Short-selling crypto is a trading strategy where you profit from falling prices. Instead of buying an asset and hoping it rises, you borrow a coin at its current price, sell it, then aim to buy it back later at a lower price. If executed well, you keep the difference as profit. This guide explores short-selling in detail, from trading methods you can use, to risk factors, and more.

How to Short Cryptos Step by Step:

Beginner traders in crypto may find the process of shorting coins intimidating, so we’ve made a quick guide to get you started on your first trade. Below is an overview of each stage, from choosing an exchange to making your first trade.

1. Choose an Available Crypto Platform / Exchange for Shorting Cryptos

The most important step is selecting the right platform to trade on because you need to choose an option that aligns with your needs, supports the coins you’re interested in, and provides fair services. At WR Trading, we often try out new exchanges and brokers to find the best platforms for our readers. We believe PrimeXBT, Bitunix, and Bitget are the best choices for crypto shorting.

Crypto Platform:

Leverage Crypto Futures:

Features:

Account:

1. PrimeXBT

Up to 1:500 on Crypto Futures

- Low Minimum Deposit: Only 0.001 BTC

- No KYC required for most account setups

- Multi-asset trading platform with crypto, forex, and commodities

- Trade more than 100 Cryptos with leverage

- Copy Trading Feature

2. Bitget

Up to 1:150 on Crypto Futures

- Easy Account Opening

- Fast Deposits / Withdrawals

- Deposit/Withdraw Fiat

- More Than 1,000 Cryptos

- Trading Bots, Copy Trading, Staking & more

- 24/7 Customer Support

- High liquidity and fast execution

3. Bitunix

Up to 1:125 on Crypto Futures

- No-KYC Exchange

- Fast Deposits / Withdrawals

- More Than 1,000 Cryptos

- Free Bonuses

- $10 Minimum Deposit

- 24/7 Customer Support

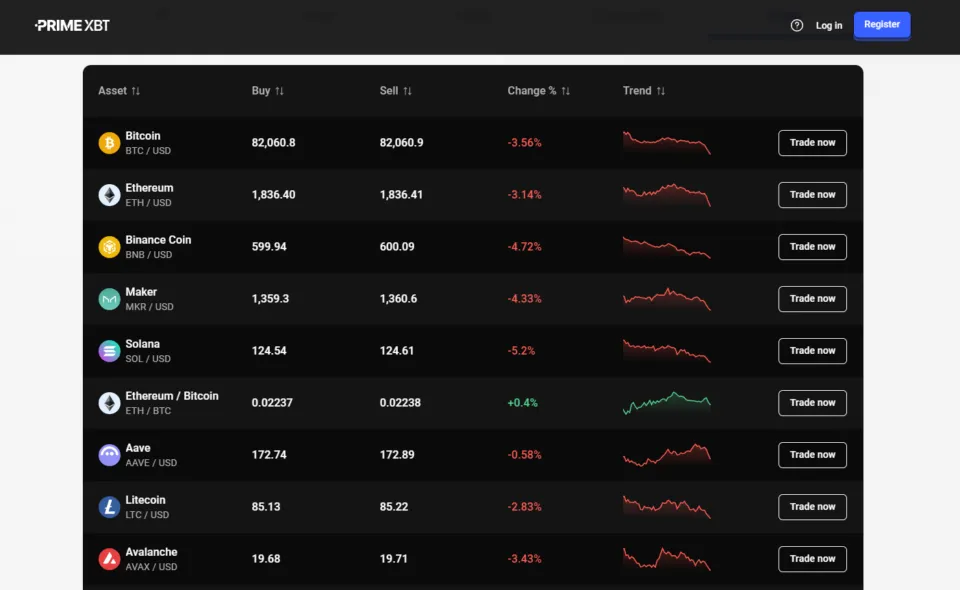

PrimeXBT

PrimeXBT for multi-asset margin trading that covers cryptocurrencies, forex, and commodities. It’s perfect for a streamlined way to manage positions across different markets, including crypto. PrimeXBT usually offers relatively low fees and a user-friendly interface for margin or short selling.

PrimeXBT’s main draw is its straightforward approach to leveraged trading: you can often open positions with up to 200x leverage on certain crypto pairs. If you’re looking to short major coins like Bitcoin or Ethereum, the liquidity is solid. PrimeXBT is available in over 150 countries but does not provide services in the United States or Canada.

