SabioTrade Review 2026: All Pros, Cons, Payouts, Rules

- Quick assessment phase

- Fast-pass potential (no minimum trading days)

- No time limit to pass challenges

- Accessible high profit split (90% for $479 account)

- Cost-competitive versus other prop firms

- Regular weekly payouts

- Weekend holding is allowed by default

- Comprehensive educational package

- Wide asset class availability

- An overall good reputation in the industry

- Tighter risk parameters (6% max trailing drawdown)

- Relatively lower max FX leverage (1:30)

- Max drawdown resets after every payout

- No MT4, MT5, and cTrader support

- No instant funding account

SabioTrade is a modern prop firm that offers an enticing one-step assessment process, but is it really legit and trustworthy, or a potential scam that could run off with your money? As professional and experienced traders at WR Trading, we did our due diligence and reviewed, tested, and holistically checked SabioTrade under different key conditions, including the cost of its challenges, the other account types it offers, the corresponding rules and risk limits, available leverage, profit sharing scheme, and which broker or platform it actually uses.

This review is not 100% positive (or simply an advertisement for SabioTrade). We outline here all the advantages and positive things we observed, as well as the drawbacks and “not-so-good” aspects we noted. Hence, if you want a clear and decisive answer on whether SabioTrade is secure and safe (and whether it is a great place to start if you are a beginner), or if it raises too many red flags to be labelled a potential scam, keep reading to find out.

Summary from Our Expert:

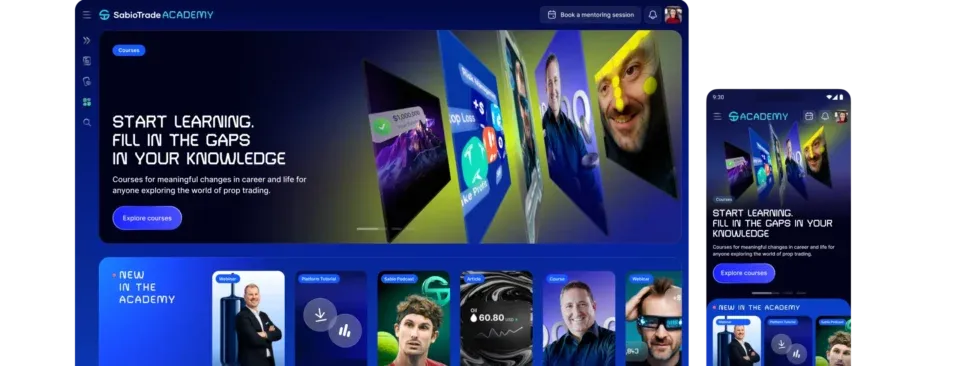

We also spent time exploring the prop firm’s educational resource hub (SabioTrade’s Trading Academy) that automatically comes after you subscribe to its free trial, and genuinely found it comprehensive, well-thought-out, and extremely useful, especially for beginners.

The negatives: I did not like the 6% max trailing drawdown, which is relatively tight compared to other prop firms. The maximum 1:30 FX leverage is also lower than that of many of its competitors. SabioTrade’s lack of support for MT4, MT5, and cTrader means you need to be comfortable with its in-house trading platform and adapt your workflow if you are used to external terminals.

Our final consideration is its reputation, which has been generally positive based on its community sources from Reddit and other online forums. That said, its only 2023 launch prompts us to be more prudent in assigning it a higher score, as we want to see how it develops and whether it can remain trustworthy and competitive in the years to come.

4 SabioTrade Customer Reviews And Ratings

What is SabioTrade?

SabioTrade is a proprietary trading firm (prop firm) developed in 2022 and launched in July 2023. The firm is operated by CODEVIL IT ENGINEERING LIMITED (doing business as SabioTrade), which is registered in Dublin, Ireland. SabioTrade in-house web and mobile trading platforms are powered by Quadcode rather than on MT4, MT5, or cTrader. It supports trading across multiple asset classes, including FX pairs, indices, stocks, ETFs, commodities, and cryptocurrencies.

