Learn about the 10 best PayPal Forex brokers that make trading easier by accepting PayPal deposits and offering smooth PayPal withdrawals. PayPal is one of the most trusted and convenient payment methods for traders who want fast deposits, secure payments, and straightforward withdrawals.

At WR Trading, we carefully analyzed and selected these 10 brokers based on ease, transaction speed, and fees charged on PayPal withdrawals. Let’s examine their features.

According to our analysis at WR Trading, these are the Top 10 PayPal Forex brokers:

Broker:

PayPal:

Advantages:

Account:

Yes

- Multiple Regulations

- Leverage up to 1:400

- Minimum Deposit $100

- 1.260+ Assets

- Copy Trading available

- MT4, MT5, and own platforms

Yes

- Commissions $2.25 per lot per side

- Spreads from 0.0 pips

- ASIC & VFSC regulated

- MT4, TradingView, cTrader

- Execution speed: 35 ms

Yes

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commissions from $4/1 Lot

- MetaTrader 4/5, cTrader, FxPro Edge

- 5x Regulated Broker

Yes

- Spreads from 0.0 pips

- Commissions $3 per side

- Copy Trading

- MT4, MT5, WebTrader, cTrader

- 24/7 support

- Multiple Regulations (ASIC, CySEC, & more)

Yes

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

Yes

- Spreads from 0.0 pips

- Commissions $3 per side

- Copy Trading

- MT4, MT5, WebTrader, cTrader

- 24/7 support

- Multiple Regulations (ASIC, CySEC, & more)

Yes

- $50 Minimum Deposit

- Zero commission for real stocks and ETF trades, 1% on cryptos

- 5,000+ Markets

- eToro investing platform and app

- Multiple regulations (FCA, CySEC, & more)

Yes

- More than 350 tradable assets

- Spreads from 0.1 Pips

- Leverage up to 1:30

- Demo Account

- $50 Minimum Deposit

- CySEC regulated

- Libertex Platform, MT4/MT5

Yes

- Regulated by multiple authorities

- Spreads from 0.0 Pips

- Leverage up to 1:200

- Commission from 0% per lot

- 2,100+ tradable assets

- xStation 5, xStation Mobile

Yes

- Multiple regulations

- Leverage up to 1:50

- Demo account available

- More than 100 FX pairs

- No Commission

- Plus500 WebTrader, Plus500 App

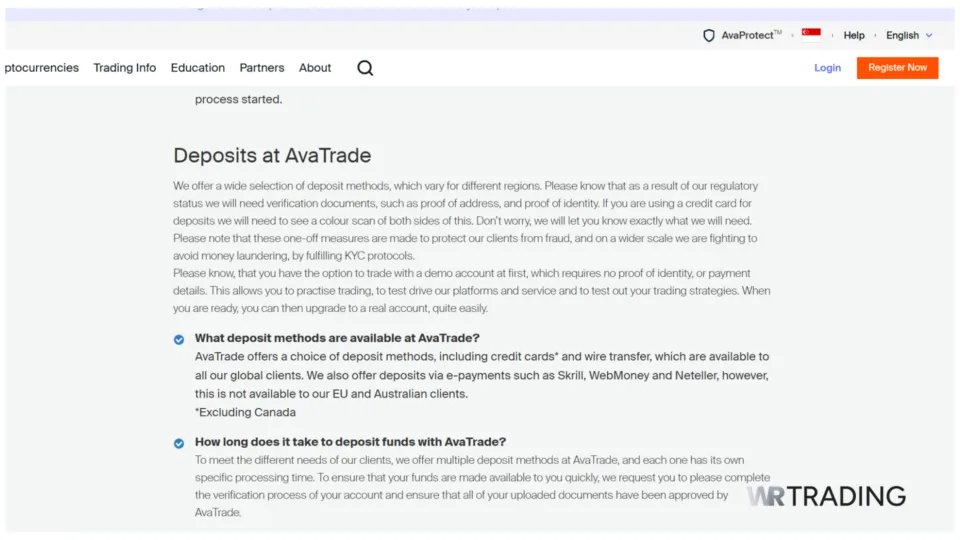

#1 AvaTrade

As our best PayPal broker, Avatrade was established in 2006 and has its headquarters in Ireland. The Central Bank of Ireland is one of Avatrade’s regulatory bodies. Since its inception, the platform has executed approximately 2 million trades per month.

This Forex broker allows clients to trade over 100 instruments, including cryptocurrency, commodities, stocks, and more. AvaTrade offers a range of trading platforms, including AvaOptions, MetaTrader 4, and MetaTrader 5. The broker provides an AvaSocial app, which enables beginners to chat with world-class traders and replicate their strategies. In 2020, AvaTrade partnered with Trading Central to enhance its client services.

Trading Central offers daily market news, the best strategies to maximise market movement, and new tools such as adaptive candlesticks. Our top-rated PayPal broker has implemented every necessary cybersecurity measure to protect client information.

It offers a diverse array of educational tools and resources. AvaTrade offers a comprehensive trading eBook for advanced knowledge, a section for beginners to learn everything about trading, and a set of video tutorials.

