FPM Trading Broker Review 2026: Regulation, Fees, Ratings

- Low $50 Minimum Deposit

- Popular MT4/MT5/cTrader Offered

- Raw Spreads From 0.0 Pips

- Free VPS Available

- High Leverage 1:500

- 24/7 Support

- Huge Range Of 10,000+ Markets

- Copy Trading/PAMM Available

- Super Fast Execution

- Limited regulation

- Lack of negative balance protection

Find out whether FPM Trading is the best broker for your trading needs in our in-depth review. When choosing a broker in 2025, trust, transparency, and execution matter. That’s why we thoroughly tested and reviewed FPM Trading, opening accounts, verifying platform stability, examining fees, and assessing support.

Regulated by the Mauritian Financial Services Commission (FSC), it stands out as a robust multi-asset broker. We particularly liked the accessible breadth of platforms, the range of tradable instruments, and the low-cost account funding. Another standout point was their trustworthiness, as confirmed by smooth order execution and consistently responsive customer service throughout our tests.

That said, like any broker, it’s not without drawbacks. Poor regulation, limited global availability, and a lack of negative balance protection were some of these issues. Explore everything you need to know about FPM Trading in this review to determine if the broker is the right choice.

FPM Trading Experience Summary from Our Expert:

Surprisingly, however, I found FPM Trading’s trading environment (from tight spreads to fast trade execution) itself is built reasonably well. Their VPS offering, broad market range, responsive customer support, and inclusion of popular charting software also stood out as genuine strengths.

However, I also encountered issues that traders should take seriously.

The broker does not offer negative balance protection, and a few elements of the product information didn’t match what I saw on the platform (more on this later).

I also verified that email authentication failed on some providers, which is not something you see with top-tier brokers. These findings decreased my confidence. Overall, FPM Trading is a broker I’d approach with more due diligence, especially if you’re planning to trade larger capital.

See here my full video review on FPM Trading (It also includes a 0.75$ commission discount):

3 FPM Trading Customer Reviews And Ratings

What Is FPM Trading? Forex & CFD Broker Overview

FPM Trading is a multi-asset CFD broker launched in 2025 and based in Mauritius. Their market range includes Forex, metals, commodities, indices, crypto, stocks, and futures.

The broker supports the MetaTrader 4, MetaTrader 5, and cTrader charting software. This diversity reflects a broader trading infrastructure that caters to both beginner and advanced traders.

FPM Trading’s primary account types are ‘Standard’ and ‘Raw,’ which you can open individually, jointly, or corporately. Leverage is up to 1:500, and the minimum deposit to trade live is AU$100 (about $60).

FPM Trading Regulation: Is This Broker Safe or a Scam?

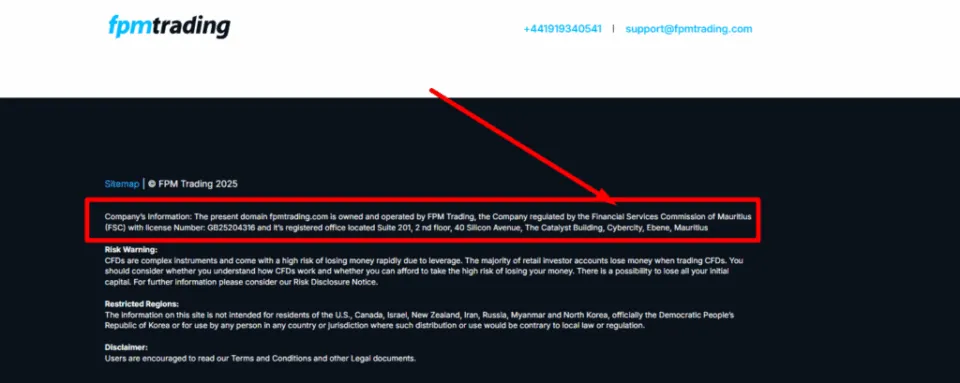

Yes, FPM Trading is regulated by the Financial Services Commission of Mauritius with license number GB25204316. This competitive oversight promises strict capital requirements and sound internal procedures. While the FSC is known, it’s of a low to mid-tier ranking compared to other regulators because it’s based offshore.

