Explore the 10 Forex brokers well-suited to HFT traders, highlighting their strengths and considerations.

High-frequency trading (HFT) demands that a broker keep up with your lightning-fast strategies. But with a plethora of brokers out there, we’ve narrowed down the options to the 10 best platforms that allow HFT trading and algorithms in 2026:

HFT Forex Broker:

Supports HFT:

Advantages:

Account:

Yes, High-Frequency Trading supported

API Access

- Offshore A-Book Broker

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- High liquidity and fast execution

- MT4, MT5

- No limited trading

- Perfect for HFT Strategies

Yes, High-Frequency Trading supported

API Access

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/MT5 & cTrader

Yes, High-Frequency Trading supported

API Access

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

Yes, High-Frequency Trading supported

API Access

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- MT4/5, RTrader, CopyFX

Yes, High-Frequency Trading supported

API Access

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4 ,MT5

Yes, High-Frequency Trading supported

API Access

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 4$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

Yes, High-Frequency Trading supported

API Access

- Multiple regulated

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 2$/1 Lot

- Personal support

- MT4, MT5

Yes, High-Frequency Trading supported

API Access

- Micro Accounts Available

- Spreads from 0.0 Pips

- Leverage up to 1:888

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5

Yes, High-Frequency Trading supported

API Access

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

Yes, High-Frequency Trading supported

API Access

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

See here our comparison of the best forex brokers that allow HFT strategies on YouTube:

1. StarTrader

StarTrader is a rapidly expanding Forex and CFD broker that has rapidly gained the attention of traders seeking rapid execution and low fees, two key elements of high-frequency trading (HFT). Founded with a focus on innovation and end-user usability by being connected to the biggest liquidity providers like Goldman Sachs or Deutsche Bank, StarTrader now caters to over 100 nations, boasting a globally headquartered infrastructure that is ideal for algorithmic trading. Due to the fact of deep liquidity, fast execution, high leverage (1:1000), and narrow spreads, it is our number one winner in our HFT Forex Broker comparison.

For HFT traders, one of the best aspects of StarTrader is the raw spread on Forex and CFDs with low commission from 3$ per 1 lot trade, which allows for reduced transaction fees for high-frequency, high-volume positions. This is especially useful for retail and novice HFT traders who survive on thin margins. The broker supports MetaTrader 4 and MetaTrader 5, both of which enjoy lightning-fast execution speeds, automation, and compatibility with third-party software and APIs.

API connectivity is supported, enabling seasoned traders to implement their own proprietary HFT algos. Combined with spreads as tight as 0.6 pips, negligible minimum deposits, and no deposit/withdrawal fees, the broker offers a cost-conscious and reliable foundation for HFT strategies.

In summary, StarTrader is the ideal solution for those interested in engaging in high-frequency trading without much hassle, simple-to-implement tools, and institutional-level technology.

| Feature | Description |

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Forex, CFDs |

| Minimum Deposit | $100 |

| Account Types | Standard, ECN, Islamic |

| Spreads | Low, from 0.0 pips (ECN), from 1.3 pips (Standard) |

| Commissions | $3 (ECN) per halfturn, $0 (Standard) |

| API Access | Yes |

| Other Features | Zero deposit/withdrawal fees |

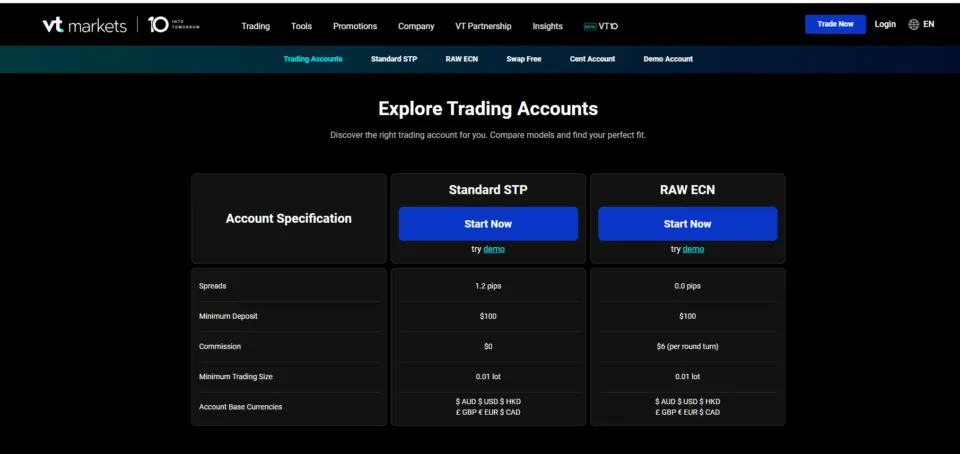

2. VT Markets

VT Markets excels in providing a robust trading environment suitable for HFT strategies. During our testing, we discovered that the platform offers lightning-fast execution speeds and low latency, essential for high-frequency trading. VT Markets utilises the Equinix NY4 data centre, ensuring minimal delays and reliable performance. By these features, it is highly ranked in our HFT Broker comparison as number 2.