Its business model revolves around a single-step evaluation/assessment process that, if the trader successfully passes, immediately gives them an 80% profit share split for its Essential accounts and a 90% split for its Advanced, Ultimate, and Prime accounts.

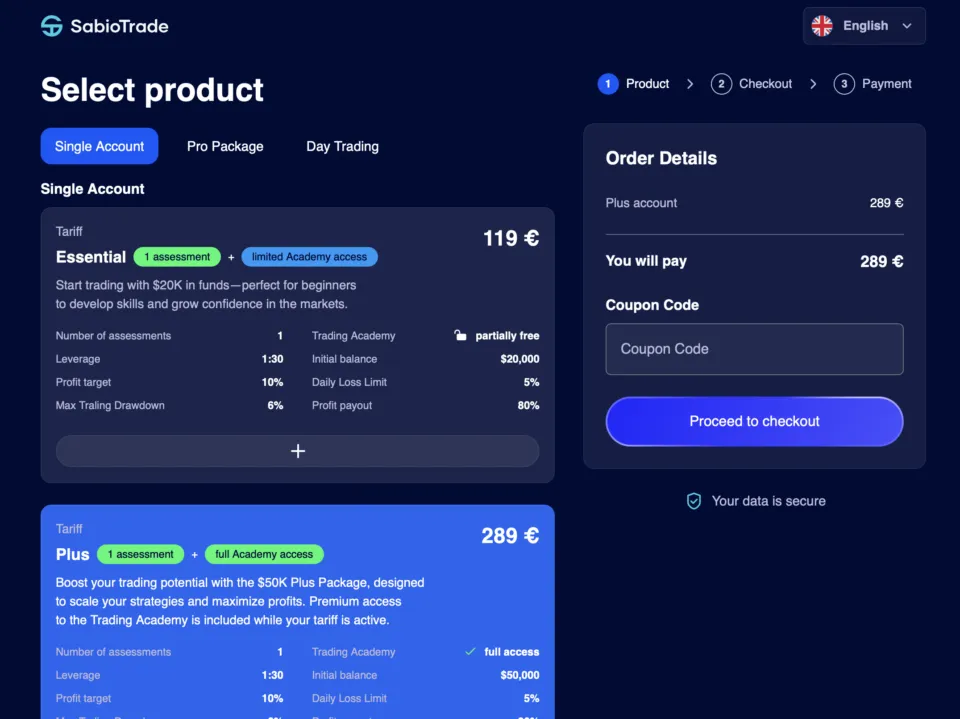

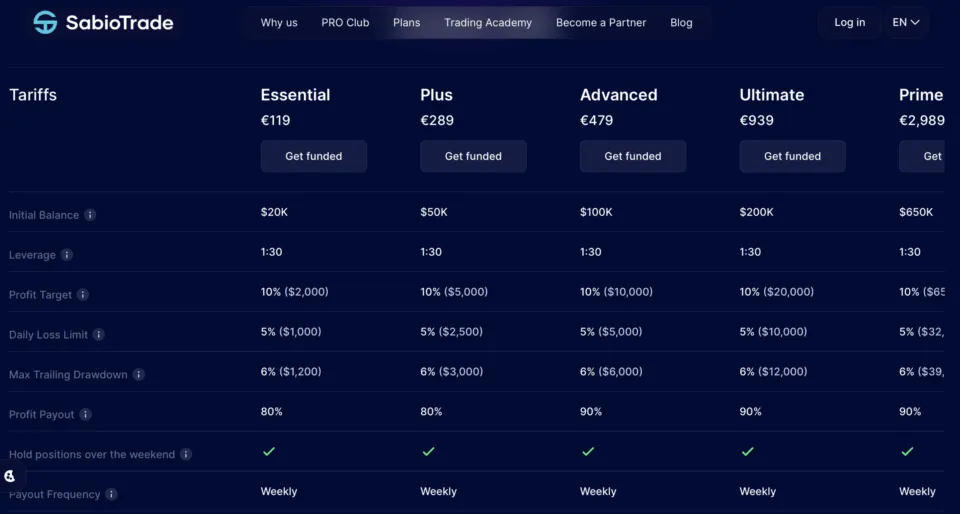

The following are the costs and initial balances for each account:

- Essential: $119 for $20,000

- Plus: $289 for $50,000

- Advanced: $479 for $100,000

- Ultimate: $939 for $200,000

- Prime: $2,989 for $650,000

Is SabioTrade legal?

