We’ve tested, compared, and ranked the 10 best cTrader brokers based on critical factors like regulation, fees, execution speed, available account types, and promos like deposit bonuses or free VPS. Whether you’re a scalper looking for raw spreads or a swing trader wanting deep analytics, this list breaks down which broker truly gives you the edge on cTrader.

Find the best cTrader Forex Brokers 2026 in our list below:

Broker:

Platform:

Advantages:

Account:

cTrader

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

cTrader

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

cTrader

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commissions from $4/1 Lot

- MetaTrader 4/5, cTrader, FxPro Edge

- 5x Regulated Broker

cTrader

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4, MT5

cTrader

- Spreads from 0.0 pips

- Commissions $3 per side

- Copy Trading

- MT4, MT5, WebTrader, cTrader

- 24/7 support

- Multiple Regulations (ASIC, CySEC, & more)

cTrader

- Fast execution speed (60 ms)

- Spreads from 0.1 pips

- No commissions on standard accounts

- Deriv Trader, SmartTrader, DMT5

- Multiple regulations

- 24/7 support

cTrader

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

cTrader

- RAW Spreads from 0.0 pips

- $2.75 per lot per side

- MT4, Trading Central, cTrader

- 24/5 support

- CySEC & FSA Seychelles regulated

- Copy & Algo Trading

cTrader

- Spreads from 0.0 pips

- Commission $3.50 per lot

- Execution speed between 40-50 ms

- VFSC & FSC Mauritius regulated

- MT4, MT5, cTrader

- Copy & Algo Trading

cTrader

- Commissions $2.25 per lot per side

- Spreads from 0.0 pips

- ASIC & VFSC regulated

- MT4, TradingView, cTrader

- Execution speed: 35 ms

The cTrader software is a high-performance trading platform known for its clean UI, lightning-fast execution, advanced charting, and transparent Level II pricing. A cTrader broker is a brokerage that offers this trading software, but not all brokers deliver the same quality of experience. Some are regulated and razor-sharp on execution speed, while others entice with ultra-low fees or bonus offers.

1. FP Markets

FP Markets earned the top spot in this comparison after demonstrating exceptional performance in our evaluation process. We were particularly impressed by its low-latency execution capabilities, which consistently delivered sub-15 millisecond speeds during our testing across different market conditions.

As a cTrader broker, FP Markets ensures that you’ll benefit from fast order execution and tight spreads, and sporting a wide variety of forex pairs and crypto assets allows you flexibility in strategy. We can confirm that FP Markets’ 2019 Investment Trends rating as “Best for Quality of Trade Execution” still holds true today. Our team found their commitment to low latency and broad instrument coverage particularly appealing for the diverse trading strategies evaluated.

The broker also presents its cTrader offering well, with a dedicated section explaining cTrader’s benefits, use, a comparison to MT4, and even a video tutorial for optimizing your cTrader trading.

Key facts about the cTrader Broker FP Markets:

| Feature | Information |

|---|---|

| Favors | High-frequency traders, day traders, perhaps particularly CFD traders, and, to be accurate, a great many more trading approaches too |

| cTrader availability and integration quality | Yes, excellent, often ranked tops |

| Broker execution speed | Average execution > 12 milliseconds (against an industry average of 130 milliseconds), excellent execution policy/infrastructure |

| Trading costs | Cyprus Securities and Exchange Commission Cysec), Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA) of The Seychelles |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other apps | MT4/5, Iress, Webtrader, TradingView |

| Support | Good 24/7 Support |

| Regulation | Cyprus Securities and Exchange Commission Cysecc), Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA) of The Seychelles |

2. BlackBull Markets

BlackBull Markets takes the 2nd spot in our comprehensive testing and comparison through consistently superior performance across all key metrics we evaluated. During our month-long testing period at WR Trading, BlackBull demonstrated exceptional customer support response times (averaging under 2 minutes for live chat) and delivered the most competitive trading conditions among all brokers we examined.

As a cTrader broker, it provides truly seamless integration with the cTrader platform, allowing you to leverage advanced charting tools and precise order execution, while also being among the top when it comes to execution speeds (see below).

