Leeloo Trading Review 2026 | All Pros & Cons, Costs, Rules

- A variety of funded accounts, including entry accounts, foundation accounts, weekly and bundle accounts, to meet every type of trader's needs.

- It offers a one-step evaluation process, making it easier for traders to access funding quickly.

- You get a 14-day free trial to test out the platform before deciding to purchase a practice account.

- When your practice account reaches its trial limit, you can reset the account for a fee.

- You can trade up to 10 accounts simultaneously under a single Rithmic ID.

- Leeloo offers a 100% profit share on the first $ 12,500 in profits.

- You can place trades during news events and carry positions.

- Lack of detailed information regarding maximum leverage and prop trading fees of partnering brokers.

- You are required to trade for 30 days before you can withdraw your first profits.

- Leeloo doesn't provide any form of training or prop trading educational resources.

- Only futures contracts are available.

Leeloo is one of the few prop firms that offer a fair challenge with less stringent rules. We have tested our strategies on the Leeloo practice account and have secured a performance account.

After meeting the 30-day trade requirements, we were able to cash out our profits via Rise. To help you get started, we have reviewed below how Leeloo works, its challenges and costs, account types, rules, and other additional information.

Summary from Our Expert:

7 Leeloo Customer Reviews And Ratings

What is Leeloo Trading?

Leeloo is a fast-growing prop firm that helps traders unlock their full potential by providing funding. The firm was established in Montana by an accomplished entrepreneur and trader, Jody Dahl.

Leeloo Trading is among the few prop firms that understand traders’ psychological and financial challenges. This understanding is reflected in the platform’s minimal restrictions and its flexibility for prop trading. We were allowed to trade during news events and carry positions overnight, a flexibility several prop firms do not offer. Leeloo is also one of the first prop live account providers to provide traders with a static drawdown. They also add a competitive edge to their prop trading with their performance-based trading and contests.

Traders get to put their strategies and knowledge to the test and win rewards, including unlimited rollovers, flexible account management, discounts, and more. Before you can receive Leeloo funding and additional benefits, you have to pass the practice account challenge. The challenge will require you to test your trading and risk-reward ratio skills under real market conditions using simulated currency.

Is Leeloo legal?

Yes, Leeloo is a legal prop trading firm. After exploring the platform, we can attest that Leeloo is trustworthy. Countries have not implemented rules and regulations for proprietary firms. The only way to find out whether a prop firm is reputable is to read expert reviews online and explore the platform yourself.

The firm has an excellent rating of 4.6 on Trustpilot. We examined reviews from actual users on Trustpilot, FPA, and YouTube, and most left positive comments regarding the platforms. Traders praised the platform’s quick withdrawal process, various account types, and integrity. For a first-hand experience of how Leeloo works, you can take advantage of its Leeloo offers a 14-day free trial.

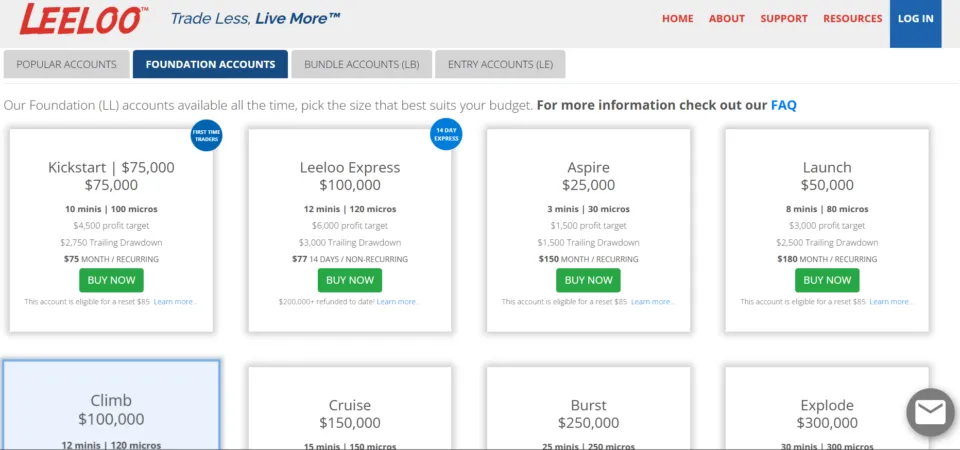

Prop Trading Account Types with Leeloo

Leeloo offers traders four major categories of prop trading accounts. Each category includes several account types with varying rules and requirements. Below, we have compiled the list of Leeloo prop trading account types and categories:

Foundation Accounts

All foundation accounts are accessible at any time and require a minimum of 10 days. We found that every foundation account is eligible for an $85 reset fee, except the Leeloo Express account. The different sizes of Leeloo Foundation accounts are

| Account Name | Account Size | Cost | Profit Target | Drawdown Limit | Minis | Micros |

| Kickstart | $75,000 | $75/Month | $4,500 | $2,750 | 10 | 100 |

| Express | $100,000 | $77/14 days | $6,000 | $3,000 | 12 | 120 |

| Aspire | $25,000 | $150/Month | $1,500 | $1,500 | 3 | 30 |

| Launch | $50,000 | $180/Month | $3,000 | $2,500 | 8 | 80 |

| Climb | $100,000 | $220/Month | $6,000 | $3,000 | 12 | 120 |

| Cruise | $150,000 | $305/Month | $9,000 | $5,000 | 15 | 150 |

| Burst | $250,000 | $525/Month | $15,000 | $6,500 | 25 | 250 |

| Explode | $300,000 | $675/Month | $20,000 | $7,500 | 30 | 300 |

| Static Max Loss | $100,000 | $675/Month | $6,000 | $3000 Static | 12 | 120 |

Bundle Accounts

This category gives you three accounts for the price of one and is nonrecurring, meaning the account is only valid for 30 days. Each account is nonrecurring, and only one out of all three accounts can qualify for a performance account. Every bundle account type is eligible for a reset, but you can reset only one account within the bundle. The different sizes of Leeloo bundle accounts are

| Account Name | Account Size | Cost | Profit Target | Drawdown Limit | Minis | Micros |

| Bundle Aspire | $25,000 | $250 | $1,500 | $1,500 | 3 | 30 |

| Bundle Launch | $50,000 | $280 | $3,000 | $2,500 | 8 | 80 |

| Bundle Climb | $100,000 | $320 | $6,000 | $3,000 | 12 | 120 |

| Bundle Burst | $250,000 | $625 | $15,000 | $6,500 | 25 | 250 |

| Bundle Cruise | $150,000 | $405 | $9,000 | $5,000 | 15 | 150 |

| Bundle Explode | $300,000 | $775 | $20,000 | $7,500 | 30 | 300 |

Entry Accounts

The Leeloo entry accounts are affordable for beginner traders. During our research, we discovered that the entry account has requirements similar to those of other categories but has a limited payout structure. The different sizes of Leeloo entry accounts are

| Account Name | Account Size | Cost | Profit Target | Drawdown Limit | Minis | Micros |

| Entry LE Aspire | $25,000 | $26/Month | $1,500 | $1,500 | 3 | 30 |

| Entry LE Launch | $50,000 | $38/Month | $3,000 | $2,500 | 8 | 80 |

| Entry LE Climb | $100,000 | $58/Month | $6,000 | $3,000 | 12 | 120 |

| Entry LE Cruise | $150,000 | $70/Month | $9,000 | $5,000 | 15 | 150 |

| Entry LE Burst | $250,000 | $126/Month | $15,000 | $6,500 | 25 | 250 |

| Entry LE Explode | $300,000 | $169/Month | $20,000 | $7,500 | 30 | 300 |

| Entry LE Glide Micro | $100,000 | $75/Month | $2,000 | $625 Static | 2 | 20 |

Weekly Accounts

When you qualify for a performance account using a weekly account, you can request weekly payouts. Leeloo’s weekly accounts have the exact qualifying requirements and are eligible to be reset. The different sizes of Leeloo weekly accounts are

| Account Name | Account Size | Cost | Profit Target | Drawdown Limit | Minis | Micros |

| Aspire WK | $250,00 | $250/Month | $1,500 | $1,500 | 3 | 30 |

| Launch WK | $50,000 | $295/Month | $3,000 | $2,500 | 8 | 80 |

The Challenges and Costs on Leeloo Explained

Leeloo offers various prop accounts, also referred to as performance accounts. We had to pass the Leeloo one evaluation challenge to qualify for a performance account and receive funding.

The challenge has just one requirement: trade for a certain number of days and reach the profit target without exceeding the max drawdown limit. We tested and passed the Leeloo Express Foundation account, and here is how we went about it:

Step 1: Purchase Leeloo Express Practice Account

The Leeloo Express account goes for 77$ dollars, which is quite affordable. The subscription is nonrecurring any lastonly s 14 days, so we purchased, it as the challenge requires prop trading fo10en days. We used a PayPal account with a linked debit card to make the payment, and the process was swift.

