Crypto CFDs are financial derivatives that enable traders to predict the price movements of cryptocurrencies without owning the actual assets. To trade Cryptocurrency CFDs on Bitcoin, Ethereum, and other assets, individuals need a reputable and regulated broker.

We have thoroughly examined the pros and cons of Crypto CFDs and selected 10 of the best cryptocurrency brokers to showcase in this guide. According to our analysis at WR Trading, here are 10 of the best CFD Crypto Brokers in 2026:

Broker:

Number of Crypto CFDs:

Features:

Account:

5 (BTC, ETH, SOL, LTC, XRP against USD)

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

21 (e.g. BTC, ETH, ADA, EOS, against USD)

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

44 (e.g. BTC, ETH, against USD, XAU)

- High Leverage up to 1:1000

- RAW ECN Spreads from 0.0 pips

- Fastest execution

- Attractive Bonus Programs

- Copy Trading

- MT4 / MT5

- Personal support 24/7

20+ (e.g. BTC, ETH, USDC, USDT)

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

12 (e.g. BTC, XRP, BCH, ETH, against USD & AUD)

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

23 (e.g. BTC, ETH, DASH, LTC against USD)

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4, MT5

40+ (e.g. BTC, ETH, LTC, XRP, against USD)

- Low Minimum Deposit: Only 0.001 BTC

- Spreads from 0.1 Pips

- Leverage up to 1:500 for crypto and 1:1000 for forex

- Multi-asset trading platform with crypto, forex, and commodities

- No KYC required for most account setups

- Integrated copy trading feature for novice traders

7+ (e.g. BTC, ETH, XRP, against USD)

- Commissions $2.25 per lot per side

- Spreads from 0.0 pips

- ASIC & VFSC regulated

- MT4, TradingView, cTrader

- Execution speed: 35 ms

7+ (e.g. BTC, ETH, XRP, LTC against USD)

- Commissions $2.25 per lot per side

- Spreads from 0.0 pips

- ASIC & VFSC regulated

- MT4, TradingView, cTrader

- Execution speed: 35 ms

30+ (e.g. BTC, ETH, DOGE, against USD)

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

#1 Vantage Markets

As our top ranked Crypto CFD broker, Vantage Markets has been in operation for over 14 years. It offers access to over 40 digital currencies, including major coins like Dogecoin, Cardano, Bitcoin, and Ethereum.

This broker enables traders to buy and sell cryptocurrency CFDs by predicting their price trends and capitalising on them to generate a profit. This means traders don’t have to deal with wallets or exchanges. Vantage Markets supports several trading apps on desktop and mobile platforms. This broker helps traders make informed decisions through technical analysis reports and market trend news.

It provides several educational resources and courses via its academy. Vantage Markets holds licenses from ASIC, FSCA, CIMA, SIBL, and VFSC.

Key Facts about Vantage Markets:

| Feature | Vantage Markets |

|---|---|

| Crypto CFDs | 5 – BTC, ETH, SOL, LTC, XRP against USD |

| Headquarters | Australia |

| Trading platforms | MetaTrader 4, MetaTrader 5, ProTrader, TradingView, Vantage App |

| Accounts | Standard STP, Raw ECN, Pro ECN, Swap Free |

| Account currency | USD, EUR, GBP, JPY, CAD, AUD, NZD, SGD, HKD, PLN |

| Transaction options | Bank transfer, Credit/Debit card, PayPal, Skrill, Neteller, Apple Pay/Google Pay, Perfect Money, Astropay, Broker-to-Broker Transfer |

| Minimum deposit | $50 |

| Leverage | Up to 500:1 |

| Commission | $1.50 per lot per side (Pro ECN account), $3.00 per lot per side (Raw ECN account), $0.00 per lot per side (Standard STP account) |

| Min Order | 0.01 lots |

| Spread | From 0.0 pips |

| Instruments | Forex, Commodities, Indices, Cryptos, Shares, ETFs |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection, No swap accounts, One Click Trading |

#2 BlackBull Markets

According to our analysis at WR Trading, BlackBull Markets takes the 2nd position. Selwyn Loekman and Michael Walker founded the company in 2014. Since its inception, BlackBull Markets has established a presence in more than 180 countries.

This financial enterprise offers about 26,000 tradable instruments, including metals, equities, commodities, and indices. BlackBull Markets provides trading platforms, including MetaTrader 4, MetaTrader 5, BlackBull Invest, BlackBull CopyTrader, cTrader, and TradingView.