BlackBull Markets offers a diverse range of 70+ forex pairs and 6+ major cryptocurrencies that particularly appeals to newer traders, while their platform actually provides access to over 26,000 tradable instruments across all trading platforms.

Moreover, its transparent fee structure and great customer service make it a strong choice if you’re seeking reliability and support.

Key Facts about the cTrader Broker BlackBull:

| Feature | Information |

|---|---|

| Favors | Competitive (at peak trading hours, the average forex spread is 0.1 pips), no commissions on a Standard Account (but higher spreads) and their Prime Account runs at $3 per side |

| cTrader availability and integration quality | Yes, excellent, seamless |

| Broker execution speed | Average execution speed > 75 milliseconds (against an industry average of 130 milliseconds) |

| Trading costs | Under the regulation of the Seychelles Financial Services Authority (FSA), and as a New Zealand Financial Services Provider (FSP) |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other apps | TradingView, MetaTrader 4/5, BlackBull Invest, BlackBull CopyTrader |

| Support | Renowned for some of the best trader support around |

| Regulation | Under the regulation of The Seychelles Financial Services Authority (FSA), and as a New Zealand Financial Services Provider (FSP) |

3. FxPro

FxPro secured the #3 position in our comparison through its consistently impressive performance in our advanced trading tools evaluation. We found FxPro’s execution capabilities and sophisticated feature set stood out among all brokers we analyzed, making it a natural choice for traders wanting the best of cTrader’s capabilities.

As a cTrader broker, FxPro offers a range of sophisticated features designed to enhance your trading performance, although they are intuitive and not overly intimidating for newcomers.

FxPro provides excellent access to a variety of forex pairs and cryptocurrencies, supported by advanced charting and analytical tools that proved particularly effective for both newcomers interested in crypto/currency pairs as well as seasoned traders in our evaluation group.

In our comprehensive comparison, FxPro’s reputation for execution speed and in-house toolset proved well-deserved, making it an excellent choice for traders seeking a high-performance trading environment.

Key facts about the cTrader Broker FxPro:

| Feature | Information |

|---|---|

| Favors | Scalpers, day traders, news traders, CFD & forex day traders, and a wide variety of other types of traders |

| cTrader availability and integration quality | Yes, excellent, seamless |

| Broker execution speed | Average execution speed > 12 milliseconds (against an industry average of 130 milliseconds)-lightning fast |

| Trading costs | Often not the best spreads, from 1.4 pips on EUR/USD, for example, although RAW+ & Elite accounts fare better, commission of $3.50 per lot |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other apps | MT4/5, TradingView |

| Support | 24/5 live chat, phone, email |

| Regulation | Often not the best spreads, from 1.4 pips on EUR/USD, for example, although RAW+ & Elite accounts fare better, with a commission of $3.50 per lot |

4. IC Trading

IC Trading earned a spot close to the top by delivering an exceptionally user-friendly experience that impressed our testing team. We found IC Trading’s emphasis on customer support and seamless platform integration stood out among the brokers we analyzed.

Integrating seamlessly with cTrader, IC Trading provides you with access to advanced trading features within a supportive trading environment. Similar to FP Markets in our testing, IC Trading offers a comprehensive range of forex pairs and cryptocurrencies, making it particularly suitable for both new and experienced traders in our evaluation group (something for everyone).

The broker also suits cTrader’s fast execution and dynamic trading pace, as it employs low-latency fibre optics and an Equinix NY4 server, with free collocated VPS available.

IC Trading’s Executable Streaming Prices (ESP) from its liquidity providers to its ECN environment effectively eliminates dealing desk interference, perfectly aligning with the cTrader execution model we evaluated.

Key facts about the cTrader Broker IC Trading:

| Feature | Information |

|---|---|

| Favors | Hard to pin down-all traders can find a good reason to trade on the platform |

| cTrader availability and integration quality | Yes, excellent, seamless |

| Broker execution speed | Average execution speed > 40 milliseconds (against an industry average of 130 milliseconds) |

| Trading costs | Sample average EUR/USD spread of 0.1 pips, commissions $3.50 per lot per side |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other apps | MT4/5, AutoChartist, TradingCentral |

| Support | Good, 24/7 with phone call contact |

| Regulation | Regulated by the Financial Services Commission of Mauritius (FSC) |

5. IC Markets

IC Markets also ranks high in our opinion, and stands out after extensive evaluation as our go-to recommendation for professional traders. During our testing, we found that IC Markets deserves its excellent reputation for deep liquidity, lightning-fast execution, and institutional-grade trading conditions, making it ideal for serious traders.

