Forex trading strategies are a set of analytical rules that forex traders use to determine when or whether to buy or sell a currency pair. Since market conditions are often influenced by factors like economic data, you need to diversify your trading strategy. Whether you’re a beginner or a seasoned trader, you need trading strategies to achieve your set goals. Here’s a list of our top 10 advanced forex trading strategies, along with their features:

These are the best advanced Forex Trading Strategies

- Carry trades: Capitalizes on the difference in interest rate between currency pairs for long-term profits.

- Forex future scalping with footprint charts and order book (order flow trading): Use real-time order flow data to execute precise short-term trades.

- Reversal trading with technical analysis: Capitalizes on spotting trend reversals using key indicators like candlestick patterns or RSI.

- Algorithmic trading with VWAP (buying/selling in the range of VWAP): Uses the Volume-Weighted Average Price to execute trades within specific price ranges.

- News trading: Leverage market volatility during news events to capitalize on rapid price movements.

- Arbitrage trading: Leverage price inefficiencies between brokers or markets for low-risk profit opportunities.

- Fundamental macro trading: Base trades on macroeconomic factors and long-term trends like GDP growth.

- Bonds spread trading: Trade on the correlation between bond yield spreads and currency movements for predictive insights.

- Market sentiment analysis: Use tools like the Commitment of Traders (COT) report for market direction.

- Grid trading strategy: Set up a grid of buy and sell orders to profit from market fluctuations in trending and ranging markets.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

List of 10 Top Advanced Forex Trading Strategies

#1 Carry Trades in Forex

| Aspect | Carry Trades |

|---|---|

| Timeframe | Long-term (1 Month to 1 Year+) |

| Costs | Low (Swap Costs – 0.1% – 0.5%) |

| Leverage | Moderate (1:10 to 1:30) |

| Risk | Interest rate changes, currency depreciation |

| Profit Technique | Profit from interest rate differentials between currencies |

Carry trade is one of the most popular strategies professionals use to profit from the interest-rate differential between two currencies in the financial market. In this strategy, traders borrow at low interest rates and invest the proceeds in a financial asset with a higher interest rate.

For example, a trader may borrow Swiss franc (CHF) at a 0.5% interest rate to buy Australian government bonds yielding 5%. The trader will profit from the 4.5% interest rate differential if the exchange rate remains the same. However, it is important to note that the specific currencies involved in carry trade depend on global monetary policies and economic conditions.

Like any other trading strategy, carry trades have its benefits and risks attached. Because carry trades involve borrowing, it is easy for investors to use leverage to boost their potential returns. But in the event that the interest rate or currency pair trends move in the wrong direction, losses may outweigh the interest rate differential profit.

Although individual investors often engage in carry trades, they are more common among large institutional investors and hedge funds that can manage the associated risks. Some popular currencies used for carry trades are the Japanese Yen, New Zealand Dollar (NZD), Swiss Franc, and Canadian Dollar.

#2 Forex Future Scalping with Footprint Charts and Orderbook (Orderflow Trading)

| Aspect | Forex Future Scalping (Order Flow Trading) |

|---|---|

| Timeframe | Very Short-term (1 Minute to 3 Minutes) |

| Costs | High due to spreads (1% – 3%) |

| Leverage | High (1:50 – 1:100) |

| Risk | High volatility, market noise |

| Profit Technique | Requires quick execution and understanding of market depth and order flow |

Scalping is a short-term strategy in which traders open and close multiple trading positions to take large or small profits daily. Here, traders hold positions for a very short time and close them when they notice a favorable shift in the market. When applied to forex futures, scalping analyzes currency futures contracts instead of spot forex markets.

Traders using this strategy are highly disciplined and decisive decision-makers who want to avoid missing potentially profitable setups. The following are some of the tools and techniques we recommend scalpers master to refine decision-making:

- Footprint charts: These charts provide detailed insights into market activity within each candlestick by showing the traded volume at each price level. When the price reaches a resistance zone, the footprint chart shows the trader an increase in the sell-side volume at the bid.

