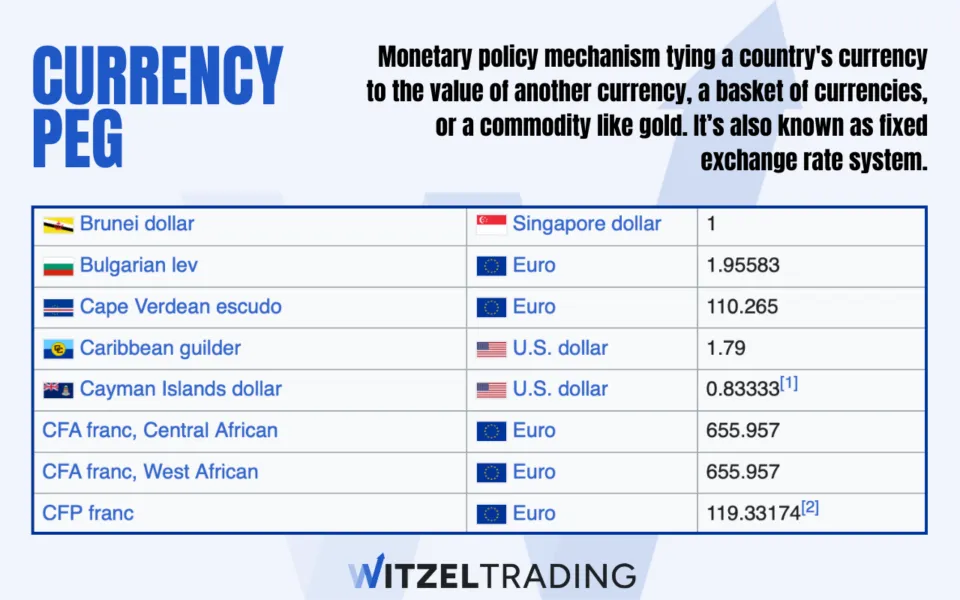

A currency peg (also known as a fixed exchange rate system) is a monetary policy mechanism tying a country’s currency to the value of another currency, a basket of currencies, or a commodity like gold. By fixing their currency’s value, governments aim to bring stability to their economies, particularly as regards international trade and investment.

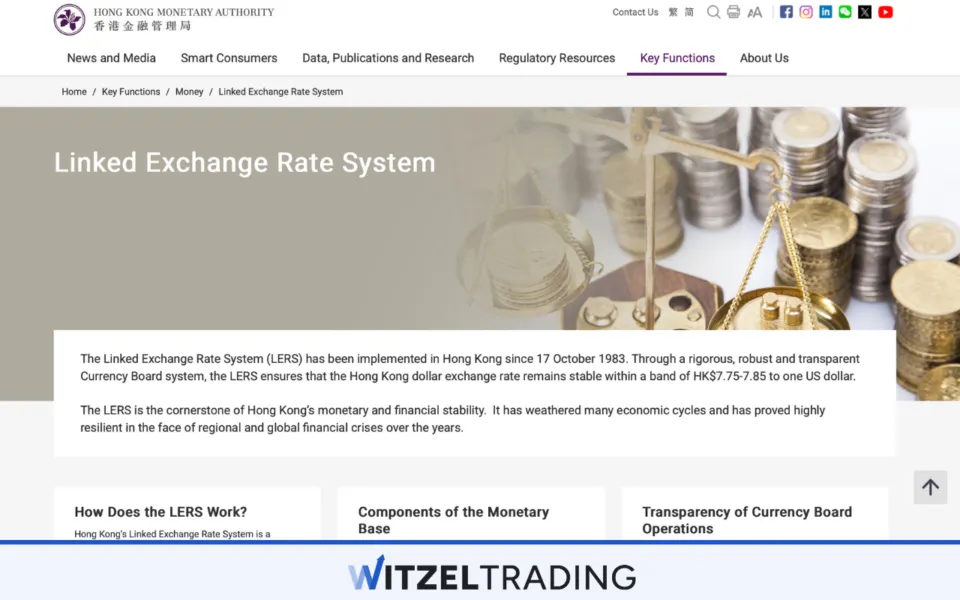

For example, the Hong Kong dollar is pegged to the US dollar at a fixed rate of around 7.8 HKD to 1 USD, minimizing fluctuations in the exchange rate, and allowing businesses and investors to operate with greater predictability.

