Crude oil trading growth has increased significantly due to the equal increase in energy demand and price volatility. As crude oil trading expands, platforms now offer advanced trading tools, more market access, and tight spreads. However, to get the best results while trading these assets, it’s essential to choose the right broker.

At WR Trading, we’ve tested hundreds of brokers. We’ve shortlisted 10 of the best crude oil trading brokers for WTI and Brent:

Broker:

Spreads on WTI/Brent Crude Oil:

Features:

Account:

WTI/Brent spread – from 0.1 pips

- High Leverage up to 1:1000

- RAW ECN Spreads from 0.0 pips

- Fastest execution

- Attractive Bonus Programs

- Copy Trading

- MT4 / MT5

- Personal support 24/7

WTI/Brent spread – 3.53 pips

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

WTI/Brent spread – varies

- Multiple regulations

- Leverage up to 1:50

- Demo account available

- More than 100 FX pairs

- No Commission

- Plus500 WebTrader, Plus500 App

WTI/Brent spread – 6 pips

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- MT4/MT5/RTrader/CopyFX

WTI/Brent spread – from 0.0 pips

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4 ,MT5

WTI/Brent spread – from 0.02 pips

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

WTI/Brent spread – from 2.7 pips

- Mauritius-regulated broker

- High Leverage up to 1:1000

- Multiple account types

- More than 850 trading instruments

- MT4, MT5, PU Prime App

WTI/Brent spread – from 0.0 pips

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 4$/1 Lot

- 26,000+ Markets

- TradingView, MT4/5, cTrader

WTI/Brent spread – from 0.6 pips

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

WTI/Brent spread – 7.3 pips

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

List of the 10 Best Oil Trading Platforms & Brokers

This is our top 10 of the best crude oil trading brokers for WTI and Brent:

- StarTrader: Offers high-leverage options and multi-platform access.

- Vantage Markets: High-speed execution with minimal slippage due to its fibre optic technology

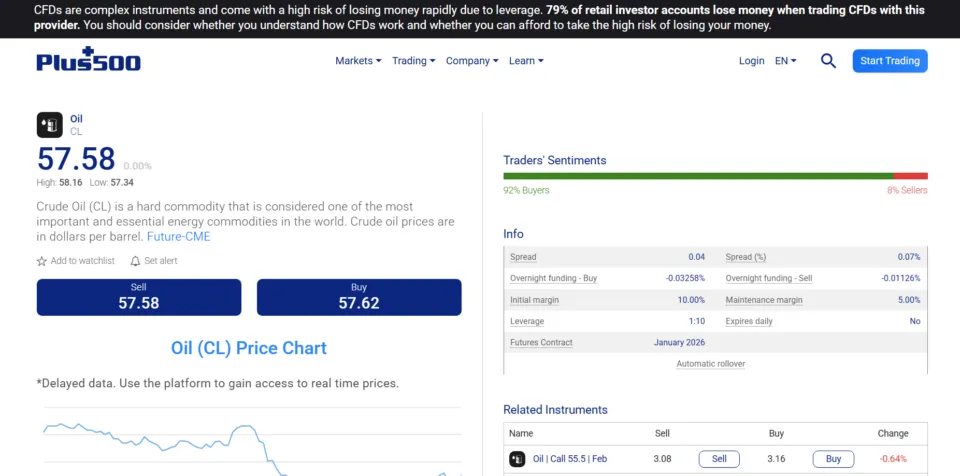

- Plus500 (US): A dedicated broker for US traders who trade oil futures.

- RoboForex: Offers accounts with zero commission on trades for crude oil

- IC Trading: Ensures tight spreads and fast execution due to deep liquidity pools

- Pepperstone: Known for ultra-low spreads and institutional-grade execution on oil markets.