In our research, we confirmed the broker’s operational or registered office address is: Suite 201, 2nd floor, 40 Silicon Avenue, The Catalyst Building, Cybercity, Ébène, Mauritius. Secondly, we noticed two company registrations in two separate countries:

- ‘FPM Trading’ (with registration number C220727 in Mauritius)

- ‘Y.S. Wyltava Ltd’ (with registration number HE474324 in Cyprus)

Also, we noticed that the company registered on 24 April 2025 in both regions, which aligns with the broker being awarded the FSC license a day later.

In our experience, offshore regulators are generally not as stringent as financial watchdogs in North American, Australian, and European regions.

Highly regarded regulators typically enforce stricter investor protections, compensation schemes, and transparency obligations. This contrasts with the likes of the FSC.

This doesn’t mean FPM Trading is unsafe, but it does mean that extra due diligence is required. Always verify the level of protection offered by a broker or regulator before funding. On top of this, traders must check the broker’s pricing model, as fee structures and spreads can vary significantly under lighter regulation.

Nonetheless, WR Trading has over nine years of experience with countless brokers. Our review of FPM Trading will provide you with all the information you need to make informed decisions.

United States, Canada, Israel, New Zealand, Iran, Russia, Myanmar and North Korea, officially the Democratic People’s Republic of Korea.

What Does FPM Trading Offer? Platforms, Markets & Key Features

FPM Trading’s offers combine low spreads, fast execution from an NY4 server, world-class liquidity, and market-leading pricing. They are a full-service multi-asset broker that gives traders access to popular global markets

Below is a detailed breakdown of the broker’s main features:

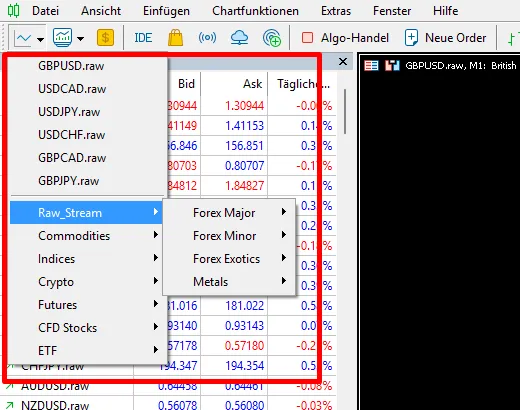

Tradable Asset Classes on FPM Trading

It’s crucial to note that the full selection of tradable markets on FPM Trading is only on cTrader. Meanwhile, this is quite limited on the MetaTrader platforms. We counted 108 individual assets on MT4, consisting of 59 forex pairs, 11 metal pairs, 6 commodity markets, 12 indices, 12 crypto pairs, and 8 futures markets. MT5 only houses forex and metal pairs (slightly different assets but very similar).

On the other hand, cTrader offers more or less the same as the MetaTrader packages. However, you’ll also find many Hong Kong US/UK/EUR stock CFDs and exchange-traded funds (ETFs) like ACWI, AGG, and BND.

FPM Trading Trading Platforms: MT4, MT5 & cTrader

FPM supports several trading platforms that cater to a wide variety of traders:

- MetaTrader 4 (MT4) – widely used, supports standard FX/CFD features, expert advisors (EAs), indicators; web version available

- MetaTrader 5 (MT5) – More advanced: better multi-asset support, depth of market, multiple order types; web version available

- cTrader – known for advanced charting, ECN pricing, algorithmic trading (cTrader Algo), built-in copy trading features, and unique desktop add-ons. Advanced users can also leverage automation and API connectivity for strategy deployment.

Overall, cTrader delivers noticeably smoother and faster performance. Although the MetaTrader products are limited in functionality, they are still quite efficient.

