This article, brought to you by WR Trading, reviews the 10 best forex brokers available to traders in Ghana. We’ll highlight their key features, benefits, and why they are well-suited for the Ghanaian market. No matter your level of expertise, this guide will help you find the forex broker that best matches your trading style and goals.

These are the Top 10 Forex Brokers for traders in Ghana in 2025:

Broker:

Availability:

Advantages:

Account:

Available in Ghana

Deposit Currencies: GHS, USD, EUR, GBP, AUD, NZD, SGD, CAD, JPY, CHF

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

Available in Ghana

Deposit Currencies: GHS, AUD, USD, EUR, ZAR, GBP, SGD, CAD, CHF, HKD, JPY, MXN, BRL

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

Available in Ghana

Deposit Currencies: GHS, USD, EUR, AUD, SGD, CAD, GBP, NZD, JPY, HKD

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

Available in Ghana

Deposit Currencies: GHS, EUR, USD

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

Available in Ghana

Deposit Currencies: GHS, USD, EUR, GBP, AUD, SGD, JPY, CAD, HKD, BRL

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

Available in Ghana

Deposit Currencies: GHS, GBP, USD, EUR, CHF

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

Available in Ghana

Deposit Currencies: GHS, AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, CHF

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4 ,MT5

Available in Ghana

Deposit Currencies: any (automatically converted into the base currency of the account)

- Multiple regulated

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 2$/1 Lot

- Personal support

- MT4, MT5

Available in Ghana

Deposit Currencies: GHS, EUR, USD

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 4$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5

Available in Ghana

Deposit Currencies: GHS, USD, AUD, GBP, EUR, CAD, JPY, HKD

- Offshore A-Book Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500

- High liquidity and fast execution

- MT4, MT5

What Are The 10 Best Forex Brokers In Ghana?

Below is a brief review of each broker, focusing on their key strengths and why they are great for traders in Ghana. Additionally, we’ve included a key facts table to provide quick insights into what each broker offers.

1. BlackBull Markets

BlackBull Markets is about giving Ghanaian traders access to a vast range of tradable assets. Therefore, if you’re the kind of trader who likes to explore multiple markets along with forex, BlackBull Markets is your best option. With over 26,000 assets, including commodities, indices, cryptocurrencies, futures, and stocks, you’re never short of options to build a diverse portfolio. This extensive offering is paired with tight spreads from 0.0 pips, which means you can trade without worrying about high costs eating into your profits.

Another standout feature of BlackBull Markets is its powerful trading platforms – MetaTrader 4, MetaTrader 5, MetaTrader Web Trader, cTrader, TradingView, and BlackBull Trade. If you’re doing deep technical analysis or setting up automated trading strategies, BlackBull Markets provides the environment to do so effectively. Plus, with responsive customer support available through multiple channels, you’ll always have help when you need it.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $6 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, MetaTrader Web Trader, cTrader, TradingView, and BlackBull Trade. |

| Asset Types | Forex, commodities, indices, cryptocurrencies, futures, and stock. |

| Tradable Assets | Over 26,000 |

| Currency Pairs | Over 70 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Webinars, tutorials, education hub, |