- Order book analysis: Scalpers use order book analysis to view pending buy and sell orders. It shows the market liquidity zones that act as support or resistance. Scalpers use this information to predict price reactions and spot potential market breakouts.

- Order flow: Since order flow tracks executed trades, scalpers use this information to confirm market momentum. They time trades with aggressive buyers or sellers, so sudden shifts in order flow help them know the best market entries and exits.

#3 Reversal Trading with Technical Analysis

| Aspect | Reversal Trading With Technical Analysis |

|---|---|

| Timeframe | Short to medium-term (1 hour to 1 Week) |

| Costs | Moderate (0.5% – 1%) (Possible slippage) |

| Leverage | Moderate (1:10 – 1:50) |

| Risk | False signals, sudden market moves |

| Profit Technique | Involves identifying potential reversal points using indicators like RSI or MACD |

Reversal trading is also one of the most profitable strategies seasoned traders use. It is a change in the direction of the current price of a currency pair. Traders capitalize on shifts in this market momentum to identify moments of entry or exit of a trade. Some of the key indicators for reversals to predict the potential trend shift in the market are RSI and moving averages.

For example, let’s look at the EUR/USD currency pair. After a stable upward trend, suppose the pair reaches a high of 1.1100, which declines to a low of 1.090. This is an indication of a bearish reversal, and traders interpret this as the previous upward trend in EUR/USD losing its strength and a new downward trend beginning.

Traders who hold long positions in the pair may decide to sell to protect their profits if the price continues to decline. While the traders who follow trends might short to capitalize on the anticipated downward movement. At WR Trading, we recommend that traders combine technical tools and wait for a clear signal, like a candle pattern, to confirm a reversal before making a decision.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

#4 Algorithmic Trading with VWAP (Buying/Selling in Range of VWAP)

| Aspect | Algorithmic Trading with VWAP |

|---|---|

| Timeframe | Varies (typically intraday, 5 minutes to 6 hours) |

| Costs | Low to moderate (0.2% to 0.5%) |

| Leverage | Moderate (1:10 to 1:50) |

| Risk | System errors, market conditions |

| Profit Technique | Focuses on executing trades around the Volume Weighted Average Price for optimal pricing |

Algorithmic trading, or automated trading, is a trading strategy where traders use a computer program for automated trades. Here, the trader can generate profits faster than a human trader. The computer follows defined instructions based on price, timing, and a mathematical model required by the trader.

VWAP (Volume Weighted Average Price) is an algorithm used to assess the average price of a security, weighted by traded volume over a specific time. In algorithmic trading, VWAP is a reference point for executing trades because it provides a benchmark for comparing the current trade price against the day’s average trading price.

Traders can develop a range-based VWAP, identify buy or sell signals when the price breaches the range, and execute the trades to minimize slippage. This form of trading strategy faces challenges like market impact, and the rapid price shifts require optimization through techniques like regular backtesting.

#5 News Trading

| Aspect | News Trading |

|---|---|

| Timeframe | Short-term (5 minutes – 1 Hour) |

| Costs | Varies (can be as high as 3%) |

| Leverage | High (1:50 – 1:100) |

| Risk | Volatility spikes, unexpected outcomes |

| Profit Technique | Trades around economic news releases and requires quick execution |

News trading is a strategy traders use to keep track of market trends. Here, news traders use market sentiments to try and make profitable trades. In trading sessions, economic news and data are one of the major triggers of market volatility.