As an HFT software, it supports MetaTrader 4 and MetaTrader 5 and cTrader, equipped with advanced charting tools and automated trading capabilities. VT Markets’ competitive pricing with tight spreads and low commissions makes it an attractive option for HFT traders. Additionally, the broker is regulated by multiple financial authorities like FSCA in South Africa and SCB in UAE.

For HFT traders, VT Markets’ combination of speed, technology, and competitive pricing makes it a strong contender.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Forex, Indices, Soft Commodities, Energy, ETFs, Share CFDs |

| Minimum Deposit | $100 |

| Account Types | Standard STP, Raw ECN, and Pro ECN account. |

| Spreads | Low, starting from 0.0 pips |

| Commissions | Variable (standard account – built into spreads, raw account – from 3$ per 1 Lot Trade) |

| API Access | Yes |

| Other Features | Demo account |

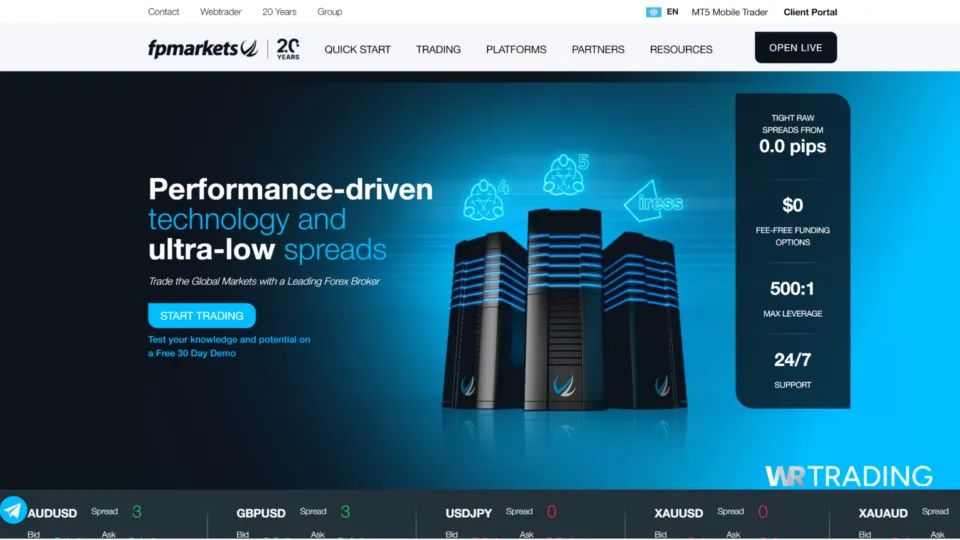

3. FP Markets

FP Markets is our third excellent choice for HFT because it emphasises speed and efficiency. The broker’s use of Equinix data centres in New York and London ensures ultra-low latency, which is crucial for high-frequency trading. FP Markets offers access to MetaTrader 4, MetaTrader 5, cTrader, and IRESS platforms.

The broker is known for its tight spreads and low commissions, making it cost-effective for frequent traders. We found that FP Markets is regulated by ASIC and CySEC, providing high security and trust. The extensive educational resources, including webinars and market analysis, benefit traders looking to refine their strategies.

Perhaps one aspect we found most appealing is the online resources available to clients. FP Markets’ educational resources are a valuable bonus, especially for traders looking to sharpen their HFT skills.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Forex, Commodities, Indices, Gold, Oil, Silver, Bonds |

| Minimum Deposit | $100 |

| Account Types | Standard, Raw and Islamic |

| Spreads | Low, starting from 0.0 pips |

| Commissions | $ 0 for Standard account, $3.50 per 100k round turn (Raw account) |

