FP Markets Review 2025: All Pros/Cons & User Ratings

- Instant ECN Execution

- Spreads from 0.0 Pips

- Low Commissions From $3.00/1 Lot per Trade

- 24/7 Personal Support

- MT4/MT5, cTrader, TradingView

- Low Minimum Deposit

- Highly regulated

- Wide selection of account-based currencies

- Broad trading instrument range

- Too many concerns on ECN and execution quality

- Limited account selection

- A few withdrawal options incur some charges

Discover whether FP Markets is the best broker for your trading in our comprehensive review. We personally opened multiple accounts, tested execution speed, analysed platform stability, collated the spreads and commissions, and evaluated the responsiveness of its customer service.

Our goal is to provide you with a transparent, expert-driven assessment of FP Markets’ regulation, costs, trustworthiness, platforms, and overall performance, so you can make a smart decision.

With regulation from authorities like ASIC and CySEC, a broad market offering of over 10,000 instruments, and impressive platform diversity, FP Markets initially stood out during our tests. But, as with any broker, it also comes with drawbacks that traders should know, particularly around user-reported concerns.

In the full breakdown below, we reveal where FP Markets excels, where it falls short, and how it compares against other high-quality brokers we’ve explored at WR Trading.

FP Markets Experience Summary from Our Expert:

On the bright side, there were many more positives, which are consistent with the broker’s excellent overall reviews. Their execution was consistently smooth and quick, while the spreads were competitive across both accounts.

I also appreciated the ability to invest in thousands of markets, covering seven asset classes, plus the two bond markets on TradingView. Another impressive strength was the availability of four charting platforms, which offer versatility and flexibility for all traders.

All in all, FP Markets is a fantastic, well-rounded broker and one I consider relatively safe. The only caveat for traders is that they should truly understand the company’s withdrawal and execution policies (where I’ve noted the most complaints, although not all are warranted).

1 FP Markets Customer Reviews And Ratings

What Is FP Markets?

FP Markets (or First Prudential Markets) is an Australian multi-licenced retail derivatives broker founded in 2005 by Matthew Murphie. Their asset selection includes forex, stocks, metals, commodities, indices, crypto, bonds, and ETFs.

These are available on popular charting software brands, namely MetaTrader 4, MetaTrader 5, cTrader, and TradingView. FP Markets lets you choose between two account types (‘Standard’ and ‘Raw’) that require a minimum deposit of $50-100 each.

FP Markets also caters to passive users through managed accounts and a proprietary social trading platform. Similar to the latter is an integrated professional copy service from Signal Start, dedicated to those who follow and provide forex signals. The trading broker services traders from most nations worldwide. However, typical exceptions (usually countries on known global sanctions lists) include Iraq, Iran, Cuba, Myanmar, Afghanistan, Sudan, Liberia, Libya, Yemen, the Russian Federation, and the United States.

Is FP Markets Regulated?

Yes, FP Markets is regulated in six regions under different names by the following regulators (always verify whether you fall under any of these):

- First Prudential Markets PTY Ltd by the Australian Securities and Investments Commission (ASIC AFS Licence No: 286354)

- First Prudential Markets Ltd by the Cyprus Securities and Exchange Commission (CySEC Licence No:371/18)

- FP Markets (Pty) Ltd by the Financial Sector Conduct Authority in South Africa (FSP Number 50926)

- FP Markets Limited by the Capital Markets Authority (CMA) of Kenya (Licence No.103)

- First Prudential Markets Limited by the Financial Services Authority in the Seychelles (FSA Licence No. SD 130)

- FP Markets Ltd by the Financial Services Commission in Mauritius (Licence No. GB21026264)

Furthermore, the broker is registered in St. Vincent & the Grenadines (Limited Liability Company Authorisation No. 126, LLC 2019).

