Trading XAG/USD using forex brokers requires a sound strategy, as factors such as industrial demand and interest rate decisions can significantly impact prices. The pair has high liquidity, particularly during overlapping trading sessions. Due to the potential complexities of trading XAG/USD with forex brokers, we decided to review the pair across various forex brokers to determine which one works best.

Hence, we’ve compiled a list to help you identify the top 10 silver trading brokers in 2026 for:

Broker:

XAG/USD Spreads:

Features:

Account:

XAG/USD spreads from 0.0 to 1,7 Pips

- High Leverage up to 1:1000

- RAW ECN Spreads from 0.0 pips

- Fastest execution

- Attractive Bonus Programs

- Copy Trading

- MT4 / MT5

- Personal support 24/7

XAG/USD spreads are currently at 1.79 pips

- ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:500

- Low Commission from 1.5$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Pro Trader

XAG/USD spreads are currently at 1.79 pips

- Multiple regulations

- Leverage up to 1:50

- Demo account available

- More than 100 FX pairs

- No Commission

- Plus500 WebTrader, Plus500 App

XAG/USD spreads are currently on 0.17 Pips

- Different ECN Accounts

- Spreads from 0.0 Pips

- Copy Trading available

- Leverage up to 1:2000

- Low Commission from 6$/1 Lot

- High liquidity and fast execution

- MT4/MT5/RTrader/CopyFX

XAG/USD spreads from 0.894 – 1.894

- Raw Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- cTrader, MT4 ,MT5

XAG/USD spreads from 0.016 to 0.02 pips

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

XAG/USD spreads from 0.0 – 0,7

- Mauritius-regulated broker

- High Leverage up to 1:1000

- Multiple account types

- More than 850 trading instruments

- MT4, MT5, PU Prime App

XAG/USD spreads from 0.0 – 1.7

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commission from 4$/1 Lot

- 26,000+ Markets

- TradingView, MT4/5, cTrader

XAG/USD spreads from 0.0 – 1.2

- ECN/STP Accounts

- Spreads from 0.0 Pips

- Leverage up to 1:1000

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- MT4/5 and Pro Trader

XAG/USD spreads are currently on 1.2 pips

- No Minimum Deposit

- Spreads from 0.0 Pips

- 26,000+ Markets

- Leverage up to 1:500

- Low Commission from 2$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader, Invest Account

- New Zealand regulated

List of the 10 Best Silver Trading Brokers to Trade XAG/USD

Once again, here is our list of the 10 best Silver Trading Brokers in 2026:

- StarTrader: Competitive spreads with deep liquidity for XAG/USD trading. Regulated and beginner-friendly

- Vantage Markets: High trust score due to its strong reputation

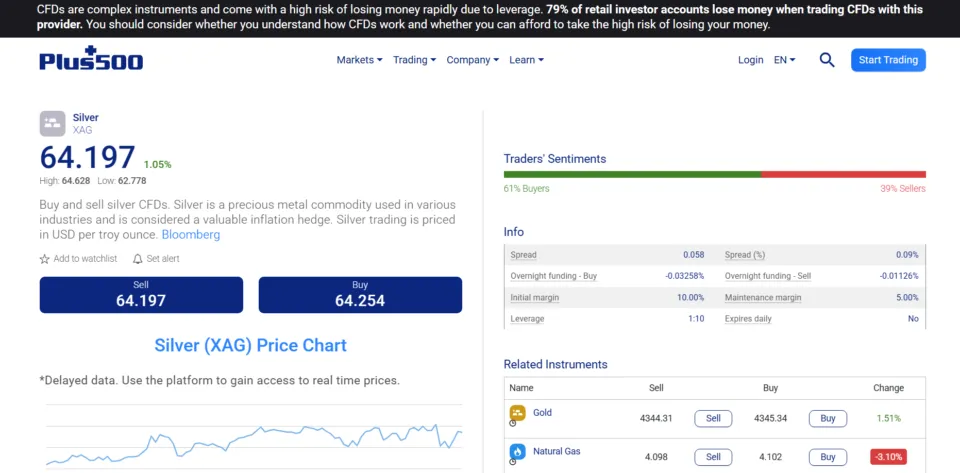

- Plus500 (US): Regulated platform for US traders offering Silver Futures (SI) with competitive pricing and intuitive trading tools

- RoboForex: Tight Silver spreads

- IC Trading: Provides VPS hosting while trading XAG/USD

- Pepperstone: Beginner-friendly broker with ultra-fast execution and tight pricing backed by multiple top-tier licenses.

