FBS Review 2026 | Regulation, Platforms & Fees

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:3000

- Copy Trading Available

- Low Commission from 6$/1 Lot

- MT4/5 & FBS Trader

- Limited regulatory oversight in some jurisdictions

- Withdrawal fees on certain payment methods

- Inactivity fees after 180 days of no trading

- Customer support response times can vary

- Some account types have high minimum deposits

- Limited cryptocurrency trading options

- Platform options restricted to MetaTrader 4 and 5

FBS operates as a forex and CFD broker delivering access to over 550 trading instruments spanning diverse asset classes. We tested this brokerage extensively so as to evaluate its offered leverage, cost structures, platform technology, regulatory framework, support quality, and the complete trading experience provided by FBS.

This review presents our experience with FBS across every critical dimension to help you assess whether this broker satisfies your trading requirements. We examined the platform for pricing efficiency, reliability of execution, technological architecture, as well as its regulatory standing in order to give you a fair appraisal.

FBS Experience Summary from Our Expert:

My MetaTrader 5 evaluation demonstrated great functionality, with sub-second execution under standard market conditions. I liked the FBS Trader mobile app’s intuitive interface and genuinely comprehensive charting. I also have to say, the unlimited demo account validity offers significant value compared to brokers that put a limit on how long you get a demo account.

What impressed me most is the ultra-high leverage (reaching 1:3000) that makes FBS one of the highest leverage options in the regulated broker space. When I withdrew, I got funds within 18 hours through electronic wallet channels. The educational resources are comprehensive (they have webinars, video tutorials, and structured courses).

What I didn’t like was the regional feature variations, particularly limited bonus offerings for EU clients due to CySEC restrictions. The multi-entity regulatory structure creates confusion about which protections apply based on jurisdiction.

Email support response times went over 24 hours (albeit for non-urgent inquiries). The single account type at FBS also limits flexibility, when other brokers offer multiple tiers. That said, overall FBS gave me a competitive environment if you’re prioritizing maximum leverage and mobile capabilities, though you should carefully consider the regional variations and regulatory complexity for your purposes.

0 FBS Customer Reviews And Ratings

What is FBS?

Since being founded in 2009, FBS has established itself as a global forex and CFD broker serving traders across 150+ countries. The company operates through multiple regulated entities (positioned strategically across different jurisdictions), with concentrated market presence in Asia-Pacific, Middle Eastern, African, and Latin American territories.

Their instrument selection comprises over 550 trading products including forex currency pairs, equity indices, commodity markets, cryptocurrency derivatives, and individual company shares through CFD structures. FBS distinguishes itself through ultra-high leverage reaching 1:3000 in applicable jurisdictions, competitive spreads starting at 0.7 pips, and a proprietary mobile trading application featuring over 90 technical indicators.

The firm caters to both novice traders seeking accessible entry requirements and experienced market participants demanding sophisticated execution environments. Since inception, FBS has accumulated over 27 million registered users globally and maintains expanding operations, with consistent monthly trading volumes in the billions of dollars.The broker structures its product offering around a streamlined account framework designed to accommodate distinct trading methodologies and capital allocations. FBS supports industry-standard MetaTrader 4 and MetaTrader 5 platforms while delivering a proprietary FBS Trader mobile application emphasizing comprehensive account oversight and user-friendly navigation.

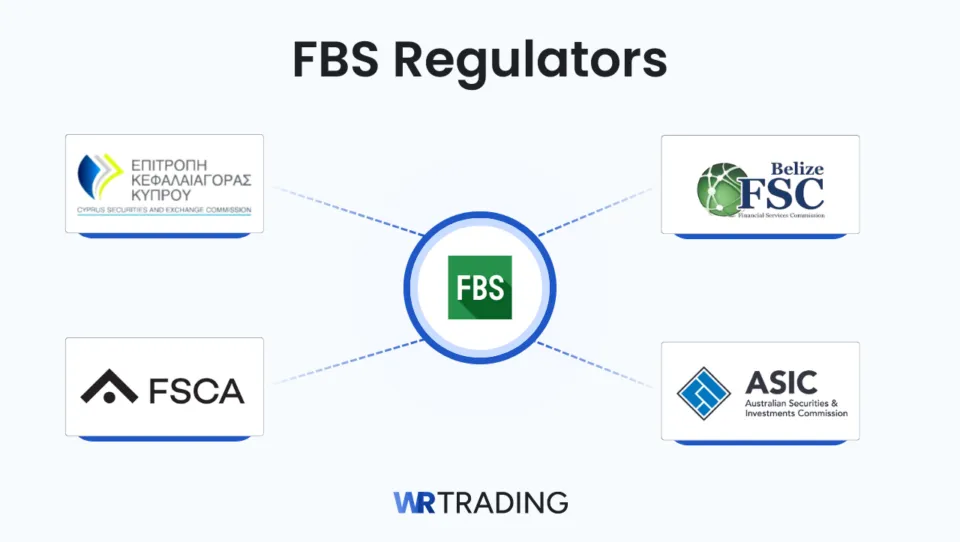

Is FBS Regulated?

Yes, FBS maintains regulatory authorization through multiple financial oversight bodies including Belize’s FSC, Cyprus’s CySEC, Australia’s ASIC, and South Africa’s FSCA. The primary entity FBS Markets Inc. holds Financial Services Commission authorization from Belize under license number 000102/460. Tradestone Ltd. operates under Cyprus Securities and Exchange Commission supervision with license number 331/17.

Additional entities include Intelligent Financial Markets Pty Ltd regulated by the Australian Securities and Investments Commission (ASIC) holding ABN 48 155 185 014, and FBS South Africa authorized by the Financial Sector Conduct Authority (FSCA) under FSP number 52218.

The broker secures client deposits by keeping trader funds separate from company operational capital in dedicated bank accounts. We can happily confirm that FBS is not a scam, and upholds international financial standards across every regulated subsidiary.

