Forex trading fees are all of the costs you’ll incur when engaging in the buying and selling of currencies. Fees can be direct, such as spreads and commissions, or indirect, like swap rates and various account-related charges (margin call fees, inactivity fees).

Trading fees are the costs charged by brokers and financial institutions for facilitating currency trading. You need a comprehensive understanding of these fees so that you can make informed decisions and manage your trading expenses (and ultimately your profitability) effectively.

List of Common Forex Trading Fees:

- Spread: The difference between the bid and ask price of a currency pair.

- Commission: A fee charged by brokers per trade (or per lot).

- Swap Fees (overnight charges): Fees incurred for holding positions overnight.

- Margin Call Fees: Charges applied when your account falls below the required margin level.

- Inactivity Fees: Fees charged for dormant accounts over a specified period.

- Market Data Fees: Costs for accessing real-time market data and analysis tools.

- Deposit/Withdrawal Fees: Charges for transferring funds into or out of your trading account.

- Currency Conversion Fees: Fees for converting one currency to another within your trading account.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

What Are The Most Common Forex Trading Fees?

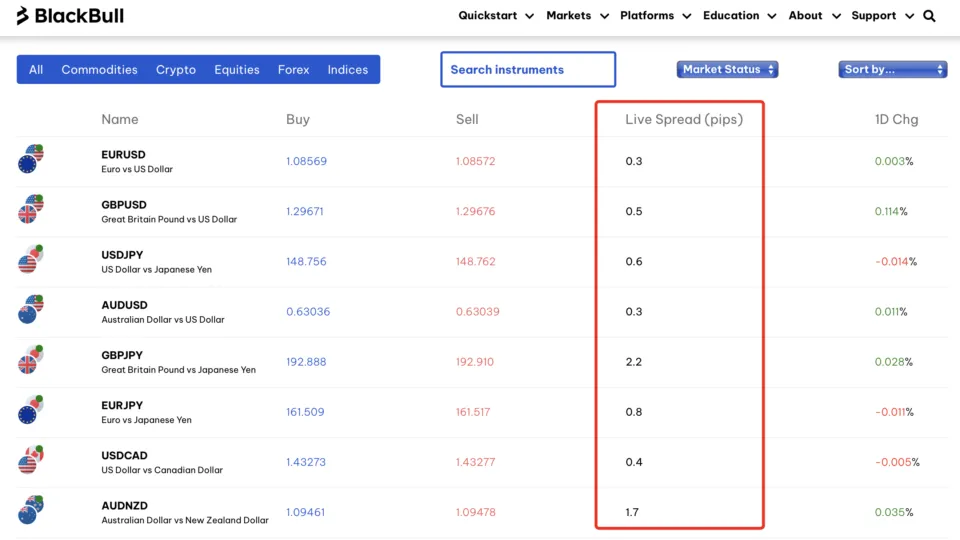

1. Spread

The spread is the difference between the bid (selling) price and the ask (buying) price of a currency pair. It’s essentially the broker’s compensation for executing your trade. The spread is also the primary cost in forex trading, as brokers often earn profits through spreads, especially in commission-free trading accounts.

For a spread example, consider the EUR/USD currency pair with a bid price of 1.1000 and an ask price of 1.1002, making the FX spread here 2 pips (1.1002 – 1.1000 = 0.0002).

If you buy 1 standard lot (100,000 units) of EUR/USD:

- Spread in pips: 2 pips

- Monetary value per pip: $10 (for a standard lot)

- Total spread cost: 2 pips x $10 = $20

Thus, you’ll incur a $20 cost due to the spread on this trade.