| API Access | Yes |

| Other Features | Low-cost accounts |

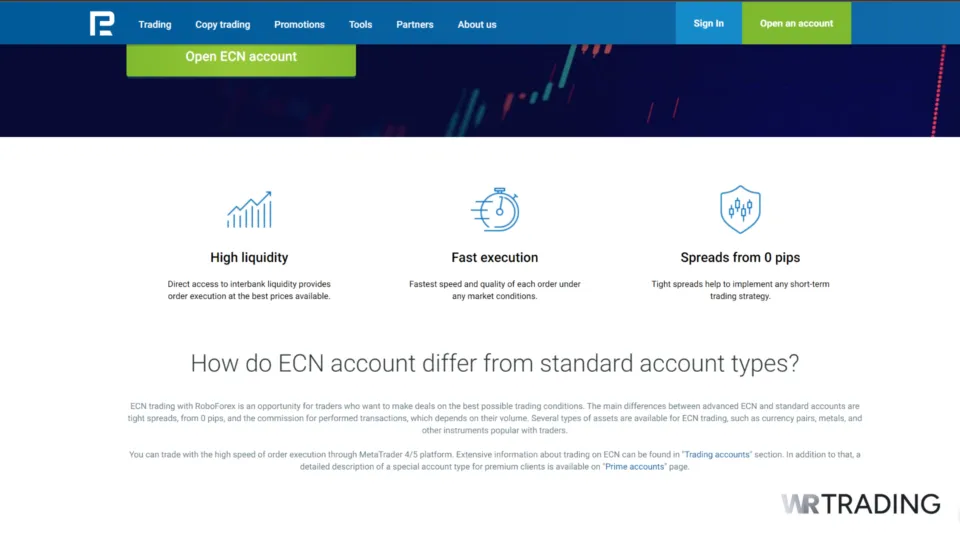

4. RoboForex

RoboForex’s Electronic Communication Network (ECN) model caters to aggressive trading styles. Traders can access MT4, MT5, and their proprietary R Trader platform. RoboForex allows scalping and hedging strategies, which are beneficial for HFT.

The broker’s competitive spreads, high-leverage options, and promotional offers like bonuses and cashback programs enhance its appeal to HFT traders. RoboForex operates under the regulation of the IFSC, which provides a moderate level of security.

Our testing revealed that trading instruments such as bonds and cryptocurrencies are unavailable. However, HFT traders still get transparent access to multiple features and other trading instruments.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Stocks, Indices, Futures, ETFs, Soft Commodities, Currencies |

| Minimum Deposit | $10 |

| Account Types | Prime,ECN, Pro-Standard, Pro-Cent |

| Spreads | Variable, starting from 0.0 pips (ECN Prime) |

| Commissions | Variable (standard account – built into spreads, raw account – commission fees apply) |

| API Access | Yes |

| Other Features | Educational materials available |

5. IC Trading

IC Trading is a well-established broker focusing on low spreads and fast execution. Like FP Markets, it offers industry-standard MT4 and MT5 platforms with built-in algorithmic trading features.

We found IC Trading reliable when it comes to client trust and security. The broker is regulated by the Financial Services Commission of Mauritius (FSC) and has an insurance policy up to $1,000,000 for each client. The platform offers a comprehensive suite of educational resources, making it suitable for traders of all levels.

While the advanced features may seem overwhelming to beginners, IC Trading provides the tools and environment for successful high-frequency trading.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Currencies, stocks, CFDs, Commodities, Futures, Bonds |

| Minimum Deposit | $200 |

| Account Types | Standard, Raw Spread, cTrader |

| Spreads | Variable, starting from 0.0 pips (Raw Spread account) |

| Commissions | $7 per standard lot round turn |

| API Access | Yes |

| Other Features | Demo account |

6. BlackBull Markets

BlackBull Markets is another strong contender for HFT traders. The company gives traders access to popular MT4 and MT5 platforms and its BlackBull Markets platform. BlackBull Markets focuses on low-latency execution and deep liquidity through its ECN network. It is known for its competitive commissions and focus on providing a good platform for algo traders.

BlackBull Markets impressed us with its well-rounded offering for various experience levels. BlackBull Markets seems a solid choice for traders seeking a dependable platform with multiple options.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Forex, Equities, Commodities, Futures, Indices |

| Minimum Deposit | $0 |

| Account Types | Standard, ECN Prime, Institutional |

| Spreads | Variable, starting from 0.0 pips |

| Commissions | Negotiable for ECN Prime, variable for other accounts (Standard: built into spread; commissions may apply for other account types) |