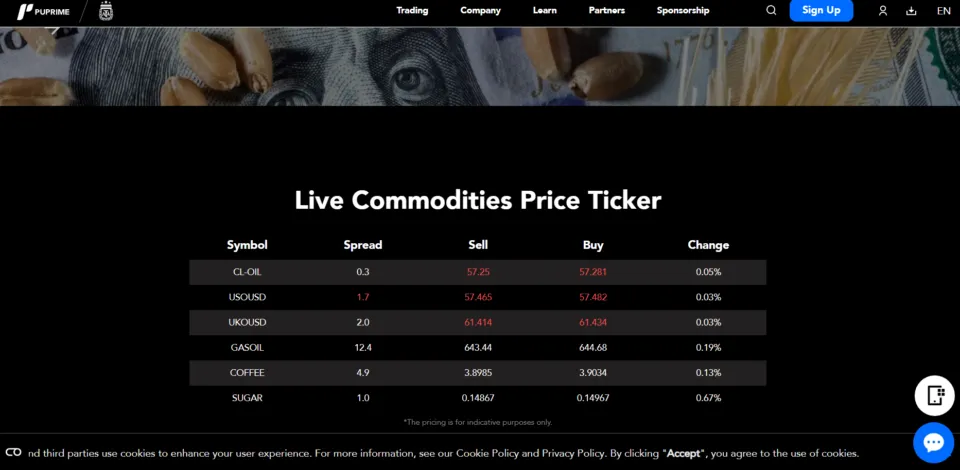

- PU Prime: Offers a wide range of account types and robust trading platforms for global energy markets.

- VT Markets: Delivers low-cost trading with advanced charting tools and reliable order execution.

- Moneta Markets: Features easy account setup, competitive spreads, and strong support for CFD oil trading.

- BlackBull Markets: Supports MT4, MT5, and BlackBull’s proprietary platform for seamless oil trading

1. StarTrader

StarTrader, at number one, is a safe, flexible, and globally regulated broker with lightning-fast execution. It operates under some of the world’s strongest regulators, like the FCA and ASIC, to give added confidence that client money will never be used for hedging or other operations. Its offerings include MT4, MT5, and the StarTrader Mobile App for easy access. Both Standard and ECN accounts are available with competitive spreads.

Key Facts About StarTrader

| Feature | StarTrader |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Standard, ECN, Demo |

| Tradable Instruments | Forex, Commodities, Indices, Shares, Crypto |

| Trading Platforms | MetaTrader 4, MetaTrader 5, StarTrader Mobile App |

| Regulation | FCA (UK), FSCA (South Africa), FSC, FSA (Seychelles), SCA, ASIC |

| Minimum Deposit | $50 |

| Minimum Order | 0.01 lots |

| Leverage on WTI/Brent Crude Oil Trading | Up to 1:500 |

| Spreads on WTI/Brent Crude Oil Trading | From 0.1 pips |

| Commissions on WTI/Brent Crude Oil Trading | $0 (Standard), $3 per side (ECN) |

| Accepted Currency | USD, EUR, GBP, AUD, more |

| Transaction Options | Bank Transfer, Cards, Skrill, Neteller, Crypto |

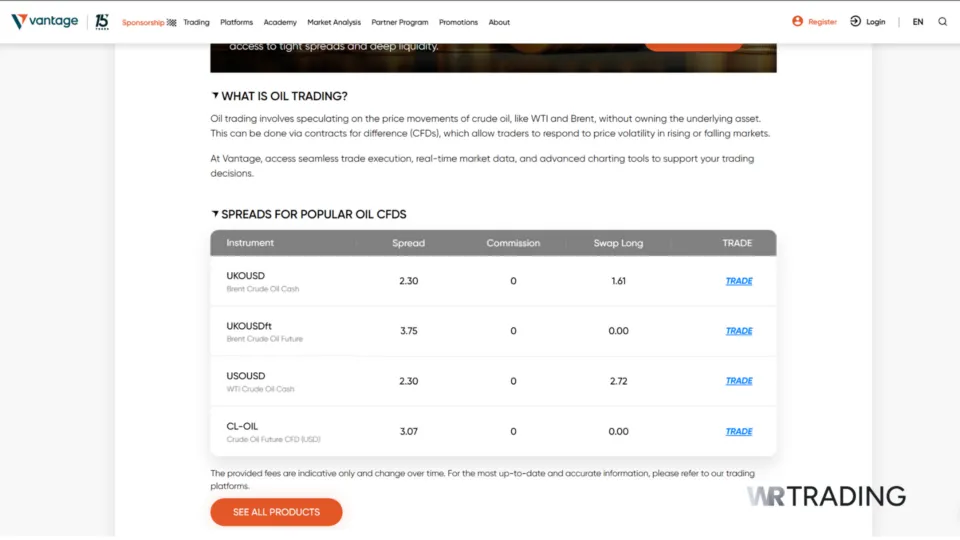

2. Vantage Markets

Vantage Markets is renowned for offering excellent trading conditions, particularly for commodities like crude oil. The platform is known for its tight spreads, often starting from as low as 0.0 pip for oil trades. This low spread can significantly reduce trading costs, especially for active traders who engage in frequent trading.

One of the key advantages of Vantage Markets is the high leverage, which can go up to 500:1. This enables traders to control larger positions with relatively small capital, maximising the potential return on volatile oil markets.