The types of trading accounts on Blackbull Markets are ECN Standard, ECN Prime, and ECN Institutional. The ECN Standard account is ideal for beginner traders. It offers spreads from 0.8 and a minimum deposit of $0. ECN Prime is perfect for experienced traders. You can benefit from a spread of 0.1 and a commission of $6 per lot. High-volume traders opt for the ECN Institutional account, which has a minimum deposit requirement of $20,000.

You can enjoy favourable trading conditions, including trade execution speeds below 100ms, low minimum deposit requirements, and reliable customer support. BlackBull Markets offers comprehensive educational trading resources on its website, as well as over 3,000 tutorial videos on its YouTube channel.

Key Facts About BlackBull Markets:

| Feature | BlackBull Markets |

|---|---|

| Crypto CFDs | 21 – e.g. BTC, ETH, XRP, LTC, ADA, EOS against USD |

| Headquarters | New Zealand |

| Trading platforms | MetaTrader 4, MetaTrader 5, TradingView, BlackBull Invest, BlackBull CopyTrader, cTrader |

| Accounts | ECN Prime, ECN Institutional, ECN Standard |

| Account Currencies | NZD, USD, GBP, EUR, CAD, CHF, HKD, SGD, AUD, JPY |

| Transaction Options | Bank transfer, Credit/Debit card, PayPal, Skrill, Neteller |

| Minimum deposit | $0 |

| Leverage | 1:500 |

| Min Order | 0.01 lots |

| Spread | From 0.0 pips |

| Commission | Zero commission (ECN Standard). $6 per lot (ECN Prime), $4 per lot (ECN Institutional) |

| Instruments | (70+ forex pairs), stocks, indices, commodities, futures, and cryptocurrencies. |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection, No swap accounts, One Click Trading |

| Contests and bonuses | Refer a friend bonus |

#3 StarTrader

StarTrader, the third-best CFD broker on our list, is a multi-asset broker offering CFD instruments including cryptocurrencies, forex, equities, commodities, and indices, with regulation from authorities like the FCA, SCA, FSA, FSC, ASIC, and FSCA.

The broker provides access to over 44 crypto CFD pairs with leverage and features fast execution speeds and low spreads. StarTrader offers MetaTrader 4, MetaTrader 5, and its own platforms, with account types including Standard (commission-free, wider spreads) and ECN (raw spreads, commission) requiring a $50 minimum deposit.

Key Facts About StarTrader

| Feature | StarTrader |

|---|---|

| Available Crypto CFDs | Over 44 crypto CFD pairs, including BTCUSD and ETHUSD, including new pairings like BTCXAU and ETHXAU. |

| Headquarters | Seychelles. |

| Trading platforms | MT4, MT5, WebTrader, and mobile app. |

| Accounts | Standard STP, ECN, and Islamic (swap-free) accounts. |

| Account currency | AUD, CAD, EUR, GBP, USD, NZD. USDT. |

| Transaction Options | Cryptocurrency, Visa/Mastercard, E-wallets (STICPAY, Bitwallet), and International Bank Wire Transfers. |

| Minimum Deposit | $50 |

| Leverage | Maximum leverage up to 1:1000 for most assets. Up to 1:20 for stock CFDs. |

| Commission | ECN Account: $7 per standard lot, round turn.Standard STP Account: Commission-free |

| Min Order | 0.01 |

| Spread | ECN: from 0.0 pips; Standard: from 1.3 pips. |

| Instruments | Over 1,000 CFDs on Forex, commodities, indices, shares, ETFs, and cryptocurrencies. |

| Liquidity provider | A deep pool of 14 liquidity providers. |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Copy Trading, MAM/PAMM accounts, VPS hosting, trading on MT4/MT5, and advanced charting tools. |

#4 Moneta Markets

Moneta Markets is our fourth-best Crypto CFD broker. This broker offers over 40 cryptocurrencies, including Bitcoin and Ethereum, and enables you to trade both short and long crypto CFD assets while utilising leverage. With this financial company, you can access the crypto market 24/7. It has a regulatory license from the FSCA and undergoes regular audits to maintain the quality and integrity of its services.

Aside from crypto CFDs, Moneta Markets offers Share CFDs, commodities, indices, and forex, with spreads starting from 0.0%. Furthermore, this broker uses several Tier 1 liquidity providers, ensuring that all trades are executed at the best possible price. Moneta Markets incorporates ProTrader, AppTrader, CopyTrader, MetaTrader 4, and MetaTrader 5. Three types of accounts are available: Prime ECN, Ultra ECN, and Direct STP.

