Learn how to trade crypto instantly without identity verification using our expertly tested no-KYC exchanges at WR Trading. No-KYC trading means you can buy, sell, and withdraw cryptocurrencies without submitting documents like passports or driver’s licenses. These platforms skip the “Know Your Customer” process, allowing traders to keep their privacy while still accessing major crypto markets.

We personally tested several exchanges to find which ones offer the fastest sign-up, strongest security, the best crypto variety, a great trading experience, and the most reliable withdrawal systems without requiring ID verification. Platforms that made our list allow users to start trading immediately after registration using only an email address. In this guide, we’ll explain how no-KYC trading works, how to choose a trusted exchange, and how to withdraw your profits securely while keeping full control of your privacy.

Quick Overview of Top 10 No KYC Crypto Exchanges

Crypto Platform:

KYC:

Features:

Account:

No KYC

- No KYC Crypto Exchange

- Fast account opening

- Leverage Trades up to 125x

- Crypto Futures and Spot Trading

- Free Deposit Bonus

No KYC

- Low Minimum Deposit: Only 0.001 BTC

- No KYC required for most account setups

- Multi-asset trading platform with crypto, forex, and commodities

- Trade more than 100 Cryptos with leverage

- Copy Trading Feature

No KYC

- No KYC needed

- Bisq trading platform

- No daily withdrawal limit

- 100+ crypto assets

- iOS and Android app

- In-depth FAQ section

No KYC

- No KYC required

- No minimum deposit

- From 0.2% maker and 0.2% taker fees

- CoinEx trading platform

- 1,219+ cryptos

- Leverage: up to 100:1

- iOS and Android app

No KYC

- No KYC required

- No minimum deposit required

- Trading platform: Best Wallet app

- 1,000+ cryptos

- Good customer support (email, FAQs, Social Media)

- iOS and Android app

No KYC

- No KYC needed

- No minimum deposit

- From 0.2% maker and 0.2% taker fees

- Poloniex trading platform

- 763+ cryptos

- Leverage: up to 100:1

No KYC

- From 0% maker and 0.0500% taker fees

- No KYC required

- 1,830+ crypto assets

- MEXC trading platform

- MX token perks reduce costs for active users

- Minimum deposit: $10

- iOS and Android app

No KYC

- No KYC required

- No minimum deposit

- Leverage: up to 100:1

- 1,194+ cryptos

- PancakeSwap trading platform

- Fees (V3) from 0,01%

No KYC

- No KYC required

- No minimum deposit

- V4 trading fees from 0,0%

- Uniswap trading platform

- 2,000+ cryptos

- Support via chat & email

No KYC

- No KYC required

- No minimum deposit

- Raydium trading platform

- Leverage: up to 50:1

- 1,259+ cryptos

- Crypto swaps and crypto perpetuals

List of the Best Crypto Exchanges That Do Not Require KYC

Check out our 10 best no-KYC exchanges that we tested in-depth and verified if they offer a truly privacy-focused trading experience. We recommend that our readers do their due diligence when signing up, which means starting with a small balance, checking if trading functionality works, and ensuring that withdrawing is available without KYC. Note that fiat deposits are not available with no-KYC platforms, and only crypto deposits are allowed with the exchanges below.

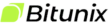

1. Bitunix – Best for high-leverage crypto futures trading

Bitunix is our best no-KYC exchange at WR Trading, with a score of 5/5 stars, for traders who want privacy without sacrificing performance. The platform allows users to open an account instantly with only an email address, enabling access to over 600 crypto assets and leverage up to 125:1. In our opinion, this makes it ideal for traders who want fast entry to futures markets while maintaining anonymity. Fees are low, with maker-taker starting at just 0.08% and 0.1%, decreasing with higher trading volume.

The platform’s Bitunix Academy is another strong point we found, offering valuable educational content that teaches users about futures mechanics, margin allocation, and liquidation risks, making it useful even for intermediate traders. Order execution is fast during our testing, and the charting system includes TradingView integration for clear analysis. Bitunix also supports real-time risk monitoring tools, margin adjustments, and built-in stop-loss management, which are essential for crypto trading.

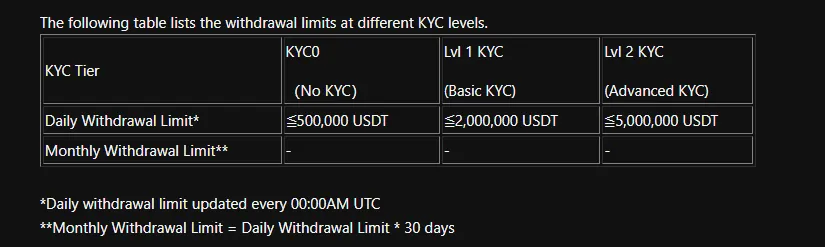

While the exchange provides convenience and competitive fees, traders should note that Bitunix operates with minimal regulatory supervision, meaning protections depend mainly on its internal systems. Also, the daily withdrawal limit is only $10,000 for accounts without KYC. Still, we recommend Bitunix because of its solid security features, responsive support, and status as one of the most comprehensive no-KYC platforms for high-leverage crypto traders.

| Feature | Bitunix |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | $10,000 |

| Minimum Deposit | $10 |

| Spreads and Commission | From 0.08% maker and 0.1% taker fees, lowers depending on trading volume |

| Trading Platforms | Bitunix trading platform |

| Asset Types | Cryptocurrency and cryptocurrency futures |

| Tradable Cryptocurrency Assets | Over 611 |

| Leverage | 125:1 |

| Customer Support | Email, live chat, and help center |

| Demo Account | No |

| Educational Content | Bitunix Academy and blog |

| Mobile App Availability | iOS and Android |

| Regulation | FinCEN |

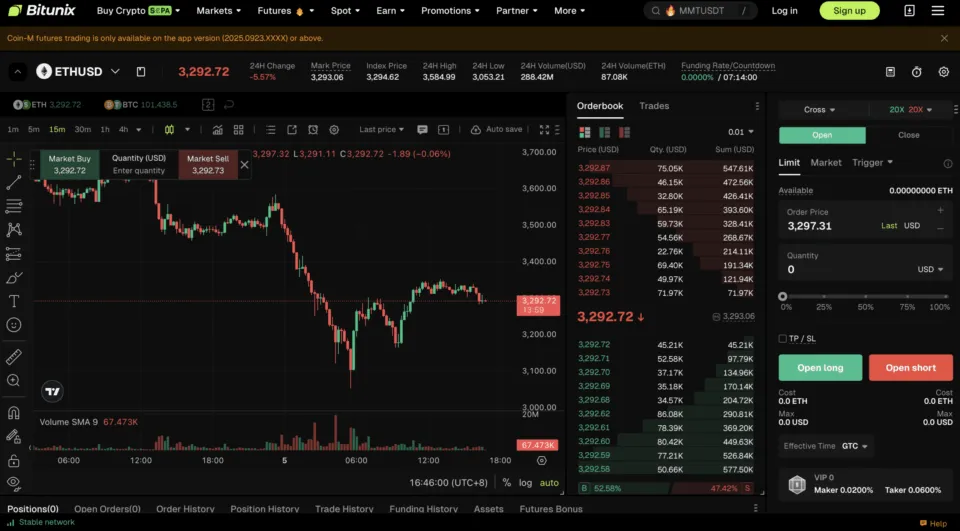

2. PrimeXBT – Best for high daily withdrawal of $20,000 with no KYC

PrimeXBT takes our 2nd place at WR Trading because it has built a strong reputation as a multi-asset platform offering crypto and traditional market exposure with no KYC required. Crypto traders can freely deposit and withdraw crypto, enjoying a daily withdrawal limit of $20,000 without submitting any personal documents. The platform lists crypto and crypto futures on over 30 cryptocurrencies, which is unfortunately low compared to our other brokers.