Bitunix

Bitunix is a relatively new platform focusing on futures contracts for major and mid-cap cryptocurrencies. It offers leverage up to 125, and the exact limit can vary by coin. Funding your account can be done via fiat, altcoins, or stablecoins, as the platform emphasizes quick onboarding. Bitunix has a user-friendly interface for opening short positions, detailing margin requirements and estimated liquidation points at a glance.

Volume and liquidity depend heavily on the specific crypto pair you’re trading. While BTC and ETH usually see tighter spreads, smaller altcoins might come with higher volatility and lower liquidity, making shorting riskier. Bitunix’s stance on KYC can differ by region; in some cases, unverified accounts face withdrawal limits or can’t use higher leverage tiers. U.S. traders may run into access blocks until they verify their accounts on Bitunix.

Bitget

Bitget covers many services, from straightforward spot trading to advanced derivatives like perpetual futures. Many cryptos can be shorted on Bitget using up to 125x leverage, creating opportunities for substantial profits. The platform often runs promotions, like deposit bonuses or fee rebates, that might reduce the overall cost of short-selling.

Unfortunately, Bitget does not operate in the US due to regulatory reasons. Nevertheless, the exchange is available in over 60 regions. If you do sign up, you’ll probably need to complete standard KYC steps to unlock full features and withdrawal options above certain thresholds. Margin calls and liquidation processes on Bitget mirror those on other derivatives platforms, with clearly stated maintenance margins. If you’re new to shorting, consider taking advantage of the demo account they offer.

2. Sign Up for Your Crypto Trading Account

The sign-up process usually requires giving an email address, creating a password, and then confirming your account via a link or code. Make sure you set up two-factor authentication (2FA) right away to protect against unauthorized access. If you plan to deposit larger sums or aim for higher withdrawal limits, some platforms might request additional details at this stage, or they might allow you to deposit funds but lock withdrawals until you complete KYC checks.

Therefore, if you’re in a region with tighter rules, read each platform’s Terms of Service carefully. Some might ask you to confirm you’re not a resident of certain countries, or they may have disclaimers about the maximum leverage allowed in your jurisdiction. Failing to comply with these rules could lead to complications, such as locked accounts.

3. Verification

Exchanges follow Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines. You’ll likely need to submit a government-issued ID, proof of residence, and maybe take a selfie for identity confirmation. The advantage of completing verification is unlocking higher deposit and withdrawal limits. If the platform encounters suspicious activity and you’re unverified, they may freeze your account until you provide more documentation.

Some platforms let you trade crypto with no KYC, especially if they’re less regulated or located offshore. This “no KYC” route can be appealing to those who value privacy, but it usually caps withdrawal limits or excludes certain features.

4. Account Funding or Demo Account

Traders ready to commit real capital have the following deposit options: bank transfers, credit or debit cards, and direct crypto transfers. Some platforms provide stablecoin deposit addresses, making it simpler to convert external tokens into a tradable balance. While deposit times vary, crypto deposits can often be credited faster than traditional bank transfers, depending on network congestion and required confirmations.

On the other hand, if the platform offers a demo account, it’s wise to practice there first. Demo trading helps you learn the interface, place short orders, and see how margin or leverage affects potential profits and losses. This is valuable if you’re new to short-selling, as mistakes on a real account can be costly. Spending a week or two in a risk-free environment can sharpen your instincts before moving to live trades.

5. Start Trading

Once your account is funded (or you’re set up in demo mode), you can open and close short positions in a few steps:

- Pick a Pair: Select the crypto pair you want to short (BTC/USDT, ETH/USDT, etc).

- Adjust Leverage: Decide how much leverage to use, if any. A lower crypto leverage ratio can reduce liquidation risk.

- Place an Order: Then, input how much money you want to go into the trade. Market orders get filled immediately at the current rate, while limit orders wait until the market hits your desired price.

- Monitor Your Position: Check the live P&L (profit and loss) and keep an eye on margin usage. If you suspect a rebound, place a stop-loss order to cap losses.