The CySEC license represents Tier-1 regulatory achievement for European Union clients, providing enhanced oversight including MiFID II compliance with protection through the Investor Compensation Fund (ICF) offering coverage up to €20,000 per eligible claim. The ASIC regulation delivers Tier-1 protection appropriate for Australian clients.

The FSC Belize provides Tier-3 oversight with more flexible trading conditions including higher leverage options. FBS provides negative balance protection across all accounts, ensuring traders cannot lose more than their deposited capital.

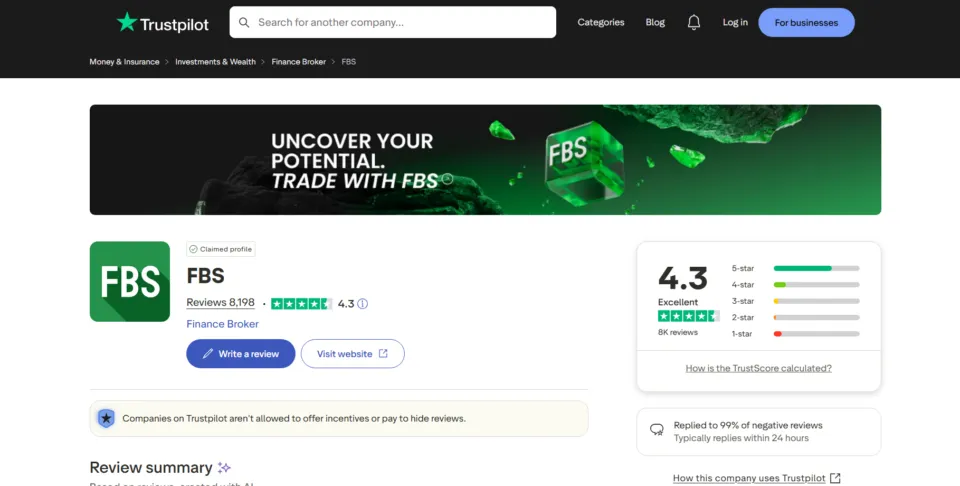

How Good are the Reviews About FBS?

FBS gets generally favorable online assessments across prominent review platforms (4.3 stars on Trustpilot). Independent review aggregators also give above-median ratings, with traders commonly highlighting swift execution speeds, good customer service interactions, and competitive cost structures. Numerous users specifically endorse the FBS Trader mobile application and the educational resource quality.

Smooth deposit processing and relatively quick withdrawal completions, particularly through electronic wallet and cryptocurrency channels, are consistently emphasized. Traders appreciate the ultra-high leverage availability and the breadth of available trading instruments. The 24/7 customer support via live chat receives consistent praise for responsiveness and multilingual capabilities.

Complaints center around feature variations between different regulatory entities and withdrawal processing delays for some users. Several traders report frustration with bonus availability restrictions in certain jurisdictions. Some users mention occasional spread widening during high-impact news events, but this is standard industry practice and not unique to FBS.

Reddit trading communities discuss FBS with balanced perspectives, acknowledging competitive pricing while noting the multi-entity regulatory structure frustrations. Forex Peace Army features mixed sentiment with satisfied traders praising execution quality while others raise concerns about leverage risks and regional feature limitations.Third-party review sites typically rate FBS favorably for its ultra-high leverage options and mobile trading capabilities, but often highlight the regulatory variations as a consideration. The consensus positions FBS as a legitimate brokerage offering competitive conditions, particularly suited for traders comfortable with offshore regulatory oversight and looking for maximum leverage.

Does FBS Face Any Negative Reviews or Customer Concerns?

Yes, there are criticisms and complaints about FBS that warrant attention. The foremost concern involves regional feature variations based on regulatory jurisdiction. Traders report confusion about which bonuses, leverage options, and instrument selections apply to their specific registration entity. EU clients particularly note restricted bonus availability due to CySEC regulations.

The FSC Belize license represents Tier-3 oversight rather than premium regulatory frameworks, creating concerns for traders prioritizing maximum protection. Traders registering through the global website may not automatically receive CySEC or ASIC protections unless their account resides directly with those entities.

Some users report withdrawal processing delays with international wire transfers, with processing times occasionally extending beyond advertised timeframes. These delays appear more frequent during peak periods or when additional verification requirements arise. However, electronic wallet withdrawals consistently process faster, both in our testing and user reports.

Also, some forum discussions mention execution quality variations during high-impact news releases (spread widening and occasional slippage during volatile periods). These occurrences fall within normal industry patterns, and they appear within acceptable ranges at FBS, compared to competitors. To their credit, the broker maintains transparency about variable spread conditions during low liquidity.

We identified no verified scandals or major regulatory enforcement actions against FBS. The broker maintains its licenses in good standing across all operating jurisdictions. The criticisms largely reflect operational implementation choices and inherent multi-entity regulatory complexity, rather than systematic fraud or malpractice.

What Can FBS Offer You?

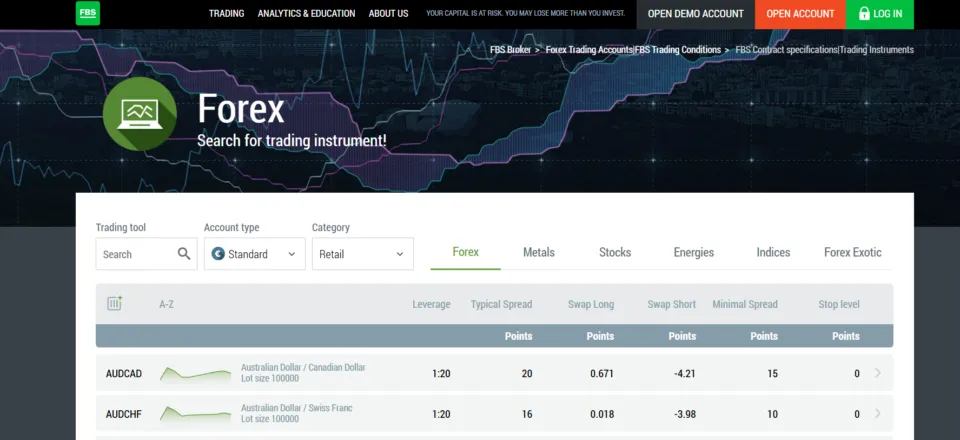

FBS delivers trading access to over 550 CFD instruments distributed across six primary asset categories. Currency trading encompasses 40+ forex pairs spanning major, minor, and exotic combinations including EUR/USD, GBP/USD, USD/JPY, and emerging market currencies. Index products feature 15+ global equity benchmarks including the S&P 500, NASDAQ 100, FTSE 100, DAX 40, and Nikkei 225.

