News trading is a forex strategy that involves making trades based on economic news releases and events. Not all FX brokers allow news trading due to their terms and conditions, and you’ll need a geared broker with high liquidity and fast execution speed - news forex traders depend on these features.

Here we’ll detail the 10 best forex brokers that we’ve analysed and determined to be suitable for news trading. We’ll list our feature comparisons and findings on liquidity, execution speed, and other key factors critical to successful trading during high-impact news events.

Find the best Forex Brokers that allow News Trading in the table listed below:

Broker:

News Trading:

Advantages:

Account:

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- 5x regulated broker

- Spreads from 0.0 Pips

- More than 10,000 markets

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- MT4/MT5/RTrader/CopyFX

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4 ,MT5

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- Multiple regulated

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 2$/1 Lot

- Personal support

- MT4, MT5

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 4$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5

Yes, suitable for News Trading

(ECN/RAW Spread Accounts)

- Offshore A-Book Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500

- High liquidity and fast execution

- MT4, MT5

The 10 Best Forex Brokers for News Trading in Detail

When selecting a broker for news trading, you should prioritise those that offer the following features:

- Liquidity. Liquidity ensures your ability to enter and exit trades without significant price slippage.

- Execution speed. This is essential for capturing quick price movements.

- Low latency. You want minimal time taken for orders to be executed, something especially crucial during volatile market conditions

- No restrictions on news trading, and your approach specifically

- VPS availability for news trading

- Strong economic calendar and other tools (news tools)

Here is our Top 10 News Trading Brokers:

- FP Markets: FP Markets offers deep liquidity that ensures minimal slippage during volatile market conditions

- Vantage Markets: Competitive spreads that contribute to lowering your trading costs and enhancing your profitability

- RoboForex: RoboForex offers you a diversity of trading instruments, giving you the flexibility to adapt to news events

- Moneta Markets: A user-friendly platform that simplifies trading for both beginners and experienced traders

- BlackBull Markets: A broker that will facilitate you in capturing rapid price movements through quick order execution

- Pepperstone: Offering you advanced trading platform options like cTrader and MetaTrader

- IC Trading: Offering low spreads and high liquidity makes IC Trading particularly beneficial for news trading

- XM: Multiple account types give you the flexibility to choose an account that suits your individual trading needs

- FBS: A very user-friendly interface makes it easier for you to execute your strategies quickly

- VT Markets: This is a broker with a growing reputation for excellent customer service and reliable support

1. FP Markets

FP Markets is renowned for its deep liquidity and advanced trading infrastructure; it’s widely regarded as the best ECN broker for news trading, and it’s our #1 pick of the bunch.

We found this broker’s ability to enhance liquidity and provide our team with a truly seamless trading experience to be top-notch, making it particularly well-suited for news trading.

In a nutshell:

- The broker gave us access to a wide range of currency pairs, making it an excellent choice for news trading.

- With low spreads and fast execution speeds, FP Markets allowed us to react swiftly to economic news.

- Their proprietary trading platforms are equipped with advanced tools that were a great aid when our team was trying to analyse the impact of news effectively.

| Feature | FP Markets |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | ECN, tight spreads and rapid execution, overall low cost trading, great analysis tools |

| Markets | Spreads start from 1.0 pips on the Standard account, with lower 0.0 pips spreads on RAW accounts |

| Leverage | Up to 1:500 |

| Spreads | You can get a Standard, Platinum, or Premier Account on the Iress platform, or a Standard or RAW account on MetaTrader. |

| Commissions | Commission is $3.00 per lot per trade |

| Account types | You can get a Standard, Platinum, or Premier Account on the Iress platform, or a Standard or RAW account on MetaTrader |

| Regulation | Regulated by the Cyprus Securities and Exchange Commission (CySEC) as well as ASIC |

| Support | 24/7 Support |

2. Vantage Markets

Vantage Markets is our #2 choice because it offers competitive spreads and high liquidity, and it’s already a well-known home for news traders.

In our evaluation, there were no liquidity hiccups when we needed it most, and alongside a supportive technical build, Vantage Markets proved ideal for the news traders on our team.