Leverage options reach 500:1 for major crypto pairs, and trading fees are fixed at 0.05%, simplifying cost calculation. We liked how simple and highly customizable the platform’s layout is, making it suitable for manual or automated strategies. PrimeXBT also provides a demo account, allowing users to test features and trading strategies before committing funds.

We found that security remains a top focus for PrimeXBT through two-factor authentication, whitelisted addresses, and cold storage systems. Also, unlike other no-KYC trading platform PrimeXBT holds licenses by some of the most respected regulators, such as FSA, FSCA, BCR, and FSC.

| Feature | PrimeXBT |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | $20,000 |

| Minimum Deposit | $10 |

| Spreads and Commission | 0.05% fixed fee |

| Trading Platforms | PrimeXBT trading platform |

| Asset Types | Stocks, forex, cryptocurrencies, crypto futures, commodities, and indices. |

| Tradable Cryptocurrency Assets | Over 30 |

| Leverage | 500:1 |

| Customer Support | Email and live chat |

| Demo Account | Yes |

| Educational Content | Educational articles and market research section |

| Mobile App Availability | iOS and Android |

| Regulation | FSA, FSCA, BCR, and FSC |

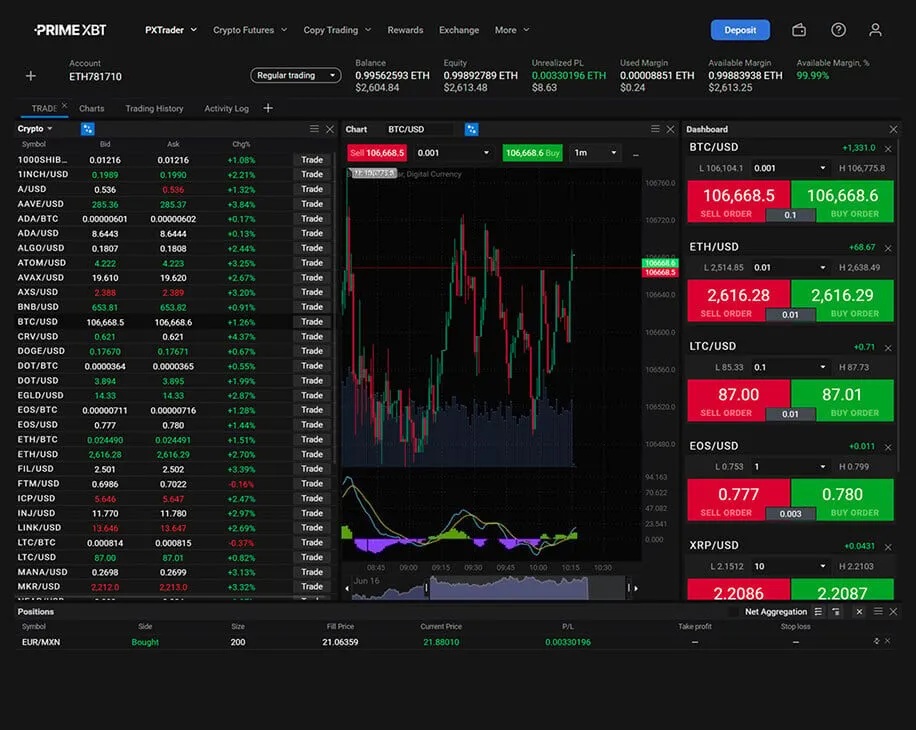

3. Bisq – Best for no KYC P2P trading

Bisq easily takes our 3rd spot at WR Trading as the best decentralized peer-to-peer (P2P) exchange designed specifically for privacy-focused traders. It operates without central custody, meaning users always retain control of their funds. Trading takes place directly between peers using multisignature Bitcoin addresses, and accounts require no registration, identification, or central approval.

We liked how much flexibility Bisq offers with over 100 supported assets for those who value privacy above speed. The platform charges a 1.3% fee for BTC-based trades or a 0.65% fee for BSQ-based trades, keeping costs reasonable considering the added security of decentralization. We felt safe trading on Bisq as it runs on open-source software, so traders can review the code and verify how transactions are handled, building trust through transparency.

In our opinion, Bisq’s privacy features are unmatched, but liquidity can be lower than on centralized platforms, and trade settlement may take longer because of Bitcoin network confirmation times. For traders who value full anonymity, self-custody, and decentralization, we highly recommend Bisq, as it remains one of the safest non-KYC environments in crypto.

| Feature | Bisq |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | No limit |

