A forex demo account is a virtual trading account that allows users to practice trading currencies in real-time market conditions. It offers simulated trading in a risk-free environment, ideal for learning strategies and platform functions without using real money.

To help you choose the right forex demo account, we tested and reviewed the top 10 providers. We evaluated each forex practice account based on ease of use, realism of trading conditions, supported currencies, and overall experience so that you can find the best fit for your FX trading journey.

Find the top 10 free and unlimited forex demo accounts in our comparison table 2026 below:

Broker:

FX Demo Account:

Advantages:

Account:

$ 100,000+ (Adjustable)

Unlimited And Free

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

$ 10,000+ (Adjustable)

Unlimited And Free

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

$ 10,000+ (Adjustable)

Unlimited And Free

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

$ 10,000+ (Adjustable)

Unlimited And Free

- CFTC & NFA regulated

- Spreads from 0.8 Pips

- More than 80 FX pairs

- Leverage up to 1:50

- No Commission

- TastyFX Web Platform, TastyFX Mobile App, MT4, ProRealTime

$ 10,000+ (Adjustable)

Unlimited And Free

- Offshore A-Book Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500

- High liquidity and fast execution

- MT4, MT5

$ 10,000+ (Adjustable)

Unlimited And Free

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- MT4/MT5/RTrader/CopyFX

$ 10,000+ (Adjustable)

Unlimited And Free

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

$ 10,000+ (Adjustable)

Unlimited And Free

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

$ 10,000+ (Adjustable)

Unlimited And Free

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4 ,MT5

$ 10,000+ (Adjustable)

Unlimited And Free

- Multiple regulated

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 2$/1 Lot

- Personal support

- MT4, MT5

Comparison of The Best 10 Forex Trading Demo Accounts:

Let’s examine the top 10 FX demo trading accounts, considering the main features, overviews, and pros and cons.

- BlackBull Markets is our most preferred choice for a Forex demo account due to its multi-platform support, a broad selection of account types, and a competitive variety of traded assets.

- Vantage Markets provides a FX demo account with the most flexible settings. It has the quickest signup process and the highest base account currency support compared to the other brokers.

- FP Markets is best for traders seeking a platform with the most financial instruments. The broker supports multiple charting software and allows users to open 10 demo accounts.

- TastyFX is tailor-made for US traders. There are a few regulated forex brokers in America, except for tastyfx, which is backed by IG.

- VT Markets suits traders looking for top market research analytics on MT4.

- RoboForex: The greatest strengths is that clients can open up to 50 demo accounts simultaneously.

- Pepperstone: Has the edge in supporting four popular trading platforms and offering unique account types during the demo stage, such as the zero-spread account.

- Moneta Markets is best for those who prefer direct market access while benefiting from other perks like high leverage and market selection.

- IC Trading sets itself apart with a wide market selection, leverage, and demo account balance, among other advantages.

- XM is a standout option for a competitive forex demo account and offers many customer support channels.

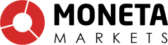

1. BlackBull Markets

We found BlackBull Markets’ forex demo account to be the overall best. This New Zealand-based CFD broker offers over 26,000 markets across popular asset classes, from forex to stocks. BlackBull lets you demo-trade on MT4, MT5, cTrader, and TradingView, an incredibly diverse range.

Our tests show that your account size is unlimited, and you can expand it anytime. We confirmed with BlackBull’s customer support that you can open up to five demo accounts, reset your balance, and have unlimited virtual funds.

Another advantage of BlackBull Markets is opening a demo account with seven different base currencies.

All these benefits make BlackBull Markets the best offering in our comparison guide.

| Feature | Information |

|---|---|

| Forex Demo Accounts | Standard, Prime, swap-free |

| Maximum Forex Demo Account Balance | N/A (automatically resettable) |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2014 |

| Regulators | FMA (New Zealand), FSA (Seychelles) |

| Supported Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Maximum Leverage | 1:500 |