Key Facts About Vantage Markets

| Feature | Vantage Markets |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Raw ECN, Standard STP, Pro ECN, Islamic, Cent, Premium |

| Tradable Instruments | Forex, Indices, Energy, Gold/Silver, Commodities, Shares, ETFs, Stocks, Oil, Bonds, Energies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Vantage FX App, Tradingview, ProTrader |

| Regulation | ASIC, CIMA, VFSC, SIBL |

| Minimum Deposit | $50 (Standard and RAW), $10,000 (Pro ECN) |

| Minimum Order | 0.01 lot |

| Leverage on WTI/Brent Crude Oil Trading | Up to 1:500 (varies by account type and instrument) |

| Spreads on WTI/Brent Crude Oil Trading | 3.53 (Spreads are liable to change based on market conditions) |

| Margin on WTI/Brent Crude Oil Trading | Margin is liable to change based on market conditions |

| Commissions on WTI/Brent Crude Oil Trading | $3 (Raw), $0 (Standard), $1.50 (Pro ECN) per round lot |

| Accepted Currency | AUD, USD, EUR, GBP, NZD, CAD, SGD, JPY, CHF, ZAR |

| Transactions Options | Bank wire transfer, credit/debit cards, e-wallets (Skrill, Neteller, PayPal), UnionPay, Boleto, BPAY, Astropay, Fasapay, Domestic Fast Transfer, International EFT, China Union Pay, JCB, Broker-to-Broker Transfer, Pagsmile, Perfect Money. |

3. Plus500 (US)

Plus500 US is our third-best WTI/Brent broker at WR Trading. For futures traders in the United States seeking a straightforward and clean futures experience, Plus500 US provides a simple platform with intuitive risk management controls. It is, however, noteworthy that Plus500 has a different fee structure. The broker charges $0.89 commission for standard and mini contracts, $0.49 for micro contract.

At WR Trading, we found this platform to be unique because it offers oil trading services under strong regulatory protection, making it particularly appealing to traders interested in the energy sector.

Key Facts About Plus500

| Feature | Plus500 |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes, Oil futures like Micro WTI Crude Oil, Crude Oil, Brent Crude Oil, Heating Oil, and E-mini Crude Oil. |

| Account Types | Futures Account (standard, mini, micro available) |

| Tradable Instruments | Futures on Energies (Crude oil, natural gas, gasoline, etc.), forex, indices, metals, cryptocurrencies |

| Trading Platforms | Plus500 WebTrader and Plus500 mobile App |

| Regulation | CFTC, NFA Member |

| Minimum Deposit | $100 |

| Minimum Order | 1 Contract |

| Leverage on WTI/Brent | 1:10 |

| Spreads on WTI/Brent | Variable |

| Commissions | $0.89 (standard and mini contract), $0.49 (micro contract) |

| Margin on WTI/Brent Crude Oil Trading | Intraday Margin: Ranges from $80 to $1,500 |

| Accepted Currency | USD |

| Transactions Options | USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, ZAR, SGD |

| Transaction Options | Bank Transfer, Cards, Skrill, Neteller, Crypto |

4. RoboForex

RoboForex allows traders to access Brent crude oil through CFDs. Their trading platforms, such as MT4, MT5, and cTrader, offer comprehensive tools to help traders analyse price movements and implement automated strategies. RoboForex provides high leverage, low spreads, and a variety of account types suited to different trading styles.

At WR Trading, we appreciate RoboForex for its high leverage of up to 1:2000, making it suitable for traders looking for substantial exposure with minimal capital. Its range of account types and low minimum deposit requirements make it accessible to traders of all levels.

Key Facts About RoboForex

| Feature | RoboForex |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Pro, ECN, Prime, R Stocks Trader, ProCent |

| Tradable Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies, ETFs, Metals, Futures, Energies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, R StocksTrader, R Mobile Trader, R WebTrader, MT 4 MultiTerminal |

| Regulation | FSC Belize |

| Minimum Deposit | $10 (Prime, ECN, Pro, ProCent), $100 (RStocksTrader) |

| Minimum Order | 0.01 lot |

| Leverage on WTI/Brent Crude Oil Trading | 1:20 |

| Spreads on WTI/Brent Crude Oil Trading | 6.0 pips |

| Margin on WTI/Brent Crude Oil Trading (Hedged) | 50% |

| Commissions on WTI/Brent Crude Oil Trading | $16 (Swapfree) |

| Accepted Currency | USD, EUR, GOLD |

| Transactions Options | Bank wire transfer, credit/debit cards, electronic payment systems (Skrill, Neteller, etc.), QR and Vouchers |

5. IC Trading

IC Trading is another excellent platform for trading crude oil. This broker offers highly competitive conditions, making it a favourite among traders focusing on oil. Spreads on IC Trading are as low as 0.0 pips for oil trading, which helps minimise transaction costs and maximise profit potential. IC Trading offers up to 1000:1 leverage, providing flexibility for traders who want to maximise their exposure to oil price movements.