| Minimum Deposit | 0.001 BTC |

| Spreads and Commission | 1.3% BTC trading fee or BSQ trading fee of 0.65% |

| Trading Platforms | Bisq trading platform |

| Asset Types | P2P cryptocurrency |

| Tradable Cryptocurrency Assets | Over 100 |

| Leverage | Not available |

| Customer Support | Matrix bisq.chat and social media |

| Demo Account | No |

| Educational Content | In-depth FAQ section |

| Mobile App Availability | iOS and Android – only shows trade notifications |

| Regulation | Bisq is not regulated as it’s a decentralized P2P exchange |

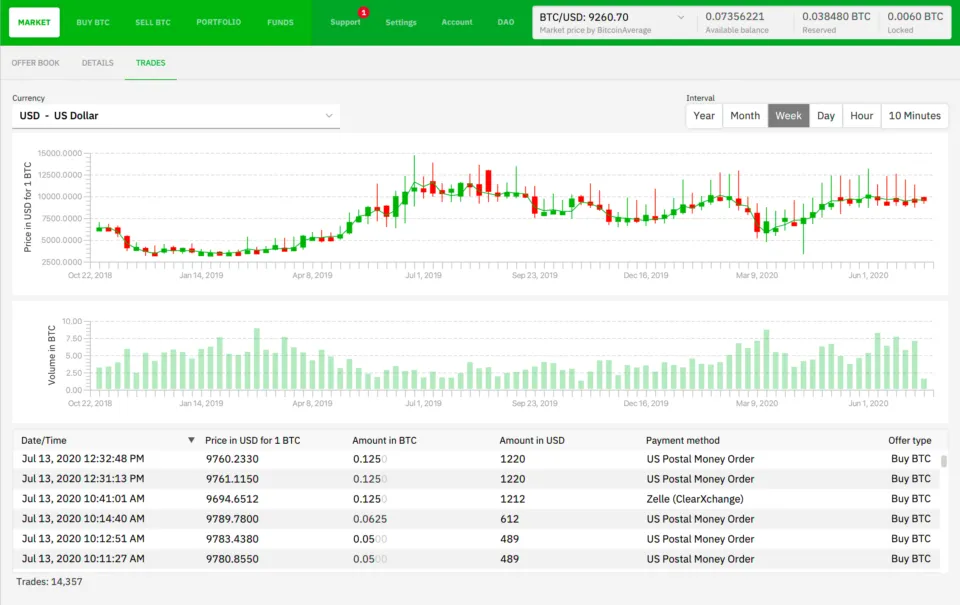

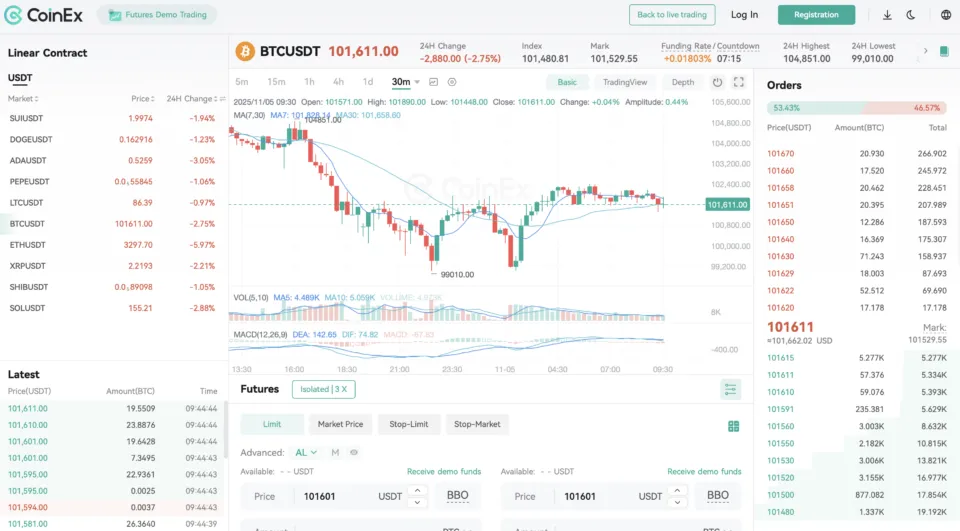

4. CoinEx – Best for wide altcoin selection and futures markets

CoinEx offers one of the broadest selections of tradable crypto assets among no-KYC exchanges, listing over 1,200 cryptocurrencies across spot, margin, and futures markets. It operates under the Estonian FIU and the Polish Ministry of Finance, giving it partial regulatory credibility while still allowing users to trade without mandatory verification for basic features.

The exchange provides leverage up to 100:1, with maker and taker fees starting at 0.2%, reduced further when holding CET tokens. CoinEx also features a clean, user-friendly platform on desktop, iOS, and Android with excellent liquidity on major pairs.

We found the exchange to be very beginner-friendly because CoinEx Academy provides guides and tutorials that help traders understand futures, funding rates, and market indicators more clearly. The main drawback of using CoinEX is that no-KYC users can withdraw only up to $10,000 per day, higher limits and fiat gateways require identity verification.

| Feature | CoinEx |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | $10,000 |

| Minimum Deposit | No minimum deposit, depends on the deposit method |

| Spreads and Commission | From 0.2% maker and 0.2% taker fees, lowers depending on if you hold the CET token |

| Trading Platforms | CoinEx trading platform |

| Asset Types | Spot cryptocurrency, crypto margin trading, futures cryptocurrency, and P2P cryptocurrency |

| Tradable Cryptocurrency Assets | Over 1,219 |

| Leverage | 100:1 |

| Customer Support | Email and live chat |

| Demo Account | Yes |

| Educational Content | CoinEx Academy |

| Mobile App Availability | iOS and Android |

| Regulation | Polish Ministry of Finance as a VASP Register, and FIU from Estonia |

5. Best Wallet – Best decentralized crypto wallet for no KYC swaps

Best Wallet is a decentralized crypto wallet that lets users buy, swap, and hold thousands of cryptocurrencies directly from their wallet, all without any KYC checks. The app connects to major decentralized exchanges, like SushiSwap or Uniswap, through a DEX aggregator, ensuring users always get the best swap rates across multiple liquidity pools.

There is no need to deposit or withdraw funds to any DEXs or CEXs since all assets remain under the wallet holder’s control. Network and aggregator fees apply during swaps, and gas fees depend on blockchain congestion. Best Wallet’s interface is simple and clean, making it easy for users to perform swaps, manage tokens, and interact with Web3 applications across multiple chains.

We liked using Best Wallet because it’s non-custodial and never holds user funds, eliminating centralized risk. However, this also means users must back up their private keys securely. Also, the wallet is mainly used for holding or doing simple trades, so more advanced features like leverage trading are unavailable.

| Feature | Best Wallet |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | No limit |

| Minimum Deposit | No minimum deposit, depends on the deposit method |

| Spreads and Commission | Swaps route via a DEX aggregator, so you pay DEX/aggregator fees plus network gas; on-ramp fees vary by provider. |

| Trading Platforms | Best Wallet App |

| Asset Types | Cryptocurrency |

| Tradable Cryptocurrency Assets | Over 1,000 |

| Leverage | Not available |

| Customer Support | Email, FAQs, and social media |

| Demo Account | No |

| Educational Content | FAQ section |

| Mobile App Availability | iOS and Android |

| Regulation | Not regulated |

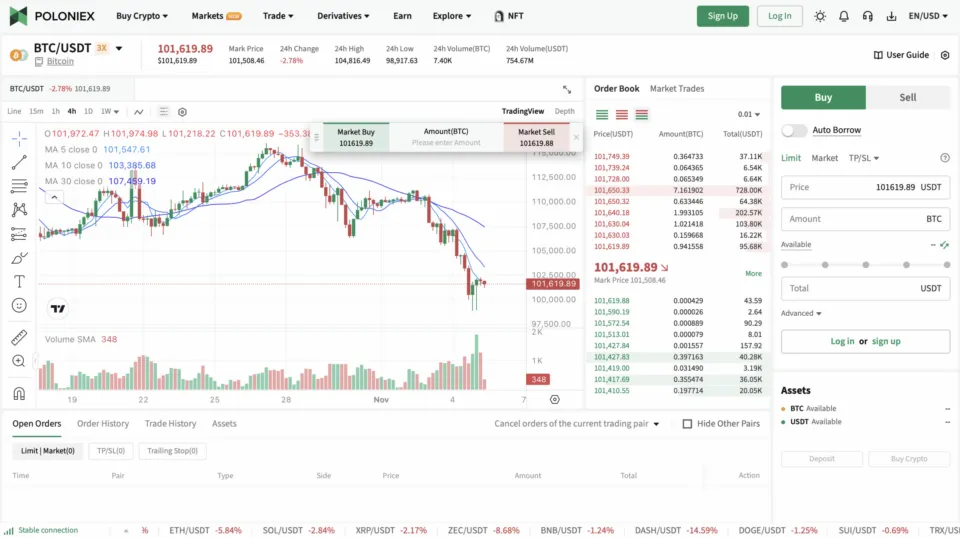

6. Poloniex – Best for altcoin spot trading with simple maker-taker fees

Poloniex is a long-running exchange founded in 2014 that impressed us with its legacy reputation with modern no-KYC functionality. Users can trade over 760 cryptocurrencies instantly after registering with just an email address, with leverage up to 100:1 for futures markets. Its fee structure starts at 0.2% maker and 0.2% taker, with lower rates for traders holding TRX or HTX tokens.

The platform’s trading interface is simple but effective in our experience, supporting real-time data, charting, and a wide selection of altcoin pairs. Customer support is available through live chat, and the Poloniex blog provides educational material for traders looking to refine their strategies.