Yes, SabioTrade operates legally in most countries. That said, note that its specific legal status depends on the domestic trading rules of different countries. For instance, retail CFD trading is prohibited in the US. Overall, as long as your country does not ban or restrict access to prop firms, then you can legally open an account with SabioTrade.

Since its inception in 2023, its reputation has been generally positive based on community feedback. Keep in mind, however, like most prop firms, it is not a broker and, as such, is not regulated as a broker, so standard “broker-style” investor protections and safety measures don’t apply. Lastly, SabioTrade does not publish a dedicated page of “demo trading statements” for public verification. What we found are simply marketing payout snippets/testimonials on the homepage.

Is SabioTrade secure to use?

Yes, to its credit, SabioTrade is mainly secure due to its own efforts. This includes its privacy policy, which details its concrete security controls, such as TLS encryption in transit, pseudonymization by default, restricted employee access on a “need-to-know” basis, and hosting in isolated, secure data centres with segmented networks. In addition, its in-house trading platform is powered by Quadcode rather than by cheaper yet more vulnerable third-party open terminals. All of these measures help create an overall safe trading environment.

Prop Trading Account Types with SabioTrade

Here is a comprehensive look at SabioTrade’s five account types: Essential, Plus, Advanced, Ultimate, and Prime, and all the key details for each account type, including how much they cost and the account balance they give:

| Essential | Plus | Advanced | Ultimate | Prime | |

|---|---|---|---|---|---|

| Initial Balance | $20k | $50k | $100k | $200k | $650k |

| Assessment Fee | $119 | $289 | $479 | $939 | $2,989 |

| Leverage: | Forex: 1:30 Stocks: 1:20 ETFs: 1:20 Commodities: 1:25 Crypto: 1:30 | Forex: 1:30 Stocks: 1:20 ETFs: 1:20 Commodities: 1:25 Crypto: 1:30 | Forex: 1:30 Stocks: 1:20 ETFs: 1:20 Commodities: 1:25 Crypto: 1:30 | Forex: 1:30 Stocks: 1:20 ETFs: 1:20 Commodities: 1:25 Crypto: 1:30 | Forex: 1:30 Stocks: 1:20 ETFs: 1:20 Commodities: 1:25 Crypto: 1:30 |

| Profit Target | 10% ($2,000) | 10% ($5,000) | 10% ($10,000) | 10% ($20,000) | 10% ($65,000) |

| Daily Loss Limit | 5% ($1,000) | 5% ($2,500) | 5% ($5,000) | 5% ($10,000) | 5% ($32,500) |

| Max Trailing Drawdown | 6% ($1,200) | 6% ($3,000) | 6% ($6,000) | 6% ($12,000) | 6% ($39,000) |

| Profit Share | 80% | 80% | 90% | 90% | 90% |

| Weekend Position | Supported | Supported | Supported | Supported | Supported |

| Frequency of Payout | Weekly | Weekly | Weekly | Weekly | Weekly |

| Required Trading Days | None | None | None | None | None |

| Assessment Time Limit | None | None | None | None | None |

The Challenge and Costs of SabioTrade Explained

SabioTrade offers a one-step challenge/assessment phase that gives you access from $20k to $650k (at $119 to $2,989), depending on the plan/account you choose. The profit target (10%), daily loss limit (5%), and max trailing drawdown (6%) are the same regardless of the account you choose. The key difference lies in the challenge cost and the corresponding initial fund/balance each plan grants.

Note that all of SabioTrade’s available accounts require you to pass a one-step assessment/challenge phase, and it does not offer an account with “instant funding”, unlike other prop firms. Instant funding lets you trade a funded account immediately, without first passing a challenge or assessment.

