At WR Trading, we explored the top 10 XAU/USD brokers by examining key factors such as leverage, transaction methods, trading fees, and other additional trading assets and pairs.

According to our analysis, here are some of the ten best Gold (XAU/USD) trading brokers:

Broker:

XAU/USD Spreads:

Features:

Account:

XAU/USD spreads from 0.0 pips

- High Leverage up to 1:1000

- RAW ECN Spreads from 0.0 pips

- Fastest execution

- Attractive Bonus Programs

- Copy Trading

- MT4 / MT5

- Personal support 24/7

XAU/USD spreads are currently on 0.75 pips

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

XAU/USD spreads are variable

- Multiple regulations

- Leverage up to 1:50

- Demo account available

- More than 100 FX pairs

- No Commission

- Plus500 WebTrader, Plus500 App

XAU/USD spreads are currently up to 1.9 pips

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- MT4/MT5/RTrader/CopyFX

XAU/USD spreads from 0.0 pips

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4 ,MT5

XAU/USD spreads from 0.05 Pips

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

XAU/USD spreads from 0.7 pips

- Mauritius-regulated broker

- High Leverage up to 1:1000

- Multiple account types

- More than 850 trading instruments

- MT4, MT5, PU Prime App

XAU/USD spreads from 0.0 pips

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 4$/1 Lot

- 26,000+ Markets

- TradingView, MT4/5, cTrader

XAU/USD spreads from 0.1 pips

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

XAU/USD spreads are currently on 1.5 pips

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

List of the Best 10 Gold (XAU/USD) Trading Brokers

Here is our list of the 10 best Gold (XAU/USD) trading brokers in 2026:

- StarTrader – Known for competitive XAU/USD spreads and leverage of up to 1:1000.

- Vantage Markets – Best Gold trading broker for beginners and well-regulated by up to well-recognised regulators

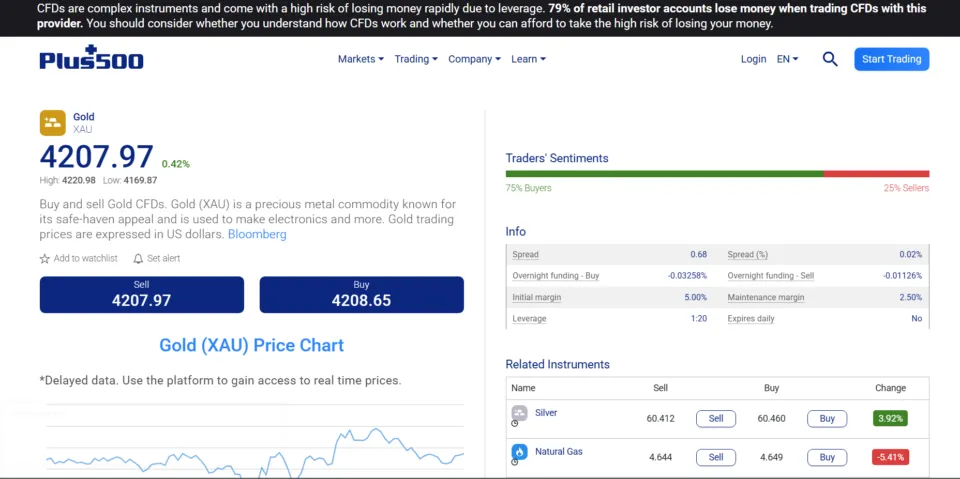

- Plus500 (US) (For Gold Futures GC) – Designed for U.S. traders, offering seamless access to Gold Futures (GC) with a user-friendly platform.

