Prop trading firms that accept US traders are typically highly regulated and offer varying fee structures. Due to the differences in challenges, fee structures, and profit target, we’ve carefully reviewed and selected the best five prop trading firms that accept U.S. traders. Let’s dive into the details so you can make the best decision for your goals.

These are the 5 Best Prop Trading Firms that accept US Traders in 2026:

- Apex Trader Funding: No trading style restrictions

- UProfit: offers a range of account sizes with affordable fees

- Instant Funding: Simple funding process and fast payouts

- Earn2Trade: Easy withdrawals and excellent customer service

- Leeloo Trading: Offers traders a practice account with real payouts

List of the 5 Best Prop Trading Firms that Accept US Traders:

#1 Apex Trader Funding

We recommend Apex Trader Funding as one of the top prop trading firms for US citizens due to its flexible funding model and fast one-step evaluation process. It allows traders to keep 100% of the first $25,000 in profits, with no restrictions on trading styles. The lack of daily drawdowns and competitive profit splits make it highly appealing. Apex also offers fast payouts and excellent support.

Key Facts About Apex Trader Funding

| Feature | Apex Trader Funding |

|---|---|

| Accepts U.S. Traders | Yes |

| Headquarters | Austin, Texas |

| Profit Split | Receive 100% of the first $25,000 per account and 90% beyond that |

| Fee Structure | Rithmic PA: Monthly fee option of $85 monthly or a one-time, lifetime payment fee for that particular amount Tradovate PA: Monthly fee option of $105 monthly, or a one-time, lifetime payment fee for that particular account |

| Leverage | Determined by margin requirements and account size |

| Payouts | Two payouts per month |

| Evaluation Period | 7 trading days |

| Profit Target | Depends on account size from $1500 – $20,000 |

| Website | https://apextraderfunding.com |

#2 UProfit

Based on our research, we discovered that UProfit Trader is one of the best prop trading firms for US citizens. In our opinion, their simple, one-step evaluation process makes it easier for traders to get funded quickly without too much hassle. They also offer a range of account sizes with affordable fees, so you can find one that suits your trading style.

Key Facts About UProfit

| Feature | UProfit |

|---|---|

| Accepts U.S. Traders | Yes |

| Headquarters | Sugar Land, Texas |

| Profit Split | 80/20 split |

| Leverage | Not stated |

| Fee Structure | Plans start at $39 |

| Payouts | Payouts are processed Monday through Friday within 24 hours. Holidays are excluded. |

| Evaluation Period | 5 days |

| Profit Target | Varies between $900 – $10, 000 |

| Website | https://uprofit.com |

#3 Instant Funding

In our experience, Instant Funding stands out as one of the top prop trading firms for U.S. traders because of its simple funding process and fast payouts. We rank it highly for its transparent trading conditions, flexible programs, and the ability to scale accounts up to $1.28 million. Based on the feedback from traders, the firm’s customer support is quick and helpful, ensuring you get assistance whenever you need it.

Key Facts About Instant Funding

| Feature | Instant Funding |

|---|---|

| Accepts U.S. Traders | Yes |

| Headquarters | London, England |

| Profit Split | 80% |

| Fee Structure | $79 (one-time fee with no recurring monthly charges) |

| Leverage | 1:100 |

| Payouts | Bi-weekly after the first trade, weekly subsequently |

| Evaluation Period | None |

| Profit Target | No profit targets |

| Website | https://instantfunding.io |

#4 Earn2Trade

We selected Earn2Trade as one of the top prop trading firms because of its solid reputation and focus on helping traders succeed. In our opinion, their Trader Career Path® allows you to test your skills with virtual accounts and offers quick funding after passing evaluations. They also provide easy withdrawals, a supportive community, and excellent customer service, which many traders appreciate.

Key Facts About Earn2Trade

| Feature | Earn2Trade |

|---|---|

| Accepts U.S. Traders | Yes |

| Headquarters | Sheridan, Wyoming, USA |

| Profit Split | Offers an 80/20 profit split scheme |

| Fee Structure | A $139 fee is deducted from their first profit withdrawal |

| Leverage | Depends on margin requirements and account size |

| Payouts | Tuesdays, weekly |

| Evaluation Period | 10 days |

| Profit Target | Not stated |

| Website | https://www.earn2trade.com/non-us |

#5 Leeloo Trading

Leeloo™ is on our list of top prop trading firms because it offers flexible trading options and multiple account choices that cater to different skill levels. We recommend their unique approach, allowing you to start with a practice account and progress to a Performance Account where you can earn real payouts. Their user-friendly platform, supportive community, and performance-based contests make it easy for traders to test their skills.

