OneUp Trader Review 2026: All Pros & Cons, Costs, Rules

- OneUp Trader avoids hidden fees, with the evaluation fee being the most prominent upfront cost.

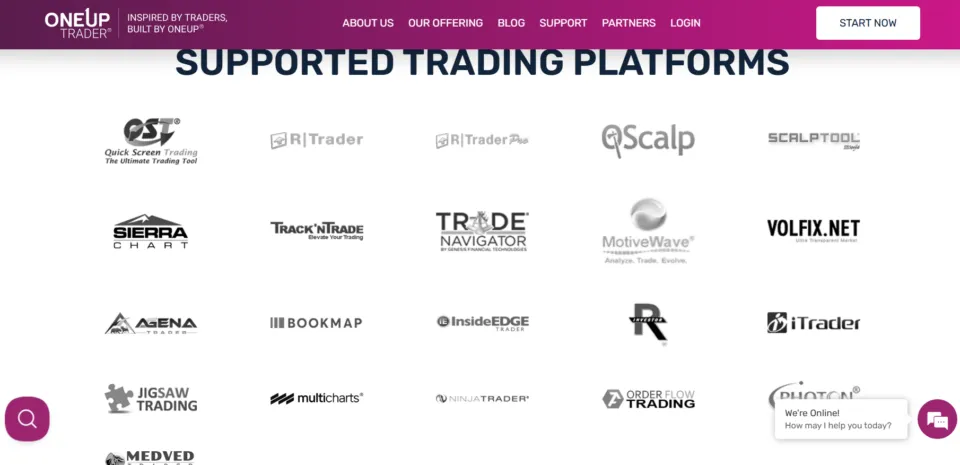

- Traders get access to over 20 popular prop trading platforms such as NinjaTrader.

- OneUp Trader's evaluation appears to be a single-step process and perfect for those who prefer a streamlined approach.

- OneUp allows traders to choose between a 90% or 50% profit split option based on their preferences.

- OneUp Trader offers various deposit and withdrawal methods to provide flexibility for funded traders.

- All traders have access to 24/7 customer support via dedicated phone and email support for inquiries and assistance.

- Does not offer instant funding options, requiring traders to go through an evaluation process before accessing funded accounts.

- Requires traders to pay a monthly subscription fee to maintain access to funded accounts.

For aspiring traders seeking to graduate from simulated accounts to real-world markets with significant capital, proprietary trading firms (prop firms) offer a compelling path. OneUp Trader stands out as a prop firm with a unique structure and features.

We’ve reviewed the OneUp Trader, dissecting its advantages and potential drawbacks to help you decide if it aligns with your trading goals.

Summary from Our Expert:

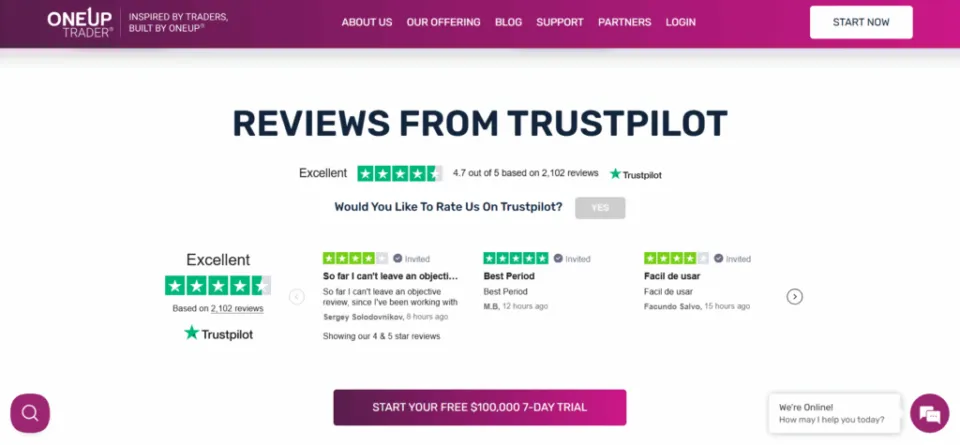

9 OneUp Trader Customer Reviews And Ratings

What is OneUp Trader?