| API Access | Yes |

| Other Features | Demo account, educational resources |

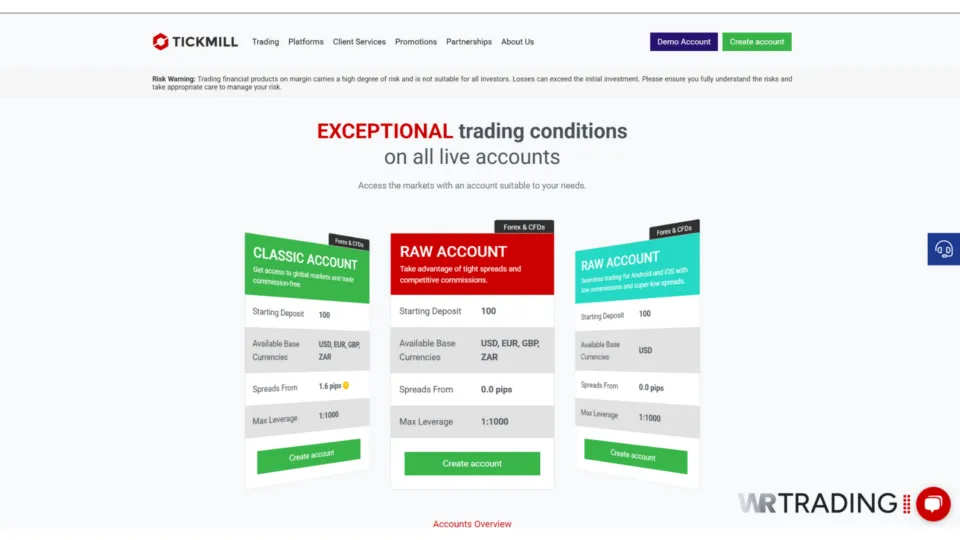

7. Tickmill

While they may not be the most well-known name, Tickmill has garnered a loyal following, particularly among high-frequency traders (HFT). Founded in 2014, Tickmill has maintained a reputation for being a reliable and competitive HFT software.

Their Raw Account boasts some of the tightest spreads in the industry, averaging around 0.5 pips for the EUR/USD pair. This minimal spread translates to lower costs for high-volume traders, a crucial factor in HFT strategies that capitalise on small price movements.

Tickmill is regulated by the UK’s Financial Conduct Authority (FCA), a Tier-1 regulator, the CySEC, and the FSA.

Tickmill is perfect for those who focus on forex and CFDs. While the platform options are limited to MetaTrader, Tickmill’s focus on core functionality and affordable pricing makes it a solid choice for traders looking for a streamlined experience.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Forex, Gold, Silver |

| Minimum Deposit | $100 |

| Account Types | Pro, VIP, Classic |

| Spreads | Variable, starting from 0.0 pips (ECN Pro) |

| Commissions | $2 per 100k USD traded (ECN Pro), variable for other accounts |

| API Access | Yes |

| Other Features | 3.5% interest, cash rebates |

8. XM

Regulated by the FCA, CySEC, ASIC, and IFSC, XM ensures high levels of security and client fund protection, including negative balance protection and segregated client funds. Customer support at XM is available 24/5 via live chat, email, and phone, and the broker supports over 25 languages, ensuring that clients worldwide can get the help they need.

XM serves clients from more than 190 countries, with a client base exceeding 5 million traders worldwide. The broker has received numerous awards, including Best FX Service Provider (2022), Best Forex Broker (2022), Best Forex Customer Service (2021), and Best Trading Platform (2021).

XM boasts a high order execution speed, with 99.33% of orders reportedly executed in under a second. HFT Traders worried about slippage can rest assured.

Our tests showed that seasoned traders might find the platform a bit basic, but XM is a good option for new traders seeking a well-supported learning environment.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Stocks, Indices, Oil, Gold |

| Minimum Deposit | $5 |

| Account Types | Micro Account, Standard Account, Ultra Low Account (Islamic account) |

| Spreads | Low, starting from 0.6 pips |

| Commissions | $3.50 commission per lot per trade on XM Zero accounts |

| API Access | Yes |

| Other Features | $30 sign-up bonus |

9. Pepperstone

With a strong global presence that extends to clients from over 150 countries, Pepperstone remains a top choice for HFT traders. One key feature we noticed is its competitive pricing, particularly appealing to high-frequency traders. This HFT software offers tight spreads, starting from as low as 0.0 pips on the Razor account, coupled with low commissions, $3.50 per side per lot.

Pepperstone is regulated by multiple top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Dubai Financial Services Authority (DFSA). For HFT traders, this means greater confidence in the broker’s reliability and the safety of their funds.

While educational resources might be limited, Pepperstone’s focus on regulation with multiple Tier-1 licenses adds a layer of security that many traders will appreciate.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Forex, Commodities, Indices, Currency Indices, Shares, ETFs |

| Minimum Deposit | $0 |

| Account Types | Standard and Razor accounts. |

| Spreads | Low, starting from 0.0 pips |

| Commissions | Variable based on account type: Standard or Razor Account |

| API Access | Yes |

| Other Features | $0 deposit/withdrawal fees |

10. Moneta Markets

Moneta Markets is a South African forex and CFD broker founded in 2019. Whether you’re a seasoned pro or just starting, the platform has features that could make it a good fit.