Key Facts About Leeloo Trading

| Feature | Leeloo Trading |

|---|---|

| Accepts U.S. Traders | Yes |

| Headquarters | Alpharetta, Georgia, United States |

| Profit Split | up to 90% |

| Fee Structure | Varies from $26 – $169 monthly depending on the plan |

| Leverage | Not stated |

| Payouts | 30 days after trading |

| Evaluation Period | 10 days |

| Profit Target | Depends on the account ($4, $500, $6,000, $1500) |

| Website | https://www.leelootrading.com |

Is Prop Trading Legal in the United States?

Yes, prop trading is perfectly legal in the U.S., and many traders are drawn to it because it allows them to trade using a firm’s money rather than their own. This way, you can explore larger market opportunities without putting your capital at risk.

At WR Trading, we recommend this approach if you’re confident in your trading skills and want to scale up. However, it’s important to follow regulations set by bodies like the SEC and FINRA, as they ensure everything stays compliant and transparent. Prop firms often have their own set of rules too, which you need to stick to.

Is Prop Trading Regulated in the United States?

Yes, prop trading is regulated in the U.S., mainly by agencies like the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority). These bodies set strict rules to ensure that both prop firms and traders, like you, operate fairly and transparently.

When you sign up with a prop firm, you should check that they follow these regulations. This helps protect you from unfair practices and keeps your trading experience secure. At WR Trading, we recommend always choosing firms that prioritize compliance, so you can trade with peace of mind knowing you’re in a regulated environment.