Withdrawals are capped at $10,000 daily for non-verified users, which suits most retail traders seeking privacy and flexibility, but can be a limit for those with larger crypto balances. Although it is not regulated, Poloniex maintains stable operations and a large liquidity pool on major pairs. We recommend Poloniex for altcoin traders who value convenience, anonymity, and straightforward spot trading.

| Feature | Poloniex |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | $10,000 |

| Minimum Deposit | No minimum deposit, depends on the deposit method |

| Spreads and Commission | From 0.2% maker and 0.2% taker fees, lowers depending on if you hold TRX or HTX |

| Trading Platforms | Poloniex trading platform |

| Asset Types | Spot cryptocurrency, crypto margin trading, futures cryptocurrency, and P2P cryptocurrency |

| Tradable Cryptocurrency Assets | Over 763 |

| Leverage | 100:1 |

| Customer Support | Email, FAQs, and live chat |

| Demo Account | No |

| Educational Content | Poloniex blog |

| Mobile App Availability | iOS and Android |

| Regulation | Not regulated |

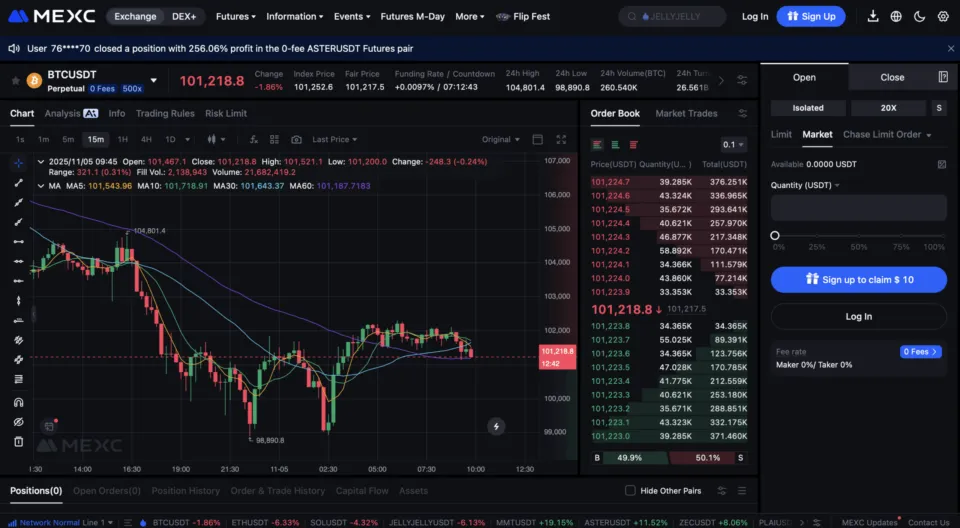

7. MEXC – Best for perpetual futures and frequent new listings

MEXC is our best exchange for the highest leverage and broadest asset selection of any no-KYC exchange. Traders can access leverage up to 500:1 and trade over 1,800 cryptocurrencies, including newly listed coins that appear before most major exchanges. We found its fee model extremely competitive, starting at 0% maker and 0.05% taker, with further reductions for MX token holders.

The platform’s futures section features an advanced layout, allowing users to customize chart indicators, order types, and margin settings. A demo account is available for practice that we recommend beginners to start with, and MEXC Learn offers detailed guides on perpetual contracts, funding rates, and liquidation management. However, daily withdrawal limits for unverified users are low at $1,000, and only crypto can be transferred.

| Feature | MEXC |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | $1,000 |

| Minimum Deposit | $10 |

| Spreads and Commission | From 0% maker and 0.0500% taker fees, lowers to 0.0250% ~ 0.0400% depending on if you hold the MX token |

| Trading Platforms | MEXC trading platform |

| Asset Types | Cryptocurrency, P2P cryptocurrency, and cryptocurrency futures |

| Tradable Cryptocurrency Assets | Over 1,830 |

| Leverage | 500:1 |

| Customer Support | Email, live chat, and help center |

| Demo Account | Yes |

| Educational Content | Learn section |

| Mobile App Availability | iOS and Android |

| Regulation | Estonian Financial Intelligence Unit, licensed as a VASP |

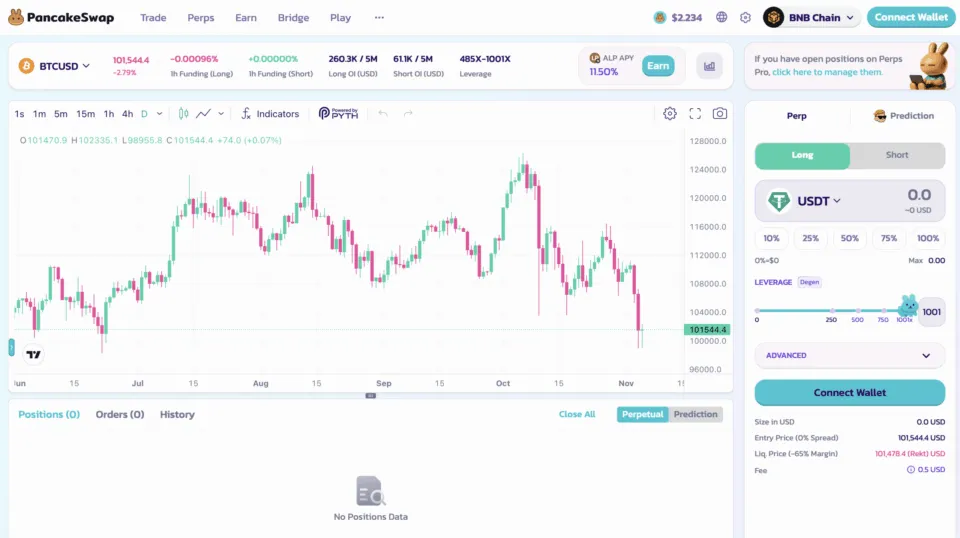

8. PancakeSwap – Best for low-fee BNB Chain token swaps

PancakeSwap is the leading decentralized exchange on the BNB Smart Chain, giving traders complete control of their funds without any verification. It allows users to trade, stake, and provide liquidity with thousands of tokens while connecting directly through a self-custodial wallet.

Trading fees are fixed at 0.25% on V2, while V3 offers flexible fee tiers ranging from 0.01% to 1%, depending on pool selection. This makes PancakeSwap highly cost-efficient for those trading smaller BNB-based tokens. Since all funds stay in the connected wallet, there are no withdrawal limits or centralized custody risks.

PancakeSwap’s decentralized model ensures global accessibility, but it requires more technical skills as users must understand how to manage wallets, gas fees, and network settings manually. For those comfortable with DeFi, Pancake Swap is our best DEX, offering low-cost and permissionless crypto swaps.