Below is a comparison table showing each account type’s cost, initial balance, and key trading metrics (profit target, daily loss limit, and max trailing drawdown):

| Essential | Plus | Advanced | Ultimate | Prime | |

|---|---|---|---|---|---|

| Assessment Fee | $119 | $289 | $479 | $939 | $2,989 |

| Initial Balance | $20k | $50k | $100k | $200k | $650k |

| Profit Target (10%) | $2,000 | $5,000 | $10,000 | $20,000 | $65,000 |

| Daily Loss Limit (5%) | $1,000 | $2,500 | $5,000 | $10,000 | $32,500 |

| Max Trailing Drawdown (6%) | $1,200 | $3,000 | $6,000 | $12,000 | $39,000 |

As shown, if you get SabioTrade’s cheapest available account option (Essential), you will have to pay a one-time assessment fee worth $119, and in return, you will be given an account with $20,000 initial balance. On the other end of the spectrum, if you get SabioTrade’s highest-tier account option (Prime), you will have to pay a one-time assessment fee worth $2,989, and you will receive an account with a massive $650,000 initial balance.

The good thing about SabioTrade’s challenge structure is that its trading rules and parameters remain the same across its different accounts. As shown in the table, the profit target, daily loss limit, and max trailing drawdown percentages remain constant regardless of the account you choose.

Promo Codes for Rebates

SabioTrade routinely runs promo campaigns, rebates, and discount code offers. On its own site, it sometimes gives discounts and even free assessment accounts, and its updates occasionally announce limited-time promotions. In addition, some of its published content actively promotes its Wethrift coupon page, where you can save 10% to 40% with one of the active promo/discount codes. We can offer you a 30% Discount Code on your first purchase on Sabio Trade:

- Get 30% off with the code “WRTrading” (Note: Works only with the registration-button below)

How difficult is it to pass the challenge on SabioTrade?

Overall, the difficulty of passing the challenge on SabioTrade depends on the trader’s level. Suppose you’re an experienced trader (intermediate to advanced). In that case, you will find the single-step assessment relatively easy, as you can pass it quickly (compared to the two-step challenge from other prop firms). Additionally, there are no minimum trading days, allowing you to achieve a clean run and hit the 10% profit target as soon as possible, especially when using a proven trading strategy.

On the other hand, beginner traders may find the challenge moderate. This is because SabioTrade has a relatively tight max trailing drawdown (at 6%), which can be a challenge for beginners, as they would really need to ensure they have a proper risk management setup to avoid a potential breach. That said, since it is a single-step assessment, it is easier to pass than the two-step process required by other prop firms.

What are the rules for traders on SabioTrade?

Here is a comprehensive list of rules that SabioTrade imposes on its traders:

| Rules | Details |

|---|---|

| 1. Daily Loss Limit | 5%; calculated based on the last trading day’s EOD balance |

| 2. Max Trailing Drawdown | 6%; calculated based on your equity |

| 3. Profit Target | You need to make at least one trade every 30 days to keep your account active |

| 4. Minimum Trading Days | None; there is no minimum trading days required |

| 5. Time Limit | None; there is no time limit to complete your assessment |

| 6. Trade Activity | You need to make at least 1 trade every 30 days to keep your account active |

| 7. Weekend Holding | Allowed on all SabioTrade account types |

| 8. Maximum Leverage | 1:30 for Forex and Crypto 1:25 for Commodities 1:20 for Stocks and ETFs 1:100 for Indices |

| 9. Payout Frequency | Every 7 days |

| 10. Drawdown Reset | For every withdrawal request, your maximum trailing drawdown resets to your starting balance |

| 11. Overnight Holding | Allowed on all SabioTrade account types |

| 12. News Trading | Allowed; there is no specific rule banning or restricting this approach on their platform |

Become a Profitable Trader on SabioTrade with WR Trading Mentorship Program

Learn to trade effectively on SabioTrade and reach your goal to get funded and receive your very first payout as a prop trader by applying to our one-on-one personal coaching program at WR Trading. Here, you will learn high risk-reward trading strategies that only require 1-2 hours per day to implement on your SabioTrade challenge account (and of course on your funded account after passing the evaluation phase). Additionally, we teach different market scenarios when you should only consider trading and when you should NOT trade at all.

(Learn A Proven Trading System To Pass Prop Firm Challenges And Get Funded)

What happens if you fail on SabioTrade?