Closing your short position involves buying back the crypto, which can be done using the same interface as buying. This time, simply select the “sell” button to exit the short position. If you’re in profit, the difference between the higher selling price and the lower buying price is yours. If the market goes against you, the difference comes out of your margin balance.

Example of Shorting a Cryptocurrency

Let’s say Bitcoin is trading at $100,000, and you strongly believe it’s headed for a correction to $90,000. You open a short position for 1 BTC using 5x leverage. That means you only post a fraction of the total trade value – about $20,000 – while effectively controlling a $100,000 position.

- BTC drops to $90,000: You can close your short by buying back that 1 BTC at $90,000. The difference of $10,000 (minus fees) is your profit, multiplied by your leverage factor for margin calculations.

- BTC rises to $110,000: You’re now $10,000 down. With 5x leverage, you risk a margin call or forced liquidation if your account equity can’t handle the loss. This scenario shows why shorting with high leverage can be precarious, one big rally and your position can be in serious trouble.

6. Withdrawal Profits

When you’re ready to withdraw profits, head over to the exchange’s deposit page. There you can select to withdraw either cryptocurrency or fiat.

- Crypto: You can withdraw in Bitcoin, Ethereum, USDT, or whichever tokens the platform supports. Blockchain network fees apply.

- Fiat: Some exchanges let you transfer money directly to a bank account. Processing times and fees differ by region.

Pros and Cons of Shorting Crypto

If you want to short cryptocurrencies, you should definitely weigh the pros and cons:

Pros

- Profit from falling prices in bear markets

- Possible hedging tool for existing crypto portfolios

- Multiple instruments (futures, CFDs, options) for strategy variety

- Potential to earn on short-term volatility swings

- May require less capital if high leverage is used responsibly

- Some brokers offer negative balance protection

- Easy access to shorting on many major exchanges

- Options trading can limit losses to the premium

- Certain automated tools or bots can handle short trades for you

- Great for news trading

Cons

- Huge losses if the coin’s price spikes

- Complex derivative rules like funding rollovers can confuse new traders

- Sudden news or hype can inflate prices, triggering liquidation

- Overleveraging can lead to forced liquidation with minimal price moves

- Fees like overnight financing or borrowing costs reduce net profits

- Time decay in options can eat away at profits if the market doesn’t move enough

- Thin liquidity on certain altcoins can cause slippage and unexpected price jumps

- Emotional stress is high when markets rally against your short

- Not all altcoins are available to short

- Requires good market understanding to know when to set short positions

Which Methods Are Available to Short Cryptocurrencies?

Crypto has three main ways to short crypto – futures, CFDs, and options. Each method comes with unique pros and cons, so choose one that aligns with your comfort level, trading goals, and regulatory constraints in your region.

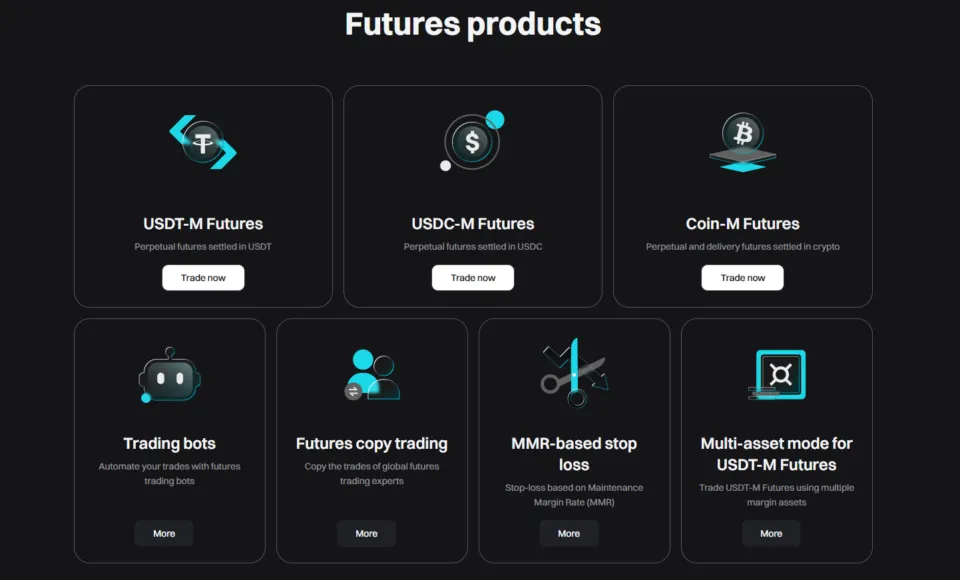

Crypto Futures

Crypto futures are contracts that let you buy or sell a digital asset at a predetermined price on a specific future date. When you go short on a futures contract, you’re committing to sell that cryptocurrency at the agreed-upon price later.