Commodity markets include energy contracts (Brent crude oil, West Texas Intermediate, natural gas), precious metals (gold, silver, platinum, palladium), and limited soft commodities. Cryptocurrency derivatives cover Bitcoin, Ethereum, Litecoin, Ripple, and additional digital assets with around-the-clock trading availability. Equity CFDs provide exposure to 130+ individual company shares spanning US, UK, and European exchanges, featuring corporations like Apple, Tesla, Amazon, and Microsoft.

Asset Classes

- Forex Trading: 40+ currency pairs with spreads beginning at 0.7 pips on the Standard account. Leverage extends to 1:3000 on major pairs in global entities (reduced to 1:30 for CySEC-regulated EU clients). Exotic pairs like USD/TRY and USD/ZAR carry higher margin requirements.

- Indices: 15+ global equity benchmarks with competitive spreads during liquid market hours. Popular indices demonstrate tight pricing with S&P 500 spreads averaging around 0.6 points during optimal sessions.

- Commodities: Energy products and precious metals with floating spread structures. Gold trading offers particularly competitive conditions with leverage reaching 1:500 on Standard accounts. Agricultural commodities are not currently offered.

- Cryptocurrencies: Major digital assets available as CFDs with leverage and continuous 24/7 trading. Crypto positions carry zero swap charges on overnight holdings.

- Share CFDs: US and European equities with fractional lot capabilities. Commission structures vary by market with specific fees outlined in contract specifications. European equities carry commission charges while US stocks may trade commission-free depending on account entity.

Financial Products

FBS deals solely in CFD products (Contracts for Difference) spanning every available market sector. You speculate on value fluctuations rather than purchasing actual securities. Every leveraged CFD trade magnifies your possible returns alongside corresponding downside exposure equally.

Platforms Available

FBS offers MT4 and MT5 compatibility across computer terminals, smartphones, and browser interfaces. Each platform supplies sophisticated graphing tools, extensive technical analysis resources, plus full compatibility with automated Expert Advisors and systematic trading programs. The proprietary FBS Trader mobile application emphasizes streamlined mobile trading with over 90 technical indicators, one-click trading functionality, and integrated educational resources. WebTrader provides browser-based access without requiring software installation.

Copy Trading

FBS facilitates copy trading through MetaTrader 5 platform integration. Users choose signal managers by evaluating their verified track records such as profit yields, success frequencies, and exposure measurements. The system replicates trades from selected providers in real-time proportional to allocated capital. The FBS Trader app includes social trading features enabling strategy discovery and performance tracking.

Leverage

Maximum leverage extends to 1:3000 on Standard accounts for forex and gold trading in non-EU jurisdictions. Trading ratios reduce automatically as your balance grows beyond specific capital limits or when open trades expand. CySEC-regulated EU clients face restricted leverage of 1:30 on major forex pairs and 1:20 on minor pairs, gold, and major indices in compliance with ESMA regulations. Indices, stocks, and ETFs carry instrument-specific leverage restrictions typically ranging from 1:100 to 1:500.

Is FBS Beginner-friendly?

Yes, based on our testing, FBS accommodates beginner traders effectively. We found the Standard account with its $5 minimum deposit exceptionally accessible, allowing beginners to start with minimal capital risk. The commission-free structure simplifies cost calculations for newcomers unfamiliar with separate commission charges.

We explored the educational resources and discovered comprehensive coverage including the FBS Academy with over 30 articles, video tutorials, structured courses, and the Trader’s Brew Podcast. The available content covers platform navigation, technical analysis fundamentals, fundamental analysis principles, and trading psychology adequately for getting started.

We confirmed the simulated trading environment (a demo account of $100,00 without time restriction) accurately mirrors real market pricing across MT4, MT5, and FBS Trader platforms, enabling extended practice without financial exposure.

The copy trading capabilities we evaluated through MT5 integration benefit beginners by enabling strategy replication from experienced signal providers. This approach allows learning through observation while potentially generating returns, though understanding inherent risks remains essential.

Testing the 24/7 customer support, we received live chat responses within 2-4 minutes across 15 languages. Support quality proved adequate for beginners, and the lower 1:30 leverage available to EU CySEC-regulated clients also provides more appropriate risk parameters for beginners.

Can Professionals Find Value at FBS?

Again, yes, as our analysis indicates professional traders can derive value from FBS’s Standard account, though the single-tier account structure limits flexibility compared to competitors offering dedicated ECN accounts. We tested the platform extensively and identified professional-grade characteristics including competitive spreads from 0.7 pips, quality execution speeds, and pricing appropriate for certain scalping methodologies.

During testing, the Standard account’s zero-commission structure combined with spreads around 1.0-1.1 pips on EUR/USD delivered competitive total trading costs for active traders. This pricing positions reasonably against industry alternatives for professional traders, though dedicated ECN accounts from competitors typically offer tighter raw spreads plus transparent commissions.

We found the ultra-high 1:3000 leverage enables professionals to optimize capital deployment across diversified position portfolios (in jurisdictions where available). Our testing confirmed complete Expert Advisor support and algorithmic trading compatibility across both MetaTrader platforms. We observed sophisticated traders successfully implementing advanced order types and automated trading systems.

The FBS Trader mobile application proved exceptionally capable for professionals requiring comprehensive mobile trading functionality. The platform delivers institutional-quality charting tools with over 90 technical indicators and one-click execution capabilities.