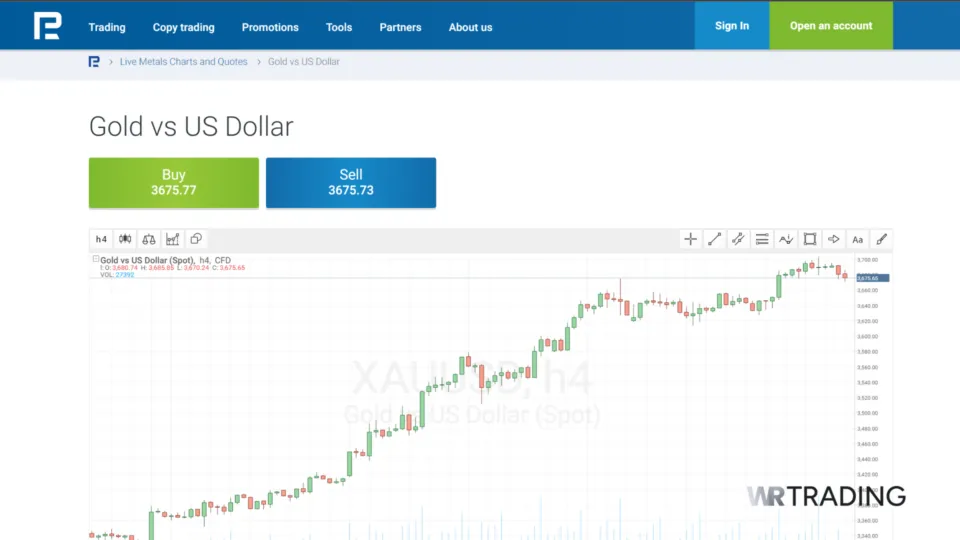

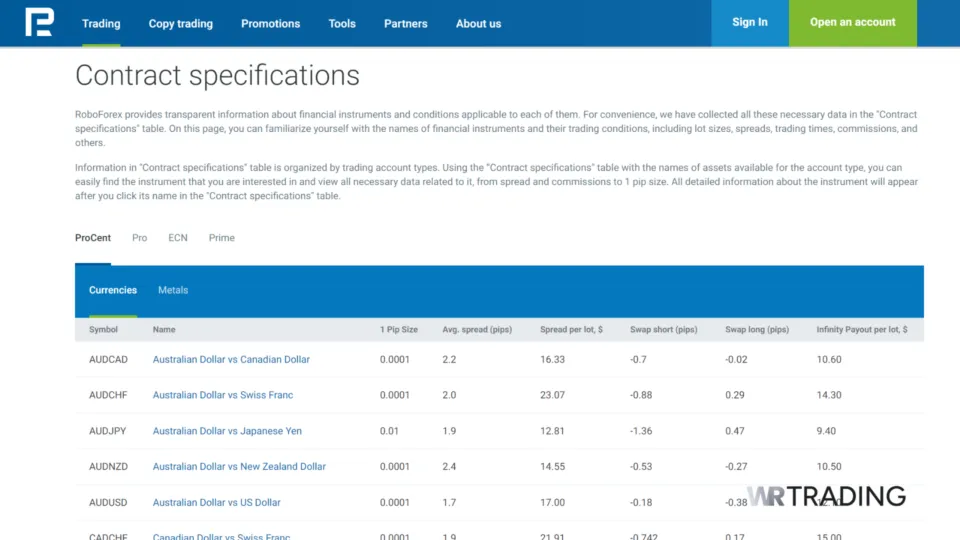

- RoboForex – Great for its diverse array of trading tools, including copy trading for XAU/USD traders

- IC Trading – Known for fast trade execution and high leverage of up to 1:1000

- Pepperstone – Trusted for institutional-grade execution and ultra-low trading costs.

- PU Prime – Recognized for global market access and strong gold trading conditions.

- VT Markets – Popular for commission-free gold trading and beginner-friendly platforms.

- Moneta Markets – Best for fast trade execution and flexible account options on gold.

- BlackBull Markets – offering tight spreads and commission for XAU/USD trading.

#1. StarTrader

Founded in 2019 and headquartered in London, StarTrader is a new broker that has already developed a reputation for rapid execution times and favorable trading conditions for gold (XAU/USD) traders. The broker falls under various jurisdictions, providing a balance between flexibility and protection for traders.

StarTrader offers spreads from 0.0 pips, leverage up to 1:1000, and deep liquidity, which is very attractive to gold traders who seek tight pricing and fast order execution. The broker supports both MT4 and MT5 platforms, copy trading, and a simplified mobile app, catering to both professionals and novices.

With more than 500,000 registered traders worldwide, StarTrader has become a suitable option for those who want to take advantage of gold price movement with ease, speed of execution, and transparency.

