Forex broker regulation is the licensing and oversight provided by recognized financial authorities such as the FCA, CFTC, ASIC, CySEC, and others. These regulators enforce strict standards that protect traders, ensure transparency, and prevent fraudulent practices.

Therefore, choosing a regulated broker is important as it means your funds are safeguarded, trading conditions are fair, and you have access to legal recourse if disputes happen. In our guide at WR Trading, we’ve researched the top 10 regulated forex brokers, selected based on their licenses with tier-one authorities, track record of compliance, fund protection measures, and transparency in client dealings.

These are our Top 10 Regulated Forex Brokers in 2026:

Broker:

Regulation:

Advantages:

Account:

CySEC, CBI, ASIC, FSCA, FFAJ, KNF, BVI, ISA

- High Leverage up to 1:1000

- RAW ECN Spreads from 0.0 pips

- Fastest execution

- Attractive Bonus Programs

- Copy Trading

- MT4 / MT5

- Personal support 24/7

ASIC, FCA, BaFin, FINMA, DFSA, FSCA, MAS, JFSA, FMA

- Multiple regulations

- Leverage up to 1:50

- Demo account available

- More than 100 FX pairs

- No Commission

- Plus500 WebTrader, Plus500 App

FCA, CySEC, ASIC, BaFin, CMA, DFSA

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

ASIC, FCA, BaFin, FINMA, DFSA, FSCA, MAS, JFSA, FMA

- No Minimum Deposit

- Spreads from 0.6 Pips

- Access to 17,000+ Markets

- Leverage up to 1:200

- Low Commissions from $3 per trade

ASIC, FCA, BaFin, FINMA, DFSA, FSCA, MAS, JFSA, FMA

- CFTC & NFA regulated

- Spreads from 0.0 Pips

- More than 68 FX pairs

- Leverage up to 1:50

- Demo account available

- Oanda Mobile, Oanda Web, MT4, TradingView

ASIC, FCA, BaFin, FINMA, DFSA, FSCA, MAS, JFSA, FMA

- Multiple regulations

- Spreads from 0.0 Pips

- Commission: fixed $5 per $100k USD traded on FX

- More than 80 FX pairs

- Leverage up to 1:50

- Forex.com App, Forex.com Web Trader, MT5

CySEC, KNF, FCA, DFSA, FSC, IFSC

- Spreads from 0.0 Pips

- Leverage up to 1:200

- Commission from 0% per lot

- 2,100+ tradable assets

- xStation 5, xStation Mobile

CySEC, CBI, ASIC, FSCA, FFAJ, KNF, BVI, ISA

- Leverage up to 1:400

- Minimum Deposit $100

- 1.260+ Assets

- Copy Trading available

- MT4, MT5, and own platforms

CySEC, CBI, ASIC, FSCA, FFAJ, KNF, BVI, ISA

- Instant ECN Execution

- Spreads from 0.0 Pips

- Low Commissions From $3.00/1 Lot per Trade

- 24/7 Personal Support

- MT4/MT5, cTrader, TradingView

- Low Minimum Deposit

CySEC, CBI, ASIC, FSCA, FFAJ, KNF, BVI, ISA

- Leverage up to 1:400

- Minimum Deposit $100

- 1.260+ Assets

- Copy Trading available

- MT4, MT5, and own platforms

List of the Best Regulated Forex Brokers:

In this section, we will provide a brief review of each of the top five regulated forex brokers. The focus will be on their regulatory status and key features that make them stand out.

1. StarTrader

StarTrader is regulated by multiple tier-1 regulators worldwide, including the FCA in the UK, CMA in Kenya, and ASIC in Australia, which is why we gave it a high score of 95%. Spreads begin at 0.0 pips, and commissions range from 0% to $6 per lot depending on the account. Traders can access more than 500 instruments with leverage up to 1000:1.

The broker provides MetaTrader 4 and MetaTrader 5, two platforms known for reliability and advanced forex features such as automated trading, detailed charting, and custom indicators. However, it doesn’t have a good range of trading platforms, so some users may feel limited in their options. Also, the educational section is a great starting point for any new forex trader as it contains trading guides, webinars, and market insights.

Regulators:

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Capital Markets Authority of Kenya (CMA)

- Financial Sector Conduct Authority (FSCA)

- Vanuatu Financial Services Commission (VFSC)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – from 0% to $6 per lot |

| Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| Asset Types | Forex, commodities, indices, shares, crypto |

| Tradable Assets | Over 500 |

| Leverage | Up to 1000:1 |

| Customer Support | 24/5 phone, email, and live chat |

| Demo Account | Yes |

| Educational Content | Trading guides, webinars, and market insights |

| Regulation | FCA, ASIC, CMA, FSCA, and VFSC. |

2. Plus500

Plus500 takes our second place at WR Trading due to its wide global regulatory coverage and clear trading conditions. It holds licenses from more than ten regulators, including the Financial Conduct Authority (FCA), the Monetary Authority of Singapore (MAS), and the Australian Securities and Investments Commission (ASIC).