While ASIC and CySEC provide strong oversight for Australian and EU clients respectively, note that the primary FSC Belize entity operates under Tier-3 regulatory frameworks. Typically, professionals managing substantial capital often prioritize Tier-1 regulation from authorities like the FCA for maximum protection levels and compensation scheme access.

The $5 minimum deposit creates exceptional accessibility for professional accounts, but professional traders should verify their registration jurisdiction to understand which regulatory entity oversees their account and what protections apply.

Trading Costs on FBS?

FBS implements a streamlined single-tier pricing structure with trading costs determined by spreads on most instruments. The total expense to trade depends on your selected assets and position sizes.

The Standard account eliminates separate commission charges by embedding all costs within spreads that begin at 0.7 pips for major currency pairs. Traders seeking straightforward, all-in-one pricing find this structure appealing since it removes the need to calculate additional fees. For a full 1.0 lot EUR/USD trade, the total cost averages approximately $10-11 based on typical 1.0-1.1 pip spreads during liquid market sessions.

Share CFDs represent the exception with commission charges applied separately. European equity CFDs carry commission structures while US stocks may trade commission-free depending on the specific entity through which your account operates.

Spreads

Market liquidity and volatility drive spread fluctuations throughout trading sessions. EUR/USD typically shows spreads of 1.0-1.1 pips on Standard accounts when London and New York sessions overlap. Our testing verified these spreads held stable during typical market activity.

Exotic currency pairs will feature broader spreads. Thin liquidity and/or big news announcements will typically see expanding spreads, although this is a characteristic of forex brokers and not specific to FBS.

| Instrument | Standard Account |

|---|---|

| EUR/USD | 1.0-1.1 pips |

| GBP/USD | 1.3-1.5 pips |

| USD/JPY | 1.0-1.2 pips |

| Gold (XAU/USD) | 2.0-2.5 pips |

| S&P 500 Index | 0.5-0.7 points |

Commissions

Standard and Cent accounts operate commission-free on forex and index instruments. Your entire cost structure flows through spreads alone, simplifying calculations for position sizing.

Share CFD commission structures differ by geographic market. US equity CFDs may trade without commissions depending on entity regulations. UK and European stock CFDs apply percentage-based or fixed commissions calculated against nominal trade value, with exact rates detailed in contract specifications.

| Account Type | Forex Commission | Equity CFD Commission |

|---|---|---|

| Standard | $0 (spread-only) | Varies by market/entity |

| Cent | $0 (spread-only) | Varies by market/entity |

What are the Deposit and Withdrawal Fees at FBS?

FBS imposes zero internal fees on deposits regardless of payment methodology. Third-party payment processor charges or currency conversion fees may apply depending on selected deposit channels and account base currency.

Withdrawal fee structures change based on your selected method. Electronic wallets like Skrill, Neteller, FasaPay, Perfect Money, and SticPay process without internal FBS fees, although these payment processors often apply their own charges. Cryptocurrency withdrawals (Bitcoin, USDT) avoid internal broker fees entirely, with only blockchain network fees deducted from transfer amounts.

Bank wire transfers routinely carry processing charges from intermediary financial institutions, with these fees subtracted from withdrawals before receiving funds. Credit and debit card withdrawals might trigger processing fees depending on card issuer policies and the card network involved.

Minimum withdrawal amounts vary by payment method and are clearly displayed within the client portal interface. Currency conversion fees apply when the withdrawal currency differs from the account’s base currency.

Is FBS Good for Low Cost Trading?

Yes, FBS qualifies as a competitively-priced broker for traders who execute moderate to high trading volumes. The commission-free Standard account delivers reasonable pricing that competes with industry averages for active traders managing portfolios exceeding $1,000.

The Standard account achieves cost efficiency through zero commissions combined with spreads around 1.0-1.1 pips on EUR/USD during liquid sessions. Traders executing 10 standard lots daily on EUR/USD pay approximately $100-110 in spread costs, positioning competitively against many alternatives offering similar execution quality.

The $5 minimum deposit creates exceptional accessibility for traders beginning with limited capital. The absence of inactivity fees enhances FBS’s value proposition for traders with irregular activity patterns. Many brokers charge monthly fees for maintaining dormant accounts, but FBS imposes no such penalties.However, traders seeking the absolute tightest pricing available may prefer brokers offering dedicated ECN accounts with raw spreads plus transparent commissions.

Such accounts typically deliver lower total trading costs for very active professional traders, though they require higher minimum deposits. FBS’s single-tier structure prioritizes simplicity over tiered pricing optimization..

FBS Account Opening

Opening an account with FBS follows a streamlined online procedure taking approximately 3-5 minutes for initial registration. We tested the complete onboarding process and found it straightforward across all stages.

1. Registration

We visited the official FBS website and clicked the “Open Account” or “Register” button. The registration form requests basic personal information including your complete name, email address, and optionally your phone number and date of birth. You can register using your Google, Facebook, or Instagram account for faster signup.

Select your preferred trading platform (MT4 or MT5), account currency from 8 available options (USD, EUR, GBP, AUD, NZD, SGD, JPY, HKD), and desired maximum leverage. Confirm you do not reside in restricted jurisdictions including the United States. Accept the terms and conditions plus privacy policy documentation, then click “Register” to proceed. Your account details generate instantly, granting you entry to your member dashboard.

2. Verification of the Account

Account verification requires documentation submission across two categories. For proof of identity, we uploaded a clear, colored, unaltered copy of a valid government-issued identification document such as a passport, national ID card, or driver’s license. The document must display your complete name, date of birth, photograph, and maintain current validity (not expired).

For proof of address, you can submit a utility bill, bank statement, credit card statement, or tenancy agreement issued within the past three to six months (requirements vary by entity). The document must show your complete name and residential address matching information provided during registration.

Submit documents via the Personal Area interface. Verification staff usually complete reviews within one business day during weekdays. We tested this process and gained account approval 18 hours after submitting our documents. Upon approval, FBS emails your MT4 or MT5 login credentials.