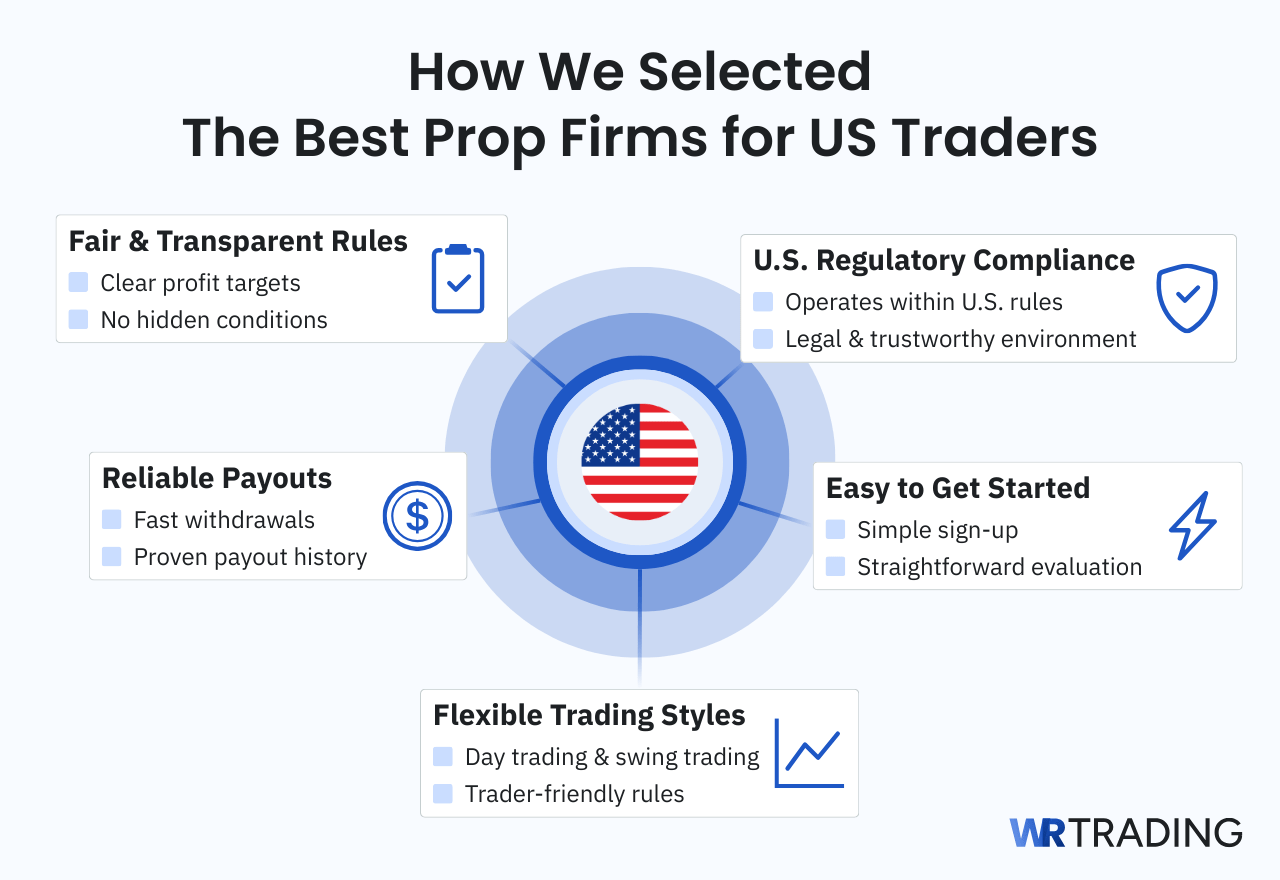

How We Selected The Best Prop Firms for US Traders

At WR Trading, we took the time to carefully research and evaluate prop firms based on key factors that matter most to you. Factors such as fair rules, reliable payouts, compliance, and flexibility are prioritised and evaluated. Our goal is to help you trade with confidence, knowing that you’re working with a trusted and transparent firm. Here’s how we made our picks:

Fair and Transparent Rules

At WR Trading, we know that fair and transparent rules are crucial when choosing a prop trading firm. That’s why we picked firms that lay out their conditions without any surprises. You’ll understand everything upfront like how much profit you need to hit or what risk limits you must follow. This means you can focus on trading, not trying to figure out tricky terms or hidden clauses.

Reliable Payouts

When you trade successfully, you deserve to get paid without delay. That’s why we selected firms known for reliable and quick payouts. You can trust that when you hit your profit targets, your money will be available without unnecessary waiting. We chose these firms because, in our experience, easy and secure withdrawals are key for long-term success in prop trading.

Compliance with U.S. Regulations

One of our top priorities at WR Trading is making sure the firms we recommend operate legally and in line with U.S. regulations. The prop firms we picked are compliant with the necessary rules and guidelines, giving you peace of mind. You’ll be able to trade knowing that your activity is within a well-regulated environment, so there’s no need to worry about any regulatory issues.

Easy to Get Started

We understand that not everyone is an expert when they first start prop trading. That’s why we focused on firms that offer easy sign-ups and straightforward evaluation processes. Whether you’re a beginner or an experienced trader, these firms let you start trading with minimal hassle. We believe a simple start gives you the best chance to succeed and move forward quickly.

Flexibility for Your Trading Style

At WR Trading, we recognize that every trader has their style. Whether you’re into day trading or prefer swing trading, the prop firms we chose give you the flexibility to trade in a way that suits you best. These firms allow for different strategies, letting you experiment and grow at your own pace while still sticking to their guidelines.