In a nutshell:

- We appreciate the ability to access various trading platforms, including MT4 and MT5, which makes essential real-time analysis easy.

- We read through the several guides on offer that are explicitly focused on news trading - they’re worthwhile.

- We sampled their Support, and found that Vantage Markets, being known for its excellent customer service, is legit - we got quick support when we needed it the most.

| Feature | Vantage |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | Starting from 1.0 pips on Standard accounts, and tighter spreads on ECN accounts |

| Markets | Forex, indices, stocks, commodities, cryptocurrencies |

| Leverage | Up to 1:500 |

| Spreads | Starting from 1.0 pips on Standard accounts, tighter spreads on ECN accounts |

| Commissions | $3.00 commission per lot per trade |

| Account types | RAW ECN, Pro ECN, Standard STP, Cent, Swap Free |

| Regulation | Australian Securities and Investment Commission (ASIC), Financial Conduct Authority (FCA) UK, Financial Sector Conduct Authority (FSCA) of South Africa, Vanuatu Financial Services Commission (VFSC) |

| Support | 24/7 Support |

3. RoboForex

RoboForex is our #3 pick, and the broker often stands out to us due to its diverse range of trading instruments (primarily stock CFDs) and account types.

We found great available forex intel on the platform, including a comprehensive “Financial calendar”, competitive spreads, and quick execution, all of which make for a welcoming news trading portal.

In a nutshell:

- We explored the broker’s provision of news trading tools that enabled our traders to monitor upcoming economic events and their potential impacts, which are ample.

- We liked the low latency and high execution speeds, which are vital during significant market news releases.

- Overall, we feel that RoboForex has been designed to be simple but highly effective, and many of our forex news traders have now found a home here.

| Feature | RoboForex |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | Depending on the account type, up to 1:2000 |

| Markets | Stocks, forex, commodities, ETFs, indices |

| Leverage | Competitive percentage commissions on ECN accounts; Standard accounts have no commission |

| Spreads | Variable; lowest on ECN accounts |

| Commissions | Competitive percentage commissions on ECN accounts; Standard accounts no commission |

| Account types | Pro, ECN, Prime, ProCent, R StocksTrader |

| Regulation | Financial Services Commission (FSC) |

| Support | 24/7 Support |

4. Moneta Markets

Moneta Markets is gaining popularity for its user-friendly trading environment and reliable execution. We have previously covered the broker from various perspectives.

When we sampled them from a forex news trader’s perspective, we found great trading intel, quick execution, and relatively low trading costs. This puts Moneta high on our list of great news trading brokers.

In a nutshell:

- The broker offers competitive spreads and a range of account types tailored to various trading strategies.

- We loved the Moneta Markets economic calendars (they offer a standard and a professional version, the latter filtered by time zone and other metrics), as well as the news feeds, both of which made it easier for the team to stay informed about upcoming events that could impact their open trades.

- The customer service is genuine and reliable, and the educational resources are excellent, making it a great option for MT4.

| Feature | Moneta Markets |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | ECN broker (Prime ECN account 0.0 pips), rapid execution, great intel, overall low costs |

| Markets | Stocks & commodities, forex, bond CFDs, ETFs, indices, cryptocurrency |

| Leverage | Up to 1:500 |

| Spreads | Competitive spreads that start from 0.0 pips for ECN account holders |

| Commissions | Standard accounts typically charge no commission, while ECN accounts incur a $3.00 commission per lot per trade. |

| Account types | Prime ECN and Ultra ECN, STP, PAMM & Islamic swap-free |

| Regulation | Australian Securities and Investments Commission (ASIC), Financial Sector Conduct Authority (FSCA) of South Africa, The Seychelles Financial Services Authority (FSA) |

| Support | Support has a good reputation, available 24/5 |

5. BlackBull Markets

BlackBull Markets is renowned for its robust liquidity and highly efficient execution, making it an excellent choice for ECN trading.

We found that high liquidity and a supportive environment significantly reduced the burden of our news-trading evaluation. When combined with their excellent Support, it’s not hard to see why many news traders have made a home here.