Forex traders can access leverage of up to 300:1 on professional accounts, with spreads on EUR/USD starting at 0.8 pips and no added commissions. This simplicity makes it one of the most transparent brokers for traders who value regulation and straightforward costs.

The Plus500 WebTrader platform is designed for usability and includes features such as guaranteed stop-loss orders and negative balance protection, both enforced under regulatory requirements. More than 2,800 instruments are available, and traders can get support through 24/5 live chat and email. Plus500 also provides its services to US traders with a dedicated trading academy with articles and videos to help clients understand markets and risk controls.

Regulators:

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- Financial Markets Authority of New Zealand (FMA)

- Monetary Authority of Singapore (MAS)

- Financial Sector Conduct Authority (FSCA)

- Dubai Financial Services Authority (DFSA)

- Israel Securities Authority (ISA)

- Estonian Financial Supervision Authority (EFSA)

- Securities Commission of the Bahamas (SCB)

- Financial Services Authority of Seychelles (FSA)

| Feature | Information |

|---|---|

| Spreads and Commission | Spread-only model: spreads from 0.8 pips (EUR/USD) No commission |

| Trading Platforms | Plus500 WebTrader, mobile app |

| Asset Types | Forex, commodities, indices, shares, ETFs, options, crypto |

| Tradable Assets | Over 2,800 |

| Leverage | Up to 300:1 |

| Customer Support | 24/7 live chat, and email |

| Demo Account | Yes |

| Educational Content | Plus500 Academy with articles and videos |

| Regulation | FCA, CySEC, ASIC, FMA, MAS, FSCA, DFSA, ISA, Estonian FSA, SCB, and FSA Seychelles |

3. Pepperstone

Pepperstone is our third pick because it blends cost-effective forex trading with seven layers of regulatory protection. It is licensed by top-tier bodies including the FCA, ASIC, and BaFin, ensuring that traders are protected under strict compliance rules in Europe, Australia, and beyond. Spreads on major forex pairs start from 0.0 pips with commissions from $3 per lot, while leverage can go as high as 500:1. The broker offers more than 1,200 instruments, giving traders access to a large, regulated trading environment.

On the platform side, Pepperstone supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView, allowing for advanced charting, automation, and market depth analysis. Support is available 24/5 through live chat, phone, and email, backed by research tools and webinars that meet regulatory standards for client information. For traders who want low costs without compromising oversight, Pepperstone delivers a balance of performance and security.

Regulators:

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- Federal Financial Supervisory Authority of Germany (BaFin)

- Securities Commission of the Bahamas (SCB)

- Capital Markets Authority of Kenya (CMA)

- Dubai Financial Services Authority (DFSA)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, and TradingView |

| Asset Types | Forex, commodities, indices, cryptocurrency, stocks, and ETFs |

| Tradable Assets | Over 1,200 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Webinars, educational videos, and trading guides |

| Regulation | FCA, CySEC, ASIC, BaFin, SCB, CMA, and DFSA |

4. IG

IG is one of the most heavily regulated forex brokers worldwide, licensed by more than ten authorities including the FCA, CFTC, NFA, ASIC, and FINMA. This means the broker is available for US traders with leverage capped at 50:1. With such broad regulation coverage, traders are assured that every aspect of their account is monitored under strict compliance rules.

Forex spreads can start from 0.0 pips with commissions from $3 per lot, and leverage is capped at 200:1. Therefore, if you need ultra-high leverage IG is not a suitable option. IG also provides access to over 17,000 instruments alongside forex trading, making it one of the largest selections of regulated markets available.

The broker offers its proprietary platform alongside MetaTrader 4 and ProRealTime, giving traders a mix of professional charting, automation, and execution speed. IG Academy provides structured learning through courses, videos, and webinars, aligning with regulatory requirements for transparent client education.

