Diversifying your trading portfolio by exploring alternatives to forex trading can mitigate risk and potentially enhance your returns. Here we’ll look at 10 notable alternatives to forex trading, providing detailed insights into each to assist you in potentially expanding your trading horizons.

Quick List of Forex Trading Alternatives

- Stock trading

- Growth (stock) investing

- Value (stock) strategy

- Futures trading

- Options trading

- ETF trading

- Crypto trading

- Commodity trading

- Bond trading

- Spread betting

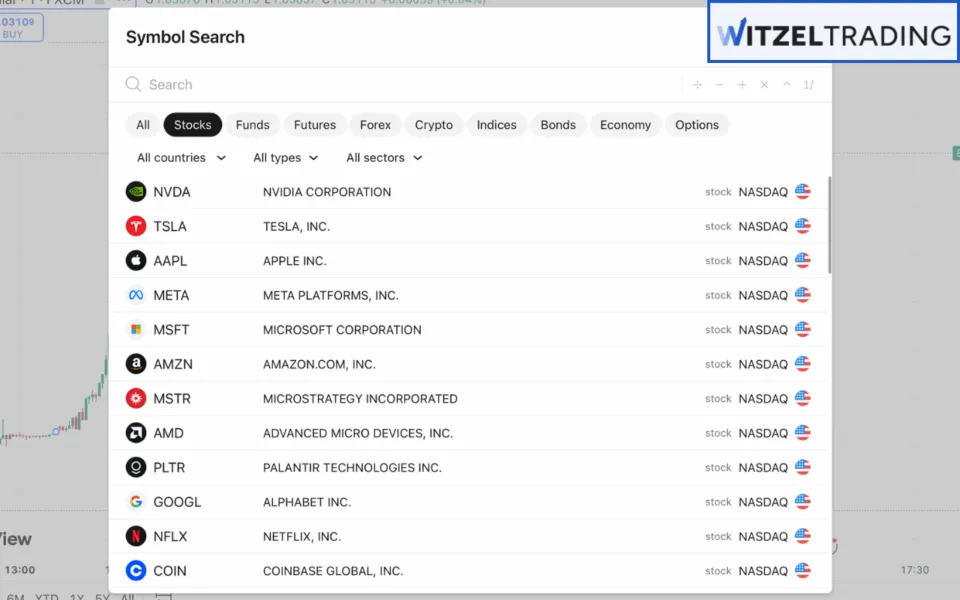

1. Stock Trading

Stock trading involves buying and selling shares of publicly traded companies with the aim of capitalizing on price movements. You can engage in stock trading through various strategies, including day trading, swing trading, and long-term investing.

Key Features:

- Ownership. Purchasing a stock signifies partial ownership in a company, entitling you as a shareholder to dividends and voting rights.

- Liquidity. Stocks of major companies are typically highly liquid, allowing for easy entry and exit positions.

- Regulation. Stock markets are heavily regulated, providing a thick layer of investor protection.

| Specification | Details |

|---|---|

| Minimum investment | Varies, some brokers offer fractional shares allowing investments as low as $1. |

| Time horizon | Flexible, can be short-term (days) to long-term (years). |

| Risk level | Moderate to high, depends on market volatility and company performance. |

| Potential return | Historically, average annual returns range from 7% to 10%. |

| Liquidity | High, especially for stocks of large-cap companies. |

See our full comparison of Forex vs Stocks here.

2. Growth Investing

Growth investing focuses on companies expected to grow at an above-average rate compared to other firms. While many favor small cap companies, a more moderate (and less risky) approach entails buying into more established, larger companies than the bottom rung.

With this approach, you’re seeking capital appreciation through increases in stock prices, rather than periodic dividends as a shareholder.

Key Features:

- High potential returns. Growth stocks can offer substantial returns if the company performs well.

- Volatility. These stocks can be more volatile, with prices subject to significant fluctuations.