| Regulation | Financial Services Authority in Seychelles |

2. FP Markets

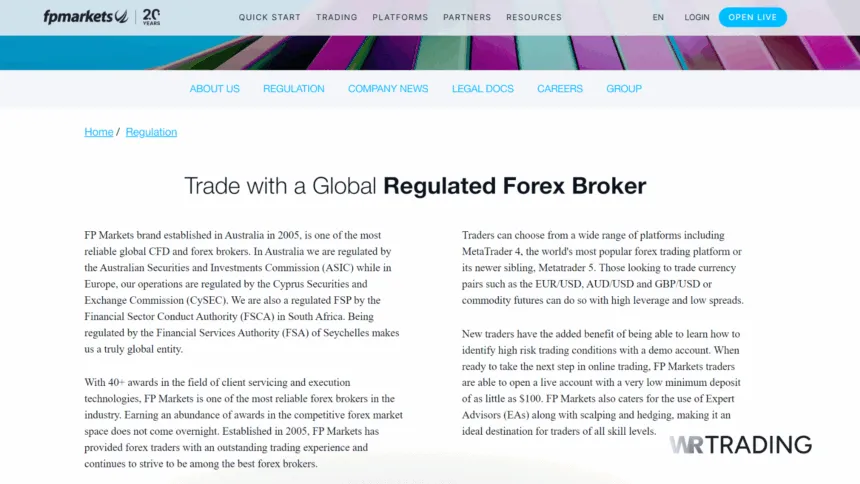

FP Markets takes the second spot among the best forex brokers because it puts cutting-edge trading platforms in the hands of Ghanaian traders. If you’re someone who likes to have all the best tools, like forex calculators, alerts, and technical indicators, FP Markets delivers. With platforms like MetaTrader 4, MetaTrader 5, cTrader, TradingView, IRESS, and WebTrader, you’re not limited to a one-size-fits-all approach. Instead, you get a versatile setup where you can conduct deep technical analysis, automate your trades, or enjoy the smooth interface that these platforms are known for.

However, FP Markets doesn’t stop at just offering great platforms; it’s focused on keeping your trading costs as low as possible. Spreads starting from 0.0 pips mean you’re paying minimal fees on your trades, leaving more profit. Plus, with over 60 tradable forex pairs, you have many opportunities to diversify your portfolio.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.0 pips Commission – From no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, IRESS, and WebTrader. |

| Asset Types | Forex, stocks, indices, commodities, cryptocurrency, and ETFs. |

| Currency Pairs | Over 60 |

| Tradable Assets | Over 10,000 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Video tutorials and trading glossary. |

| Regulation | ASIC, FSCA, FSA, FSC, and CySEC. |

3. Vantage Markets

Vantage Markets takes our number three spot because we know how to keep Ghanaian traders engaged with great promotions that add value to your trading experience. New traders are greeted with a generous deposit bonus to kickstart their trading journey on the platform. Any deposits afterwards are given bonuses depending on the transaction amount. While trading on the platform, you’ll receive V-Points that can be redeemed for various trading benefits.

On the platform front, Vantage Markets doesn’t disappoint. With the Vantage App, MetaTrader 4, MetaTrader 5, and ProTrader, you have the freedom to trade from anywhere, whether you’re at home or on the go. The Vantage app is user-friendly and offers all the functionality you need to stay on top of the forex markets. At the same time, the trading platforms provide advanced technical indicators, multiple charts, and different trade settings. Plus, you can utilise leverage up to 500:1 with low spreads starting from 0.0 pips.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.0 pips Commission – From $3 per lot |

| Trading Platforms | Vantage App, MetaTrader 4, MetaTrader 5, TradingView, and ProTrader. |

| Asset Types | Forex, stocks, indices, commodities, bonds, and ETFs. |

| Tradable Assets | Over 1,000 |

| Currency Pairs | Over 40 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Courses, webinars, and ebooks. |

| Regulation | ASIC and CIMA |

4. RoboForex

RoboForex is the broker for Ghanaian traders who want to take their trading to the next level with high leverage. As our 4th recommendation, the broker offers up to 2000:1 leverage, letting you amplify your market exposure like few others can. This is ideal for traders who are confident in their strategies and want to maximise their potential returns. Plus, you have multiple account types to choose from based on your trading preferences.

Beyond leverage, RoboForex offers a staggering 12,000+ tradable instruments. Whether you’re interested in stocks, indices, or ETFs, there’s no shortage of options to diversify your trading portfolio alongside forex. RoboForex’s solid platform options, including MetaTrader 4, MetaTrader 5, and R Stocks Trader, provide all the tools you need to execute your trades effectively.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.0 pips Commission – from 10/ mio |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and R Stocks Trader. |

| Asset Types | Stocks, indices, futures, ETFs, commodities, and forex. |

| Tradable Assets | Over 12,000 |

| Currency Pairs | Over 40 |

| Leverage | 2000:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | None |

| Regulation | Financial Services Commission (FSC) of Belize |

5. Moneta Markets

Moneta Markets is an excellent pick for Ghanaian traders who need a variety of assets and trading platforms. With a broad range of assets, like forex, commodities, indices, ETFs, bonds, and stocks, Moneta Markets makes it easy to take advantage of different market conditions. The leverage options are flexible, going up to 1000:1, which means you can adjust your risk and reward ratios to suit your preferences.