So, if the market price of the coin is lower at the contract’s expiration – or when you choose to close the position – you can profit from the difference. Popular futures exchanges for crypto include Bitget, Bybit, PrimeXBT, and KuCoin. These platforms often provide leverage, which can increase profit potential.

| Aspect | Details |

|---|---|

| How It Works | Sell a futures contract and buy it back at a lower price before expiration. |

| Popular Platforms | Binance, PrimeXBT, Bitget, Bybit, KuCoin, OKX. |

| Leverage | Ranges from 1:5 to 1:125, depending on the platform and asset. |

| Contract Expiry | Some contracts have fixed expiration dates, while perpetual futures never expire. |

| Costs & Fees | Maker/taker fees, funding rates, and rollover fees for holding positions overnight. |

| Best For | Traders who want high leverage and deep liquidity for short-term and high-frequency trading. |

| Main Risk | High leverage can lead to rapid liquidation if the price moves against the trade. |

Crypto CFDs

Contracts for Difference (CFDs) on crypto allow you to speculate on coin price movements without holding the underlying asset. When shorting via CFDs, you enter into an agreement with the broker to exchange the difference in price from the trade’s open to close. If the price drops, you gain the difference; if it rises, you owe the difference. Many Crypto CFD platforms also offer leverage, letting you control a larger position than the funds in your account alone would allow.

A great benefit of CFDs is you won’t have to worry about wallet addresses or blockchain fees, and you can open and close trades quickly. However, CFDs aren’t always regulated the same way in each country, and some regions either ban or heavily restrict them.

| Aspect | Details |

|---|---|

| How It Works | Enter a contract with a broker or exchange to profit from price changes without owning crypto. |

| Popular Platforms | eToro, Plus500, IG, AvaTrade, Vantage |

| Leverage | Varies from 1:2 to 1:100, depending on the platform. |

| Ownership | No need to store crypto, manage private keys, or deal with blockchain fees. |

| Costs & Fees | Spread costs, commission, overnight financing fees, and potential inactivity fees. |

| Best For | Those who prefer quick trades without owning crypto, with easy access to shorting via brokers. |

| Main Risk | Without owning the underlying asset, your funds depend entirely on the platform’s reliability. |

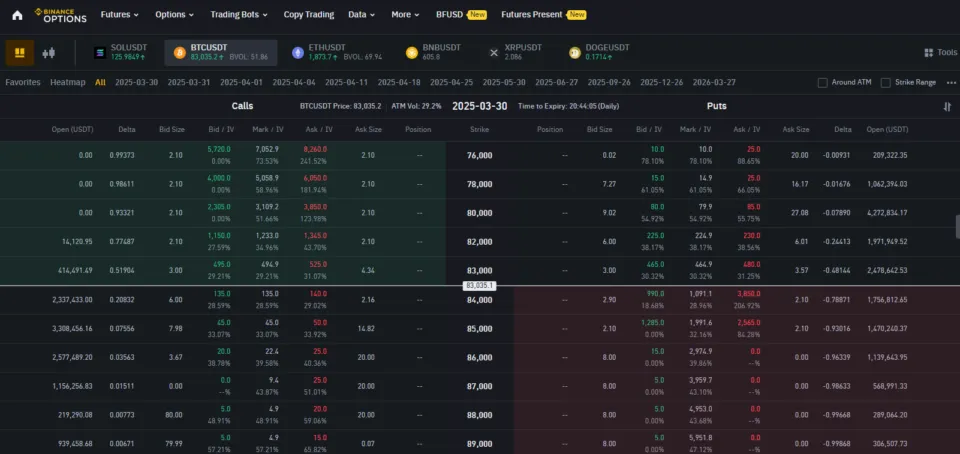

Crypto Options

Crypto options give you the right, but not the obligation, to buy (call) or sell (put) a certain digital asset at a specified strike price within a set timeframe. Shorting via options often means purchasing put options, which gain value if the coin’s price falls below the strike.