- Dividends. Growth companies often reinvest earnings into the business, resulting in lower or no dividend payouts, although this is offset for you by the rise in their share value.

| Specification | Details |

|---|---|

| Minimum investment | Varies, depends on stock prices and broker requirements. |

| Time horizon | Long-term, typically 5 years or more to realize growth potential. |

| Risk level | High, due to market volatility and company-specific risks. |

| Potential return | Can exceed average market returns, varies by company performance. |

| Liquidity | Moderate to high, depends on the specific stock. |

3. Value Strategy

Value investing entails selecting stocks that appear to be trading for less than their intrinsic (or book) value. Seasoned investors employing this strategy look for companies undervalued by the market but with strong fundamentals.

Key Features:

- Undervalued stocks. The strategy focuses on identifying and investing in undervalued companies.

- Dividends. Value stocks often pay dividends, providing income in addition to potential price appreciation.

- Lower volatility. Generally considered less volatile than growth stocks.

| Specification | Details |

|---|---|

| Minimum investment | Varies, depends on stock prices and broker requirements. |

| Time horizon | Long-term, allows time for the market to recognize the stock’s true value. |

| Risk level | Moderate, though considered safer, there’s risk if the stock doesn’t appreciate as expected. |

| Potential return | Aligns with market averages, potential for steady returns. |

| Liquidity | High, especially for well-known companies. |

4. Futures Trading

Futures trading involves contracts to buy or sell an asset at a predetermined price at a specified time in the future. These contracts are standardized and traded on exchanges, and many traders prefer both the standardized nature of futures as well as the trading environment.

Key Features:

- Leverage. Futures contracts often require a margin, allowing you to control large positions with a relatively small investment (with margin at approximately 3 – 12% of the contract’s notional value, leverage can range from about 8:1 to over 30:1, although some cryptocurrency futures exchanges give leverage as high as 125:1).

- Standardization. The quantity, qualities, and delivery times of futures contracts are standardized.

- Diverse assets. Futures are available for various assets, including commodities, indices, and currencies.

| Specification | Details |

|---|---|

| Minimum investment | Varies, margin requirements depend on the contract and exchange. |

| Time horizon | Short to medium-term, contracts have specific expiration dates. |

| Risk level | High, leverage amplifies both gains and losses. |

| Potential return | Potentially high, proportional to market movements and leverage used. |

| Liquidity | Varies, major contracts like oil and gold are highly liquid. |

See our full comparison of Forex vs Futures here.

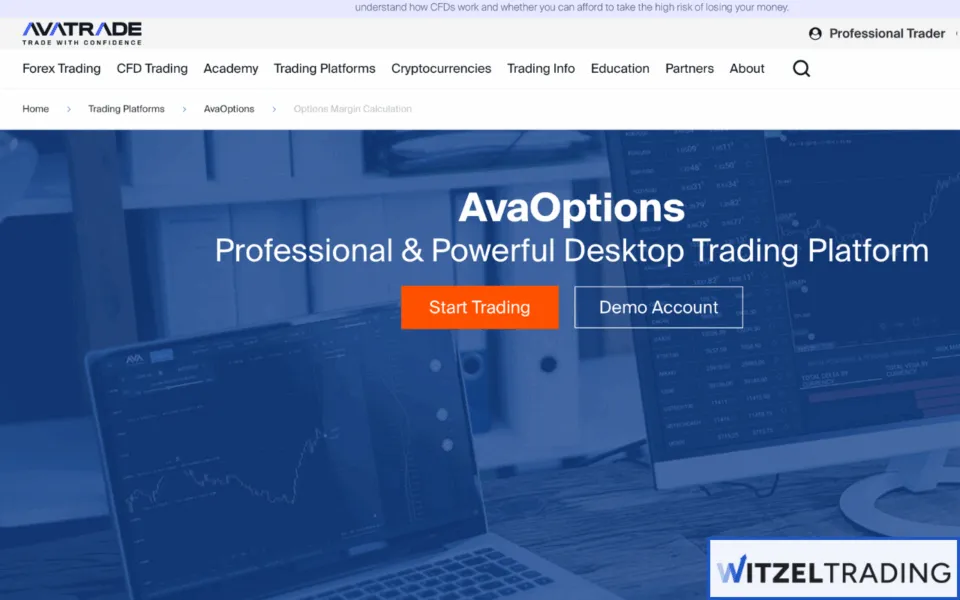

5. Options Trading

Options trading provides the right (but not the obligation) to buy or sell an underlying asset at a predetermined price before or at a specific expiration date. Options can be based on various assets, including stocks, commodities, and currencies, and although they are typically more complex than trading forex pairs, they come with a predetermined potential loss or gain – something that appeals to many traders.