In terms of commissions, IC Trading operates with minimal fees, charging only $3.50 per side per lot on raw spread accounts. This competitive commission structure is beautiful for frequent traders who rely on tight cost management to remain profitable. The broker offers transparent swap rates, updated daily based on the position and underlying market factors.

Key Facts About IC Trading

| Feature | IC Trading |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Standard, Raw accounts, Islamic |

| Tradable Instruments | Forex CFDs, Indices, Commodities, bonds, stocks, Gold and Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader and cTrader |

| Regulation | Financial Services Commission of Mauritius (FSC) |

| Minimum Deposit | $200 |

| Minimum Order | 0.01 lot |

| Leverage on WTI/Brent Crude Oil Trading | 1:200 |

| Spreads on WTI/Brent Crude Oil Trading | From 0.0 pips (Raw Account) and 0.8 pips (Standard Account) |

| Commissions on WTI/Brent Crude Oil Trading | $3.5 (Raw MetaTrader), $3 (Raw cTrader), and $0 (Standard) per lot side |

| Accepted Currency | AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, CHF |

| Transactions Options | Skrill, PayPal, Mastercard, UnionPay, Visa, Neteller, wire transfer and broker-to-broker |

6. Pepperstone

Pepperstone is known for delivering razor-sharp spreads and institutional-grade execution, which, in turn, facilitates the trading of highly volatile commodities such as oil. Platforms like MT4, MT5, cTrader, and TradingView are available. Couple this with deep liquidity and fast order execution, and traders are practically immune to slippage.

For the trader who desires cost efficiency, Pepperstone offers a pricing model that minimizes spread, and there are no hidden fees, making it extremely reliable for participants in the oil market.

Key Facts About Pepperstone

| Feature | Pepperstone |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Standard (spread-based), Razor (ECN-style) |

| Tradable Instruments | CFDs: Oil, Forex, Indices, Metals, Crypto, Shares |

| Trading Platforms | MT4, MT5, cTrader, TradingView |

| Regulation | ASIC, FCA, CySEC, DFSA, BaFin, CMA, SCB |

| Minimum Deposit | $200 |

| Minimum Order | 0.01 lot |

| Leverage on WTI/Brent Crude Oil Trading | 1:100 (varies by region) |

| Spreads on WTI/Brent Crude Oil Trading | 0.02 pips |

| Commissions on WTI/Brent Crude Oil Trading | Zero Commission on Standard; $7 per round turn on Razor |

| Accepted Currency | USD, EUR, GBP, AUD, JPY |

| Transaction Options | Bank Transfer, Card, E-wallets |

7. PU Prime

Pu Prime offers a flexible, globally regulated CFD trading experience where WTI and Brent oil can be traded together with other commodities under the same umbrella. It offers Cent, Standard, Prime, and ECN accounts where nano lot size trading is allowed, with leverage going up to 1:1000.

The broker also offers easy-to-use trading platforms, like MT4, MT5, WebTrader, and their proprietary mobile app. Requiring only a $20 minimum deposit amount, PU Prime delivers depth, control, and competitive conditions in energy markets.

Key Facts About PU Prime

| Feature | PU Prime |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Cent, Standard, Prime, ECN, Islamic |

| Tradable Instruments | Commodities, Forex, Metals, Indices, Stocks, ETFs |

| Trading Platforms | MT4, MT5, WebTrader, Mobile App |

| Regulation | FSA (Seychelles), FSC (Mauritius), FSCA (South Africa), ASIC (Australia) |

| Minimum Deposit | $20 (Cent), $50 (Standard), $1,000 (Prime), $10,000 (ECN) |

| Minimum Order | From 0.01 lots |

| Leverage on WTI/Brent Crude Oil Trading | Up to 1:1000 |

| Spreads on WTI/Brent Crude Oil Trading | 3.7 pips (Standard), 2.4 pips (Prime/ECN) |

| Commissions on WTI/Brent Crude Oil Trading | Zero Commission (Standard, Cent), $7 per side (Prime), $2/side (ECN) |

| Accepted Currency | USD, EUR, GBP, CAD, AUD, SGD, NZD, HKD, JPY |

| Transaction Options | Bank transfer, credit/debit cards, e-wallets |

8. VT Markets

VT Markets delivers a very simple trading environment. Both WTI and Brent crude are supported with super-low spreads beginning from 0.0 pips on RAW accounts and some of the best leverage in the industry (up to 1:500). All available accounts are tradable on MT4 and MT5. The $100 minimum deposit allows beginner traders to trade professionally in the global energy market.