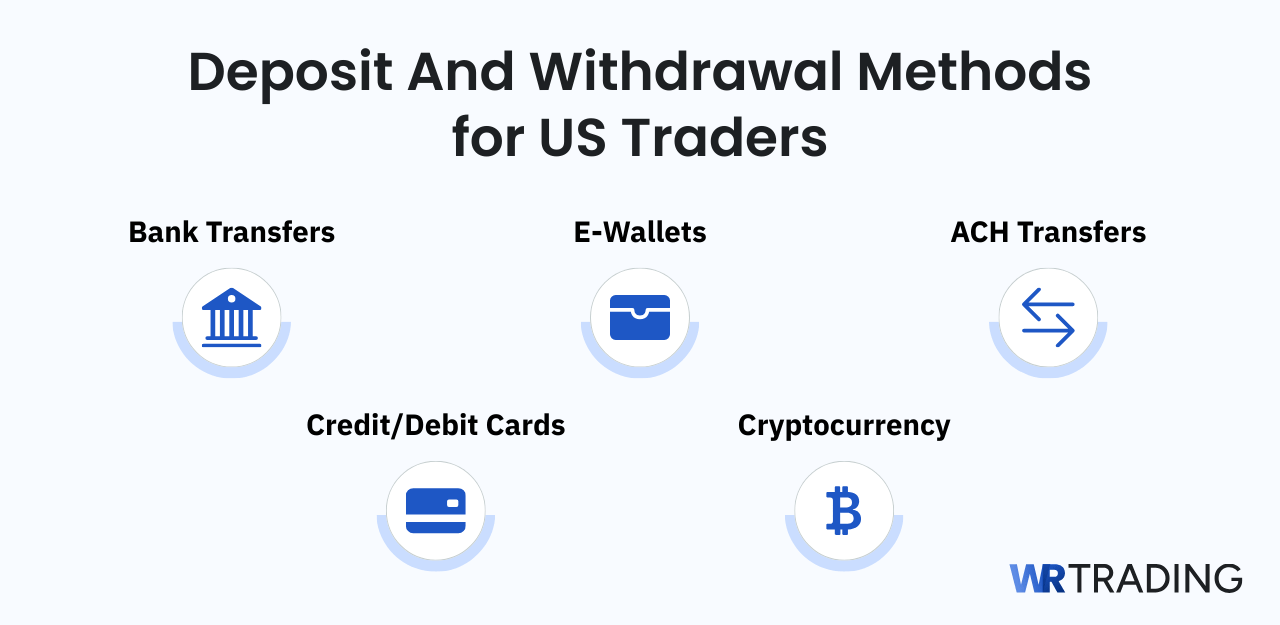

Deposit And Withdrawal Methods for US Traders

When it comes to deposit and withdrawal methods for U.S. traders, having multiple reliable and secure options is essential. Prop firms that cater to U.S. traders usually offer a range of payment methods that suit different preferences. Here are some common methods we found:

- Bank Transfers: Many prop firms support direct bank transfers, which is a safe and popular choice for U.S. traders. It can take a few days for funds to process, but it’s reliable for both deposits and withdrawals.

- Credit/Debit Cards: Depositing funds using credit or debit cards is a quick and convenient option. Most major cards like Visa and Mastercard are accepted, allowing for instant deposits.

- E-Wallets: Some firms also allow you to use digital wallets like PayPal, Skrill, or Neteller for faster transactions. These methods can be quicker than traditional bank transfers and often come with lower fees.

- Cryptocurrency: With the growing acceptance of crypto, many prop firms now allow deposits and withdrawals in cryptocurrencies like Bitcoin. This method can offer greater flexibility and faster transactions, especially for traders comfortable with crypto.

- ACH Transfers: ACH (Automated Clearing House) transfers are another popular method for U.S. traders, providing a seamless way to deposit or withdraw directly from a checking or savings account.

By choosing a prop firm that offers diverse deposit and withdrawal options, you can manage your funds more easily and focus on trading.

What Are The Taxes on Prop Trading in the USA?

When you trade with a prop firm, your earnings are typically treated as self-employment income, meaning you’ll be responsible for reporting and paying taxes on your profits. Since prop trading firms don’t withhold taxes for you, it’s up to you to stay on top of your tax obligations.

We suggest keeping track of your profits throughout the year, as you may need to pay quarterly estimated taxes to avoid penalties. You’ll likely report your earnings on a Schedule C for business income, and depending on your state, you may also have state income taxes to consider.

It’s important to remember that your earnings from prop trading might also be subject to a 15.3% self-employment tax, which covers 12.4% for Social Security and 2.9% for Medicare. We recommend consulting with a tax professional who understands trading to ensure you’re filing everything correctly and taking advantage of any deductions or benefits you might be eligible for.

By staying informed, you’ll be better prepared to handle taxes and keep more of what you earn from your prop trading activities.

Conclusion

At WR Trading, we believe that prop trading can be a great opportunity for skilled traders to maximize their potential. However, it’s essential to understand the tax implications that come with it. As a prop trader in the U.S., managing your earnings responsibly and staying on top of your tax obligations can make all the difference in your long-term success.

Frequently Asked Questions on Prop Trading Firms that accept US Traders:

What Happens If You Don’t Meet The Profit Target in A Prop Firm?

If you don’t meet the profit target during the evaluation phase, most prop firms will allow you to reset the account for a fee. Some may offer additional time or re-evaluation opportunities, but it’s important to check each firm’s specific policies.

Can You Trade with A Prop Firm Using A Demo Account First?

Yes, many prop firms offer demo or practice accounts to help you get familiar with their platform and rules before committing to a live evaluation. This is a great way to refine your strategies and ensure you’re comfortable with their system before trading real money.

Do Prop Trading Firms Charge Extra Fees Beyond The Evaluations?

Some prop firms may have extra fees like monthly subscriptions, data fees, or platform usage fees. Make sure you review the firm’s fee structure carefully, so you understand all potential costs before committing to an account.

Can You Trade Different Assets with Prop Trading Firms?

Yes, most prop firms allow you to trade various assets like stocks, futures, forex, or crypto. Make sure the firm you’re interested in offers the asset class you’re experienced with or interested in exploring for better trading opportunities.