You can deposit funds and commence trading before completing address verification. However, withdrawal capabilities remain blocked until full verification concludes (a compliance measure aligning with anti-money laundering regulations).

3. Fund Account or Use a Demo Account

After receiving login credentials, you can capitalize your live account or practice with a demo account first. Practice accounts offer $100,000 virtual funds with no time limit. The simulation replicates actual market conditions across MT4, MT5, and FBS Trader platforms, enabling strategy testing without financial exposure.

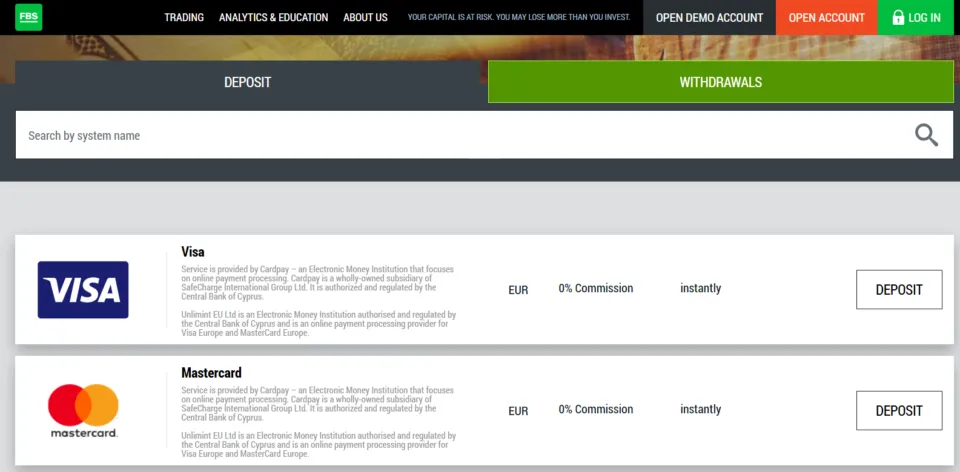

To fund your real trading account, access the Personal Area and select the preferred payment method. FBS supports bank wire transfers, credit/debit cards (Visa, Mastercard), electronic wallets (Skrill, Neteller, FasaPay, Perfect Money, SticPay), and cryptocurrency deposits (Bitcoin, USDT).

Minimum funding equals $5 for Standard accounts and $10 for Cent accounts (EU clients). Processing durations range from instant for electronic methods and cryptocurrencies to 2-3 business days for bank wires. We tested a credit card deposit which reflected in our account within 5 minutes.

What Account Types are Available with FBS?

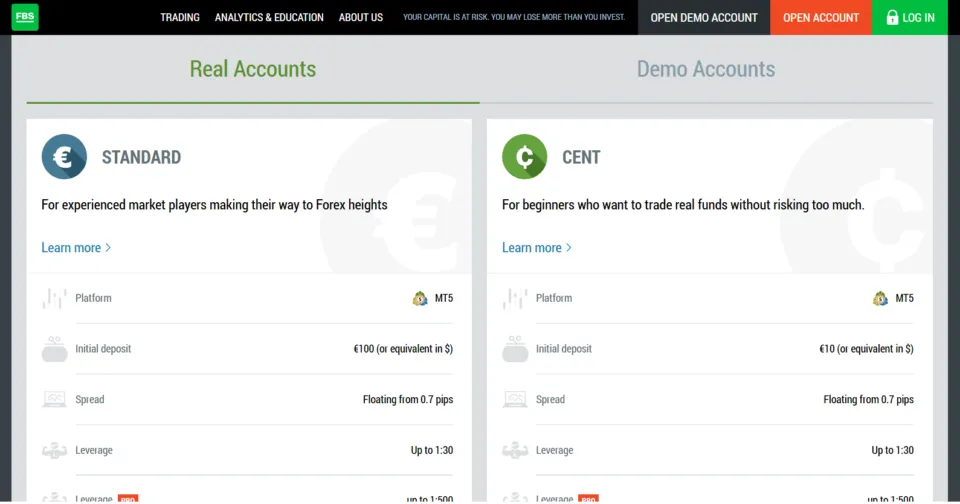

FBS offers a streamlined account structure centered around the Standard account with regional variations. The broker previously offered multiple account tiers but consolidated its offering to simplify the trader experience.

These are the three account types offered by FBS:

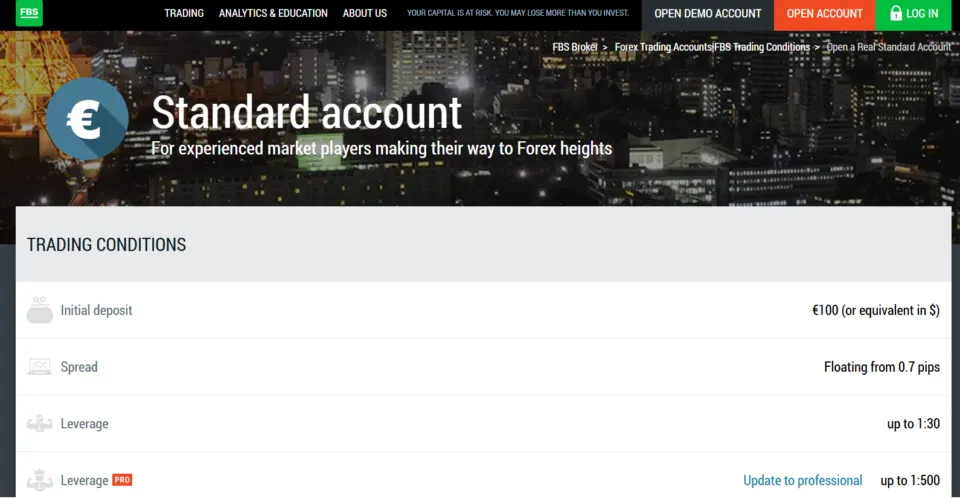

1. Standard Account

The Standard account suits traders across all experience levels who prefer simplified, all-inclusive pricing. This account eliminates commissions on forex and index instruments by building all costs into spreads that begin at 0.7 pips for major forex pairs. Entry requires just $5 (or $100 depending on regulatory entity), making it exceptionally accessible for traders starting with limited capital.