- PU Prime: Flexible leverage and diverse silver trading instruments with a strong global presence

- VT Markets: Low-cost XAG/USD trading with robust platforms and 24/7 customer support

- Moneta Markets: Best silver trading broker for professionals

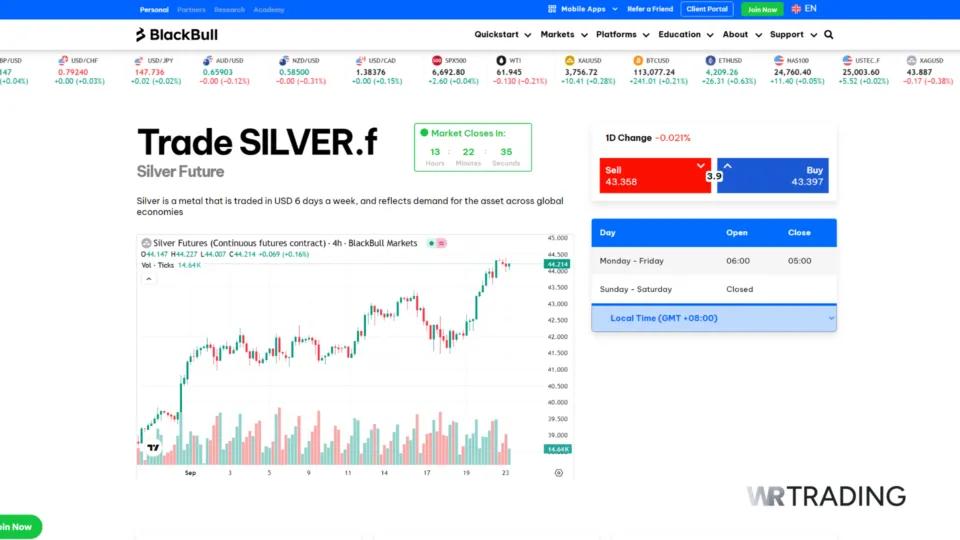

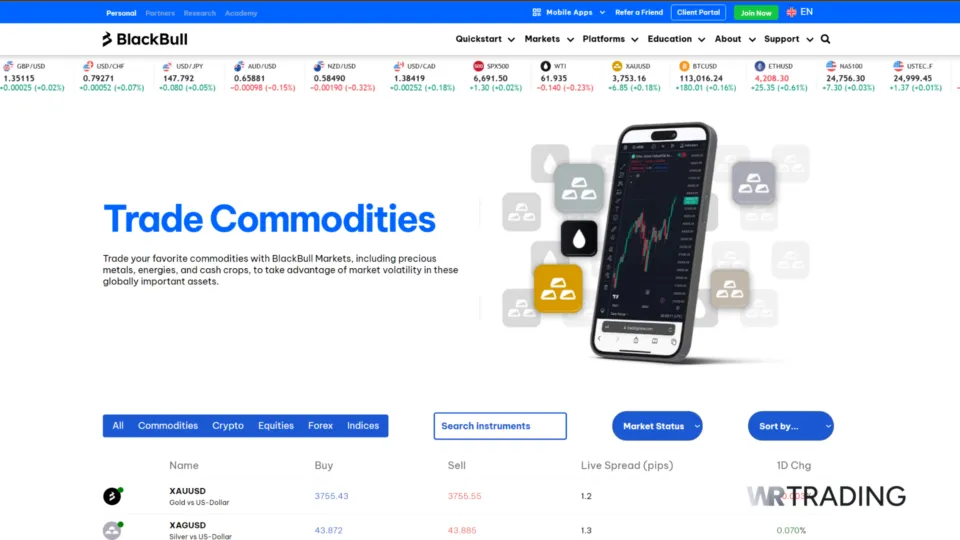

- BlackBull Markets: Tight spreads and commissions for XAG/USD trading. Offers silver CFDs, Futures, and ETFs with competitive spreads and swap rates

1. StarTrader

StarTrader offers competitive conditions for silver traders with spreads of 1.3 pips on Standard accounts and raw 0 pips spreads on ECN accounts, on which a commission of $6 per round-turn is applied. This transparent model makes it appealing to both price-sensitive traders and professionals needing raw pricing.

The broker is regulated by ASIC (Australia), FSC (Mauritius), and FSA (Seychelles). This regulation, implemented across various jurisdictions, ensures greater client fund protection and regulatory adherence.

Accounts can be opened with a deposit of just $50, and leverage is up to 1:500, which allows traders to size positions flexibly. StarTrader also offers negative balance protection, segregated accounts, and multiple funding options, making it a convenient choice to trade XAG/USD.

Key Facts About StarTrader

| Feature | StarTrader |

|---|---|

| XAG/USD Available | Yes, can trade silver via CFDs on precious metals |

| Account Types | Standard, ECN, Islamic/Swap-Free, Demo |

| Tradable Instruments | Forex, CFDs on commodities (including metals), indices, shares, ETFs, cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, StarTrader App, Copy Trading |

| Regulation | ASIC (Australia), FCA (UK), SCA, FSCA, FSC, FSA |

| Minimum Deposit | $50 |

| Minimum Order | From 0.01 lots |

| Leverage on XAG/USD | Up to 1:500 (varies by entity) |

| Spreads on XAG/USD | Standard: from 1.3 pips; ECN: from 0 pips |

| Commissions on XAG/USD | Variable Margin Calculated by: Contract size x Open Price x Lot x (the exchange rate of quote currency, exchange to account currency) x Margin Percentage |

| Margin on XAG/USD | Variable Margin Calculated by:Contract size x Open Price x Lot x (the exchange rate of quote currency, exchange to account currency) x Margin Percentage |

| Accepted Currency | USD, EUR, GBP, AUD, NZD, CAD (varies by account/entity) |

| Transactions Options | Visa/Mastercard, bank transfers, e-wallets (Skrill, Neteller, PerfectMoney), crypto, others |