OneUp Trader, established in 2018 and headquartered in Delaware, United States, operates as a proprietary trading firm (prop firm). OneUp Trader is known for its single-stage evaluation, with specific profit targets and drawdown limits. A fee is associated with the review, which can be a barrier to entry for some.

Upon completing the evaluation, traders gain access to a funded account. OneUp Trader offers a range of account sizes depending on your experience levels and risk tolerance. These accounts usually range from $25,000 to $250,000, allowing traders to manage a significant amount of capital without personal financial risk.

Unlike some prop firms with hidden costs, OneUp Trader clearly outlines its evaluation fee and profit-sharing structure. Traders typically keep 90% of the profits while the firm takes only 10%. There’s an additional incentive, as some prop firms, like OneUp Trader, allow traders to keep 100% of their profits on the initial $10,000 earned.

Is OneUp Trader legal?

Yes, OneUp Trader’s legitimacy is backed by PCI DSS certification and several positive reviews from experts. Unlike some prop firms with layers of regulatory requirements, OneUp Trader prioritises a streamlined experience. That way, you can enjoy a faster onboarding process and focus on what matters most – prop trading. Nevertheless, the lack of regulation by major financial bodies doesn’t take away its reliability.

The PCI DSS badge on OneUp Trader’s official website means it adheres to the Payment Card Industry Data Security Standard (PCI DSS). To further validate its reputation, we checked genuine client reviews on trusted platforms like Trustpilot to gauge clients’ experience with OneUp Trader.

Most reviews were positive, and experts also lauded OneUp as a safe, reliable, and secure prop trading firm. You’ll also find lots of good reviews from top experts on YouTube and Reddit communities.

While this lack of oversight may raise a red flag for some traders, the firm boasts a spotless record. The absence of a rigid regulatory framework also helps the firm implement new trading tools.

Prop Trading Account Types with OneUp Trader

| Account Type | Starting Capital | Profit Split | Evaluation Fee (Monthly) | Scaling Plan | Contracts |

| $25,000 Account | $25,000 | 90% | $65 | Increases with balance | 3 (max) |

| $50,000 Account | $50,000 | 90% | $75 | Increases with balance | 6 (max) |

| $100,000 Account | $100,000 | 90% | $150 | Increases with balance | 12 (max) |

| $150,000 Account | $150,000 | 90% | $175 | Increases with balance | 15 (max) |

| $250,000 Account | $250,000 | 90% | $325 | Increases with balance | 25 (max) |

The profit split across all account types is a consistent 90%, which we found to be highly favourable for traders. Here’s a detailed breakdown of the options and associated benefits for traders.

$25,000 Account

Subscription Options:

- $125/month for a 90% profit split

Account Features:

- Maximum of 3 contracts

- $100 balance reset

- $1,500 profit target

- $500 daily loss limit

- $1,500 trailing drawdown

- First $10,000 at 100% profit

$50,000 Account

Subscription Options:

- $75/month for a 90% profit split

Account Features:

- Maximum of 6 contracts

- $100 balance reset

- $3,000 profit target

- $1,250 daily loss limit

- $2,500 trailing drawdown

- First $10,000 at 100% profit

$100,000 Account

Subscription Options:

- $150/month for a 90% profit split

Account Features:

- Maximum of 12 contracts

- $100 balance reset

- $6,000 profit target

- $2,000 daily loss limit

- $3,000 trailing drawdown

- First $10,000 at 100% profit

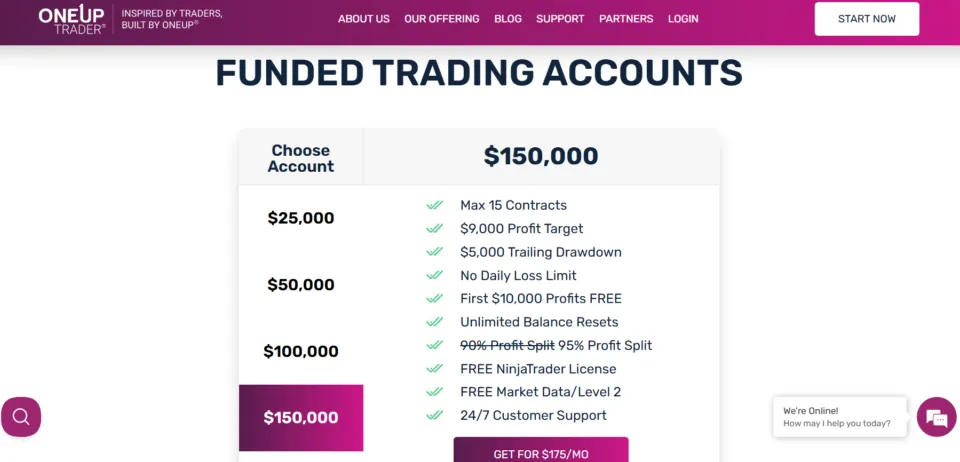

$150,000 Account

Subscription Options:

- $175/month for a 90% profit split

Account Features:

- Maximum of 15 contracts

- $100 balance reset

- $9,000 profit target

- $3,000 daily loss limit

- $4,500 trailing drawdown

- First $10,000 at 100% profit

$250,000 Account

Subscription Options:

- $325/month for a 90% profit split

Account Features:

- Maximum of 25 contracts

- $100 balance reset

- $15,000 profit target

- $5,000 daily loss limit

- $7,500 trailing drawdown

- First $10,000 at 100% profit

The Challenges and Costs of OneUp Trader are explained

OneUp Trader offers an attractive program for aspiring traders seeking access to larger capital. We tested and reviewed OneUp Trader’s accounts and identified one challenge. Also called an evaluation. This challenge is designed to be a one-step process, which is quite simple.

Unlike some prop firms with multiple stages, OneUp Trader offers a single evaluation to determine your eligibility for a funded account.

Here’s a quick rundown of the OneUp Trader evaluation:

| Account Size | Minimum Days to Trade | Profit target | Trailing Drawdown | Daily Loss Limit |

| $25,000 | 15 business days | $1,500 | 6% | No limit |

| $50,000 | 15 business days | $2,500 | Less than 6% | No limit |

| $100,000 | 15 business days | $3,500 | Less than 6% | No limit |

| $150,000 | 15 business days | $5,000 | Less than 6% | No limit |

| $250,000 | 15 business days | $7,500 | Less than 6% | No limit |

The core requirements revolve around meeting a minimum prop trading period and achieving a set profit target. OneUp Trader focuses on attainable goals to ensure the challenge is achievable for qualified traders.

The specific profit target you need to reach will vary depending on the account size you choose. However, it’s generally a fixed 6% gain, designed to assess your ability to generate consistent profits. OneUp Trader values consistency over a single significant win. While there’s no daily loss limit imposed, it goes without saying that sound risk management practices remain paramount throughout the evaluation.

Promo Codes for rebates

Based on our research, there aren’t any widely advertised promo codes or rebate programs specifically for OneUp Trader. This is likely due to their focus on a transparent fee structure with a clear evaluation cost and profit-sharing model. However, OneUp Trader offers a new-trader incentive: 100% of withdrawals up to $10,000. After this initial withdrawal, there will be a 90% profit split on all profits.

Since there aren’t any current rebate programs, the best way to potentially save on your OneUp Trader experience is to focus on acing the evaluation process on your first try. This eliminates the need to pay the evaluation fee multiple times.

Payouts on OneUp Trader

| Percentage | Payout Method | Processing Time (Business Days) |

| 100% (Up to $10,000 Profit) | Bank Wire or Cryptocurrency | 1 to 2 days |

| 90% (Profits After $10,000 Threshold) | Bank Wire or Cryptocurrency | 1 to 2 days |

After we reviewed OneUp Trading’s payout process in detail, it’s evident that they’ve established a structured, transparent system to facilitate trader payouts. You can request your first withdrawal after your 15th day of prop trading. This initial waiting period ensures you get acquainted with the platform and trading requirements.

OneUp Trader offers a tiered profit-sharing structure that incentivises successful traders. The initial 100% withdrawal is a sweet perk for newly funded traders. You get to keep all the profits you make until your total earnings hit $10,000. It’s a great way to build your capital quickly without sharing with OneUp Trader. Once your earnings surpass $10,000, the profit-sharing model shifts to a 90/10 split. You retain 90% of all subsequent profits, while OneUp Trader keeps 10% as its fee.

There’s also a minimum withdrawal threshold of $1,000 for your share of the profits. This means you’ll need at least $1,000 in your profit pool before you can make a withdrawal request. Our testing also found the withdrawal process to be swift. OneUp Trader processes withdrawal requests submitted between Monday and Friday on the same day, as long as the minimum threshold is met. The funds should then appear in your account within 1-2 business days (depending on your bank).