Step 2: Leeloo Challenge

This is the stage where we had to put our knowledge, skills, and risk management strategies to the test. The fundamental analysis is one test, and the psychological test is another to account for. Hitting a $6000 profit target within ten days with a trailing drawdown and being unable to reset the account was no walk in the park.

However, Mental fortitude is part of what makes a great trader. You can pass the evaluation as long as you know what you’re doing. After we passed the evaluation, we were given a refund of our tryout fee of $77.

Step 3: Sign the E-doc Proprietary Agreement

Leeloo sent a congratulations email with an attached e-signature form to our email within 48 hrs of passing the challenge. We signed the form and logged in to our members’ area. After that, we made our first payment for performance account data. The type of account you use to qualify for the performance account determines the cost of your data.

Step 4: Leeloo Trader

After signing the e-form and making payment within 72 hours, we received an email confirming that our performance account had been activated. This is when we officially became Leeloo traders.

All other types of accounts follow the same process. The differences are in the profit target, minis and micros, and drawdown limit. You must actively cancel your practice account subscription to prevent further charges. Leeloo does not provide a refund if you fail to cancel and get billed the following month.

Promo Codes for Rebates

Leeloo offers special coupons, promo codes, and lifetime discounts, but you have to be an active member to take advantage of them. Traders can earn rewards such as edge enhancers, rebates, extra cash, and discounts on account resets.

We discovered that Leeloo doesn’t have a promo section on their website. Instead, promo codes, discounts, and coupons are announced on their social media pages. To take advantage of Leeloo promo offers, it’s best to follow their social media, which is linked at the bottom of the website.

Payouts on Leeloo

| Payout Method | Percentage | Payout Processing Time |

| Rise works | 100%-90% | 1 to 3 days |

Leeloo only supports one withdrawal method: the Rise payment platform. Before we were able to request a payout, we had to register with Rise. Here is a step-by-step process on how our registration process went

Step 1: Accept Invite

You’ll get an invite in your email from Leeloo to join Rise Works and create a profile. We clicked on the accept the invite button and got a pop-up welcoming us to the rise pay platform.

Step 2: Register Account

Select the “Get Started” link and fill in all required fields. After filling out the form, a verification code was sent to our email, which we filled out and completed the signup.

Step 3: Confirm Contractor Invite

After completing the sign-up, you will get a pop-up stating that Leeloo has invited you to join Rise as a contractor. Click on the checkbox and select confirm.

Step 4: Fill in Personal Details

After clicking confirm, you will be redirected to another form and required to fill in additional personal details, such as contact details, recovery email, and address. You should ensure your information is accurate so that they will verify it.

Step 5: Choose Registration Type

You will be asked to choose a registration type. We selected the individual option and were asked whether we pay US income tax and enter our SSN/TIN. After that, you are to confirm the Rise pre-agreements and click the button. Review and sign the agreement document.

Step 6: Verify Identity

After signing the document, you will be asked to verify your identity. You will be prompted to fill in the required fields and select a means of identification. We were also asked to perform a face verification and enter the verification code sent to our email.

Step 7: Account Security

Choose the type of account security you want, and create a password. You will be given a security code, which you can download or copy and paste. Hit next to create your Rise ID and click complete the onboarding process. The platform will redirect you to your dashboard.

After successfully creating and verifying your Rise Works account, you just need to follow these steps to request your payout;

- On your Leeloo dashboard, Click on PA accounts.

- Once you have an account that qualifies for payout, click the request for payout button.

- Insert the amount you want to withdraw.

You will get a notification that you have successfully requested a payout. You should note that you can request a payout only on the last Saturday of each month, between 2 am EST and 5 pm EST.

Trading Platforms of Leelo Trading

Leeloo Trading supports three major prop trading platforms:

NinjaTrader 7

It is one of the best trading platforms designed for active future traders. Ninjatrader 7 has an easy-to-use interface, making it easy for beginners. The platform offers low margins, simulated trading, advanced market analytics tools, and powerful market visualization. It is a reliable source for future multi-time frames and quantum trading indicators.

Leeloo offers a free NinjaTrader SIM license to traders who qualify for a performance account.

NinjaTrader 8

This is an upgrade from NinjaTrader 7. It offers thousands of add-ons for traders to use when conducting well-informed analytics and backtesting.

With NJ 8, you can use volumetric bars and custom volume profile indicators to identify buying and selling pressure and confirm market direction. Leeloo offers its Performance account traders a free NJ8 sim license. With the license, traders can access NJ 8 automated trade management features.