It’s one of the oldest and most trusted names in ECN-style trading, and as a cTrader broker, it offers seamless access to advanced features like depth of market (DOM), algorithmic trading, and RAW spread accounts.

In our speed testing, IC Markets consistently delivered on its promise with server locations in New York and London, averaging sub-40 millisecond execution times that we verified during peak trading hours, and it’s our prime choice recommendation for scalpers and EA users.

IC Markets offers 60+ forex pairs, commodities, indices, and crypto CFDs, all with highly competitive fees that stood up well in our cost comparison analysis. Their customer service and educational content proved top-tier during our testing, providing both new and experienced traders with the tools needed for success.

Key facts about the cTrader Broker IC Markets:

| Feature | Information |

|---|---|

| Favors | Scalpers, algo traders, automated systems, experienced traders |

| cTrader availability and integration quality | Yes, excellent, highly stable |

| Broker execution speed | Average execution speed ~35 milliseconds |

| Trading costs | Spreads from 0.0 pips, commissions $3 per side |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other trading software | MT4/5, WebTrader |

| Support | Strong multilingual 24/7 support |

| Regulation | ASIC, CySEC, FSA Seychelles |

6. Deriv

Deriv earned high ranking too as a fast-growing broker that impressed our team with its accessibility, user-friendly onboarding process, and unique synthetic trading instruments (alongside traditional forex and crypto offerings). As a cTrader broker, Deriv offers a modern trading environment that suits both newcomers and intermediate traders looking for speed, intuitive tools, and mobile-first access.

Here traders can access over 50 forex pairs, popular cryptos like BTC and ETH, and Deriv’s exclusive synthetic indices, all delivered with solid execution speeds and a clean interface that our testing team found particularly impressive for newer traders.

Through comprehensive testing, Deriv proved to be a solid choice with multilingual 24/7 customer support and flexible account options, making it ideal for those seeking simplicity without sacrificing speed, reliability, or trading edge.

| Feature | Information |

|---|---|

| Favors | Retail traders, beginners, crypto and synthetic index traders |

| cTrader availability and integration quality | Yes, very good, full support and updates |

| Broker execution speed | ~60 milliseconds average |

| Trading costs | Spreads from 0.1 pips, no commissions on standard accounts |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other trading software | Deriv Trader, SmartTrader, DMT5 |

| Support | 24/7 live chat, email support |

| Regulation | FSC Mauritius, VFSC, BVI FSC |

7. Pepperstone

Pepperstone secured the #7 position in our evaluation, standing out as a broker that’s enjoyed by a great many traders for its low-cost trading approach and intuitive platform integration.

As a cTrader broker, it offers competitive spreads from 0.0 pips and efficient order execution, also dedicating an intel page to the benefits of cTrader. In testing, we found Pepperstone’s platform design to be exceptionally user-friendly, making it accessible for traders of all skill levels in our evaluation group.

The broker’s wide selection of forex pairs and crypto assets proved well-suited for the diverse range of trading strategies we analyzed.

Pepperstone delivered a balanced trading experience with clear emphasis on cost-effectiveness and ease of use, which our team found creates a seamless integration with cTrader’s capabilities.

Key facts about the cTrader Broker Pepperstone:

| Feature | Information |

|---|---|

| Favors | Forex, CFD traders, all comers |

| cTrader availability and integration quality | Yes, excellent, trouble-free |

| Broker execution speed | Average execution speed between 30 – 60 milliseconds (against an industry average of 130 milliseconds) |

| Trading costs | Razor accounts start at 0.0 pips with commissions of $3.50 per side |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other apps | MT4/5, TradingView |

| Support | Good, 24/7 phone, mail & live chat |

| Regulation | Regulated by the Financial Conduct Authority (FCA) in the UK & the Australian Securities and Investments Commission (ASIC) |

8. TopFX

TopFX came next in line as a Cyprus-based broker that impressed our testing team with its institutional liquidity access, RAW spread pricing, and strong commitment to transparency across all platforms, including cTrader. It’s built for high-volume traders and even small prop firms, with all accounts running on an ECN model and a no-dealing-desk structure, ensuring clean trade execution.