When it comes to user experience, Moneta Markets excels with its platform selection: MetaTrader 4, MetaTrader 5, Pro Trader, and MT4 WebTrader. These platforms are designed to simplify trading, even for beginners, while offering all the advanced tools experienced traders expect. Spreads start from 0.0 pips, and there are over 45 currency pairs available for trading.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – from no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Pro Trader, and MT4 WebTrader. |

| Asset Types | Forex, commodities, indices, ETFs, bonds, and stocks. |

| Tradable Assets | Over 1,000 |

| Currency Pairs | Over 45 |

| Leverage | 1000:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Blogs and guides. |

| Regulation | Cayman Islands Monetary Authority and Financial Sector Conduct Authority. |

6. Pepperstone

Pepperstone is the broker that serious traders in Ghana turn to for in-depth market analysis and insights. If you thrive on understanding market movements and making data-driven decisions, Pepperstone has you covered. The broker offers analysis tools and resources, such as daily market updates, technical indicators, and alerts, to help you stay ahead of over 90 forex pairs.

But it’s not just about analysis – Pepperstone excels in trade execution. With lightning-fast trade execution speeds of 30 ms and spreads starting from 0.0 pips, this broker ensures that you enter positions at the right time. The platforms offered, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, are well-suited for traders who demand precision and reliability in their trading. Pepperstone is our overall top choice at WR Trading due to its comprehensive range of features and trading tools provided to users.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.0 pips Commission – From no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, and TradingView |

| Asset Types | Forex, commodities, indices, cryptocurrency, stocks, and ETFs. |

| Tradable Assets | Over 1,200 |

| Currency Pairs | Over 90 |

| Leverage | 500:1 |

| Customer Support | Email and phone support. |

| Demo Account | Yes |

| Educational Content | Webinars, educational videos, and trading guides. |

| Regulation | FCA, CySEC, ASIC, BaFin, CMA, and DFSA. |

7. IC Trading

At WR Trading, we believe IC Trading is the best CFD broker for Ghanaian traders. This broker specialises in CFDs, offering a wide range of products, including forex, commodities, indices, stocks, bonds, and cryptocurrency. IC Trading is known for its razor-thin spreads from 0.0 pips and high liquidity, making it an excellent choice for traders prioritising cost efficiency. You’ll have over 60 forex pairs to trade with 500:1 leverage.

IC Trading stands out for its impressive platform options, such as MetaTrader 4, MetaTrader 5, and cTrader. These platforms have advanced trading tools, such as customisable charts, various order types, and automated trading capabilities. With strong regulatory backing from the Financial Services Commission of Mauritius, your funds are in safe hands.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.0 pips Commission – From no commission to $3.50 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and cTrader. |

| Asset Types | Forex, commodities, indices, stocks, bonds, and cryptocurrency. |

| Tradable Assets | Over 2,250 |

| Currency Pairs | Over 60 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Tutorials and blogs |