Key Facts About VT Markets

| Feature | VT Markets |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Standard STP, Raw ECN, Islamic (Swap-Free), Cent Account, PRO ECN |

| Tradable Instruments | Commodities, Forex, Indices, Shares, ETFs |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, TradingView, VT Markets Mobile App |

| Regulation | FSP, FSCA, FSC, SCA |

| Minimum Deposit | $100 |

| Minimum Order | From 0.01 lot |

| Leverage on WTI/Brent Crude Oil Trading | Up to 1:500 |

| Spreads on WTI/Brent Crude Oil Trading | From 0.0 pips (RAW), 1.2 pips (Standard) |

| Commissions on WTI/Brent Crude Oil Trading | $6 per round turn (RAW); None (Standard) |

| Accepted Currency | USD, EUR, GBP, AUD, CAD, NZD, SGD |

| Transaction Options | Bank transfer, credit/debit cards, e-wallets, and local payment methods |

9. Moneta Markets

Moneta Markets is a broker with an intuitive platform that is fast and easy, where WTI and Brent crude, alongside other CFDs, can be traded with a maximum leverage of 1:500. This broker enables flexible position size management for both retail and professional account holders. It offers Standard and RAW ECN accounts, which are simply a choice between spread-only or commission-based pricing.

The globally accepted MT4 and MT5 platforms, as well as the broker’s ProTrader platform, ensure swift order executions. All of these, plus the fact that accounts can be opened with just $50, make Moneta Markets a preferred broker for crude oil trading.

Key Facts About Moneta Markets

| Feature | Moneta Markets |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Direct STP, Prime ECN, Islamic |

| Tradable Instruments | Commodities (oil, metals), Forex, Indices, Shares, ETFs, Cryptos |

| Trading Platforms | MT4, MT5, ProTrader, MT4 WebTrader, App Trader, MetaTrader App |

| Regulation | ASIC (Australia), FSP, FSCA, FCA, SLIBC |

| Minimum Deposit | $50 |

| Minimum Order | From 0.01 lot |

| Leverage on WTI/Brent Crude Oil Trading | Up to 1:500 |

| Spreads on WTI/Brent Crude Oil Trading | From 0.6 pips |

| Commissions on WTI/Brent Crude Oil Trading | $6 per round turn (ECN); None (Standard) |

| Accepted Currency | USD, EUR, GBP, AUD, CAD, NZD, SGD |

| Transaction Options | Bank transfer, credit/debit cards, e-wallets, local methods |

