Finding the right forex broker with 0.0 pips spreads can significantly reduce your trading costs and profitability. Zero spreads minimize the cost of each trade, making your trading more efficient. In this article, we review the 10 best no-spread Forex brokers.

We tested each broker under live trading conditions, reviewing spreads, execution speed, liquidity, platform stability, and reliability to provide a list that gives you clear and trustworthy options.

This is the List of the Best Forex Brokers With No Spreads in 2026:

Broker:

Spreads:

Advantages:

Account:

From 0.0 Pips + Low Commission from 3.5$/1 Lot

- High Leverage up to 1:1000

- RAW ECN Spreads from 0.0 pips

- Fastest execution

- Attractive Bonus Programs

- Copy Trading

- MT4 / MT5

- Personal support 24/7

From 0.0 Pips + Low Commission from 3$/1 Lot

- Leverage up to 1:500

- High liquidity and fast execution

- cTrader, MT4 ,MT5

- Fast ECN Structure for Trading

From 0.0 Pips + Low Commission from 1.5$/1 Lot

- ECN Accounts

- Copy Trading available

- Leverage up to 1:500

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

From 0.0 Pips + Low Commission from 3$/1 Lot

- ECN/STP Accounts

- Leverage up to 1:1000

- High liquidity and fast execution

- MT4/5 and Pro Trader

From 0.0 Pips + Low Commission from 3.5$/1 Lot

- Mauritius-regulated broker

- High Leverage up to 1:1000

- Multiple account types

- More than 850 trading instruments

- MT4, MT5, PU Prime App

From 0.0 Pips + Low Commission from 6$/1 Lot

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 4$/1 Lot

- 26,000+ Markets

- TradingView, MT4/5, cTrader

From 0.0 Pips + Low Commission from 3$/1 Lot

- 5x regulated broker

- More than 10,000 markets

- Leverage up to 1:500

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, IRRES

From 0.0 Pips + Low Commission from 3$/1 Lot

- Tier-1 Regulated Broker

- Leverage up to 1:500 (1:30 EU)

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

From 0.0 Pips + Low Commission from 2$/1 Lot

- No Minimum Deposit

- 26,000+ Markets

- Leverage up to 1:500

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

From 0.0 Pips + Low Commission from 6$/1 Lot

- Different ECN Accounts

- Copy Trading available

- Leverage up to 1:2000

- High liquidity and fast execution

- MT4/MT5/RTrader/CopyFX

List of the 10 Best Zero Spread Brokers

Finding a reliable broker with zero spreads can significantly reduce your trading costs. Here, we present a detailed review of the top brokers offering zero spreads, each tested for performance and reliability to ensure the best trading experience.

See our complete video comparison of the best no-spread brokers here:

1. StarTrader

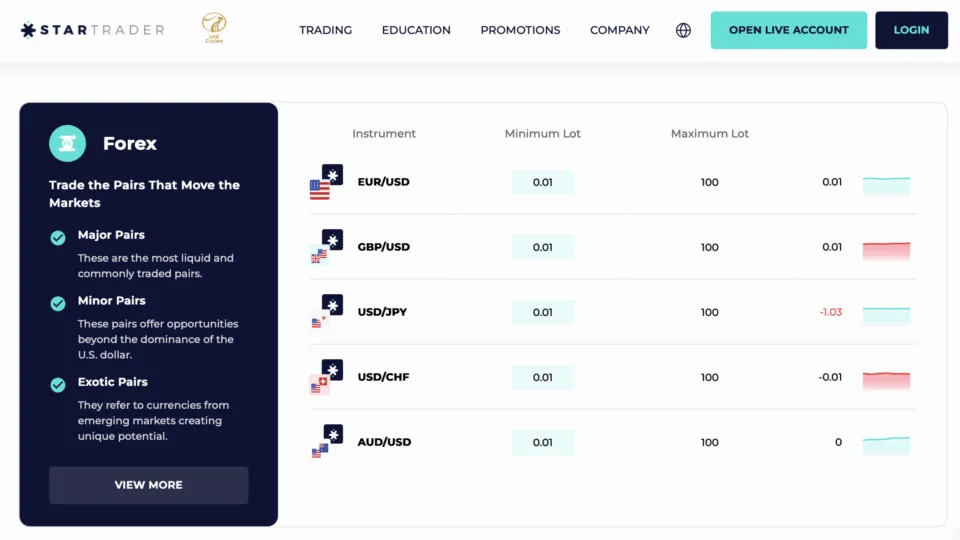

We scored StarTrader’s ECN account a 5/5 because it offers the best no spread (zero spreads 0.0) forex trading experience with a low commission of $3.50 per lot, which keeps transaction costs low and transparent for high volume forex traders. The broker supports more than 50 forex pairs, including majors, minors, and select exotics, giving traders a wide range of markets to apply zero-spread conditions.

Execution speeds average around 30 milliseconds, which reduces slippage and allows precise entry during fast-moving sessions such as the London or New York open. Traders can open accounts in six base currencies, including USD, EUR, GBP, AUD, CAD, and NZD, which helps avoid unnecessary conversion fees when depositing or withdrawing.

Minimum trade sizes start at 0.01 lots, providing traders flexibility in managing risk while still benefiting from tight spreads. Funding is available through cards, bank transfers, and e-wallets, and processing is quick, which ensures that trading capital can be accessed without delays.