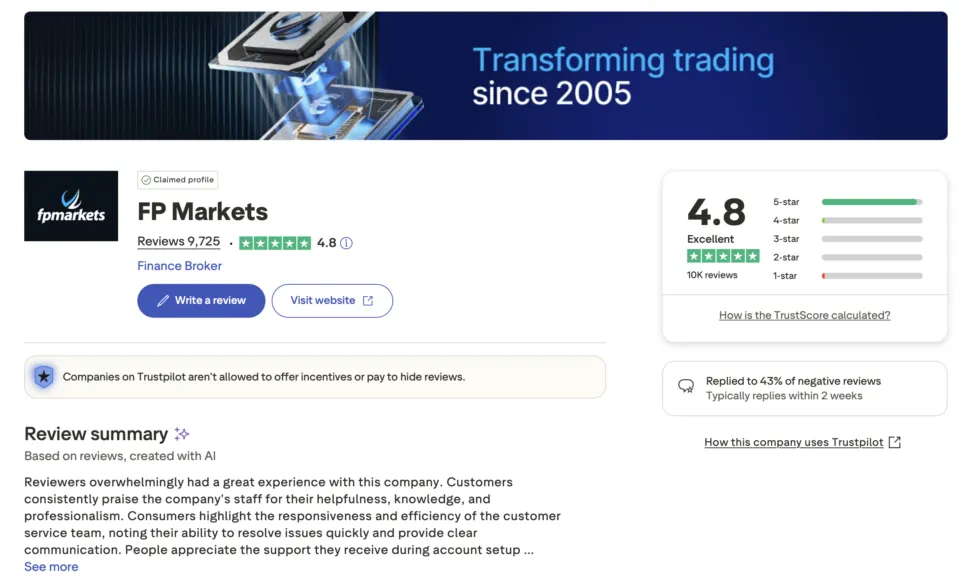

How Good Are The Reviews About FP Markets?

We estimate that at least 80% of the reviews for FP markets are positive. Here are some ratings from trustworthy sites to demonstrate (at the time of writing):

- 4.8 stars out of 5 from 9506 reviews on TrustPilot

- 4.4 stars out of 5 from 2245 reviews on TradingView

- 4.6 stars out of 5 from 51 reviews on Myfxbook

- 8.88 stars out of 10 on WikiFX

Are There Critics and Complaints about FPM?

Yes, several complaints crept up despite the massive number of positive feedback. We have listed the most considerable ones below (although minor ones include the need for more regional payment methods and requests for TradingView on the Standard account):

- Many users wished that the broker had more account types.

- Plenty of traders doubted whether the company was truly an ‘ECN broker’ due to several instances of perceived market manipulation, execution delays, and spreads higher than advertised.

- Clients reported several cases of supposed withdrawal delays.

What Are The Offers Of FP Markets?

FP Market’s primary offers include derivative products on popular charting platforms, managed accounts, and social trading. The company also provides access to a Virtual Private Server/VPS, pattern detection service, and AI-powered analytical tools, among other features.

Asset Classes

You can trade forex, stocks, metals, commodities, indices, crypto, bonds, and ETFs through FP Markets.

The broker’s complete selection of 10,000+ markets is on TradingView. Stocks account for most of this high number. Other than this, the range is similar on all the charting platforms. For instance, on MT5, we counted the following 962 instruments:

- 71 forex pairs

- 781 stocks

- 17 metals

- 5 commodities

- 18 indices

- 12 cryptocurrencies

- 58 ETFs

TradingView lacks ETFs, commodities, and metals for FP Markets.

Platforms

FP Markets impressively offers four charting platforms that cater to all skill and experience levels: MT4, MT5, cTrader, and TradingView.

- MT4 and MT5 are relatively alike overall, with straightforward layouts that make it easy to navigate charts, indicators, and order tools for anyone. The main difference is that MT5 offers more markets, timeframes, indicators, and order tools, along with a multi-threaded system and a slightly more intuitive user interface.

- cTrader was first released in 2011, a year after MT5. It is more niche, modern, and advanced than MetaTrader, though the UI is comparable in many ways.

- TradingView is the most advanced charting platform among the four (with free and tiered pricing plans). There is also a brilliant social network aspect attached to this software. One major downside with TradingView is that it doesn’t natively support automated trading (unlike MT4/5 and cTrader).

Trading Tools

Users benefit from a wide range of helpful technical tools, ranging from analytics to a pattern detection service:

- TradeMedic – an AI-powered tool designed to empower trading performance with personalised data-driven insights and behavioural patterns. It’s available only for traders using MT4 and MT5 with FP Markets.

- Virtual Private Server (VPS – a dedicated virtual environment or machine that hosts a trader’s platform away from the regular broker servers. These private servers are popular among users of algorithmic trading bots and high-frequency strategies that depend on ultra-fast execution, continuous uptime, and minimal latency.

FP Markets covers your monthly subscription with an affiliated VPS provider. However, one must deposit at least $1000 and meet a monthly minimum trading volume of 5-40 lots on forex and metals combined. The VPS is available with all supported charting software, except TradingView.

- Traders Toolbox – a free suite of 12 Wall Street-grade trading tools on MT4 and MT5, combining a robust trading infrastructure with valuable market insights and an array of trade assistance applications.