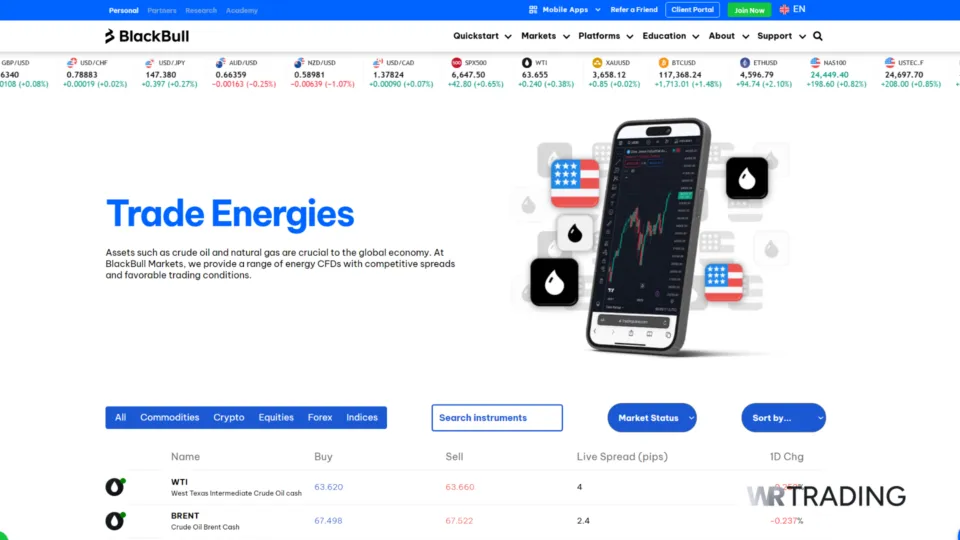

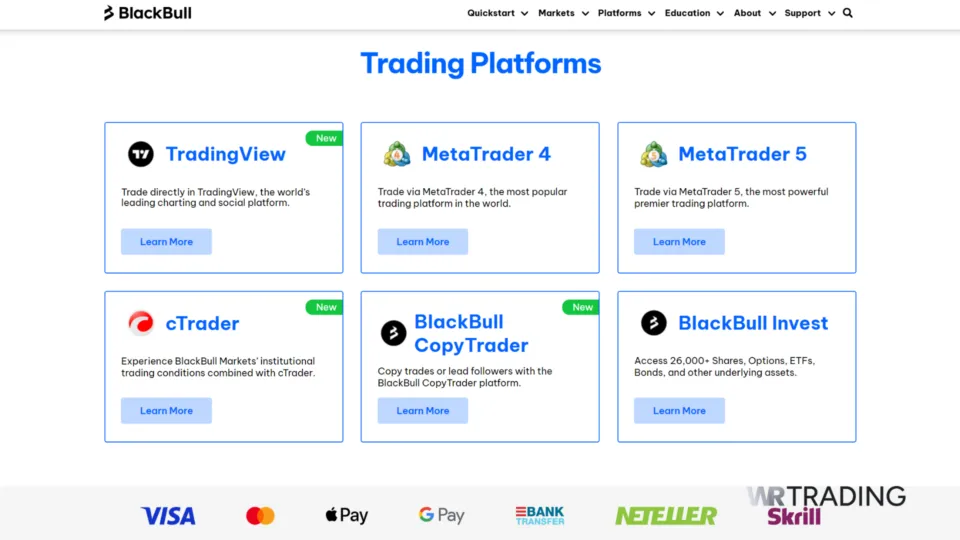

10. BlackBull Markets

Our review of BlackBull Markets, a well-established ECN broker based in New Zealand, reveals its strengths in offering access to global commodity markets, including Brent crude oil. Known for its deep liquidity pools and no-dealing desk execution, BlackBull Markets ensures that traders can execute large orders without slippage, a critical factor in oil trading.

We at WR Trading found this particularly useful for professional and institutional traders who deal in large volumes. BlackBull Markets offers up to 500:1 leverage, providing the flexibility needed to manage risk. Traders can utilise over five different third-party platforms to trade oil.

Key Facts About BlackBull Markets

| Feature | BlackBull Markets |

|---|---|

| WTI/Brent Crude Oil Trading Available | Yes |

| Account Types | Standard, Prime, Institutional, Swap-Free |

| Tradable Instruments | Forex, Indices, Commodities, Shares, ETFs, Cryptocurrencies, Metals, Equity Indices, Futures |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blackbull Invest, Blackbull CopyTrader |

| Regulation | Seychelles Financial Services Authority (FSA), NZ FSP |

| Minimum Deposit | $0 (Standard), $2,000 (Prime), $20,000 (ECN Institutional) |

| Minimum Order | 1 |

| Leverage on WTI/Brent Crude Oil Trading | Up to 1:100 |

| Spreads on WTI/Brent Crude Oil Trading | 7.3 (Spreads change based on live market conditions) |

| Margin on WTI/Brent Crude Oil Trading | Varies based on market condition |

| Commissions on WTI/Brent Crude Oil Trading | $0 (Standard), $4 (ECN Institutional), $6 (ECN Prime) per round lot |

| Accepted Currency | USD, EUR, GBP, AUD, NZD, CAD, CHF, JPY, HKD, XAU, BTC, ETH |

| Transactions Options | Airtm, AMEX, Skrill, SEPA, Poli, PaymentAsia, Neteller, Local Bank Transfer, Bank wires, credit/debit cards, Neteller, China Union Pay, AstroPay, crypto, Beeteller, Boleto, Fasapay, FxPay, Help2Pay, HexoPay |

What Is Important When Choosing a Good Oil Trading Platform & Broker?

Traders seeking to capitalise on the oil market require a dependable platform. This is why, at WR Trading, we prioritise the essential elements that define a top-quality trading environment so that traders can access the best opportunities in the oil market. Here are some of the key considerations we focused on:

Liquidity

Liquidity refers to how easily and quickly an asset can be bought or sold without affecting its price. In oil trading, liquidity is important because it ensures that trades can be executed at the desired price with minimal slippage. A good oil trading platform or broker will offer access to highly liquid markets, such as West Texas Intermediate (WTI) and Brent Crude, enabling traders to enter and exit positions seamlessly.