Key Facts About Avatrade:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2006 |

| Headquarters | Ireland |

| Trading platforms | MetaTrader 4, MetaTrader 5, AvaOptions, AvatradeGO, WebTrader, AvaTrade App |

| Accounts | Retail, Professional, Islamic |

| Account currency | USD, GBP, CHF, JPY, CAD, AUD, EUR, HKD, ZAR, MXN |

| Transaction Options | Bank cards, Perfect Money, Web Money, Skrill, Neteller, wire transfer, PayPal |

| Minimum deposit | $100 |

| Leverage | 400:1 |

| Min Order | 0.01 lot |

| Spread | From 0.0 pips |

| Instruments | ETFs, individual shares, stock indices, commodities, currency pairs |

| Liquidity provider | Multiple tier 1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection, No swap accounts, One Click Trading |

| Contests and bonuses | Referral bonus, welcome package |

#2 Fusion Markets

Fusion Markets is our 2nd best Forex broker that accepts PayPal deposits and withdrawals. It is known for offering some of the lowest trading costs you can find. The broker is regulated by the Australian Securities and Investments Commission (ASIC), Vanuatu Financial Services Commission (VFSC), and the Financial Services Authority of Seychelles (FSA).

Because it has no minimum deposit, Fusion Markets is accessible to all levels of traders, from beginners to high-volume professionals. The broker offers a wide choice of trading instruments, including forex pairs, commodities, indices, US stocks, and cryptocurrencies.

Fusion Markets does not charge any fees for deposits or withdrawals, including those made through PayPal. While its education materials are basic, the platform does very well with its market analysis tools and 24/7 support.

Key Facts About Fusion Markets:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2017 |

| Headquarters | Australia |

| Trading platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Accounts | Classic, Zero, Islamic (Swap-Free), Demo |

| Account currency | USD, EUR, GBP, AUD, JPY, SGD, THB, NOK, SEK, CZK, HUF, CHF, DKK |

| Transaction Options | Bank transfer, Credit/Debit card, Interac, PayPal, Skrill, Neteller, Fasapay, Jeton bank, MiFinity, Dragon Pay, Cryptos |

| Minimum deposit | $0 |

| Leverage | Up to 500:1 (varies by regulation and asset) |

| Min Order | 0.01 lots for most products |

| Spread | From 0.0 pips (Zero account) |

| Instruments | Forex, Metals, Energy, Commodities, Indices, Cryptos, US Stocks, ETFs |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes (IB, Affiliate, Refer a Friend) |

| Trading features | Negative Balance Protection (for ASIC clients), copy trading, VPS hosting, Market Buzz AI tool |

| Contests and bonuses | Referral bonus, occasional promotions |

#3 FxPro

FxPro is our 3rd best Forex broker at WR Trading that accepts PayPal deposits and withdrawals. It is a well-known Forex and CFD broker with its head office in the UK. The broker offers a flexible trading experience with many account choices, bringing in both new and seasoned traders. FxPro gives traders a choice of top-level platforms, including MT4, MT5, cTrader, and its own FxPro WebTrader and FxPro mobile App.

With a minimum deposit of $100, the broker lets you trade thousands of instruments. This includes forex, commodities, indices, stocks, and cryptocurrencies. FxPro does not charge fees for using PayPal, but this depends on the client’s regulatory jurisdiction. The broker also stands out for offering trading features, like negative balance protection and different ways to fill your trades.

Key Facts About FXPro:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 1999 |

| Headquarters | United Kingdom |

| Trading platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, FxPro Webtrader, FxPro Mobile App |

| Accounts | Standard, Raw+, Elite, cTrader |

| Account currency | USD, EUR, GBP, AUD, JPY, CHF, and more |

| Transaction Options | Bank Transfer, Credit/Debit Card, PayPal, Skrill, Neteller, and more |

| Minimum deposit | $100 |

| Leverage | Up to 1:500, varies by asset and regulation |

| Min Order | 0.01 lot |

| Spread | Variable, from 0.0 pips (RAW+ account with commission) |

| Instruments | Forex, Shares, Spot Indices, Futures, Spot Metals, ETFs, Spot Energy, Cryptos |

| Liquidity provider | Multiple tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes, FxPro Partners and Refer a Friend |

| Trading features | Negative Balance Protection, Multiple Execution Methods |

| Contests and bonuses | Referral bonuses |

#4 IC Markets

IC Markets, our 4th-best Forex broker that accepts PayPal deposits and withdrawals, stands out for its focus on clear pricing and “True ECN” environment. This setup ensures fast execution, tight spreads, and fair trading conditions for both individual traders and institutional clients. IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

The broker lets you trade over 2,250 instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. It is famous for its very low spreads, starting from 0.0 pips on its Raw Spread accounts, making it a top choice for scalpers and other fast-execution traders. IC Markets also provides free PayPal deposits and withdrawals, ensuring a smooth and cost-effective funding experience.