2. Vantage Markets

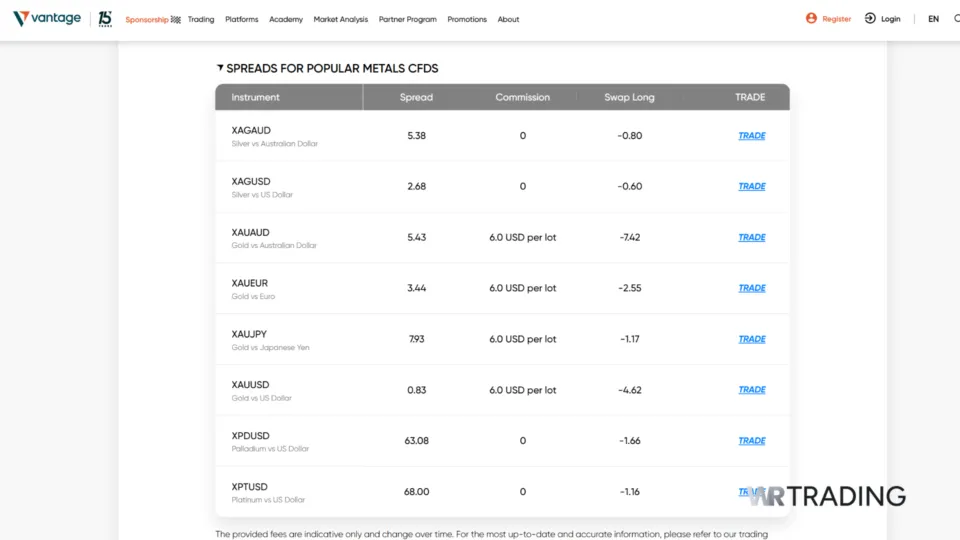

The third broker on our list is Vantage Markets, and the reason is not far-fetched. This broker has excelled in implementing highly functional trading platforms, offering relatively low prices, and providing excellent customer care services. This reputable international broker offers its customers exceptional support.

Although their spreads are not the tightest, Vantage Markets has a massive trust score because it complies with numerous regulations. It compensates with various trading suites and swift execution spreads, enabling you to personalize and customize your trading experience. The platform is available to both professional and amateur silver traders.

Key Facts About Vantage Markets

| Feature | Vantage Markets |

|---|---|

| XAG/USD Available | Yes |

| Account Types | Raw ECN, Standard STP, Pro ECN, Islamic, Cent, Premium |

| Tradable Instruments | Forex, Indices, Energy, Gold/Silver, Commodities, Shares, ETFs, Stocks, Oil, Bonds, Energies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Vantage FX App, Tradingview, ProTrader |

| Regulation | ASIC, CIMA, VFSC, SIBL |

| Minimum Deposit | $50 (Standard and RAW), $10,000 (Pro ECN) |

| Minimum Order | 0.01 lot |

| Leverage on XAG/USD | For XAG/USD: 100:1, For others: up to 1:500 (varies by account type and instrument) |

| Spreads on XAG/USD | For XAG/USD: 1.79, For others: from 0.0 pips (Raw ECN and Pro ECN accounts), From 1.0 pips (Standard STP and CENT accounts) |

| Commissions on XAG/USD | $3 (Raw), $0 (Standard), $1.50 (Pro ECN) per round lot |

| Margin on XAG/USD | 50% to 80% to be stopped out |

| Accepted Currency | AUD, USD, EUR, GBP, NZD, CAD, SGD, JPY, CHF, ZAR |

| Transactions Options | Bank wire transfer, credit/debit cards, e-wallets (Skrill, Neteller, PayPal), UnionPay, Boleto, BPAY, Astropay, Fasapay, Domestic Fast Transfer, International EFT, China Union Pay, JCB, Broker-to-Broker Transfer, Pagsmile, Perfect Money. |

3. Plus500 (US)

Plus500 (US) is the best for US traders in our comparison at WR Trading. It provides a safe and regulated entry point for U.S. investors to trade silver in futures contracts instead of CFDs. The company is regulated by the U.S. Commodity Futures Trading Commission (CFTC) and is a registered member of the National Futures Association (NFA), providing strong regulatory security and complete separation of funds.

Trading commissions are flat: $0.89 per regular-sized silver futures (SI) contract and $0.49 per micro, with no extra charge for account maintenance, market data, or platform use. While there is a $10 per-contract automated liquidation fee when margin levels are low, overall costs are competitive with other U.S. futures brokers.

The broker’s proprietary WebTrader platform is designed with ease, featuring adjustable charts, live price alerts, and watch lists. Silver traders can also get access to detailed contract specifications and live market depth, supported by 24/7 customer service.