Regulators:

- Australian Securities and Investments Commission (ASIC)

- Bermuda Monetary Authority (BMA)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Financial Conduct Authority (FCA)

- Federal Financial Supervisory Authority of Germany (BaFin)

- Polish Financial Supervision Authority (KNF)

- Swiss Financial Market Supervisory Authority (FINMA)

- Dubai Financial Services Authority (DFSA)

- Financial Sector Conduct Authority (FSCA)

- Monetary Authority of Singapore (MAS)

- Japan Financial Services Agency (JFSA)

- Financial Markets Authority of New Zealand (FMA)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, IG Trading Platform, and ProRealTime |

| Asset Types | Forex, commodities, indices, cryptocurrency, stocks, IPOs, and ETPs |

| Tradable Assets | Over 17,000 |

| Leverage | 200:1 |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | IG Academy, news, seminars, and webinars |

| Regulation | ASIC, BMA, CFTC, NFA, FCA, BaFin, KNF, FINMA, DFSA, FSCA, MAS, JFSA, and FMA |

5. Oanda

Oanda has built a reputation as a trusted broker through strict regulation and long-standing market presence. It is overseen by multiple tier-one regulators including the CFTC in the United States, the FCA in the United Kingdom, and the ASIC in Australia. Traders benefit from variable spreads starting from 0.0 pips and a transparent commission model beginning at $40 per million traded. Maximum leverage is set at 200:1, ensuring compliance with risk management standards.

For forex traders, Oanda offers access to thousands of instruments across currencies, indices, and commodities. Its platforms include MetaTrader 4 and Oanda Trade, both containing advanced charting and analytical tools. Customer support is available through live chat, email, and phone, with detailed market analysis provided directly on its site. Oanda’s long track record under strict regulatory supervision makes it a reliable option for traders who prioritize security and transparency.

Regulators:

- Commodity Futures Trading Commission (CFTC)

- Polish Financial Supervision Authority (KNF)

- Financial Services Commission, British Virgin Islands (FSC)

- National Futures Association (NFA)

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Canadian Investment Regulatory Organization (CIRO)

- Japanese Financial Services Agency (JFSA)

- Monetary Authority of Singapore (MAS)

- Dubai Financial Services Authority (DFSA)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – from $40 per million traded |

| Trading Platforms | MetaTrader 4, OANDA Trade Web, OANDA Trade Mobile |

| Asset Types | Forex, indices, commodities, bonds, metals, crypto |

| Tradable Assets | Over 2,400 |

| Leverage | 200:1 |

| Customer Support | 24/5 phone, email, and live chat |

| Demo Account | Yes |

| Educational Content | Articles, videos, webinars, and trading courses |

| Regulation | CFTC, KNF, FSC, NFA, FCA, ASIC, CIRO, JFSA, MAS, and DFSA |

6. Forex.com

Forex.com is one of the better choices for traders who want high leverage and strict oversight. The broker is regulated in multiple tier-one jurisdictions, including the United States, United Kingdom, and Japan, which ensures traders operate under clear compliance rules. Spreads begin at 0.0 pips depending on account type, and commissions start from $60 per million traded. Maximum leverage reaches 500:1, giving traders flexibility while still being supervised by leading regulators.

Forex.com offers more than 4,500 tradable assets across forex, indices, commodities, and crypto, which provides plenty of opportunities for diversification. The platform suite includes MetaTrader 4, MetaTrader 5, WebTrader, and its own Forex.com app, giving traders several ways to execute their strategies.

Regulators:

- Canadian Investment Regulatory Organization (CIRO)

- Cyprus Securities and Exchange Commission (CySEC)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Cayman Islands Monetary Authority (CIMA)

- Financial Conduct Authority (FCA)

- Securities and Futures Commission of Hong Kong (SFC)

- Japanese Financial Services Agency (JFSA)

- Monetary Authority of Singapore (MAS)

- Australian Securities and Investments Commission (ASIC)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – from $60 per million traded |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Forex.com App |