| Regulation | Financial Services Commission of Mauritius |

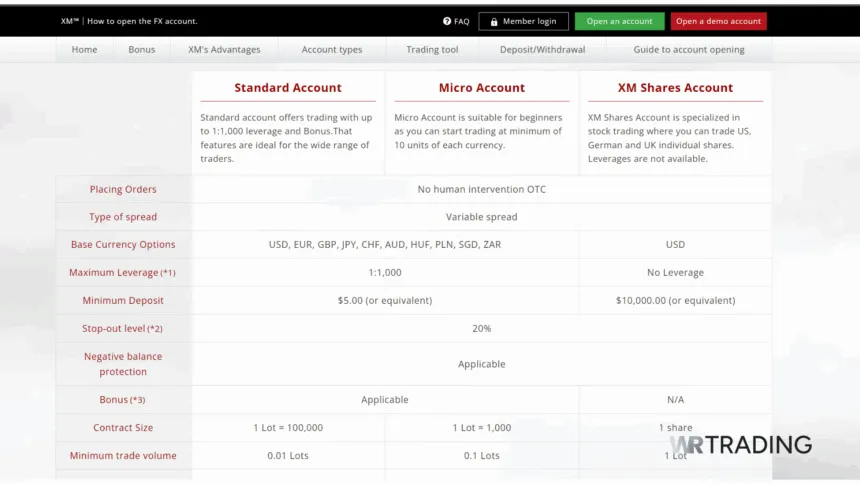

8. XM

XM is a broker that excels in providing excellent research and analysis tools to traders in Ghana. The broker offers a range of research tools, including daily market analysis, trading signals, and in-depth reports. This makes it easier to stay informed about market developments and make data-driven trading decisions.

In addition to its research capabilities, XM offers competitive trading conditions with leverage up to 1000:1 and spreads starting from 0.0 pips. The platforms available – MetaTrader 4, MetaTrader 5, and MetaTrader WebTrader are all user-friendly and packed with features that Ghana traders need. The broker is heavily regulated by multiple authorities, including ASIC, CySEC, DFSA, FCA, FSCA, and the FSC, ensuring a secure trading environment.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $3.50 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and MetaTrader WebTrader. |

| Asset Types | Forex, stocks, indices, and commodities. |

| Tradable Assets | Over 1,000 |

| Currency Pairs | Over 55 |

| Leverage | 1000:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | Educational videos, webinars, platform tutorials, and XM Live. |

| Regulation | ASIC, CySEC, DFSA, FCA, FSCA, and FSC. |

9. FBS

FBS is the go-to broker for Ghanaian traders seeking ultra-high leverage options. Offering leverage up to 3000:1, FBS allows traders to amplify their market exposure significantly. The high leverage, combined with competitive spreads from 0.0 pips and low commissions, makes FBS a strong choice for traders who like to trade aggressively.

In addition to its leverage, FBS provides a user-friendly trading experience with platforms like MetaTrader 4, MetaTrader 5, and the FBS app. These platforms are designed to be intuitive, making it easy for Ghanaian traders to navigate the forex market. The broker offers a range of educational resources through the FBS Academy, helping traders improve their skills and knowledge.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | Varies based on account:Spread – from 0.7 pips Commission – From no commission to $3.50 per lot |

| Trading Platforms | FBS app, MetaTrader 4, and MetaTrader 5. |

| Asset Types | Forex, stocks, indices, and commodities. |

| Tradable Assets | Over 50 |

| Currency Pairs | Over 40 |

| Leverage | 3000:1 |

| Customer Support | Email, live chat, and phone support. |

| Demo Account | Yes |

| Educational Content | FBS Academy |

| Regulation | CySEC |

10. VT Markets

VT Markets is a broker that understands the needs of traders in Ghana, offering a broad range of account types designed to fit various trading styles. Whether you’re the kind of trader who prefers the simplicity of a standard account with no commission or you lean towards the precision of a raw ECN account with tight spreads from 0.0 pips, VT Markets has you covered. This flexibility gives you the freedom to optimise your strategies according to your personal preferences and trading goals.