Key Facts About IC Markets:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2007 |

| Headquarters | Australia |

| Trading platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Accounts | Raw Pro+, Raw Pro, Raw Spread, Raw Spread (cTrader), Standard, Starter |

| Account currency | USD, EUR, GBP, AUD, JPY, CHF, NZD, SGD, HKD, CAD |

| Transaction Options | Bank transfer, Credit/Debit card, PayPal, Skrill, Neteller, UnionPay, Fasapay, etc. |

| Minimum deposit | $0 |

| Leverage | Up to 1:1000 (varies by regulation) |

| Min Order | 0.01 lot |

| Spread | From 0.0 pips |

| Instruments | Forex, Commodities, Indices, Cryptocurrencies, Stocks, CFDs, Futures, Bonds |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection (under certain regulations), VPS hosting, and social trading |

| Contests and bonuses | Occasional promotions |

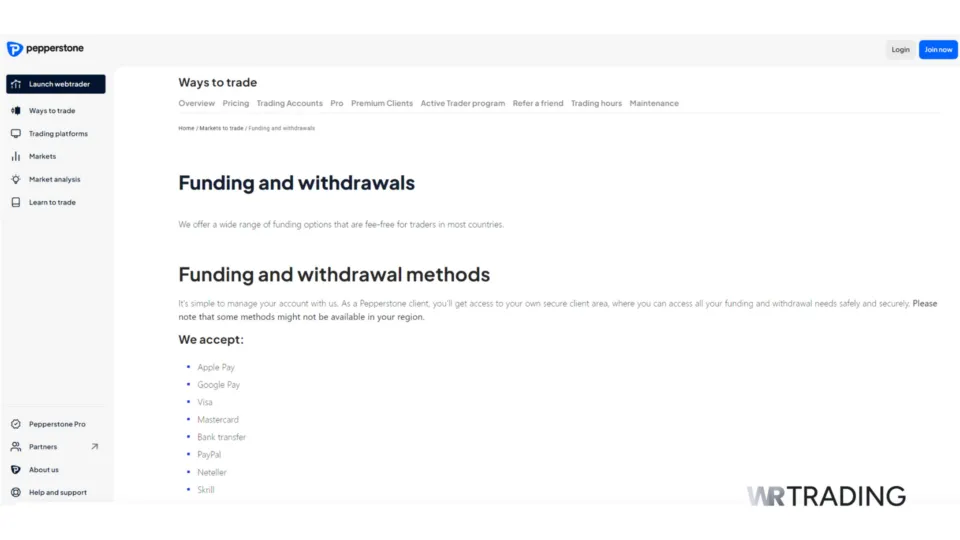

#5 Pepperstone

This broker offers more than 1,200 trading instruments, including commodities and shares. Pepperstone has top-notch trading platforms, including cTrader, TradingView, MetaTrader 4, and MetaTrader 5.

This award-winning PayPal Broker provides traders with new market analysis and educational resources. The broker’s official website offers webinars, training guides, and videos. Pepperstone uses the best liquidity providers, including tier 1 banks.

Key Facts About Pepperstone:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2010 |

| Headquarters | Australia |

| Trading platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Accounts | Standard, Razor, Swap-Free |

| Account currency | USD, EUR |

| Transaction Options | Bank transfer, Credit/Debit card, PayPal, Skrill, Neteller |

| Minimum deposit | $0 |

| Leverage | Up to 500:1 |

| Min Order | 0.01 lots |

| Spread | From 0.0 pips |

| Instruments | Forex, Commodities, Indices, Cryptos |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Negative Balance Protection, No swap accounts, One Click Trading |

| Contests and bonuses | Welcome Bonus, Refer a friend |

#6 IC Trading

IC Trading is our 6th-best PayPal Forex broker, offering convenient PayPal deposits and withdrawals with no fees. The broker provides high leverage up to 1:500 and tight spreads,making it a great choice for day traders and fast execution strategies.

It also gives you access to modern trading platforms, like MetaTrader 4, MetaTrader 5, and cTrader, ensuring flexibility across different trading styles.

Key Facts About IC Trading:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2007 |

| Headquarters | Australia |

| Trading platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Accounts | cTrader Zero, Zero, Standard, swap free |

| Account currency | USD, EUR, AUD, NZD, JPY, CAD, CHF, SGD, HKD, GBP |

| Transaction Options | PayPal, Bank transfer, Credit/Debit card, and more |

| Minimum deposit | $200 |

| Leverage | Up to 1:500 (dependent on jurisdiction and asset) |

| Min Order | 0.01 lot |

| Spread | From 0.0 pips |

| Instruments | Forex, commodities, indices, stocks, futures, bonds, and cryptocurrencies |

| Liquidity provider | Multiple Tier-1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Copy trading, negative balance protection (dependent on jurisdiction) |