| Asset Types | Forex, commodities, indices, shares, crypto |

| Tradable Assets | Over 4,500 |

| Leverage | Up to 500:1 |

| Customer Support | 24/5 phone, email, and live chat |

| Demo Account | Yes |

| Educational Content | Guides, video tutorials, webinars |

| Regulation | CIRO, CySEC, CFTC, NFA, CIMA, FCA, SFC, JFSA, MAS, and ASIC |

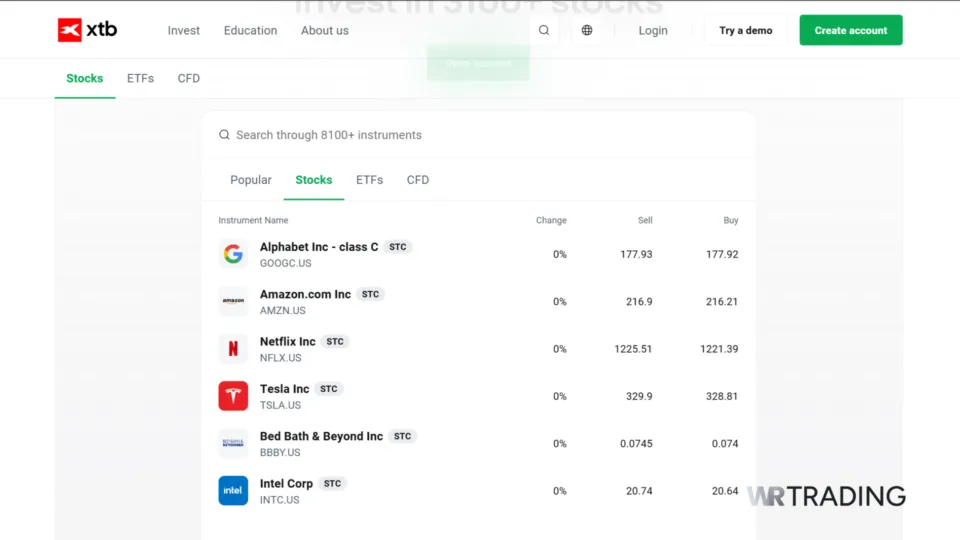

7. XTB

XTB is a European broker we recommend for strict regulation and its advanced proprietary platform. It holds licenses from multiple regulators, including the FCA in the United Kingdom and CySEC in Cyprus, which ensures compliance across retail and professional accounts. Spreads start from 0.0 pips with commissions as low as $3.50 per lot on certain account types, while leverage reaches 200:1. However, for EU clients leverage is capped at 30:1 due to regulations.

Over 2,100 instruments are available, covering forex, indices, commodities, stocks, and ETFs, which makes XTB a diverse but tightly regulated option. The xStation 5 platform is the core of the trading experience, offering quick execution, fast order placement, and built-in analytics for forex traders.

Regulators:

- Cyprus Securities and Exchange Commission (CySEC)

- Polish Financial Supervision Authority (KNF)

- Financial Conduct Authority (FCA)

- Financial Sector Conduct Authority (FSCA)

- Dubai Financial Services Authority (DFSA)

- International Financial Services Commission of Belize (IFSC)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From 0% to $3.50 per lot |

| Trading Platforms | xStation 5 and xStation Mobile |

| Asset Types | Forex, stocks, indices, ETFs, and commodities |

| Tradable Assets | Over 2,100 |

| Leverage | 200:1 |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Knowledge base and market analysis |

| Regulation | CySEC, KNF, FCA, FSCA, DFSA, and IFSC |

8. AvaTrade

AvaTrade operates under strong global regulation, holding licenses in Europe, Asia, Africa, and the Middle East. It offers spreads from 0.0 pips with commissions up to $6 per lot depending on account structure, while leverage reaches 400:1. AvaTrade offers more than 1,250 assets across forex, commodities, indices, stocks, bonds, and ETFs, providing access to multiple markets with oversight from multiple tier-one regulators.

The broker supports MetaTrader 4 and MetaTrader 5 alongside its proprietary AvaTrade platforms, including a mobile app and AvaOptions for forex options trading. Customer support is available via phone, email, and live chat, while its education hub provides detailed tutorials, strategy guides, and market analysis for forex traders.

Regulators:

- Cyprus Securities and Exchange Commission (CySEC)

- Central Bank of Ireland (CBI)

- Australian Securities and Investments Commission (ASIC)

- Financial Sector Conduct Authority (FSCA)

- Financial Futures Association of Japan (FFAJ)

- Polish Financial Supervision Authority (KNF)

- British Virgin Islands Financial Services Commission (BVI FSC)

- Israel Securities Authority (ISA)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $6 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, AvaOptions, AvaTrade App, and Mac Trading |

| Asset Types | Forex, commodities, indices, ETFs, bonds, and stock |

| Tradable Assets | Over 1,250 |

| Leverage | 400:1 |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Tutorials, technical analysis, strategy overviews, and guides |

| Regulation | CySEC, CBI, ASIC, FSCA, FFAJ, KNF, BVI FSC, and ISA |

9. FP Markets

FP Markets is another first-class forex broker at WR Trading since it combines tight pricing with tier-1 global oversight. The broker is regulated by six authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). Traders can access spreads from 0.0 pips and commissions starting at $3 per lot, which is highly competitive under such strict supervision. Maximum leverage reaches 500:1, but it can vary depending on the jurisdiction

FP Markets offers more than 10,000 tradable assets, covering forex, commodities, indices, shares, bonds, and ETFs. Trading is supported across MetaTrader 4, MetaTrader 5, cTrader, TradingView, and IRESS, so users can select a platform that matches their style. With strong customer support through email, phone, and live chat, FP Markets gives traders both reliable service and trustworthy conditions.

