Exotic currency pairs are simply forex markets that comprise a major currency (like the US dollar, euro, British pound, etc.) and another from a so-called emerging economy (e.g., the Turkish lira, South African rand, Mexican peso, and so on). While exotic pairs are similar to major and minor pairs, they also possess distinct qualities. Thus, learning everything you need to trade exotic pairs is key.

The list below contains the most popular exotic pairs (in no particular order). Of course, there are many more exotic pairs, depending on the broker or trading platform:

List of Popular Exotic Currencies:

- USD/CNH – USD dollar / Chinese renminbi

- USD/TRY – US dollar / Turkish lira

- USD/ZAR – US dollar / South African rand

- USD/MXN – US dollar / Mexican peso

- USD/NOK – US dollar / Norwegian krone

- USD/HKD – US dollar/Hong Kong dollar

- USD/HUF – US dollar / Hungarian forint

- USD/SGD – US dollar / Singapore dollar

- EUR/SGD – Euro / Singapore dollar

- EUR/TRY – Euro / Turkish Lira

- EUR/ZAR – Euro / South African rand

- EUR/PLN – Euro / Polish zloty

- EUR/HUF – Euro / Hungarian forint

- EUR/NOK – Euro / Norwegian krone

- EUR/CZK – Euro / Czech Koruna

- GBP/ZAR – British pound / South African rand

- GBP/SGD – British pound / Singapore dollar

- CHF/SGD – Swiss franc / Singapore dollar

- SGD/JPY – Singapore dollar / Japanese yen

- ZAR/JPY – South African rand / Japanese yen

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

What Are The Pros And Cons Of Trading Exotic Currency Pairs?

Let’s briefly look at the benefits and drawbacks of exotic pairs:

Pros

- Higher volatility

- Diversification

- Carry Trading

- Insight into Emerging Markets

Cons

- Volatility Risks

- Low liquidity

- Higher transaction costs

- Limited availability of data

Pros of trading Exotic Currency Pairs

- Higher volatility: Greater volatility offers the chance for significant price movements (leading to potentially higher profits). Exotic pairs are quite volatile because of their association with less stable and unpredictable economies.

- Diversification: Many exotic pairs move in unique trends as they depend less on major and minor currencies (given their distinct economies). This provides opportunities for traders to diversify.

- Carry Trading: Emerging economies generally offer higher interest rates than their developed counterparts. This incentivizes traders holding positions in exotic markets for long periods as they earn small interest daily.

- Insight into Emerging Markets: Trading exotics exposes one to the economic performance and currency trends of developing countries, which can benefit traders seeking a global macroeconomic perspective.

Cons of trading Exotic Currency Pairs

- Volatility risks: Although greater volatility can mean higher profit, the potential for substantial losses is the same.

- Low liquidity: The trading volumes for many exotic pairs are lower than other markets (a partial contributor to the high volatility). This leads to wider spreads, higher volatility and an increased risk of slippage.

- Higher transaction costs: The wide spreads of exotic pairs amplify the cost of trading, which can erode profits (particularly for short-term traders).

- Limited Availability of Data: Information on exotic currencies and their respective economies may be harder to find, making informed trading decisions more challenging.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

How To Trade Exotic Currency Pairs

Below is a step-by-step guide to trade exotic pairs.

- Understand exotic pairs: We have briefly defined exotic pairs – but there’s more. Traders should get to grips with the volatility and price movements of these markets and their sensitivity to economic and geopolitical events.