You can fail SabioTrade’s challenge by either breaching the daily loss (set at 5%) or breaching the max trailing drawdown (set at 6%) during the one-step evaluation phase. When this happens, your evaluation automatically stops. From this point, you have two primary options:

- Buy a reset (Sabio provides a reset option)

- Please start a new assessment (a single plan or avail their PRO bundles: PRO 3 or PRO 12 that give multiple assessment attempts)

Note that if you availed a PRO 3 or PRO 12 from the get-go, then you will have three assessment tries (for PRO 3) or 12 assessment tries (for PRO 12) before you technically fail your challenge. In other words, SabioTrade’s PRO bundles give you multiple chances to pass the evaluation until you exhaust the maximum available attempts.

Is SabioTrade suitable for beginner traders?

Yes, particularly if it is your first time trying out how prop firms work and are constrained by a limited budget. This is because SabioTrade offers a free trial, along with comprehensive educational resources, to help you learn the fundamentals of prop trading. Afterwards, it’s one-step evaluation provides a relatively low-cost entry point (mainly if you apply a discount or promo code). Together, these make it comparatively cheap and affordable compared to other, more mainstream prop firms.

Can Serious Traders use SabioTrade?

Yes, SabioTrade can be effectively used by serious traders (from intermediate to advanced), and even professionals. To be more specific, here are the key aspects these traders can benefit from:

- For Intermediate Traders: The quick one-step assessment, together with the availability of overnight and weekend positions, lets you focus on execution and proper risk management.

- For Advanced Traders: In addition to the quick assessment and availability of overnight and weekend positions, the sheer number of options you have when it comes to asset classes, which includes FX pairs, indices, stocks, ETFs, commodities, and crypto, gives you flexibility.

- For Professional Traders: The profit split of 90% for at least a $100k account (which costs $479) makes it relatively high paying compared to other prop firms, especially considering the cost and the potential savings you can get by using promo or discount codes to reduce the $479 sticker price further. In addition, the high ceiling for account size (up to $650k for Prime) allows for greater profit potential.

Lastly, for all these traders, SabioTrade implements modern privacy/security measures across its payment channels (primarily for payouts to profitable traders). This helps serious traders feel safe and secure, and makes the prop firm’s payment scheme more trusted, especially as SabioTrade consistently guarantees and pays out earnings without fail or constant issues.

Payouts on SabioTrade Explained

Here is a detailed breakdown of SabioTrade’s payout structure, including its profit-sharing scheme, payout, processing, interval, and frequency, as well as any applicable withdrawal fees:

| Payout System | Details |

|---|---|

| 1. Profit Share/Split | 80% for Essential and Plus Accounts 90% for Advanced, Ultimate, and Prime Accounts |

| 2. Payout Frequency | Weekly |

| 3. Payout Processing | Within 24 hours |

| 3. Payout Interval | You need to wait at least 7 days from your previous payout to request a new payout |

| 4. Withdrawal Fee (Internal) | None; SabioTrade does not impose payout fees |

| 5. Withdrawal Fee (External) | Transfer fees may apply depending on your payment method and country. |

As shown, SabioTrade’s payout structure is straightforward and uncomplicated. Note that you can request a payout once per week, and you must wait a full 7 days before making another request.

The prop firm also guarantees quick processing of your payout request, ensuring it won’t take more than 24 hours, and in most cases, it goes to your bank account within a few minutes to a couple of hours. In addition, the prop firm clarifies that it does not impose any payout (withdrawal) fee, and any deduction from your earnings is due to the applicable transfer (bank) fees imposed by your local bank.

Does SabioTrade really pay out profits?

Yes, SabioTrade guarantees that you will receive your share of the profit you earned on the platform. We also checked and reviewed community feedback from various sources (such as Reddit and other online forums), and users have confirmed that the prop firm really does deliver on its promise. That said, some users encountered delays in transferring to their bank accounts due to their location. Also, note that you can choose whether to be paid in full every week or leave some earnings on the platform for future withdrawals.