In a nutshell:

- Like Moneta Markets above, we appreciated our access to a comprehensive Economic Calendar and real-time news updates, which are essential for news traders.

- With low spreads and minimal slippage, BlackBull Markets became an ideal environment for our traders to capitalise on market volatility during news releases.

- Customer support is excellent, and our news traders experienced a highly supportive environment in which to work.

| Feature | BlackBull |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | ECN, quick execution, great news trading intel, overall competitive costs, great service |

| Markets | Forex, metals, stocks, indices, commodities, cryptocurrency |

| Leverage | Up to 1:500 |

| Spreads | ECN accounts starting from 0.0 pips |

| Commissions | Standard accounts no commission, RAW accounts $6.00 per lot per trade |

| Account types | Standard, Prime, and Institutional |

| Regulation | The Seychelles Financial Services Authority (FSA) |

| Support | Known for excellent 24/7 Support |

6. Pepperstone

Pepperstone is highly regarded for its trading technology and rapid execution speed, and in all of our previous sampling of this broker, we’ve been impressed.

Fast execution is a key component of every news trader’s toolbox, and Pepperstone offered us a well-rounded news trading arena.

In a nutshell:

- The broker provides access to a variety of trading platforms, including cTrader and MetaTrader, which are essential for news trading.

- We found that tight spreads are the norm here, and the broker is, for the most part, very accommodating of a diverse range of trading strategies.

- Their low latency allowed our forex news traders to react quickly to economic events, making it one of the best brokers for this strategy.

| Feature | Pepperstone |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | Forex, stock, CFDs, commodities, indices, ETFs |

| Markets | Forex, stock CFDs, commodities, indices, ETFs |

| Leverage | Up to 1:400 |

| Spreads | Spreads start from 0.0 pips |

| Commissions | No commission on Standard accounts, otherwise $6.00 per lot per trade |

| Account types | Standard, Pro, Razor, PAMM, Islamic |

| Regulation | ASIC, CySEC, FCA, and others |

| Support | Great 24/7 Support |

7. IC Trading

IC Markets is a popular venue among our team members, and it’s a frequent choice among news traders due to its deep liquidity and low-cost trading.

A comparatively low-cost platform, IC Trading offered us a decent (over 60) variety of forex pairs through which we could capitalise on market news, supporting a range of trading preferences.

In a nutshell:

- The broker offers low spreads and fast execution, something our forex news trading team members consider crucial for making quick trades during news events.

- We enjoyed ultra-low spreads in all market conditions, as well as the broker’s detailed regional (fundamental) forecasts.

- Combine this with a very decent selection of trading tools to help you prepare for market movements, and IC Trading shines as a great forex news trading platform.

| Feature | IC Trading |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | ECN, rapid execution, super tight spreads, great forecasts and analysis for news trading |

| Markets | Forex, stocks, commodity CFDs, bonds, futures, cryptocurrency |

| Leverage | Up to 1:500 |

| Spreads | Spreads as low as 0.1 pips |

| Commissions | Commissions between $3.00 – $3.50 per lot |

| Account types | Standard, RAW, Islamic |

| Regulation | The Financial Services Commission of Mauritius (FSC) |

| Support | 24/7 Support |

8. XM

XM is a well-known broker that provides excellent support for news trading, and is, in fact, the preferred broker of many traders on our evaluation team who prioritise forex news trading.

We gained fast execution and consistently low spreads, and can honestly say that forex news trading is highly facilitated at XM. With 99% of trades executed in under a second, this broker prioritises speed and transparency.

In a nutshell:

- We thoroughly enjoyed the Real-Time Economic Calendar, as well as the fact that XM’s various account types cater to both novice and experienced traders.

- We were able to capitalise on rapid price movements during news releases without any hiccups.