But the flexibility doesn’t stop at account types. VT Markets impressed us with its platform offerings. You can trade utilising the most powerful trading software – MetaTrader 4, MetaTrader 5, Webtrader, and the VT Markets app. The platforms are packed with advanced features like detailed charting tools, automated trading capabilities, and real-time market data, ensuring you’re always ready to act on market opportunities.

| Feature | Information |

|---|---|

| Eligible for Ghanaian Traders? | Yes |

| Spreads and Commission | MetaTrader 4, MetaTrader 5, Webtrader, and the VT Markets app. |

| Trading Platforms | Email, help centre, and live chat. |

| Asset Types | Forex, stocks, indices, ETFs, bonds, and commodities. |

| Tradable Assets | Over CFDs 1,000 |

| Currency Pairs | Over 40 |

| Leverage | 500:1 |

| Customer Support | Email, help center, and live chat. |

| Demo Account | Yes |

| Educational Content | VT Markets Academy |

| Regulation | ASIC, FSCA, and Mauritius FSC |

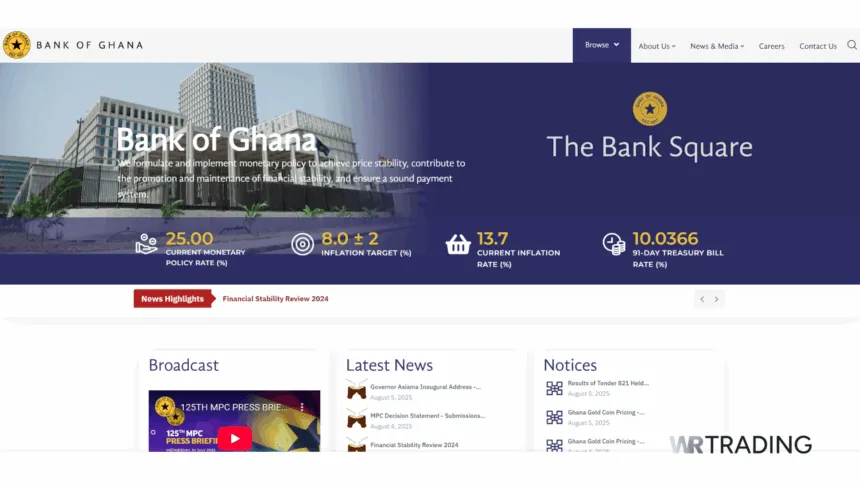

Is Forex Trading Legal in Ghana?

Yes, forex trading is legal in Ghana. The Bank of Ghana oversees all financial activities within the country, including forex trading. This means that as long as you are trading through a broker that is properly regulated, you can engage in forex trading without any legal issues.

How Are Forex Brokers Regulated in Ghana?

Forex brokers operating in Ghana are not directly regulated by the Bank of Ghana or any other specific local authority. Instead, they are controlled by international bodies such as ASIC, FCA, or CySEC. These international regulatory organisations enforce rules to ensure brokers operate transparently, protect client funds, and provide a fair trading environment.

Security of the Regulation in Ghana

When a forex broker is regulated by a top-tier authority like ASIC, FCA, or CySEC, it must comply with a strict set of rules and guidelines designed to protect traders. Here’s what regulated brokers must do:

- Segregate Client Funds: Brokers must keep client funds in separate accounts from their operational funds. This ensures that your money is safe, even if the broker faces financial difficulties.

- Maintain Sufficient Capital: Regulated brokers are required to maintain a certain level of capital to ensure they can meet their financial obligations. This reduces the risk of the broker becoming insolvent.

- Provide Transparent Operations: Brokers must offer clear and accurate information about their services, fees, and trading conditions. They are prohibited from engaging in misleading or deceptive practices.

- Undergo Regular Audits: Brokers are subject to regular financial audits conducted by the regulatory authority. These audits ensure that the broker is operating within the law and adhering to financial standards.

- Implement Anti-Money Laundering (AML) Procedures: Brokers must comply with AML regulations, which involve monitoring transactions and reporting any suspicious activities. This helps to prevent illegal activities such as money laundering and fraud.

- Offer Fair Trading Conditions: Brokers must ensure that their trading platforms and conditions are fair and transparent. This includes providing accurate pricing, reliable trade execution, and safeguarding against market manipulation.

- Provide Customer Support: Regulated brokers are required to offer adequate customer support to address any issues or inquiries from traders promptly.

- Complaints Handling Processes: Brokers must have procedures in place to handle complaints from traders. This ensures that any disputes are resolved fairly and transparently.

How to Find Out if a Ghana Regulator regulates Your Forex Broker?