| Feature | PancakeSwap |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | No withdrawal limit as funds are kept on a crypto wallet |

| Minimum Deposit | No deposit needed, as coins are kept in your crypto wallet |

| Spreads and Commission | 0.25% trading fee on V2, while Exchange V3 allows users to choose between fee tiers of 0.01%, 0.05%, 0.25%, and 1% |

| Trading Platforms | Pancake Swap trading platform |

| Asset Types | Cryptocurrency swaps and cryptocurrency perps |

| Tradable Cryptocurrency Assets | Over 1,194 |

| Leverage | 100:1 |

| Customer Support | FAQs and PancakeSwap’s Telegram channel |

| Demo Account | No |

| Educational Content | Pancake Swap Blog |

| Mobile App Availability | Not available |

| Regulation | Not regulated |

9. Uniswap – Best for Ethereum and multi-chain swaps with deep liquidity

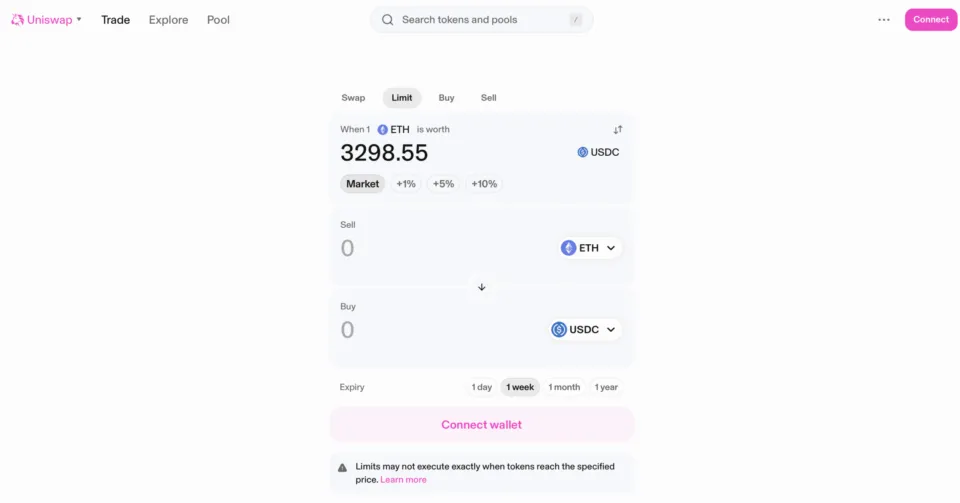

Uniswap is the largest and easiest decentralized exchange to use on the Ethereum network, offering complete privacy and self-custody for crypto trading. It allows users to connect their wallets, such as MetaMask or Coinbase Wallet, and trade over 2,000 tokens instantly without signing up or submitting any personal information.

Fees depend on the chosen liquidity pool, with V3 tiers set at 0.01%, 0.05%, or 1%. Swaps execute directly on-chain, giving traders complete control of their assets and ensuring transparency. The platform also supports multiple networks, including Arbitrum, Optimism, and Polygon, allowing faster and cheaper transactions.

However, since Uniswap is non-custodial, users are responsible for managing their private keys and gas fees, which can be tricky to manage for complete beginners. There is a detailed help center that provides guides on how to get started, which was helpful while we were testing the decentralized exchange.

| Feature | Uniswap |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | No withdrawal limit as funds are kept on a crypto wallet |

| Minimum Deposit | No deposit needed, as coins are kept in your crypto wallet |

| Spreads and Commission | V3 trading fee tiers 0.01%, 0.05%, and 1%. V4 trading fees from 0% to 100% |

| Trading Platforms | Uniswap trading platform |

| Asset Types | Cryptocurrency swaps |

| Tradable Cryptocurrency Assets | Over 2,000 |

| Leverage | Not available |

| Customer Support | Live chat, email, and FAQs |

| Demo Account | No |

| Educational Content | Detailed guides in the Help Center |

| Mobile App Availability | Not available |

| Regulation | Not regulated |

10. Raydium – Best for trading Solana coins with no KYC

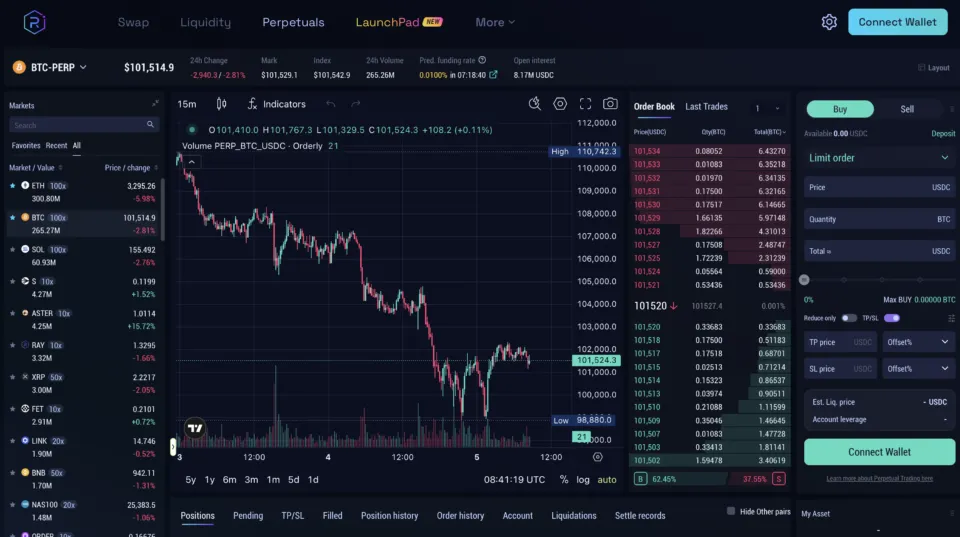

Raydium operates on the Solana blockchain, offering fast, fee-efficient trading for users who want full privacy and control trading SOL coins. It connects directly to self-custodial wallets such as Phantom or Solflare and enables trading of over 1,200 Solana-based tokens with no KYC required.

Fees on standard AMM pools are 0.25%, while Concentrated Liquidity Market Maker (CLMM) pools offer variable fees ranging from 0.01% to 2%. Raydium’s interface integrates directly with Solana’s Serum order book, ensuring deep liquidity and rapid transaction confirmation times that outperform most Ethereum-based DEXs.

As a decentralized exchange, Raydium does not hold user funds, making it inherently safer from centralized risks but fully reliant on user wallet security. Also, we liked that Raydium is one of the only DEXs that offer leveraged crypto trading up to 50:1, allowing us to increase our positions during our trading tests.

| Feature | Raydium |

|---|---|

| Requires KYC? | No |

| Daily Withdrawal Limit Without KYC | No withdrawal limit as funds are kept on a crypto wallet |

| Minimum Deposit | No deposit needed, as coins are kept in your crypto wallet |

| Spreads and Commission | Standard AMM pools have a trading fee of 0.25%. CLMM pools have one of eight fee tiers – 2%, 1%, 0.25%, 0.05%, 0.04%, 0.03%, 0.02%, and 0.01%. |

| Trading Platforms | Raydium trading platform |

| Asset Types | Cryptocurrency swaps and cryptocurrency perpetuals |

| Tradable Cryptocurrency Assets | Over 1,259 |

| Leverage | 50:1 |

| Customer Support | Public docs and community channels like Discord |

| Demo Account | No |

| Educational Content | Radium docs that contain guides |

| Mobile App Availability | Not available |

| Regulation | Not regulated |

6 Easy Steps To Trade Crypto Without KYC

Quick Steps to Trade Crypto Without KYC:

To trade crypto without KYC, you only need to follow our 6 simple steps. Pick a crypto exchange without KYC, you can choose one of our options, as we’ve already done the research for you. Then, register your crypto trading account using just an email and a strong password, and enable two-factor authentication for added safety.

Next, fund the account by depositing cryptocurrency directly into your exchange wallet, since fiat deposits usually require verification. Once funded, start trading by going to the trading interface and selecting your preferred pair, such as BTC/USDT or ETH/USDT, and then inputting how many coins you want to exchange. Once you’ve completed these steps, you can then buy or sell crypto without KYC and track performance directly from the trading dashboard. When you finish trading, withdraw your profits instantly to your private wallet to stay in full control of your funds.