One major plus side is that Moneta Markets keeps fees low, especially for commodities, indexes, and crypto. We found it even easier to test the platform thanks to zero extra charges for deposits and withdrawals in most cases. They cater to different trading styles with various account options, whether you prefer commission-free trades or razor-thin spreads. Plus, they haven’t skimped on trading platforms.

Moneta Markets’ well-designed platform features the industry-standard MetaTrader 4 and 5 and Trading Central analysis tools. For those who take their trading seriously, free VPS hosting keeps things running smoothly.

| Feature | Description |

|---|---|

| HFT Allowed | Yes, HFT Strategies and HFT Bots, Expert Advisors (EAs) allowed |

| Products | Forex, Commodities, Indices, Share CFDs |

| Minimum Deposit | $50 |

| Account Types | Standard, Prime, and ECN Forex |

| Spreads | Very low, starting from 0.0 pips |

| Commissions | Up to $3 per lot per side for Prime ECN |

| API Access | Yes |

| Other Features | Sharia-compliant trading |

How did we choose the best HFT Forex Brokers?

High-Frequency Trading (HFT) thrives on speed and precision. Selecting the right broker on WR Trading for your HFT strategy requires careful consideration. Here are some key criteria to guide your choice:

- Execution Speed and Latency: We choose brokers with robust infrastructure and cutting-edge technology to ensure orders are filled with minimal latency (delay). In recent years, nearly 10% of all trades used HFT, which has a clearing time of just a few seconds. Ideally, execution times should be below 50 milliseconds to capitalise on fleeting market opportunities.

- Low Costs, High Volume: HFT strategies involve high trade volume with tiny profit margins. Therefore, competitive fees are usually key for this trading strategy. We look for brokers offering low commissions, tight spreads (the difference between the buy and sell price), and minimal non-trading fees. ECN (Electronic Communication Network) accounts are often preferred as they provide raw spreads and commission-based pricing.

- Liquidity Matters: Deep liquidity ensures smooth order execution. To minimise slippage (the difference between the expected and actual price of a trade), we often look for brokers with access to a vast pool of buyers and sellers. Brokers with connections to major exchanges and Electronic Market Makers (EMMs) are ideal.

- Proper Tech Support: HFT relies heavily on advanced technology. We need a broker that offers robust trading platforms like MetaTrader 4 and 5 or cTrader and provides API (Application Programming Interface) access for integrating custom algorithms. Reliable technical support is crucial to troubleshoot any issues that might arise.

Why Are Not All Brokers Accepting HFT Trading?

Not all brokers accept high-frequency trading (HFT) (including bots and algorithms) because it requires latency-free execution, involves complicated infrastructure, creates issues of fairness in the market, and results in minimal profitability for the broker. While HFT is lucrative for traders who possess advanced algorithms, it creates significant problems for brokers.

Here are the reasons behind brokers’ varying policies on high-frequency trading (HFT):

- Infrastructure Burden: HFT demands thousands of trades per second to be fired, placing immense pressure on a broker’s servers and computing infrastructure. Smaller or less sophisticated brokers can’t even contemplate handling this volume without compromising platform performance for everyone. Brokers need ultra-low latency systems and data centres to accommodate HFT, a technically and expensive setup.

- Market Integrity and Fairness: Brokers fearful of creating a level and equal playing field are likely to block or limit HFT. These programs are likely to manipulate micro-movements of price and trade faster than human traders, thereby inducing volatility and slippage in the market for other traders. HFT is thought by some regulators to create “unfair advantages.”

- Profitability Concerns: HFT takes tiny margins on huge volumes. Traders benefit from the model, yet brokers more often gain less in commission terms due to thin spreads and tiny orders. The cost of sustaining HFT infrastructure may outweigh the profit for brokers prioritising larger client bases.

What is the Regulation and Security of an HFT Broker?

Regulatory authorities establish rules and standards that govern HFT activities, including trading practices, market access, and risk management. Key regulatory bodies overseeing HFT may include:

- Financial Conduct Authority (FCA) in the UK

- Securities and Exchange Commission (SEC) in the United States

- Australian Securities and Investments Commission (ASIC) in Australia

- Commodity Futures Trading Commission (CFTC) in the United States

- European Securities and Markets Authority (ESMA) in the European Union

These regulatory bodies enforce compliance with regulations such as Market Abuse Regulation (MAR), Market Conduct Rules, and Anti-Money Laundering (AML) requirements to maintain market integrity and protect investors from abusive or manipulative trading practices.