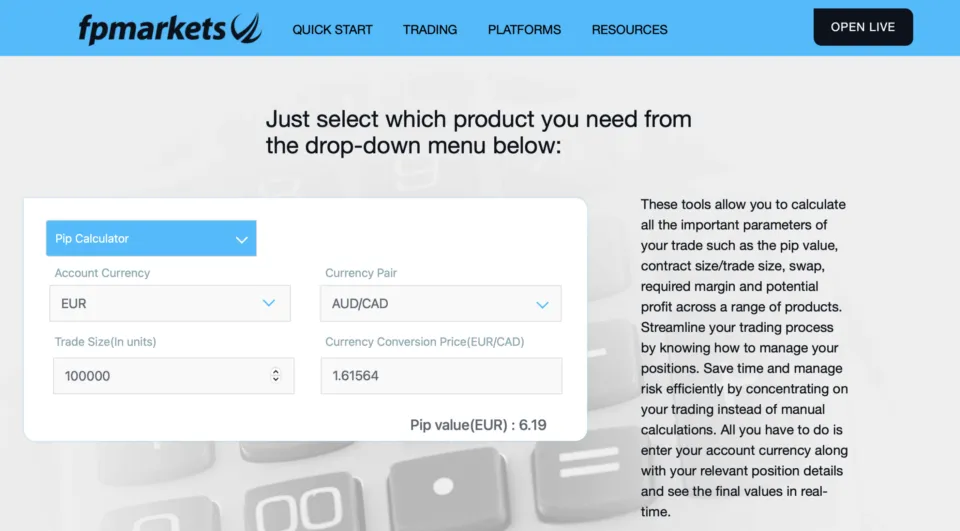

- Forex Calculators – included here are calculators for pips, margin, swaps, and profit, along with a currency converter.

- Autochartist – a technical analysis tool that scans for tens of trade setups monthly across various assets delivered via email, mobile, and directly on MT4/5.

- Trading Central – a third-party platform integrated with the broker, delivering an in-depth economic calendar, news, analytics, sentiment research, technical views, and more (internationally recognized by top trade and research associations).

Copy/Social Trading

Most brokers nowadays incorporate a comprehensive copy/social trading aspect in their offerings. FP Markets does so in two distinct products.

- The first, ‘Social Trading,’ allows anyone to browse, follow, and automatically copy the strategies of top-performing traders on MT4/5. Meanwhile, those who are copied build a following, increasing their potential for performance fees.

- The second product is called ‘Signal Start,’ promoted as a one-stop turnkey solution for providing and following signals. It comes with a $25/month subscription fee to join, while providers charge $30-100 per month to their followers.

Education

FP Markets has an educational section on its website that includes trading courses, glossary, webinars, podcasts, and platform tutorials. They also boast a dedicated ‘Traders Hub’ that dives deep into fundamental and technical analysis.

Managed accounts

Managed accounts offer an alternative, more professional long-term passive income stream from copy trading. Those who are followed or copied sign up for a MAM (Multi-Account Manager). Meanwhile, investors subscribe to PAMM (Percentage Allocation Money Management) accounts and allocate their funds to the designated managers.

Is FP Markets Suitable For Beginners?

Yes, FP Markets is well-suited for beginners thanks to its user-friendly setup, trusted regulation, and accessible learning resources. The broker offers the familiar MetaTrader 4 and MetaTrader 5 platforms, which are intuitive for new users and widely supported.

With a low $50-100 minimum deposit, FP Markets allows beginners to start small. Finally, the broker’s regulated framework further gives new traders confidence in safety and fund security.

Should Professionals Use FP Markets?

Yes, FP Markets is well-suited for professional traders. They can benefit from ECN-style Raw accounts with tight spreads and a transparent pricing model, as well as the advanced cTrader and TradingView platforms.

Moreover, FP Markets offers MAM and PAMM managed accounts, ideal for money managers and investors who manage multiple portfolios or handle client funds. These accounts provide a structured framework for performance-based income and scalable management.

Finally, the broker’s VPS hosting, third-party tools (like Autochartist and Trading Central), and AI analytics suite (TradeMedic) also make it a strong choice for seasoned traders.

What Are The Trading Costs On FP Markets?

The trading costs mainly include spreads (from 0.08 on the euro) and $3 per-lot-per-side commissions, which only apply to the Raw account):