Key Facts about StarTrader

| Feature | StarTrader |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Standard, ECN, Demo |

| Tradable Instruments | Forex, Commodities, Metals, Indices, Shares, Crypto |

| Trading Platforms | MetaTrader 4, MetaTrader 5, StarTrader Mobile App |

| Regulation | FCA (UK), FSCA (South Africa), FSC, FSA (Seychelles), SCA, ASIC |

| Minimum Deposit | $50 |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | Up to 1:1000, can be restricted by regional regulations |

| Spreads on XAU/USD | From 0.0 pips (ECN account), typically 1.3 pips (Standard Account) |

| Commissions on XAU/USD | Varies by account type |

| Margin on XAU/USD | Ranges from 1:20 to 1:200 |

| Accepted Currency | USD, EUR, GBP, AUD, CAD, JPY, SGD, AED |

| Transaction Options | Bank cards, Wire Transfer, Neteller, Skrill, Perfect Money, SticPay, Local Bank Transfers |

#2. Vantage Markets

According to our research at WR Trading, Vantage Markets is the third-best broker for XAU/USD trading. This broker was established in 2009. Over the years, it has accrued more than 5 million registered traders. Vantage Markets offers traders access to top-class trading platforms such as ProTrader, MetaTrader 4, and MetaTrader 5.

Trading gold on Vantage Markets opens traders up to profitable opportunities in the global financial network and provides a hedge against currency devaluation. The broker supplies a lot of information on the intricacies of gold trading. We noted that this broker allows its clients to replicate the strategies of highly successful traders.

Key Facts about Vantage Markets

| Feature | Vantage Markets |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Pro ECN, Raw ECN, Standard STP, CENT, Premium, Swap-free |

| Tradable Instruments | Forex, Indices, Energy, Share CFDs, Precious Metals, ETFs, Bonds, Soft commodities |

| Trading Platforms | Vantage App, MetaTrader 4, MetaTrader 5, Trading View, ProTrader |

| Regulation | Australian Securities and Investment Commission (ASIC), Cayman Islands Monetary Authority (CIMA), VFSC, SIBL |

| Minimum Deposit | $50 (Standard and RAW), $10,000 (Pro ECN) |

| Minimum Order | 0.01 lots (for Standard STP, CENT, Raw ECN, and Pro ECN accounts) |

| Leverage on XAU/USD | 500:1 |

| Spreads on XAU/USD | Currently, at 0.75 pips. Typically, from 0.0 pips (Raw ECN and Pro ECN accounts), from 1.0 pips (Standard STP and CENT accounts) |

| Commissions on XAU/USD | $6 per lot |

| Margin on XAU/USD | 50% – 80% to be stopped out |

| Accepted Currency | AUD, USD, GBP, EUR, NZD, SGD, JPY, CAD, HKD, ZAR |

| Transaction Options | Domestic Fast Transfer, International EFT, BPAY, POLi Payment, Bank cards (MasterCard and Visa), China Union Pay, Neteller, Skrill, JCB, AstroPay, Broker-to-Broker Transfer, Pagsmile, Fasapay, Perfect Money, Thailand Instant Bank Transfer |

#3. Plus500 (US)

At WR Trading, we found Plus500 (US) to be among the most suitable brokers for U.S.-based traders to trade Gold Futures (GC contracts). It is our third-best gold trading broker. Unlike many overseas-based global brokers, Plus500 (US) is strictly regulated under U.S. law, making it one of the few compliant and trustworthy options available.

It is most suitable for those who prefer trading futures, with an easy platform and transparent fee plan. Plus500 (US) is regulated by both the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). This gives US traders strong levels of protection while they enjoy access to the gold price action.

Overall, Plus500 (US) is appealing to investors who need access to the international gold market while staying within the completely U.S.-regulated environment, a balance between security, transparency, and compliance.