When the market falls, you can choose to exercise the option or sell it at a profit. If the market goes in the opposite direction, you can let the option expire and limit your loss to the premium you paid. This limited-loss structure can be appealing to traders who want to cap their downside risk.

| Aspect | Details |

|---|---|

| How It Works | Buy put options (to short) or sell call options (to profit from price drops). |

| Popular Platforms | Binance, OKX, and KuCoin. |

| Leverage | Options do not have direct leverage, but the premium structure allows traders to control larger positions with less capital, creating an effect similar to leverage. |

| Contract Types | American-style (exercisable anytime) or European-style (only at expiration). |

| Costs & Fees | Premium cost, exchange fees, and liquidity spread that varies between platforms. |

| Best For | Traders looking for defined risk (limited losses) while speculating on price drops with put options. |

| Main Risk | Options lose value as expiration approaches because there is less time for the price to move in the profitable direction. |

Leveraged Tokens

Leveraged tokens allow traders to short coins without using margin, borrowing funds, or worrying about liqudiations. These tokens are pre-packaged leveraged positions, which automatically adjust to maintain a set leverage ratio – 2x, 3x, or 5x. Despite their convenience, leveraged tokens aren’t ideal for long-term holding. They rebalance daily, which means their price can deviate from expectations due to compounding effects – especially in choppy markets.

| Aspect | Details |

|---|---|

| How It Works | Buy a token that represents a pre-packaged leveraged short position without needing margin. |

| Popular Platforms | Binance, KuCoin, and Bybit. |

| Leverage | 2x, 3x, or 5x, varies between platforms. |

| No Liquidation Risk | Since tokens auto-adjust, there’s no forced liquidation like in futures trading. |

| Costs & Fees | Usually higher trading fees and funding costs than spot trading. |

| Best For | Beginners and short-term traders who want leveraged short exposure without the complex interfaces of other trading instruments. |

| Main Risk | Leverage resets daily, which can cause compounding effects over time. |

What Are the Risks of Shorting Cryptos?

Short-selling crypto can be profitable, but it also comes with multiple layers of risk. Below are five key hazards to watch for, each deserving serious consideration if you’re planning to go short crypto.

Liquidation and Margin Calls

Leverage allows you to borrow more funds to trade, increasing the upside of taking a short position. However, if the market moves against your short, you may face a margin call requiring more funds to sustain the position. If you fail to supply them in time, the platform might liquidate your trade to prevent a negative balance. Liquidations usually happen quickly, leaving you with a realized loss.

Volatile Price Swings

Crypto markets can see rapid moves in minutes or even seconds, especially around major news events or sudden hype. If you’re short and a quick pump occurs, your position could be liquidated before you can react. This volatility is why consistent monitoring and stop-loss strategies are vital.

Regulatory and Exchange Risks

Some exchanges aren’t regulated by strict financial authorities, raising questions about their solvency or dispute resolution processes. If your exchange halts trading or experiences liquidity problems, you might struggle to close your short at the right price – or at all. Therefore, choose a platform with a solid history of providing fair services and check their recent reviews to ensure they maintain a great trading environment.

Fee Accumulation

Between leverage fees, funding rates, and possible overnight financing costs, short positions can become expensive to maintain. If you keep a position open for weeks or months, these charges may eat into or even exceed your profits. Always calculate total costs before opening a trade to ensure it’s still viable.

Psychological Strain

Betting on a price drop runs counter to the optimism many people associate with crypto. Watching the market unexpectedly rally can be stressful, and emotional decisions often lead to bigger losses. Clearly defined entry, exit, and stop-loss levels can help mitigate moves driven by panic. Also, watch out for over-trading, as it can lead to psychological strain as always, you should never trade more than you can afford to lose.