Regulators:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA)

- Financial Services Commission of Mauritius (FSC)

- Securities Commission of the Bahamas (SCB)

- Financial Services Authority of Seychelles (FSA)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, IRESS, and WebTrader |

| Asset Types | Forex, stocks, bonds, indices, commodities, cryptocurrency, and ETFs |

| Tradable Assets | Over 10,000 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Video tutorials and trading glossary |

| Regulation | ASIC, FSCA, FSA, SCB, FSC, and CySEC |

10. Interactive Brokers

Interactive Brokers is one of the most heavily regulated brokers in the world, licensed in multiple jurisdictions including the United States, United Kingdom, Switzerland, and Japan. Forex traders can access spreads from 0.1 pips with commissions ranging between 0.08 and 0.20 basis points of trade value. Leverage is capped at 50:1, reflecting strict US and EU regulatory requirements.

IB offers Trader Workstation (TWS), Client Portal, and IBKR Mobile, which give users professional-grade execution, market depth, and risk management tools. The broker’s education section, IBKR Campus, provides webinars, courses, and podcasts to help clients learn new strategies and gain market insights. We recommend Interactive Brokers for traders who want top-tier regulation, forex trading education, and access to global markets.

Regulators:

- U.S. Securities and Exchange Commission (SEC)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Financial Conduct Authority (FCA)

- Canadian Investment Regulatory Organization (CIRO)

- Australian Securities and Investments Commission (ASIC)

- Securities and Futures Commission of Hong Kong (SFC)

- Monetary Authority of Singapore (MAS)

- Japanese Financial Services Agency (JFSA)

- Hong Kong Monetary Authority (HKMA)

- Commission de Surveillance du Secteur Financier (CSSF)

- Swiss Financial Market Supervisory Authority (FINMA)

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.1 pips Commission – from 0.08 to 0.20 bps of trade value |

| Trading Platforms | Trader Workstation (TWS), Client Portal, IBKR Mobile |

| Asset Types | Forex, futures, stocks, options, ETFs, bonds, metals, crypto |

| Tradable Assets | Over 1,000 |

| Leverage | Up to 50:1 |

| Customer Support | 24/6 phone, email, and live chat |

| Demo Account | Yes |

| Educational Content | IBKR Campus, webinars, podcasts, and courses |

| Regulation | SEC, CFTC, NFA, FCA, CIRO, ASIC, SFC, MAS, JFSA, HKMA, CSSF, and FINMA |

How We Tested the Best Regulated Forex Brokers

Testing and comparing forex brokers is a process that requires a thorough evaluation of multiple factors to ensure that traders are getting the best possible service. Here’s an overview of how we conducted our testing to identify the most regulated and reliable forex brokers:

Regulatory Status

The first and most crucial aspect we examined was each broker’s regulatory status. We checked for licenses and oversight from top-tier regulatory bodies such as ASIC, FCA, CySEC, and others. A broker’s regulatory status indicates its adherence to strict financial standards, operational transparency, and client protection measures.

Trading Conditions

We evaluated each broker’s trading conditions, including spreads, commissions, and execution speeds. Tight spreads and low commissions are vital for minimising trading costs, while fast execution speeds are essential for effective trading, especially for strategies like scalping and high-frequency trading.

Range of Instruments

A diverse range of trading instruments allows traders to diversify their portfolios and explore various market opportunities. We assessed various financial products available, including forex pairs, indices, commodities, shares, and cryptocurrencies.

Trading Platforms

The functionality and reliability of trading platforms are crucial for a seamless trading experience. We tested the brokers’ platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and proprietary platforms, to ensure they offer advanced charting tools, user-friendly interfaces, and automated trading capabilities.

Customer Support

Quality customer support is essential for resolving issues and providing assistance when needed. We contacted each broker’s customer service to evaluate their responsiveness, professionalism, and availability. We ensured that support was accessible via multiple channels, including live chat, email, and phone.

Educational Resources

Educational resources help traders improve their skills and make informed trading decisions. We reviewed the educational materials provided by each broker, including webinars, tutorials, articles, and market analysis, to determine their comprehensiveness and usefulness.

Security of Funds

The safety of client funds is essential. We investigated each broker’s measures to protect client funds, such as segregation of funds, negative balance protection, and participation in compensation schemes.

What Are Trading Brokers’ Regulations?