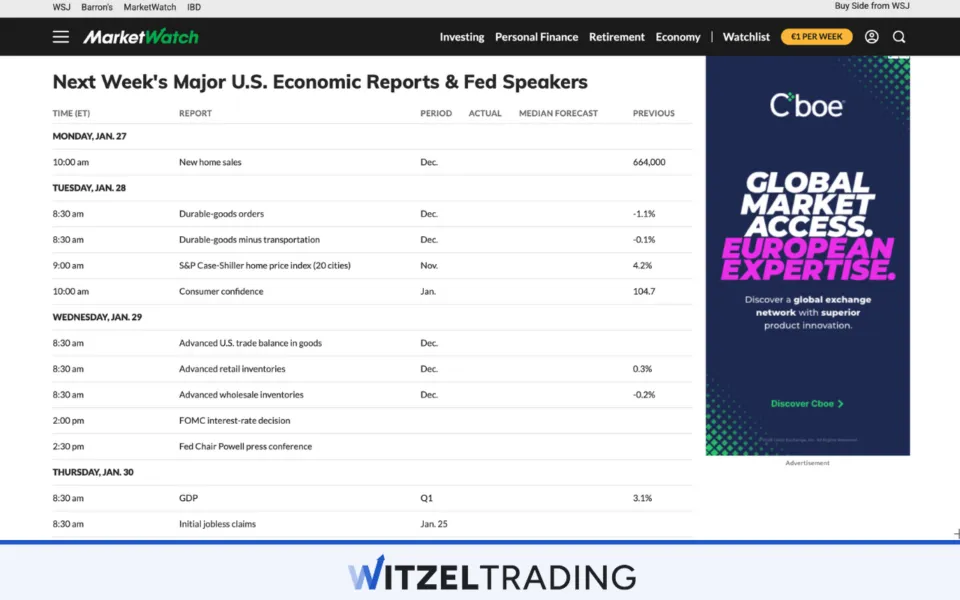

Traders plan trades around major announcements like interest rate decisions, Non-Farm Payrolls (NFP), and past data to further anticipate market reactions and set effective entry and exit levels.

Although news trading offers great opportunities for traders, it also has some risks due to market volatility. Some strategies traders use to reduce these risks include limit orders, avoiding overleveraging, and using stop-losses.

#6 Arbitrage Trading

| Aspect | Arbitrage Trading |

|---|---|

| Timeframe | Very short term (seconds to minutes) |

| Costs | Low |

| Leverage | High (1:50 – 1:100) |

| Risk | Execution delays, minimal profit margins |

| Profit Technique | Exploits price differences between brokers, echanges, or instruments. |

Arbitrage trading is one of the simplest trading strategies. It allows traders to find assets traded on different markets at different prices to make a profit. Opportunities for arbitrage trading often happen in almost all financial instruments like Options, Forex, and Shares.

Traders use this form of strategy when an asset is listed on exchanges in two countries. Due to the discrepancies in foreign exchange rates in both countries, the price of the asset can differ between the two exchanges.

For example, the EUR/USD currency pair is trading at 1.1050 on the London Forex market while it’s trading at 1.1065 on the New York Forex market. If you buy both the EUR/USD in the New York market and the EUR/USD in the London market, you could earn a profit of 0.0015. This price discrepancy helps traders exploit the difference between the two markets for profits.

The following are some of the different types of arbitrage trading, and they are:

- Statistical Arbitrage

- Triangular Arbitrage

- Retail Arbitrage

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

#7 Fundamental Macro Trading

| Aspect | Fundamental Macro Trading |

|---|---|

| Timeframe | Long-term (1 Month – 1 Year+) |

| Costs | Low (Spreads: 0.5 – 2 pips) |

| Leverage | Moderate (1:10 – 1:30) |

| Risk | Political/Economic risks and slow returns |

| Profit Technique | Based on economic data, monetary policies, and macroeconomic trends |

In macro trading, traders capitalize on profiting from analyzed economic data like inflation, GDP growth, and unemployment. Most macro traders continuously analyze the fundamental data published on economic calendars daily. They also focus on understanding how global economic trends and policies influence currency values.

For example, in October 2024, forex traders focused on the outcome of the ECB’s meeting due to its potential to influence interest rates in the Eurozone. Any sign of a shaky stance from the ECB president could negatively affect the euro’s value, while a positive stance might strengthen it.