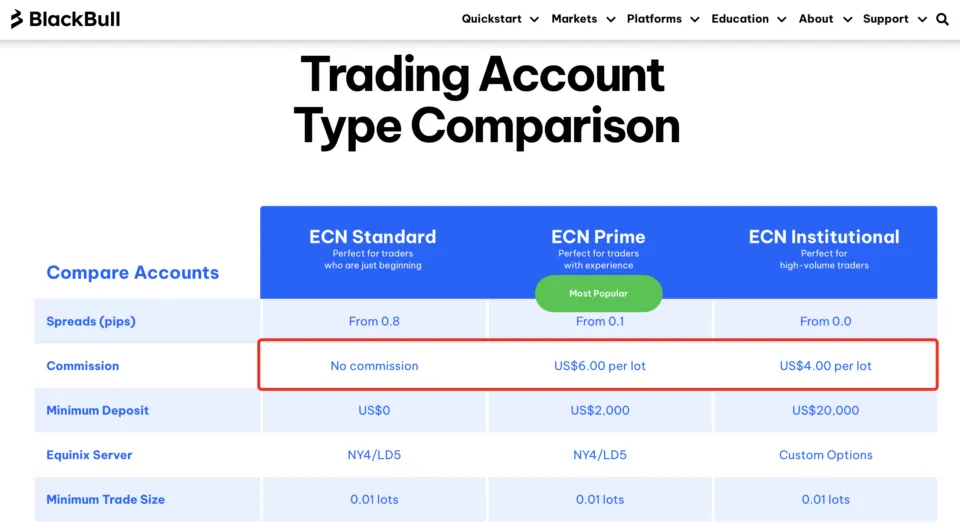

2. Commission

Commissions are fixed (or variable) fees charged by brokers per trade. They are common with “raw spread” or ECN accounts, where spreads are minimal, but a commission is added.

As an example, a broker charges you a commission of $7 per 100,000 units (1 standard lot) traded.

If you buy 1 standard lot of USD/JPY:

- Commission per side: $7

- Total round-trip commission: $7 (entry) + $7 (exit) = $14

Therefore, you’ll end up paying a total of $14 in commissions for this trade.

3. Swap fees (overnight charges for leverage)

Swap fees (or rollover fees) are charged when you hold a leveraged position overnight. These fees depend on the interest rate differential between the two currencies in the pair, and you must consider them when contemplating holding past close of day.

Let’s say for example that you hold a long position on AUD/USD overnight. If the interest rate for AUD is higher than that of USD, you might very well earn a positive swap. Conversely, however, if the AUD interest rate is lower, you’ll incur a negative swap fee.

Let’s assume the broker provides a swap rate of -0.5% per day for holding 1 standard lot of AUD/USD:

- Notional value of 1 lot: 100,000 AUD

- Daily swap fee: 100,000 x 0.5% / 365 ≈ $1.37

Thus, you’ll be paying approximately $1.37 for each day the position is held overnight.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

What are “Additional Fees” for Forex Traders?

Beyond spreads, commissions, and swap fees, there are other charges that you need to be aware of:

4. Margin Call Fees

A margin call fee occurs when your account equity falls below the required margin level, forcing the broker to close your positions. Some brokers charge fees for this process, as it’s seen as management of your trading account.

Say, for example, that you’re trading with leverage, and your equity drops below the required margin. The broker will forewarn you and then closes your position, while also charging you a $50 margin call fee.

5. Inactivity Fees by Forex Brokers

Inactivity fees are charged when your account remains dormant for a specified period, which is typically between three and 12 months, depending on the brokerage.

Your broker might, for example, charge $10/month after 6 months of inactivity. If you don’t trade for a year, the total inactivity fee is:

- Inactivity fee = $10/month x 12 months = $120

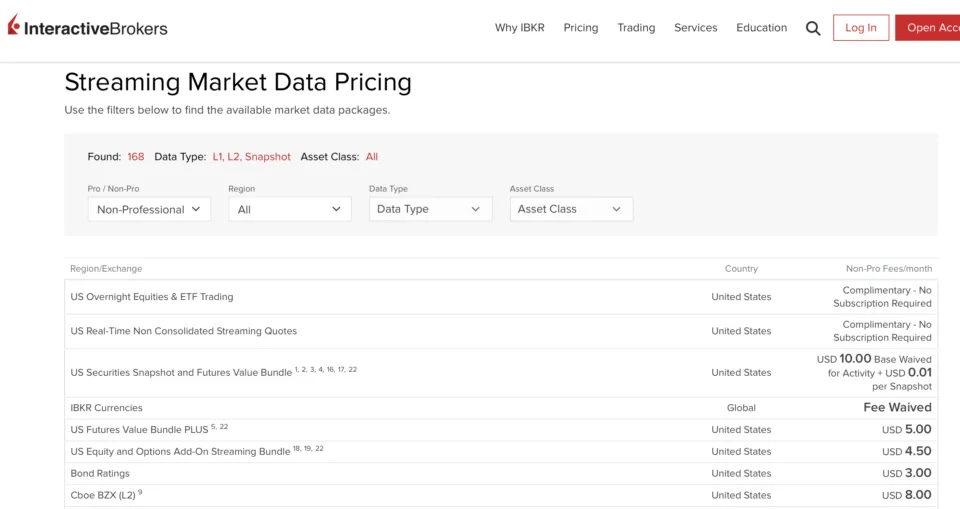

6. Market Data Fees

Some brokers will charge fees to access premium market data, such as real-time price feeds or advanced analytics.

As and example, a broker will charge $25/month for premium market data access.

7. Deposit/WithdrawalFees for Forex Accounts

Some but certainly not all brokers charge fees for depositing or withdrawing funds from your trading account. These fees vary from broker to broker, and by payment method.

If your broker does charge money movement fees, let’s say for example that it’s 2% on withdrawals. Let’s further say that you want to withdraw $1,000, making the fee:

- Withdrawal fee = $1,000 x 2% = $20

8. Currency Conversion Fees

If your trading account is in a different currency than your deposit currency, brokers may charge conversion fees.

As an example, if the broker charges a 0.5% conversion fee, and you deposit $1,000 into an account denominated in EUR:

- Conversion Fee = $1,000 × 0.5% = $5

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

How High Forex Trading Fees Can Limit Your Profit

Let’s assume, in an example calculation, that you trade EUR/USD with a spread of 2 pips and no commission.

You open and close a trade of 1 lot (100,000 units). The total cost is:

- Spread cost = 2 pips x $10 = $20

If your profit from the trade is $50, your net profit after fees is:

- Net Profit = $50 – $20 = $30

Now, compare this to a broker with a 1-pip spread:

- Spread cost = 1 pip x $10 = $10Net Profit = $50 – $10 = $40

From the example above, it’s easy to see how lower fees can significantly increase your profitability-the accumulative effect of persistently low fees can have a big impact on your annual net profit.

Is a Forex Spread Account or a RAW Spread Account cheaper?

RAW accounts are generally cheaper than other account structures for forex traders. In a comparison calculation to determine which account type is cheaper, let’s look at a spread versus RAW (or commission only) account.

Spread account example:

You’re looking at a 1 pip spread on EUR/USD for 1 lot:

- Spread cost = 1 pip x $10 = $10

In the RAW spread + commission example, let’s say you’re looking at a Raw spread of 0.1 pips + $3 commission per side:

- Spread cost = 0.1 pip x $10 = $1

- Commission = $3 (opening) + $3 (closing) = $6

- Total Cost = $1 + $6 = $7

In this case, the RAW Forex Broker account is cheaper by $3, but you’ll need to take an in-depth look at a broker’s offer to determine whether or not you’ll come out ahead over the long term.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Which are the Best Forex Brokers with the Lowest Costs?

You need to shop around and weigh up brokers’ in-house costs against other benefits they might provide you, but some of the lowest cost forex brokers include:

1. BlackBull Markets

- Spreads at BlackBull start at 0.0 pips.

- Commissions are typically $6 per lot round trip.

- BlackBull features ECN accounts, fast execution.

2. FP Markets

- Spreads starting at 0.0 pips.

- Commissions are $6 per lot round trip.

- Features of FP Markets include tight regulation and tight spreads.