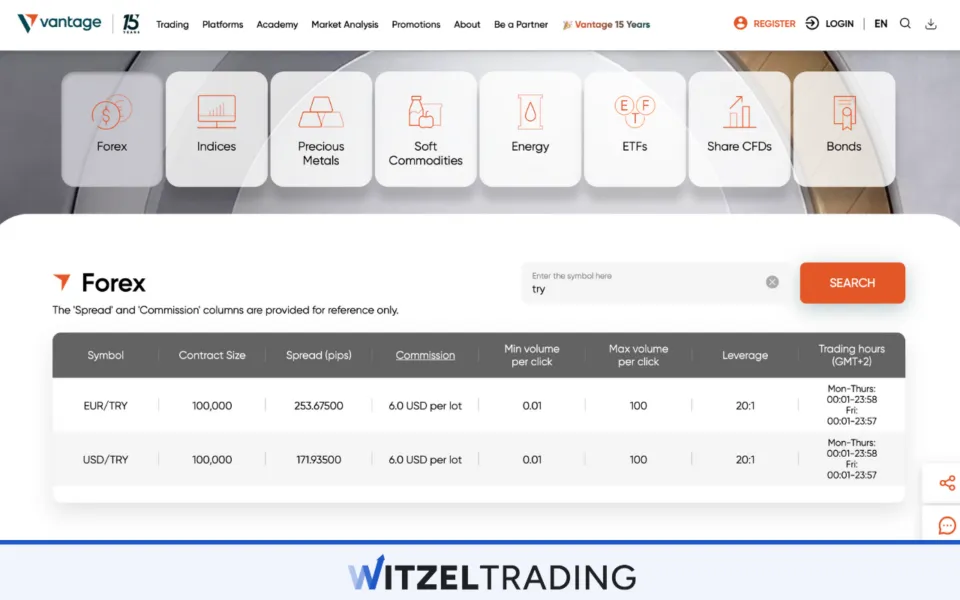

- Practice on a demo account: This stage allows you to build your strategy without financial risk and familiarize yourself with the trading platform. We recommend opening an account with FP Markets, Vantage Markets, or RoboForex. These brokers provide competitive spreads, fast execution, educational resources, and a wide range of exotic pairs.

- Develop a trading strategy: Traders should grasp the two types of analysis when deciding on a trading strategy: technical and fundamental analysis. The former refers to indicators and chart patterns, while the latter refers to macroeconomics like interest rates and inflation. Combining these two strands of analysis is what helps you best predict the price movements.

- Learn about risk management: Traders should also develop solid plans around managing risk through techniques like stop loss orders, safe position sizing and diversifying trades.

- Open a live account and start trading: Assuming you are profitable for a sufficient time on the demo, now is the time to start trading in the real markets. The first step is to use any of the brokers we recommended to create your account.

- Deposit money and choose your currency pair: Then, transfer your trading capital with any of the available payment methods. Head to the trading platform and choose the exotic pair you want to trade. Then simply execute the position by going ‘long’ (buying) or ‘short) (selling) depending on what your strategy suggests.

- Monitor and adjust your trades: Implement trade management (by adjusting your stop loss, etc.) and monitor your positions. Also, keep an eye on economic events and news updates related to the exotic pairs you’re trading.

- Continuously learn and improve: Traders should also look to improve their performance through analysing their strategy and past trades. Also, consider educational resources provided by the recommended brokers for learning.

What Are The Best Strategies To Trade Exotic Currency Pairs?

Here is a general breakdown of strategies you can use to trade exotics:

- Trend trading: Exotic pairs are known to move in extended directional movements. This is particularly true when there are huge economic imbalances (e.g., USD/TRY). As with other markets, many experts consider trend following as the safest trading strategy.

- Reversal trading: Of course, trading reversals is the opposite of trading trends. Given the volatility of exotic pairs, these can also present massively sharp moves.

- Breakout trading involves taking advantage of situations where exotic pairs break out of key levels. To signal a potential breakout, you usually look for patterns like flags and wedges in these areas, along with momentum indicator analysis.

- Carry trading/carry hedging: Earlier, we referred to carry trading. It is a non-directional strategy in which the goal is to earn small interest by holding certain exotic pairs for long periods. The key is to find pairs with the highest interest rate differential.

Carry hedging is combining the potential of profiting with carry trading and mitigating risk with hedging. The idea is to open two positions moving in the opposite direction: one would be a usual carry trade and another that would offset the potential losses of this position.

- Correlation trading: This strategy involves capitalising on relationships between exotic pairs and other markets like commodities. For example, USD/NOK (or the Norwegian Krone) moves in tandem with oil prices.

Many practice this strategy for hedging purposes or to identify the likelihood of the exotic pair in question moving in a certain direction (based on a specific correlation coefficient).

How High Is The Liquidity Of Exotic Currency Pairs?

As expected, liquidity is quite low for most exotic pairs in comparison to other pairs. The main reason is that currencies from emerging economies have fewer participants, which equals low trading volume.

Speaking of which, it is tricky to measure the latter metric accurately. However, we can rely on data from Statista (as recent as April 2022):

- USD/CNH had the highest daily trading volume of the entire forex market at 6.6%. USD/HKD and USD/SGD boasted 2.4% and 2.3%, respectively. Meanwhile, other markets like USD/MXN and USD/SEK commanded around 1%.