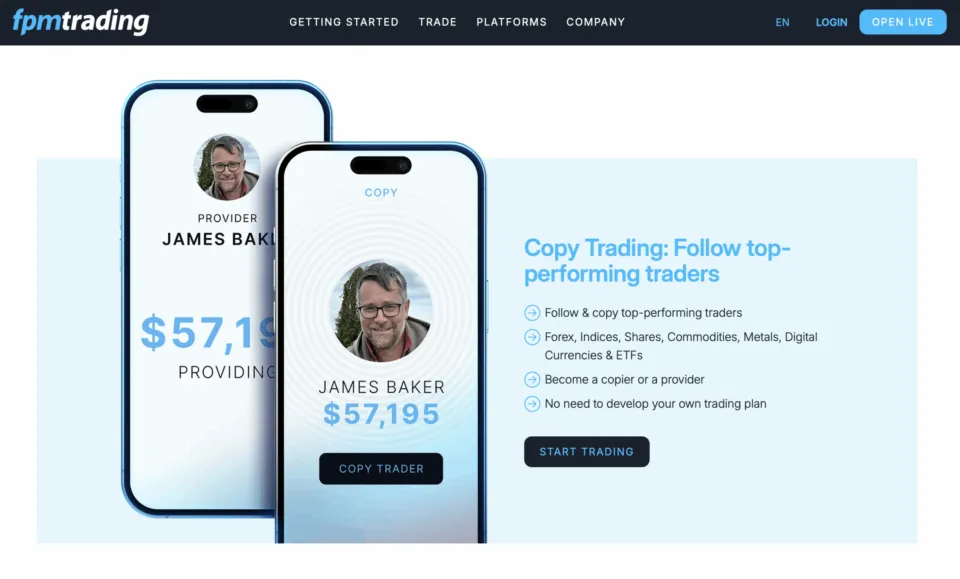

Copy Trading, MAM & PAMM on FPM Trading

One of FPM Trading’s most appealing features is its copy trading platform, powered by cTrader Copy. It enables traders to automatically replicate the strategies of other successful investors (known as ‘Providers’) in real time.

Users can find, follow, and copy profitable Providers from a wide selection of consistent performers. Each profile includes detailed statistics such as all-time gain, maximum drawdown, and trade history, making it easier for investors to analyse performance and diversify their portfolios across different strategies.

For advanced traders, FPM Trading also offers the opportunity to become a Provider and earn additional income by sharing strategies with followers. Additionally, FPM has MAM (Multi-Account Manager) and PAMM (Percentage Allocation Money Management) accounts. These are catered towards wealthier clients who prefer a pooled funding system or professional fund management. Still, copy trading and PAM/MAMM have some similarities despite differences in structure, fees, profit sharing, and accessibility.

FPM Trading VPS (Virtual Private Server) for Algorithmic Trading

A VPS is a dedicated virtual environment or machine that hosts a trader’s platform away from the regular broker servers to which one would ordinarily connect. This system means that your trade execution is even faster and uninterrupted. These private servers are popular among users of algorithmic trading bots and high-frequency strategies that depend on continuous uptime and minimal latency.

It’s common for brokers to offer a VPS free of charge, removing the need for a personal monthly subscription. However, there are some volume requirements to meet. In the case of FPM, the broker can sponsor traders on MT4 or MT5 with their dedicated VPS based on these conditions:

- Monthly trading volume above 5 lots in forex and metals on a Standard account (or 10 lots across both markets on a Raw account)

- Minimum $1000 deposit

Forex Calculators & Trading Tools

This broker offers the following calculators (which can be accessed directly on their website or client portal) for risk management:

- Pip calculator – calculates the value of one pip in a chosen base currency for a specific trade size and currency pair.

- Currency converter – instantly converts one currency into another using real-time exchange rates.

- Margin calculator – determines the required margin to open a position based on leverage, trade size, and instrument.

- Swaps calculator – estimates the interest (swap) charges or credits applied when holding forex positions overnight.