Every exchange was reviewed for its trading performance, fee structure, and stability during live market conditions. We also examined how efficiently each platform processes deposits and withdrawals, how well liquidity holds up during volatile periods, and how secure user funds remain in non-custodial or exchange wallets.

Furthermore, account setup, order execution speed, and interface design were tested on desktop and mobile to ensure a smooth experience without verification delays. Each platform had to prove that users can trade privately while maintaining access to full functionality.

1. Pick a Crypto Exchange Without KYC

Finding a no-KYC exchange is the first step toward quick, private access to digital assets. Many platforms promise sign-ups requiring only an email address, but you should verify whether these claims are true. Read user experience reviews to spot any hidden identity checks or restrictions that appear later. Reading community feedback on deposit reliability, withdrawal limits, and overall platform stability provides a sense of the exchange’s transparency.

Also, look at other aspects that affect the trading experience, as you want the exchange to feature all your needed tools and cryptos. Check the variety of trading pairs, liquidity, trading tools, and fee structure. Exchanges with higher daily volumes usually have tighter spreads, which means smaller differences between buy and sell prices.

We recommend using Bitunix and PrimeXBT (for more brokers, jump to the beginning or end of the article) for No KYC Crypto Trading:

- Bitunix: Offers hassle-free sign-up and straightforward trading without identity checks. Provides a user-friendly interface, plus a range of crypto pairs for quick, private transactions.

- PrimeXBT: Allows up to $20,000 in deposits without asking for personal documents. Combines leveraged trading options with no-KYC onboarding for greater flexibility and privacy.

- No KYC Crypto Exchange

- Fast account opening

- Leverage Trades up to 125x

- Crypto Futures and Spot Trading

- Free Deposit Bonus

- Low Minimum Deposit: Only 0.001 BTC

- Spreads from 0.1 Pips

- Leverage up to 1:500 for crypto and 1:1000 for forex

- Multi-asset trading platform with crypto, forex, and commodities

- No KYC required for most account setups

- Integrated copy trading feature for novice traders

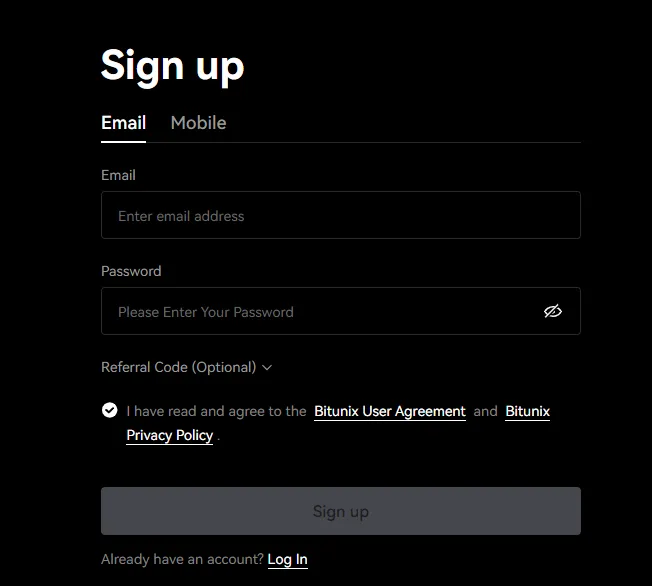

2. Register Your Crypto Trading Account

Opening an account on a no-KYC platform involves supplying an email address and creating a secure password. A verification email might arrive to confirm ownership, and clicking the link completes the setup. This quick approach is opposite to regulated exchanges that demand government documents, photos, or video calls. The minimal process appeals to many who prefer not to share personal data online.

Also, most platforms allow optional security features at sign-up. Enabling two-factor authentication (2FA) creates an extra layer of protection since a code from a mobile device is required at login. Some exchanges also let you lock withdrawals to addresses you approve in advance. Adding these measures helps keep funds safe, especially on platforms that do not request official identification during registration.

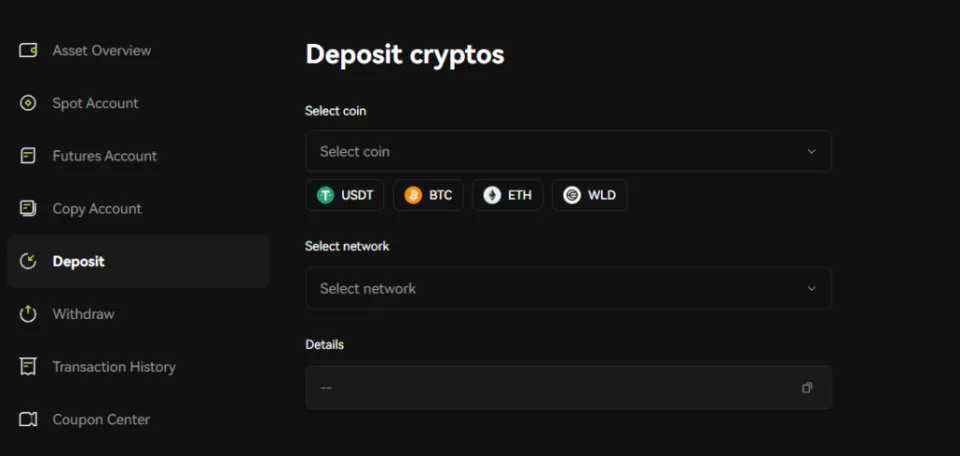

3. Fund The Account

Next, transfer funds into your account using a crypto wallet, as fiat currency deposits usually require completing a KYC. When sending crypto to your exchange wallet, select the right coin and its matching blockchain. Sending ETH over the ERC-20 network to an ERC-20 deposit address avoids costly mistakes, and the same principle applies to other tokens. Sending tokens to the wrong address or using the incorrect blockchain will lead to a total loss of funds.

Once the exchange provides a deposit address, copying or scanning it accurately lowers the risk of misdirected transfers.

Watching the transaction status requires checking a block explorer, where blocks and confirmations show progress. Some coins confirm faster than others, so deposits can vary depending on the blockchain. Once the required number of confirmations is reached, the deposited amount appears in your account balance. At this point, the platform’s trading features become available, allowing you to proceed to the next steps.