Key Facts About Plus500 (US)

| Feature | Plus500 |

|---|---|

| XAG/USD Available | Yes, through Silver Futures (SI) contracts |

| Account Types | Standard Futures Account |

| Tradable Instruments | Futures: Metals (Silver, Gold, Platinum), Crypto, Forex, Indices, Energy, Agriculture, Interest Rates |

| Trading Platforms | Proprietary WebTrader platform (desktop & mobile) |

| Regulation | CFTC, NFA (member) |

| Minimum Deposit | $100 (debit/Apple Pay); $200 (wire transfer) |

| Minimum Order | micro futures contracts |

| Leverage on XAG/USD | 1:20 as per US regulations |

| Spreads on XAG/USD | Variable |

| Commissions on XAG/USD | $0.89 per regular-sized silver futures (SI) contract and $0.49 per micro |

| Margin on XAG/USD | Day Margin: $1,000 (Silver), $200 (Micro Silver) |

| Accepted Currency | USD |

| Transactions Options | Bank wire transfer, credit/debit cards, PayPal |

4. RoboForex

Ranking fourth on our list at WR Trading is RoboForex. It is worth noting that RoboForex is a multifaceted broker. This broker welcomes traders from around the world and allows them to trade various instruments, including Forex, Cryptocurrencies, Stocks, Indices, and even Silver.

Established in 2009 and licensed by FSC Belize, RoboForex’s standout platform is its copy trading platform, RStocksTrader, which can be particularly beneficial for newbie silver traders. Professional silver traders can utilise the platform, as it offers a wide range of accounts to suit various trading needs and purposes.

Key Facts About RoboForex

| Feature | RoboForex |

|---|---|

| XAG/USD Available | Yes |

| Account Types | Pro, ECN, Prime, R Stocks Trader, ProCent |

| Tradable Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies, ETFs, Metals, Futures, Energies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, R StocksTrader, R Mobile Trader, R WebTrader, MT 4 MultiTerminal |

| Regulation | FSC Belize |

| Minimum Deposit | $10 (Prime, ECN, Pro, ProCent), $100 (RStocksTrader) |

| Minimum Order | 0.01 lot |

| Leverage on XAG/USD | 1:300 (Prime), 1:500 (ECN and R StocksTrader), 1:2000 (ProCent and Pro) |

| Spreads on XAG/USD | For XAG/USD: Currently at 0.17 pips. For General Account Types: 0.0 pips (Prime, ECN), 0.01 pips (R Stocks Trader), 1.3 pips (Pro, ProCent) |

| Commissions on XAG/USD | $0 (Pro and ProCent) Available (Prime, ECN, and R StocksTrader) |

| Margin on XAG/USD | 200% |

| Accepted Currency | USD, EUR, GOLD |

| Transactions Options | Bank wire transfer, credit/debit cards, electronic payment systems (Skrill, Neteller, etc.), Q, R and Vouchers |

5. IC Trading

IC Trading ranks as our fifth-best XAG/USD broker. The review conducted by WR Trading revealed that by engaging in IC trading, traders have access to more than 2,000,000 tradable products, including Silver, Bonds, Stocks, Cryptocurrencies, and Indian stocks, with a commission rate of around 3.5%.

IC Trading’s highly competitive spread of 0.0 pips is a service provision that places it among some of the best brokers in the silver trading market. They are based in Mauritius and are overseen by the Financial Services Commission FSC). Finally, they offer flexible leverage options offering up to 1:1000.

Key Facts About IC Trading

| Feature | IC Trading |

|---|---|

| XAG/USD Available | Yes |

| Account Types | Standard, Raw accounts, Islamic |

| Tradable Instruments | MetaTrader 4, MetaTrader 5, WebTrader, and cTrader |

| Trading Platforms | Skrill, PayPal, Mastercard, UnionPay, Visa, Neteller, wire transfer, and broker-to-broker |

| Regulation | Financial Services Commission of Mauritius (FSC) |

| Minimum Deposit | $200 |

| Minimum Order | 0.01 lot |

| Leverage on XAG/USD | 1:500 |

| Spreads on XAG/USD | For XAG/USD: Average of 0.894 – 1.894. For General Account Types: From 0.0 pips (Raw Account) and 0.8 pips (Standard Account) |

| Commissions on XAG/USD | $3.5 (Raw MetaTrader), $3 (Raw cTrader), and $0 (Standard) per lot side |

| Accepted Currency | AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, CHF |

| Transactions Options | Skrill, PayPal, Mastercard, UnionPay, Visa, Neteller, wire transfer and broker-to-broker |

6. Pepperstone

Pepperstone is a beginner-friendly Melbourne-based broker regulated by ASIC, FCA (UK), CySEC, BaFin (Germany), DFSA (Dubai), CMA (Kenya), and SCB (Bahamas), providing traders with confidence because of best-in-class regulation.

For silver, Pepperstone offers 0.016 pips spreads on Standard accounts and 0.02 pips spreads on Razor accounts with a $7 flat round-turn commission per lot. Such a pricing model, combined with good liquidity and quick execution times, makes Pepperstone especially attractive to professional metal traders.

The broker also provides clients with access to MT4, MT5, and cTrader so that traders can select the platform best suited to their strategy. With no minimum deposit, low-latency leverage, and always low trading commissions, Pepperstone is also a top choice for beginners who want to trade XAG/USD.