- Profit calculator – shows the potential profit or loss of an FX trade based on entry, exit, and lot size.

- Position size calculator – helps you determine the optimal lot size for a trade based on your account balance and risk percentage.

Is FPM Trading Suitable for Beginner Traders?

FPM Trading can be a suitable option for beginners, especially for those seeking a low cost broker with a straightforward setup. Their integration with cTrader and MetaTrader allows traders to use familiar tools for analysis and execution.

Opening an account is relatively quick, and the broker provides demo access. This allows newcomers to practise trading in real conditions before committing real capital.

Beginners will likely appreciate FPM’s commission-free structure on its Standard account. This makes it easier to calculate expenses upfront without worrying about per-trade charges. The broker also gives access to multiple asset classes, enabling new traders to experiment and diversify early on.

Is FPM Trading Good for Professional and High-Volume Traders?

No, professional traders will find FPM Trading a limited fit for their needs. FPM Trading’s ecosystem mainly leans toward retail and beginner audiences instead of institutional-grade trading conditions. Their focus is on user-friendly tools like MT4, MT5, and cTrader, coupled with copy-trading options.

However, professionals will benefit from the MAM/PAMM accounts, which are tailored for fund managers or investors handling multiple portfolios.

FPM Trading Fees & Trading Costs: Spreads, Commissions & Other Charges

The main trading costs of FPM Trading are spreads and commissions. Below is a breakdown of both in more detail:

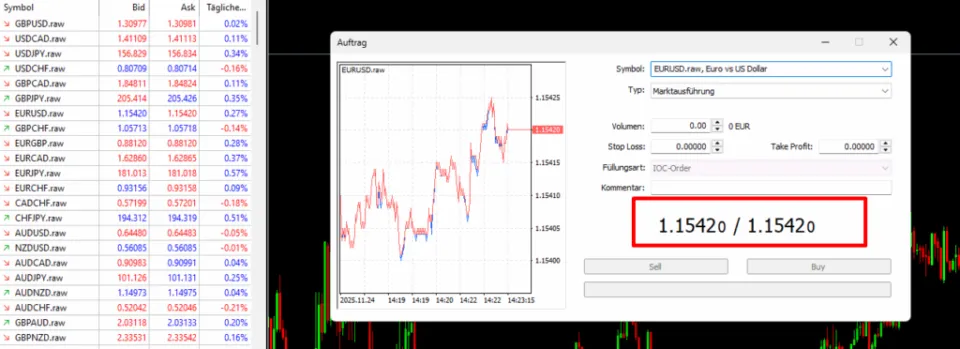

FPM Trading Spreads on Forex, Indices, Commodities & Crypto

FPM provides floating spreads on their Standard accounts and spreads that start from 0 on their Raw accounts (albeit with a fixed commission on top). Spreads are generally cheaper across a wide choice of markets like forex, commodities, and indices, but wider on digital currencies.

We should keep in mind that spreads fluctuate based on factors like market liquidity, volatility, and trading hours. Also, the Raw spreads are only available when trading forex and metals.

The table below compares both types of spreads (in pips) to expect across different assets on average.