Standard accounts allow leverage extending to 1:3000 in non-EU jurisdictions (with automatic reductions as account size grows). CySEC-regulated EU clients receive maximum 1:30 leverage on major pairs. This account type supports conversion to an interest-free structure accommodating Muslims adhering to halal investment guidelines. Minimum trade size starts at 0.01 lots.

The spread-only cost structure simplifies trading economics for all participants. Maximum open positions reach 500 simultaneously with 200 pending orders allowed. The account provides access to the complete instrument range including forex, indices, commodities, shares, and cryptocurrencies.

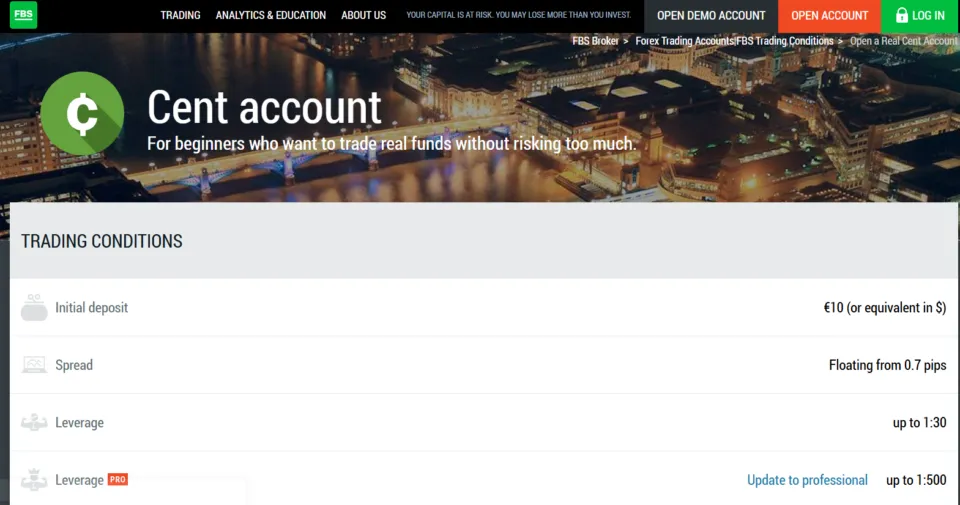

2. Cent Account

The Cent account caters specifically to absolute beginners and traders testing strategies with minimal risk exposure. Position sizes denominate in cents rather than standard currency units, reducing position value by 100 times. This enables micro-trading with extremely small capital requirements.

Minimum funding equals $5 globally or $10 for EU clients. The Cent account operates commission-free with identical spread pricing to the Standard account (from 0.7 pips). Maximum leverage reaches 1:1000 in non-EU jurisdictions (reduced to 1:30 for EU clients). Islamic account options remain available.

The cent denomination limits total position sizes, making this account optimal as a training environment where beginners can trade real market conditions with minimal financial risk. The account provides identical platform access and instrument selection as the Standard account.

3. Professional Account

Professional accounts become available to traders who qualify based on experience, knowledge, and financial criteria. Qualification requires completing an assessment survey demonstrating adequate trading expertise. Professional accounts offer enhanced leverage options and remove certain regulatory restrictions applicable to retail clients.

EU professional clients access leverage beyond the standard 1:30 retail limitation, extending to 1:500 on major pairs. Professional account holders waive certain investor protection measures including negative balance protection in some jurisdictions. The account requires meeting specific financial thresholds and demonstrating substantial trading experience.

Professional status qualification varies by regulatory entity and requires annual reconfirmation to maintain status.

How to Fund Your FBS Account

FBS supports numerous deposit methodologies providing flexibility across different regions and payment preferences. We found that deposit processing times vary from instant (for electronic methods) to 2-3 business days for bank transfers.

- Credit and debit card deposits (Visa, Mastercard) process instantly. Cards must belong to the registered account holder for compliance with anti-money laundering regulations. Be aware that certain credit card companies might treat broker funding as cash withdrawals, which could generate extra charges.

- Electronic payment systems including Skrill, Neteller, FasaPay, SticPay, and Perfect Money offer instant deposit confirmation. These methods prove popular in regions with limited banking infrastructure. Transaction limits vary by payment processor.

- Wire transfers suit bigger funding amounts and typically complete in two to three working days. Provide complete banking details supplied in the Personal Area. Cross-border payments might attract correspondent banking charges, although FBS itself levies zero deposit costs.

- Cryptocurrency deposits (Bitcoin, USDT) provide fast, borderless transactions. Digital currency funding usually processes in half an hour to one hour based on current blockchain traffic volumes. Deposit bonus eligibility may vary for cryptocurrency funding methods depending on regional regulations.

FBS levies no internal charges on deposits regardless of selected methodology. Banking institutions and other payment processors will likely impose their own fees. Conversion charges occur when deposit currency differs from your account denomination.

Withdrawal Options with a FBS Account

Withdrawal processing with FBS typically completes within 15-20 minutes for electronic payment methods and 2-3 business days for bank wires following internal approval. The broker’s policy required us to make withdrawals following the identical routing as deposits (to comply with global anti-money laundering regulations).

To initiate a withdrawal, access the Personal Area and select the withdrawal option. Select the same funding channel you used for deposits, then specify how much you wish to withdraw. Minimum withdrawal thresholds vary by payment method.

- Digital wallet services like Perfect Money, FasaPay, Neteller, SticPay, and Skrill provide immediate funding verification.These methods incur no internal FBS fees, though payment processors may charge their own withdrawal fees.

- Cryptocurrency withdrawals provide rapid, borderless transactions. Processing completes within 15-20 minutes, with blockchain confirmation durations varying by network congestion. No internal FBS fees apply to crypto withdrawals, only blockchain network fees.

- Bank wire transfers require longer processing, completing within 2-3 business days after internal approval. Third-party banks typically charge you for making international transfers. FBS applies no internal wire transfer fees, but intermediary bank charges typically reduce the received amount.

