The primary difference between Forex and Futures lies in their inherent market structure and the nature of the asset being traded on each market. Forex is a decentralized over-the-counter (OTC) market that facilitates the trading of global currency pairs. In contrast, the Futures market is traded on centralized exchanges and offers financial contracts that legally bind the buyer to purchase or the seller to sell at an agreed price and at a specified future date.

Forex vs. Futures Trading: Key Facts

| Specification | Forex | Futures |

|---|---|---|

| 1. Market Type | Decentralized Market – Operates via OTC with no centralized exchange. | Centralized Exchanges – Trading is centralized in exchanges, such as the Chicago Mercantile Exchange. |

| 2. Instruments Traded | All currency pairs from various countries worldwide. | Contracts based on stock indices, bonds, currencies, commodities, and even interest rates. |

| 3. Trading Hours | Open 24 hours from Mondays to Fridays and closed on weekends. | It depends on the specific exchange and future contract. |

| 4. Contract Terms/Limits | There are no standardized or fixed contract terms. Lot sizes also vary. | With specific terms and contract sizes. |

| 5. Expiration | No expiration; you can hold your positions indefinitely | Contracts have expiration dates (monthly, quarterly, etc.) and must be rolled over to maintain positions |

| 6. Liquidity | Highly liquid as Forex is the largest financial market in the world. | Varies on the specific contract (and underlying asset class). Generally, it is less liquid than forex. |

| 7. Minimum Investment | Depending on the broker, the minimum can be as little as $1 | Much higher minimum investment; often requiring at least $500 |

| 8. Brokers | Notable brokers include Interactive Brokers, XTB, XM, and Forex.com | Notable brokers include Interactive Brokers, NinjaTrader, AMP Futures |

| 9. Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and other broker-provided platforms | ThinkorSwim, NinjaTrader, Interactive Brokers, TradeStation, CME Globex |

| 10. Leverage | Generally much higher leverage compared to futures; it can go as high as 1000:1 (or even up to 2000:1 for some offshore brokers) | Generally, a lower leverage ceiling of around 500:1, depending on the specific contract, broker, and time of day. For instance:E-mini S&P 500 (ES): Maintenance Margin: $16,745.00; Day Trading Margin: $400.00Micro E-mini S&P 500 (MES): Maintenance Margin: $1,674.00; Day Trading Margin: $40.00*maintenance margin is set by the exchange while the day trading margin is set by the specific broker |

| 11. Risk | Driven primarily by market volatility (rapid price movement) | Driven primarily by contract expiration and sudden price gaps |

| 12. Profit Potential | Generally provides higher profit potential due to higher leverage | Relatively lower profit potential due to lower leverage availability |

| 13. Regulation | Due to being decentralized, it is overall less regulated as specific regulation varies by country and/or region | Futures markets are highly regulated with centralized exchanges enforcing much stricter rules and standards |

| 14. Trading Cost | – Low commissions (most brokers offer commission-free trading)- Spread-based pricing (difference between bid and ask price) | – Commissions charged per contract – Often with exchange fees, clearing fees, and potential data fees depending on the contract |

| 15. Hedging Use Case | Commonly used for hedging currency-related risks. | Often used by institutions to hedge against commodity and market risks |

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

What are the key differences between Forex and Futures?

Here are the three distinct differences between Forex and Futures:

1. Market Structure

Forex – A decentralized market with no centralized exchanges. Hence, trading is done via OTC through brokers, liquidity providers, and banks.

Futures – A centralised market where contracts are traded on regulated exchanges such as the more popular Chicago Mercantile Exchange (CME), New York Mercantile Exchange (NYMEX), and Intercontinental Exchange (ICE).

2. Financial Instruments Traded

Forex – Only currency pairs can be traded.