Trading broker regulations are a set of rules and standards that forex brokers must adhere to, ensuring they operate fairly, transparently, and securely. To legally offer services, brokers must obtain a license from recognized financial authorities, which confirms that they meet the regulator’s financial and operational standards.

These regulations are enforced by governmental and independent regulatory bodies across different regions. The primary aim of these regulations is to protect traders and maintain the integrity of the financial markets.

Key Objectives of Broker Regulations

- Protecting Traders: Regulations protect traders from fraudulent activities and ensure their funds are safe. This includes measures such as segregating client funds from the broker’s operational funds, which helps prevent the misuse of client money.

- Ensuring Transparency: Regulated brokers must provide transparent pricing and clear terms of service. This means traders can trust their quotes and know all fees upfront.

- Maintaining Market Integrity: Regulators enforce rules that promote fair trading practices and prevent market manipulation. This helps maintain a level playing field where traders can operate without unfair advantages or deceptive practices.

- Financial Soundness: Regulatory bodies often require brokers to maintain sufficient capital reserves to meet financial obligations. This reduces the risk of broker insolvency and protects traders’ investments.

Compliance and Audits

Regulated brokers must comply with ongoing requirements set by their regulatory bodies. This includes regular financial reporting, audits, and adherence to conduct rules.

Brokers that fail to comply with these regulations can face severe penalties, including fines, license suspension, or revocation.

Different Tiers of Regulations

Regulatory bodies in the forex industry vary in their levels of oversight and enforcement. Understanding these different tiers can help traders choose brokers with the highest safety and transparency standards.

Top-Tier Regulators

Top-tier regulators are known for their stringent standards and rigorous enforcement. Brokers regulated by these authorities are generally the most trustworthy and secure.

- Financial Conduct Authority (FCA): The FCA, based in the UK, is among the most respected regulatory bodies. It enforces strict requirements on brokers, including high capital adequacy standards, segregation of client funds, and regular audits. This ensures that brokers operate with transparency and protect their clients’ interests.

- Australian Securities and Investments Commission (ASIC): ASIC is another top-tier regulator known for its rigorous regulatory framework. Brokers under ASIC’s oversight must adhere to strict financial standards, provide transparent pricing, and ensure the security of client funds through segregation.

- Cyprus Securities and Exchange Commission (CySEC): CySEC regulates brokers in Cyprus and is part of the European Union’s regulatory framework. It requires brokers to meet high financial and operational standards, including regular audits and client fund protection measures.

- Federal Financial Supervisory Authority (BaFin): BaFin regulates brokers in Germany, enforcing strict rules around transparency, client protection, and financial stability. It’s regarded as one of Europe’s toughest regulators and ensures that brokers operate responsibly within the EU framework.

- Commodity Futures Trading Commission (CFTC): The CFTC oversees the US derivatives and forex markets. Its role includes enforcing transparency, monitoring broker activity, and protecting traders from manipulation or abusive practices.

- National Futures Association (NFA): The NFA is the self-regulatory body for the US futures and forex industries. It ensures that brokers comply with ethical standards, maintain capital adequacy, and provide transparent pricing to protect clients.

Mid-Tier Regulators

Mid-tier regulators provide good oversight but may not be as stringent as top-tier regulators. However, they still ensure a reasonable level of security and transparency.

- Financial Sector Conduct Authority (FSCA): Based in South Africa, the FSCA oversees financial markets and enforces regulations to ensure fair trading practices and client protection. While not as stringent as the FCA or ASIC, the FSCA maintains significant regulatory standards.

- Dubai Financial Services Authority (DFSA): The DFSA regulates brokers in the Dubai International Financial Centre (DIFC). It requires brokers to comply with financial soundness and client protection measures, although the regulatory framework is slightly less rigorous than that of top-tier regulators.

- Securities and Commodities Authority (SCA): The SCA regulates brokers operating across the UAE outside the DIFC. It plays a central role in maintaining fair market practices, setting financial standards, and ensuring that clients’ funds are protected under UAE law.

Lower-Tier Regulators

Lower-tier regulators provide basic regulatory oversight. Brokers regulated by these authorities may offer less security and transparency than those under top or mid-tier regulators.

- International Financial Services Commission (IFSC): The IFSC, based in Belize, provides a regulatory framework that is less strict than that of top-tier regulators. While it offers some level of oversight, it is not as rigorous in enforcing compliance and protecting clients.

- Vanuatu Financial Services Commission (VFSC): The VFSC offers a more lenient regulatory environment. Brokers regulated here must meet basic financial standards, but the enforcement level is lower than that of higher-tier regulators.

Is a Regulated Broker Secure to Use?