- Credit and debit card withdrawals follow identical routing as deposits up to the total deposited amount. Processing requires 3-5 business days. Any earnings beyond your original card funding total require extraction through different channels like wire transfers or digital wallets.

You’ll hit withdrawal complications if you try to withdraw via methodologies differing from your deposit method, when account verification remains incomplete, or when your trading volume doesn’t meet the requirements connected to promotional bonuses. Regional bonus restrictions particularly affect EU clients due to CySEC regulations.

Can You Get Negative Balance Protection at FBS?

Yes, FBS provides negative balance protection to all retail clients across all account types and regulated entities. This safeguard ensures traders cannot lose more than their deposited capital.

Negative balance protection activates when extreme market volatility drives account balance below zero. Under these circumstances, FBS automatically resets the account balance to zero at no cost to the trader, eliminating the risk of you owing money to the broker (beyond your initial deposit).

During sudden market gaps occurring over weekends (or following major economic announcements), the protection mechanism proves particularly valuable. Negative balance protection applies across all trading instruments including forex, indices, commodities, cryptocurrencies, and share CFDs.

FBS’s stop-out level equals 20% of required margin. The platform will automatically close your positions (with the least profitable going first) when margin drops to this threshold. This automatic liquidation mechanism works in conjunction with negative balance protection and gives you genuinely comprehensive risk management. Margin call warnings activate at 40% margin level, alerting you before automatic liquidation occurs.

Customer Support Options at FBS?

FBS delivers customer support through multiple channels with 24/7 availability and multilingual assistance in 15+ languages. We tested support quality across different contact methods and received consistently responsive service.

Live chat provides the fastest response channel with agents typically responding within 2-4 minutes. Their instant messaging service runs continuously, addressing queries about accounts, platform technical problems, funding or withdrawal concerns, plus broader trading assistance. We found live chat agents knowledgeable about account features and trading conditions.

Email support operates through dedicated channels for different inquiry types. Written replies arrive within two to six hours for simple queries, extending to one or two business days when matters demand deeper examination. We tested email support and received detailed responses within 12 hours for account-specific questions, though weekend response times extended notably.

- info@fbs.com (general support inquiries and technical assistance)

- support@fbs.eu (for European entity clients)

- Various regional support email addresses available for specific jurisdictions

Phone support is available through multiple regional numbers with business hours varying by location. The phone lines provide direct voice communication for urgent matters.

FBS’s online knowledge hub features comprehensive frequently-asked-question areas addressing registration procedures, software operation, funding processes, cash extraction, market terms, and solving technical difficulties. Their self-help documentation works especially well for fixing routine problems independently before reaching out to staff.

| Contact Method | Availability | Average Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/7 | 2-4 minutes | 15+ languages |

| 24/7 | 2-48 hours | 15+ languages | |

| Phone | Regional hours | Immediate | Multiple |

| Help Center | 24/7 | Self-service | Multiple |

Multilingual support accommodates traders across Asia-Pacific, Middle East, Africa, Europe, and Latin America. Major languages include English, Spanish, Arabic, Chinese (Simplified and Traditional), Vietnamese, Thai, Indonesian, and Portuguese.

Support also comes in the form of Twitter, Facebook, and Instagram channels, for those who prefer to pursue their inquiries and glean updates via social media.

Are FBS Profits Taxable?

Yes, trading gains from FBS activities face taxation requirements in most jurisdictions. The responsibility for understanding and fulfilling tax obligations in your country of residence rests squarely with you as a trader.

Tax authorities treat CFD trading profits as taxable capital gains. Treatment varies significantly across jurisdictions, with some countries taxing trading profits as ordinary income and others applying specific capital gains rates. The applicable tax rate depends on factors including total annual income, trading frequency, and whether trading constitutes a primary income source or supplementary income.

FBS does not withhold taxes from trading profits or automatically report earnings to tax authorities in most jurisdictions. You must report on your trading activity’s tax liability according to your local regulations.

Some countries exempt certain trading activities from taxation or provide allowances for capital losses to offset gains. Expert guidance from certified accountants addressing your unique circumstances remains crucial for meeting regulatory obligations correctly.

Most countries mandate that traders keep thorough documentation of every transaction, capturing opening and closing price points, trade volumes, fee expenses, plus actual gains or deficits. Both MetaTrader platforms automatically produce complete trading histories that simplify tax filing procedures. Consulting with professional accountants helps guarantee you meet jurisdiction-specific reporting requirements.

Compare Alternatives To FBS

When considering FBS, compare it with established alternatives including IC Markets, Pepperstone, XM, Exness, and RoboForex. Each broker offers distinct advantages and disadvantages across regulatory frameworks, cost structures, platform selections, and product ranges.

- IC Markets specializes in ECN execution with some of the tightest spreads available globally. The broker attracts professional traders and algorithmic developers through superior platform infrastructure and cTrader integration. With ASIC and CySEC regulatory licenses, IC Markets ensures robust supervision for clients in Australia and Europe, representing stronger oversight than FBS’s primary Belize entity.

- Pepperstone delivers outstanding execution quality with industry-leading pricing on raw spread accounts. The broker’s customer service and educational materials surpass what many competitors provide. Pepperstone operates under FCA and ASIC regulation, ensuring Tier-1 regulatory protection superior to FBS’s multi-entity structure.

- XM operates under multiple licenses including CySEC and ASIC. The broker emphasizes educational content and trader development programs similar to FBS. XM offers generous bonus structures across most jurisdictions with simpler multi-account management capabilities than FBS.

- Exness provides ultra-low minimum deposits and unlimited leverage options in certain jurisdictions, positioning competitively against FBS’s ultra-high leverage. The broker maintains FSA and CySEC regulation with competitive pricing for high-frequency traders.

- RoboForex holds CySEC regulation and offers diverse account types with competitive ECN pricing. The broker provides comprehensive bonus programs and copy trading features similar to FBS, though with more sophisticated multi-tier account structures.