The direct STP account is suitable for beginners, featuring a minimum deposit of $50, spreads starting from 1.2 pips, and a 50% stop-loss level. The Ultra ECN account is ideal for professional high-volume Moneta Market Traders and managers, with a minimum deposit of $50,000 and spreads from 0.0 pips.

Traders who prefer scalping and use expert advisors can opt for the Prime ECN account, which features a 50% stop-out level and a commission of $3 per lot per side. These apps have the best tools for both technical and fundamental analysis, including an economic calendar and AI market buzz.

Key Facts About Moneta Markets:

| Feature | Moneta Markets |

|---|---|

| Available Crypto CFDs | 20+ – e.g. BTC, ETH, USDC, USDT |

| Headquarters | South Africa |

| Trading platforms | MetaTrader 4, MetaTrader 5, ProTrader, AppTrader |

| Accounts | Standard, True ECN, Islamic |

| Account currency | AUD, USD, GBP, EUR, CAD, CHF, HKD, SGD, NZD, JPY, BRL |

| Transaction Options | Bank transfer, Credit/Debit card, PayPal, Skrill, Neteller, Apple Pay/Google Pay, Perfect Money, Astropay, Broker-to-Broker Transfer |

| Minimum deposit | $50 |

| Leverage | 1:1000 |

| Min Order | 0.01 lots |

| Spread | From 0.0 pips |

| Commission | $0 per lot per side (Direct STP), $3 per lot per side (Prime ECN), $1 per lot per side (Ultra ECN) |

| Instruments | Forex, Commodities, Indices, Cryptos, ETFs, Bonds |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection, No swap accounts, One Click Trading |

#5 FP Markets

According to our analysis at WR Trading, FP Markets is the 2nd-best Crypto CFD broker. It is one of the most popular companies where you can trade the five most popular cryptocurrencies in the digital currency domain: Bitcoin, Ripple, Bitcoin Cash, Litecoin, and Ethereum.

The prices for these cryptocurrencies are not pegged to any other financial instrument or central bank authority. FP Markets offers MetaTrader 4 and MetaTrader 5, two of the most popular platforms for trading cryptocurrencies. These apps have customizable interfaces, allow one-click trading, and are compatible with Android, Mac, and iOS devices. Furthermore, we noticed that FP Markets enables fast trade execution with a latency as low as 40 milliseconds.

This company has up to 20 years of experience in the financial markets. It follows the regulations of the CySEC, ASIC, FSC, FSCA, ASFL, and FSA.

FP Markets utilises multiple tier-1 liquidity providers, ensuring traders have access to tighter spreads and deep liquidity. FP Markets has integrated TradingView, MetaTrader 4, MetaTrader 5, and cTrader into its trading platform offering. FP Markets provides various educational resources to help transform an amateur trader into a professional.

Key Facts About FP Markets:

| Feature | FP Markets |

|---|---|

| Crypto CFDs | 12 – available in major assets like Bitcoin, XRP (Ripple), Bitcoin Cash, Litecoin, and Ethereum for positions against USD and AUD |

| Headquarters | Australia |

| Trading platforms | MetaTrader 4, MetaTrader 5, WebTrader, TradingView, cTrader |

| Accounts | Standard, Raw ECN |

| Currencies | AUD, BRL, CAD, CHF, EUR, GBP, HKD, NZD, PLN, MXN, SGD, USD, ZAR |

| Transaction Options | Bank transfer, Credit/Debit card, PayPal, Skrill, Neteller |

| Minimum deposit | $100 AUD or equivalent |

| Leverage | Up to 500:1 |

| Min Order | 0.01 lot |

| Spread | From 0.0 pips |

| Commission | $0 per lot (standard account), $3 per lot per side (Raw ECN account) |

| Instruments | Forex, Commodities, Indices, Cryptos, Metals, Bonds, ETFs |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection, No swap accounts, One Click Trading |

#6 IC Trading

IC Trading is our fifth-best Crypto broker. This company has provided a viable environment for institutional and retail clients. With IC Trading, you can get variable spreads on the MT4 and MT5 trading apps.

These platforms are available on both Android devices and iPhones. Furthermore, we noted that IC Trading offers access to a trade risk calculator, a one-click trade module, and a spread monitor on its MetaTrader 4 app. Furthermore, clients can take trade positions from 1 micro lot to 200 lots.