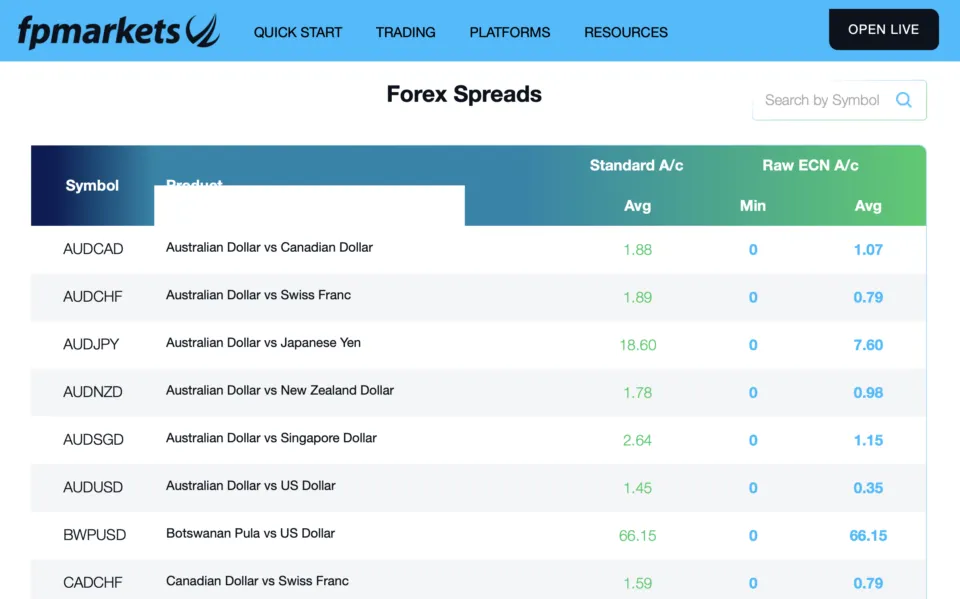

Spreads

The spreads start at a pip on a wide choice of markets on FP Markets’ standard accounts. Meanwhile, they begin from 0 on the Raw account. While competitive, spreads fluctuate noticeably depending on liquidity, volatility, and trading hours. So, it’s worth checking them before every trade.

For FP Markets, we noticed that spreads are lowest for most assets, such as forex, commodities, and indices, while peaking primarily for cryptocurrencies.

Below is a breakdown of the average spread to expect on various popular instruments:

| Standard spread | Raw spread | |

|---|---|---|

| EURUSD | 1.18 | 0.08 |

| GBPUSD | 1.49 | 0.39 |

| Gold | 20.93 | 6.96 |

| Silver | 21.72 | 1.57 |

| US500 | 0.46 | N/A |

| UK100 | 1.52 | N/A |

| WTI crude oil | 0.02 | N/A |

| Coffee | 0.86 | N/A |

| Bitcoin | 2,171.09 | N/A |

| Polkadot | 27.36 | N/A |

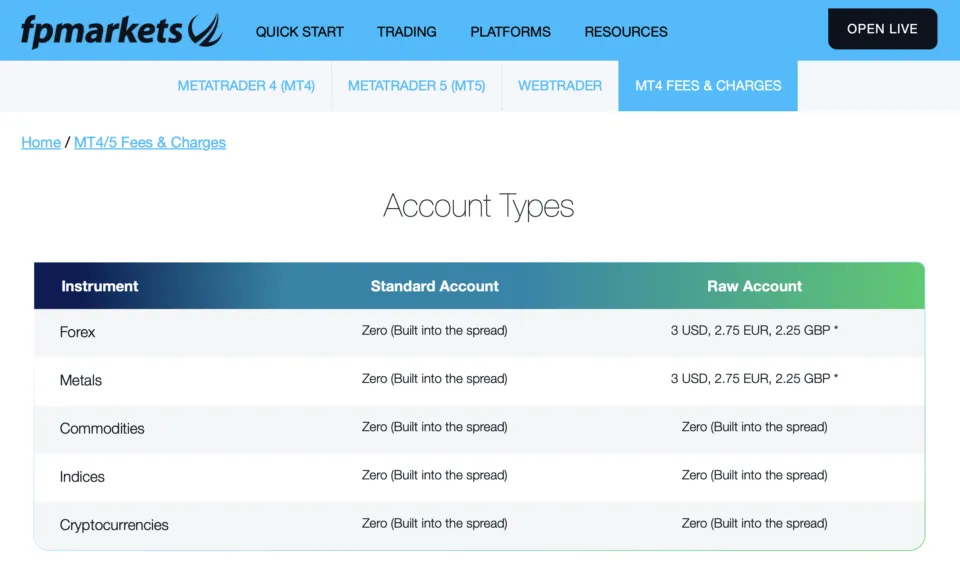

Commissions

Commissions on the Raw account are fixed at $3 per lot per side ($6 total for round-turn of every trade) for forex and metals. Shares and ETFs come with various commissions per share or as a percentage of each trade. The rest of the markets on the Raw account don’t incur a commission.

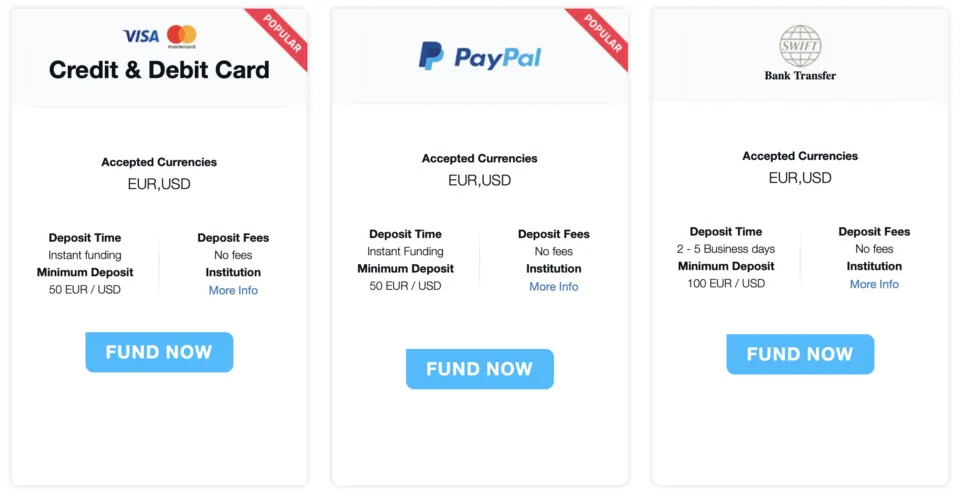

Are There Deposit and Withdrawal Fees?