Keep in mind that OneUp Trader’s program has specific requirements regarding profit targets and maximum drawdowns for each account size. Make sure you understand these rules before applying, as they can impact your overall profitability.

See the table under OneUp trading account types for more details.

Trading Platforms

Exploring OneUp Trader even further, we discovered that it supports over 20 trading platforms. Here’s an overview of the trading platforms available through OneUp Trader:

NinjaTrader

OneUp Trader designates NinjaTrader as its preferred trading platform. Compared to the other supported trading platforms, NinjaTrader is quite popular and well-known for its automated trading capabilities.

OneUp Trader even offers a free NinjaTrader license for funded accounts using their Desktop Version 8.1. This eliminates a potential barrier to entry for aspiring prop traders and ensures familiarity with the platform throughout the evaluation and funding stages.

R | Trader

R | Trader, offered by Rithmic, is a solid foundation for both novice and experienced traders. While it might not boast the bells and whistles of its advanced sibling, R | Trader Pro, we still found it provides a solid experience with all the essential functionalities you need to navigate the futures markets.

Gaining a comprehensive understanding of order flow and potential price changes is also facilitated by the platform’s access to quotes and depth-of-market (DOM) information. For those seeking to conduct fundamental market analysis, R | Trader provides a curated selection of built-in technical indicators.

R | Trader Pro

While R | Trader provides a robust foundation, R | Trader Pro unlocks the platform’s full potential. During our testing, we found this platform to be better suited to traders who require advanced functionality and extensive customisation options. R | Trader Pro surpasses the limitations of basic bar charts. It offers a diverse array of advanced charting capabilities.

Traders can explore various chart types, such as Renko and Kagi, to visualise market behaviour from multiple perspectives and potentially uncover previously hidden patterns. Advanced charting is not the only improvement on this platform.

We also found that the new features were not available in its other Rithmic versions. The platform offers a high degree of customisation through the addition of custom indicators, studies, and overlays. The Rithmic Trader Pro mobile application is available for both iOS and Android.

Sierra Chart

Sierra Chart is a more comprehensive charting and analysis suite designed to empower serious traders. The platform offers more advanced chart types that go beyond basic bars and candlesticks. As a trader, you can access Renko, Kagi, and PnF charts.

From custom indicators to studies and overlays, Sierra Chart grants you extensive control over the visual representation of market data. For the truly technical trader, Sierra Chart’s easy-to-use scripting language (Easy Language) empowers you to create your custom indicators.

Other Supported Platforms

We were impressed with the number of options OneUp Trader supports. Besides the previous options, you can choose any of the following platforms:

- Quantower

- Medved Trader

- Trade Navigator

- Volfix.net

- eSignal

- Jigsaw Trading

- Agena Trader

- Motive Wave

- MultiCharts

- Photon

- QScalp

- QST- Quick Screen Trading

- Track’n Trade

- Inside Edge Trader

- Investor RT

- ATAS Order Flow Trading

- Bookmap

All these available trading platforms provide flexibility for traders who are comfortable with specific platforms or have experience using particular tools. As a beginner, a platform like NinjaTrader, with its simple interface, might be a good starting point.

More experienced traders, on the other hand, are more likely to gravitate towards platforms with advanced features like R | Trader Pro or Sierra Chart.

Which broker does OneUp Trader use?

OneUp Trader emphasises NinjaTrader as its leading broker for prop trading. Although the trading firm offers a good selection of popular trading platforms, NinjaTraders remains its primary broker. Traders can utilise NinjaTrader’s platform for free during the evaluation period and continue to access it at no cost upon funding their accounts.

Taxes on OneUp Trader

OneUp Trader does not withhold taxes from traders’ earnings. The platform ensures there are no data fees or hidden fees on withdrawals. That said, traders are still responsible for setting aside funds to cover their tax obligations. Depending on your jurisdiction and tax laws, profits generated from prop trading are classified as capital gains. As such, you are expected to fill out annual tax returns, report trading income, and pay any applicable taxes owed on profits.

Support and Education

OneUp Trader has a dedicated support team you can reach via phone and email. They can address your questions and concerns regarding the evaluation process, account management, platform usage, and other aspects of your experience.