Rithmic Pro

Rithmic Pro is one of the best professional prop trading and charting platforms for futures traders. Leeloo provides its official traders free access to Rithmic Trader Pro. The platform supports manu, nd automated simulated trading.

With R Trade Pro, you can easily navigate charts and quickly place and modify orders. It is highly customizable, allowing you to create custom indicators and perform in-depth technical analysis.

Which Broker is Used by Leeloo?

While exploring Leeloo, we discovered that the platform partners with top tier have partnered with top brokerage platforms that offer low margins. Some of these platforms include NinjaTrader and Rithmic Pro. Leeloo Trading itself is not a broker, but a platform that provides trade funding solutions.

Taxes on Leeloo

Leeloo does not deduct your taxes from your profits for you. The responsibility for declaring your profit lies with you according to the laws of the country you are located in. Prop trading is treated as a business, when you officially become a Leeloo trader, you’re viewed as an entrepreneur.

So when filing, it is best to declare your profits as compensation for the work you did with Leeloo. You may not be liable for lower rates if you declare your profit as capital gains. Consult your accountant to be well informed about the applicable rules and tax rates for such means of income in your country.

Support and Education

Leeloo provides several articles and videos that help traders use the platform efficiently. They do not offer prop trading tips, educational resources, or chart analysis. For further inquiries or if you encounter any issues while using the platform, contact Leeloo via support@Leelootrading.com. You can also send them a message via their website’s live chat.

Ace your Evaluation and Get your Funded Account Fast with WR Trading Mentorship

Getting funded and receiving consistent long-term payouts (not just 1 or 2) at Leeloo Trading requires you to be on top of your trading game with a clear and defined system that is simple to execute and follow. If you want a step-by-step blueprint of how to do this, you can consider applying to our exclusive coaching at WR Trading, where if you get accepted into our program, you will have access to a 1-on-1 personal trading mentorship that will unlock your potential of being the best prop trader you can be and avoiding being one of too many traders who do not even pass the evaluation phase and end up wasting their money.

(Learn A Proven Trading System To Pass Prop Firm Challenges And Get Funded)

Alternatives

We did our research, and here are top prop firms that offer traders several benefits, like Leeloo;

- The Trading Pit: This is a moderate-risk, transparent prop firm that offers traders up to 80% split of profits. After you pass its evaluation challenge, it will fully refund your fee with your first payout. You can only trade CFDs and futures at this prop firm. All trading pit accounts have a maximum leverage of 1:30. They offer weekly payouts, educational resources, and a great scaling plan.

- FTMO: Funded Trading MetaTrader Operator (FTMO) is one of the most popular and reputable prop firms. The platform offers traders a profit share of 80%-90%. We like FTMO because it provides a wide range of trading options, including bonds, stocks, indices, cryptocurrencies, commodities, and forex. It uses a two-step evaluation process and does not accept US clients.

- Apex Trader Funding: For beginner traders with limited capital, we suggest checking out Apex Trader. The platform is easy to navigate and offers flexibility regarding its terms. You also get 100% of your first $25,000 profit. After that, the profit split is 90- 1. On Apex, you can trade on holidays and during news events.

- 5%er: This prop firm is a low-risk platform with affordable fees starting at as low as $39. Instruments you can trade on 5%er include indexes, commodities, forex, and cryptocurrencies. The platform has flexible terms; we were able to hold positions overnight and over the weekends. 5%er offers a 5% profit share. Other benefits of 5%er include instant funding, discounts, and frequent payouts.

Conclusion

Leeloo is best for beginner and expert traders who want to improve their skills. The platform’s 30-day withdrawal requirement teaches beginner traders to slow down and focus on what matters, rather than a payout. We prefer Leeloo because it offers a wide range of accounts.

It has a transparent payout system and a great support team. While exploring the platform, we appreciated their honesty regarding their terms and requirements. When attempting the challenge, keep a clear head and implement a great risk-to-reward ratio and strategy; it will help you get through.

Frequently Asked Questions on Leeloo:

Does Leeloo offer a free trial?

Yes, Leeloo offers a 14-day free trial for you to familiarize yourself with the platform’s process and tools. The free trial is only available to individuals who do not have an existing Rithmic account.

What withdrawal methods are available on Leeloo?

Leeloo only supports one withdrawal payment method, Rise Works. After you pass the evaluation process, the firm will send you an email invite to create an account with Rise.

When can I request a payout on Leeloo?

You can only request a payout on the very last Saturday of the month between 2 am and 5 pm EST. Leeloo offers edge enhancers that allow you to request a payout every Saturday.