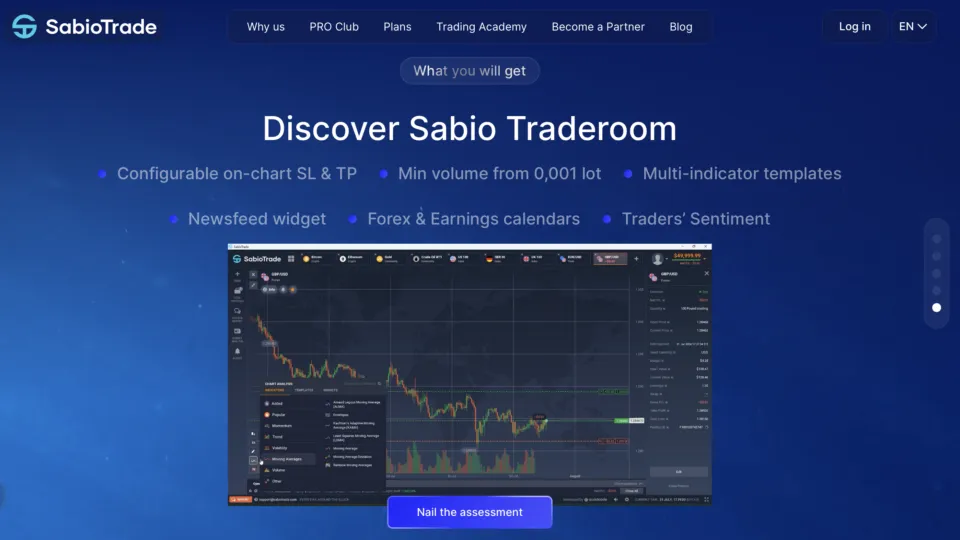

Which trading platforms are available on SabioTrade?

SabioTrade exclusively uses its in-house trading platform, powered by Quadcode. This contrasts with other prop firms that support MT4, MT5, and cTrader as their trading platforms. The following are SabioTrade’s two trading platforms:

- Sabio Traderoom – SabioTrade’s official default trading platform for web/browser access.

- SabioTrade Mobile App – SabioTrade’s mobile app version of its trading platform is available on both iOS and Android.

What are the trading fees and spreads on SabioTrade?

Aside from the one-time assessment fee that you pay based on the account tier you get, here are all the other additional usual fees in a prop firm that you may (or may not) encounter on the SabioTrade platform:

| Fees | Details |

|---|---|

| Optional PRO Club | This optional opt-in allows you to have more assessment attempts instead of the default single attempt. PRO 3 costs $259 (gives 3 assessment tries), and PRO 12 costs $829 (gives 12 assessment tries) |

| Spreads | Zero spreads apply only to assessment accounts. It then mimics the normal spreads on forex pairs, once the assessment is passed. |

| Commission | Zero; SabioTrade guarantees that it does not take any commission for the trades you make |

| Overnight (Swaps) Fees | Swap fees apply when holding overnight positions |

| Monthly Trading Fees | None; SabioTrade clarifies that it does not take monthly fees or any form of maintenance fees |

Which broker is used by SabioTrade?

SabioTrade does not list an external broker. Instead, all trading is conducted on its in-house “Sabio Traderoom” platform. As a prop firm, it also positions itself as having its own unique in-house platform (and, in fact, it contrasts itself with other prop firms that require you to choose a broker). In other words, you use the same platform (Sabio Traderoom) from your evaluation phase until you receive a funded account.

Finally, SabioTrade does not publicly disclose whether any positions are hedged with any third-party broker or liquidity provider (LP) in the background. However, its FAQ states that the capital they give you after passing the assessment is “fictitious” or “virtual” and may not require any broker or LP at all.

Taxes on SabioTrade

Traders are responsible for their own taxes on their earnings on SabioTrade. Note that the payouts from prop firms are typically treated as ordinary business/income (and not capital gains), since you’re sharing profits from essentially a business arrangement rather than realising gains on securities you actually buy and sell (again, you trade virtually with SabioTrade and the funds are fictitious).