| Market | Standard Spread in Points | Raw Spread in Points |

|---|---|---|

| EURUSD | 0.11 | 0.01 |

| GBPUSD | 0.14 | 0.01 |

| Gold | 0.20 | 0.07 |

| Silver | 0.045 | 0.026 |

| US500 | 0.46 | 0.46 |

| UK100 | 1.52 | 1.52 |

| DAX40 | 0.5 | 0.5 |

| WTI oil | 0.04 | 0.04 |

| Brent Crude Oil | 0.02 | 0.04 |

| Bitcoin | 15$ | 15$ |

| Ethereum | 2$ | 2$ |

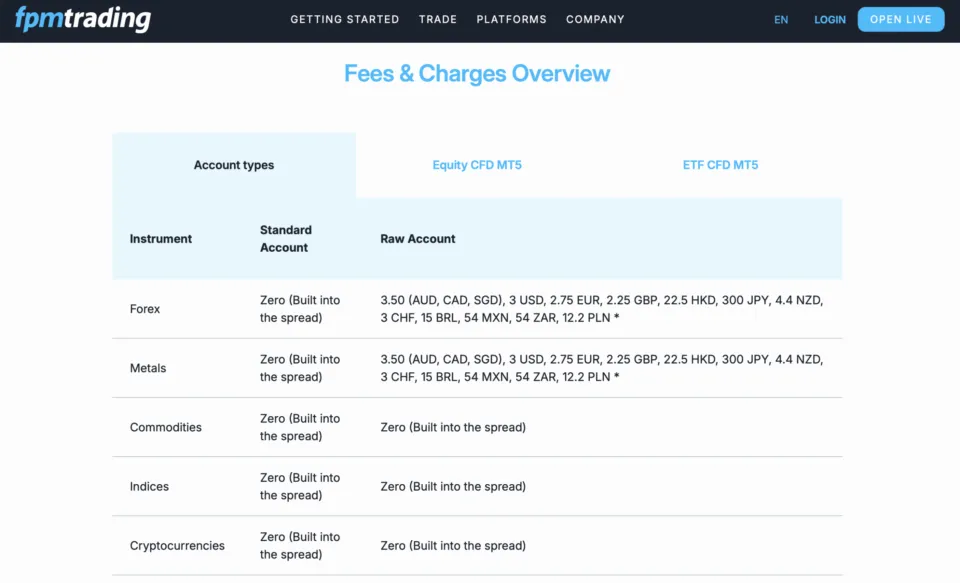

FPM Trading Commissions on Raw Accounts

The Standard account incurs no commission. Meanwhile, the commission on the Raw account is calculated for every lot, fixed at $3 per side or $6 per round turn (i.e., opening and closing a trade).

For lower position sizes, multiply the appropriate micro lots by $0.03. For example:

- For a trade with a position size of 0.05 (five micro lots), the commission would be $0.15 per side or $0.30 in total

- For a trade with a position size of 0.65 (65 micro lots or 6.5 mini lots), the commission would be $1.95 per side or $3.9 in total

Does FPM Trading Charge Deposit or Withdrawal Fees?

No, traders can enjoy fee-free deposits and withdrawals. Still, the relevant payment processors or banks will probably levy their own (they are often the highest for bank wires). At WR Trading, we always recommend funding with a debit/credit card, which offers the lowest fees and super-quick confirmation.

Also, having spoken with the broker’s customer support, they confirmed that no currency conversion charges apply. However, the relevant payment processors or banks sometimes apply their own.

Is FPM Trading a Low-Cost Broker for Active Traders?

Yes, FPM Trading can be considered a relatively low cost broker. The platform keeps its trading fees manageable through tight spreads, commission-based pricing, and competitive leverage across many trading symbols.

While fees vary by instrument and account type, its overall structure makes it appealing to traders seeking to minimize costs without sacrificing market access.

FPM Trading Registration Process

Let’s detail the process of opening an account with FPM Trading from start to finish.

Step 1: FPM Trading Registration Process

Firstly, one visits the broker’s website. On the dropdown box at the top of the homepage, click on the ‘Start Trading’ button. This will bring up an ‘Account Application’ page that previews five steps:

- Personal Details – requests personal information (full name, gender, country, preferred language, and phone number).

- Further Information – traders fill in their date of birth, address, employment, occupation, annual income bracket, and source of funds.