We reviewed liquidity by analysing how various platforms provide access to deep markets with enough volume to accommodate both large and small trades. Brokers with strong liquidity connections to global oil markets ensure that traders face fewer disruptions and get the best possible prices, even during periods of high volatility.

Commission and Fees

Commission rates and trading fees have a direct impact on profitability. We believe that a good oil trading platform or broker should offer competitive commission structures, especially when dealing with high volumes of trades. Oil trading can involve spreads, overnight fees for holding positions, and, in some cases, direct commissions.

When reviewing brokers, we compared the fee structures, including spreads and any hidden costs, across various platforms. Brokers offering zero-commission trading or low-cost spreads were rated higher, as lower fees enable traders to keep more of their profits. However, we considered the overall quality of service in relation to the fees charged, as cheaper platforms sometimes offer fewer tools or less reliable execution.

Execution Speed

In oil trading, especially during periods of high volatility, prices can fluctuate. Slow execution can lead to missed opportunities or increased losses. A platform or broker with fast execution speed ensures that your trade is completed at the price you intended.

We assessed execution speed by looking at broker data on how quickly trades are processed under normal and volatile market conditions. The best brokers offer lightning-fast execution times, a feature that enables traders to capitalise on real-time price movements.

Regulation and Security

Well-regulated brokers adhere to industry standards that protect traders, including segregating client funds, providing insurance in case of broker insolvency, and enforcing transparent trading practices. Regulation ensures that brokers operate within a legal framework, giving traders peace of mind that their funds and trades are secure.

We reviewed platforms and brokers based on their regulatory status, prioritising those regulated by respected authorities such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Platforms with top-notch regulatory oversight scored higher, as they guarantee a more secure platform.

Trading Platform

A good trading platform is the backbone of any oil trading experience. We believe that a platform should offer user-friendly navigation, top charting tools, technical indicators, and access to real-time market data. Traders often rely on these features to analyse market trends, track price movements, and execute trades efficiently.

During our review, we evaluated platforms based on their usability, customisation options, and the range of tools provided. Platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) that offer extensive charting and automated trading options were rated higher. We considered whether the platforms were available on desktop, mobile, or web browsers, which would give traders flexibility in how they manage their trades.

Which Oil Trading Broker Is the Best For Beginners?

From our top 10 analysis, brokers like StarTrader, BlackBull and RoboForex appeal to beginners much more than the rest. For most newbie oil traders, simplicity and accessibility are most important. Everything from low minimum deposits and an easy-to-use platform to simple fee structures can help center the beginner’s mind on learning.

RoboForex has one of the lowest minimum deposits of $10 and many account types; this is decent for a beginner who wants to try out different trading styles. Blackbull Markets, starting at $0, is a no minimum deposit broker with a very transparent pricing model. Blackbull also provides educational support for beginners on its official YouTube channel.

Which Oil Trading Broker Is the Best for Professionals?

Liquidity, tight spreads, and execution speed during times of heightened volatility are the added demands professional traders require from their broker. This is exactly what StarTrader and IC Trading provide to oil traders by offering trading conditions that are on par with institutions for retail participants.

StarTrader allows high-volume trading through multiple third-party platforms integrated into its offering. The broker has a no-dealing desk execution, making it suitable for scalpers and other market participants. IC Trading offers spreads from 0.0 pips and leverage of up to 1:500. This speed and accuracy contribute to peak performance for professionals at the WTI and Brent markets.

Leverage on Crude Oil Trading

In Brent crude oil trading, brokers offer leverage ratios that vary depending on the account type, jurisdiction, and the trader’s experience. A standard leverage ratio for oil trading is 100:1, meaning a trader can control $100,000 worth of oil contracts with just $1,000 in their account. Some brokers offer higher leverage, such as 500:1, which gives traders even more exposure to the oil market.

However, this means that even small price movements in WTI crude oil can result in significant gains or losses. While high leverage can lead to greater profits, it requires a higher level of skill and a solid risk management plan. For beginners, lower leverage is often more suitable as it reduces the risk of significant losses while still allowing traders to benefit from price movements in the oil market.

How High Are The Commissions on Oil Trading By Brokers?

In crude oil trading, brokers charge commissions in several ways, typically through either spread-based fees or flat-rate commissions. For spread-based commissions, the cost is embedded in the difference between the buy (ask) and sell (bid) prices. Brokers generally offer spreads ranging from 0.1 to 0.5 pips on oil, depending on the platform.