| Maximum Number of Demo Accounts Allowed | 5 |

| Available Markets | Forex, stocks, commodities, futures, indices, crypto |

| Base Currencies Supported | USD, EUR, GBP, AUD, NZD, CAD, SGD |

| Available Customer Support Channels | Email, phone, live chat, WhatsApp |

Pros

- Demo trading is available on multiple platforms

- Unlimited demo account balance

- Numerous base account currencies

- Swap-free demo account available

- No specific maximum limit

Cons

- N/A

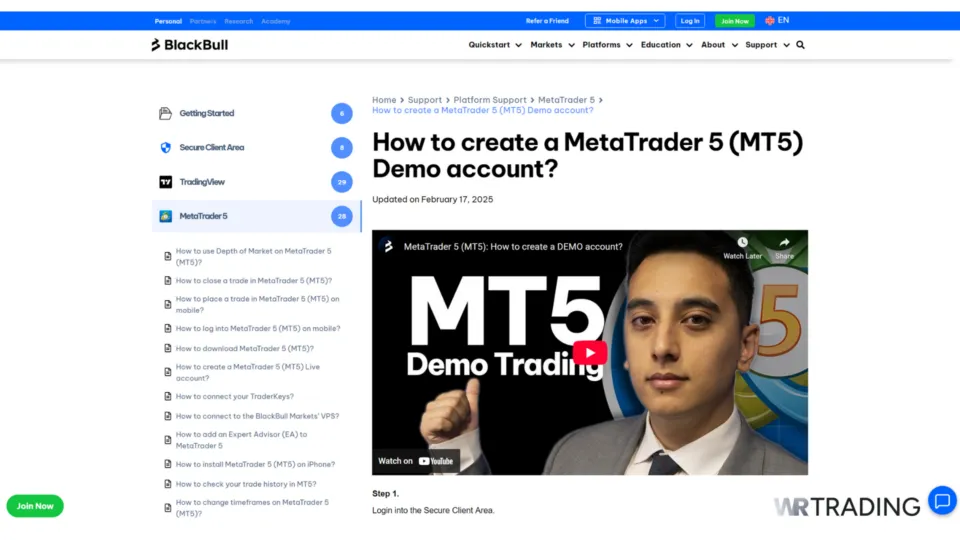

2. Vantage Markets

Vantage Markets is a forex broker from Vanuatu that has earned second place among the best demo accounts. As with BlackBull, the CFD provider lets you trade on the same four platforms (MT4, MT5, cTrader, and TradingView). However, you can open a demo account using MetaTrader charting packages.

Still, we admired the quick signup process with Vantage Markets, where little information was required. Unlike most brokers, it’s quite distinct that you can reset your demo account balance with brokers. Usually, one must contact customer support to reset, which is more time-consuming.

Vantage Markets shines by offering a demo account with the most flexible settings.

| Feature | Information |

|---|---|

| Forex Demo Accounts | Standard, Raw/ECN, Perpetual |

| Maximum Forex Demo Account Balance | $1,000,000 |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2009 |

| Regulators | ASIC (Australia), VFSC (Vanuatu), FSCA (South Africa) |

| Supported Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | 1:500 |

| Maximum Number of Demo Accounts Allowed | N/A |

| Available Markets | Forex, indices, commodities, stocks, ETFs, bonds, crypto |

| Base Currencies Supported | USD, EUR, GBP, JPY, AUD, NZD, CAD, SGD, HKD |

| Available Customer Support Channels | Email, phone, live chat |

Pros

- Fast demo account signup process

- Provides a high number of traded markets

- Resettable demo account balance

- Very high base account currency support

Cons

- Only MT4 and MT5 are available as demo accounts

- Limited number of demo accounts to open

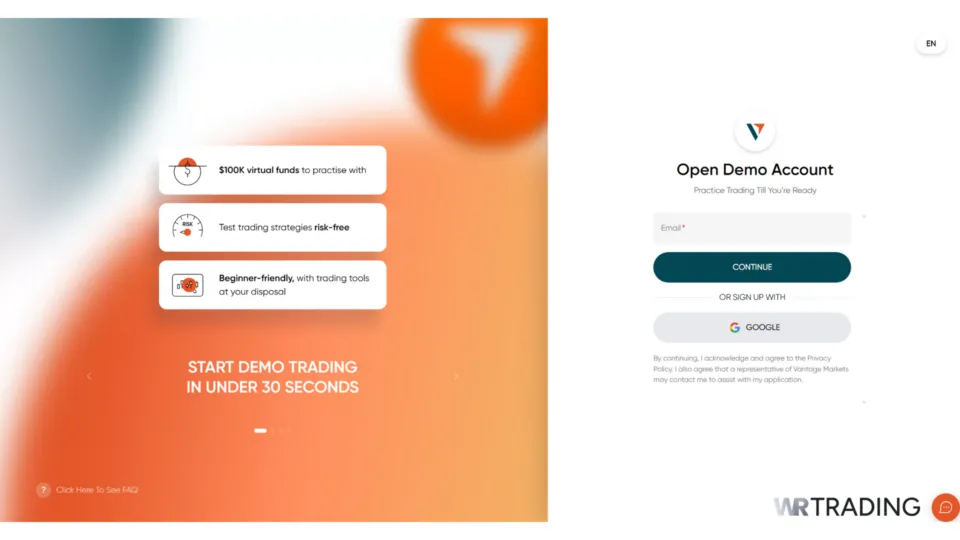

3. FP Markets

First Prudential Markets (or FP Markets) is a multi-regulated Australian CFD broker. Like Vantage, FP Markets allows you to trade on the MetaTrader, cTrader, and TradingView platforms.