| Contests and bonuses | Occasional promotions |

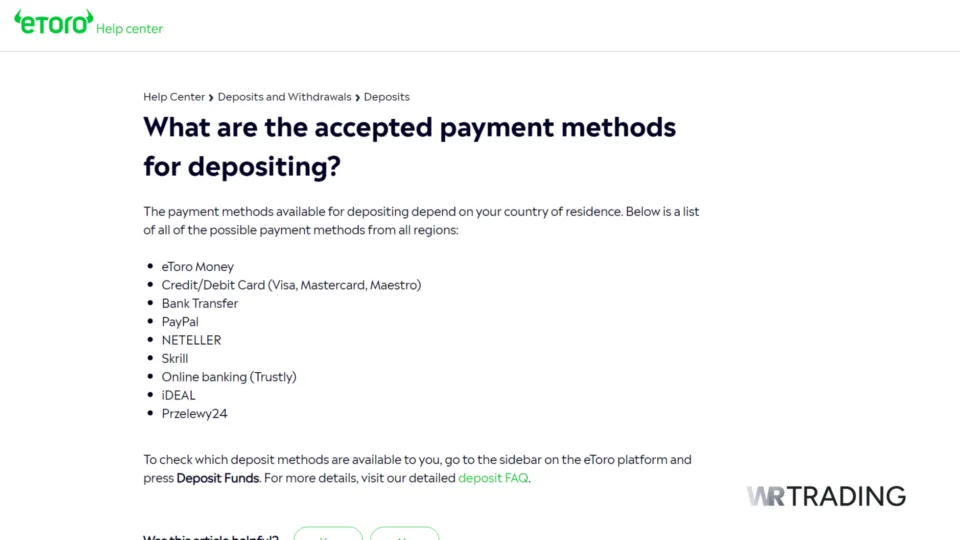

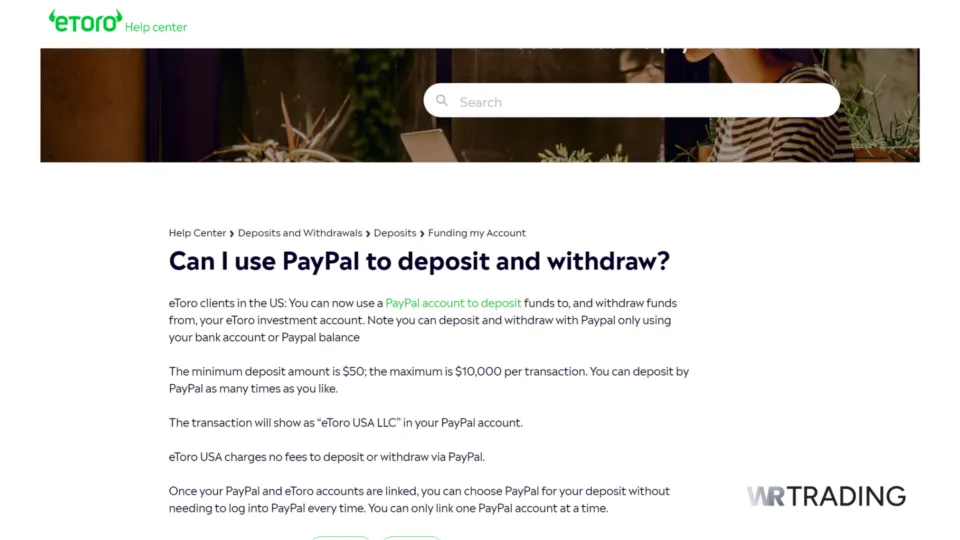

#7 eToro

Based on our analysis at WR Trading, eToro is our second-best option for PayPal brokers. Established in 2007, eToro is a multi-asset investment company that is an excellent choice for traders of all skill levels. This platform has a presence in about 140 countries.

It is primarily known as a Copy Trading platform where people can implement the strategies of successful traders. Traders who allow other people to copy their strategy can join eToro’s Investor Program. Some benefits of the investor program include monthly payments and spread rebates.

eToro offers thousands of tradable assets, including 5,084 stocks, 671 ETFs, 99 cryptocurrencies, 55 currencies, 35 commodities, and 21 indices. The Financial Conduct Authority (FCA) and the Australian Securities & Investment Commission (ASIC) approve the financial company. eToro partners with top financial institutions such as JP Morgan and Deutsche Bank.

The trading platform has a VIP club with five levels ranging from Diamond to Silver. Some club benefits include access to a dedicated account manager, access to Trading Central, and transaction discounts. Deposits are free. However, some charges depend on user activity, withdrawals, and trading spreads. eToro’s website has educational content.

Key Facts About eToro:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2007 |

| Headquarters | Israel |

| Trading platforms | eToro money, eToro app |

| Accounts | Retail client, professional client |

| Account currency | AUD, CAD, CHF, CZK, DKK, GBP, HKD, ILS, MXN, NOK, NZD, PLN, SGD |

| Transaction Options | Etoro money, bank transfer, bank cards, PayPal, Skrill, Neteller, Klarna |

| Minimum deposit | $10 |

| Leverage | 30:1 |

| Min Order | 0.01 lot |

| Spread | from 0.0 pips |

| Instruments | Stocks, Indices, ETFs, commodities, crypto assets, currencies |

| Liquidity provider | Multiple Tier 1 liquidity provides |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Options Trading, Copy Trading, fundamental analysis, technical analysis |