Key Facts About Pepperstone

| Feature | Pepperstone |

|---|---|

| XAG/USD Available | Yes, via silver CFDs on major platforms |

| Account Types | Standard, Razor, Islamic (region-dependent), Demo |

| Tradable Instruments | Forex, Commodities (inc. silver), Indices, Shares, Crypto CFDs |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Regulation | ASIC, FCA, CySEC, BaFin, DFSA, CMA, SCB |

| Minimum Deposit | None required for Standard accounts |

| Minimum Order | From 0.01 lots (CFD standard) |

| Leverage on XAG/USD | Varies by jurisdiction and regulation |

| Spreads on XAG/USD | From 0.02 pips (Razor ECN), 0.016 pips (Standard) |

| Commissions on XAG/USD | $7 Included in Razor pricing, Standard (spread-only) |

| Margin on XAG/USD | Variable margin Depends on account leverage, trade size, the instrument and account currency. |

| Accepted Currency | Multiple base currencies supported |

| Transactions Options | Bank transfer, credit/debit card, e-wallets (e.g., Skrill, Neteller), depending on region |

7. PU Prime

PU Prime offers a well-rounded silver trading experience with flexible accounts, moderate costs, and strong regulatory oversight. The broker is overseen by ASIC (Australia), FSCA (South Africa), FSC (Mauritius), and FSA (Seychelles), which guarantees traders of its compliance and business standards.

Silver (XAG/USD) spreads are as low as 0.7 pips on the Standard account and as low as 0.0 pips on ECN accounts, with a $7 round-turn commission. Traders can begin with a minimum of $50 for the Standard account, and the Prime ($1,000) and ECN ($10,000) accounts offer tighter spreads and less expensive trading.

Leverage is flexible up to 1:1,000, with leverage automatically adjusted to 1:500 when account equity increases above $20,000. The tiered structure renders PU Prime suitable for both emergent traders and professionals with larger portfolios.

Key Facts About PU Prime

| Feature | PU Prime |

|---|---|

| XAG/USD Available | Yes, via silver CFDs on major platforms |

| Account Types | Cent, Standard, Prime, ECN, Islamic (varies by region) |

| Tradable Instruments | Forex, Indices, Spot Metals (incl. Silver), Commodities, Shares, ETFs, Bonds, Crypto |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, PU Prime App, PU Social (copy trading) |

| Regulation | ASIC (Australia), FSCA (South Africa), FSC (Mauritius), FSA (Seychelles) |

| Minimum Deposit | $50 (Standard), $1,000 (Prime), $10,000 (ECN) |

| Minimum Order | From 0.01 lot |

| Leverage on XAG/USD | Up to 1:1000 (reverts to 1:500 over $20K equity) |

| Spreads on XAG/USD | 0.7 pips (Standard account), 0.0 pips (ECN accounts) |

| Commissions on XAG/USD | $7 per round-turn |

| Margin on XAG/USD | Variable Margin Contract size x Lot x Open Price x (the exchange rate of quote currency, exchange to account currency) x Margin Percentage / (Account Leverage) |

| Accepted Currency | Multiple (USD, EUR, GBP, AUD, SGD, etc.) |

| Transactions Options | Bank transfers, credit/debit cards, e-wallets (Skrill, Neteller), and crypto in some regions |

8. VT Markets

VT Markets has a secure and flexible trading platform with a special focus on commodities such as silver (XAG/USD). The broker is FSCA (South Africa) and FSC (Mauritius)-licensed and has additional international authorisations, ensuring compliance and investor protection. Clients are also protected by insurance up to $1,000,000 for added security.

Dealing commissions on silver are minimal, with a minimum spread of 1.2 pips on the commission-free Standard STP account. The Raw ECN account offers a 0.0 pip spread for an additional $6 round-turn commission per lot, ideal for traders using high volumes who need a tighter execution.

Both accounts have a minimum deposit of only $50–$100, with leverage up to 1:500. Negative balance protection and segregated funds also enhance security, and the versatility of account options makes VT Markets a good choice for beginners and seasoned silver traders alike.

Key Facts About VT Markets

| Feature | VT Markets |

|---|---|

| XAG/USD Available | Yes, via silver CFDs |

| Account Types | Standard STP (from $50–$100), Raw ECN; Swap-Free and Cent accounts also available |

| Tradable Instruments | Forex, Commodities (incl. silver), Indices, Shares, ETFs, Crypto |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile App |

| Regulation | FSCA (South Africa), FSC (Mauritius), SCA, FSP |

| Minimum Deposit | $50–$100 depending on account type |

| Minimum Order | 0.01 lot |

| Leverage on XAG/USD | Up to 1:500 |

| Spreads on XAG/USD | Standard STP: from 1.2 pips; Raw ECN: from 0.0 pips |

| Commissions on XAG/USD | STP: spread-only; ECN: $6 per standard lot (round-turn) |

| Margin on XAG/USD | Variable margin Calculated by: Open Price x Contract Size x Lots x Margin Percentage/Account Leverage |

| Accepted Currency | USD, AUD, GBP, EUR, CAD, HKD, etc. |

| Transactions Options | Bank transfer, credit/debit cards, e-wallets (Skrill, Neteller, PayPal) |

9. Moneta Markets

Moneta Markets offers a low-cost and flexible trading experience, with strong safeguards for silver (XAG/USD) traders. It’s also the best broker for professional traders. The broker is regulated by the FSCA (South Africa) and holds registration in Saint Lucia, which allows it to trade globally with international compliance standards.