- Overall, we believe it’s an intuitive platform that offers a great combination of simplicity and sufficient trading sophistication to enable regular profitability.

| Feature | XM |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | Market maker, but tight spreads and ultra-fast execution, decent selection of forex pairs |

| Markets | Forex, stocks, indices, metals & energies and other commodities, cryptocurrencies |

| Leverage | Up to 1:1000 |

| Spreads | Low spreads from 0.0 pips, variable based on account type |

| Commissions | Commissions between $3.00 – $3.50 per lot |

| Account types | Standard, Micro, Ultra-Low, Shares Account |

| Regulation | Cyprus Securities and Exchange Commission (CYSEC) |

| Support | 24/5 Support |

9. FBS

FBS is another broker that has often been included in our reviews, and it offers a range of trading tools beneficial for news trading.

We found that the ample available information and low spreads made FBS a good choice for forex news traders, and many of our traders welcomed the high leverage on offer.

In a nutshell:

- The broker provided a user-friendly platform and low spreads, and it was easy to execute our strategies during high-impact news events.

- Our more seasoned traders gleaned high leverage (up to 1:3000) on forex pairs.

- While not usually considered a significant benefit, FBS offers educational resources to help you better understand market dynamics, and we found them extremely worthwhile during our evaluation.

| Feature | FBS |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | STP/ECN hybrid, fast execution, no conflict, low spreads, great intel |

| Markets | Forex, stocks, metals & other commodities, indices |

| Leverage | Up to 1:3000 |

| Spreads | Spreads start from 0.9 pips, |

| Commissions | Commissions start from $1.3 per lot |

| Account types | Standard, Cent |

| Regulation | Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Financial Services Commission of Belize (FSC) |

| Support | 24/7 Support (that works more like 24/5 Support…) |

10. VT Markets

VT Markets is an emerging broker that rounds out our list at #10. Focused on providing a reliable trading environment, this broker is a good choice for forex news traders.

We knew that VT Markets is part of the Vantage group of companies. Still, we were impressed at how the broker offered a sleek trading experience and comparatively low trading costs, while seemingly designed for forex news trading (it isn’t specifically).

In a nutshell:

- We loved the competitive spreads and fast execution times-no complaints from our forex news traders there.

- The VT Markets Economic Calendar and other market analysis tools helped us stay fully informed about significant events.

- We appreciated the educational resources that focus on news trading techniques and strategies.

| Feature | VT Markets |

|---|---|

| News trading allowed? | Yes |

| Benefits for FX news traders | ECN, fast execution, some of the lowest spreads around, great resources all round |

| Markets | Forex, metals and energies, some other commodities, stock CFDs, indices, bonds, ETFs |

| Leverage | Up to 1:500 |

| Spreads | Low spreads from 0.04 pips to higher, based on instruments traded |

| Commissions | $3.00 commission per lot per trade |

| Account types | Low spreads from 0.04 pips to higher, based on the instruments traded |

| Regulation | Australian Securities and Investment Commission (ASIC), Mauritius Financial Services Commission (FSC) |

| Support | 24/7 Support |

Why don’t all Forex Brokers offer News Trading?

Not all forex brokers will support you in news trading, and this can be for a variety of reasons, such as market conditions excluding them due to high volume, internal risk management imperatives, or regulatory restrictions.

- Market conditions: Some brokers may lack the necessary infrastructure to handle the increased volatility and trading volume that often accompanies news events.

- Risk management: News trading can result in wider spreads and slippage, which brokers may want to avoid to manage their risk exposure.

- Regulatory restrictions: Some jurisdictions have regulations that may limit the types of trading strategies brokers can offer, impacting their ability to facilitate news trading truly.

- Reduced risk. By restricting news trading during periods of volatility or as a general policy, brokers can reduce their own risk of losses and maintain order flow. There is also the flip side, where risks are eliminated for novice or impulsive traders who jump in on the back of news without truly understanding market dynamics and suffer heavy losses.

How we selected the Best News Trading Forex Brokers

The selection of the best news trading forex brokers was based on various criteria, including speed of execution, liquidity realities, spreads, regulation, the platform features, including VPS, and Support quality:

- Execution speed. The ability to execute trades quickly is paramount for news trading.

- Liquidity. Brokers with higher liquidity are better equipped to handle large order volumes during news releases.

- Spreads. Tight spreads reduce trading costs, making it easier for you to profit from quick movements.