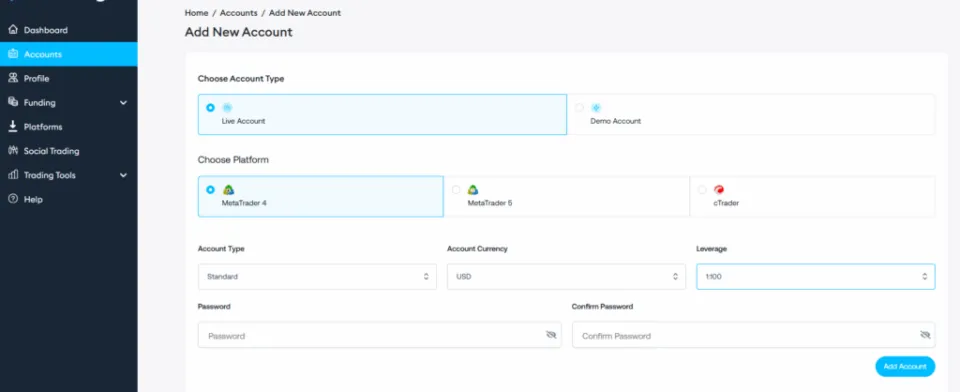

- Account Configuration – the choice of platform, account type, trading currency, and leverage are presented here, along with the setting of your password.

- Declaration – here, you declare how many times you’ve traded over a certain period and accept the terms and conditions

- Start Trading – finally, you are taken to the client portal where you can verify your identity, open different accounts, upload documents, etc.

Assuming you have stable, uninterrupted internet access, this process takes around 5-10 minutes.

Step 2: FPM Trading Account Verification (KYC)

The first step is to confirm your country of residence. More specifically, traders can choose whether to be based in the United States or elsewhere. Like many brokers, FPM doesn’t accept American clients.

Afterwards, you are required to verify your identity document: an ID card, a green ID booklet, a residence permit, or a passport. Powered by the Sumsub verification platform, this process can happen on your computer or phone (using a QR code).

One negative we found here is that, the broker does not accept traders from United States, Canada, Israel, New Zealand, Iran, Russia, Myanmar and North Korea, officially the Democratic People’s Republic of Korea.

Nonetheless, once you have selected the document type, you are prompted to scan the document with your camera, following clear visual guidelines. Finally, traders can expect an email within an hour confirming whether their verification was successful (and the steps to rectify it if it failed).

Step 3: Funding Your FPM Trading Account & Using a Demo Account

Once verified, traders can easily connect their preferred funding method and meet the minimum deposit. Alternatively, start with a practice or demo account (which you can set up without undergoing this whole KYC procedure). Once enough demo trading is performed, consider upgrading to and funding a live account following the previous steps.

FPM Trading Account Types & Minimum Deposit: Standard vs Raw

FPM mainly provides ‘Standard’ and ‘Raw’ account types, both of which traders can try in the demo stage. In summary, the primary difference between the two is that the spreads start from zero pips with the latter (along with a $3 per-side lot commission). Meanwhile, the spreads begin from 1 pip with no commission on the latter.

Also, the Raw spreads are only available when trading forex and metals.

Here are the detailed features of both accounts (swap-free or Islamic versions are also provided):

| Standard | Raw | |

|---|---|---|

| Minimum opening balance | $100 AUD or equivalent | $100 AUD or equivalent |

| Spreads | From 1 pip | From 0 pips |

| Execution | ECN-pricing | ECN-pricing |

| Commission per lot | Zero | $3 per side |

| Minimum trade size | 0.01 lot | 0.01 lot |

| Expert advisors | Yes | Yes |

| Mobile app | Yes | Yes |

| VPS available | Yes | Yes |

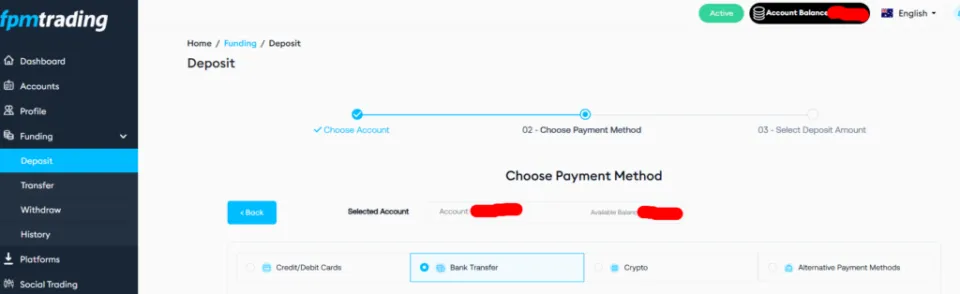

How to Deposit Money to Your FPM Trading Account

Below are the steps to follow:

- Log in to your personal client portal, which you can access from the broker’s homepage.