Key Features:

- Flexibility. Options can be used for hedging, income generation, or speculative purposes.

- Leverage. Options offer inbuilt leverage because a small premium can control a large position (for example, instead of outlying $10,000 to buy 100 shares priced at $100, you could pick up a call option on the same shares at a strike price of $105, expiring in one month, priced at $2 per share, thus costing $200)

- Risk management. Buyers have a capped risk limited to the premium they paid.

| Specification | Details |

|---|---|

| Minimum investment | Depends on the option’s premium, can be low but varies. |

| Time horizon | Defined expiration dates, can be short-term (weekly) to long-term (annual). |

| Risk level | Moderate to high, depends on the strategy employed. |

| Potential return | Potentially high, depends on your initial analysis and an absence of unexpected events |

See our full comparison of Forex vs Options here.

6. ETF Trading

Exchange-Traded Funds (ETFs) are marketable securities that track an index, commodity, bonds, or a basket of assets like an index fund. ETFs are traded on stock exchanges, much like stocks, and are popular among retail and institutional investors for their simplicity and diversification.

Key Features:

- Diversification. Products like Vanguard ETFs provide exposure to a wide range of assets, reducing individual security risk.

- Liquidity. Traded like stocks on major exchanges, ETFs are generally highly liquid.

- Low Costs. ETFs often have lower expense ratios compared to mutual funds, making them more cost-effective investment options for many.

| Specification | Details |

|---|---|

| Minimum investment | The cost of one ETF share, varies based on the specific ETF. |

| Time horizon | Flexible, suitable for short-term trading or long-term investing. |

| Risk level | Low to moderate, depends on the ETF’s underlying assets. |

| Potential return | Varies, tied to the performance of the tracked index or asset basket. |

| Liquidity | High, ETFs trade on stock exchanges throughout market hours. |

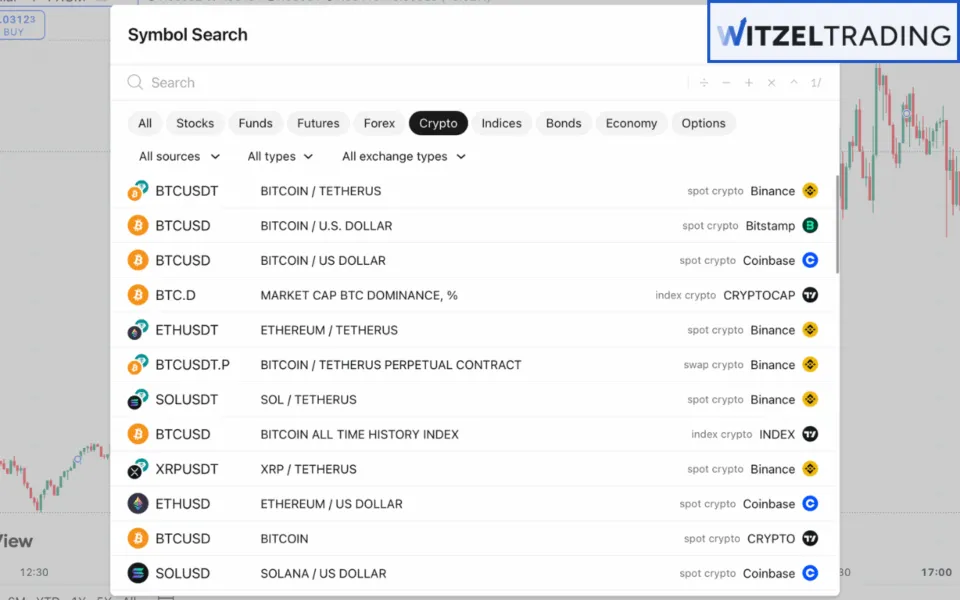

7. Crypto Trading

Cryptocurrency trading involves buying, selling, or exchanging digital currencies like Bitcoin, Ethereum, and others (altcoins). It has gained immense popularity due to its high volatility and the potential for significant (often gigantic) returns.