IC Trading has formed a partnership with the top liquidity providers in the global market. It has state-of-the-art servers in New York. This broker is transparent in its business dealings, as it holds a license from the Financial Services Commission of Mauritius. IC Trading maintains a segregated account for clients’ funds.

Key Facts About IC Trading:

| Feature | IC Trading |

|---|---|

| Available Crypto CFDs | 21 – BTC, ETH, DASH, Litecoin, Bitcoin Cash, Ripple, EOS, Emercoin, Namecoin, PeerCoin, Polkadot, Stellar, Chainlink, Dogecoin, Tezos, Uniswap, Cardano, Binance Coin, Avalanche, Luna, Polygon Matic, Moonbeam, Kusama against USD |

| Headquarters | Australia |

| Trading platforms | MetaTrader 4, MetaTrader 5, WebTrader, cTrader |

| Accounts | Standard, Raw Spread |

| Account currency | USD, EUR, AUD, NZD, JPY, CAD, CHF, SGD, HKD, GBP |

| Transaction Options | Bank cards, PayPal, Visa, Neteller, Wire transfer, Broker to Broker, |

| Minimum deposit | $200 |

| Leverage | 1:1000 |

| Commission | $3 per $100,000 (for Raw spread account on cTrader and TradingView) $3.5 per lot per side (for Raw Spread account on MetaTrader $0 per lot per side (for Standard account on MetaTrader |

| Min Order | 0.01 lots |

| Spread | From 0.0 pips |

| Instruments | Forex, Commodities, Indices, Cryptos, Stocks, Bonds |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection, No swap accounts, One Click Trading |

#7 PrimeXBT

PrimeXBT started its operations in 2018, and today, it has customers from more than 150 different countries. This broker lets you trade cryptocurrencies like Bitcoin and other CFDs like oil, gold, stocks, and indices.

In 2025, PrimeXBT added a very popular trading system called MetaTrader 5 (MT5) through a partnership with PXBT Trading Ltd, giving traders powerful charting capabilities. You can also trade using their website platform or a mobile app. To fund your trading account with cryptocurrency, you can use Bitcoin (BTC), Ethereum (ETH), USD Tether (USDT), and USD Coin (USDC), among others.

To deposit regular government-issued money (like US Dollars or Euros), process large Crypto transactions, or make larger withdrawals, you will need to complete a full identity check. The platform also offers learning tools, like video guides and articles, to help you become a better trader.

Key Facts about PrimeXBT:

| Feature | PrimeXBT |

|---|---|

| Available Crypto CFDs | 40+ Crypto CFDs, BTC, ETH, LTC, XRP, Dogecoin, Solana, Cardano, Chainlink, Sandbox, Axie Infinity. |

| Headquarters | St Lucia. |

| Trading Platforms | PXTrader, PrimeXBT Mobile App, MetaTrader 5 (MT5). |

| Accounts | Standard Trading Account, Copy Trading Account, COV-Denominated Account, and Islamic (swap-free) accounts. |

| Account Currency | BTC, ETH, USDT, USDC, USD, EUR, and GBP |

| Transaction Options | Crypto Deposits (BTC, ETH, USDT, USDC), Fiat Deposits: Visa/Mastercard, Bank Transfer, AdvCash. Crypto Withdrawals to external wallets or Zengo, Fiat Withdrawals (Zengo integration). |

| Minimum Deposit | $10 (for most accounts). 0.001 BTC (for BTC-denominated accounts). |

| Leverage | Up to 1:500 |

| Commissions | Crypto CFDs: Variable spread fee. Crypto Futures: Maker 0.01%, Taker from 0.045%. |

| Min Order | 0.01 lots |

| Spread | Variable spreads from 0.0 pips. |

| Instruments | Over 100 instruments, including Crypto Futures, Crypto CFDs, Forex, Indices, Commodities, and Stocks. |

| Liquidity Provider | Internal order matching, external liquidity providers, top market makers, and multiple exchanges. |

| Mobile Trading | Yes |

| Affiliate Program | Yes |

| Trading features | Copy Trading, advanced charting tools, adjustable leverage, cross/isolated margin modes, “Buy Crypto” module, Negative balance protection, and an economic calendar. |

#8 Fusion Markets

Fusion Markets is a Forex and CFD broker licensed by ASIC, FSA (Seychelles), and VFSC. The broker is renowned for its low fees, fast trade processing, and no broker-imposed minimum deposit. You can trade more than 250 different markets, including cryptocurrencies. When you trade cryptocurrencies as CFDs, there are no extra commission fees.