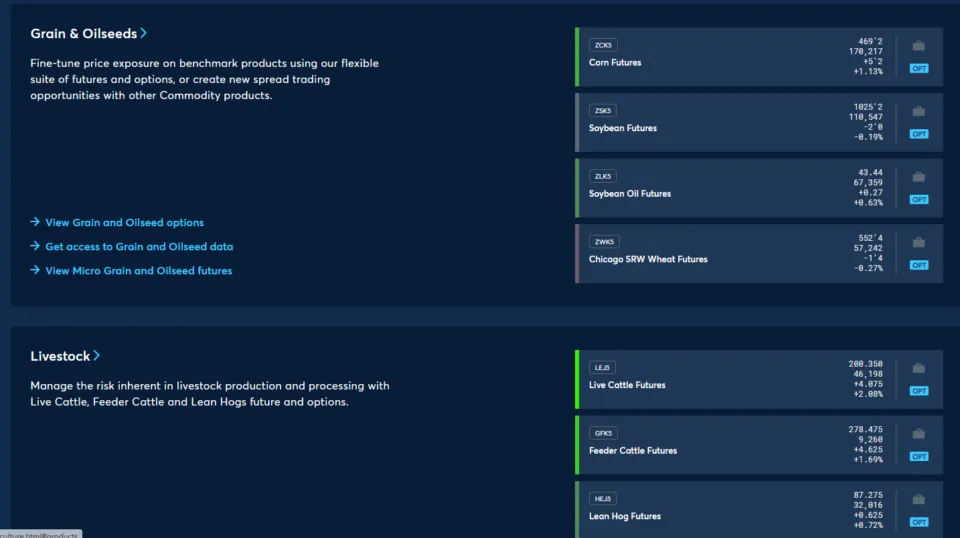

Futures – Contracts based on various asset classes such as stock indices, bonds, currencies, commodities, and even interest rates can be traded.

3. Expiration

Forex – There is no expiration, and you can hold your positions indefinitely.

Futures – Future contracts have expiration dates. Therefore, they must be rolled over to maintain positions.

What are the key similarities between Forex and Futures?

Here are the three notable similarities between Forex and Futures:

- Volatility Level – Both markets experience high volatility, especially around the time when major economic announcements are expected.

- Leverage Availability – Both the Forex and Futures markets offer leverage, though at different levels.

- Use for Hedging – Both markets can be used for hedging purposes (especially by institutions). Forex is primarily used to hedge against currency risks, while Futures are typically used to hedge against market as well as commodity risks.

Which is more risky: Forex or Futures?

Both Forex and Futures are risky. That said, between the two, Forex is arguably the riskier market to trade. This is largely due to the fact that Forex allows for a significantly higher leverage ceiling than Futures.

While Futures traders generally have access to around 500:1 depending on the specific contract and broker, Forex traders can have access to leverage as high as 1000:1 (or even up to 2000:1 for some offshore brokers). This much higher leverage makes it much easier to incur massive losses, as it amplifies both your position size and also the risk you are taking.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Can I trade Forex using Futures?

Yes! You can trade currency pairs using Futures. Instead of the traditional way of trading forex, which is called “spot trading” (we will cover this later), you can use currency pair futures to speculate on or hedge currency movements. To illustrate this, suppose you want to trade EUR/USD using a futures contract, here’s how it generally goes:

Step 1: Select the currency pair’s contract

The futures contract for EUR/USD is called the Euro FX Futures (6E) and is listed on the Chicago Mercantile Exchange (CME).

Step 2: Carefully understand and evaluate the contract’s specifications

Here’s the contract terms for Euro FX Futures (6E):

| Feature | Information |

|---|---|

| Contract Name | Euro FX Futures (6E) |

| Contract Size | €125,000 per contract |

| Margin Requirement | $5,000 |

| Tick Size | 0.00005 |

| Minimum Price Fluctuation | $6.25 per tick |

| Expiration | Quarterly (March, June, September, December) |

Step 3: Sample Trade (Going Long)

After reading the contract terms, you can proceed with trading it. If you believe that EUR/USD will go up, you can buy the Euro FX Futures (6E) contract. Because it has a $5,000 margin requirement, you need $5,000 to open the trade (representing leverage of roughly 25:1 relative to the contract size of about €125,000 vs. $5,000).

Assume the current price is 1.1000 when you purchase the contract, and at expiration it moves to 1.1050, an increase of 0.0050 (100 ticks). Since the minimum tick size is 0.00005 (valued at $6.25 per tick), this movement results in a profit of $625 ($6.25 × 100 ticks) at expiration.

On the other hand, if the price falls below 1.1000, you will then incur a loss (with each tick downward representing a loss of $6.25).

Forex Spot Trading vs. Forex Futures Trading

While both can trade currency pairs, they differ in their approach. Forex Spot Trading is simply the traditional way of trading currency pairs in the Forex market. It involves immediate (on the spot) execution of buying and selling transactions at the current market price, similar to stock or crypto trading.

In contrast, Forex futures trading involves buying and selling standardized futures contracts, where currency pairs serve as the underlying asset. Hence, they have a predetermined price and a set expiration date (as we have illustrated above).

Pros and Cons of Forex Trading

Here are the key pros and cons of Forex trading compared with Futures trading:

Pros

- Much Higher Liquidity

- Generally Higher Leverage Access

- More Accessible Trading Hours

- Lower Transaction Costs

- No Expiry Dates

Cons

- Much Higher Volatility

- Risk of Over-leverage

- No Centralized Regulation

- Counterparty Risk

- Risk of Slippage and Requotes

Pros of Forex Trading

Being the largest financial market, the forex market is also the most liquid. This is especially true when compared with Futures. Compared with futures, Forex allows a significantly higher leverage ceiling of up to 1000:1 on many brokers.