Key Facts About Plus500

| Feature | Plus500 |

|---|---|

| XAU/USD Available | Yes, Gold Futures like Gold, Micro Gold, E-mini Gold, 1 Ounce Gold |

| Account Types | Standard, mini, micro (Futures accounts) |

| Tradable Instruments | Gold Futures, Energy Futures, Agricultural Futures, Metals, Indices Futures, Cryptos (as regulated) |

| Trading Platforms | Plus500 WebTrader, Plus500 Mobile App |

| Regulation | CFTC, NFA (Member) |

| Minimum Deposit | Varies by funding method (typically $100) |

| Minimum Trade Size | 1 Gold Futures Contract (GC) |

| Leverage on XAU/USD | Exchange-regulated (typically 1:20 for Gold Futures in the US) |

| Spreads on XAU/USD | Variable, exchange-based pricing |

| Commissions on XAU/USD | $0.89 standard and mini contract (futures), $0.49 micro contract |

| Margin on XAU/USD | Intraday Margin: Ranges from $25 to $500 |

| Accepted Currency | USD |

| Transaction Options | Bank transfer (ACH, Wire), Debit/Credit cards, PayPal |

#4. RoboForex

Based on our research, RoboForex takes the fourth position. This financial brokerage company has a license from the Financial Services Commission of Belize. It offers a wide range of technical trading tools on its MetaTrader suite and R MobileTrader app.

The XAU/USD trading pair is available on RoboForex’s ProCent, Pro, ECN, and Prime accounts. The broker allows its clients to trade this pair for a minimum spread and margin percentage of 0 pips and 100% respectively.

Traders who use trading volumes of at least three standard lots have access to a free VPS service. Furthermore, RoboForex offers a welcome bonus of $30 for new account holders.

Key Facts about RoboForex

| Feature | RoboForex |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Prime, ECN, R StocksTrader, Pro, ProCent |

| Tradable Instruments | Stocks, Indices, Futures, ETFs, Metals. Energy commodities, Commodities, Currencies |

| Trading Platforms | MetaTrader 4, MetaTrader 4 MultiTerminal, MetaTrader 5, R StocksTrader, R WebTrader, R MobileTrader |

| Regulation | Financial Services Commission of Belize |

| Minimum Deposit | $10 (For Prime, ProCent, Pro and ECN accounts), $100 (For R Stocks Trader) |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | 1:300 (Prime)1:500 (ECN and R StocksTrader)1:2000 (ProCent and Pro) |

| Spreads on XAU/USD | Currently at 0 – 1.90 pips (Varies based on market condition for XAU/USD) Floating from 0 pips (Prime and ECN) From 0.01 pips (R StocksTrader) Floating from 1.3 pips (ProCent and Pro) |

| Commissions on XAU/USD | 10/mio |

| Margin on on XAU/USD | 100% (50% hedged margin) |

| Accepted Currency | USD |

| Transaction Options | Local bank transfer, Skrill, AstroPay, Perfect Money, Neteller, SticPay, Bank cards, QR & vouchers |

#5. IC Trading

According to our analysis at WR Trading, IC Trading is our fifth-best broker for gold trading for both institutional and retail traders. It has a license from the Financial Services Commission of Mauritius. The trading platforms on this broker are MetaTrader 4, MetaTrader 5, and cTrader. This broker offers two types of accounts: Raw Spread (best for scalpers) and Standard.

All trades occur at speeds lower than 40 ms with an Equinix NY4 server. This broker offers a leverage as high as 1:1000, a 0.01 micro lot size, and spreads from 0.0 pips.

With a few steps, you can open a new account on IC Trading without any extensive requirements. Furthermore, IC Trading derives its liquidity from top-tier liquidity providers, including hedge funds and highly ranked investment banks.

Key Facts about IC Trading

| Feature | IC Trading |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Raw Spread, Standard |

| Tradable Instruments | Forex CFD, Indices, Stocks, Commodities, Bonds, Forex, Crypto |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, WebTrader |

| Regulation | Financial Services Authority of Mauritius |

| Minimum Deposit | $200 |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | 1:500 |

| Spreads on XAU/USD | From 0.0 pips (Raw spread account) From 0.8 pips (Standard account) |

| Commissions on XAU/USD | $3 per $100,000 for Raw Spread (cTrader) $3.5 per lot per side for Raw Spread (MetaTrader) $0 per lot per side for the standard account |

| Accepted Currency | USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, CAD |

| Transaction Options | Neteller, Visa, UnionPay, Skrill, Neteller, PayPal, Broker to Broker, Wire transfer, Debit and Credit cards |

#6. PepperStone

Based on our investigation at WR Trading, Pepperstone is among the most trustworthy brokers for XAU/USD trading due to its extremely tight spreads and advanced trading platforms. Founded in 2010 in Melbourne, Pepperstone is overseen by top-level regulators, giving traders solid confidence in security and compliance.