For detailed broker comparisons across specific parameters including spreads, commissions, regulation, and platform features, visit WR Trading’s broker comparison tool.

| Broker | Regulation | Min Deposit | EUR/USD Spread | Commission | Max Leverage |

|---|---|---|---|---|---|

| FBS | FSC, CySEC, ASIC | $5 | From 0.7 pips | $0 | 1:3000 |

| IC Markets | ASIC, CySEC | $200 | From 0.0 pips | $3.50/lot | 1:500 |

| Pepperstone | FCA, ASIC | $200 | From 0.0 pips | $3.50/lot | 1:500 |

| XM | CySEC, ASIC | $5 | From 1.0 pips | $0 | 1:888 |

| Exness | FCA, CySEC | $10 | From 0.0 pips | $3.50/lot | Unlimited |

| RoboForex | CySEC | $10 | From 0.0 pips | $3/lot | 1:2000 |

Develop Your FBS Trading Skills with WR Trading Mentoring

Maximize your trading potential with professional guidance through WR Trading’s comprehensive mentoring program. Our experienced traders provide personalized coaching covering technical analysis, risk management, trading psychology, and strategy development tailored to your experience level and trading goals.

The mentoring program includes one-on-one sessions, detailed market analysis, trade review and feedback, and ongoing support as you develop your trading skills on FBS or any other broker platform. Whether you’re starting with the $5 minimum Standard account or utilizing ultra-high leverage features, structured education accelerates your learning curve and helps avoid costly beginner mistakes.

Visit WR Trading Mentoring to learn more about our coaching services and how we can help you trade more confidently and profitably.

Conclusion: FBS Is a Competitive Broker with Ultra-High Leverage and Accessible Entry Requirements

FBS delivers competitive trading conditions through tight spreads and zero commissions on most instruments. What we like about them includes the exceptionally low $5 minimum deposit (creating unprecedented accessibility), the ultra-high 1:3000 leverage (among the highest in the regulated broker space), and the comprehensive educational resources (including the FBS Academy with structured courses). Professionals will enjoy the leverage available combined with sophisticated execution environments.

The unlimited demo account validity provides extended practice opportunities without time pressure, while the proprietary FBS Trader mobile application delivers exceptional functionality with over 90 technical indicators. The absence of inactivity fees benefits traders with variable trading frequencies, and the negative balance protection provides essential safeguards for retail traders. The MetaTrader 4 and MetaTrader 5 platforms deliver reliable execution quality under normal market conditions.

What we don’t like centers on the multi-entity regulatory structure creating confusion about which protections apply based on registration jurisdiction. The primary FSC Belize entity represents Tier-3 oversight rather than premium Tier-1 authorities. The single Standard account structure limits flexibility compared to brokers offering multiple tiered accounts with varying cost structures.

Regional feature variations prove frustrating, particularly for EU clients facing restricted bonus availability and leverage limitations due to CySEC regulations. The spread-only pricing model, while simple, delivers higher total costs compared to dedicated ECN accounts offering raw spreads plus transparent commissions. Email support response times extend beyond industry best practices for complex inquiries.

We recommend FBS for cost-conscious traders who prioritize ultra-high leverage availability and are comfortable with multi-entity regulatory oversight. The Standard account delivers reasonable value for active traders executing frequent trades on major pairs. The $5 minimum deposit creates exceptional accessibility for beginners starting with limited capital, though you must exercise extreme caution with the ultra-high leverage options available outside EU jurisdictions.

Confirm which regulated entity holds your account and understand which regulatory protections apply to your specific jurisdiction. EU traders benefit from CySEC oversight with ICF protection but face restricted leverage and limited bonus availability. Non-EU traders access higher leverage but operate under Tier-3 regulatory frameworks.

Start with smaller deposits to test withdrawal processes and platform reliability. Read all terms and conditions carefully, particularly regarding promotional bonuses, to avoid account restrictions. FBS functions as a legitimate broker with competitive conditions particularly suited for traders valuing maximum leverage and mobile trading capabilities, though the multi-entity regulatory complexity represents a consideration for those prioritizing premium regulatory protection.

FAQ: Frequently Asked Questions on FBS

Why does FBS Have Such Complicated Regulatory Architecture?

FBS operates through multiple legal entities across different jurisdictions to serve clients worldwide while complying with varying regional regulatory requirements. This multi-entity structure allows FBS to offer services in numerous countries, each with distinct financial regulations. For example, FBS Markets Inc. holds licenses from CySEC and FSCA to serve European and South African clients respectively, while other entities operate under regulations in Belize and other jurisdictions. This complexity enables FBS to provide region-specific features like varying leverage limits and bonus programs that align with local regulatory standards. While this structure can seem confusing, it’s actually common among international brokers seeking to maintain regulatory compliance across multiple markets.

Does FBS Accept US Clients?

No, FBS does not accept clients from the United States (or several other restricted jurisdictions). The broker explicitly prohibits registration from US residents and citizens due to regulatory compliance requirements. US-based traders must seek alternative brokers regulated by the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA).

Can I Use Expert Advisors (EAs) on FBS?

Yes, FBS fully supports Expert Advisors (EAs) and algorithmic trading strategies on both MetaTrader 4 and MetaTrader 5 platforms. Traders can develop custom EAs, purchase third-party automated trading systems, or utilize free EAs from the MQL5 marketplace. The platforms support full EA functionality including backtesting capabilities and optimization features for strategy development.

Does FBS Offer Different Features by Region?

Yes, FBS offers different features depending on the regulatory entity through which traders register. EU clients regulated by CySEC face restricted leverage of 1:30, limited bonus availability due to ESMA regulations, and access to the Investor Compensation Fund (ICF) providing coverage up to €20,000. Non-EU clients typically access higher leverage reaching 1:3000, broader bonus availability, and more flexible trading conditions but operate under Tier-3 regulatory frameworks like FSC Belize. Australian clients benefit from ASIC oversight with appropriate investor protections. Feature availability varies significantly based on registration jurisdiction, creating potential confusion about which conditions apply to specific accounts.