Flat-fee commissions, on the other hand, charge a set amount per trade, regardless of the trade size. Brokers that charge flat fees per trade often set commission rates between $3 $7 per side per lot. This means that for each transaction (opening and closing a trade), traders could pay between $6 $14 in total commissions.

What Are The Swaps on Oil Trading?

A swap, known as an overnight or rollover fee, is the cost or benefit of holding a position open overnight in leveraged trading. While it is not a direct commission, overnight holding costs (swaps) apply to traders holding oil positions overnight.

You can think of swaps as an indirect commission because they accumulate over time. They are based on the interest rate differential between currencies in the oil contract and can either be a credit or a charge depending on the position (long or short) and the broker’s policies.

For short-term traders, swaps may not have a significant impact since positions are usually closed before the end of the trading day. However, for swing traders or those holding long-term positions in WTI/Brent, swap rates can accumulate over time. For example, if a trader has a long position on crude oil for several weeks, the cumulative swap fees can become substantial, affecting the profitability of the trade.

Types of Financial Products to Trade Brent Crude Oil

Below are the different financial products to trade Brent crude oil and a breakdown of each of the products to help you decide which could be the best for you:

Options on Oil

Options provide traders with the right, but not the obligation, to buy or sell Brent crude oil at a predetermined price before a specified expiration date. Usually, traders pay a premium for this right, and the maximum loss is limited to the premium paid if the option expires worthless.

At WR Trading, we find that options can be helpful for traders looking to hedge their existing positions or take advantage of market swings with limited downside risk. For traders who anticipate significant price movements in Brent crude, options offer a flexible way to benefit from such fluctuations.

Contracts For Difference (CFDs)

CFDs are a popular financial product that allows traders to speculate on the price movements of Brent crude oil without owning the underlying asset. Instead of buying physical barrels of oil, traders enter into a contract with their broker to exchange the difference in price from the time the position is opened to when it is closed.

At WR Trading, we recommend CFDs due to their flexibility, as they allow traders to profit from both rising and falling oil prices. The ability to go long or short makes CFDs ideal for traders who want to capitalize on market volatility in the oil market. Recent data projects the global CFD market to reach $3.8 billion by 2030, which reflects its growing popularity among traders.

Futures Contracts

Futures are standardised contracts that obligate traders to buy or sell a specific amount of Brent crude oil at a predetermined price on a future date. Unlike options, futures do not provide the flexibility to back out of the trade, making them a higher-risk product. Recent data reveal that more than 1 million contracts of Brent crude oil futures and options trade daily, with around 4 million contracts of open interest.

So, for traders looking to speculate on longer-term movements in Brent crude oil, futures could be the answer. This instrument offers a way to gain pure exposure to oil prices without many of the fees or spreads associated with other products like CFDs.

Conclusion

At WR Trading, we know that in the volatile world of oil trading, every tick counts. A single price swing could mean a profit or a loss. That’s why we’ve meticulously researched and reviewed the top 10 oil trading brokers, looking beyond just competitive spreads and leverage to focus on the crucial factors that drive success like lightning-fast speed and rock-solid reliability.

Brokers like Blackbull Markets, Roboforex, and IC Trading stood out for their exceptional trading conditions. Blackbull Markets provides seamless transactions, deep liquidity pools, and no-dealing desk execution for oil traders, ensuring they can execute large orders without slippage. Roboforex offers a minimum deposit of $10 and leverage up to 1:20, making it ideal for oil traders looking for substantial exposure with minimal capital and risk.

With spreads as low as 0.8 pips and leverage up to 1:500, IC Trading provides oil traders with the flexibility to amplify their exposure to oil price movements while still helping them minimize transaction costs.

Each of these brokers offers the depth and dependability traders need to thrive in the volatile crude oil markets.

Frequently Asked Questions on Oil Trading Brokers:

Can I Trade WTI or Brent Crude Oil on MetaTrader 4 or MetaTrader 5?

Yes, most leading brokers such as FP Markets, Vantage Markets, and IC Trading offer access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are highly popular for oil trading due to their advanced charting tools, automation, and execution speed.

What is The Difference Between Trading Oil via CFDs and Futures?

CFDs (Contracts for Difference) allow you to speculate on oil price movements without owning the actual asset. At the same time, Futures involve buying or selling oil at a future date at a predetermined price. Retail traders typically prefer CFDs for their flexibility, while institutional traders commonly use Futures.

How Do Commissions Work in Oil Trading?

Commissions can either be integrated into the spread or charged as a separate fee per trade. Some brokers, like FP Markets and IC Trading, charge around $3.50 per side per lot, while others rely on spread-based pricing.