Pepperstone also offers leverage of 1:400, 0.05 pips spreads on gold, and high liquidity from tier-1 liquidity providers, and thus it is suitable for both retail and professional traders. The broker also supports automated trading, copy trading, and several platforms (MT4, MT5, cTrader) to offer flexibility depending upon various types of trading styles.

Award-winning support, a good pricing policy, and fast execution make Pepperstone an essential broker for gold traders seeking speed in execution, reliability, and near-institutional conditions.

Key Facts about PepperStone

| Feature | Pepperstone |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Standard, Razor |

| Tradable Instruments | Forex, Commodities, Metals, Indices, ETFs, Cryptocurrencies, Shares |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Regulation | ASIC (Australia), FCA (UK), DFSA (Dubai), CySEC (Cyprus), SCB (Bahamas), CMA (Kenya), BaFin |

| Minimum Deposit | $0 |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | Up to 1:400 (depending on jurisdiction) |

| Spreads on XAU/USD | 0.05 (Razor and Standard) |

| Commissions on XAU/USD | Zero commission (Standard)$3.50 per lot per side (Razor account) |

| Accepted Currency | USD, EUR, GBP, AUD, CAD, JPY, NZD, SGD, HKD, CHF |

| Transaction Options | Bank cards (Visa, MasterCard), PayPal, Skrill, Neteller, UnionPay, Wire Transfer, POLi, BPay, Local Bank Transfers |

#7. PU Prime

At WR Trading, we learned that PU Prime is an excellent choice for those who seek broad market access and fair conditions for trading XAU/USD. Established in 2015 with its office located in Seychelles, PU Prime has become an award-winning broker, serving clients from more than 120 countries worldwide at the moment.

PU Prime provides spreads of 0.7 pips, leverage between 1:100 and 1:1000 on gold, and over 2,000 tradable instruments, including forex, precious metals, indices, stocks, and cryptocurrencies. For gold investors, the broker provides fast execution speeds, advanced charting features, and several account types, making it perfect for professionals and beginners alike.

With its global presence, competitive trading ecosystem, and diversification of products, PU Prime is a complete platform for anyone who is interested in trading gold within the purview of a broader multi-asset portfolio.

Key Facts about PU Prime

| Feature | PU Prime |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Standard, Prime, Cent, ECN |

| Tradable Instruments | Forex, Commodities, Precious Metals, Indices, Shares, Cryptocurrencies, ETFs |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile App |

| Regulation | FSA (Seychelles), FSC (Mauritius), FSCA (South Africa), ASIC |

| Minimum Deposit | $50 (Standard)$20 (Cent)$1,000 (Prime)$10,000 (ECN) |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | From 1:100 to 1:1000 |

| Spreads on XAU/USD | From 0.7 pips |

| Commissions on XAU/USD | Zero commission (Standard & Cent accounts)$7 per lot per side (Prime account)$2 per side lot (ECN account) |

| Margin on XAU/USD | 50% |

| Accepted Currency | USD, EUR, GBP, AUD, JPY, NZD, SGD, CAD, HKD |

| Transaction Options | Credit/Debit cards, Bank transfers, Skrill, Neteller, SticPay, Perfect Money, UnionPay, Local Payment Solutions |

#8. VT Markets

Based on our findings at WR Trading, VT Markets is a great broker for investors who want to benefit from the change in gold prices. Established in 2016 and operating from Sydney, VT Markets has FSCA and FSC regulations, providing investors with security and convenience.

Gold traders enjoy spreads as low as 0.0 pips, up to 1:500 leverage, and fast speeds of execution backed by Equinix servers. VT Markets also provides ease of use through MT4, MT5, and a mobile app, available to both amateur and professional traders. With over 1,000 instruments available to trade and solid customer support, VT Markets is now a favorite for XAU/USD traders.