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 1.3 pips Commission – from no commission to $3.50 per lot |

| Trading Platforms | MT4, MT5, and WebTrader |

| Asset Types | Crypto, forex, commodities, indices, stocks, and ETFs |

| Customer Support | Live chat and email support |

| Demo Account | Yes |

| Educational Content | Knowledge center, news room, and webinars. |

| Regulation | FCA, ASIC, CMA, FSCA, and VFSC |

2. IC Trading

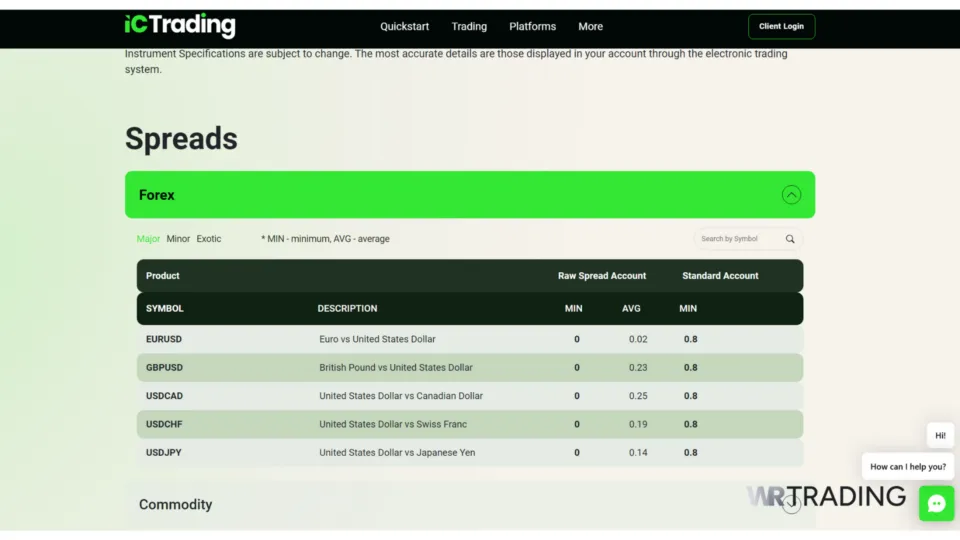

IC Trading is known for its extensive range of trading instruments and zero spreads on major currency pairs, making it our second best no spread forex broker. Our testing confirmed that their ECN pricing model of $3.50 per lot ensures incredibly tight spreads and deep liquidity, making it an excellent choice for traders who require precise and cost-effective trading.

IC Trading processes orders through deep liquidity providers, which helps maintain stable pricing and fast fills even when markets move quickly. The broker supports execution speeds averaging under 30 milliseconds, giving traders the ability to enter and exit positions when needed.

Traders can choose between MT4, MT5, and cTrader, each of which supports advanced order types and automated strategies that benefit from raw pricing. Also, all platforms come with a demo account, allowing you to test the forex broker for free. However, they do have a limited on the amount of funds in a demo account.

| Feature | Information |

|---|---|

| Spreads | Varies based on account: Spread – from 0.0 pips Commission – From $3.50 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and cTrader |

| Tradable Assets | Forex, commodities, indices, stocks, bonds, and cryptocurrencies |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Tutorials and blogs |