FP Markets allows traders to open a demo account in 14 base currencies. This is quite convenient and a valuable change from the usual USD, EUR, and GBP-based accounts many brokers offer.

Furthermore, one can trade eight different asset classes, more than most other brokers.

| Forex Demo Accounts | Standard, Raw |

| Maximum Forex Demo Account Balance | N/A |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2005 |

| Regulators | ASIC (Australia), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), FSC (Mauritius) |

| Supported Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | 1:500 |

| Maximum Number of Demo Accounts Allowed | 10 |

| Available Markets | Forex, stocks, metals, commodities, indices, crypto, bonds, ETFs |

| Base Currencies Supported | USD, EUR, GBP, JPY, AUD, NZD, CAD, CHF, BRL, MXN, ZAR, PLN, HKD, SGD |

| Available Customer Support Channels | Email, phone, live chat |

Pros

- Multi-regulated

- Up to 10 demo accounts can be opened

- Demo trading is available on multiple platforms

- Multiple base account currencies supported

Cons

- Restricted leverage on retail accounts

- Long sign-up process

4. TastyFX

| Feature | Information |

|---|---|

| Forex Demo Accounts | Standard |

| Maximum Forex Demo Account Balance | $10,000 |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2019 |

| Regulators | CFTC |

| Supported Platforms | MetaTrader 4, TradingView, ProRealTime |

| Maximum Leverage | 1:50 |

| Maximum Number of Demo Accounts Allowed | 1 |

| Available Markets | Forex |

| Base Currencies Supported | USD |

| Available Customer Support Channels | Email, phone, live chat |

TastyFX (previously IG US) is a US-regulated broker part of the IG Group. It is a forex-only service that lets US traders to speculate on 82 pairs using MT4, along with the advanced TradingView and ProRealTime charting software.

The actual TastyFX platform is cutting-edge, boasting unique features like client sentiment data and trading signals from Autochartist. It also excels in its customer support, which is available 24/6. The broker also prides itself on having the tightest spreads with no commissions, a claim we confirmed through our testing.

In summary, TastyFX is ideal for American traders seeking a demo account by a regulated forex broker, backed by the existing powerhouse of IG.

Pros

- Regulated and part of the large IG Group

- Provides a wide range of currency pairs

- Great customer support

Cons

- Only available for US traders

- The broker only offers forex

- Only one base currency is supported

5. VT Markets

VT Markets is a multi-regulated broker established in 2015. Like Moneta, it boasts direct market access with its standard (STP) and raw (ECN) accounts. VT Markets provides a cent account (albeit only on a live account).

Another benefit is trading a good mixture of popular and not-so-popular markets with the broker.

We found VT Markets’ standout feature to be its integration with Trading Central on MT4. Trading Central is an AI-powered portal for market analytics, research, and trade opportunities.

| Feature | Information |

|---|---|

| Forex Demo Accounts | Standard, Raw |

| Maximum Forex Demo Account Balance | $100,000 |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2015 |

| Regulators | ASIC (Australia), FSCA (South Africa), FSC (Mauritius) |

| Supported Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | 1:500 |

| Maximum Number of Demo Accounts Allowed | N/A |

| Available Markets | Forex, indices, energies, metals, commodities, stocks, bonds, ETFs |

| Base Currencies Supported | USD, EUR, GBP, AUD, CAD |

| Available Customer Support Channels | Email, phone, live chat |

Pros

- Multi-regulated broker

- No limits on the number of demo accounts you can open

- $100,000 maximum demo account balance

- Great range of tradable assets

- Offers renowned Trading Central on MT4

Cons

- Cent account isn’t available during the demo stage

6. RoboForex

RoboForex is a Belize-based derivatives broker founded in 2009. It offers two MetaTrader-based accounts (ECN and Pro) and a demo account for its proprietary R StocksTrader platform.

RoboForex’s most notable feature is its maximum leverage (up to 1:2000), which is perfect for the more speculative traders. Despite the higher risk, RoboForex demo accounts allow these traders to test their ideas and strategies.