Fusion Markets offers several types of accounts to suit different traders. The classic account has no separate commission, and the cost of trading is built into the spread. Then there is the zero account, where spreads start from 0.0 pips, but a small, low commission applies to each trade.

Key Facts about Fusion Markets:

| Feature | Fusion Markets |

|---|---|

| Available Crypto CFDs | Bitcoin, Ethereum, Litecoin, Stellar, EOS, Solana, Dogecoin, and more. |

| Headquarters | Melbourne, Australia. |

| Trading platforms | MT4, MT5, cTrader, TradingView, and mobile apps. |

| Accounts | Classic, Zero, and Swap-Free (Islamic). |

| Account currency | AUD, CAD, EUR, GBP, JPY, SGD, THB, USD, NOK, SEK, CZK, HUF, CHF, and DKK. |

| Transaction Options | Visa/Mastercard, PayPal, Skrill, Neteller, Crypto (BTC, ETH, LTC, USDT, XRP), Bank Wire, and other local options depending on region. |

| Minimum Deposit | $0 (no minimum). |

| Leverage | 1:2 for Retail clients in Australia (ASIC). Up to 1:500 (potentially higher in some regions) |

| Commission | Crypto CFDs: No commission |

| Min Order | 0.01 lots. |

| Spread | From 0.0 pips. 0.04% on Bitcoin and 0.09% on Ethereum. |

| Instruments | Over 250 CFDs on Forex, indices, commodities, metals, energies, shares, ETFs, and cryptocurrencies. |

| Liquidity Provider | Institutional liquidity providers via Gleneagle Securities. |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Copy Trading (Fusion+), API trading, VPS hosting (subject to conditions), and educational resources. |

#9 XTB

XTB started in Poland in 2002 and has grown into a global broker. It now serves customers in more than a dozen countries across three continents. What makes XTB special is the huge variety of instruments you can trade. This includes stocks, forex, commodities, and cryptocurrencies. This large selection means that all kinds of traders can find something that fits their strategy, and it is all provided within a safe and well-regulated framework.

The broker gives traders a choice between two main accounts. The first is a Standard account, which does not charge any separate commissions. The second is a Professional account, which offers the same spread structure as the Standard account but offers higher leverage. There is also an Islamic (Swap-Free) account for Shariah-compliant traders.

At the heart of XTB’s service is its own trading platform, called xStation 5. You can use xStation 5 on a website, on a desktop computer, or on a mobile app. It is very popular because it is easy to use while still providing powerful and advanced charts for analysis.

Key Facts about XTB:

| Feature | XTB |

|---|---|

| Available Crypto CFDs | Bitcoin, Ethereum, Litecoin, Ripple, Stellar, Dogecoin, and more. |

| Headquarters | Warsaw, Poland, and London, UK. |

| Trading platforms | xStation 5 (Web, Desktop, Mobile). |

| Accounts | Standard (spread-only), Professional, and Islamic (swap-free, variable spreads, and admin fee). |

| Account currency | Offers various currencies, including USD, AUD, GBP, PLN, JPY, and EUR. |

| Transaction Options | Bank transfer, credit/debit card, and e-wallets like Skrill and PayPal. |

| Minimum Deposit | No minimum deposit |

| Leverage | 1:2 for Retail clients (EU/UK). Up to 1:200, for professional clients under certain regulatory bodies. |

| Commission | No commission for crypto CFD trading on Standard accounts. |

| Min Order | 0.01 lots. |

| Spread | Variable from 0.0 pips |

| Instruments | Over 10,000 instruments, including Forex, Indices, Commodities, Stocks, ETFs, and cryptocurrencies. |

| Liquidity provider | Internal liquidity, X Open Hub. |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Advanced charting, sentiment analysis, market news, an economic calendar, risk management tools (stop-loss, take-profit), and a Trading Academy with educational resources. |

#10 Pepperstone

Pepperstone lets you trade many different instruments in the financial market, including cryptocurrencies. You can also trade commodities like oil and gold. To make trading easy for everyone, Pepperstone works with well-known trading platforms like MetaTrader 4, MetaTrader 5, cTrader, and TradingView. This means you get a seamless trading experience, whether you are just learning or have been trading for a long time.

Pepperstone also allows you to choose between different account types. You can pick a Standard account that has no extra fees, or a Razor account that gives you the lowest possible starting spreads for a small commission.