| Contests and bonuses | Welcome bonus, referral bonus |

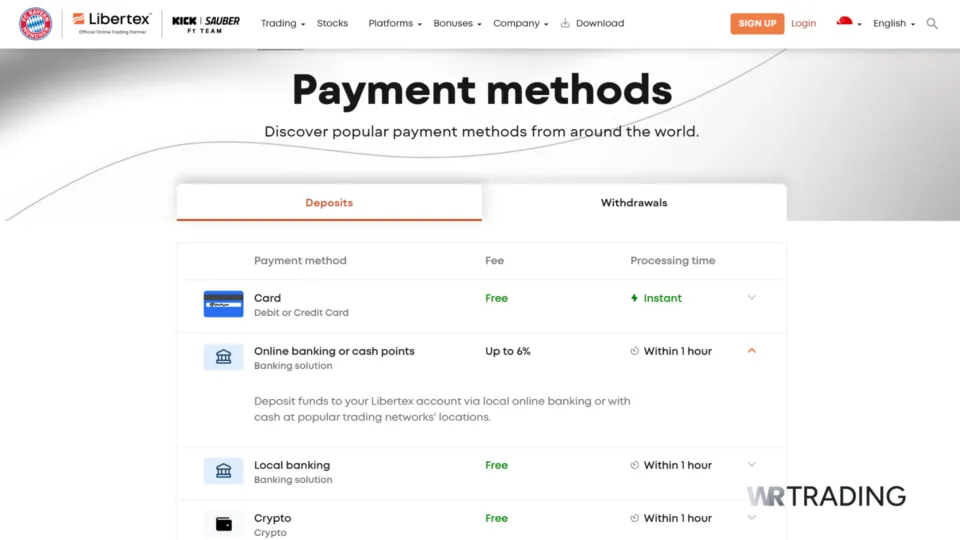

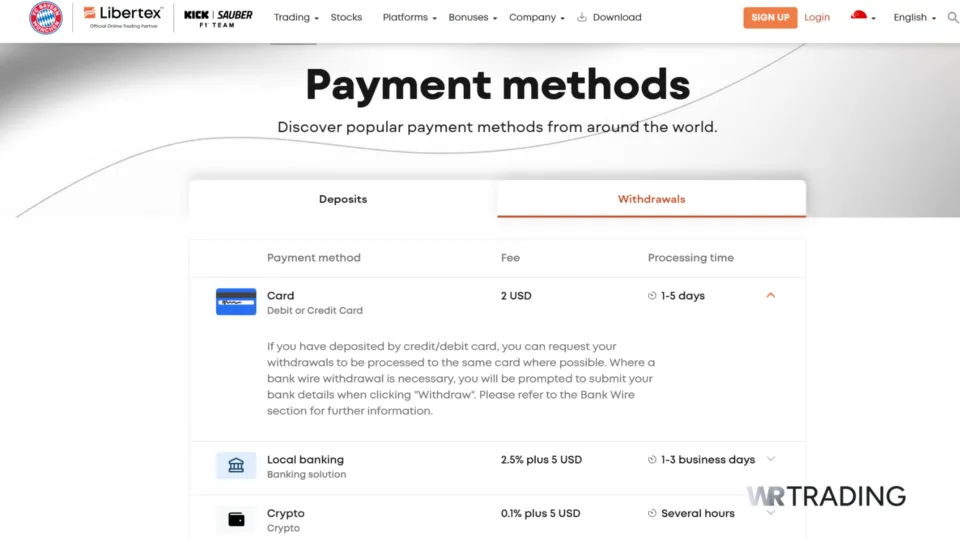

#8 Libertex

Libertex Broker, established in 1997, has over 25 years of experience in the financial market. Serving clients in more than 120 countries, Libertex boasts a customer base of over 3 million. The broker offers access to over 300 tradable assets and has earned 40 international awards for outstanding customer support and innovative tech solutions.

Key Facts About Libertex:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 1997 |

| Headquarters | Cyprus |

| Trading platforms | MetaTrader 4, MetaTrader 5, Libertex |

| Accounts | Libertex portfolio, Libertex CFD |

| Account currency | South African Rand, US dollar |

| Transaction Options | Bank cards, Skrill, Neteller, Rapid transfer, Wire transfer, PayPal, Paysafe, Trustly, Help2Pay |

| Minimum deposit | $10 |

| Leverage | 1:1000 |

| Min Order | 0.01 lot |

| Spread | From 0.0 pips |

| Instruments | Cryptocurrency, Stocks, Indices, commodities, ETFs, bonds |

| Liquidity provider | Multiple Tier 1 liquidity providers |

| Mobile trading | Yes |

| Affiliate Program | Yes |

| Trading features | Fraud warning, economic calendar, daily trading news digest, real-time news from stock markets, ready-made online trading signals |

| Contests and bonuses | Loyalty program, welcome bonus, Bitcoin mining |

#9 XTB

XTB’s tradable assets include 57 Forex pairs, 22 commodities, 36 indices, 171 ETFs, 1848 stocks, and more than 40 crypto assets. XTB offers two types of accounts: standard and professional.

The standard account is excellent for retail trading, while the professional account is for special legacy traders. This broker has a license from the Cyprus Securities & Exchange Commission (CySEC) and the Financial Conduct Authority (FCA).

Its xStation trading platform offers innovative technical trading features and tools. The xStation trading app offers webinars, an economic calendar, client sentiment data, 39 technical indicators, 30 drawing tools, and a new streaming service.

XTB has optimised this app for smartphones, tablets, and smartwatches. We noticed that XTB’s research resources come from the brightest in the finance industry.