Key Facts about Currency Peg

- Stability focus: Currency pegs reduce exchange rate volatility, making international trade and investment more predictable for a country. Currency pegging can foster economic stability, but it also requires careful management by a country’s central bank.

- Management intensive: Maintaining a peg requires the central bank to monitor and intervene in forex markets, often using foreign reserves.

- Popular pegs: The US dollar and the euro are the most commonly pegged-to currencies.

- Currency peg types: Currency pegs can be classified as either “soft pegs” or “hard pegs”, depending on the level of flexibility that’s allowed.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Why does Currency Pegging exist?

Countries choose to peg their currencies for several strategic reasons, ranging from economic stability, fostering global trade (boosting exports), and controlling inflation.

Below are the primary motivations behind currency pegging:

1. Stabilizing trade relationships

Pegging can help stabilize trade relationships with a country’s key partners, because if, for example, a country’s major trading partner has a stable currency, pegging to that currency ensures the exchange rate remains consistent. This benefits exporters and importers alike, but is particularly valuable for countries with export-driven economies.

Of course, China comes to mind as a prime example, since it pegged its yuan to the US dollar until 2005 in order to maintain its competitiveness in global markets.

2. Attracting foreign investment

A stable currency reduces the risks associated with currency fluctuations, making the country a more attractive destination for foreign investment. Investors feel more confident in committing capital when exchange rates remain predictable.

As a prime example, the United Arab Emirates’ dirham is pegged to the US dollar, reassuring investors in the oil and tourism industries-essentially the twin pillars of the UAE economy.

3. Combating hyperinflation

In countries facing hyperinflation and/or severe economic instability, pegging the currency to a stronger foreign currency can help restore confidence and bring inflation under control.

The classic example is that of Argentina, which pegged its peso to the US dollar in the 1990s to curb hyperinflation (although the policy eventually failed due to fiscal mismanagement).

What are the Pros and Cons of Currency Pegging?

Pros

- Reduced exchange rate volatility

- Enhanced trade relationships

- Inflation control

- Confidence building

Cons

- Loss of monetary policy independence

- Depletion of foreign reserves

- Vulnerability to speculation

- Risk of misalignment

Countries that peg their currency can avail themselves of the following pros

- Reduced exchange rate volatility. A pegged currency minimizes fluctuations, creating a stable environment for businesses and investors engaged in international trade.

- Enhanced trade relationships. Countries with pegged currencies can foster stronger trade partnerships by reducing uncertainties tied to currency conversion rates, making business easier and less risky.

- Inflation control. In economies prone to high inflation, a currency peg can help anchor prices, by tying the currency’s value to a more stable foreign currency.

- Confidence building. Pegged currencies often inspire greater confidence among foreign investors, making it easier for countries to attract capital and loans.

Conversely, the flip side of pegging your currency comes with the following cons

- Loss of monetary policy independence. Countries with pegged currencies must align their monetary policies with the currency they’re pegged to, limiting their ability to respond to domestic economic issues by conventional means that would be available to countries with a free currency.

- Depletion of foreign reserves. Maintaining a currency peg demands ample foreign reserves, as central banks must intervene frequently to buy or sell currencies to stabilize the exchange rate.

- Vulnerability to speculation. Pegged currencies are often targets for speculative attacks. If investors doubt a central bank’s ability to maintain the peg, they may sell the currency, leading to crises.