The forex market is open 24 hours from Mondays to Fridays. In contrast, futures trading depends on the exchange and contract.Many forex brokers offer commission-free trading with tight spreads, making forex usually cheaper compared to futures, as commissions and exchange fees often apply. Compared with futures contracts that have definitive expiration dates, forex trades remain open until you decide to close them.

Cons of Forex Trading

Due to being the most liquid financial market, volatility in Forex is often the highest as well especially during key events globally. While access to more leverage can be beneficial, it can also expose many traders, particularly beginners, to massive losses.

Unlike the futures market, which has centralized exchanges, Forex is decentralized, and the regulations vary per region and country. Since forex trades happen over the counter, traders rely on their brokers to execute their trades. This increases the potential risk of price manipulation and even outright fraud.

Since forex typically experiences high volatility, you may suffer from slippage (where your orders are filled at a worse price) or requotes (brokers rejecting your orders due to sudden price changes).

Forex trading not only has various advantages and disadvantages, but Futures also have pros and cons that need to be weighed up.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Pros and Cons of Futures Trading

Here are the key pros and cons of Futures trading compared with Forex trading:

Pros

- Highly Regulated Market

- Lower Risk from Over-leverage

- Centralized Clearing System

- More Diverse Tradable Assets

- Much Greater Hedging Scope

Cons

- Limited/Variable Trading Hours

- Higher Trading Cost

- Expiry Issues

- Larger Capital Requirement

- Position Sizing Issues

Pros of Futures Trading

Since futures trading happens on centralized exchanges, this provides higher transparency and prevents broker manipulation, as futures brokers are also similarly highly regulated. Since futures generally offer a lower leverage ceiling than Forex, this then reduces the risk of incurring massive losses (which can instantly wipe out your account) as a result of extremely high leverage.

Being highly regulated, all trades go through a centralized clearing house. This ensures fair trade execution and prevents potential broker manipulation and fraud. Unlike the forex market, which is limited to currency pairs, futures contracts can be based on more asset classes beyond currencies, such as stock indices, commodities, bonds, and even interest rates.

Since futures contracts can be based on various asset classes, they can also be effectively used to hedge different types of assets. On the contrary, Forex heavily focuses solely on hedging against currency risks.

Cons of Futures Trading

The futures market has relatively limited trading hours, as they depend on the specific exchange and futures contract. This makes it less flexible than Forex’s trading hours. Futures trading typically includes exchange fees, clearing fees, and commissions, making it relatively more costly than forex trading.

Since Futures contracts expire on specific dates, you are required to either roll over your positions or be forced to close them before expiration. Futures contracts typically require bigger capital for you to even start trading (especially when compared with forex’s extremely low minimum investment requirement of just $1 for many brokers)

Since futures contracts have standard sizes, they offer less flexibility in adjusting your position size, as you have no option but to adapt to the predefined contract size.

Learn Forex and Futures Trading With WR Trading

If you want to further deepen your understanding of Forex or Futures trading, including exploring advanced concepts, effective trading strategies, and best risk management practices, you can explore our extensive resources at https://wrtrading.com/.

(Never Trade In Uncertainty Again – Join The WR Trading Mentorship)

Frequently Asked Questions on Forex vs Stock Trading

Which market is better for scalping and short-term trading?

In general, Forex is more ideal for short-term trading, including day trading or scalping, due to its standard 24-hour availability, relatively higher liquidity, and tight spreads. On the other hand, the trading schedule for futures varies greatly depending on the specific exchange and contract.

Is the Forex market more liquid than the Futures market?

Yes, the Forex market is generally much more liquid than the Futures market. In fact, it is the most liquid financial market, as it is also the largest in terms of total trading volume.

Can I trade currency pairs using futures?

Yes, you can trade currency pairs using Futures. This can be done by trading forex futures contracts (such as what we have illustrated) instead of the traditional way of trading currency pairs in the forex market (i.e., spot trading).

Which market is better for beginners?

Generally, forex trading is better suited for beginners. This is mainly due to the much lower capital requirement, which allows you to start trading at as low as $1 (depending on the specific broker). In contrast, futures trading often requires at least $1,000 or more to start, significantly increasing the barrier to entry, especially for beginners with far smaller access to capital.

Which market is more regulated?

Futures are much more heavily regulated because they trade on centralized exchanges, such as the Chicago Mercantile Exchange (CME), New York Mercantile Exchange (NYMEX), and Intercontinental Exchange (ICE), with oversight from regulatory bodies like the Commodity Futures Trading Commission (CFTC) in the US and European Securities and Markets Authority (ESMA) in Europe. On the other hand, being decentralized, Forex is less regulated, particularly in offshore brokerages.