Key Facts about VT Markets

| Feature | VT Markets |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Standard STP, Raw ECN, Islamic (Swap-Free), Cent Account, PRO ECN |

| Tradable Instruments | Forex, Commodities, Indices, Shares, Precious Metals, Energies, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, TradingView, VT Markets Mobile App |

| Regulation | FSP, FSCA, FSC, SCA |

| Minimum Deposit | $100 |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | Up to 1:500 |

| Spreads on XAU/USD | From 0.0 pips (Raw ECN) From 1.2 pips (Standard STP) |

| Commissions on XAU/USD | Zero commission (Standard STP)$6 per lot per side (Raw ECN) |

| Accepted Currency | USD, EUR, GBP, AUD, CAD, NZD, SGD, HKD, JPY |

| Transaction Options | Bank transfer, Visa/Mastercard, Skrill, Neteller, SticPay, UnionPay, FasaPay, Local Bank Options |

#9. Moneta Markets

WR Trading chose Moneta Markets as a secure choice for traders who need fast access to gold trading with easy-to-use features. Founded in 2019 in Sydney, the broker caters to the global community and is licensed by ASIC and FSCA (South Africa).

For XAU/USD trading, Moneta Markets provides tight spreads of 0.10 pips, leverage of up to 1:1000, and different types of accounts to suit new as well as experienced traders.

Its MT4, MT5, and in-house WebTrader platforms provide advanced charting features, one-click trading, and hassle-free execution. With more than 1,000 instruments to trade, traders are able to diversify among forex, shares, indices, and cryptocurrencies and keep gold at the focal point of their strategy.

Key Facts about Moneta Markets

| Feature | Moneta Markets |

|---|---|

| XAU/USD Available | Yes |

| Account Types | Direct STP, Prime ECN, Islamic (Swap-Free) |

| Tradable Instruments | Forex, Commodities, Precious Metals, Indices, Shares, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, MT4 WebTrader, PRO Trader, App Trader, MetaTrader App |

| Regulation | ASIC (Australia), FSP, FSCA, FCA, SLIBC |

| Minimum Deposit | $50 |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | Up to 1:1000 |

| Spreads on XAU/USD | From 0.10 pips (Prime ECN) From 1.30 pips (Direct STP) |

| Commissions on XAU/USD | Zero commission |

| Margin on XAU/USD | 1% |

| Accepted Currency | USD, EUR, GBP, AUD, CAD, NZD, JPY, SGD, HKD |

| Transaction Options | Bank transfer, Visa/Mastercard, Skrill, Neteller, FasaPay, SticPay, UnionPay, Local Payment Options |

#10. BlackBull

According to our analysis at WR Trading, BlackBull is one of the best Gold trading broker. With its headquarters in New Zealand, this company has been in operation since 2014. Blackbull provides unparalleled trading services with competitive spreads from 0.0 pips and a maximum leverage of 1:500.

We noticed that trades involving the XAU/USD pair take place within 75 milliseconds. Furthermore, traders can get access to reputable trading tools such as MT4, MT5, cTrader, and more. BlackBull Markets has over 1500 educational videos on its official YouTube channel, covering various aspects of trading, from setting up your account to becoming an expert.

Key Facts About BlackBull

| Feature | BlackBull |

|---|---|

| XAU/USD Available | Yes |

| Account Types | ECN Standard, ECN Prime, ECN Institutional |

| Tradable Instruments | Forex, Commodities, Indices, Crypto, Equities, Metals |

| Trading Platforms | TradingView, MetaTrader 4, MetaTrader 5, cTrader, BlackBull CopyTrader, BlackBull Invest |

| Regulation | Financial Services Authority in Seychelles, NZ FSP |

| Minimum Deposit | $0 (ECN Standard) $2,000 (ECN Prime) $20,000 (ECN Institutional) |

| Minimum Order | 0.01 lot |

| Leverage on XAU/USD | Up to 1:500 |

| Spreads on XAU/USD | From 0.8 (ECN Standard) From 0.1 (ECN Prime) From 0.0 (ECN Institutional) Depending on market conditions for XAU/USD (Currently at 1.2 pips) |

| Commissions on XAU/USD | Zero commission (ECN Standard) $6 per lot (ECN Prime) $4 per lot (ECN Institutional) |

| Margin on XAU/USD | 50% – 70% to be closed out |

| Accepted Currency | USD, EUR, JPY, GBP, CHF, CAD, AUD, NZD, HKD, XAU, BTC, ETH |

| Transaction Options | Bank cards (Visa and MasterCard), Bank transfer, Crypto, Airtm, Skrill, Neteller, SEPA, HexoPay, AMEX, PaymentAsia, Poli, Beeteller, Boleto, AstroPay, Local bank transfer, Help2Pay, FXPay, FasaPay, China Union pay |

What is Important when Choosing a Good Gold (XAU/USD) Trading Broker?