Yes, although the fees only apply to a few withdrawal options; deposits incur no fees. Some methods you can expect to be charged a slight fee (up to 2%) include Neteller, Skrill, and other locally specific payment options.

Traders should be aware that external providers, such as banks, payment gateways, e-wallets, and card issuers, may apply their own charges, which are outside FP Markets’ control. As a tip to keep transaction costs low, avoid international bank wire transfers and e-wallet services like Skrill and Neteller; use VISA/Mastercard, where possible.

Additionally, currency conversion costs may apply when funding or withdrawing in a currency different from your account base currency, depending on the chosen payment method and provider.

Is FP Markets Suitable For Low Cost Trading?

Yes, FP Markets is a low cost broker. They offer competitive spreads (from 0-1 pip) and commissions (on average $3 per lot per side), making it suitable for fee-conscious traders.

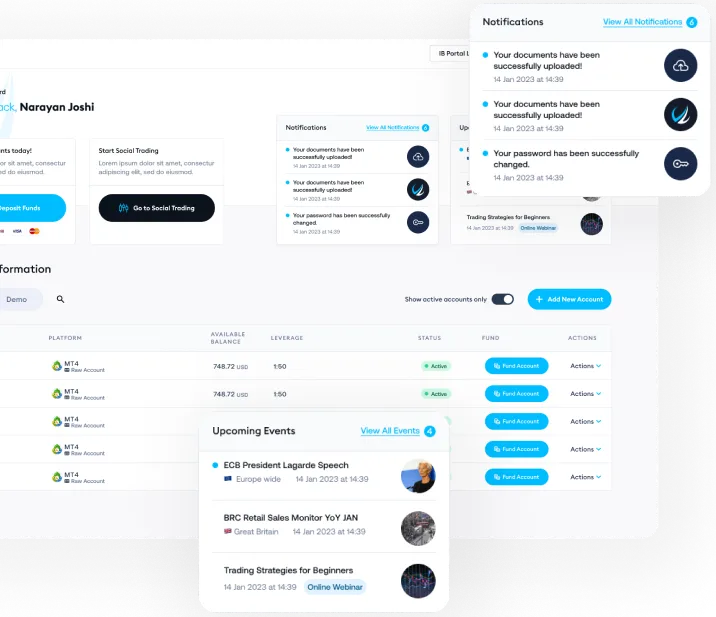

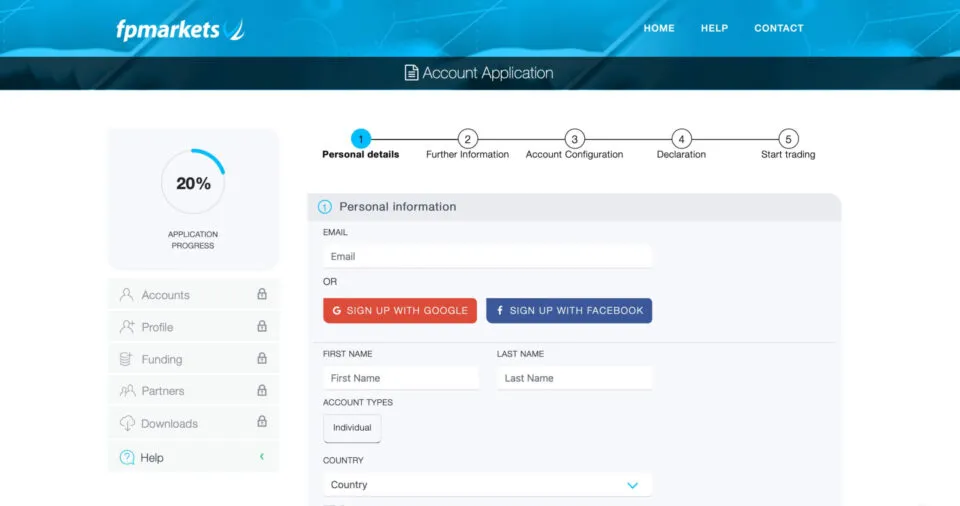

How To Open An Account With FP Markets:

Step 1: Registration

Visit the broker’s website. A dropdown box will appear when you hover over ‘QUICK START’ at the very top of the homepage. Here, select ‘START TRADING,’ which brings up an account application page divided as follows:

- Personal Details – personal information (full name, gender, country, preferred language, and phone number). Also, one needs to input a One-Time PIN sent to their email address.