- Find the Funding tab on the left-hand side and choose ‘Deposit’ from the dropdown box.

- Choose from the presented options, enter the desired amount, and follow the prompts.

It’s crucial to enter the correct information the first time, maintain an uninterrupted internet connection, and keep the browser pages open.

Traders can fund with:

- Mastercard/VISA card (no deposit fees; instant or near-instant reflection)

- Cryptocurrency like Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, and USDT (no deposit fees; instant or confirmation up to an hour after the transaction)

- Bank wire (no deposit fees; payments can take up to five working days to reflect, depending on the bank)

How to Withdraw Money from Your FPM Trading Account

To withdraw funds from your FPM Trading account, follow these steps:

- Log in to your personal client portal

- Navigate to the ‘Withdrawals’ section.

- Choose your preferred withdrawal method (such as bank wire, credit card refund, or crypto withdrawal).

- Enter the amount you wish to withdraw and provide the necessary payment details.

- Confirm the withdrawal request.

Allow FPM Trading a working day to process the withdrawal. Once they’ve confirmed all is in order, these are the withdrawal times for each payment method (no minimums apply):

- Cards: 1-2 working days or longer, depending on your payment processor

- Crypto: up to one day in the worst-case scenario (but usually in an hour)

- Bank wire: between 2-5 working days

Withdrawals can sometimes be declined, primarily because they don’t meet certain rules. The most common reason is using a different withdrawal method than the one used for deposits. Brokers often return funds to the original payment channel, in the order in which deposits were made, before settling for bank transfer (or other alternative) for excess profits.

Another common cause is unmet bonus or promotion conditions (where applicable). Traders can also run into issues if they attempt to withdraw more than their free or available balance while still holding open positions. As long as the account is verified, payment details match, and trading activity meets platform requirements, withdrawals are generally processed without complications.

Does FPM Trading Offer Negative Balance Protection?

Based on our research, no (even though one of the agents we chatted with confirmed otherwise). Having checked FPM’s terms and conditions, there is no mention of covering negative balances or similar terminology. This is expected for brokers with weaker regulation compared to their counterparts, where such protection is clearly mentioned.

Using risk management tools such as stop losses and conservative position sizing generally prevents traders from losing more than their deposited capital. However, some very rare ‘black swan’ events with wild price movements can, unfortunately, leave a trader with a negative balance. In this case, a broker could pursue the user through debt collection or legal action, depending on the amount owed.

Thus, the apparent lack of negative balance protection is sometimes the make-or-break factor for anyone considering investing with FPM.

FPM Trading Customer Support: Live Chat, Phone & Email

The main customer support channels (which are multi-lingual) include live chat, phone, and email:

| Live chat | Phone | |

|---|---|---|

| Powered by LiveChat Available 24/7 Includes excellent chatbot that answers many queries without needing a live agent | +441919340541 or + 230 489 2661 (directly to their registered Mauritius office) | support@fpmtrading.com |

Traders can also request a callback by submitting a form on the relevant section of the broker’s website.

Do You Need to Pay Taxes on Profits from FPM Trading?

It depends on your country. While Mauritius is a tax haven, this doesn’t exempt all FPM users from paying tax. Your country of residence determines whether trading profits are taxable or not. Generally, most countries that aren’t regarded as tax havens or have low tax rates would treat these as income or capital gains.

One must consult with a tax professional to gain the proper knowledge and remain compliant. When taxes apply, it’s wise to gather your trade history for accurate filing. In some exceptional cases (depending on the nation), tax loss harvesting can be used to reduce your overall liability.