Key Facts about Pepperstone:

| Feature | Pepperstone |

|---|---|

| Available Crypto CFDs | A total of over 30 crypto CFDs are available. Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, Stellar, Dogecoin, and more. |

| Headquarters | Melbourne, Australia. |

| Trading platforms | MT4, MT5, cTrader, TradingView, and Pepperstone platform mobile app. |

| Accounts | Standard (spread-only) and Razor (commission + raw spreads) accounts. Islamic (swap-free). |

| Account currency | AUD, CAD, EUR, GBP, JPY, SGD, USD, NZD, HKD, and CHF. |

| Transaction Options | Visa/Mastercard, Apple Pay, Google Pay, PayPal, Skrill, Neteller, Bank Transfer, and BPay. No crypto deposits. |

| Minimum Deposit | $0. $200 recommended. |

| Leverage | 1:2 for Retail clients (EU/UK/AU). Up to 1:500 for non-EU/AU clients. |

| Commission | Standard Account: $0 Razor Account: $0 for crypto CFDs, $3.50 commissions on other assets. |

| Min Order | 0.01 lots. |

| Spread | Crypto CFDs: Variable from 0.0 pips. Razor Account: Spreads from 0.0 pips. |

| Instruments | Over 1,200 tradable instruments, including Forex, shares, indices, commodities, ETFs, and cryptocurrencies (as CFDs). |

| Liquidity provider | Multiple top-tier liquidity providers. |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Fast execution (often under 30ms), multiple copy trading platforms (MetaTrader Signals, DupliTrade, cTrader Copy), Smart Trader Tools for MT4/MT5, and API trading. |

Conditions of Crypto CFDs

While trading cryptocurrency CFDs, there are specific metrics that you need to understand. We will take you through them.

- Leverage: Leverage is a concept that enables traders to control a larger position with a smaller capital. It is a ratio that depends on the broker of choice and the cryptocurrency being traded. For crypto CFDs, you will likely see leverage ratios of 2:1, 5:1, 10:1, and 20:1

- Margin requirement: This is the amount of funds required to open and maintain a larger trading position. Let us imagine that a broker requires a 10% margin for Ethereum. It means that a trader needs $100 to open a $1,000 position.

- Liquidity: Liquidity is the ease with which a trader can exit or enter a market position without significantly affecting the price. For example, Ethereum and Bitcoin have high liquidity.

- Commission: This amount is the levy that a broker charges for each trade. This amount is usually a percentage of your trade.

- Spread is the difference between the ask and bid price of a cryptocurrency.

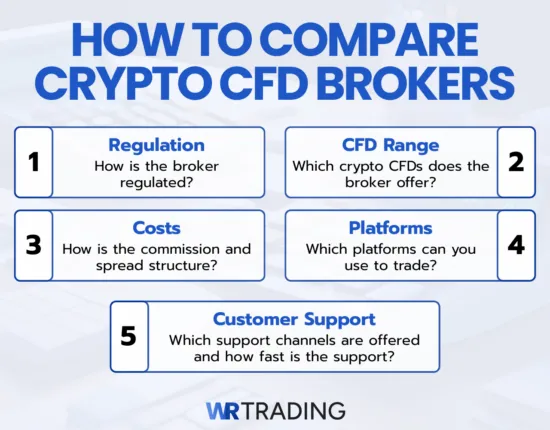

How We Compared the Best Crypto CFD Brokers

At WR Trading, we considered the following key factors in comparing the best crypto CFD brokers. They include:

- Regulation: We looked at how these brokers are regulated. Regulation is like having a government rule book that makes sure everyone follows the rules and plays fair. A broker that is regulated by a trusted body is a safe place to keep your money. That body keeps an eye on the broker to make sure they do not cheat you. If a broker is not regulated, your money might be at higher risk.

- Range of Crypto CFDs: We also checked the different kinds of crypto CFDs a broker offers. A good broker should have a wide menu of different crypto coins you can trade, from the most popular ones like Bitcoin to other less popular ones you may also want to try. Having a lot of choices lets you pick what you want to trade, so you are not stuck with only a few options.

- Costs: Some brokers charge a small fee for every trade (commission), while others include the cost in the price (spread). At WR Trading, we looked for brokers with low costs so you can keep more of your profits. We also made sure the costs are easy to understand, so there are no surprises later.