- If the forex market is estimated to turnover about $7.5 trillion daily (according to the Bank of International Settlements), USD/CNH would be worth roughly $495 billion daily.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Why Are The Fees Higher When Trading Exotic Currency Pairs?

It’s simple – low liquidity increases the costs of trading for brokers. Liquidity represents a high number of participants and massive demand. When this happens, brokers and other trading platforms can provide competitive spreads.

Unfortunately, it is different for exotic pairs. The demand for these currencies is lower than other markets. Also, exotic currencies are more volatile (since they are less liquid), making them prone to sharp, unpredictable changes.

These factors represent risks for brokers to offer these markets. There are higher costs for quoting, executing, and managing these positions. So, they have to charge higher spreads (and/or commissions) to account for the effort.

Exotic vs Minor vs Major Pairs

Here is a brief comparison table for the three types of pairs in forex.

| Exotic Pairs | Minor Pairs | Major Pairs | |

|---|---|---|---|

| Definition | Pairs with a major currency and one from an emerging economy) | Pairs with a combination of major currencies, excluding USD | Pairs that include a major currency like EUR and GBP against USD |

| Examples | USD/ZAR, GBP/SEK, EUR/TRY | EUR/GBP, NZD/JPY, CAD/CHF | USD/JPY, EUR/USD, AUD/USD |

| Spreads | 5-50 pips on average | 2-5 pips on average | 0-2 pips on average |

| Daily volatility | 100-600 pips on average | 50-200 pips on average | 40-120 pips on average |

| Trading volume | Lowest | Medium | Highest |

| Risk level | High | Moderate | Moderate to low |

| Best for | Experienced traders seeking greater diversification | Intermediate to advanced traders seeking more opportunities away from major pairs | All traders (especially beginners) seeking to benefit from low-cost, stable trading |

Which Factors Influence Exotic Currency Pairs?

Oh, there’s quite a few! It actually isn’t different from other pairs in forex:

- Economic indicators: Traders have to look at the stability of each economy represented in the currencies they trade. Exotic markets can be affected by Gross Domestic Product, inflation rates, unemployment rates and other indicators.

- Central bank policies: Here, we mainly refer to interest rate decisions. However, monetary policies like quantitative easing (or tightening) and currency interventions can be highly influential.

- Political stability: It’s not just the economy we should consider but also the politics. The countries represented in exotic pairs are known for having unstable governments and political unrest. Also, geopolitical risks like potential sanctions and trade agreements should be studied.

- Global risk sentiment: When there is economic uncertainty globally, many traders see exotic pairs as riskier assets (which presents selling opportunities). Conversely, if the economy is performing well globally, the appetite for exotic pairs increases (which presents buying opportunities).

- General market speculation: Exotic pairs are just like other markets – always up for speculation. Hundreds of thousands, if not millions, flock to these currencies due to their unique features in hopes of profiting.

Learn Forex Trading With WR Trading

Exotic pairs perfectly represent the scope of opportunities in forex. However, traders should be more concerned about the best markets. This is where WR Trading shines.

Our trading education program is tailored to help you trade smarter and more profitably. We focus on mastering high risk-to-reward strategies, creating effective trading plans, minimizing time commitment, and understanding precisely when to trade and when to stay out. The course is divided into three modules, guiding traders through the fundamentals and proven methods for achieving consistent profitability.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Conclusion

Exotic pairs are excellent for traders who want to explore beyond the somewhat cliched major and minor pairs. Thanks to their high volatility and other factors, they provide an opportunity to diversify. Of course, the downsides include higher trading costs, low liquidity, and potential exposure to political and economic stability.

Still, being successful with exotic pairs is the same as with other forex markets: equipping yourself with the proper knowledge, practising, and developing solid trading strategies. This is how exotics can be a considerable part of your forex trading watchlist.

Frequently Asked Questions on Exotic Currency Pairs

Are exotic pairs suitable for beginners?

No. Exotic pairs have higher volatility, larger spreads, and lower liquidity. These conditions aren’t suitable for beginners, who need proper experience and skill to deal with them.

Which exotic pairs have the lowest spreads and volatility?

Generally, currencies like the Singaporean dollar (SGD), Hong Kong dollar (HKD), and Chinese renminbi (CNH) paired against the USD best fit this description. This is due to their countries’ stable economies and higher liquidity levels.

Are exotic pairs more profitable than other pairs in forex?

While there are unique features that naturally lead to higher profits faster, other factors should be considered. These include the trading strategy and a trader’s skill, which play a more crucial role than the market being traded.