Other advantages of RoboForex include opening numerous demo accounts and the lack of balance limits. Finally, traders should consider the broker’s $30 welcome bonus when switching to a live account.

Overall, Roboforex features bare-bones demo functionality but stands out by allowing you to open up to 50 demo accounts.

| Feature | Information |

|---|---|

| Forex Demo Accounts | ECN, Pro, R StocksTrader |

| Maximum Forex Demo Account Balance | N/A |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2009 |

| Regulators | FSC (Belize) |

| Supported Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | 1:2000 |

| Maximum Number of Demo Accounts Allowed | 50 |

| Available Markets | Forex, commodities, metals, ETFs, futures, indices, stocks |

| Base Currencies Supported | USD, EUR |

| Available Customer Support Channels | Email, phone, live chat, Telegram, WhatsApp, Messenger |

Pros

- High maximum leverage

- Decent demo account type range

- Competitive market selection

- Wide range of customer support options

- Ability to open up to 50 demo accounts

Cons

- Limited market support on MetaTrader platforms

7. Pepperstone

Pepperstone is a multi-regulated Australian broker with appealing demo trading benefits. Live account holders can open up to 10 demo accounts (non-live account holders can open up to 5 demo accounts).

Most of Pepperstone’s trading platforms allow you to test their standard and special zero spread accounts on a demo.

Pepperstone is one of the few brokers supported by the cutting-edge TradingView. cTrader is another advanced software that allows you to trade using your Pepperstone account. The advantages of these platforms are that demo accounts never expire if there is regular activity (while MT4 and MT5 accounts expire after 30 days).

Pepperstone is another excellent option for a demo account, especially if you want to trade with cTrader or TradingView.

| Feature | Information |

|---|---|

| Forex Demo Accounts | Standard, Razor (zero spread) |

| Maximum Forex Demo Account Balance | $50,000 |

| Unlimited And Free Forex Demo | Yes, and free |

| Year established | 2010 |

| Regulators | FCA (UK), ASIC (Australia), CySEC (Cyprus), CMA (Kenya), BaFin (Germany), SCB (Bahamas) |

| Supported Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Maximum Leverage | 1:500 |

| Maximum Number of Demo Accounts Allowed | 5-10 |

| Available Markets | Forex, commodities, indices, stocks, ETFs, crypto |

| Base Currencies Supported | USD, GBP |

| Available Customer Support Channels | Email, phone, live chat |

Pros

- Multi-regulated

- Multi-trading platform support

- Demo trading is provided for standard and zero spread accounts

- Broad instrument selection

Cons

- Limit on demo account size

- Limited number of base currencies

8. Moneta Markets

Moneta Markets (formerly under Vantage Markets) is a relatively new yet popular multi-regulated CFD broker. It offers access to 1000+ instruments in popular categories like forex, commodities, and stocks.

The CFD provider emphasises account availability through STP (straight-through processing) and ECN (electronic communication network) execution. This assures traders that their positions will be handled without manipulation on live accounts.

Other benefits of Moneta Markets include decent leverage, competitive market selection, and support for several base currencies.

| Feature | Information |

|---|---|

| Forex Demo Accounts | Direct STP, Prime ECN |

| Maximum Forex Demo Account Balance | $100,000 |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2020 |

| Regulators | FSCA (South Africa), IBC (Saint Lucia), FSA (Seychelles), ASIC (Australia) |

