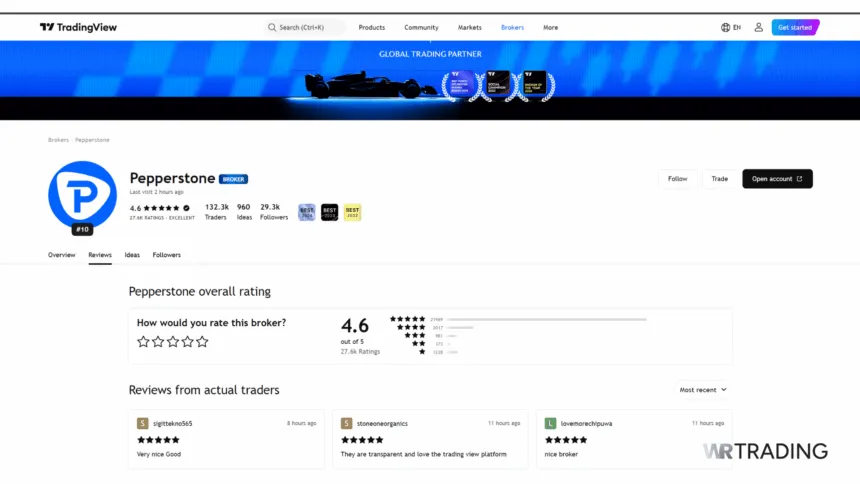

4. Pepperstone

Pepperstone is a TradingView forex broker that is becoming equally well-known as a TradingView crypto broker.

It offers comparatively low-cost trading and a user-friendly environment, giving you competitive spreads and market-related commission costs.

Offering a great selection of forex pairs and crypto assets, both novices and seasoned pros dig into TradingView’s charting ability via Pepperstone, with forex and CFD traders favouring the platform.

Key Facts about the TradingView Broker Pepperstone:

| Feature | Information |

|---|---|

| Key features | Extremely sleek trading technology with excellent Support, low latency, user-friendly platform |

| Minimum deposit | $0 |

| App download | Extremely sleek trading technology with excellent support, latency, and a user-friendly platform |

| Trading costs | Spreads on Razor accounts kick off at 0.0 pips, and commissions at $3.50 per side |

| Assets to trade | Spreads on Razor accounts kick off at 0.0 pips, and commissions at $3.50 per side. |

| Broker execution speed | Strong 24/7 Suppor,t including by phone |

| Regulation | Regulated by the Australian Securities & Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK |

| Inbuilt copy & algo trading | No |

| Is TradingView free at the brokerage? | TradingView Essential, Plus, or Premium subscriptions come free and auto-renew, courtesy of Pepperstone |

| Other apps available | MT4/5, cTrader |

| Support | Strong 24/7 Support, including by phone |

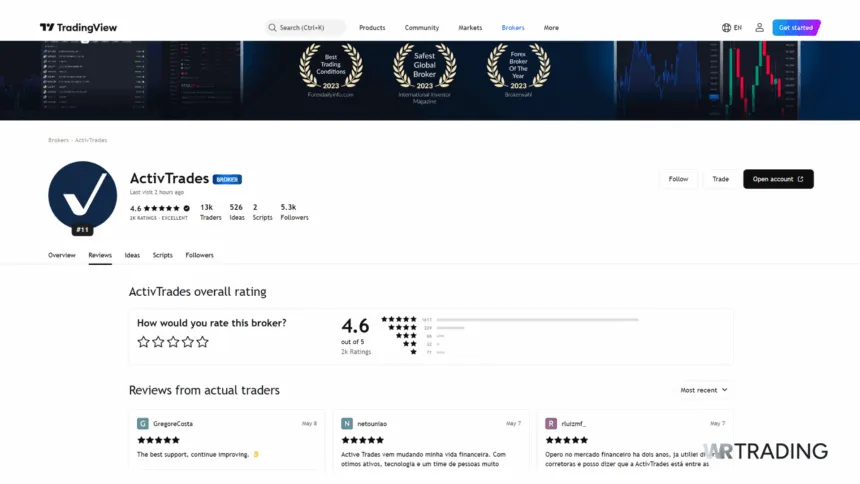

5. ActivTrades

UK-based ActivTrades is a TradingView forex broker (voted the Best Forex Broker Europe in 2022) and a hotbed for CFD traders.