Key Facts About XTB:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2002 |

| Headquarters | Poland |

| Trading platforms | xStation 5 |

| Accounts | Standard account, professional account |

| Account currency | 250 EUR |

| Transaction Options | Paysafe, PayPal, Bank cards, bank transfer |

| Minimum deposit | $0 |

| Leverage | 1:500 |

| Min Order | 0.01 lot |

| Spread | from 0.5 pips |

| Instruments | Forex, commodities, shares, real estate investment indices, equity indices, ETF |

| Liquidity provider | Multiple Tier 1 liquidity providers |

| Mobile trading | yes |

| Affiliate Program | yes |

| Trading features | One-click trading and more |

| Contests and bonuses | none |

#10 Plus500

Plus500 is known for offering a simple, easy-to-use platform for trading CFDs. The broker is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Its platform is accessible on both web and mobile, providing a seamless trading experience. With a minimum deposit of $100, traders can access a wide range of instruments, including forex, indices, commodities, shares, and options. Plus500 also accepts PayPal deposits and withdrawals, making funding and accessing your account fast, secure, and convenient.

Key Facts About Plus500:

| Feature | Information |

|---|---|

| PayPal Available | Yes |

| Founded | 2008 |

| Headquarters | Israel |

| Trading platforms | Proprietary WebTrader, Plus500 App |

| Accounts | Retail, Professional, Demo |

| Account currency | EUR, GBP, USD |

| Transaction Options | Bank transfer, Credit/Debit card, PayPal, Skrill |

| Minimum deposit | $100 |

| Leverage | Up to 1:30 |

| Min Order | Varies by instrument |

| Spread | Varies |

| Instruments | CFDs on Crypto, Forex, Equity Index, Commodities, Agriculture, Interest rates, Metals, Energy |

| Liquidity provider | Not specified, internal market-making model |

| Mobile trading | Yes, proprietary app |

| Affiliate Program | Yes |

| Trading features | Guaranteed Stop Order (fee applies), Negative Balance Protection (regulated regions), Demo Account |

| Contests and bonuses | Referral bonuses |

How We Tested Forex Brokers That Accept Paypal Deposits and Withdrawals

At WR Trading, we tested PayPal’s usability on these brokers’ platforms to see if it works without any problems. Here is our analysis:

- PayPal Availability and Fees: First, we verified that each broker accepts PayPal by reviewing their official websites and checking user feedback. We also examined whether any additional fees apply to PayPal transactions. In the end, the brokers we chose demonstrated seamless PayPal usability and performed reliably in our testing.

- Broker Safety and Regulation: We only selected brokers regulated by reputable financial authorities, like ASIC, FCA, and CySec, ensuring transparent operations and the safety of traders’ funds.

- Trading Costs: We evaluated the cost of trading. We looked at the spreads, minimum deposits, and fees for each broker, focusing on brokers that offer transparent pricing and fair trading conditions.

- Platforms and Tools: We tested each broker’s website and mobile app to ensure they are easy to use. We also checked for tools that will be helpful to traders, like charts, news updates, and educational guides.

- Customer Support: We assessed each broker’s customer support, checking response times and ease of contact. Reliable support is crucial for getting help when you need it.

Pros and Cons of Using PayPal on a Forex Broker for Deposits/Withdrawals

Paypal is a great payment system with significant advantages and features that still need improvement. Let’s see the pros and cons of PayPal in full detail.

Pros:

- High Accessibility and Brand Trust

- Ease of Use

- Top Notch Security

Cons:

- Transaction Fees are Significant

- Account Limitations

Pros

Using PayPal for deposits and withdrawals with a Forex broker offers several advantages that can enhance your trading experience. They include:

PayPal offers user-friendly customisation and a global presence, with hundreds of millions of clients from more than 200 countries. Many Forex brokers use PayPal to expand their customer base, so PayPal is likely available in your country.

Moreover, this payment method has proven itself, creating a credible record for potential users. Thanks to its worldwide outreach, the payment platform supports various currencies, helping traders manage their funds in multiple denominations.

Furthermore, setting up an account on PayPal is relatively easy. You only need an email address, a Local bank account, ID verification, and personal details. PayPal processes deposits and withdrawals very fast.

PayPal uses state-of-the-art algorithms and fraud detection schemes to protect every user’s information. Traders do not need to share their credit card or bank details with the broker. PayPal provides a seller protection program to shield businesses and individuals from unverified transactions.

Cons

While PayPal is a popular and convenient payment method, using it for deposits and withdrawals with a Forex broker has drawbacks. Here are some potential cons:

Traders using PayPal will incur charges for deposits, withdrawals, currency conversion, and other financial services. The broker itself might add extra fees for PayPal transactions.

PayPal usually places certain limits on the amount of funds that users can transfer. This barrier can be restrictive for high-volume traders. PayPal can freeze your account without warning if it suspects any nefarious activity on your account. This freezing can last for days before resolution. Most people will find this experience frustrating.

Security of PayPal Transactions

PayPal has put several security measures in place to shield traders from nefarious actors. These measures include:

- Software Integrity checks: PayPal performs periodic server inspections to verify the integrity of your browser if you decide not to use the official app. You can’t sign in to your account if it does not meet the required safety standards.

- Fraud monitoring System: PayPal has IT specialists and Artificial Intelligence systems to protect against fraudulent elements, email phishing, and identity theft. Once suspicious activity occurs on your account, PayPal’s security specialists will investigate.

- Two-Factor Authentication: PayPal uses two-factor authentication (2FA) to provide an extra layer of security. This security mechanism generates a unique one-time code that will be sent to your phone number or email anytime you want to log in to your account. This measure will shield a user if their username and password are compromised.