The broker offers three tailored account types: direct STP Account with spreads of 1.2 pips, no commission, prime ECN Account with 0.0 pip spreads, $3 round-turn commission per lot, and ultra ECN Account with 0.0-pip spreads, with an ultra-low $1 round-turn per lot charge for professional clients.

Minimum deposits are $50, and leverage is up to 1:1000 for forex and precious metals, variable instantly by the client portal. With strong regulation, dynamic accounts, and low-cost pricing, Moneta Markets appeals to both retail and professional traders who require accuracy and affordability in trading silver.

Key Facts About Moneta Markets

| Feature | Moneta Markets |

|---|---|

| XAG/USD Available | Yes, via silver CFDs available on all platforms |

| Account Types | Standard STP (from ~$50–$100), Raw ECN; Swap-Free and Cent accounts also available |

| Tradable Instruments | Forex, CFDs on Commodities (incl. silver), Indices, Shares, ETFs, Crypto |

| Trading Platforms | MetaTrader 4, MetaTrader 5, ProTrader (Web), AppTrader, CopyTrader |

| Regulation | FSCA (South Africa), SLIBC |

| Minimum Deposit | $50 for Direct STP and Prime ECN; $20,000 for Ultra ECN |

| Minimum Order | From 0.01 lot |

| Leverage on XAG/USD | Up to 1:1000 |

| Spreads on XAG/USD | STP: from 1.2 pips; Prime / Ultra ECN: from 0.0 pips |

| Commissions on XAG/USD | Prime ECN: $3 per round-turn; Ultra ECN: $1 per round-turn; STP: no commission |

| Margin on XAG/USD | 1% |

| Accepted Currency | USD, EUR, GBP, AUD, others depending on jurisdiction |

| Transactions Options | Bank transfer, credit/debit cards, e-wallets (e.g., Skrill, Neteller), other region-specific methods |

10. BlackBull Markets

BlackBull Markets remains our top choice for XAG/USD trading due to its tight spreads, low commissions, access to ECN trading, and high leverage of up to 1:500. As our top broker, it offers up to four account types (Standard, Prime, Institutional, and Swap-Free) and multiple trading instruments.

In our review, we found that BlackBull provides access to deliverable traded instruments such as Silver Futures, as well as CFDs and ETFs. We noticed that this broker offers tight spreads starting from 0.0 pips. These features on the platform make BlackBull an ideal choice for both beginners and professionals.

Key Facts About BlackBull Markets

| Feature | BlackBull Markets |

|---|---|

| XAG/USD Available | Yes |

| Account Types | Standard, Prime, Institutional, Swap-Free |

| Tradable Instruments | Forex, Indices, Commodities, Shares, ETFs, Cryptocurrencies, Metals, Equity Indices, Futures |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blackbull Invest, BlackBull CopyTrader |

| Regulation | Seychelles Financial Services Authority (FSA), NZ FSP |

| Minimum Deposit | $0 (Standard), $2,000 (Prime), $20,000 (ECN Institutional) |

| Minimum Order | 0.01 lot |

| Leverage on XAG/USD | Up to 1:500 |

| Spreads on XAG/USD | From 0.8 (ECN Standard) From 0.1 (ECN Prime) From 0.0 (ECN Institutional) Depending on market conditions for XAU/USD (Currently at 1.2 pips) |

| Commissions on XAG/USD | $0 (Standard), $4 (ECN Institutional), $6 (ECN Prime) per round lot |

| Margin on XAG/USD | 50% – 70% to be closed out |

| Accepted Currency | USD, EUR, GBP, AUD, NZD, CAD, CHF, JPY, HKD, XAU, BTC, ETH |

| Transactions Options | Airtm, AMEX, Skrill, SEPA, Poli, PaymentAsia, Neteller, Local Bank Transfer, Bank wires, credit/debit cards, Neteller, China Union Pay, AstroPay, crypto, Beeteller, Boleto, Fasapay, FxPay, Help2Pay, HexoPay |

What Is Important When Choosing a Good XAG/USD Trading Broker?

While we chose a good XAG/USD broker, here are some of the crucial factors we reviewed and kept in mind:

- Regulation and licensing

- Spreads and commissions (overall costs)

- Leverage options

- Trading platforms offered

- Range of tradable instruments

- Deposit and withdrawal methods

- Client fund security

- Customer support availability

Liquidity

When selecting an XAG/USD broker, liquidity is a key factor. A broker with high liquidity ensures seamless trading, competitive pricing, and low costs. On the other hand, a broker with low liquidity can put your trades at risk, leading to delayed orders, failed trades, and steep risks.

When evaluating a broker’s liquidity, it is crucial to consider its trading activity, customer feedback, and market capacity. These factors will help you make an informed decision about selecting the right silver broker.

Commissions

Another essential factor to consider when reviewing a silver broker is their commission. The commission charged by a broker directly impacts the cost of your trading and overall profitability. High commission fees can reduce your return on investment, while low commission fees can maximise your gains.