With low trading fees on most assets and an intuitive platform feel, ActivTrades attracts new and intermediate traders as well as pros who enjoy the straightforward design and fast execution.

Although ActivTrades’ product portfolio is comparatively meagre compared to FP Markets or BlackBull’s extensive range, its marriage with TradingView allows you to dive deep into your preferred asset analysis and enjoy rapid subsequent execution.

Key Facts about the TradingView Broker ActivTrades:

| Feature | Information |

|---|---|

| Key features | Low-latency execution, great support for educational resources |

| Minimum deposit | $0 |

| App download | ActivTrades outperforms the rest with an average execution time of > 4 milliseconds, far ahead of the industry average of 130 milliseconds. |

| Trading costs | Forex, indices, shares, bonds, commodities, ETFS, and cryptocurrencies |

| Assets to trade | ActivTrades outperforms the rest with an average execution time of > 4 milliseconds, far ahead of the industry average of 130 milliseconds. |

| Broker execution speed | ActivTrades puts the rest in the shade with an average execution time of > 4 milliseconds, which is far ahead of the industry average of 130 milliseconds |

| Regulation | Regulated by the Financial Conduct Authority (FCA) in its hometown and the Comissão do Mercado de Valores Mobiliários (CMVM) elsewhere in the EU |

| Inbuilt copy & algo trading | No |

| Is TradingView free at the brokerage? | Yes, TradingView Basic |

| Other apps available | MetaTrader 4/5 |

| Support | Low-latency execution, great supporting for educational resources |

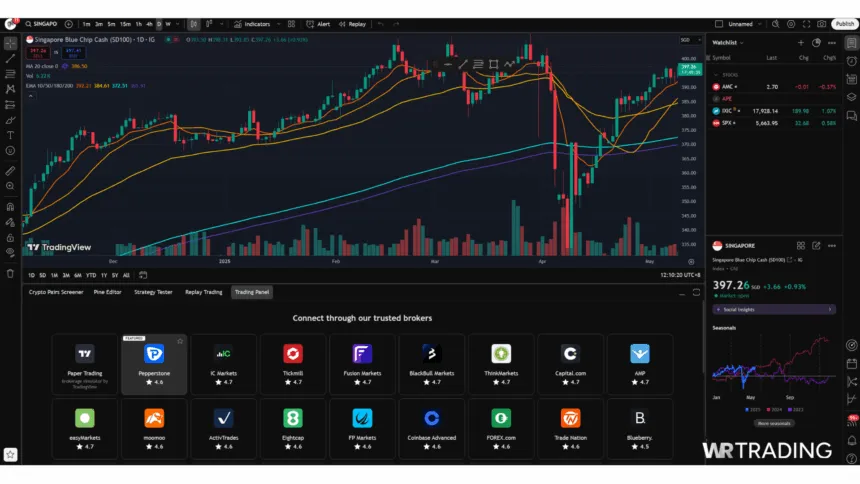

How to Connect Your Broker with TradingView:

To connect your broker with TradingView, start at your TradingView account, ideally logging into both your TradingView and broker accounts:

- Open a trading panel and look for your preferred broker on the displayed list.

- Click “Connect” (you’ll be prompted to sign into your broker account, unless you’re already signed in).

- If you want to connect multiple brokerages where you have accounts, you’ll need to do them one by one (some brokers will require that you fund a live account before connecting to TradingView, if you haven’t already).

How to Trade with Your Broker on TradingView:

- Once you’ve connected your broker with TradingView, log in and open a Trading Panel to view charts and look for trading opportunities.

- Your broker account credentials will be managed through the connection setup (you don’t need to log in separately to the brokerage after you’ve made the connection, as that initial integration handles the communication between TradingView and your broker).

- You can access TradingView’s charting tools and place trades directly from TradingView using the TradingView interface.

- You’ll see Buy/Sell buttons directly on the charts in TradingView, the market spreads, and you can adjust contracts on the RHS.

- When you click on Buy or Sell, an order execution window opens.

- You’ll set up and complete your orders, and your broker will implement the actual execution (TradingView immediately sends your initiated trade orders to your brokerage, which then executes them).

How Good is the Execution Speed on TradingView?

Since TradingView itself doesn’t execute trades but handles the actual trade execution, the speed of execution you experience will depend on your chosen broker.