| Regulation | Financial Services Commission of Mauritius |

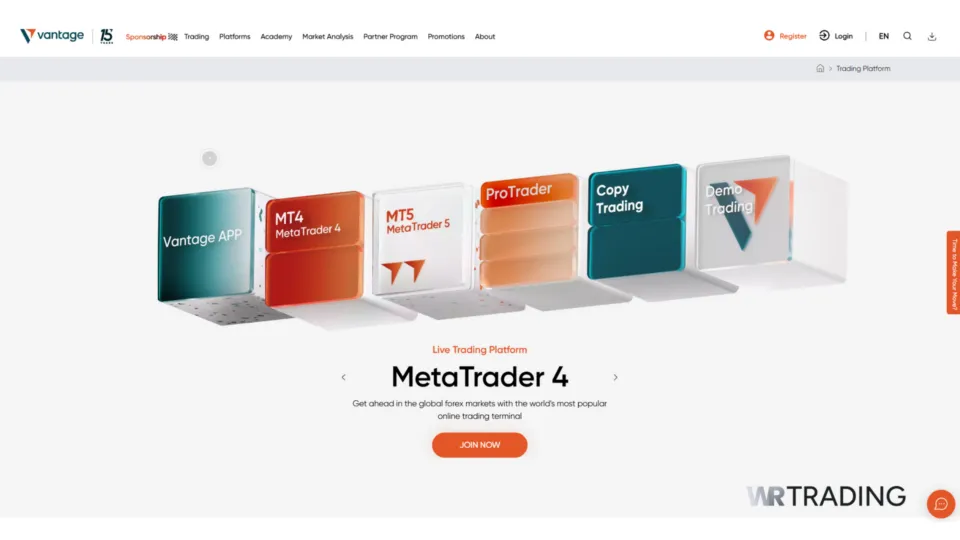

3. Vantage Markets

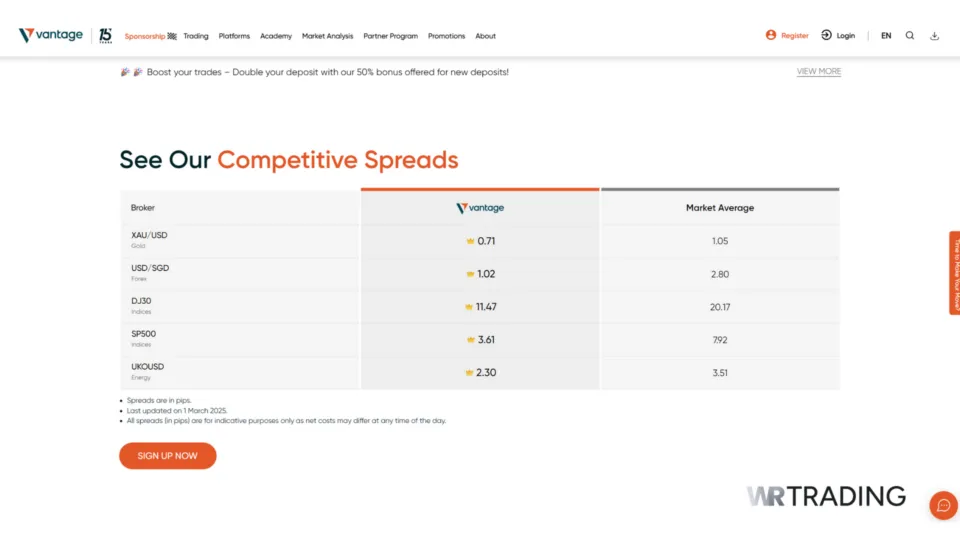

Vantage Markets impresses with its zero-spread accounts and exceptional execution speeds, which is why it took 3rd place in our list at WR Trading. We liked that their Raw ECN account offers zero spreads on major currency pairs, making it a cost-effective choice as commissions start from $1.50 per lot.

In addition to their competitive spreads, Vantage Markets excels in providing strong customer support, available 24/5 to assist with any inquiries. The broker’s educational resources are extensive and user-friendly, helping traders enhance their market knowledge. Moreover, their trading platforms, MetaTrader 4, ProTrader, and MetaTrader 5, are reliable and support various trading strategies, ensuring that traders can operate efficiently and effectively.

| Feature | Information |

|---|---|

| Spreads | Varies based on account: Spread – from 0.0 pips Commission – From $1.50 per lot |

| Trading Platforms | Vantage App, MetaTrader 4, MetaTrader 5, and ProTrader |

| Tradable Assets | Forex, stocks, indices, commodities, bonds, and ETFs |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Courses, webinars, and ebooks |

| Regulation | Australian Securities and Investments Commission |

4. Moneta Markets

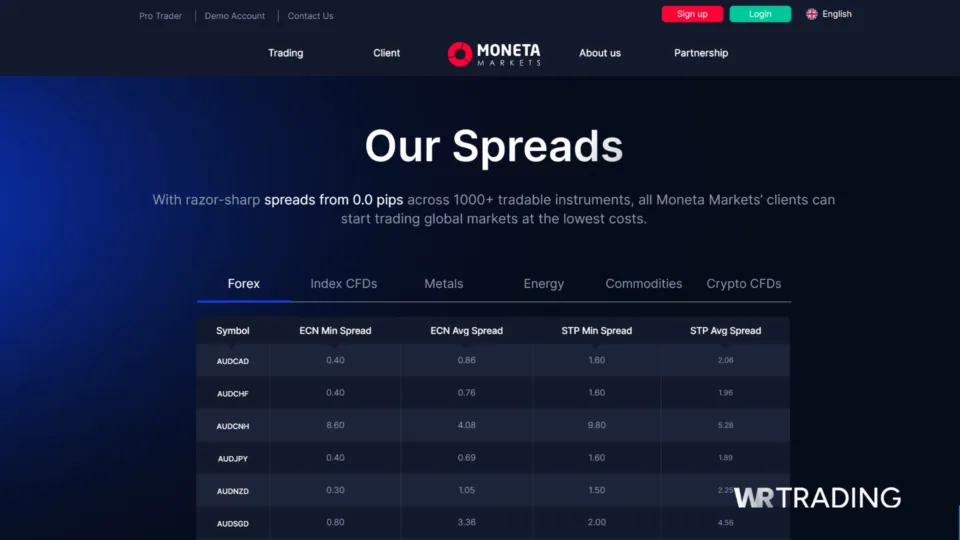

Moneta Markets offers traders zero spread accounts, making it an attractive option for those looking to reduce their trading costs. During our evaluation, we discovered that Moneta Markets provides zero spreads on major currency pairs through their Prime and Ultra ECN accounts, which enhances trading efficiency and cost-effectiveness.

Moneta Markets is notable for its wide range of tradable assets, including Forex, commodities, bonds, ETFs, indices, cryptocurrencies, and stocks. The broker’s platforms, including MetaTrader 4, MetaTrader 5, and their proprietary WebTrader, support multiple indicators and are easily customizable. Using these indicators and platforms can be confusing for new traders, so we were disappointed that the guides were not as in-depth as we’d like.

| Feature | Information |

|---|---|

| Spreads | Varies based on account: Spread – from 0.0 pips Commission – from $1 |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Pro Trader, and MT4 WebTrader |

| Tradable Assets | Forex, commodities, indices, ETFs, bonds, and stocks |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Blogs and guides |

| Regulation | Cayman Islands Monetary Authority and Financial Sector Conduct Authority |

5. PU Prime

PU Prime offers Prime and ECN accounts with raw spreads from 0.0 pips on major forex pairs. The Prime account charges $3.50 per side per lot, while the ECN account reduces this to $1 per side, making it one of the lowest commission options in the industry. More than 40 forex pairs are available, and liquidity is aggregated from top-tier providers. Average execution speeds come in under 50 milliseconds, which is suitable for scalping and other time-sensitive strategies.

Account setup is flexible, with multiple base currency options that reduce conversion costs, and minimum trade sizes start from 0.01 lots. PU Prime also offers VPS hosting for qualified accounts, which is useful for running expert advisors without interruptions.