Market Surveillance

Regulators employ sophisticated surveillance systems to monitor HFT activities and detect irregularities or potential market abuse. Market surveillance tools analyse trading data in real time, flagging suspicious patterns or behaviours that may indicate manipulative trading, insider trading, or other violations of market rules.

Regulatory authorities work closely with exchanges, trading platforms, and market participants to ensure timely investigation and enforcement actions against offenders.

Risk Management

Our research found that top HFT firms implement robust risk management practices to mitigate operational, financial, and regulatory risks associated with high-speed trading. Effective risk management strategies include pre-trade risk checks, position limits, circuit breakers, and automated monitoring systems to proactively identify and address potential risks.

Cybersecurity

Cybersecurity is critical to HFT operations, given the reliance on electronic trading systems and connectivity to global markets. We noticed that the best HFT firms invest in cybersecurity measures to safeguard their trading infrastructure, data, and proprietary algorithms from cyber threats such as hacking, malware, and distributed denial-of-service (DDoS) attacks.

Is HFT Trading legal or not?

High-frequency trading (HFT) is not illegal and is a legal practice for market participation. It’s a legitimate trading method that uses powerful computers and algorithms to exploit tiny market inefficiencies quickly.

Our research shows that the best brokers are well-regulated by top-tier authorities. These regulatory bodies are constantly working to define and prevent any form of market manipulation or giving unfair advantages.

Benefits of Using Trading APIs for HFT Trading:

Trading APIs are integral to the success of High-Frequency Trading (HFT) by enabling direct and automated interaction with trading platforms. HFT Traders often turn to trading application programming interfaces (APIs), which provide direct access to market data and order execution.

Here’s why you should use Trading APIs for HFT Trading:

1. Speed and Low Latency

Trading APIs offer ultra-fast order execution and low latency, making them well-suited for HFT strategies. APIs allow you to bypass traditional trading interfaces and connect directly to exchange servers or liquidity pools. This action reduces the time required to transmit orders, resulting in faster trade execution.

2. Customisation and Flexibility

Trading APIs provide high customisation and flexibility, allowing traders to tailor their trading strategies to specific market conditions and objectives. APIs enable the automation of trading processes, including order generation, risk management, and trade monitoring, based on pre-defined algorithms or rules.

This allows traders to fine-tune their strategies and adjust real-time parameters to adapt to changing market dynamics.

3. Access to Market Data

APIs grant access to real-time market data, including price quotes, order book depth, and trade history, enabling traders to make informed decisions quickly. By integrating market data feeds directly into their trading algorithms, HFT traders can analyse market trends, identify trading opportunities, and execute trades precisely.

4. Scalability and Efficiency

Trading APIs facilitate the scalability and efficiency of HFT operations by streamlining the trade execution process and reducing manual intervention. With APIs, traders can execute multiple trades across different markets and asset classes simultaneously.

This scalability allows HFT firms to handle high trading volumes and capitalise on various market opportunities.

5. Risk Management and Compliance

While trading APIs offer significant benefits for HFT, they pose risks, particularly regarding system reliability, connectivity issues, and potential errors. When using trading APIS, HFT traders must implement robust risk management measures and adhere to regulatory requirements.

This includes implementing failover mechanisms, monitoring system performance, and maintaining compliance with market regulations to mitigate operational and legal risks.

Which Execution Model is Important for HFT Trading Forex Brokers?

For HFT, execution at low latency is crucial on a direct basis. HFT methods rely on nanosecond windows in which to profit from price differentials. A slight delay of milliseconds is enough to make or break a trade.

Hence, the execution model the broker uses can have a direct bearing on HFT algorithm success. In order to prevent slippage and fill trades at target prices, having an efficient, direct, and transparent execution model broker is important. These are the best execution models for HFT trading:

1. ECN (Electronic Communication Network)

ECN brokers deal orders of various participants, i.e., banks, hedge funds, and other traders, on a network. The model provides tight spreads, deep liquidity, and fast execution and is highly effective for HFT. Since ECN brokers do not trade against clients, there is no dealing desk intervention, reducing execution delays and slippage.

2. STP (Straight Through Processing)

STP brokers route orders directly to liquidity providers without human intervention. This process offers instant and rapid execution with little possibility of requotes. While less overt than ECN, STP offers guaranteed speed and visibility and is applicable for HFT strategies that are partially professional.

3. DMA (Direct Market Access)

DMA provides investors with direct market access to order books in real-time and the ability to send orders straight into the market. It is the optimal model for professional HFT firms because it gives them maximum control, very low latency, and complete price transparency. Institutional investors have conventionally used DMA but is now increasingly offered by high-end retail brokerages.