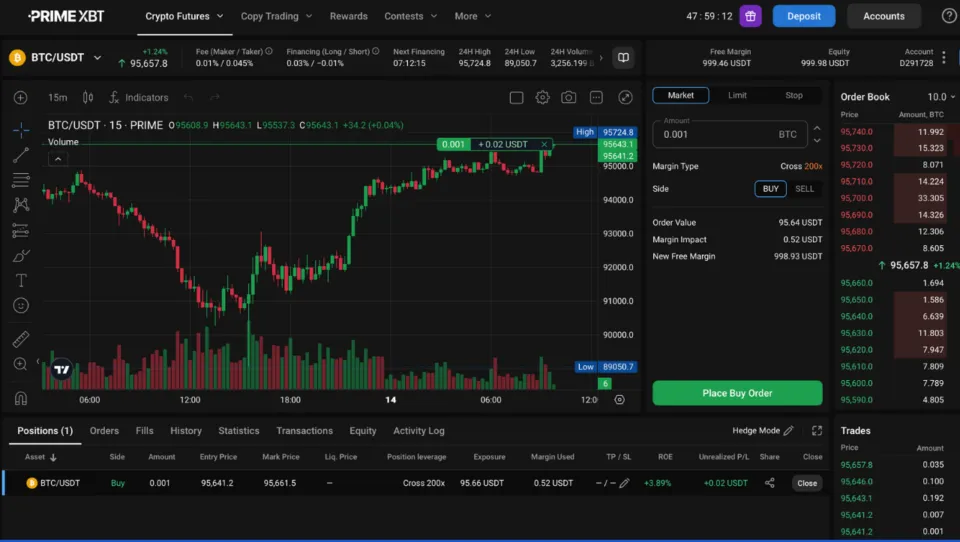

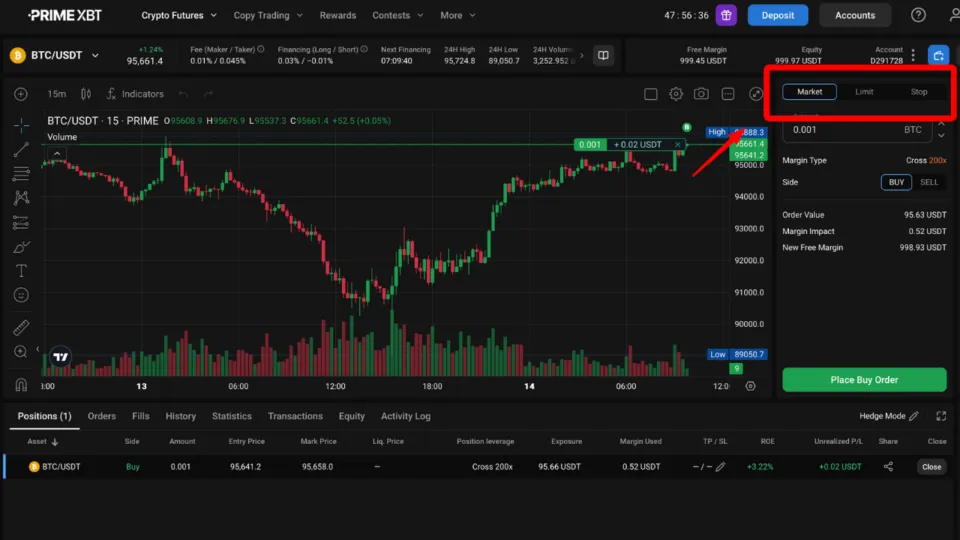

4. Start Trading

Navigate to the trading interface of your chosen cryptocurrency exchange; this is usually a tab at the top of the website. The trading interface displays price charts, order books, and a list of supported trading pairs. Spot trading is the simplest method for those new to digital assets. It involves purchasing the actual coin and holding it in your exchange wallet or eventually transferring it to a personal wallet. A spot market interface might offer market, limit, or stop orders. Market orders execute at the current best price, while limit orders let you aim for a more favorable rate.

You’ll want to complete your technical analysis by reviewing price movements and indicators. This can help spot trends and predict future price movements. Some beginners track support and resistance levels on the chart, which are points in price history that may cause the market to stall or reverse. Rather than rushing into trades based on quick price jumps, setting a trading plan and possibly starting with small amounts can ease the learning process. This helps establish familiarity with the exchange and reduces the likelihood of error.

Expert Experience on Trading With No KYC Exchanges

The main challenge I encountered was learning to balance speed with safety as these platforms operate without traditional regulation. Therefore, I always had to transfer funds to a private wallet after trading to avoid leaving large balances on the exchange, which was tedious as many exchanges set withdrawal limits. What I enjoy most about trading on no-KYC platforms is the control it gives me. I can move funds instantly, trade anonymously, and avoid unnecessary verification delays.

5. Buy Or Sell Crypto Without KYC

Once you’ve completed your technical analysis and are ready to set a trade, follow these steps:

- Find the trading dashboard: Look for the “Trade,” “Exchange,” or “Markets” tab. This page shows a real-time price chart, an order book listing current bids and asks, and a list of available trading pairs. Many platforms also display your account balance near the order forms, making it easier to see how much capital you can use.

- Pick the correct trading pair: Check that the pair matches the currency you funded and the coin you want to trade. For example, if you deposited USDT and plan to acquire BTC, select BTC/USDT. Getting the pair right ensures accurate pricing and immediate order matching.

- Select order type: A market order fills at the best available price. A limit order waits until the market moves to your target price. Beginners often use market orders for simplicity, while experienced traders might use limit orders to control cost or lock in a specific entry.

- Specify the amount: Decide how many coins or how much of your balance to commit. The order form usually shows a preview of cost, fees, or the total quantity received. Reviewing these details avoids unintentional trades.

- Buy crypto without KYC: Double-check the information, then complete the transaction. A successful buy or sell instantly updates your wallet balance. Most platforms log each trade in a transaction history page, which you can reference later for recordkeeping or tax purposes.

6. Withdrawal Profits

The final step is to transfer gains back to a personal wallet. Access the withdrawal page, select the coin you want to withdraw, and paste your external wallet address. It is essential to be precise with the address and network. A mismatch, such as sending a BEP-20 token to an ERC-20 address, could result in permanent loss. Many no-KYC exchanges also specify a minimum withdrawal amount or fee.

When finalizing the withdrawal, it’s common to need a confirmation code via email or 2FA. This adds a layer of protection if someone gains access to your account. Once you confirm, the transaction will be processed on the blockchain, and you can track its progress through a block explorer. Testing with a small withdrawal before moving large sums can help confirm that everything works as expected.

What Does KYC Mean on Crypto Exchanges?

Know Your Customer (KYC) is a common process in crypto exchanges used to verify and monitor client identities. Exchanges that follow strict KYC rules ask for government-issued identification and personal details to fulfill anti-money laundering (AML) and counter-terrorism financing (CTF) requirements. Those rules can vary by location and are often enforced by financial regulatory agencies. Exchanges that operate with full compliance are recognized as safer by traditional institutions since they must follow a stricter set of guidelines.

KYC can increase trust among users who appreciate the accountability measures. On the other hand, some individuals object to handing over too much personal information. They may cite privacy concerns or a desire to avoid the risk of data breaches.

There have been examples of hacking incidents where criminals obtained user data from compromised exchanges, resulting in identity theft or fraud. This is why many choose no-KYC options, seeing them as safer for preserving personal privacy in the long run.

What Is the Risk When Trading Crypto Without KYC?

While trading on a no-KYC exchange is great for privacy, there are some negatives you should know about before trading. In our expert opinion, here are the main risks of trading crypto without KYC:

- Less-known exchanges may skip or not have up-to-date security checks, making them potential targets for hacking. Without top-tier protocols, user funds can be more vulnerable.

- Exit schemes are a huge possibility, especially if the platform is crypto-only. Operators can vanish with deposited assets, and tracking or recovering funds is difficult since crypto transfers are irreversible.

- Liquidity can be inconsistent as fewer traders use non-KYC exchanges compared to tier-1 exchanges, so larger trades might slip into unfavorable price points. Monitoring order books beforehand can reduce slippage.

- Customer support on no-KYC sites may be slow to respond, especially if operators do not have a large support staff. Complex issues can linger unresolved, which is not ideal when dealing with investments.

- Stolen accounts are problematic because there is no ID-based recovery. Weak passwords or zero 2FA leave accounts wide open to unauthorized transfers.

- Exchange policies can shift abruptly, making users comply with new verification rules or face frozen balances.

- National regulators like CySEC might later classify no-KYC trading as illegal. That can lead to IP bans or forced closures, making access difficult.