The commission structure of a silver broker is typically complex, encompassing management fees, storage fees, trading fees, and other miscellaneous charges. You will need to thoroughly examine each aspect of the fees and look for transparency and clarity in their pricing.

Execution Speed

Look out for your broker’s execution speed, another vital consideration for enjoying a seamless trading experience. The speed at which your transactions are executed directly impacts the amount of investments you can accrue.

If it is fast, your trades will be carried out quickly, allowing you to capitalize on market opportunities. On the other hand, if it’s slow, it can result in slippage, where your trades will be executed at unfavorable prices, leading to missed opportunities. To review your broker’s execution speed, look for advanced trading platforms, direct market access, low latency, and high-speed servers.

Regulations

The next factor to consider when reviewing a broker is scrutinizing their regulatory compliance, as this is a crucial way to ensure that your trading experience is secure. Regulatory bodies establish stringent rules that brokers must adhere to, and a regulated broker is required to maintain transparent business practices, protect clients’ funds and assets, and ensure dispute resolution mechanisms.

Different countries have other regulatory bodies governing silver brokers. For instance, the US relies on the CFTC, the UK boasts of the FCA, and Australia has the ASIC. Always ensure that a reputable financial authority regulates your broker.

Advanced Trading Platforms

Before choosing a silver broker, review its advanced trading platforms. An exceptional platform is needed to navigate the fast-paced silver market.

Having an advanced trading platform ensures that your trade execution is both fast and secure, allowing you to make informed decisions. With real-time data and customizable charts, traders can capitalize on these features to leverage market opportunities. Moreover, advanced platforms provide 24/7 access to the market, ensuring you are connected at all times and from anywhere.

Spreads

You will need to review the spreads the broker is offering. Spreads represent the difference between the selling and buying prices of Silver. Tight or competitive spreads enable traders to enter trades at favorable prices, thereby maximizing market profits

On the other hand, wide spreads increase trading costs, delay trade execution, and reduce profitability. Opt for brokers whose spreads range from 0.0 pips to 0.8 pips.

Instruments Availability

The availability of instruments offered by a silver broker is another factor to consider when selecting the right broker for your needs. The broker you choose should offer a wide range of silver products, including futures, CFDs, and ETFs. Verify that your broker meets your specific requirements for silver trading.

Which Silver Trading Broker Should Be Chosen by Beginners?

Beginners must look for a silver broker offering top-tier regulation, low startup costs, and a user-friendly trading platform. Demo accounts, educational resources, and reliable customer support are essential features for building confidence.

At WR Trading, we recommend Pepperstone as a starting point for new traders. It requires no minimum deposit, super-tight spreads of 0.0 pips on silver (XAG/USD) through its Razor account, and the backing of ASIC and other global regulators. The broker is also underpinned by user-friendly platforms like MT4, MT5, and TradingView that enable novices to get the hang of things without emptying their pockets.

What Is the Best XAG/USD Broker for Professionals?

For serious investors, the best silver broker is one that has excellent liquidity, very tight spreads, high leverage, and outstanding platform functionality. Tight commission levels and fast execution are the only things that matter when managing bigger positions profitably.

At WR Trading, we recommend Moneta Markets (Ultra ECN account) for professionals. It has 0.0-pip spreads on XAG/USD and a barely-affecting-$1 per-lot round-turn commission that makes it one of the most price-efficient setups for high-volume trading. Execution is lightning-fast, leverage may be established up to 1:1000, and the platform suite supports MT4, MT5, and TradingView for discretionary and algorithmic trading methods.

The combination of cheap trading, institutional-grade execution, and platform adaptability places Moneta Markets as a top option among serious silver traders.

Leverage on XAG/USD

The leverage on XAG/USD varies between brokers and trading platforms. Typically, leverage is up to 1:500, allowing traders to control larger positions with small amounts of capital. For example, with 1:500 leverage, a trader can control a $500,000 position with $100 capital.

It is important to know that the higher the leverage, the higher the potential losses. Therefore, traders should consider their risk appetite carefully before selecting their leverage. Some brokers also offer flexible leverage, allowing them to adjust their leverage based on market conditions.

Commissions on XAG/USD

The XAG/USD trading element varies depending on the broker, trading platform, and account type. While some brokers offer commission-free trading, others charge commissions per trade. A typical commission on XAG/USD ranges from 0.1% to 0.5% of the trade value. For Silver, if a trader buys 100 ounces, then the commission will be between $1 and $50.

Some brokers offer tiered commissions, where higher trading volumes result in lower commissions. ECN or STP brokers offer lower commissions thanks to direct market access.

Swaps on XAG/USD

Swaps refer to the interest rate difference between the currency pairs, in this case, XAG/USD. When trading XAG/USD, a trader may be charged or credited a swap fee, depending on the direction of the trade or the interest rate differential.

For instance, when trading a long XAG/USD position, the trader may incur a swap fee since they are essentially borrowing US dollars to purchase Silver. Conversely, they might be credited in a short XAG/USD position. Silvers are lending the US dollar to sell Silver.

Swap fees are usually credited as a percentage of the trade value and are charged to the trader’s account at the end of each trading day. The amount, however, is dependent on market conditions and the broker’s policies.