- Further Information – traders fill in their date of birth, address, employment, occupation, identity number, annual income bracket, and source of funds.

- Account Configuration – the choice of platform, account type, trading currency, and leverage are presented here, along with the setting of your password.

- Declaration – here, you declare things how many times you’ve traded over a certain period, trading experience, etc. Finally, one must view and accept the terms and conditions.

- Start Trading – you are taken to the client portal, where you verify your identity, open different accounts, upload documents, etc.

Assuming stable, uninterrupted internet access, this process lasts 5-10 minutes.

Step 2: Account Verification

Once registered, you’ll head to the ‘Accounts’ tab on the portal to start the verification. You’ll need to verify your identity using an ID card, residence permit, green ID booklet, or passport via the Sumsub verification platform on desktop or mobile via QR code.

After choosing your document type, simply scan it using your device camera and follow the on-screen instructions. In our experience with Sumsub on a few other brokers, the final confirmation occurred within 15 minutes.

Sadly, this took much longer with FP Markets, around a whole day to be specific. Although it’s still a standard time in the industry, it was faster with other companies during regular business hours. Hence, we recommend verifying your account well in advance of funding it so you can trade promptly.

Step 3: Account Funding & Using A Demo Account

After verification, clients should connect their preferred payment method and fund their account with the minimum $50-100 deposit. Those who prefer to practise first should try the demo account (no full KYC needed), allowing them to test platforms, spreads, and execution risk-free.

Once they are confident in their strategy and platform familiarity, they can transition to a live account and deposit real funds using the steps outlined earlier.

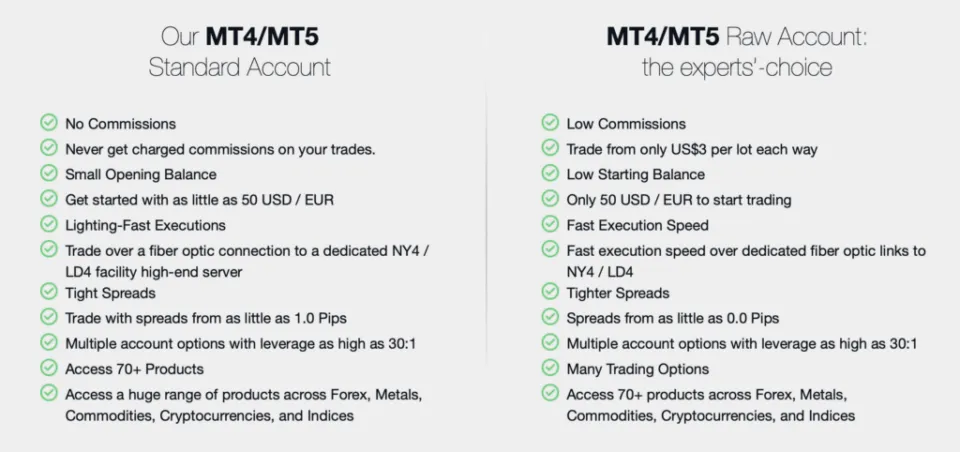

Which Account Types Are Available With FP Markets?