- Data Encryption: All PayPal transactions are secured using Secure Sockets Layer (SSL) protocol technology with 128-bit encryption. The financial company ensures that industry regulations and standards protect users’ personal and financial information.

How to Deposit Money on a Broker Via PayPal

It is easy to deposit money with a broker using PayPal. Here are the steps to follow

Select a Broker With The Payment Method PayPal

The first obvious step is to have a broker in mind. Choose a reliable, highly regarded, regulated forex broker with competitive spreads and a user-friendly trading platform. Ensure the company has a mobile app and accepts PayPal as a deposit method. Please create an account with the broker and navigate to their web app via your smartphone or computer.

Download the PayPal App

Get the PayPal app from your device’s mobile store. This step is essential because some brokers might require you to validate your transactions via the PayPal app.

Deposit the Funds and Download the Necessary Trading App

Open your broker’s website or Mobile app. Choose PayPal as your payment method and fix the amount that you want to deposit. Navigate to your mobile phone’s store and get the trading app that your broker uses. Install it and start trading.

How to Withdraw Money via PayPal

The steps to withdraw money from a Forex broker via PayPal are equally easy as making a deposit. They include:

Step 1: Navigate to the Withdrawal Section of your Broker’s Website

Log in to your broker’s website using your username and password. Click on the “Funds” or “Withdrawal “ section. Depending on the broker’s website layout, you will find that tab on your dashboard or account settings.

Step 2: Choose PayPal and Put in your Desired Withdrawal Amount

Check through the list of payment options. Click on “PayPal”. Specify the amount of funds you want to withdraw. Put in a value within the broker’s maximum limit. Also, ensure that your account balance is sufficient.

Step 3: Provide your PayPal Account Details

Input the email address associated with your PayPal account. Double-check and ensure the address is correct to avoid any problems with the transfer. Your broker will send a message that your request is being processed. Others might require two-factor authentication, such as sending a verification code to your phone number or email address.

Step 4: Receiving the PayPal Funds

After the processing, PayPal should notify you that the funds are in your account. This process will take a few business days.

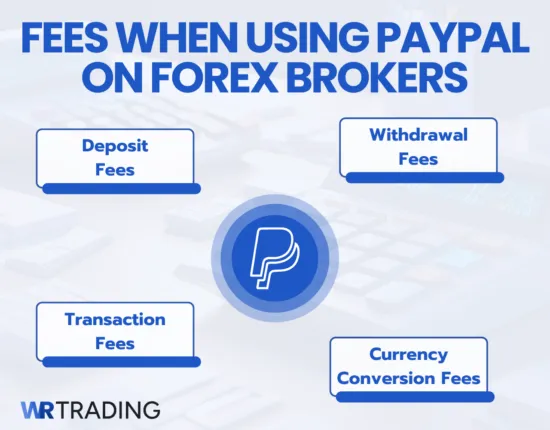

Fees: When using PayPal on Forex Brokers

When using PayPal on Forex brokers, you might incur specific fees, which include:

- Deposit/withdrawal fees: Some brokers charge deposit, withdrawal, or both fees. This fee can be a fixed amount or a small fraction of the funds you want to deposit or withdraw.

- Currency Conversion fee: PayPal charges a conversion fee of 2.5% to 3.5% if you transact in a currency other than your PayPal account currency.

- Transaction fees: PayPal charges the broker a fee for receiving payments. The broker might decide to deduct this charge from a trader’s balance.

Other fees might be associated with PayPal transactions, depending on the broker. Some brokers don’t directly collect these fees, but sometimes require users to pay them manually. It is best to check the brokers’ terms and conditions for any extra levy associated with using PayPal as a payment method.

Alternatives to PayPal:

There are many alternatives to PayPal, each with advantages and drawbacks. Let’s examine some of them.

Wire Transfer

Wire transfer is an electronic transaction method for moving funds between bank accounts. It is a popular deposit method for deposits and withdrawals on Forex brokers. The only thing that a trader needs to do is access the broker’s account details and make the transfer.

Wire transfer is an excellent option for high-volume trading and is a highly secure payment method. However, the charges associated with wire transfers are high.

Bank Cards

There are two types of bank cards – debit cards and credit cards. Debit and credit cards come with several advantages and disadvantages. Some of the benefits are:

- Credit cards can help traders develop a reliable history, which they can use to obtain funds for future transactions.

- Both debit and credit cards have a high level of security.

- Transactions with bank cards are fast. This payment method is widely accepted.

Bank cards are not perfect. Traders who use them will incur significant transaction charges. There is a security risk if the broker of choice is not reputable.

Cryptocurrency

Cryptocurrencies are digital payment methods built on the structure of a Blockchain. They are relatively new to the financial ecosystem. Many lay people who don’t understand how cryptocurrencies work tend to avoid them on brokerage platforms.

See here our comparison for Brokers who accept Crypto Deposits.

However, that should not be the case. Cryptocurrencies don’t rely on a centralised financial authority like a major bank. The pros of cryptocurrency are as follows:

- Instant deposits and withdrawals on some broker platforms

- Cryptocurrency gives you a high level of anonymity while making transactions.