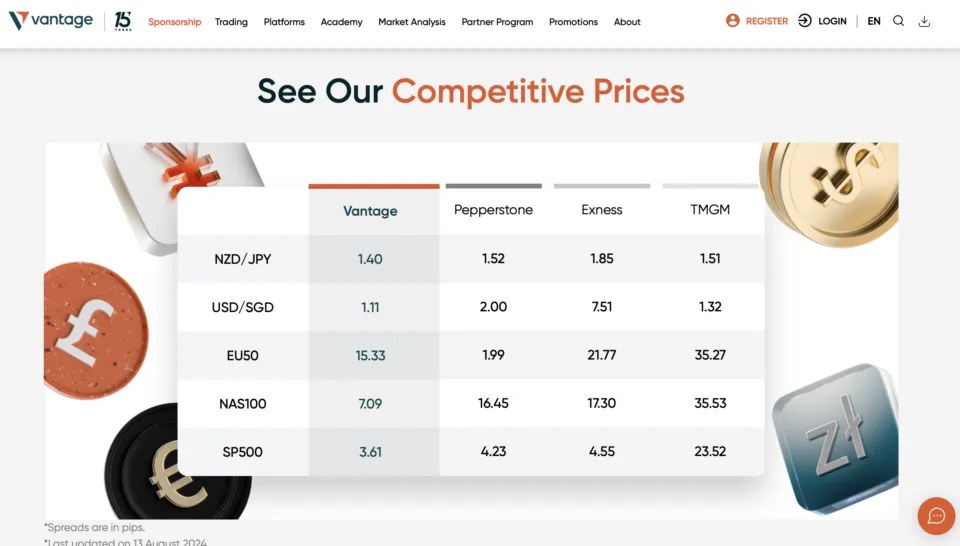

3. Vantage Markets

- Spreads at Vantage start at 0.0 pips.

- Commissions run at $6 per lot round trip.

- The principal feature of Vantage is being able to trade on advanced trading platforms.

Are Cheaper Forex Brokers the Better Forex Brokers?

Not necessarily- while lower fees can improve profitability, you should also consider factors like regulation, platform reliability, execution speed, and customer support.

Indeed, the interface and flow of things, as well as trading platforms offered can often swing traders away from trading fees being their main consideration.

In short, a slightly higher-cost broker might offer better overall trading conditions, although the three low-cost brokers mentioned above are exceptionally good all-rounders, including fee considerations.

Conclusion: FX Trading Costs Impact Your Profit

Forex trading costs can significantly impact your profitability, and by understanding spreads, commissions, swap fees, and additional charges, you can successfully manage your trading expenses.

You’ll need to do some calculations (preferably by sampling and comparing while trading on different brokers’ demo accounts) to gain an actual, legitimate profitability expectation.

By comparing brokers’s comprehensive offer and fee structures, you can choose the best broker that aligns with your trading style and appetite for trading costs. If you want to learn how to choose the best broker and trade with the lowest possible costs, join our WR Trading Mentorship!

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Frequently Asked Questions on Forex Trading Costs:

What is the most significant cost in forex trading?

The spread is usually the most significant cost, especially for frequent traders, and this is why RAW accounts that charge a fixed commision per trade have grown in popularity.

Will my swap fees be the same for all currency pairs?

No, swap fees vary depending on the currency pair and interest rate differentials.

Can I avoid inactivity fees?

Yes, by ensuring you make at least one trade or transaction within the broker’s specified inactivity period (most brokers will eventually start charging inactivity fees-only the time span varies-although some like Vantage mentioned above have abolished them).

Do all forex brokers charge commissions?

No, many forex brokers offer commission-free accounts but may charge higher spreads instead-you’ll need to do some practical calculations based on the brokers’ fee structures to see where you can minimize your trading costs.

Are RAW spread accounts better for scalpers?

Yes, RAW accounts with low spreads and commissions are ideal for scalpers, as high-frequency trading needs to minimize in-out costs as much as possible.

How do I calculate the total cost of a trade?

Add the spread cost, any commission, and any swap fees if you’re holding overnight to determine the total cost of a trade you’re contemplating.