Cryptocurrency also offers a convergence of two primary current themes – AI and data – although the abundance of dud coins makes speculation risky in an arena where volatility can be far higher than legacy financial markets.

Key Features:

- Decentralized nature. Crypto trading occurs on decentralized exchanges or through over-the-counter (OTC) markets.

- 24/7 trading. Unlike traditional markets, crypto markets operate 24/7, allowing for continuous trading.

- Volatility. High price fluctuations present both tremendous opportunities and magnified risks.

| Specification | Details |

|---|---|

| Minimum investment | Varies by exchange, you can start as low as $10 on some platforms. |

| Time horizon | Flexible, can be short-term (day trading) or long-term (HODLing). |

| Risk level | High, extreme volatility makes crypto trading risky. |

| Potential return | High, some coins have experienced exponential growth. |

| Liquidity | High for major cryptocurrencies like Bitcoin and Ethereum. |

8. Commodity Trading

Commodity trading involves buying and selling raw materials or primary products like gold, oil and gas (energy), or agricultural goods. It can be done through futures contracts, ETFs, or spot trading, and is a hale trading arena of financial markets.

Key Features:

- Hedging tool. Commodity trading is often used to hedge against inflation or market volatility.

- Leverage. Futures contracts will allow you to control large amounts of commodities with a relatively small margin.

- Global market. Commodity prices are influenced by global supply and demand dynamics, and less subject to sentiment than most other markets (although commodities can often prove to be no less risky).

| Specification | Details |

|---|---|

| Minimum investment | Varies, futures contracts often require initial margin deposits. |

| Time horizon | Short to medium-term, based on the type of contract. |

| Risk level | High, prices are influenced by unpredictable factors like weather. |

| Potential return | High, significant returns during price surges. |

| Liquidity | High for popular commodities like gold and oil. |

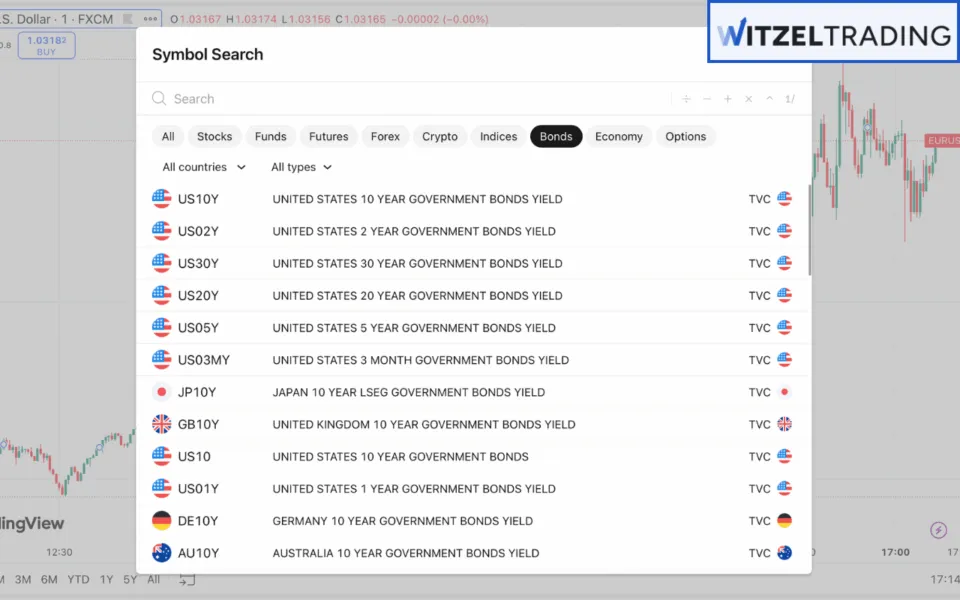

9. Bond Trading

Bond trading involves buying and selling debt securities issued by governments, municipalities, or corporations. Bonds are considered safer than stocks, although they usually offer lower returns.