- Platforms: A trading platform is the app or website you use to trade. We looked for platforms that are easy to use, even for beginners. A good platform should have simple buttons, clear charts, and tools that help you trade better. A platform that is hard to use can make trading frustrating, so we made sure the ones we suggest have simple and easy-to-understand platforms.

- Customer Support: We looked for brokers who give fast and helpful support, no matter the time of day. Good customer support means that if something goes wrong with your trade, you have someone to help you fix it right away. We understand how it helps traders feel safe knowing that help is always there.

Pros and Cons of Crypto CFDs

According to our research, we believe that you can make profits while trading on reputable Crypto CFD brokers. However, this factor does not eliminate the risks associated with investing in this type of asset. We will educate you on the advantages and disadvantages of trading cryptocurrency CFDs.

Pros

- Short Selling

- Access to multiple digital assets

- No Ownership Required

Cons

- Complexity

- Leverage

Pros

The benefits of trading cryptocurrency CFDs include:

- Short Selling: Crypto CFD brokers give room for short selling. Short selling allows investors to make a profit from both falling and rising markets. Let us assume that you speculate around the rope in the pond. To benefit from this falling price, you can open a short position.

- Access to multiple digital assets: Cryptocurrency CFD brokers provide access to a wide range of cryptocurrencies. We noted that this helps people to diversify their investments and increase the probability of making a profit.

- No Ownership Required: During cryptocurrency CFD trading, investors don’t own the digital assets. Therefore, they don’t have to worry about their security or storage.

Cons

The risks associated with trading Crypto CFDs are:

- Complexity: Crypto CFDs are complex financial instruments that require skill to handle efficiently. Beginner traders may incur substantial losses when trading these assets without proper supervision.

- Leverage: The Crypto leverage from CFD brokers can amplify potential losses if the market moves against their trading position.

Where Are The Crypto CFDs Allowed and Forbidden?

Countries like Australia, Canada, and most of Europe freely allow the trading of Crypto CFDs. Oftentimes, brokers that offer this crypto CFD trading are based in countries with more relaxed financial rules.

However, countries like the United States and the United Kingdom believe that crypto CFDs are too risky, and so they are banned in these countries. Because the rules are different everywhere, it is an excellent idea to check what is allowed in your country before you start to trade.

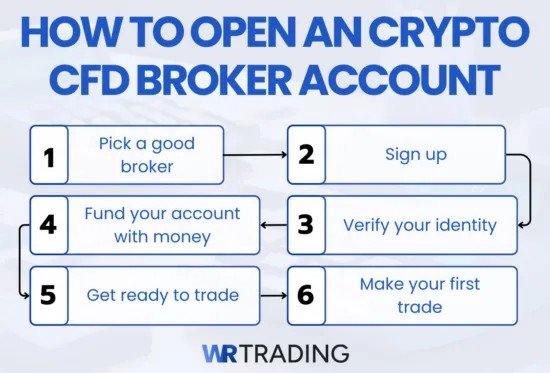

How To Open An Account With A Crypto CFD Broker

You can open an account to trade Crypto CFDs in the following steps:

- Pick a Good Broker: You need to choose a broker that offers Crypto CFDs and has a good reputation. Look for one that is overseen by a trusted financial group to make sure your money is safe. You should also check their fees, how many different crypto CFDs they have, and if their trading platform is easy to use.

- Sign Up: Once you choose a broker, go to their website and fill out a form to open an account. You will need to give your personal information, like your name, address, and email.

- Verify your Identity: The broker will need to verify your identity for compliance purposes and to keep your account safe. All you have to do is send them a copy of your ID, like a passport or driver’s license, and proof of your address, like a recent bill.

- Fund your Account: After your account is verified, you will need to fund it so you can start trading. You can do this using a bank transfer, a credit or debit card, or other online payment methods. Also, make sure to check if there is a minimum amount you need to put in.

- Get Ready to Trade: Once you have money in your account, you can start using the broker’s trading platform. Many brokers let you try out their trading features first with a demo account. This is a good idea to learn how they work without risking real money.

- Make Your First Trade: When you feel ready, you can start trading with real money. Choose the Crypto CFD you want to trade and decide if you think its price will increase or decrease. It is very important to use tools like “stop-loss” orders to help limit how much money you can lose if a trade goes wrong. Never trade more money than you can afford to lose.

Which Leverage Can Be Used On Crypto CFD Brokers?