#8 Bonds Spread Trading

| Aspect | Bond Spread Trading |

|---|---|

| Timeframe | Medium to Long-term (1 Week to 6 Months) |

| Costs | Low (0.5% to 1%) |

| Leverage | Moderate (1:10 – 1:30) |

| Risk | Interest rate risks, liquidity issues |

| Profit Technique | Profits from yield spreads between bonds and FX correlations |

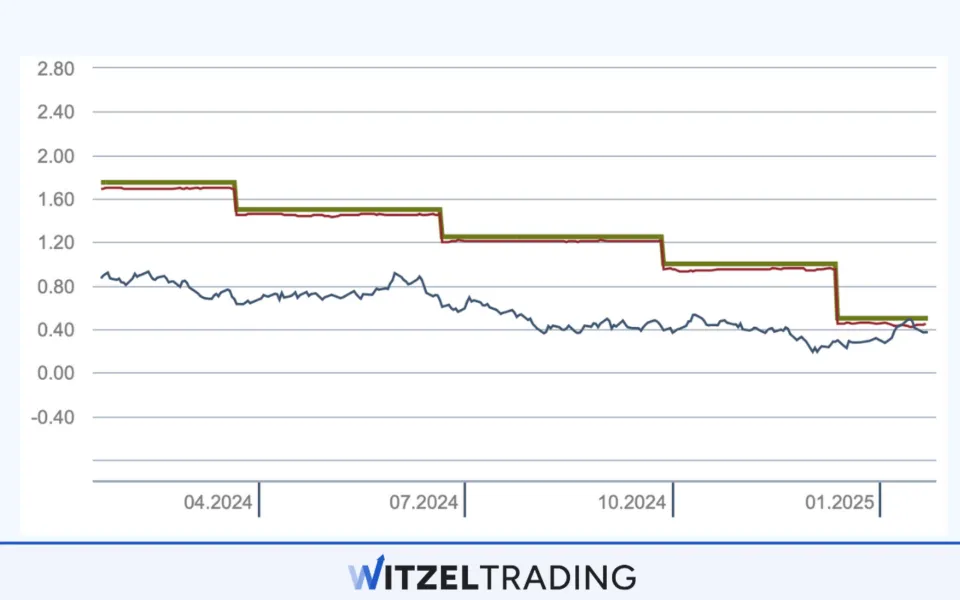

Bonds and the forex market are linked through investor’s behavior and interest rates. An increase in bond yields shows an increase in interest rates, making the associated asset a better choice for investors looking for good returns. Most forex traders use bond spread trading to get an idea of the direction of currency pairs.

Bonds spread trading is the difference between two countries’ bond yields. There are different kinds of bond spreads, like high-yield corporate bond spreads. But government bond spreads are the most sought-after by traders because they compare the yield of a country’s government bonds to a risk-free standard (e.g. US Treasuries).

For example, let’s look at Country Ace and Country Bat. If Ace’s government bonds yield 6% and Bat’s government bonds yield 3%, the spread is 3% (6%-3%). Investors can use the difference to know the risk levels between the two economies. A wider spread often indicates higher risk and yield.

Although bond spread is a great strategy, it has risks and limitations. At WR Trading, we educate traders on how to navigate these risks. Some of the risks attached to bonds spread trading include:

- Sudden economic changes that lead to a shift in yield

- Central bank policies that change the interest rates

- Market volatility that causes sudden currency trends

#9 Market Sentiment Analysis

| Aspect | Market Sentiment Analysis |

|---|---|

| Timeframe | Short to Medium-term (1 Day – 1 Week) |

| Costs | Moderate (Spread: 1–3 pips) |

| Leverage | Moderate to High (1:20 – 1:50) |

| Risk | Sentiment misreading, delayed reactions |

| Profit Technique | Uses COT reports, retail trader positioning, and volume analysis |