Yes, a regulated broker is secure to use. Regulatory bodies impose strict standards that ensure brokers operate transparently and protect client funds. This includes keeping client money in separate accounts to safeguard it from the broker’s financial issues. Regular financial reporting and independent audits are required, ensuring the broker remains financially sound and trustworthy. This oversight provides a safer trading environment, giving traders confidence in the broker’s reliability and fairness.

Be Aware of Fake Regulations

While trading with a regulated broker generally provides security, it’s essential to be cautious of fake regulations. Some brokers may falsely claim to be controlled by reputable authorities to lure unsuspecting traders. These fraudulent brokers can pose significant risks, including potential loss of funds and unfair trading practices.

Always verify a broker’s regulatory status directly with the regulatory body to protect yourself. Most regulatory authorities have online databases where you can check a broker’s license number and regulatory details. Be wary of brokers that provide vague information or do not appear in these official databases.

Ensuring your broker’s legitimacy helps secure your investments and provides peace of mind while trading.

If you’re having trouble avoiding fake platforms, consider joining the WR Trading course. This course covers everything you need to know about forex trading, from using the correct platforms and strategies to mastering technical analysis.

How to Find Out if a Forex Broker Is Regulated

Ensuring that a forex broker is regulated is essential for the safety and security of your trading activities. Here’s a detailed guide to help you verify the regulatory status of a forex broker.

Step 1: Check the Broker’s Website

Start by visiting the broker’s official website. Reputable brokers typically display their regulatory information prominently, often in the footer of their homepage or within an “About Us” or “Regulation” section. Look for details such as the name of the regulatory authority and the broker’s license number. This initial check gives you the basic information about the broker’s claimed regulatory status.

Step 2: Verify with the Regulatory Authority

Take the regulatory information you found on the broker’s website and visit the official website of the regulatory authority mentioned. For example, if the broker claims to be regulated by the UK’s Financial Conduct Authority (FCA), visit the FCA’s website.

Step 3: Use the Regulator’s Online Database

Once on the regulator’s website, find their online database or search tool. Most regulatory bodies provide a way to look up brokers by their license number or name. Enter the broker’s details into the search tool. This step helps you confirm that the broker is listed with the regulatory authority and that their license is valid. If you’re unsure which regulatory body to check, the International Organisation of Securities Commission (IOSCO) provides a directory of regulators worldwide.

Step 4: Verify the Broker’s Details

After finding the broker in the regulator’s database, verify that all the details match what is provided on the broker’s website. This includes the broker’s name, license number, and regulatory status. Ensuring that the details are consistent helps confirm the broker’s legitimacy.

Step 5: Check the License Status

Make sure that the broker’s license is active and in good standing. Regulatory databases will indicate whether a license is current, suspended, or revoked. An active license status is essential for ensuring the broker is regulated and compliant with necessary standards.

Disadvantages of Unregulated Forex Brokers

Trading with unregulated forex brokers can expose you to significant risks that jeopardise your investments and trading experience. Here are some key disadvantages of dealing with unregulated brokers:

Lack of Security

One of the most significant risks of trading with unregulated brokers is the lack of security for your funds. Unregulated brokers are not required to follow financial standards or maintain segregated accounts for client funds. This means your money could be used for the broker’s operational expenses or be at risk if the broker becomes insolvent.

Potential for Fraud

Unregulated brokers operate without oversight from a regulatory body, which increases the potential for fraudulent activities. These brokers can manipulate trading conditions, offer false promises, and even disappear with your funds without any legal repercussions.

The absence of regulatory scrutiny makes it easier for such brokers to engage in unethical practices.

No Legal Recourse

You have little to no legal recourse if you encounter problems with an unregulated broker, such as withdrawal issues or unfair trading practices. Regulatory bodies provide a platform for resolving disputes between traders and brokers. Without this regulatory oversight, traders are left vulnerable and without support in a conflict.

Lack of Transparency

Unregulated brokers often lack transparency in their operations. They may not provide clear information about their business practices, financial health, or trading conditions. This lack of transparency can lead to hidden fees, unfair terms, and an overall lack of trust in the broker’s services.

Pros of Regulated Brokers

Choosing a regulated forex broker offers numerous advantages that can significantly enhance your trading experience and protect your investments. The right trading broker is essential to save costs and ensure quick order execution. Here are some key benefits of trading with regulated brokers:

Enhanced Security

Regulated brokers are required to maintain high financial standards, which include segregated accounts for client funds. This separation protects your money and cannot be used for the broker’s operational expenses. In the event of the broker’s insolvency, your funds remain secure.