Long vs Short Positions on Crypto

Here is a simple table comparing key aspects of going long (buying) vs. going short (selling) on cryptocurrencies:

| Aspect | Long Position | Short Position |

|---|---|---|

| Market Bias | You expect prices to go up | You expect prices to go down |

| Profit Mechanism | Buy low, sell high; gain from rising prices | Sell high, buy back low; gain from falling prices |

| Loss Potential | Limited to your initial investment unless leverage is used | Potentially unlimited if prices keep rising |

| Margin Use | Often optional, can amplify gains/losses | Commonly used, magnifies risk if the market moves higher |

| Hedging | Not used as a hedge for existing holdings | Can offset losses on other crypto you hold long |

| Main Risk Factor | Price drops, leading to partial or total investment loss | Price spikes, forcing margin calls and large losses |

| Regulatory Aspect | Generally straightforward, but margin adds complexity | Tighter rules in some jurisdictions for short-selling |

Which Cryptocurrencies Can Be Shorted?

Any cryptocurrency can be shorted, provided the exchange offers margin or derivative contracts for that coin. Common examples are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Binance Coin (BNB)

- Cardano (ADA)

Some trading platforms support shorting small-cap tokens, but liquidity might be lower, leading to wider spreads and a higher chance of slippage. If your plan involves shorting a lesser-known coin, check the trading volume and order-book depth.

Without adequate liquidity, you might not be able to open or close positions at the price you want, especially during fast market moves. Also, ensure the exchange supports the coins you want to short.

How Much Money Can You Make When Shorting Cryptos?

Your earnings come from the difference between the price at which you open a short and the lower price at which you close it. If you short-sell 1 BTC at $100,000 and buy it back at $95,000, your gross gain is $5,000 (minus fees and potential funding charges). How large or small that gain becomes depends on factors such as leverage, the size of your position, and how steeply the market drops.

What Are the Fees When Shorting Cryptos?

Different platforms have different fee structures, which can include:

- Maker/Taker Fees: If you use a limit order that adds liquidity, you might pay a maker fee (often lower). A market order removing liquidity comes with a taker fee.

- Funding Rates: Perpetual futures contracts usually have a funding mechanism where longs pay shorts or shorts pay longs, depending on the market’s balance. This cost (or credit) can change multiple times daily.

- Borrowing Costs: If you borrow a coin directly or use a margin loan, the platform may charge daily or hourly interest.

- Overnight or Rollover Fees: Holding a short position overnight might trigger small daily charges, especially with CFDs or leveraged tokens.

Conclusion: Shorting Cryptos Is a Good Strategy for the Right Market Sentiment

Short-selling cryptocurrencies creates an avenue to profit when prices fall, which can be helpful in bearish environments or during high volatility events. Whether you choose futures, CFDs, or advanced DeFi platforms, having a clear plan and risk management is needed. The potential rewards can be compelling, but the pitfalls – ranging from large price spikes to margin calls – should be carefully managed.

Ultimately, short-selling works best for traders who keep a close eye on market news, have a solid understanding of leverage, and remain disciplined about stop-loss orders. If you meet those criteria, shorting can be a hedging tool and a way to capitalize on downtrends.

Frequently Asked Questions on Shorting Cryptos Futures:

How Does Short Selling Differ From Going Long in Crypto?

Short selling is the opposite of buying a coin hoping it rises. Instead, you borrow the coin, sell it at the current price, and aim to buy it back at a lower rate for profit.

Can U.S. Residents Legally Short Crypto?

Yes, U.S. traders can legally short crypto if they use a regulated and U.S.-approved exchange. Some platforms restrict or ban U.S. users from margin or derivatives trading due to regulatory constraints.

Is It Possible to Short Crypto Without Leverage?

Yes, a few exchanges or brokerages let you open “short” positions without high leverage, essentially at a one-to-one ratio. You’d still face losses if the market moves up, but your risk of liquidation is lower.

Which Method Is Best for Beginners to Short Crypto?

Futures and CFDs are commonly recommended due to broader educational resources and simpler user interfaces. Options can be more complex to understand, but they can also cap losses at the premium you pay. The choice largely depends on your comfort with each product’s mechanics and risk profile.

What if My Short Position Stays Open Too Long?

Holding a short for an extended period can rack up fees such as daily funding or borrowing costs. You also expose yourself to sudden rallies or bullish news that might spike the coin’s price. If you plan a long-term short, monitor the market’s sentiment and your platform’s ongoing fees.