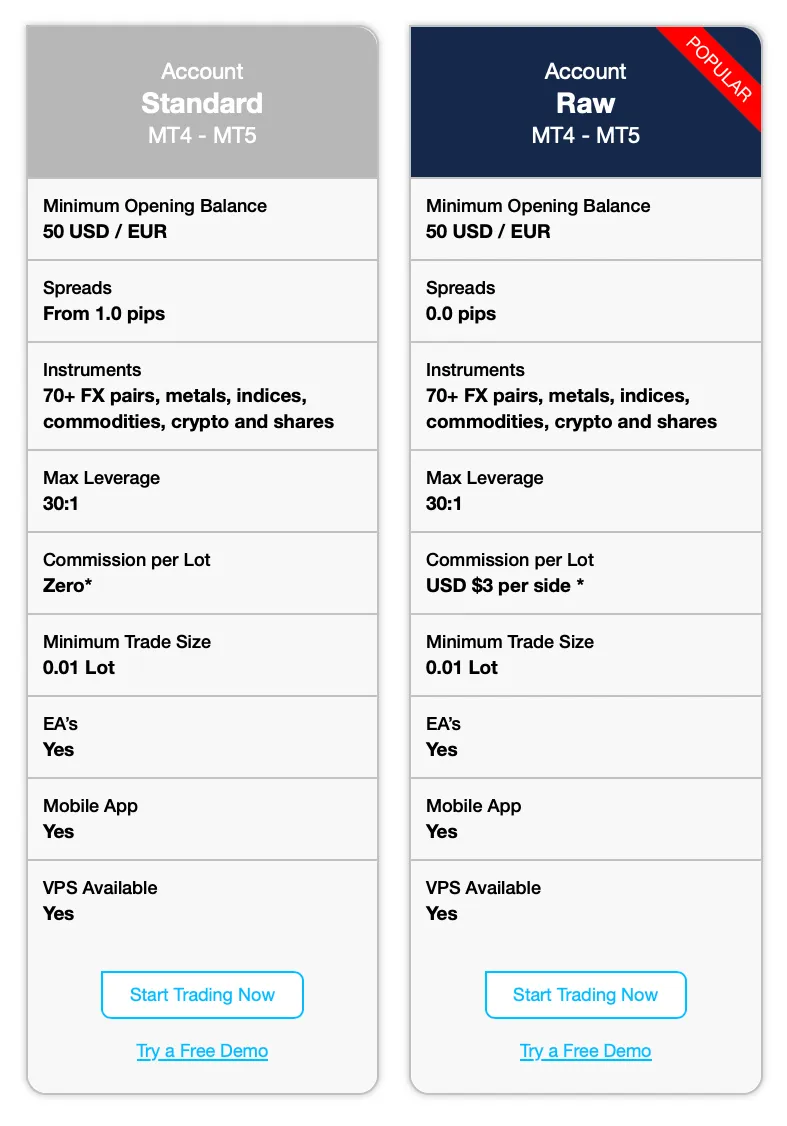

The account types you can choose with this broker are Standard and Raw (each with Islamic or swap-free variants). Both accounts are similar in many aspects. The key differences are the spreads, the inclusion of commissions, the available trading platforms, and the instruments:

| Standard | Raw | |

|---|---|---|

| Minimum opening balance | $50-100 | $50-100 |

| Spreads | From 1 pip | From 0 pips |

| Commission | N/A | $3 per side per lot |

| Trading Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader, TradingView |

| Instruments | Forex, metals, indices, commodities, crypto | Forex, metals, indices, commodities, stocks, crypto |

| Max. leverage | 1:500 | 1:500 |

| Execution | ECN-pricing | ECN-pricing |

| Minimum trade size | 0.01 lot | 0.01 lot |

| Mobile app available? | Yes | Yes |

| Expert advisors available? | Yes | Yes |

| VPS available? | Yes | Yes |

How To Deposit Money On Your FP Markets Trading Account

- Log in to your personal client portal of FP Markets.

- Find the Funding tab on the left-hand side and choose ‘Deposit’ from the dropdown box. It’s worth noting that some methods work with a lower deposit than the $50-100 required by the broker (also, the list below is non-exhaustive).

- Choose from the presented deposit options, enter the desired amount, and follow the prompts.

These are your deposit options – generally, traders living in one of the regions where FP Markets is regulated will be afforded more choices:

| Credit/debit card | Bank transfer | Cryptocurrency | E-wallets | |

|---|---|---|---|---|

| Method | VISA/Mastercard, incl. Apple Pay/Google Pay | Local and international | USDT (ERC20, TRC20, and BEP20 variants), XRP, Litecoin, Ethereum, Bitcoin – Binance Pay is also included) | Neteller, Skrill |

| Reflection time | Near instant | 5-10 working days | Up to a working day | Up to 30 mins |

| Minimum deposit | 40 USD/EUR/GBP | $20 | €50 | $5 |

Ensure all details are entered accurately on the first attempt, keep a stable internet connection, and avoid closing any browser tabs during the process.

How To Withdraw Money From Your FP Markets Trading Account

To withdraw funds from your FPM Markets account:

- Log in to your personal client portal

- Navigate to the ‘Withdrawals’ sub-section under the ‘Funding’ tab

- Pick the desired withdrawal option (same as those with the deposits)

- Enter the amount and provide the necessary payment details.

- Confirm the withdrawal request.

It takes a maximum of a working day for the broker to process a withdrawal. Afterwards, these are the average processing times to expect for different options (including the minimum withdrawal amounts):

| Credit card | Bank transfer | Cryptocurrency | E-wallets | |

|---|---|---|---|---|

| Time | 1-10 business days | 1-10 business days | 1 business day | 1-5 business days |

| Minimum withdrawal amount | $0.01 | $100 | €50 | $0.01 |

Withdrawals at FP Markets are declined for a few common reasons. The most frequent is attempting to withdraw through a different payment method than the one originally used to deposit. Like most regulated brokers, FP Markets typically returns funds to the same channels in which the deposits were made, and then sends any excess profits through alternative options such as bank transfer.

Trying to withdraw more than your available free balance while holding open trades also triggers a rejection.

If your account is verified, your payment details match (plus they are up-to-date), and your trading activity is legitimate, FP Markets will process your withdrawal without fuss.

Does FP Markets Offer Negative Balance Protection?

Yes, FP Markets provides negative balance protection to ensure traders never lose more than the funds available in their trading account, even in extreme market conditions. While this helps prevent debt scenarios, it should not replace disciplined risk management, such as sensible position sizing and precise stop-loss planning.