| Supported Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | 1:500 |

| Maximum Number of Demo Accounts Allowed | N/A |

| Available Markets | Forex, indices, commodities, stocks, ETFs, bonds |

| Base Currencies Supported | USD, EUR, GBP, JPY, NZD, CAD, SGD, HKD |

| Available Customer Support Channels | Email, phone, live chat |

Pros

- Direct market access

- Multi-licensed broker

- Supports many base currencies

- Wide range of tradable instruments

Cons

- Only MetaTrader platforms are supported

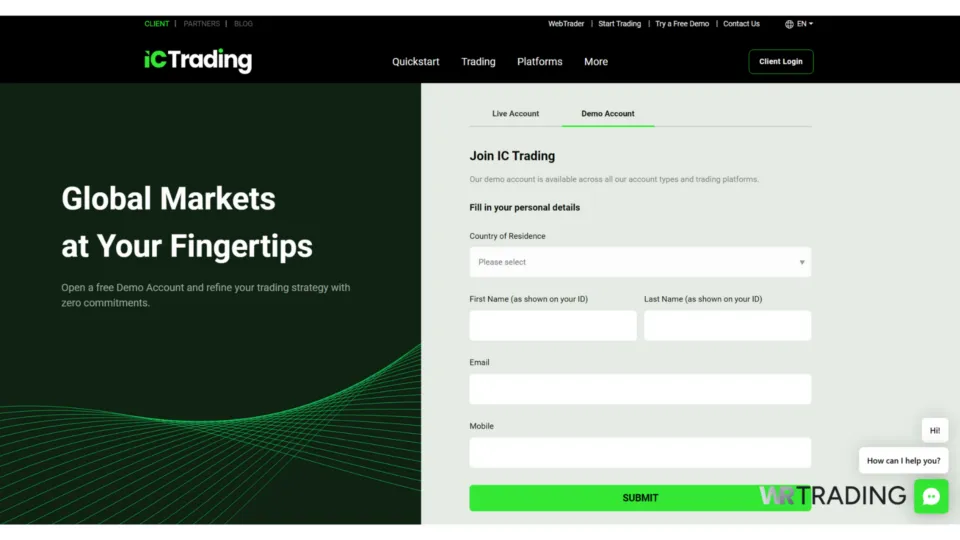

9. IC Trading

IC Trading (not to be confused with IC Markets) is a relatively new broker based in Mauritius. Despite its recency, it offers trading in eight asset classes. Like XM, IC Trading boasts a high maximum demo account balance, giving traders the peace of mind of opening many positions.

The most outstanding feature of IC Trading is its expansive selection of available markets, which range from stocks and crypto to forex and futures. While forex is highly popular, other traders are interested in different instruments to diversify their horizons.

| Feature | Information |

|---|---|

| Forex Demo Accounts | Standard, Raw Spread |

| Maximum Forex Demo Account Balance | $5 million |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2022 |

| Regulators | FSC (Mauritius) |

| Supported Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Maximum Leverage | 1:500 |

| Maximum Number of Demo Accounts Allowed | N/A |

| Available Markets | Forex, commodities, indices, bonds, stocks, futures, cryptocurrencies |

| Base Currencies Supported | USD, EUR, GBP, AUD, CHF, NZD, JPY, SGD, CAD, HKD |

| Available Customer Support Channels | Email, phone, live chat |

Pros

- Huge market selection

- High maximum demo account balance

- Many base currencies are supported

- No limit on how many demo accounts you can open

Cons

- Still a relatively new broker

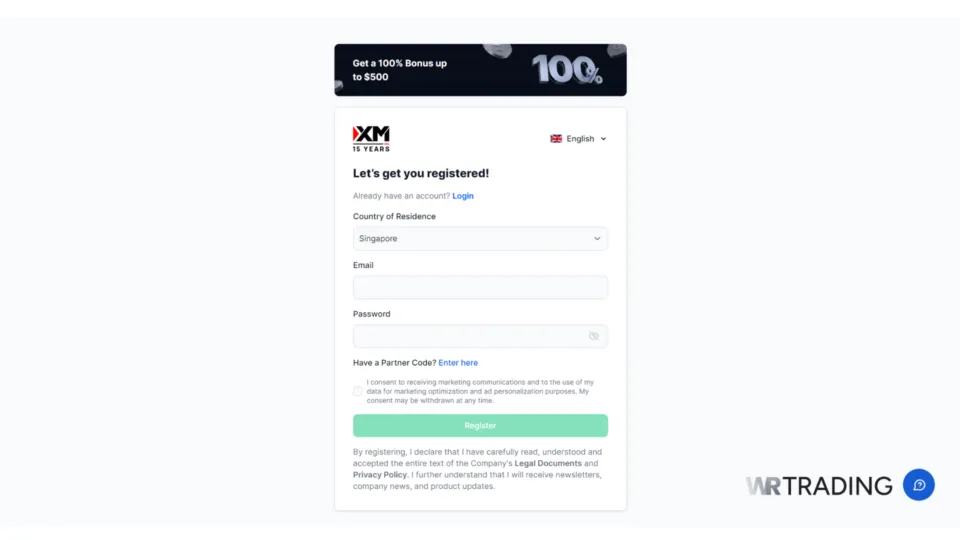

10. XM

XM is among the oldest derivatives brokers, first launched in 2009. It has an answer for every feature a demo account needs. For example, you can trade seven asset classes, slightly higher than the general five or six that other brokers offer.

XM offers two accounts on the demo account, a ‘Standard’ and an ‘Ultra Low Standard.’ The latter is similar to the former, with the main exception being the tighter spreads. Traders can choose the ‘Ultra Low Micro’ account with the same perks and the ability to trade a tenth of a standard lot.