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $3.50 per lot |

| Trading Platforms | PU Prime App, MT4, MT5, and WebTrader |

| Asset Types | Crypto, forex, commodities, shares, bonds, indices, and ETFs |

| Customer Support | Live chat, email, phone call, and help center |

| Demo Account | Yes |

| Educational Content | Pu Prime Trading Education Hub |

| Regulation | Financial Services Authority of Seychelles (FSA), Financial Services Commission of Mauritius (FSC), and Financial Sector Conduct Authority of South Africa (FSCA) |

6. VT Markets

VT Markets provides a Raw ECN account that combines 0.0 pip spreads with a $3 commission per lot, giving traders a straightforward pricing model that works across more than 40 forex pairs. Execution speeds average around 40 milliseconds, supported by liquidity aggregated from several providers. These features allow short-term traders to time entries and exits with greater confidence, while also keeping overall trading costs at a minimum.

One of the areas where VT Markets stands out is its regulatory coverage and additional account benefits. The broker is licensed by ASIC, FSCA, and the Mauritius FSC, which provides strong oversight for client protection, but it also operates under offshore licenses that enable it to offer leverage up to 1:500 for eligible clients.

| Feature | Information |

|---|---|

| Spreads and Commission | Varies based on account: Spread – from 0.0 pips Commission – From no commission to $6 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Webtrader, and VT Markets app |

| Asset Types | Crypto, forex, stocks, indices, ETFs, bonds, and commodities |

| Customer Support | Email, help center, and live chat |

| Demo Account | Yes |

| Educational Content | VT Markets Academy |

| Regulation | ASIC, FSCA, and Mauritius FSC |

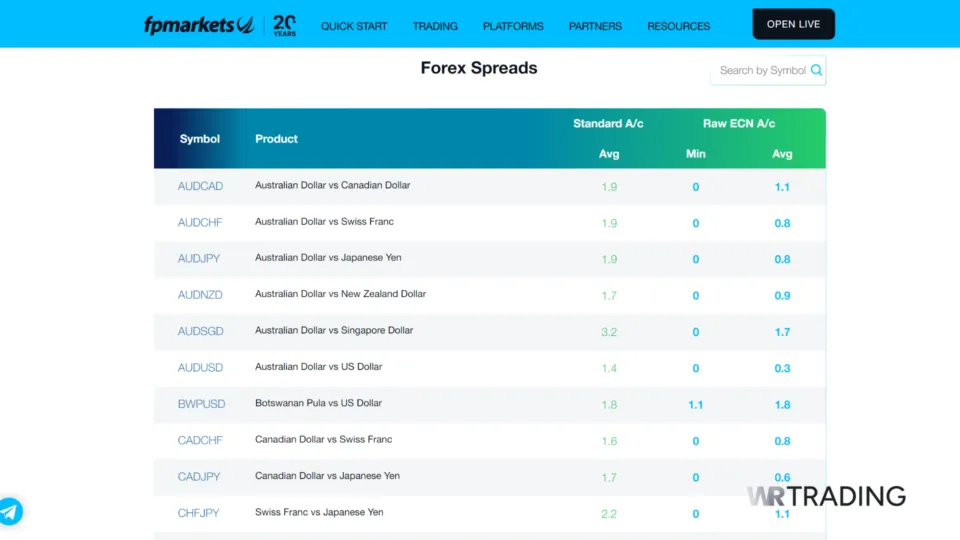

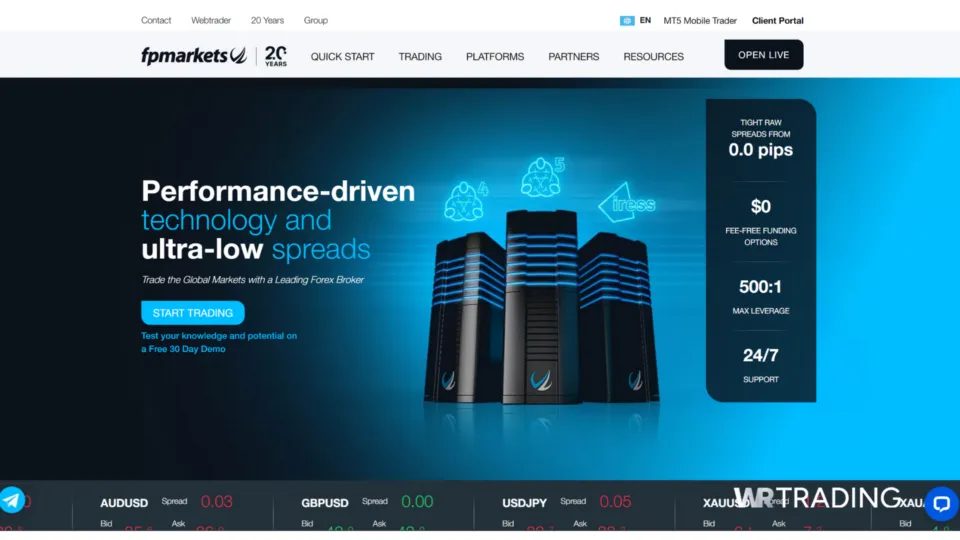

7. FP Markets

FP Markets is one of our favorite no spread forex brokers at WR Trading because its Raw ECN account delivers some of the lowest trading costs in the industry, starting from 0.0 pip spreads on major forex pairs. The account charges $3 per lot per side in commission, giving traders direct access to institutional-grade pricing that is transparent and cost-efficient.