To ensure a recognised international authority regulates your forex broker, follow these steps:

- Visit the Broker’s Official Website: Start by going to the official website of the broker you’re interested in. Look for a section that details their regulatory status. This information is usually found in the footer of the homepage or within the “About Us” or “Legal” sections.

- Locate the Regulatory Information: Once on the broker’s website, find the details regarding their regulation. Reputable brokers will display their regulatory bodies, such as ASIC, FCA, or CySEC, along with their license numbers. If this information is not easily accessible, it could be a red flag.

- Verify the License with the Regulatory Body: After noting the regulatory body and license number, visit the official website of the regulatory authority. Most regulatory bodies, like ASIC, FCA, or CySEC, have a searchable database where you can enter the broker’s license number to confirm its validity.

- Check for Any Disciplinary Actions: While on the regulatory body’s website, check if there have been any disciplinary actions or complaints filed against the broker. This can give you insight into the broker’s compliance history and overall trustworthiness.

- Confirm Contact Details: Cross-check the contact information provided by the broker on their website with the details listed on the regulatory body’s website. Discrepancies in contact information could indicate a scam or fraudulent activity.

How WR Trading Tested the Best Forex Brokers in Ghana

At WR Trading, we take the selection of forex brokers seriously, especially when it comes to recommending the best options for traders in Ghana. Our testing process is rigorous and comprehensive, ensuring that only the most reliable and high-performing brokers are included in our list. Here’s how we tested and evaluated these brokers:

Regulation and Security

We began by verifying that each broker is regulated by a reputable international authority such as ASIC, FCA, or CySEC. This step is crucial in ensuring that the broker operates under strict guidelines designed to protect traders. Additionally, we assessed how each broker handles client funds, focusing on practices like segregated accounts and the protection of funds in case the broker encounters financial difficulties.

Trading Platforms

Our evaluation of trading platforms involved thorough testing of usability, functionality, and reliability. We looked at popular platforms as well as any proprietary platforms offered by the brokers. The goal was to ensure these platforms provide a seamless user experience for both beginners and experienced traders in Ghana.

We measured the speed and reliability of trade executions to confirm that orders are processed quickly and accurately, minimising slippage and enhancing trading efficiency.

Costs and Fees

We carefully examined the spreads and commissions offered by each broker, with an emphasis on finding those that offer competitive pricing beneficial to traders. Transparency in fee structures was a key factor in our assessment. We reviewed other costs, including withdrawal fees, inactivity fees, and any hidden charges, to understand the overall cost of trading with each broker.

Range of Tradable Assets

The diversity of tradable assets was another vital aspect of our evaluation. We assessed the variety of forex pairs, commodities, indices, stocks, and cryptocurrencies available through each broker. A wide range of assets is essential for traders looking to diversify their portfolios and explore global markets beyond the local options.

Account Types

Flexibility in account options is essential for suiting different trading styles and levels of experience. We evaluated the range of account types offered by each trading broker, from standard accounts with no commission to ECN accounts with tighter spreads. This flexibility allows traders to choose an account that best suits their trading strategy and financial goals.

Leverage and Margin Requirements

Leverage is a powerful tool in forex trading, but it comes with risks. We reviewed the leverage options available from each broker, ensuring they offer flexible leverage levels that accommodate conservative and aggressive trading strategies. We examined the margin requirements to understand how much capital traders need to maintain their positions.

Educational Resources

For traders looking to improve their skills, educational resources are invaluable. We assessed the quality and breadth of educational materials provided by each broker, including webinars, tutorials, articles, and trading guides. Brokers offering comprehensive educational resources were rated higher, as these tools can help traders make more informed decisions.

Trading Tools and Features

We tested the additional trading tools and features that each broker offers. This included charting tools, technical indicators, automated trading capabilities, and risk management features. Brokers who provided many tools to enhance the trading experience and support better decision-making were given higher marks in our evaluation.

What Are Supported Payment Methods for Ghana Traders?