The speed with which your trade is executed depends on your broker’s capabilities and infrastructure.

Broker infrastructure will encompass their trading hardware (servers and the like), order routing system, and liquidity provision.

Execution speeds can also be impacted by market volatility and the order type to some extent, which is why it’s crucial to opt for a broker such as those on this list, which are known as low-latency brokerages with a commitment to speedy execution.

What Are Important Things to Consider when Choosing a TradingView Broker?

Known as an outstanding charting tool, first prize goes to low-latency brokers that give away more than TradingView Basic for free.

The quality of integration between TradingView and supported brokers is consistent so that you can examine the broker’s available assets and trading costs and (very importantly) its known execution speed.

When choosing between TradingView broker options, consider these factors:

- Execution speed. Brokers are highly aware of their execution capabilities and speed, with the better options having a strong focus on the capacity for handling orders and getting them active with lightning speed.

- Trading costs. While trading costs are generally competitive all around, repeatedly higher costs can erode your profitability over time, so it’s essential to do your homework and figure out where you’re best able to marry the instruments and trading strategies you desire, with the best value for money.

- The most fantastic range of instruments won’t always mean the best opportunities for you, so with execution speed paramount, sniff out the best cost scenario that still affords you the assets or instruments you utilise in your strategies.

- Strong Support. Never compromise on support. You’ll need it from time to time, and when you need it, you better get it- and you won’t have to if you choose from the TradingView brokers on this list.

What are Alternative Platforms where you can trade via Your Broker?

cTrader is a trading platform complete with advanced features that support the algorithmic and copy trading aspects of modern trading. TradingView doesn’t.

It’s a relatively sophisticated platform that is nonetheless intuitive. It’s growing in popularity, with many supported brokers worldwide.

There is also MetaTrader 4 (MT4), an oldie but a goodie, with at least as user-friendly an interface and loads of customisation options.

See here our comparison of the alternatives of TradingView:

MetaTrader 5 is an upgrade on MT4, offering more advanced charting tools and additional timeframes.

Conclusion:

TradingView sports excellent charting and an array of trading tools (including great trade analysis widgets) that have made it the most crucial charting aid for many traders.

Its pattern drawing and standard include risk and reward tools, further entrenching it as a truly indispensable platform for traders of various types. The right trading broker saves costs and ensures quick order execution.

Conversely, a platform like cTrader is on point with unlimited chart layouts and templates. It incorporates copy and algorithmic trading capabilities that meet the needs of thousands of modern traders. TradingView shines as a dynamic charting and market data platform that is hard to replicate.

Once again, here is our list of the best 5 TradingView brokers:

- BlackBull Markets – known for its excellent customer service and low spreads

- FP Markets – a great selection of instruments accompanied by low-latency execution

- Vantage Markets – a wide selection of instruments and customisation options awaits you

- Pepperstone – enjoyed by many traders for its ease of use and cost-sensitivity

- ActivTrades – a magnificent execution speed, together with low spreads and top-drawer training material

Frequently Asked Questions TradingView Brokers:

Can I trade forex and crypto on TradingView?

While the assets you can trade hinge on your chosen broker’s offering, TradingView supports trading both forex and cryptocurrencies through various brokers that integrate with the platform.

How do I know if TradingView supports my broker?

Go to the list of supported brokers in the ‘Trading Panel’ section of the TradingView platform, and you’ll find a comprehensive list of supported brokers there.

How do I benefit from using TradingView with a broker?

TradingView is a platform offering advanced charting tools, real-time market data, and a trading community. Still, you need a broker account for actual order execution, which also allows you access to a broad range of instruments. TradingView can only “trade” via a brokerage.

How do I choose the best TradingView broker for my needs?

Consider factors such as integration quality (it’s consistent across brokers), trading costs, the listed execution speed of the broker, their range of instruments, and customer support when choosing a broker. Certain brokers will benefit your preferred strategies and instruments, based on their focus or costs, so there’s no substitute for doing homework and analysing or even sampling the brokers on this list to see which one best suits you.

Are there other platforms similar to TradingView?

Yes, platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader offer many robust trading features and are also extensively integrated with various brokers, although TradingView shines as a charting tool above all else.

Can I use TradingView on MAC?

Yes, you can use TradingView on a Mac. It is one of the best Forex software programs for Macs.