During our tests, execution speed averaged below 40 milliseconds, which helps reduce slippage and makes FP Markets reliable for active trading. The broker supports over 70 forex pairs, providing opportunities across majors, minors, and exotics. Also, its platforms, such as MT4, MT5, and IRESS, come equipped with advanced tools that support various trading styles including automated strategies.

| Feature | Information |

|---|---|

| Spreads | Varies based on account: Spread – from 0.0 pips Commission – $3 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, and WebTrader |

| Tradable Assets | Forex, stocks, indices, commodities, cryptocurrency, and ETFs |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Video tutorials and trading glossary |

| Regulation | Australian Securities and Investment Commission |

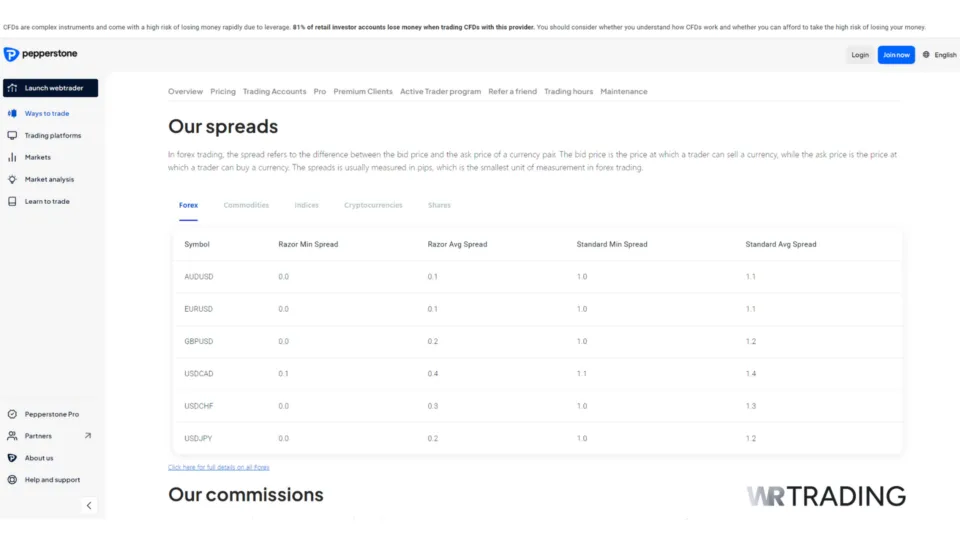

8. Pepperstone

Pepperstone provides an attractive option for traders with its zero-spread accounts, significantly cutting down on trading costs. During our testing, the Razor account stood out, offering zero spreads on major currency pairs. This account type also offers a maximum leverage of 1:30 and over 1,200 tradable assets.

In addition to competitive spreads, Pepperstone supports traders with an array of educational resources, enhancing their market knowledge and trading skills. The broker ensures rapid execution speeds, which are vital for getting the most accurate prices. Moreover, traders can utilize the top trading platforms in the industry such as MetaTrader 4, MetaTrader 5, TradingView, and cTrader.

| Feature | Information |

|---|---|

| Spreads | Varies based on account: Spread – from 0.0 pips Commission – from $2.60 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, and TradingView |

| Tradable Assets | Forex, commodities, indices, cryptocurrency, stocks, and ETFs |

| Customer Support | Email and phone support |

| Demo Account | Yes |

| Educational Content | Webinars, educational videos, and trading guides |

| Regulation | FCA, ASIC, and DFSA |

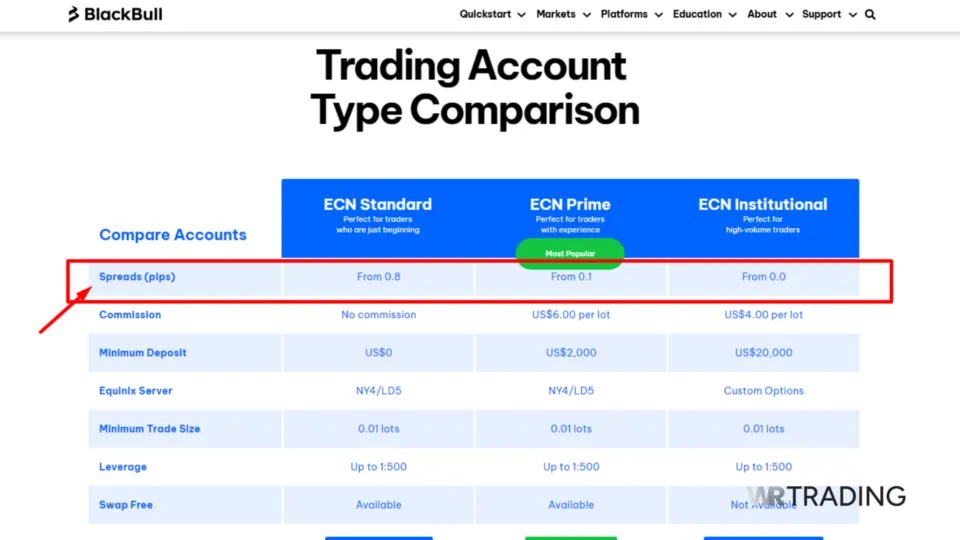

9. BlackBull Markets

BlackBull Markets stands out for its institutional-grade trading conditions and zero spread accounts. We found that their advanced technology ensures exceptionally fast execution speeds, making it ideal for high-frequency traders. BlackBull Markets offers both Standard and Prime accounts with zero spreads on major currency pairs, providing traders with cost-effective trading solutions. Additionally, their deep liquidity pool and ECN pricing model mean that traders can enjoy some of the tightest spreads in the industry.