Lastly, ECN and DMA models by brokers are best suited for HFT, while STP is possible depending on the broker’s infrastructure. Traders need to make sure their chosen broker is a non-dealing desk (NDD) environment and is API connected so that they can trade with little or no lag.

Which Role Does the Execution Speed Play in HFT Trading?

Speed of execution is the lifeblood of High-Frequency Trading (HFT), the most defining characteristic of the entire strategy, perhaps. HFT strategies are designed to exploit price inefficiencies that only last for fractions of a few milliseconds. In order to compete, traders must utilize brokers with execution speeds of less than 50 milliseconds, with top platforms boasting sub-10 millisecond execution speeds.

Why Execution Speed Matters

In HFT, milliseconds are valuable. Fast execution:

- Reduces slippage, allowing you to enter and exit at expected prices.

- Enhances fill rates, allowing you to take advantage of fleeting market opportunities to their fullest potential.

- Enhances strategy accuracy, allowing your algorithm to perform under real-world live market conditions optimally.

Hazards of Slow Execution

Slow brokers can result in:

- Lost trades or trades occurring at unfavorable prices.

- Increased market exposure and loss due to latency lag.

- Unreliable backtesting results since real-world performance will vary from simulated environments.

Brokers with the fastest execution

Based on our testing and industry requirements, the below brokers offer some of the fastest execution speeds appropriate for HFT:

- Vantage Markets – Execution times as low as <10ms, with Equinix NY4 data centre integration.

- FP Markets – Offers ultra-low latency with access to multiple Equinix data centres (NY4 & LD5).

- BlackBull Markets – Offers institutional-grade execution with cutting-edge fibre-optic infrastructure.

Utilization of VPS to minimize latency

To further increase speed, the majority of serious HFT traders make use of a Virtual Private Server (VPS). A VPS:

- Place your trading platform close to the broker servers.

- Ensures 24/7 uptime with uninterrupted order transmission.

- Lessen delays caused by local device malfunction or internet connectivity issues.

Brokers like Vantage, FP Markets, and BlackBull Markets typically offer free or discounted VPS options for professional traders.

As a whole, speed of execution isn’t just important, it’s essential to mission success with HFT. Choosing a broker that offers ultra-low latency infrastructure and VPS support can work wonders for your trading outcomes.

Using VPS Servers As Infrastructure In HFT Forex Trading for automation

In HFT, milliseconds count to make a profit or loss. It is due to this that professional traders like to trade on VPS (Virtual Private Server) infrastructure to trade their strategies. VPS Forex broker enables traders to run their trading platforms on a virtual server that is close to the data centre of the broker, less latency and faster speed of execution.

Here are the key reasons to use a Virtual Private Server (VPS) for High-Frequency Trading (HFT):

- Ultra-Low Latency: VPS servers are positioned near broker execution nodes (e.g., Equinix NY4 or LD5), reducing ping times and latency in sending orders.

- 24/7 Trading Stability: VPS ensures your platform runs all the time, even during power outages, internet outages, or hardware failure on your end.

- Automation & Speed: In usage of expert advisors (EAs) or trading robots, a VPS provides the platform to execute trades without delay and uninterrupted.

For HFT, VPS hosting is not just a nicety, it’s generally a necessity. Since HFT strategies rely on virtual instantaneous response times, delay from local equipment can significantly take away from profits. With a VPS Forex broker, the trader has the infrastructure necessary to provide optimal uptime, latency, and stable access to market data and execution servers.

Pre-eminent HFT brokers like Vantage Markets, FP Markets, and BlackBull Markets all offer bundled VPS packages, either entirely for free or at a reduced price point, mostly for professional or high-volume traders.

In general, incorporating VPS servers into your HFT setup gives you the infrastructure edge you need to maintain continuous, high-velocity trading performance.

What is the Right Platform & Software for HFT?

Due to the high-stakes nature of HFT, you could win or lose fortunes in the blink of an eye. The platform you choose goes a long way in ensuring you guarantee more wins. So, what makes a platform ideal for HFT? Here’s what to consider:

Built for Automation

HFT relies on algorithms to make trading decisions at lightning speed. Your platform should seamlessly integrate with your custom algorithms. We’ve tested platforms that offer features like API (Application Programming Interface) access and compatibility with popular algorithmic trading platforms like MetaTrader 4&5 or cTrader. These features are essential for building and deploying your algorithmic strategies.

Comprehensive Market Data

The platform should provide comprehensive market data feeds, including price quotes, order book depth, trade history, and other relevant data points. We often test specific platforms to ensure reliable data delivery with minimal latency and support integration with external data sources and APIs for additional market insights.

Speed and Latency

An ideal HFT platform must offer ultra-low latency to ensure rapid order execution. Latency, the delay between sending an order and its execution, needs to be minimised. According to a report by the TABB Group, latency below one millisecond is considered optimal for HFT.