Which Forex Broker Offers the Lowest Fees on XAG/USD?

When comparing XAG/USD fees, fees should be looked at in terms of underlying charges, such as inactivity or platform fees, commissions, and spreads. Based on our detailed broker comparison:

- Plus500 (US): Tier $0.89 per standard contract / $0.49 per micro contract with no routing, inactivity, or platform fees.

- StarTrader: Usual 0.6 pips spread on Standard accounts (no commission) or $3 per lot on Raw accounts.

- Pepperstone: 0.5 pips spread on Razor accounts or $3.50 per side, or 1.2 pips spread on Standard accounts (no commission).

- PU Prime: 0.7 pips spread on Standard, or Raw accounts with $3.50 per side commission.

- VT Markets: Around 0.6 pips spread on Standard, or $3 per side on ECN accounts.

- Moneta Markets: Around 0.7 pips spread on Standard, or $3 per side on ECN accounts.

Plus500 (US) is the most affordable broker for XAG/USD because of its all-encompassing flat fee and absence of nasty surprises, which makes it especially enticing to thrifty traders.

Types of Financial Products to Trade Silver

You can trade silver via various financial instruments, each with its own set of benefits based on your objectives, risk tolerance, and market strategy. Ranging from derivative products like CFDs to more conventional investments like futures and ETFs, the appropriate instrument can define your silver trading experience and profitability.

Here are some of the financial products to trade with Silver:

Silver CFDs

At WR Trading, this is our most recommended silver tradable instrument. Silver CFDs are contracts made between the trading broker and trader to close the difference between the opening trade and closing trade. One of the benefits of trading with CFDs is that traders will not be required to pay storage fees. Additionally, trading silver with CFDs provides the flexibility to trade in both upward and downward directions, and is typically commission-free.

Silver ETFs

ETFs are other types of tradable instruments that are preferable for traders seeking indirect exposure to the price fluctuations of Silver. ETFs are financial instruments that are good for speculating on the price of Silver. However, traders need to consider the risks, costs, and funds required to trade this instrument.

Silver Options

Silver Options are derivative instruments that enable traders to speculate on commodities using leverage. With this contract, the holder is not required to trade Silver on a set date or at a set price. This method of trading silver allows traders to gain insight into the market without owning physical bullion.

Silver Futures

Silver futures are standardized contracts that stipulate the price and date at which silver should be sold or bought in the future, binding both buyer and seller to this contract. They are used most frequently by traders for hedging and speculation.

Whereas futures are liquid and transparent, they are also risky. Prices are not merely determined by the spot market for silver but also by carry costs such as storage fees, insurance, and prevailing interest rates, which add volatility to contract prices.

For U.S. traders, silver futures are particularly popular because they’re listed on regulated exchanges such as the COMEX (part of the CME Group). Stringent oversight is assured, standardized contract sizes (5,000 troy ounces per contract), and high availability through U.S.-based brokerages assure compliance and comfort for traders.

Where to Trade Physical Silver?

Investors can purchase physical silver from certain reputable sources:

- Bullion Dealers – Local or specialist precious metal dealers selling coins and bars.

- Banks – Some banks have access to investment-grade silver products.

- Online Vault Services – Sites that buy, store, and insure silver on your behalf.

A suitable alternative is BullionVault, a reputable online bullion exchange for allocated silver. Investors can buy and sell silver in professional-grade vaults in cities such as London, Zurich, and Toronto.

BullionVault uses a minimal commission of 0.5% per transaction (lower fees on larger transactions) and an annual storage fee of 0.04%, paid daily. Buyers retain full ownership rights, so you are free to sell your holdings in seconds or even remove your silver physically if you prefer.

Conclusion

Trading silver through the XAG/USD contract offers a dynamic opportunity for diversification, hedging against inflation, and short-term gains. To succeed, it’s crucial to choose a broker that provides competitive spreads, low swap rates, diverse trading instruments, and a suitable platform.

By selecting a broker like Plus500 (US), which is suitable for silver futures traders, BlackBull, which offers tight spreads and advanced platforms, or Vantage Markets, which is highly adaptable for CFD trading, you can navigate silver’s volatility and unlock its potential for significant returns.

By adopting a disciplined approach with strict risk management, with the right strategy and broker, silver trading can be a valuable addition to your investment portfolio.

Frequently Asked Questions on Silver Trading Brokers:

What Are the Standard Fees Related to Silver Trading?

Fees related to silver trading may include spreads, commissions, overhead financing fees, currency conversion fees, and, in some cases, inactivity fees.

Is Silver Trading Good for Beginners?

Yes, it is. However, the Silvertrading imarket is highly volatile, and it is essential to educate yourself on market dynamics and risk management. Moreover, most brokers provide demo accounts, tools, and educational resources that are helpful for beginner silver traders.

What Is the Difference Between Silver CFD and Actual Silver Trading?

One of the main differences between Silver CFD and actual silver trading is ownership. With a silver CFD, you are trading contracts representing the silver market’s underlying price. On the other hand, you will need to purchase and store silver bars for actual silver trading.

What is the Ticker Symbol of Silver?

Many silver trading platforms trade under the ticker symbol XAG. They can be traded under the symbol of SILVER.