Use our free Money Management Calculator on WR Trading to calculate the needed risk amount per trade when applying a money management strategy based on percentages.

Money management in forex trading is a set of rules you follow to decide how much of your account you should risk, the size of a position, or when to cut losses or lock in gains. Our money management calculator is a tool that helps traders determine in real-time the position size that corresponds to the risk they are willing to take on each trade. Traders no longer have to calculate their positions manually, the money management calculator does this automatically with a few inputs.

Among many tools that found favor with traders, the money management calculator emerged as a favorite because it made the process of calculating risk per trade and optimizing position sizing easy. Get to know what the money management calculator is, why it’s essential, and how you can use the WR Trading Money Management Calculator to help with your trading.

What are the Specifications of the Money Management Calculator?

Our money management calculator at WR Trading has certain core elements. When utilized properly, they serve to preserve one’s trading capital. These core elements are:

- Trading Account Balance: The trading account balance is how much traders currently have in their trading account at the time of placing a new trade. When using our tool, traders will be required to input their trading account balance.

- Money Management Risk: This is how traders pre-determine and adhere to risking a certain percentage of their trading account per time. The goal is to ensure that only a comfortable portion of one’s trading account is exposed in the markets and susceptible to loss, instead of the entire account. When using our tool, traders will be required to input the percentage value they are willing to risk per trade.

- Risk Per Trade: This value is how much a trader should risk on every trade. It is derived from the trading account balance and money management risk. Our money management tool automatically calculates how much traders should risk per trade, once they input their trading account balance, and money management risk, and click the calculate button.

In a typical example, say you have a trading account of $10,000 and you want to risk 2% of your capital on every trade, our money management calculator will help detect how much it is exactly that you are risking per trade, making you confident as you go into every trade. Let’s walk through the steps to use our risk calculator and make informed decisions:

- Account Balance: You fill in the total amount of capital in your trading account. In this case, you have $10,000, you would then type that amount into the balance field.

- Set Your Risk Percentage: Determine the amount of your capital that you are ready to risk in each trade. Following the example, you would input 2%.

- Calculate: click the calculate button for instant results

- View Results: The calculator will let you know how much you are risking per trade in just a snap. This will keep you away from overexposure to the market.

The calculator’s intuitive nature and usability make it especially helpful to forex and CFD traders who use leverages most of the time by measuring and hence avoiding excessive risks.

For Which Asset and Financial Instrument Can the Money Management Calculator Be Used?

The Money Management Calculator can be used for assets like: Forex, Cryptocurrencies, Commodities, Indices, Stocks, and Metals.

The following financial instruments can be used for the Money Management Calculator: Futures, Options, Binary Options, CFDs, Forex.

Money management can be applied to all assets and financial instruments. It is a universal investment strategy.

How Does the Money Management Calculator Work?

The Money Management Calculator was created to calculate the amount of money that a trader should risk considering their account size and certain market conditions. With basic variables such as their account Balance and the percentage they are willing to risk on any single trade, the calculator ultimately produces an ideal amount the trader should risk per trade.

This helps traders adhere to proper risk management and reduces their probability of over-leveraging a trade or going into emotional decision-making over a trade.

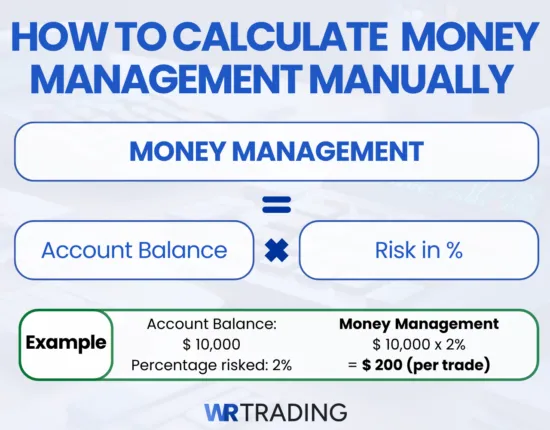

How to Calculate Money Management Manually

Manual money management involves calculating your position size, using your account balance, risk percentage, and stop-loss distance. First, you need to identify what currency pair you are trading because different pairs have different values per pip. For example, in major pairs like EUR/USD, one pip usually equates to $10 for a standard lot.

Knowing this, you can manually calculate the amount you are risking using this formula:

- Assuming, account balance = $10,000

- Percentage risked = 2%

- Money Management = ($10,000 x2%)

- = (10,000 x2/100)

- = $200 (Risk per Trade)

To include money management in selecting your position size, you can use this formula:

- Assuming, account balance = $10,000

- Percentage risked = 2%

- Stop loss = 50 pips

- Position size = ($10,000 x 2%) ÷ (50 x 10)

- = (10,000 x 2/100) ÷ 500

- = (100 x 2) ÷ 500

- = 200/500

- = 0.4 lots

If you are trading a cross pair, say GBP/JPY. The pip value must be calculated using the exchange rate of the pair relative to the account currency. Once the pip value is calculated, insert it into the same formula: (Account Balance × Risk %) ÷ (Stop-Loss × Pip Value).

What Are the Best Rules for Money Management?

In trading, the term “rules for money management” means the guidelines, strategies, and risk profile that a trader adheres to as they trade various instruments. Although there are several things to consider when practicing money management, these basic rules should be followed to fully take advantage of the risk management tool:

- Stick to Your Plan: Define risk percentage, document entry–exit rules, back-test, then commit. Log every trade, review weekly; ignore tempting signals outside plan. Example: always risk 1.5%, exit at predefined stop or target with no exceptions.

- Use Moderate Risk Per Trade: Calculate account value; multiply by 0.01–0.02 to find risk dollars. Divide by stop-loss distance for position size. Example: $5,000 account, 2 % risk, 25-pip stop yields 0.4-lot forex position per trade.

- Adjust Based on Market Conditions: Monitor ATR, VIX, or Bollinger width; label volatility high, normal, low. Widen stops, shrink size during spikes; reverse when calm. Example: double stop-loss pips during NFP releases, halve shares traded.

- Avoid Emotional Trading: Set maximum daily loss; once reached, stop trading, journal emotions. Practice breathing or leave desk. Example: after three consecutive losses, shut platform, review strategy tomorrow; avoids revenge doubling lot size attempts..

What Is The 1%-Rule in Trading?

The 1% rule states that traders should not risk more than 1% of their total capital at any given time on a trade. The rule aims to promote discipline and protect your capital. Following this rule faithfully means that a trader would need to lose a hundred trades in succession before blowing their account, all conditions being equal.

This allows market participants to trade confidently, make some mistakes, and still be profitable, as long as they are using a winning strategy. As such, this rule is suitable for beginner and pro traders alike.