We also appreciated BlackBull Markets’ trading platforms, including MetaTrader 4 and MetaTrader 5. Their user-friendly interface and comprehensive educational resources make them a great choice for those starting their trading career. Also, customer support is responsive and knowledgeable, ensuring that traders have access to help whenever needed.

| Feature | Information |

|---|---|

| Spreads | Varies based on account: Spread – from 0.0 pips Commission – from $4 to $6 per lot |

| Trading Platforms | MetaTrader 4, MetaTrader 5, MetaTrader Web Trader, cTrader, TradingView, and BlackBull Trade |

| Tradable Assets | Forex, commodities, indices, cryptocurrencies, futures, and stocks |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | Webinars, tutorials, education hub |

| Regulation | Financial Services Authority in Seychelles and the Financial Markets Authority in New Zealand |

10. RoboForex

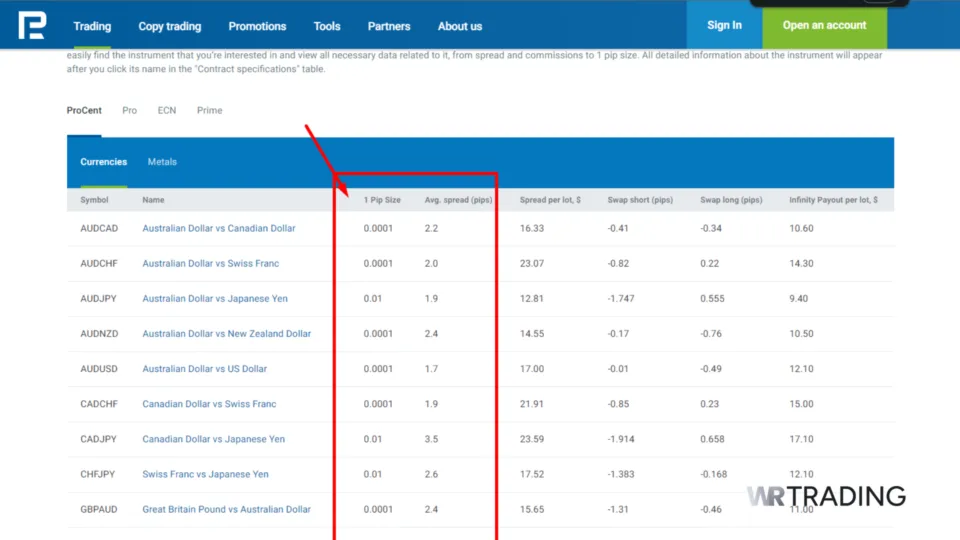

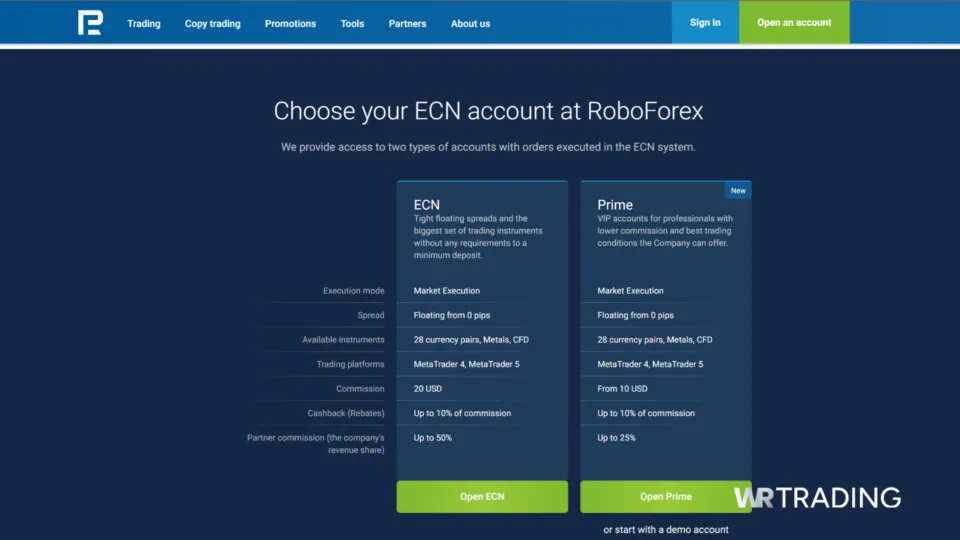

RoboForex offers diverse account options (Prime & ECN) with zero spread features, which is ideal for various trading strategies. We tested the Prime and ECN accounts, which provide zero spreads on major currency pairs, enabling cost-efficient trading. RoboForex is a solid choice for traders seeking flexibility and low trading costs.

The broker supports multiple trading platforms, including MetaTrader 4, MetaTrader 5, and R Stocks Trader, which accommodate a wide range of trading activities. We noted the impressive execution speed, suitable for high-frequency trading. RoboForex also provides excellent customer support and a wealth of educational materials, ensuring traders have the resources needed for success.

| Feature | Information |

|---|---|

| Spreads | Varies based on account: Spread – from 0.0 pips Commission – from 10 mio to 20 mio |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and R Stocks Trader |

| Tradable Assets | Stocks, indices, ETFs, commodities, and forex |

| Customer Support | Email, live chat, and phone support |

| Demo Account | Yes |

| Educational Content | None |

| Regulation | Financial Services Commission (FSC) of Belize |

What Are the Benefits of No-Spread Brokers?

No spread brokers offer several significant advantages that can enhance your trading experience and profitability. Here are some of the key benefits:

- Trading Costs

- Scalping

- Transparency

- Execution

- Trading Environment

Lower Trading Costs

One of the primary benefits of no-spread brokers is reduced trading costs. Without spreads, traders do not have to pay the difference between the bid and ask prices, which can add up over numerous trades.

This cost efficiency benefits traders who execute a high volume of trades.

Better for Scalping

No spread brokers are ideal for scalping strategies. Scalping involves making many trades to profit from small price changes. The absence of spreads means that even the smallest market movements can be profitable, making it easier for scalpers to achieve their trading goals.