Key Features:

- Steady returns. Products like US Bonds provide predictable income through interest payments (coupons).

- Lower risk. Government bonds, especially, are considered low-risk investments.

- Diversification. Bonds are seen as an essential component of a balanced portfolio.

| Specification | Details |

|---|---|

| Minimum investment | Depends on the bond type, government bonds may require a higher minimum. |

| Time horizon | Fixed-term, ranges from short-term (1-3 years) to long-term (10+ years). |

| Risk level | Low for government bonds, higher for corporate bonds. |

| Potential return | Moderate, tied to the bond’s interest rate and credit risk. |

| Liquidity | Varies, government bonds are more liquid than corporate bonds. |

10. Spread Betting

Spread betting involves speculating on the price movement of financial instruments without owning the underlying asset. It’s popular in regions like the UK due to its tax-free nature, as well as the fact that you can gain in both rising and falling markets.

Key Features:

- Tax-free. Profits from spread betting are typically not subject to capital gains tax in certain jurisdictions.

- Leverage. Allows you to magnify your positions, increasing both potential profits and risks.

- Flexibility. You can bet on both rising and falling markets with spread betting.

| Specification | Details |

|---|---|

| Minimum investment | Varies, depends on the broker and the chosen stake per point. |

| Time horizon | Short-term, often used for intraday trading. |

| Risk level | High, leveraged nature amplifies risk. |

| Potential return | High, depends on price movement and stake per point. |

| Liquidity | High, spread betting is widely available for popular assets. |

Conclusion

Each trading alternative to forex trading offers unique opportunities and risks. While forex trading is attractive for its liquidity and 24/5 availability, exploring these alternatives can help you diversify your skill set and overall portfolio.

Stock trading is great for those seeking ownership and steady growth, ETF and bond trading will suit conservative investors that prioritize stability, while crypto and commodity trading are ideal for those looking for high volatility and equally high potential returns. Ultimately, the best choice depends on your individual preferences, expertise, and financial circumstances, and diversifying across multiple instruments can help you to achieve more balanced and resilient trading outcomes.

If you’d like to learn how to adopt strategies that align with your risk tolerance and financial goals while diversifying your trading instruments and strategies, join the WR Trading Course and we’ll help you through the decisions you’ll need to make.

Frequently Asked Questions on Forex Trading Alternatives

What is the best alternative to forex trading for beginners?

Stock trading and ETF trading are considered the best alternatives for beginners. They offer lower complexity compared to forex trading and provide access to a wide range of assets. ETFs, in particular, allow for diversification with minimal effort and lower risk.

Can I trade commodities or bonds with the same broker I use for forex trading?

Many brokers offer multi-asset platforms where you can trade forex, commodities, bonds, and other instruments. However, the availability depends on the broker. Ensure that your broker is regulated and offers the specific markets you’re interested in.

Is crypto trading riskier than forex trading?

Yes, absolutely, crypto trading is generally considered riskier than forex trading due to its high volatility, less mature regulatory framework, and susceptibility to market manipulation. However, it also offers significant profit potential for more experienced traders.

What is the main advantage of spread betting over other trading alternatives?

The main advantage of spread betting is that it’s tax-free in certain jurisdictions, such as the UK. Additionally, it allows you to speculate on rising and falling markets without owning the underlying asset, providing a great flexibility with lower capital requirements.

How does options trading compare to forex trading in terms of risk?

Options trading is generally less risky for buyers, as the maximum loss is limited to the premium paid. Forex trading, on the other hand, involves higher risk due to leverage and market volatility. However, selling options (writing) can carry unlimited risk, making it riskier for the seller.

Which trading alternative offers the best diversification?

ETF trading and bond trading offer the best diversification. ETFs track indices or baskets of assets, spreading risk across multiple securities, while bonds provide steady income and stability, reducing portfolio volatility when paired with riskier assets.