- Risk of misalignment. Over time, a pegged currency can become misaligned with its true market value, leading to trade imbalances and economic distortions.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Which Pegged Currencies exist?

Numerous countries have adopted pegged exchange rate systems, and below are examples of currencies pegged to the US dollar (and other benchmarks).

| Currency | Pegged to | Exchange Rate |

|---|---|---|

| Hong Kong dollar (HKD) | US dollar (USD) | 7.8 HKD = 1 USD |

| Danish krone (DKK) | Euro (EUR) | 7.46 DKK = 1 EUR |

| Saudi riyal (SAR) | US dollar (USD) | 3.75 SAR = 1 USD |

| Singapore dollar (SGD) | Basket of currencies | Managed float system |

| Bhutanese ngultrum (BTN) | Indian rupee (INR) | 1 BTN = 1 INR |

| East Caribbean dollar (XCD) | US dollar (USD) | 2.7 XCD = 1 USD |

What is a Soft Peg?

A soft peg is a type of exchange rate regime where a country’s currency is allowed to fluctuate within a very narrow band around a fixed value. Central banks intervene periodically to ensure the currency stays within the set range, and this system theoretically provides a good balance between stability and flexibility.

The principal characteristics of a soft peg include

- Some (limited) flexibility. A soft pegged currency is not rigidly fixed, but is allowed to fluctuate slightly.

- Intervention as needed. Central banks monitor the exchange rate closely and intervene when it moves beyond acceptable limits.

China’s yuan, for example, operated under a soft peg to the US dollar for many years, allowing limited fluctuations to support economic growth, while maintaining overall stability.

What is a Hard Peg?

A hard peg is a far stricter form of currency pegging, where the exchange rate is completely fixed to another currency or benchmark, with no flexibility allowed. Hard pegs often require significant foreign reserves to maintain and are less common due to their rigidity.

The primary characteristics of a hard peg center on:

- High stability. The exchange rate remains constant, regardless of market conditions.

- No flexibility. Hard pegs provide certainty, but limit a country’s ability to respond to economic shocks, as several potential monetary policy.maneuvers are off the table with a hard peg.

As an example, the Currency Board system in Hong Kong is a hard peg to the US dollar, where the Hong Kong Monetary Authority strictly maintains the 7.8 HKD to 1 USD exchange rate.

To incorporate pegged currencies into successful trading strategies, join the WR Trading Coaching to learn the ins and outs of just how pegged currencies provide trading opportunities for retail traders in Forex Trading.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Frequently Asked Questions on Currency Peg

What exactly is a currency peg?

A currency peg is a fixed exchange rate system where a country’s currency is tied to the value of another currency, a basket of currencies, or a commodity like gold. One country’s currency value is linked “in tandem” with that of another country’s currency.

Why do countries peg their currencies to others?

Countries peg their currencies to stabilize trade relationships, attract foreign investment, control inflation, or restore economic confidence during financial crises. The single greatest persistent benefit is surely the fact that a country with a pegged currency presents a very stable and welcoming face to investors.

What are examples of pegged currencies?

Examples include the Hong Kong dollar (pegged to the US dollar), the Saudi riyal (also pegged to the US dollar), and the Danish krone (pegged to the euro).

What’s the difference between a soft peg and a hard peg?

A soft peg allows limited flexibility within a predetermined range, while a hard peg fixes the exchange rate completely, with no fluctuations allowed.

Are there risks with currency pegging?

Risks include the obvious loss of monetary policy independence, the constant risk of depleting the country’s foreign reserves, vulnerability to negative investor sentiment (speculative attacks), and potential economic misalignment.

Can a currency peg fail?

Yes, currency pegs can and do fail – if the central bank can’t defend the peg because of a lack of foreign reserves or due to conflicting economic pressures, currency pegs can collapse. Historical examples include Argentina’s peso peg, and the 1992 collapse of the British pound’s peg to the European Exchange Rate Mechanism (ERM).