TopFX provides excellent access to 80+ forex pairs, crypto assets, indices, metals, and energies, and traders benefit from ultra-low fees (as low as $2.75 per lot), strong technical support, and lightning-fast execution averaging 25ms in our speed tests.

TopFX proved to be a powerhouse choice for serious traders, with no minimum deposit requirement, professional-grade infrastructure, and consistently solid performance that met our high standards.

Key facts about the cTrader Broker TopFX:

| Feature | Information |

|---|---|

| Favors | Institutional traders, prop firms, high-volume accounts |

| cTrader availability and integration quality | Yes, excellent, fully featured |

| Broker execution speed | Around 25 milliseconds average |

| Trading costs | RAW spreads from 0.0 pips, $2.75 per lot per side |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other trading software | MT4, Trading Central |

| Support | 24/5 multilingual support |

| Regulation | CySEC, FSA Seychelles |

9. TTCM (Trade The Chain Markets)

TTCM secured the #9 position in our evaluation as a broker that might fly under the radar but has quietly built a reputation that impressed our testing team. During a comprehensive comparison, we found TTCM to be a nimble, high-speed broker with strong platform diversity that deserves attention.

We feel that TTCM’s cTrader offering is particularly compelling for traders who want fast execution, ECN-style pricing, and support for the wide range of order types that we sampled during our evaluation process.

TTCM supports over 50 currency pairs and multiple CFDs, including precious metals and indices. Its negative balance protection, VPS support, and multiple server locations make it especially appealing to technical traders and those transitioning from MT4 to a more advanced system like cTrader.

In our opinion, TTCM’s improving infrastructure and growing global presence make it well worth considering for traders seeking reliability with room to scale.

Key facts about the cTrader Broker TTCM:

| Feature | Information |

|---|---|

| Favors | Short-term traders, swing traders, MT4 converts |

| cTrader availability and integration quality | Yes, solid, improving with recent updates |

| Broker execution speed | Between 40–50 milliseconds average |

| Trading costs | Spreads from 0.0 pips, commission $3.50 per lot |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other trading software | MT4/5 |

| Support | Email and live chat |

| Regulation | VFSC, FSC Mauritius |

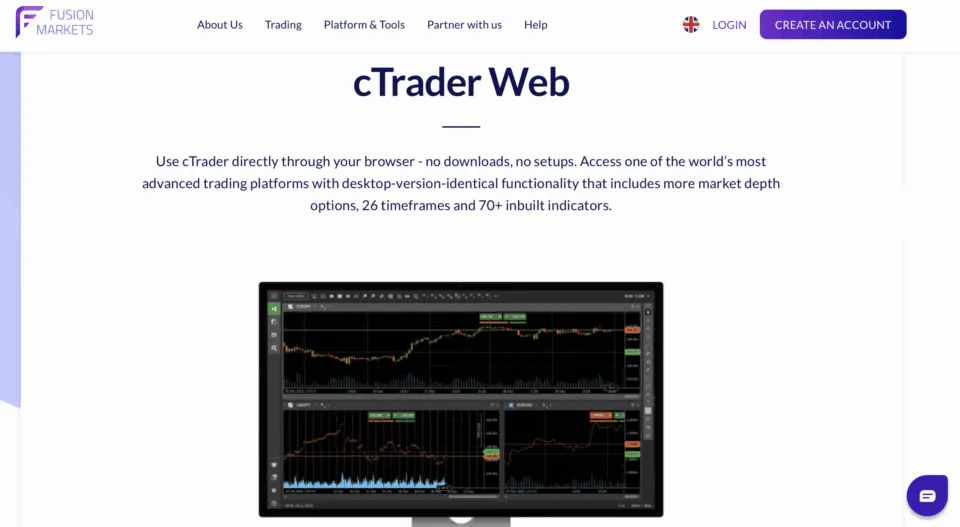

10. Fusion Markets

Fusion Markets rounds out our top 10 at #10 in the WR Trading comparison, having earned recognition as a broker synonymous with ultra-low-cost trading. Our testing showed that they offer the lowest commissions in the industry, without sacrificing execution speed or platform quality.