- There are little to no transaction fees for using digital coins on a Forex broker.

- Since there is no intermediary, Crypto deposits and withdrawals are speedy.

One downside of cryptocurrency is its high volatility. The values of these digital assets fluctuate significantly. Also, some Forex brokers don’t offer Cryptocurrency as a payment option.

Wire Transfer vs. PayPal

A wire transfer (or bank transfer) is an alternative to PayPal, sending money directly from one bank account to another. Although it is very secure, it can be slow, especially for international transfers, which can take several business days. Compared to PayPal, which is fast and offers user protection, wire transfers are less convenient for small, frequent online transactions.

However, for larger sums of money, many professionals prefer wire transfers, as they cost less in fees than PayPal’s percentage-based charges.

One major drawback of wire transfers is the lack of buyer or seller protection. Once you send money, it is difficult to recover if any issue arises. PayPal, however, provides a dispute resolution service to help solve such problems.

Bank Cards vs. PayPal

Bank cards (both credit and debit cards) are another common alternative to PayPal for funding a trading account or making online payments.

Credit cards allow instant deposits and offer strong fraud protection and the ability to dispute charges, often matching or exceeding PayPal’s security. Debit cards, on the other hand, are convenient for quick payments but generally provide less protection than credit cards.

Many traders prefer PayPal for its convenience. You don’t need to keep typing in your card information on different sites, because PayPal securely stores it. However, the fees for using PayPal can sometimes be higher than using a bank card directly, depending on the broker or vendor you are paying.

Cryptocurrency vs. PayPal

Cryptocurrency is a modern, decentralized alternative instead of PayPal, operating on independent blockchains rather than the traditional banking system.

A major advantage of cryptocurrency is that transfers can often work at any time, day or night. This means you can fund your account anytime, with the added benefit of greater privacy since transactions aren’t directly tied to your bank details.

However, using cryptocurrency can be very risky because of its volatility. It is also too complex for some users. Unlike PayPal, crypto payments are usually final and come with no fraud or dispute protection, making them a less secure option if issues arise.

Conclusion

PayPal has proven to be an efficient payment method worldwide since its inception. For this reason, many people love to use it while trading. Thankfully, we have educated you about the best forex trading brokers to choose from if you prefer PayPal. Our analysis team at WR Trading has explored every feature among hundreds of brokers and picked the top five. With these five financial organisations, you will have a smooth trading experience.

List of the Best 10 Forex Brokers that Accept PayPal Deposits & Withdrawals:

- AvaTrade – Best PayPal Forex broker

- Fusion Markets – No minimum deposit and tight spreads

- FxPro – Broker with flexible trading platforms and a wide range of instruments

- IC Markets – Offers a “True ECN” environment with low spreads

- Pepperstone – Broker with excellent trading conditions

- IC Trading– Offers tight spreads and institutional-grade trading tools

- eToro – Best cryptocurrency-based broker

- Libertex – Low-cost Forex broker

- XTB – Great customer service

- Plus500 – Broker with with Simple, Easy-to-Use Platform

Frequently Asked Questions on PayPal Forex Brokers

Why Should I Choose a PayPal Forex Broker?

You should choose one because PayPal is a reliable and secure payment method. It offers easy and quick deposits and withdrawals.

PayPal is available in many countries worldwide, has a presence in every region, and supports multiple currencies. Therefore, you will likely be able to use it. PayPal does not charge a fee to open a new account.

What Are The Pros and Cons of Using PayPal?

One great thing about PayPal is its international presence. Traders can use it from almost any location on the globe. PayPal transactions are faster than conventional banking options. PayPal’s interface is user-friendly and easy to navigate. The platform uses the latest encryption techniques to shield users’ financial information. Furthermore, creating and funding an account takes a few clicks.

However, PayPal might freeze a customer’s account if it suspects nefarious actions. This phenomenon can happen at a critical period when you need access to your funds. Another downside is the charges for withdrawals and currency conversion.

Is It Safe to Use PayPal For Forex Trading?

Yes, it is safe to use PayPal for Forex trading. PayPal uses state-of-the-art encryption algorithms, two-factor authentication, and other fraud detection measures. Nevertheless, being responsible for your safety while on the internet is essential.

What are Common Alternatives to PayPal?

Some common alternatives to PayPal include cryptocurrency, wire transfers, e-wallets, and bank cards. Examples of cryptocurrencies are Bitcoin, Litecoin, DASH, and Ethereum.

Cryptocurrencies have faster transaction speeds than PayPal because there are no central authorities to delay payments. However, not every broker accepts cryptocurrency. Two examples of e-wallets are Neteller and Skrill. Note that no transaction method is perfect. The optimal decision is to choose the option that suits you.

How Do I Create a PayPal Account?

You can create an account by downloading the PayPal app or visiting the official website. Click on “Sign Up.” Select the type of account that you want.

Follow further instructions and input your personal identity, email address, payment details, and other necessary information. Remember that you can’t create an account if you are in a country where PayPal doesn’t operate.

Do All Forex Brokers Accept PayPal?

No, not every Forex broker accepts PayPal. While PayPal may be popular, some brokers may choose not to. Before opening an account with a broker, check their payment methods to see if they accept PayPal. If you are confused about which broker to pick, this guide recommends five options.