Legal Protection

One of the primary advantages of using a regulated broker is the legal protection it offers. Regulatory bodies provide a framework for resolving disputes between traders and brokers. If you encounter any issues, you have the assurance that the regulatory authority will intervene and help determine the matter reasonably.

Transparency

Regulated brokers must operate with a high level of transparency. They are required to disclose their financial statements, trading conditions, and any potential conflicts of interest. This transparency helps build trust and ensures you are fully aware of the terms and conditions you are trading under.

Fair Trading Practices

Regulatory bodies enforce rules that promote fair trading practices. This includes ensuring brokers offer honest pricing, promptly execute trades, and avoid manipulative behaviours. As a result, traders can trust that they are operating in a fair and honest market environment.

Customer Protection

Regulated brokers are obligated to implement measures that protect their clients. This includes providing negative balance protection, ensuring you cannot lose more than your initial investment. They must follow strict procedures for handling client complaints and disputes, offering additional security and peace of mind.

Access to Compensation Schemes

Many regulatory bodies offer compensation schemes that protect traders if a broker fails. For example, in the UK, the Financial Services Compensation Scheme (FSCS) compensates clients if an FCA-regulated broker becomes insolvent. This safety net further enhances the security of trading with regulated brokers.

Are Offshore Forex Brokers Regulated?

Yes, offshore forex brokers are regulated in certain jurisdictions but the level of oversight is not always the same as what traders see from top-tier authorities. Regulators like the Financial Services Commission (FSC) in Mauritius or the International Financial Services Commission (IFSC) in Belize issue licenses, but their requirements for capital, reporting, and client protection are less demanding than those of the FCA in the UK or ASIC in Australia.

This creates a situation where brokers can legally operate under offshore regulation with safeguards for traders being more limited. Therefore, you can find brokers offering ultra-high leverage of 2000:1, more volatile assets, and so on, as the regulation isn’t as strict.

Many brokers combine offshore licenses with stronger regulatory approvals to balance flexibility with credibility. For example, Forex.com, which is regulated by the CFTC and NFA in the US, the FCA in the UK, and ASIC in Australia, also operates under the Cayman Islands Monetary Authority (CIMA). This gives the broker flexibility to provide services internationally under different regulatory conditions, while traders in core markets still benefit from strict oversight.

Conclusion

Choosing a regulated forex broker like FP Markets, Pepperstone, IG, XTB, and AvaTrade ensures your funds are secure and trading practices are fair. These brokers are top-rated for their adherence to regulatory standards, offering transparency and legal protection. In contrast, unregulated brokers pose risks such as fraud and fund insecurity. Verifying a broker’s regulatory status is essential to confidently safeguarding your investments and trading.

Once again, these are the Top 10 Regulated Forex Brokers and their Key Benefits:

- StarTrader – Designed for high-speed execution with low latency.

- Plus500 – Provides a simple, easy-to-use web and mobile trading platform.

- Pepperstone – Offers competitive spreads and robust customer support

- IG – A well-established broker with a broad range of trading instruments

- Oanda – Stands out for highly transparent pricing with no hidden markups.

- Forex.com – Has strong research tools and advanced charting features.

- XTB – Features a user-friendly platform and stringent regulatory compliance

- AvaTrade – Provides a variety of trading options and is highly trusted in the industry

- FP Markets – Known for its excellent trading conditions and strong regulatory framework

- Interactive Brokers – Provides institutional-level market access for retail traders

Frequently Asked Questions on Regulated Forex Brokers

Why Is It Important to Choose a Regulated Forex Broker?

Choosing a regulated forex broker ensures that your funds are protected and trading practices are fair. Regulatory bodies enforce strict standards and provide legal protection, reducing the risk of fraud and enhancing your trading experience.

How Can I Verify if a Forex Broker Is Regulated?

Start by checking the broker’s website for regulatory information, such as the regulatory authority and license number. Then, visit the regulator’s official website and use their database to confirm the broker’s status. Ensure all details match and the license is active.

What Are the Risks of Trading With an Unregulated Broker?

Trading with an unregulated broker can expose you to risks such as fund insecurity, potential fraud, and a lack of legal recourse. Unregulated brokers are not bound by strict standards, which can lead to unfair trading practices, making your investments vulnerable.

What Are Some Top-Tier Regulatory Bodies?

Top-tier regulatory bodies include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce strict compliance and financial standards, and brokers regulated by these bodies are generally more trustworthy.

Can More Than One Authority regulate a Broker?

Yes, a broker can be regulated by multiple authorities in different regions. This provides an extra layer of security and ensures compliance with various international standards. Multi-regulation enhances the broker’s credibility.