Enhanced Transparency

Trading with no spread brokers enhances transparency in asset pricing. Traders can see the exact price at which they buy or sell an asset without the hidden costs associated with spreads. This clarity helps traders make more informed decisions and improves overall trading efficiency.

Improved Execution

No-spread accounts often offer improved execution speeds. Since these brokers typically operate using an ECN (Electronic Communication Network) model, they can offer faster and more reliable trade execution. This is crucial for strategies that rely on quick market entry and exit.

Predictable Trading Environment

With no spreads, traders can better predict their trading costs, making planning and managing their trades easier. This predictability allows for more accurate risk management and can improve overall trading performance.

How We Tested Zero-Spread Brokers

We conducted thorough testing based on several critical criteria to ensure we recommend the best zero spread brokers on WR Trading. Our evaluation process included the following steps:

Checking Spreads

First, we checked the spreads offered by each broker. We opened live trading accounts and monitored the spreads on major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, during different market conditions. This helped us verify that the brokers consistently offered zero spreads as advertised.

| Currency Pair | StarTrader | IC Trading | Vantage Markets |

|---|---|---|---|

| EUR/USD | From 0.0 pips with an average of ~0.1 | From 0.0 pips with an average of ~0.1 | From 0.0 pips with an average of ~0.2 |

| GBP/USD | From 0.2 pips with an average of ~0.3 | From 0.2 pips with an average of ~0.4 | From 0.5 pips with an average of ~0.5 |

| USD/JPY | From 0.1 pips with an average of ~0.5 | From 0.1 pips with an average of ~0.3 | From 0.4 pips with an average of ~0.3 |

| Commission | $3.50 per lot | $3.50 per lot | $1.50 per lot |

Live Trading Environment

We conducted live trades to assess the overall trading environment. This involved placing multiple trades to evaluate the execution speed, slippage, and reliability of each broker’s trading platform. We tested the performance of various account types, such as ECN and STP accounts, to ensure that zero spreads were available across different trading conditions.

Platform Performance

Our team tested the performance of each broker’s trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and proprietary platforms. We focused on the user interface, ease of use, and the availability of advanced trading tools. This assessment ensured that traders would have a seamless and efficient trading experience.

Customer Support

We interacted with each broker’s customer support teams to evaluate their responsiveness and helpfulness. Our tests included inquiries through various channels, such as live chat, email, and phone support, which helped us determine the quality and reliability of the customer service provided.

It is important to have good broker support so that you can close any positions immediately if the trading platform has problems.

Educational Resources

Finally, we reviewed the educational resources offered by each broker. This included webinars, tutorials, articles, and other learning materials to help traders improve their skills. Brokers with comprehensive and high-quality educational content scored higher in our evaluation.

Are Zero Spread Forex Brokers Suitable For Beginners?

Yes, zero spread forex brokers can be suitable for beginners, but the benefits depend on the trading style and strategy. Beginners benefit from the ability to trade without worrying about variable spreads widening during volatile trading periods, which provides clearer cost calculations on each trade.

However, these accounts replace spreads with commissions, and beginners must understand how commission-based pricing affects overall costs. A trader who places only a few trades per week may find that a standard account with slightly wider spreads could be cheaper than paying commissions on each transaction.

For new traders, another challenge is understanding order execution speed and liquidity depth, which play a bigger role when spreads are reduced to 0.0 pips. Without sufficient liquidity, orders may face slippage that offsets the cost advantage of zero spreads. Beginners who want to use these accounts should test them on a demo account first to see how costs and execution combine in real market conditions. By doing this, they can gain the cost benefits while avoiding unexpected surprises.

Are Zero Spread Forex Brokers Suitable For Professionals?

Yes, zero spread forex brokers are highly suited for professional traders, ideally for those who rely on strategies requiring precision in entry and exit. Professionals trade higher volumes, and eliminating the spread reduces transaction costs significantly over hundreds or thousands of trades.

Commission-based models are transparent, and because professionals already plan their risk and cost structures carefully, they can easily calculate the impact of commissions per lot traded. For traders running systematic or algorithmic strategies, this predictability is needed for long-term profitability.

Zero spread accounts also pair well with the advanced trading platforms professionals use, since deep liquidity and tight execution help maintain performance even during volatile markets. Professionals can scale positions, knowing that spreads will not widen unexpectedly. For those who operate during news releases or high-volume periods, the combination of raw pricing and low latency execution provides an edge that would not be possible on wider spread accounts.

Should You Use Forex Brokers Without Spreads for HFT Trading?

Yes, zero spread forex brokers are one of the best choices for high-frequency trading (HFT), where every pip saved has a measurable impact on performance. In HFT strategies, hundreds of small trades are executed daily, and even a spread of 1 pip can turn profitable strategies into losing ones over time. Therefore, using a no spread forex broker is ideal and necessary for any HFT strategy.

Zero spread accounts remove this barrier, allowing algorithms to operate with better pricing accuracy and smaller profit targets. Commission fees are easier to plan around in HFT models, as they remain fixed regardless of market volatility.

Which Forex Broker Offers The Lowest Spread on Gold?

Among the brokers we tested, the lowest spreads on gold (XAU/USD) were available at FP Markets, IC Trading, and StarTrader. FP Markets offered spreads starting from 0.07 points, while IC Trading averaged around 0.09 points, and StarTrader ranged between 0.08 and 0.1 points. These levels make them the most cost-effective choices for traders focusing on trading gold.

Which Forex Broker Has Zero Spreads For US Traders?

Due to strict CFTC and NFA regulations, US traders have very limited access to no-spread accounts. Although they didn’t make our list we highly recommend using Forex.com and OANDA in the United States. Both brokers provide accounts with spreads starting from 0.0 pips on major pairs like EUR/USD under certain conditions, with commissions applied per lot.