We liked that XM is among the few brokers with a no-deposit welcome bonus ($30), like Roboforex. Finally, XM shines by offering multiple customer support channels, which is far higher than its competition.

| Feature | Information |

|---|---|

| Forex Demo Accounts | Standard, Ultra Low Standard |

| Maximum Forex Demo Account Balance | $5 million |

| Unlimited And Free Forex Demo | No, and free |

| Year established | 2009 |

| Regulators | CySEC (Cyprus), FSCA (South Africa), FSC (Belize), ASIC (Australia), DFSA (UAE) |

| Supported Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | 1:1000 |

| Maximum Number of Demo Accounts Allowed | 5 |

| Available Markets | Forex, commodities, indices, stocks, crypto, metals, energies |

| Base Currencies Supported | USD, EUR, GBP, JPY, AUD, CHF, ZAR, HUF, SGD, PLN |

| Available Customer Support Channels | Email, phone, live chat, Line, WhatsApp, Viber, Telegram |

Pros

- Above-average leverage

- Multiple customer support channels

- High demo account balance

- Expansive range of markets

- Several base currencies are supported

Cons

- Limited number of demo accounts to open

What is A Forex Trading Demo Account?

Forex demo accounts are designed to simulate real-time trading conditions using virtual traders. They are essential for all traders to practice, especially those new to trading FX who have yet to gain experience or understand the speculative nature of trading. Best of all, they are free to use and can be opened in minutes.

Below are three reasons to use a demo account:

- As a beginner, you must test things out in preparation for live trading.

- You want to try out the broker’s charting software and general trading conditions based on a real account.

- You already have some experience and want to learn a new strategy or test an automated trading strategy.

A demo account is an important stage all traders must pass to minimise the risks of live currency trading.

How to Find The Best Forex Demo Accounts

Let’s look at the various factors that went into our decision-making:

- Regulation

- Ease of Use

- Educational Support And Resources

- Amount of Virtual Funds

- Duration of The Demo Account

Regulation

We only considered regulated brokers when researching the best FX trading demo accounts. Firstly, you can be assured of a high level of consistency between the demo and live account, from excellent trading conditions to customer service.

More importantly, regulated brokers have an excellent reputation for offering fair, efficient live trading conditions and processing all your withdrawals (assuming no malpractice by the trader).

Ease of Use

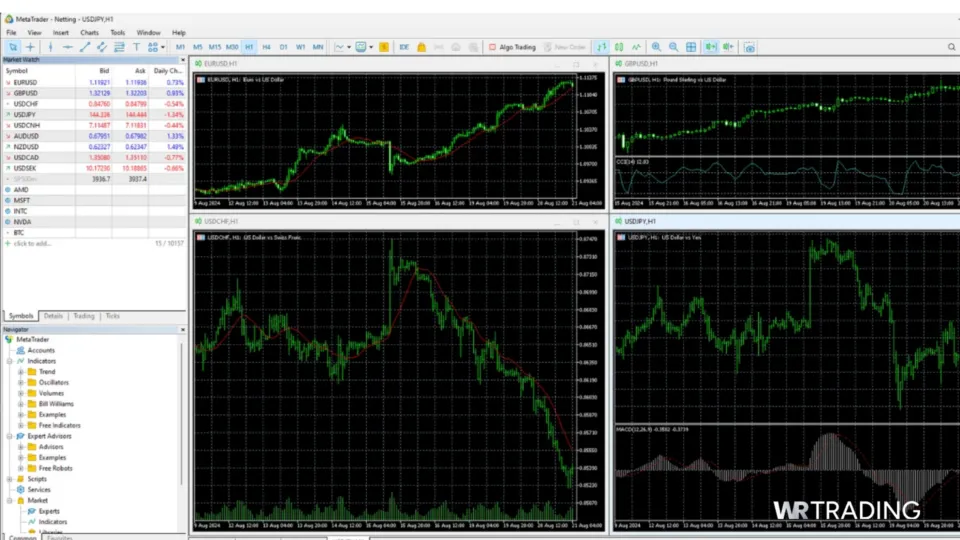

MT4 and MT5 are the most user-friendly forex trading platforms, so we focused on brokers with one or both. While boasting simplistic user interfaces, they offer the necessary functions of charting and execution.

Ease of use impacts the accessibility of demo accounts on multiple devices (desktop/laptop, smartphone, tablet). Thankfully, the MetaTrader charting packages fit this mould perfectly.