Before selecting good Gold (XAU/USD) trading brokers, we paid attention to several essential metrics. Some of them include:

Liquidity

We chose brokers with access to deep liquidity. Higher liquidity means tighter spreads, thereby reducing the charges associated with trading XAU/USD.

Individuals who rely on high-frequency trading techniques can benefit from the profits from small price movements due to the tighter spreads. Furthermore, high liquidity promotes stable prices. This way, institutional traders can execute high-volume trades without causing any price fluctuation.

Commission

At WR Trading, we understand that low commission matters to people who trade frequently or use short-term strategies like scalping. Therefore, we selected Gold trading brokers that offer low commission rates or commission-free trading. The lower commission percentage means that every trader’s potential profit is high, and they would feel encouraged to trade more.

Execution Speed

We understand the importance of speed in gold trading, especially during periods of high volatility. Therefore, all our selected brokers have reliable and fast trade execution, reducing the risk of requotes and slippages. This means traders will be able to utilise strategies and increase their performance.

Most experienced traders know that the XAU/USD pair is sensitive to geopolitical occurrences and economic news, causing its price to fluctuate. Quick trade execution speeds allow traders to open and close their positions to benefit from news releases.

Regulation

We have chosen brokers that hold operating licenses from reputable financial regulatory bodies, such as ASIC and CySEC. These brokers operate with strict standards and have the necessary structure to safeguard your funds.

They keep your funds in segregated accounts from their operating accounts to shield you in case of insolvency. Our recommended brokers are transparent about their pricing, commissions, fees, and overall operations.

Trading Platforms

All our recommended brokers have the best trading platforms, including the MetaTrader suite. The trading platforms are beginner-friendly because of their intuitive and easily navigable design. They are equipped with indicators, technical indicators, and other advanced charting tools. These trading apps can function on a wide range of devices.

Leverage on XAU/USD

Leverage for trading XAU/USD is largely based on the geographical location of the trader and the broker. For well-regulated regions such as the United States or Europe, leverage is restricted to lower levels (typically between 1:20 and 1:50). For example, U.S. brokers overseen by the CFTC restrict XAU/USD leverage to no more than 1:20.

In less regulated environments, brokers can offer leverage as high as 1:500, meaning that traders can control larger positions with fewer funds. Some brokers also offer flexible leverage that can be adjusted according to market conditions and trader experience. Retail accounts have smaller limits, but professional accounts can access higher ratios.

Commissions on XAU/USD

Trading gold commissions vary depending on the broker, account, and platform. Some brokers have no commissions but build charges into spreads, while others charge a flat fee for each trade. XAU/USD commission generally ranges between 0.1% and 0.5% of the trade value

For instance, a $100,000 trade on gold can result in a commission fee of $100 to $500, depending on the broker model. High-volume traders may benefit from tiered commission models where charges are reduced with increased trading volumes. ECN and STP brokers have the lowest commissions because of direct market access.

Swaps on XAU/USD

Swaps, or rollover charges, are applied when gold positions are held overnight. They are interest-related fees (or credits) that are based on whether the trader is long or short on XAU/USD and the swap rate of the broker.

For example, a long gold position can carry a swap charge since traders are in effect borrowing U.S. dollars in order to buy gold. A short position, however, can carry a swap credit since the trader is lending U.S. dollars versus gold. Swap charges are calculated daily as a percentage of the trade value and vary between brokers and market conditions.

Types of Financial Products to Trade Gold

At WR Trading, we have noticed that there are several financial products available to trade Gold. Let’s examine three examples.

Options

Gold options are derivative contracts that derive their value from physical gold or gold futures. Options are unlike futures in that they give investors the right and not the obligation to buy or sell gold at a given price and date.