Traders engaging in Crypto Contract for Difference (CFD) trading can utilize leverage from 1:2 up to 1:500, allowing them to control larger positions with a smaller amount of capital. In most parts of the world, and some countries outside of Europe, this what obtains.

How We Compared the Best Crypto CFD Brokers

At WR Trading, we considered several key factors before recommending and ranking these trading brokers. They include:

- Reputation: We vetted reliable crypto brokers with a proven track record in the financial industry. We read through the reviews and testimonials of many traders. Our priority is to recommend companies that will handle your funds efficiently.

- Range of Crypto Assets and Other Trading Resources: We ensured that all our recommended brokers offer a wide range of crypto assets. Additionally, we verified the availability of various trading tools and educational content to help you make informed decisions.

- Trading Conditions: We compared the available transaction options, withdrawal fees, spreads, commissions, and other relevant factors to determine the best conditions.

Crypto CFDs vs Real Cryptocurrency Trading

There are two ways to handle crypto assets: trading the actual digital asset or trading Crypto CFDs. Both methods have benefits and downsides. The table below shows the differences between them.

| Crypto CFDs | Real cryptocurrency | |

|---|---|---|

| Ownership | You do not own the crypto asset | You own the crypto asset |

| Leverage | You can use a small amount of funds to control larger positions | You need to pay the full value of the position |

| Short selling | Available | Generally not available |

| Trading fees | Spread and commission | Exchange fees (on every transaction) |

| Regulation / Security | Typically regulated by financial authorities | Varying levels of oversight (depending on the jurisdiction) |

Check out our complete guide about Crypto Trading if you want to know how to start!

Conclusion

When considering a broker for crypto CFD trading, factors such as trading platforms, fees, available assets, and regulatory compliance are important to evaluate. Some traders may prioritize features like copy-trading, while others may seek fast execution or an ECN experience.

We found Vanatge markets, Blackbull Markets, StarTrader, Moneta Markets, and FP Markets to be ahead of all the others in their offering of these features. Open a demo account with these recommended brokers and try out these features for yourself. It will be a valuable step in your crypto CFDs trading journey.

Once again, these are ten of the best CFD Crypto Brokers:

- Vantage Markets – Ideal for copy trading

- BlackBull Markets – Trusted global brand with diverse crypto offerings

- StarTrader – Offers access to 44 crypto CFD pairs with ultra-fast execution

- Moneta Markets – Good for professional traders

- FP Markets – Best overall CFD crypto broker

- IC Trading – Best for low spreads

- PrimeXBT – Offers a wide range of crypto CFD pairs and futures

- Fusion Markets – No minimum deposit, CFD crypto trading

- XTB – Offers over 40 crypto CFDs, weekend trading, and leverage up to 20:1

- Pepperstone – Offers competitive spreads on popular crypto CFDs

Frequently Asked Questions on Crypto CFD Brokers

What Are The Advantages of Trading Crypto CFDs?

Crypto CFD trading enables traders to utilise high leverage to maximise potential profits. Another benefit is that traders do not own the underlying crypto asset during CFD trading. This factor eliminates the cyber threats associated with using a digital wallet. Additionally, the availability of digital assets enables clients to diversify their investments and mitigate potential losses.

What Are the Risks Associated With Trading Crypto CFDs?

The higher leverage associated with cryptocurrency CFDs can lead to substantial losses for traders. Proper risk management strategies, such as the use of stop-loss orders, might be necessary to minimise the risks associated with crypto CFD trading.

Another challenge is counterparty risk, which occurs when your broker encounters financial difficulties and is unable to fulfil its obligations. To avoid counterparty risks, it is best to trade with regulated Crypto CFD brokers. If you are new to the cryptocurrency CFD trading world, you can use any of the five brokers that we have shown you in this guide.

What Are Crypto CFDs?

Cryptocurrency CFDs are financial derivatives that enable traders to analyse and predict potential price movements of cryptocurrencies without actually owning them. Depending on the position you take, you can make a profit or a loss while trading in a falling or rising market.

Is it Possible To Trade Crypto CFDs 24/7?

Yes, it is possible to trade crypto CFDs 24/7. The reason is the cryptocurrency market’s continuous nature. However, it is still necessary to confirm with your broker if they offer 24/7 cryptocurrency CFD trading.

How Do I Choose A Good Crypto CFD Broker?

Ensure that the broker has a license from a reputable regulatory agency. Check for charges such as commissions, spreads, and overnight trading fees. Additionally, ensure that the crypto broker offers competitive leverage ratios and has a robust customer support system in place.