For traders in Ghana, choosing a broker that offers convenient and reliable payment methods is crucial for a smooth trading experience. Here are the main categories of payment methods supported by most brokers.

Bank Transfers

Bank transfers are a secure and traditional method of transferring funds to and from your trading account. Many brokers support direct transfers from local banks in Ghana. GCB Bank (Ghana Commercial Bank), Ecobank Ghana, and Stanbic Bank are commonly used for such transactions. These banks provide secure transfer services, though the processing times can be slightly longer compared to other methods. Bank transfers are trusted for their security and are ideal for traders who prefer using established banking channels.

E-Wallets

E-wallets have become popular among Ghanaian traders due to their speed and convenience. Skrill and Neteller are two widely accepted e-wallet options that allow for quick deposits and fast withdrawals. These e-wallets offer secure transactions without the need to share bank details directly with the broker, which is an attractive feature for many traders.

Furthermore, MTN Mobile Money is another e-wallet that is extremely popular in Ghana.

It allows traders to deposit and withdraw funds directly from their mobile wallets, providing unmatched convenience for those who prefer mobile transactions.

Credit/Debit Cards

Credit and debit cards are universally accepted payment methods, making them a convenient option for Ghanaian traders. Visa and MasterCard are the most commonly used cards. These cards provide instant access to trading funds, enabling traders to start trading immediately without waiting for their funds to clear. This method is ideal for traders who value speed and convenience when funding their accounts.

Cryptocurrency

Cryptocurrency is an emerging payment method that is becoming increasingly popular among forex brokers in Ghana. Some forex brokers accept Bitcoin, Ethereum, and other major cryptocurrencies for transferring funds. Using cryptocurrency allows for fast transactions, often with lower fees compared to traditional payment methods. It offers a level of anonymity that is appealing to some traders.

Conclusion: Top Forex Brokers Are Available in Ghana

In conclusion, we’ve explored the 10 best forex brokers in Ghana, making it easier for those in the region to pick a platform that best suits them. The brokers we’ve reviewed – such as FP Markets, Vantage Markets, and RoboForex – offer a range of features designed to meet the needs of both beginner and experienced traders. If you’re looking for advanced trading platforms, high leverage, or convenient payment methods, these brokers provide secure and reliable environments for your trading activities.

Top Forex Brokers in Ghana at a Glance:

- BlackBull Markets – Wide range of tradable assets.

- FP Markets – Best trading platforms available

- Vantage Markets – Offers great promotions

- RoboForex – Provides high leverage.

- Moneta Markets – Great asset variety

- Pepperstone – Provides in-depth analysis

- IC Trading – Best CFD broker for Ghanaians

- XM – Excellent research and analysis tools

- FBS – Ultra-high leverage options

- VT Markets – Great range of account types

Frequently Asked Questions on Forex Brokers in Ghana

What Are the Top Forex Brokers in Ghana?

FP Markets, Vantage Markets, and RoboForex are among the top forex brokers for traders in Ghana. They offer strong regulatory oversight, competitive trading conditions, and user-friendly platforms. These brokers provide educational resources and up-to-date analytics.

Which Broker Offers the Best Trading Platforms in Ghana?

FP Markets is known for offering some of the best trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, IRESS, and WebTrader. These platforms are favoured for their advanced features and reliability.

Do These Brokers Offer Demo Accounts?

Yes, the top forex brokers in Ghana, including BlackBull Markets and IC Trading, offer demo accounts. These accounts allow traders to practice and familiarise themselves with the trading platform without risking real money.

Which Brokers Offer the Highest Leverage in Ghana?

RoboForex and FBS are known for offering high leverage, up to 2000:1 and 3000:1, respectively. High leverage allows traders to control larger positions with less capital. However, it increases the risk, so it should be used carefully.

What Educational Resources Do These Brokers Offer?

Many of the top brokers, such as Vantage Markets and XM, provide a wealth of educational resources. These include webinars, tutorials, articles, and trading guides designed to help traders improve their skills and knowledge. These resources are beneficial for beginners looking to learn more about forex trading.