- Regulation. We excluded brokers who are not regulated by any reputable body.

- Platform features. Brokers offering advanced trading tools and news feeds will enhance the trading experience for forex news traders.

- Slippage. Only brokers that are designed to minimise/eliminate slippage were considered.

- VPS. We only looked at brokers where you can typically access free VPS, assuming you meet various trading criteria in some cases.

- Customer Support: Reliable customer support ensures you can get the assistance you need when you need it, especially during critical trading moments.

What are the potential risks when News Trading with your Forex Broker?

While news trading can be profitable, it comes with the risk of wider spreads, slippage, increased and unreadable volatility, and market reactions that dent your planning and strategy:

- Wider spreads: During major news events, spreads may widen significantly, impacting the profitability of your trades.

- Slippage: Orders may be executed at a different price than expected due to rapid market movements, which can lead to unanticipated losses.

- Increased volatility: Sudden price changes can result in unexpected losses, particularly for traders who are not adequately prepared.

- Market reaction: Sometimes, the market may react unexpectedly to news, leading to losses even when the analysis suggests a different outcome.

Where to Find the Most Important Forex News?

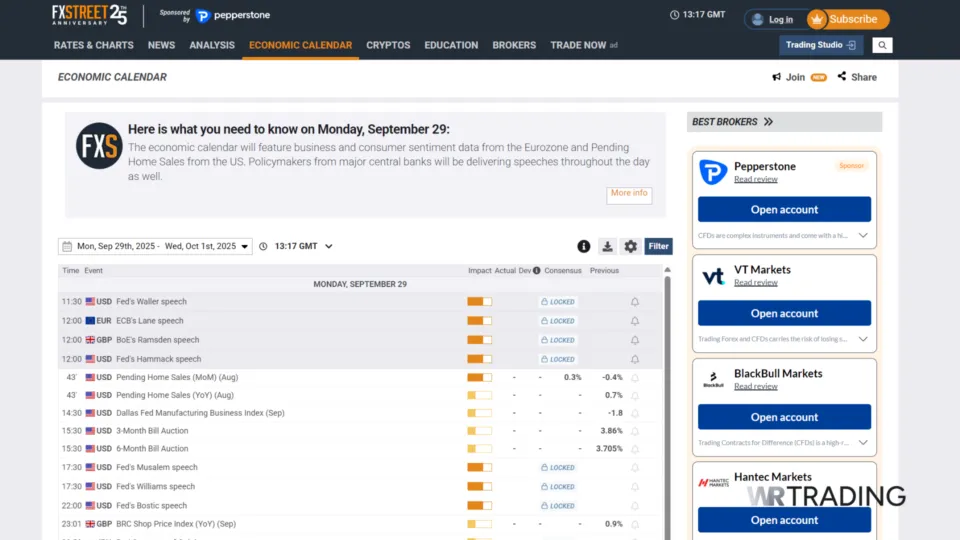

Economic calendars are the forex news traders’ primary tool, and any decent news broker will give you access to theirs on the site, but there are others worth mentioning:

- FXStreet Economic Calendar. FXStreet’s Economic Calendar is billed as “the most complete, accurate and timely tool in the Forex market”. It is formulated by a team of economists and news writers who update it continuously, as news comes in, every weekday.