We’ve found platforms like IC Markets and Pepperstone to excel in this area, providing an edge to HFT traders.

Robust API Support

Trading APIs are essential for implementing and executing algorithmic strategies in HFT. APIs provide real-time market data and facilitate the rapid execution of trades. From our experience, platforms like RoboForex and Vantage Markets offer comprehensive API support, enabling traders to deploy complex algorithms efficiently. In addition, you can see our Trading API Forex Broker Comparison.

What Are The Benefits Of 1-Click Trading On HFT Brokers?

Many trading platforms offer one-click trading, allowing traders to execute trades with a single button click without needing multiple confirmation steps. This feature provides several benefits for traders, particularly those engaged in high-frequency trading (HFT) and active day trading.

Here are some of the key advantages of one-click trading:

Speed and Efficiency

One-click trading enables traders to execute trades quickly and efficiently, reducing the time required to enter or exit positions. With just a single click, traders can instantly execute market orders, saving valuable time and allowing them to capitalise on fast-moving market opportunities.

This speed is especially beneficial for HFT strategies, where every millisecond counts in capturing fleeting market movements.

Reduced Latency

One-click trading helps reduce latency in order execution by eliminating the need for manual confirmation steps. Traders can place orders directly from the trading interface without delays caused by additional confirmation dialogues or pop-up windows.

OCT is handy for HFT traders who require rapid order execution to stay ahead of the competition and seize time-sensitive trading opportunities.

Improved Trade Timing

One-click trading allows traders to react quickly to changes in market conditions and execute trades at the optimal moment. With instantaneous order placement, traders can precisely enter or exit positions, minimising slippage and maximising trade execution efficiency.

This ability to act swiftly and decisively is crucial for achieving optimal trade outcomes, particularly in volatile or rapidly changing markets.

Streamlined User Experience

One-click trading simplifies the trading process and enhances the user experience by reducing the steps required to execute trades. Traders can place orders with a single click directly from the trading chart or order entry panel, eliminating the need to navigate multiple menus or screens.

This streamlined user interface improves efficiency and reduces the risk of errors, allowing traders to focus on their trading strategies without distractions.

Conclusion

High-frequency trading (HFT) presents a unique set of demands for Forex Brokers. As such, traders must use HFT software that provides easy access to features to help with effective trading. In this article, we’ve reviewed ten brokers catering to HFT, highlighting their strengths and considerations.

While we’ve assembled these options, you should select the ideal HFT broker based on your needs and priorities. Success hinges not only on the right broker but on in-depth market knowledge, effective risk management strategies, and a well-honed algorithmic trading approach.

Once again, here is our list of the 10 best HFT Brokers:

- StarTrader: Offers very low trading costs, direct ECN execution with low latency and high liquidity, perfect for HFT

- VT Markets: Access to 1,000+ markets with the lowest spreads and latency, API access for integration with your HFT strategies

- FP Markets: RAW Spread accounts and ECN execution

- RoboForex: Offers up to 5 different account types with different unique features, perfect for HFT

- IC Trading: Offers some of the lowest spreads starting from 0.0 pips and deep liquidity

- BlackBull Markets: NZ regulated broker with high leverage up to 1:500

- Tickmill: FIX API connection available to large private clients

- XM: Best execution policy without requotes

- Pepperstone: $0 minimum deposit and withdrawal fee, and supports automated trading via APIs

- Moneta Markets: Leverage up to 1:1000 with ECN execution and low spreads

Frequently Asked Questions on HFT Brokers

Are there ethical concerns associated with HFT?

Yes, there are ethical concerns associated with HFT, including potential market manipulation, unfair advantages over slower traders, and contributing to market volatility. Regulators and market participants continually address these issues through enhanced oversight and ethical trading practices.

How does HFT differ from traditional trading?

HFT differs from traditional trading in speed, volume, and reliance on advanced technology. While conventional trading might involve holding positions for days or weeks, HFT consists of executing thousands of trades in milliseconds to profit from minor price discrepancies.

How do HFT algorithms work?

HFT algorithms analyse large datasets, monitor market conditions, and execute trades based on predefined criteria. They use statistical models, machine learning, and other quantitative techniques to identify trading opportunities and optimise execution strategies.

Is HFT legal?

HFT is legal in most major predefined markets, including the United States, European Union, and Asia-Pacific. However, it is subject to stringent regulatory oversight to ensure fair trading practices and market integrity.

please update info , many brokers from this list dosnt allow hft and suspend profits!

Please tell me which ones? We found no rules in their terms of condition. Please help us out!