You can reach OneUp Trader support via +1 302-231-0217 or email at support@oneuptrader.com.

Learn to Trade Smarter, Better with WR Trading Exclusive 1 on 1 Coaching

Your evaluation phase at OneUp Trader is not only a test of whether you have a viable trading strategy but also if you can manage your risk so that you won’t ever breach your account and end up not even reaching your first payout (and ultimately failing your account). At WR Trading, we offer an exclusive 1-on-1 personal coaching for selected traders (you can be one of them!) to eventually develop them into top performing, consistent profitable funded traders who know how to catch the best trades while avoiding those trades that are simply not “worth it.”

(Learn A Proven Trading System To Pass Prop Firm Challenges And Get Funded)

Alternatives to OneUp Trader

Have you set your sights on prop trading but feel OneUp Trader might not be the perfect fit? While they offer a path to funded accounts, the prop trading world is vast and diverse. Here are other reliable options you can explore:

FTMO

Similar to OneUp, FTMO offers a tiered account structure for traders with varying capital levels. Their primary focus is on Forex, with account sizes ranging from $10,000 to a staggering $200,000.

To unlock a funded account, you’ll need to pass the FTMO Challenge. This challenge consists of two stages: meeting a profitability target and adhering to a drawdown limit. Once you meet these requirements, you can keep up to 90% of your earnings in your FTMO accounts. FTMO even goes the extra mile by providing a practice account and educational resources to help you prepare for the evaluation.

Apex Trader Funding

Traders who are more interested in futures and stocks will have greater flexibility with Apex Trader Funding. The trading firm’s profit-sharing model lets you retain up to 80% of your profits after meeting performance requirements. Traders can also use up to 20 accounts simultaneously.

To qualify for funding, you need to trade for at least 7 days.

5%ers

Similar to OneUp Trader, 5 %ers primarily focus on Forex traders. The trading firm allows trading of major Forex pairs, miners (gold and silver), and some indices. There is also a two-stage evaluation process with a focus on risk management in the initial stage and higher profit targets with increased leverage in the second stage.

The Trading Pit

The Trading Pit is another top prop trading firm available to US traders. It utilises a tiered evaluation process with varying difficulty levels depending on the chosen account size. This allows you to tailor the challenge to your experience and risk tolerance.

Similar to other prop firms, traders can retain up to 80% of their profits after achieving performance goals and adhering to risk parameters.

Conclusion

OneUp Trader is a unique prop trading program and offers a clear advantage with its 1-time evaluation process. This can be especially appealing to aspiring prop traders who value a straightforward path toward a funded account. Through our thorough review process, it’s evident that OneUp Trader is committed to ensuring every trader has equal opportunities for success.

The trading firm already has tools to help traders thrive. All you need to do is focus on honing your risk management skills and leveraging the platform’s resources.

Frequently Asked Questions on OneUp Trader:

Are there any additional fees or hidden costs associated with OneUp Trader?

No, there are no hidden costs or additional fees. OneUp Trader is transparent about its fee structure: traders pay only a monthly subscription fee and an evaluation fee during the evaluation phase. OneUp Trader offers access to supported prop trading platforms at no additional cost during the evaluation phase.

How does profit sharing work on OneUp Trader?

Traders on OneUp Trader can choose between two profit split options: 90% or 50%. Under the 90% profit split option, traders retain 90% of their profits after reaching certain profit thresholds, while under the 50% split option, they retain 50%.

How does OneUp Trader handle trading disputes or discrepancies?

OneUp Trader has a dedicated support team available to assist traders with any trading-related issues or discrepancies. Traders can contact the support team via email or telephone. There’s also a live chat option available on the website.

Does OneUp Trader provide access to real-time market data and analysis tools?

Yes, OneUp Trader offers access to real-time market data and a suite of analysis tools to help traders make informed trading decisions. Traders can leverage advanced charting tools, technical indicators, and economic calendars to analyse market trends and identify trading opportunities.

What is the Minimum Account size required to participate in OneUp Trader’s evaluation phase?

The minimum account size for OneUp Trader’s evaluation phase is $25,000. OneUp offers various account sizes, with costs increasing as your starting capital increases during the evaluation. You can also choose to opt for the 7-day free trial to get started.