Educational Support And Resources

MT4 and MT5 are the most user-friendly forex trading platforms, so we focused on brokers with one or both. While boasting simplistic user interfaces, they offer the necessary functions of charting and execution.

Amount of Virtual Funds

It is beneficial to use a demo account with as many virtual funds as possible. This is because traders may wish to test multiple strategies requiring various positions.

Thus, our selection criteria favoured brokers like FP Markets and BlackBull Markets, which have no maximum balance limit.

However, we have to add a caveat to this topic. Using an account balance close to what you would fund in real life is crucial. The purpose is to replicate realistic position sizes to maintain consistency.

So, if you only have $2000 to begin live trading, your demo trading account should have a similar amount.

Duration of The Demo Account

Most brokers want their traders to spend minimal time on demos, as businesses benefit from having more live traders.

That’s why we prioritised brokers with platforms like cTrader and TradingView, where no expiry exists. You can practice unlimitedly until you feel ready to trade on a live account.

We favoured brokers that permit their users to open as many demo accounts as possible. This is helpful with charting software like MT4 or MT5, given that these accounts expire relatively quickly.

Steps to Practice FX Trading:

If you want to become a profitable forex trader, first you need to practice with a demo account. There are four crucial steps to do so:

- Learn what forex or currency trading is: It may seem basic, but you should have a solid grasp of FX (trading international currencies) . We quote markets in pairs, with the exchange rate determining how much of one currency you need to buy or sell to receive another.

- Choose a trading strategy and style: FX offers countless trading strategies as the most traded market. Your style (whether scalper, day trader, swing trader, or other) determines your time horizon. Meanwhile, the range of strategies is expansive, from momentum and breakouts to trend and news trading. There is no correct method for participating in forex. It depends on your risk tolerance, personal preferences, skill level, and many other factors.

- Open a demo account: The next step is to sign up for a demo account with a forex broker (which includes any of the names above).

- Start practising: Now it’s time to practice! Although people become ready at different periods, we recommend spending at least a year on a demo account. Still, we will soon cover how best to transition smoothly into the live stage.

So, while yielding excellent results on a demo account is necessary, it doesn’t indicate how well you will ultimately perform during the latter.

How To Open A Forex Demo Account

Here’s a simple step-by-step process for opening a forex demo account:

- Choose a reputable forex broker: Start by selecting a regulated broker that offers a free demo account.

- Register for the Demo Account: Visit the broker’s website or download their trading app in an app store. Fill in a short form with basic details like your name, email address, and phone number. Some platforms also allow you to sign up using your Google or Apple account for added convenience.

- Download the trading platform: Once registered, you’ll get login credentials for the broker’s trading platform (whether that’s MetaTrader 4/5, cTrader, TradingView, or a proprietary app). Download the version for your device and operating system.

- Log in and access your virtual funds: Use the demo login details provided to access your account. Most demo accounts come preloaded with virtual funds (often between $10,000 and $100,000) so you can start practising immediately.

- Explore the platform and practise trading: Test different order types and experiment all the available trading commands. Try trading various currency pairs. Use this time to familiarise yourself with charting tools and risk management features. Even though the funds aren’t real, aim to trade as if they were. This will help you build realistic habits and avoid reckless decision-making when you switch to live trading.

Which Trading Platforms Are Available For Forex Demo Accounts?

The trading platforms generally found on forex demo accounts include MT4, MT5, cTrader, and TradingView (or a combination of the four).

Brokers often provide MT4 and MT5 as they are the most popular in forex (especially MT4). They are similar in their antiquated yet user-friendly interface, competitive charting tools, and automated trading strategies. MT5 is the most recent MetaTrader platform with a few bells and whistles, but still largely remains like its predecessor.

cTrader is far less popular, but is nonetheless excellent software. Developed by Spotware Systems, it’s a modern, fast, and highly customisable platform with a clean design, advanced order management, and transparent pricing.

Then, we have TradingView, which is slowly becoming more available with forex brokers. It’s a sophisticated charting and social trading platform with powerful, highly intuitive tools and comprehensive market data.

Finally, many brokers have also begun offering their own proprietary platforms, either browser-based or as standalone apps. These often include unique features not found in the other software, like built-in trading signals, AI-based analysis, and integrated educational resources.

What Are the Pros And Cons Of Forex Demo Trading?