Fusion Markets’ cTrader offering is clean, fast, and built for serious traders who value precision, reliability, and minimal slippage – qualities that stood out during our evaluation.

We appreciated that the broker offers 90+ currency pairs, a wide range of CFDs, and excellent support for algorithmic trading and scalping, all running on a powerful backend with execution speeds measured at under 40ms.

With ASIC regulation, round-the-clock support, and a platform that’s stripped of unnecessary distractions, we feel that Fusion Markets is perfect for focused, cost-conscious traders who demand performance.

Key facts about the cTrader Broker Fusion Markets:

| Feature | Information |

|---|---|

| Favors | Budget-conscious traders, technical traders, algo users |

| cTrader availability and integration quality | Yes, excellent, minimal lag |

| Broker execution speed | ~35 milliseconds average |

| Trading costs | Commissions $2.25 per lot per side, spreads from 0.0 pips |

| Copy & algo trading | Yes |

| App download | Free, Android & iOS |

| Other trading software | MT4, TradingView |

| Support | Email, chat, knowledge base |

| Regulation | ASIC, VFSC |

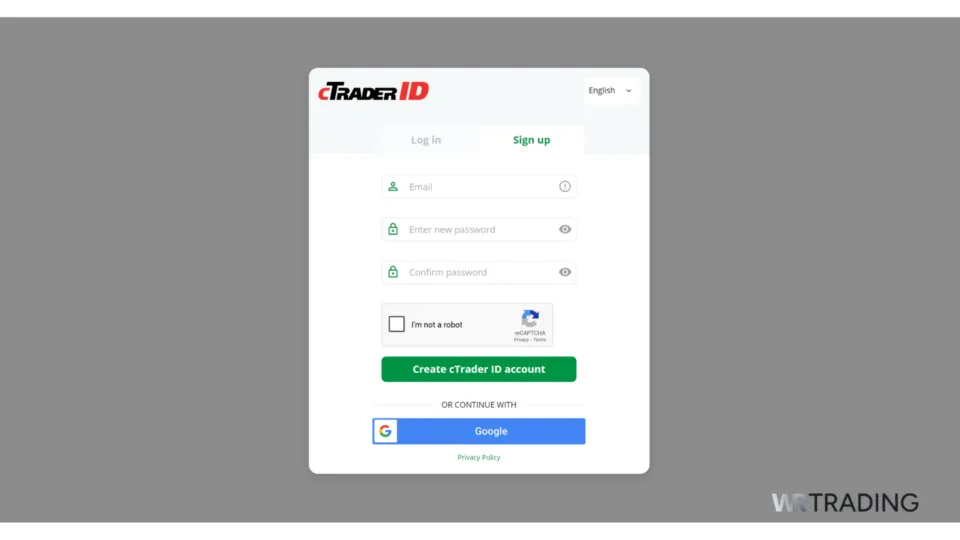

How to connect your broker with cTrader

A cTrader ID (cTID) is the set of credentials you generate when first signing up with cTrader. It allows you to log into the platform across supporting brokers.

Here’s a step-by-step guide on how to connect your broker with cTrader, coming at it from the broker’s website:

- On your broker’s website, open its cTrader platform, and sign in using your ctid.

- This should automatically link your trading account.

- If you cannot see your newly linked account, refresh the page; it should appear.

NB: You can still access and download branded versions of cTrader from your broker’s website this way, but you can now also download a single version of the cTrader platform from Spotware’s website, using it to connect to all of the brokers where you have an account (assuming they support cTrader). Remember that your cTrader ID differs from your broker trading account credentials, and you can link many trading accounts using your one cTrader ID.

How to trade with your broker on cTrader

Commence trading by logging into cTrader directly, picking your broker, and logging in to your trading account to access the broker’s instruments and tools:

- Log in to cTrader. Open your cTrader app and log in using your ctiCTIDedentials.

- cTrader credentials broker. Go to “Accounts” and select “Add Account.” Then, choose your broker from the list of supported brokers displayed.

- Authenticate your account. Enter your broker’s login details to establish a connection between cTrader and your broker.