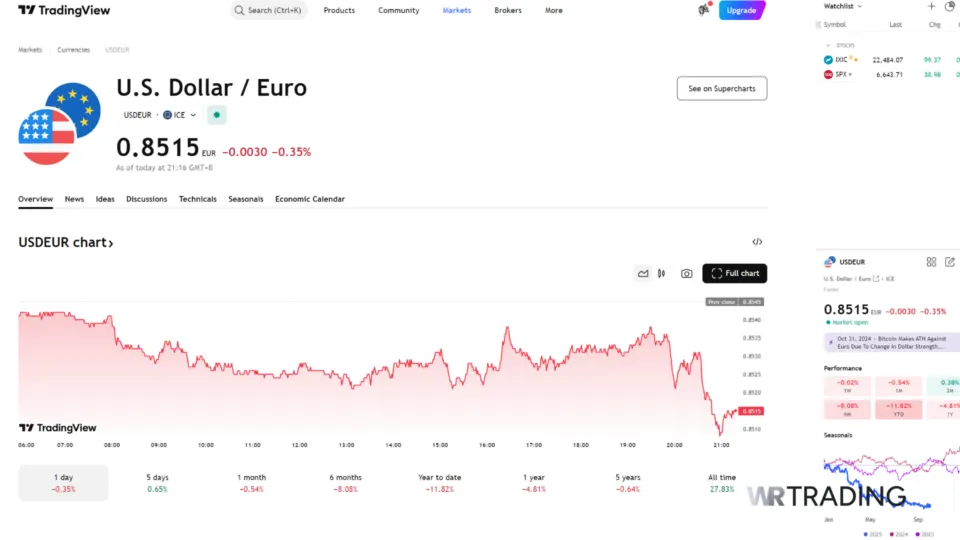

- TradingView Economic Calendar. TradingView produces a comprehensive economic calendar that shows all upcoming economic events likely to impact assets, regions, and global markets. They provide this information in chronological order and display key financial indicators, such as GDP and interest rates.

- MQL5 Economic Calendar. The MQL5 provides constantly updated forex news and a schedule of upcoming global economic events, based on statements and actions from governments worldwide.

- Babypips Economic Calendar. This calendar is similar in content, providing you with automatically updated news about upcoming financial market events and announcements from around the globe.

Top Forex News Sources:

The most reputable international news sources include Bloomberg, Reuters, Forex Factory, DailyFX, Investing.com, FX Empire, FXStreet, Forexlive, FXCM News, and Finance Magnates. Apart from news, these sites give you fundamental and technical analysis.

Specialised Forex News Platforms:

- Forex Factory: A popular community-driven platform that aggregates breaking forex news from multiple sources worldwide, combining market analysis with an active trader forum for real-time discussion.

- ForexLive: Focuses on live market commentary and instant analysis of economic releases, offering traders immediate interpretation of how news events might impact currency pairs.

- FXStreet: Combines comprehensive market analysis with educational content, providing both novice and experienced traders with technical analysis alongside fundamental news coverage.

- DailyFX offers institutional-grade research and analysis, featuring market outlooks from professional analysts and educational resources to help you understand market-moving events.

- Investing.com: Provides a comprehensive financial news hub covering forex alongside other markets, with customisable alerts and portfolio tracking features.

- Financial TV Networks: For continuous coverage, major financial television networks broadcast market news around the clock, including Bloomberg TV, CNBC, Fox Business, and BBC World Service, providing live analysis during major economic releases.

Essential Tools beyond Economic Calendars:

- Real-time news feeds from major financial data providers

- Official central bank communications and press releases

- Primary economic data from government statistical offices

- Integrated news services within trading platforms

- Social media feeds from financial journalists and analysts

- Research publications from major financial institutions

The most effective approach combines multiple sources: economic calendars for timing, major news outlets for context, and specialised forex platforms for market-specific insights.

News Trading strategies you can use with your Forex Broker

Successful news trading requires effective strategies to navigate market volatility. Here are a few popular strategies:

- Straddle strategy: With a straddle, you’ll place buy and sell orders on either side of the current market price before a news release. This allows you to profit from price movements in either direction, with your stop-loss kicking you out of the loser and your constantly adjusting take-profit riding the wave on the winning position.

- Breakout strategy: Here you’ll focus on key support and resistance levels and trade in the direction of the breakout following a news release.

- News fade strategy: After a significant news event, you can look to fade the initial move, anticipating a reversal on the back of the initial market overreaction.

- Economic Calendar analysis: You’ll use an Economic Calendar to track potentially significant upcoming news events and analyse their potential impacts on specific currency pairs.

The Impact of News on Forex Currency Pairs

News events can significantly impact forex currency pairs, as the forex market is a highly entangled trading field.

Economic indicators such as GDP reports, employment figures, and interest rate changes can lead to rapid price movements.