Hence, in practice, this means you need to report your payout income, follow your local tax rules (including whether it is classified as business or self-employment income), and keep records of all fees and expenses you pay as potential deductions. Lastly, it is also wise to consult a qualified local tax adviser/accountant to help with your prop firm income tax concerns.

What support and education is provided by SabioTrade?

Here are all of SabioTrade’s support channels:

- Email: support@sabiotrade.com; the primary and preferred support channel. This is also the fastest way to get assistance from the prop firm

- Phone: No published phone number. SabioTrade’s support email is the primary medium of communication.

- Community Channels (for general announcements and updates). Not ideal for personal and unique concerns/issues:

- Discord: https://discord.com/invite/hgMTA62ZET

- Telegram: https://t.me/sabiotrade

- Instagram: https://www.instagram.com/sabiotrade/

- X: https://x.com/sabiotrade

- Facebook: https://www.facebook.com/profile.php?id=61571973164203

Here are SabioTrade’s educational resources that are relevant for beginners and those completely new to the prop firm space:

- SabioTrade’s Trading Academy (included in all of its account tiers and even during free trial): Essentially, this is SabioTrade’s structured resource hub for all of its available educational materials.

What are the best alternatives to SabioTrade?

Here are four potential alternatives to SabioTrade, together with their key value propositions:

| SabioTrade alternative | Advantages |

|---|---|

| FundedNext | Up to 95% profit split, account sizes up to $300k, and bi-weekly/monthly payouts with $100 minimum. Some models also add evaluation-phase bonuses. |

| Apex Funded Trader | Futures-only prop firm that offers a regulated futures market over CFDs for traders and a breach safety net that locks your trailing drawdown once you hit the threshold. |

| The Trading Pit | One firm for CFDs and futures; payouts every 14 days, $100 minimum, and 5 unique trading days required for each payout. |

| FundingPips | Simple 2-step evaluation with profit split from 80% to 90% and a scaling plan up to $2M for consistently profitable traders. |

To compare more prop firms, you can use our free Prop Firm tool at WR Trading.

Conclusion: Good Conditions Are Available On SabioTrade

Our final take: SabioTrade is a solid, trusted option to start if you prefer a quick one-step assessment phase, regular, consistent weekly payouts, and a relatively high profit share without paying premium-plan prices, unlike other, more mainstream prop firms. To be specific, we appreciate how it incentivises reaching the target profit and passing the assessment as soon as possible (since it does not require a minimum trading day). We also like its 90% profit split for its mid-tier account type, the default weekend holding support, and the way it bundles its free trial with its class-leading educational resource hub, making it beginner-friendly.

That said, based on our independent evaluation, what really holds it back is its relatively tight max trailing drawdown of 6%, lower available leverage for FX (max of 1:30), and the drawdown reset that occurs every payout request. Also, its lack of support for external trading platforms means you have no choice but to stick with its in-house platform, which could take time to get used to, especially if you have been trading (and prefer to trade) on MT4, MT5, or cTrader.

Overall, if you highly value clear, uncomplicated rules, fast pass potential, and consistent, reliable payouts, we believe SabioTrade is a solid choice.

Frequently Asked Questions (FAQ) on SabioTrade

Is SabioTrade available for US clients?

No. Because SabioTrade’s funded program involves trading CFDs, and off-exchange retail CFD trading isn’t permitted in the US under CFTC/SEC oversight. SabioTrade also states in one of its published articles that CFD trading is prohibited for US citizens and residents.

Does SabioTrade guarantee payouts?

Yes, SabioTrade guarantees payouts as long as your trading activity is within its terms and conditions. In other words, as long as you have no violations, the company guarantees that you will get your earnings share.

Is there a minimum withdrawal amount?

According to SabioTrade, there is no minimum withdrawal amount required. That said, you still need to check with your own bank, as small withdrawal amounts may not cover applicable bank fees and may result in your payout request failing.

If I open multiple accounts, can I merge them?

No, SabioTrade does not allow the merging of two or more funded accounts. Hence, if you open multiple accounts with the prop firm, you will not be able to combine them later.

How long will it take to receive my assessment account after signing up?

According to SabioTrade, your assessment account should be made available as soon as you complete the payment process. Therefore, you can immediately start your assessment without waiting.