Best Alternatives to FPM Trading: Compare Top Regulated Forex & CFD Brokers

When evaluating FPM Trading, and want to understand other good options in the market, here are some of the best alternatives:

Compare top brokers side-by-side on several metrics like regulation, costs, and platforms with WR Trading’s broker comparison tool.

Vantage Markets: Multi-Regulated Alternative to FPM Trading

If you like FPM Trading’s multi-platform access but want a broker with a broader global footprint, Vantage Markets is a natural alternative. Founded in 2009, this multi-regulated broker supports MT4, MT5, cTrader, and TradingView, offering a flexible setup for both beginner and advanced traders.

We found its range of account types and payment options impressive, alongside one of the best-rated CFD trading apps. With a low $50 minimum deposit and leverage up to 1:500, it appeals to traders seeking accessibility and choice of markets.

For those comparing FPM Trading to other multi-regulated, low-cost brokers, Vantage Markets delivers a user-friendly, globally trusted experience.

StarTrader: Copy-Trading-Focused Alternative to FPM Trading

For traders who value FPM Trading’s social trading tools but prefer stronger regulation and a lower entry point, StarTrader stands out. This broker has over 12 years of experience and offers forex, indices, stocks, ETFs, and commodities for their trading instruments. With a minimum deposit of just $5, they are even more affordable than FPM.

Like FPM, StarTrader supports copy trading, but it also adds the PAMM “Social Funds” feature, ideal for investors interested in long-term managed strategies. Its straightforward Standard and ECN accounts mirror FPM’s simplicity while offering tighter spreads and more transparent pricing.

With MT4 and MT5 integration and a mobile app on both Android and iOS, StarTrader is an accessible, scalable alternative to FPM Trading for those who prefer a simple but flexible setup.

Pepperstone: Highly Regulated Alternative to FPM Trading

Pepperstone deserves serious consideration when comparing FPM Trading to a broker with a stronger global regulatory record. This Australian CFD broker, founded nearly 15 years ago, is regulated across multiple continents, a notable edge over FPM’s sole Mauritius regulation.

Pepperstone supports MT4/5, cTrader, and TradingView, plus a dedicated copy trading app, catering to a wide range of traders. With no minimum deposit and leverage up to 1:500, it offers both flexibility and depth across forex, indices, commodities, stocks, ETFs, and crypto.

Ultimately, traders who prioritise trust, global access, and customer service will regard Pepperstone as one of the best full-service alternatives to FPM Trading.

Conclusion: Is FPM Trading a Good, Safe Broker for You?

Throughout this review, we found FPM Trading’s offers were in line with those of many modern CFD brokers. They boast a decent handful of tradable markets, affordable costs, a straightforward account range, and access to recognizable trading platforms.

Conversely, the main downsides are limited regulation, the lack of a mobile app, and no negative balance protection.

Here are other aspects in more detail that we disliked:

- There were some inconsistencies in the product information. For starters, the website references bonds among its products. Meanwhile, these weren’t available on either trading platform, on either live or demo accounts. Also, the broker should have clarified that their full suite of products is only available on cTrader (since this is scaled down on MT4/5).

- Upon registration, one sees only 32 listed countries. Once on the client portal, all nations except the United States are shown. Still, in reality, the broker only accepts traders from the previously seen list.

So, you can purposefully select a country that isn’t your own initially to advance, but when you choose the true one, the broker is likely to reject the application.

- We also noticed that during testing, one of the email providers we used (Proton Mail) flagged the broker’s communication as being spoofed or improperly forwarded. Such failed authentication is common with loose or weakly regulated brokers.

In closing, while FPM Trading is brilliant in many areas as a service, it remains an offshore broker with limited reach and modest oversight. The inconsistency between its website claims and platform availability, along with failed email authentication and unclear country eligibility, highlights areas for improvement.

We recommend FPM only for small-scale traders or those experimenting with offshore brokers. Intermediate to experienced traders seeking to invest in a wider range of instruments or under stricter oversight will find better alignment with brokers like Vantage Markets, Pepperstone, and StarTrader.