Which Customer Support Is Offered by FP Markets?

FP Markets offers the standard support channels, which comprise live chat, phone, and email:

| Live chat | Phone | |

|---|---|---|

| Powered by LiveChat Available 24/7 (but live agents operate during business hours) Includes an excellent chatbot that answers many queries without needing a live agent | General customer support: +44 12 4134 0196 +44 20 4579 9140 +44 28 2544 7780 Sydney office: +61 2 8252 6800 | supportsc@fpmarkets.com |

Traders can also request a callback by submitting a form on the relevant section of the broker’s website.

Do You Need To Pay Taxes On FP Markets?

Yes, in many countries. Most nations that are not classified as tax havens treat trading profits as either capital gains or taxable income, meaning you may need to declare them.

To stay compliant, WR Trading recommends speaking with a licenced tax professional who understands your local laws. If applicable, ensure you download your full trade history for accurate reporting. Some countries may also allow tax-loss harvesting, helping offset gains and reduce overall liability.

Does FP Markets Offer An Affiliate Program?

Yes, FP Markets boasts a standard and hybrid affiliate program, along with an introducing broker (IB) program. The partnership model for the regular affiliate program is based on CPA (Cost Per Acquisition), perfect for bloggers, marketers, website publishers, and influencers.

More specifically, a forex affiliate can earn $225-450 (up to $800 in some cases) for each referred person if they’ve deposited at least $300 and traded five standard FX lots. The hybrid program offers $100-200 in CPA and, additionally, up to $1.25 per lot or up to 30% spread share.

For an IB, FP Markets promises lifetime multi-tiered and volume-based structures (but these aren’t publicly available until you consider joining).

Best Alternatives To FP Markets: Compare With Other Brokers

If you want to explore other high-quality brokers aside from FP Markets, here are some of the best alternatives.

To compare these brokers side-by-side on key metrics such as regulation, costs, spreads, and supported platforms, use our broker comparison tool.

STARTRADER

This broker is an excellent alternative for traders seeking a lower minimum deposit ($5) than FP Markets. This makes it more accessible for small accounts. Beginners will also appreciate STARTRADER’s simpler, limited range of trading platforms, as it only supports MT4 and MT5.

At the same time, users benefit from features similar to those offered by FP Markets, such as copy trading, PAMM accounts, multi-regional regulation, and a wide range of markets.

XTB

XTB differentiates itself from FP Markets by emphasizing long-term investing. While primarily being a comprehensive CFD broker, they also provide commission-free ETFs, allowing traders to mix active speculation with portfolio building.

Rather than supporting multiple charting software products, XTB offers its own powerful proprietary xStation. Unlike FP Markets, XTB has no minimum deposit, another distinction that makes it a compelling second choice.

PU Prime

PU Prime is a strong alternative to FP Markets for traders seeking a broader account range. These include Standard, Prime, ECN, and Cent, the latter of which boasts a $20 minimum deposit. Still, the brand’s general starting balance requirement is $50, which is much lower than its counterpart’s.

Also, PU Prime offers leverage up to 1:1000, providing another lower barrier to entry, more flexible capital allocation, and greater market exposure.

Learn To Trade Successfully on FP Markets with the WR Trading Mentoring

Choosing a broker is only part of the journey; developing the skill to trade confidently and consistently is what truly moves a trader forward. At WR Trading, our mentoring is built on practical, battle-tested experience gained over more than 15 years in the markets:

- Hands-on coaching tailored to FP Markets’ platforms: showing you how to use tools effectively, read the market structure properly, manage risk with precision, and execute trades with clarity.

- A structured progression from demo to live trading to build confidence before increasing your capital exposure.

- Strategy-driven guidance for navigating FP Markets’ multi-asset environment, covering clean entries, high-RR setups, disciplined exits, and removing emotional decision-making.

- Weekly live sessions, personalised chart reviews, psychology coaching, and ongoing support, mirroring the real conditions traders face every day.

No matter which broker you choose, discipline, strategy, and execution determine your results. Our mentoring ensures those foundations are strong when trading with FP Markets.

Should You Choose FP Markets? Our Final Word

FP Markets delivers a strong, well-rounded trading experience for traders who want platform choice, deep market access, and a long-standing, multi-regulated brand. They stand out with an extensive selection of markets, flexible charting platforms, and a range of other advanced tools, including Autochartist and TradeMedic.

However, there are areas where FP Markets could improve. We can’t ignore what users have reported with concerns about perceived manipulation and spreads that differ from advertised ECN conditions.

It may be worth exploring other alternatives, such as Pepperstone and XTB, especially if many traders didn’t mention these themes in the public reviews. The feedback on withdrawal delays and the need for more account variations were the other downsides for FP Markets. However, in summation, FP Markets remains a reputable, versatile broker with far more strengths than weaknesses.