There are two major types:

- Call Options: The right to buy gold at a given price.

- Put Options: The right to sell gold at a given price.

Gold options are date-expiring according to the agreement terms. They are more advanced than CFDs and are typically appropriate for experienced traders who understand how to handle premium fees, strike prices, and time decay.

Contract For Difference (CFDs)

Gold CFD allows you to sell and purchase Gold without actually possessing the physical commodity. When you trade in Gold CFDs, you are trading in the difference between the gold value at opening and closing your position.

This permits you to benefit from rising and falling prices without being required to take physical possession of the gold. CFDs also allow traders to leverage, where a small amount of capital is employed to manage a position that is larger. CFDs are typically favored by retail traders because they have a low capital requirement, are accessible, and versatile.

The other advantage is that CFDs do not have expiry dates, meaning the position can be left open for as long as the trader wants. They are highly liquid, and most brokers provide risk control facilities such as stop-loss orders to eliminate risks effectively.

Futures

Gold futures are standardized contracts in which buyers and sellers can sell or buy gold on a future date at a previously set price. They are widely employed by speculators as well as institutions to generate returns from price volatility or to hedge risk.

Like CFDs, futures can be margined, allowing investors to handle huge positions with relatively smaller capital. Nevertheless, unlike CFDs, futures contracts have set expiry dates that can be monthly, quarterly, or annually. Because of this intricacy, professional traders and institutional investors largely control futures markets.

Exchange-Traded Funds (ETFs)

Gold ETFs are exchange-traded funds that track the price of gold. As opposed to futures or CFDs, an ETF does not include leverage or exposure to derivative contracts. Rather, it allows investors to become exposed to the price of gold in a simple, more traditional stock-market form.

Gold ETFs are preferred by institutional and retail investors who want to diversify their holdings in a cheap and liquid way. They are traded and purchased similarly to stocks, without the possibility of having to handle physical gold or margin commitments. This makes them one of the most convenient and secure ways of investing in gold

Conclusion

Gold is still one of the most valuable and most traded assets in the global markets, offering stability and opportunity to traders. In this guide, we reviewed the ten best gold brokers, examining the most significant aspects of XAU/USD trading, including leverage, fees, regulation, and swaps, as well as the different available instruments like CFDs, options, futures, and ETFs.

StarTrader, Vantage, and Plus500 (US) stood out as our best brokers for XAU/USD trading.:

- StarTrader offers competitive spreads from 0.0 pips and leverage of up to 1:500 for XAU/USD traders.

- Vantage provides access to the XAU/USD pair exclusively via CFDs, offering high liquidity and active price movement similar to major forex pairs.

- Plus500 (US) also provides a compliant platform for traders to access global markets while adhering to US regulations. It is an ideal choice for US traders looking to trade futures.

Regardless of whether you are a beginner or an experienced trader, choosing the right broker is central to a successful gold trading system. Being provided with the information and means offered here, you are properly prepared to trade XAU/USD confidently.

Frequently Asked Questions on Gold Trading Brokers (FAQ)

What does XAU/USD mean in Forex Trading?

XAU/USD is a FOREX currency pair that indicates the price of one troy ounce of gold (XAU) against that of the US dollar (USD). While trading, this symbol tells you the amount of US dollars required to purchase one ounce of gold.

What are the Benefits and Risks Associated with Trading Gold (XAU/USD)?

Some of the benefits of trading gold include its ability to serve as a hedge against inflation and maintain its value for a long time, thereby serving as a long-term means of keeping wealth. A popular risk associated with trading XAU/USD is the potential for significant losses resulting from the use of high leverage.

What Factors Influence the Price of Gold (XAU/USD) in Forex Trading?

The strength of the US dollar influences the price of gold. Higher inflation, lower interest rates, and geopolitical crises can increase the value of gold, as investors run to this precious metal for safety. Furthermore, the policies of different central banks can affect the price of gold, as some of these institutions diversify away from paper fiat currencies.

What are The Periods Available for Trading XAU/USD?

You can trade gold (XAU/USD) for five days a week from Monday to Friday. At WR Trading, our advice is for traders to target periods of high liquidity. Do note that the trading market is usually closed on weekends.