- Lack of oversight means any shady activities, such as wash trading or price manipulation, go unreported. This can distort market data and trick unsuspecting traders.

Pros and Cons of No KYC Crypto Trading

Pros

- Fast sign-up with no personal documents

- Stronger privacy protection for personal identity

- Avoidance of data breaches that compromise sensitive info

- Faster deposits and withdrawals without extended checks

- Can be accessible in places that restrict crypto trading

- Removes the hassle of repeated identity checks

- Straightforward user interfaces on many no-KYC sites

- Allows quick testing of multiple exchanges to find the best fit

- Good for short-term traders who need to move quickly

- Reduces friction for obtaining access to niche tokens

Cons

- Reduced or nonexistent regulatory oversight

- Harder to pursue legal claims in case of dispute

- Support channels might be limited or less responsive

- Some platforms might restrict service in major jurisdictions

- Limited or no fiat currency deposit options

- Potential risk of exit scams or untrustworthy operators

- Lower daily or monthly withdrawal limits on some platforms

- Can result in fewer supported coins than major platforms

- Lower liquidity on certain lesser-known no-KYC exchanges

- Fewer advanced trading tools like margin or derivatives on some

Is Crypto Trading Without KYC Legal?

Yes, trading crypto without identity checks is allowed. Some jurisdictions encourage regulation through licensed providers, yet there is no universal law that bans platforms that skip traditional verification. Approaches can vary between regions, with certain nations taking a more permissive stance while others prefer tighter oversight.

Can I Trade Crypto Without KYC in the US?

Yes, you can trade crypto without KYC in the US but it’s complicated because many platforms block American IP addresses to avoid legal disputes. The United States imposes stringent rules around financial services, and regulators like the CFTC or SEC closely monitor crypto exchanges. Operators seeking to remain completely unverified often exclude US users to limit liability.

Some Americans still trade on no-KYC sites through alternative network solutions that mask location details. This path can be risky if a platform detects unauthorized access or if regulations tighten further. The overlap of federal and state-level rules adds more complexity, especially around areas like taxes and securities laws.

Is It Possible to Trade Crypto With Leverage and Without KYC?

Yes, it’s possible to trade crypto leverage without KYC on centralized exchanges in most cases. These platforms require users to complete a questionnaire to demonstrate their understanding of leverage trading. Answering correctly will open the leverage trading display, but if you get the answers wrong, you’ll have to redo this quiz until you get it right.

Bitunix, Prime XBT, and CoinEx do allow leverage trading without performing a KYC check.

On the other hand, DEXs, like dYdX, allow leveraged trading without identity checks. They operate through smart contracts and self-custodial wallets, so traders only need a compatible wallet to connect and manage positions. Transactions are governed through algorithms on the blockchain rather than a central entity.

How to Pay Taxes on Crypto Non-KYC Trades?

Tax obligations are based on profit, not on how those funds were obtained or which platform was used. Government finance agencies often care about the difference between the value at purchase and the value at sale, also referred to as capital gains. No-KYC trading does not erase the responsibility to report gains on personal income taxes. This point catches new traders off guard because they assume that anonymity means no compliance.

Maintaining accurate trading logs is how to properly report gains and losses. Traders might need to note the date of acquisition, the coin type, the amount, and the price in fiat terms. That can be more challenging with no-KYC platforms, as they might not provide official statements or convenient tax documents. Using specialized crypto portfolio tracking services or manually creating spreadsheets can help track gains for tax requirements.

Can Authorities Stop No-KYC Crypto Exchanges?

Yes and no. Regulators have tools to restrict traditional banking relationships, seize domain names, or block known IP addresses, which can disrupt no-KYC platforms. Payment channels connecting these sites to fiat currencies might be cut off, leaving crypto-only transfers as the sole option. These measures can make platforms difficult for casual users to access.

Furthermore, some no-KYC exchanges shift their operations to countries with few crypto restrictions or use decentralized systems that do not rely on a single server. Their ability to rebrand or move to new domains gives them a degree of flexibility. Traders often use VPNs or proxy services to reach these platforms despite local blocks. A cycle develops where authorities enact new limitations, and exchanges adapt methods to remain online.

Conclusion: Crypto Trading Without KYC Is Possible

After testing many platforms, we found that no-KYC exchanges deliver the best trading experience and the most private way to trade crypto anonymously. The ability to register with just an email, deposit funds instantly, and withdraw profits freely gives traders full control over their assets. Exchanges such as Bitunix and PrimeXBT stood out during our review for their smooth interfaces, strong liquidity, and wide asset selection, proving that a comprehensive trading experience and security can coexist even without ID verification.

At WR Trading, we value transparency and real results, which is why every platform featured in our list was tested by experts under live trading conditions. Our experience showed that no-KYC trading can be efficient and reliable when approached with the right balance of privacy and risk management. Consider trying out our vetted exchanges for secure crypto trading without having to give up your personal details.

Also, check our article about Forex Trading without KYC to get knowledge about the regulation.

Once again, these are the Top 10 Crypto Brokers to trade without KYC:

- Bitunix – Best overall No-KYC Crypto Exchange for high-leverage crypto futures trading

- PrimeXBT – Best for high daily withdrawal of $20,000 with no KYC

- Bisq – Best for no KYC P2P trading

- CoinEx – Best for wide altcoin selection and futures markets

- Best Wallet – Best decentralized crypto wallet for no KYC swaps

- Poloniex – Best for altcoin spot trading with simple maker-taker fees

- MEXC – Best for perpetual futures and frequent new listings

- PancakeSwap – Best for low-fee BNB Chain token swaps

- Uniswap – Best for Ethereum and multi-chain swaps with deep liquidity

- Raydium – Best for trading Solana coins with no KYC

Frequently Asked Questions:

Do No-KYC Exchanges Enforce Trading Limits on Unverified Users?

Yes, many exchanges have certain deposit or withdrawal caps. PrimeXBT allows deposits of up to $20,000 without verification, while others impose minimal restrictions and may limit withdrawals per day. Checking the specifics on the exchange’s website is a good starting point, as trading platforms have different limits.

Is Anonymity Guaranteed When Trading on No-KYC Platforms?

Anonymity can be enhanced, but blockchain transactions are generally transparent. The exchange itself might not link trades to specific personal information, yet external analytics tools can trace public wallet addresses. Additional privacy steps, such as privacy-centric coins or mixers, might be required to obscure transaction paths further, though that can come with legal and technical complexities.

Can I Deposit My Local Currency Directly Onto No-KYC Platforms?

Quite a few no-KYC exchanges are limited to crypto deposits and withdrawals. Any platform offering direct fiat deposits or withdrawals often partners with payment services that require at least minimal user verification. This is why many users prefer to buy cryptocurrency elsewhere, then deposit it into the no-KYC platform.

Can No-KYC Exchanges Suddenly Require Me to Verify My Identity?

Yes, there is always a possibility. Changes in local regulations or the exchange’s own policies can force them to adopt verification at a later stage. That scenario could freeze user funds until they comply with new requirements. Staying aware of announcements and reading the Terms of Service might provide insights into how likely this is.

Do No-KYC Exchanges Sometimes Get Shut Down?

Yes, there have been instances where certain no-KYC platforms vanished, either because of regulatory pressure, hacking incidents, or fraudulent practices. Therefore, you should not store large amounts of crypto on any single exchange and regularly withdraw profits to personal wallets.