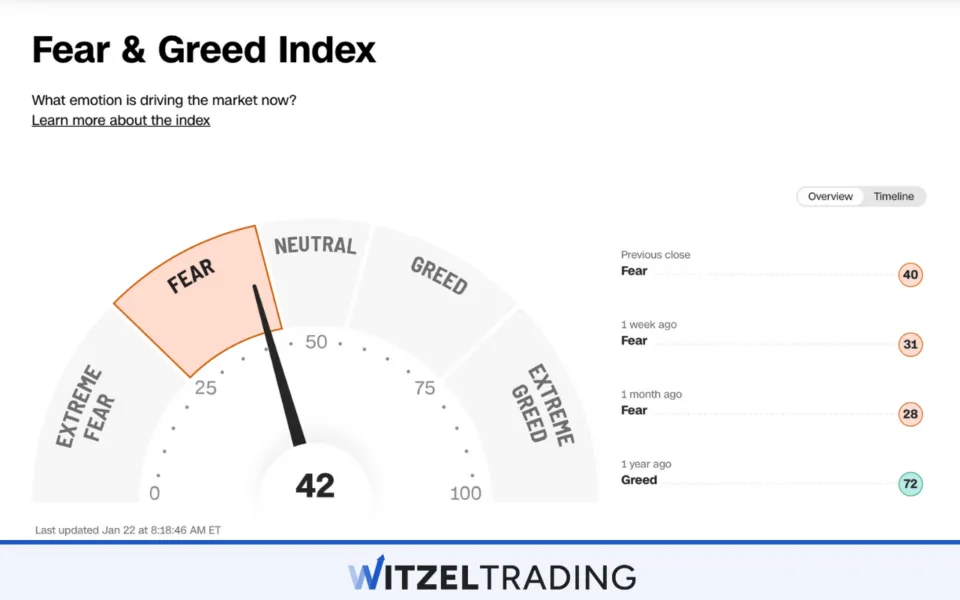

Another popular trading strategy used by traders is market sentiment analysis. It involves analyzing the current overall behavior of investors about a financial asset and financial market. The crowd’s emotions, like greed and fear, often influence the market. By understanding market sentiment, traders can predict price trends based on the market mood.

Some of the tools used for sentiment analysis include commitment of traders reports, Social media trends, and sentiment indicators. Traders also combine this trading strategy with other forms of analysis, like technical or fundamental analysis, to get a more comprehensive view of the market.

#10 Grid Trading Strategy

| Aspect | Grid Trading Strategy |

|---|---|

| Timeframe | Medium-term (1 Day – 1 Month) |

| Costs | Moderate to High (Spread and Swaps: 2% – 5%) |

| Leverage | High (1:50 to 1:100) |

| Risk | High risk in market trends |

| Profit Technique | Involves placing buy/sell orders at regular intervals around a set price level. |

Making it to the last on our list is grid trading. It occurs when buy-stop and sell-stop orders are placed below and above the already set price. This leads to multiple grids of orders at increasing and decreasing prices. In this strategy, traders capitalize on the actual price volatility in an asset by placing orders at regular intervals either below or above the set base price.

For example, a trader can place buy orders every 20 pips above the current market price and sell orders every 20 pips below it, allowing the trader to capture profits as the market fluctuates. It is one of the best strategies for capturing profits from various market conditions.

Although it has many advantages, there are also some risks involved. In highly volatile markets, grid trading can lead to huge losses if the market breaks out of a range and does not return. This can lead to several open positions with huge drawdowns.

Conclusion

Most successful traders in Forex Trading have strategies they use to boost their trading confidence and reduce their chances of incurring huge losses. At WR Trading, we offer several educational resources like video tutorials and webinars to help traders enhance their skills and understanding of the forex market. It helps to ensure traders are well-prepared and versed in the strategy before committing to real capital trading.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Frequently Asked Questions on Forex Trading Strategies

What is the Best Forex Trading Strategy for Beginners?

Market sentiment analysis and fundamental macro trading are beginners’ best forex trading strategies. They are easy to execute and give detailed insights into economic trends and market behavior.

How do I Choose the Right Strategy for My Trading Style?

You choose your trading style based on your trading goals, time availability, and risk tolerance. For example, a short-term trader might prefer scalping, while a long-term trader might prefer position trading.

Can these Strategies be Automated?

Yes, many forex strategies, such as forex future scalping, can be automated using tools like expert advisors. At WR Trading we advise traders to test automation tools in a demo environment.

Are there Risks in Combining Multiple Strategies?

Yes, combining multiple strategies can increase trading complexity and produce contradictory trade signals. This can, in turn, cause overtrading, so at WR Trading we recommend doing a thorough backtest and having a clear trading plan.

How Important is Risk Management in Forex Trading?

Risk management is vital to protecting capital and avoiding excessive losses. Setting stop-loss orders and diversifying trades is one of the most effective risk management practices in forest trading.