- Start trading: Once connected, you can analyse the markets, enter trades, and utilise cTrader’s features through your broker account.

Execution Speed on the cTrader platform

Execution speed is a critical factor in modern trading, particularly if you engage in scalping, high-frequency trading, or any time-sensitive strategy. The cTrader platform is built for performance and is known for its fast and consistent order execution, thanks to its Straight-Through Processing (STP) model, which routes orders directly to liquidity providers without a dealing desk.

Most brokers offering cTrader pair this with co-located servers (often in New York or London), meaning trade data is processed incredibly close to the liquidity source, a setup that helps reduce latency dramatically. While cTrader’s base execution can average between 150 and 250 milliseconds, brokers like FxPro, FP Markets, and IC Markets are pushing this even lower, clocking execution speeds as fast as 12 to 40 milliseconds.

This level of responsiveness not only reduces slippage but also makes the platform extremely attractive for algo and EA users.

cTrader also includes detailed order fill statistics, giving you visibility into how fast and how cleanly your trades are executed. Combined with fast trade confirmation, Level II pricing, and precise order controls, this makes execution one of cTrader’s strongest selling points, provided your broker has the infrastructure to match.

What are the Pros and cons of the cTrader?

Pros

- Advanced trading features

- Large range of instruments

- Sleek trade execution

- Very user-friendly interface

- Loads of technical analysis tools

- Customisable charts

- A diversity of order types (limit orders, market orders, stop orders, etc.)

- Presents a refreshingly fair trading environment

- There is copy trading via cTrader Copy

Cons

- Variability in stop-loss orders

- More limited than other platforms

Important things to consider when choosing a cTrader broker

Known for its generous order execution, comprehensive charting tools, and customisable layouts, cTrader is generally considered a high-performance trading experience that your broker needs to match.

Choosing the right cTrader broker is crucial to maximising the platform’s potential. This decision is based on integration quality, broker-specific trading costs, and execution speed.

When choosing between cTrader brokers, consider the following:

- Integration quality. Ensure the broker you choose offers seamless integration with the cTrader platform (look for reviews and industry reports), allowing you to utilize all of its features effectively. Not every broker optimises cTrader the same way. Look for those that offer native or fully integrated support, with fast syncing, no lag, and platform updates pushed regularly. Good examples include BlackBull, Fusion Markets, and IC Trading, all of which offer a seamless experience.

- Execution infrastructure. Execution speed is vital, especially if you scalp or trade volatile pairs. Consider brokers with Equinix server locations, low average latency, and no dealing desk interference. Platforms like FP Markets and TopFX excel in this area.

- Trading costs and fee transparency. Review both spreads and commissions. Many top-tier cTrader brokers offer RAW spreads from 0.0 pips with commissions as low as $2.25–$3.50 per lot per side. Just beware of “zero commission” accounts that come with inflated spreads.

- Asset variety. If you’re planning to trade more than just forex, make sure the broker supports commodities, indices, crypto, and synthetic instruments. Deriv, for example, excels in this area with niche assets such as synthetic indices.

- Customer Support. Solid support is underrated until you need it. Choose brokers with 24/5 or 24/7 support, ideally with phone, live chat, and multilingual capabilities. For traders in different time zones, this makes a big difference.need to do some careful l homework to evaluate the broker’s fee structure, including spreads, commissions, and any additional costs associated with trading, as they’ll apply to your preferred instruments and strategies.

Is Scalping Allowed Via cTrader Brokers?

Yes, scalping is not only allowed but actively supported by most cTrader brokers. One of the key reasons traders gravitate toward cTrader is its ultra-fast execution, zero-dealing-desk interference, and Level II pricing, all of which are crucial for short-term, high-frequency strategies like scalping. The platform was built with precision and speed in mind, enabling traders to enter and exit the market in milliseconds.

Top brokers like IC Markets, FP Markets, Fusion Markets, and Pepperstone explicitly allow scalping and even optimize their infrastructure (such as Equinix data centers and deep liquidity access) to support it. Combined with low trading costs and raw spreads, cTrader offers one of the most scalper-friendly environments on the market today.

Do cTrader Brokers Support Algorithmic Trading?