You need to understand the relationship between economic news and currency value fluctuations, since major events often result in increased volatility, which can create both opportunities and risks for you as a trader.

Can A VPS Help Trading During News?

Yes, a Virtual Private Server (VPS) can be a game-changer for forex news trading, because of the following:

- Ultra-fast execution during volatility: A VPS dramatically improves your order execution speed by positioning your trading platform physically closer to the broker’s servers and major financial data centres. This proximity means your trades reach the market faster, helping you secure better entry and exit prices during the rapid price movements that characterise news events.

- Critical speed advantages: Most quality VPS providers can connect to broker servers in under 10 milliseconds, with premium providers achieving sub-3-millisecond response times. These ultra-short execution windows significantly reduce the risk of adverse price movements between when you click “buy” or “sell” and when your order actually executes.

- Reduces slippage during news events: The physical proximity between VPS servers and broker infrastructure minimises latency (the delay between placing an order and its execution). Lower latency directly translates into faster trade fills, reduced slippage, and improved overall trading performance, especially during high-volatility periods that follow major economic announcements.

- Uninterrupted trading during critical moments: Beyond speed improvements, a VPS ensures your trading platform remains online 24/7, eliminating concerns about power outages, internet disruptions, or computer crashes during crucial market moments. This reliability is particularly valuable for automated trading systems that require instantaneous responses to news-driven market movements.

- Strategic Server Placement: Many forex brokers host their servers within major financial data centres, such as Equinix facilities in New York and London. When your VPS provider operates from these exact locations, you achieve optimal proximity to your broker’s infrastructure, further reducing execution delays.

Why VPS Is Essential for News Trading:

- Eliminates home connection issues (no more worrying about your internet cutting out during NFP or FOMC announcements!)

- 24/7 uptime (your trading platform stays connected even if your home computer crashes)

- Lightning-fast response (sub-10ms execution times mean you capitalise on price spikes instantly)

- Reduced requotes (as a forex trader, you’ll benefit from low latency and proximity to broker servers, minimising slippage and order rejections.

- Automated trading protection (EAs can continue running during news events without interruption)

For serious forex news traders, (preferably) free VPS isn’t just helpful, it’s essential. The difference between 100ms (a typical home connection) and 3ms (a quality VPS) can mean the difference between profit and loss during high-impact news releases.

Conclusion

Choosing the right forex broker for news trading is essential for maximising trading opportunities during high-impact events. The ten brokers discussed in this article offer competitive features that cater specifically to news traders, including low latency, high liquidity, and tight spreads.

However, you should be aware of the inherent risks of news trading and develop effective strategies to navigate the volatility that news events can bring.

By selecting a suitable trading broker and employing sound trading strategies, you’ll eliminate the apparent obstacles to successful news trading and optimise your potential profitability by capitalising on your analysis on the right platform at the right time.

Frequently Asked Questions:

What is news trading in forex?

News trading in forex involves making trades based on economic news releases and events that can impact currency prices. Traders who employ a news trading strategy will closely follow the Economic Calendar and learn to interpret which events or news releases have the most significant impact on currency pairs.

How do I choose the best broker for news trading?

Look for brokers that offer low spreads, fast execution, high liquidity, and advanced trading tools specifically designed for news trading. It may seem that you can trade news anywhere, but the brokers listed above are geared explicitly in many ways to enable news trading strategies. Trading on a platform that is wired differently or not focused on news trading will negatively impact your profitability and frustrate your efforts.

What risks are associated with news trading?

Risks include wider spreads, slippage, increased volatility, and potential unexpected market reactions. News won’t guarantee outcomes, but it will present you with the likelihood of positive or negative impacts on currency pairs.

Can I use any trading strategy for news trading?

While you can use various strategies, it’s essential to select those that align with the characteristics of news events, such as the straddle or breakout strategies. News trading is simple in construction, but not without risks; hence, you should employ tactics that logically tie into news impacts.

How can I stay updated on economic news?

Use an Economic Calendar, news feeds, and trading platforms that provide real-time updates on economic indicators and events that affect the forex market. The brokers listed above will provide you with ample information to enable profitable news trading on the forex market.