Do You Pay Less Fees With a Zero-Spread Forex Broker?

Yes, zero-spread forex accounts reduce overall trading costs compared to standard accounts, but the difference depends on how the broker charges commissions. Standard accounts build the fee into the spread, while zero-spread accounts show 0.0 pips but add a fixed commission per trade. The best way to see the difference is through a simple example.

Example cost on EUR/USD (1 lot trade = 100,000 units, where 1 pip = $10):

| Account type | Average spread | Commission | Cost breakdown | Total cost per trade |

|---|---|---|---|---|

| Standard account | 1.2 pips | $0 | 1.2 pips × $10 = $12.00 | $12.00 |

| Zero-spread account | 0.0 pips | $7 (round turn) | Spread = $0, Commission = $7 | $7.00 |

In our example, the standard account costs $12 because the spread is 1.2 pips, and each pip on a standard lot is worth $10. The zero-spread account only charges the commission, so the total is $7. Over many trades, these savings quickly add up, which is why zero-spread accounts are better to traders who want to keep costs low.

Not All Markets Can Be Zero Spread Because There Is a Natural Market Spread

Zero-spread accounts are often referred to as “Normal Market Spread Accounts” because not every market can operate at 0.0 pips due to the natural difference between buy and sell prices. These small spreads are a normal part of market structure and exist even when brokers advertise zero-spread conditions. Here’s more in-depth information on how this works:

Natural Market Spread

Every financial market has a natural spread, the difference between the bid (buy) and ask (sell) prices. This spread exists because of supply and demand dynamics. Liquidity providers, such as banks and financial institutions, quote different prices for buying and selling an asset, and the spread represents their profit margin and the cost of providing liquidity.

High Volatility and Low Liquidity

Maintaining zero spreads in markets with high volatility or low liquidity is challenging. High volatility can cause rapid price fluctuations, leading to wider spreads as liquidity providers manage their risk. Similarly, in markets with low liquidity, there are fewer participants and less volume, which can result in wider spreads.

Costs for Brokers

Brokers offering zero-spread accounts still need to cover their operational costs and make a profit. They typically do this by charging commissions on trades or incorporating fees in other ways. Traders must understand that while the spread may be zero, other costs could be involved.

Practical Considerations

In practice, zero spreads are more commonly offered on major currency pairs in the Forex market, where liquidity is high and trading volumes are substantial. However, for more exotic currency pairs, commodities, or other financial instruments, zero spreads are less feasible due to the natural market conditions and the costs involved for brokers.

Are There Forex Brokers Without Spreads and No Commissions?

No, there are no forex brokers that offer accounts without both spreads and commissions. Brokers need to cover the cost of providing liquidity and technology, which means they must charge traders in some form. If spreads are removed, a commission is charged per trade, and if commissions are waived, the broker adds a markup to the spread.

Are There Hidden Fees with Zero Spread Forex Brokers?

Zero spread accounts are transparent in how they charge traders, but there can still be costs outside the commission. Some brokers apply higher swap fees on overnight positions, or add markups to less liquid pairs where spreads cannot remain at 0.0 pips. Always review account terms, as differences in deposit and withdrawal charges, inactivity fees, or wider spreads during volatile news events can all impact the true cost of trading.

Conclusion

To summarize, zero spread forex brokers give traders the advantage of cutting trading costs while keeping pricing transparent. After testing several options, StarTrader came out on top for offering genuine zero spreads on major currency pairs combined with one of the most competitive commission structures in the market. Their ECN model ensures direct access to liquidity with ultra-fast execution speeds, which is needed for traders who want accurate pricing without hidden costs.

However, forex trading is highly personal, and the best broker depends on your style and goals. While StarTrader is our pick for overall conditions, it’s worth opening a demo or live accounts with different brokers from our list to see which platform, pricing model, and features match your needs best.

Once again, these are the best Forex Brokers With No Spreads:

- StarTrader – Best for fast execution speeds.

- IC Trading – Best for deep liquidity access.

- Vantage Markets – Best for advanced trading platforms.

- Moneta Markets – Best for beginner-friendly tools.

- PU Prime – Best for flexible account options.

- VT Markets – Best for high leverage trading.

- FP Markets – Best for low trading costs.

- Pepperstone – Best for algorithmic trading.

- BlackBull – Best for institutional-grade conditions.

- RoboForex – Best for diverse account types.

Frequently Asked Questions on Scalping Forex Brokers

What is a zero-spread Forex broker?

A zero-spread forex broker offers trading accounts where the difference between the bid and ask prices is zero. Instead of making money through the spread, these brokers typically charge a commission per trade. This setup provides a transparent and predictable cost structure for traders.

How do zero spread brokers make money?

Zero-spread brokers make money by charging a fixed commission on each trade, usually a small fee per lot traded. This model allows brokers to offer zero spreads while covering operational costs.

Are zero-spread accounts better for scalping?

Yes, zero-spread accounts are ideal for scalping because they eliminate the cost of spreads, allowing traders to profit from even the smallest price movements. Scalpers benefit from the predictable and low-cost trading environment, which enhances the profitability of their high-frequency trading strategies.

Do zero-spread accounts have hidden fees?

Typically, zero-spread accounts do not have hidden fees, but reviewing the broker’s fee structure is essential. Brokers are transparent about their commissions per trade. Always check for any additional charges, such as withdrawal fees or inactivity fees.

Can I trade all assets with zero spreads?

No, zero spreads are usually available only on major currency pairs. Other assets like exotic currency pairs, commodities, and indices may not have zero spreads due to natural market spreads and liquidity.