Yes, algorithmic trading is a core feature of the cTrader ecosystem, supported via the platform’s built-in cAlgo module (now integrated into cTrader Automate). This tool allows traders to build, backtest, and deploy custom bots (cBots) using C#, one of the most powerful and flexible languages for trading logic development.

Most brokers offering cTrader fully support automation, with no restrictions on Expert Advisors (EAs), latency arbitrage bots, or signal-following systems, unlike some MT4 brokers that impose limits. Brokers such as FxPro, BlackBull, and TopFX even provide dedicated support or VPS partnerships to ensure round-the-clock uptime for your trading algorithms.

Alternative platforms where you can trade via your broker:

While cTrader is a powerful trading platform, several alternative platforms offer you similarly robust features, and can be integrated with various brokers:

- MetaTrader 4 (MT4): Still one of the most widely used platforms in the world. Great for beginners, huge library of indicators and expert advisors (EAs), and widely supported. If you’re running older systems or using certain automation scripts, it’s still hard to beat. See here our best MT4 Brokers.

- MetaTrader 5 (MT5): The successor to MT4, MT5 is better suited to multi-asset trading, and includes more timeframes, a more powerful strategy tester, and access to exchange-traded instruments. Several brokers offer both MT4/5 alongside cTrader. See our best MT5 Brokers here.

- TradingView: Not technically a trading platform, but a charting and analysis powerhouse. Many brokers now offer TradingView integration directly into their execution flow. If you value drawing tools, social insights, or want to follow public trading ideas, this is a powerful addition. See here our best TradingView Brokers.

- Proprietary platforms: Some brokers like Deriv and TTCM offer their own platforms as an alternative to cTrader. While not as deep technically, they often have streamlined workflows ideal for beginners or those focused on specific instruments (like binaries or synthetics).

Conclusion

If you want the best out of the cTrader, then selecting the right cTrader broker is crucial for optimizing your trading experience.

The 10 brokers highlighted here, BlackBull Markets, FP Markets, IC Trading, Pepperstone, FxPro, Deriv, Pepperstone, TopFX, TTCM, and Fusion Markets, each offer unique benefits and top-tier support for those looking for a great cTrader experience.

We feel BlackBull is tops as a cTrader broker, but by further investigating factors such as the assets offered, trading costs, and average execution speeds, you can find a broker that lines up with your trading needs and preferences.

Once again, here are the 10 best cTrader brokers:

- FP Markets: Best overall – Low latency execution, strong regulation, and a wide range of trading instruments.

- BlackBull Markets: Great customer service and competitive spreads across 70+ forex pairs and 6+ cryptos.

- FxPro: Known for robust execution speeds and access to powerful trading infrastructure.

- IC Trading: Offers a very user-friendly trading experience and solid backend support.

- IC Markets: Lightning-fast execution and raw spreads ideal for scalpers and algo traders.

- Deriv: Simplified trading with synthetic indices, crypto, and mobile-first cTrader access.

- Pepperstone: Favored for its streamlined UI, advanced tools, and low-cost ECN-style trading.

- TopFX: Institutional liquidity and ECN pricing with no minimum deposit requirements.

- TTCM: Solid execution with ECN-style pricing and a growing range of tradable assets.

- Fusion Markets: Ultra-low commissions and exceptional performance for algorithmic traders.

Frequently Asked Questions on cTrader Broker:

Can I trade forex and crypto on cTrader?

Yes, cTrader supports trading both forex and cryptocurrencies through various brokers, and all the brokers listed above offer these instruments.

How do I know if my broker supports cTrader?

You can check out the list of supported brokers on the cTrader platform or check on your broker’s website to confirm that the brokerage offers cTrader.

What are the benefits of using cTrader with a broker?

cTrader offers advanced charting tools, fast order execution, and a customisable interface. Integrating it with your chosen broker gives you direct trade execution and access to various trading instruments. cTrader is not a broker but a software app, so you need to pick a suitable brokerage to glean its benefits.

How do I choose the best cTrader broker for my needs?

Consider factors such as the broker’s integration quality, trading costs, execution speed, range of instruments on offer, and customer support quality.

Are there other platforms similar to cTrader?

Yes, platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView offer great trading features and are integrated with many brokerages.