Pros

- No real money is involved

- Trading strategies and knowledge in a simulated environment

- Familiarising yourself

Cons

- Not withdrawable into real money

- Psychological difference

- Not a 100% simulation of the live markets

- False impression of one’s trading capital

Pros

The most significant advantage of a demo account is that no real money is involved. This means you can practice indefinitely without financial risk. Demo accounts prevent inexperienced traders from making costly mistakes.

Demo accounts allow traders to test their trading strategies and knowledge in a simulated environment. These accounts allow traders to build and optimise their trading systems to prepare them for live trading. The demo phase is essential for collecting useful performance metrics like drawdown, profit percentage, and profit factor.

The demo phase is vital to familiarising yourself with the trading platform and ensuring you can efficiently navigate from analysis to execution.

Cons

Any gains or profits from demo trading are not withdrawable into real money.

There is a big psychological difference between demo and live accounts. Demo traders can act casually during the demo phase since no real money is at stake. This mentality can carry over to the live phase with dire financial consequences.

Demo accounts are technically not a 100% simulation of the live markets. While they mimic the price movements, there will be slight variables in spreads and other volatility-related issues like slippage, which traders don’t experience in a trading demo.

Finally, demo accounts can give a false impression of one’s trading capital. Due to their demo trading experience, traders can easily take unnecessarily large positions in a live account.

How to Transition from Forex Demo Trading to Live Trading

The road from demo to live trading in forex is often tricky for most novice traders. It has become too familiar for new traders to profit on a demo account but perform poorly on a live account. The key is to ensure a smooth transition, which takes time and careful consideration.

- Use disposable funds: It may be a cliché, but currency trading should be only done with money you can afford to lose. The allure of forex trading can easily make novice traders desperate, and they often risk the money they need to pay their bills.

- Have a solid trading plan: If you fail to plan, you plan to fail. One objective of demo trading is to build a trading plan. Your trading plan in forex encompasses all the finer details of your strategy, including pre-entry, entry, trade management, and exit stages.

- Acknowledge the psychological shift: There is no turning back once a trade is made on a live account. This psychological shift may be daunting for traders executing their first position. The key to handling such a reality is to remain calm, have a neutral mindset, and follow your trading plan.

- Use a cent account: Trading on a forex cent account, as demo traders rarely use their first live account. However, it is a considerable avenue since it allows traders to trade much smaller positions while gaining the feel of real trading. Vintage Markets, FP Markets, and RoboForex are examples of brokers with a cent account.

- Start small: Successful FX trading is a marathon, not a sprint. So, forex traders should start small, even if they have substantial funds. Ideally, you want to reinvest the profits from trading (instead of using all your capital) to grow the account balance steadily over time.

So, using disposable money results in less emotional attachment and better decision-making.

Are There FX Demo Accounts Without Sign Up?

Yes. While these options are limited, we invented the free forex demo simulator on WR Trading. You can start there to create a balance of $10,000 without logging in or signing up. Another alternative is the forex demo account offered by the broker Pocket Option. However, this broker may not be suitable for everyone since it is mainly an options trading platform (and not the standard spot FX trading provided by the rest).

Is A Forex Demo Account Free Of Charge?

Yes, if a broker tries to charge you for a demo account, it’s a major red flag and likely a scam. Legitimate providers make demos freely available to help you learn their platform and test strategies before committing real money.

Are Forex Trading Demo Accounts Unlimited?

They are only unlimited in terms of their access, as in you can perform all the necessary trading activities. However, most (particularly those linked with MetaTrader) have fixed expiry times for 30 or 60 days. After this point, a trader would need to create a new demo account. Meanwhile, demo accounts connected to platforms like TradingView don’t expire.

Do You Need KYC For A Virtual Forex Account?

In the large majority of cases, full KYC isn’t necessary for a demo account. Brokers typically only require basic details like your name, email, and phone number so they can send you login credentials.

Full KYC (where identification and proof of address are needed) becomes mandatory once a trader switches to a live account to trade real money, which comes with more obligations.

Conclusion

Arguably, the most significant investor of all time, Warren Buffett, once said one shouldn’t test the depth of the water with both feet. While some experienced traders downplay the importance of a demo account, it remains an essential stage before going into live trading. The right trading broker is necessary to save costs and ensure quick order execution.

Frequently Asked Questions (FAQ)

How long does a forex trading demo account last?

Demo accounts on the MetaTrader platforms generally last 30 days before getting archived (even with activity). Those on other charting software, like cTrader, remain indefinitely as long as you actively use the account.

Can you make money as a forex trader without a demo account?

Yes, but quite unlikely. Successful live trading starts with demo trading.

Can you withdraw money from a forex trading demo account?

No, as you are trading virtual money.