The Financial Conduct Authority (FCA) is one of the most respected financial regulatory bodies, ensuring brokers adhere to strict standards for client protection and transparency. At WR Trading, we understand that regulatory oversight is crucial for choosing a reliable forex broker. Here, we present the five best FCA-regulated forex brokers, each offering unique benefits and superior trading conditions.

These are the Top 5 FCA Regulated Forex Brokers:

Broker:

Regulation:

Advantages:

Account:

FCA (+ CySEC, ASIC, DFSA, CMA, BAFIN)

- Tier-1 Regulated Broker

- Spreads from 0.0 Pips

- Leverage up to 1:500 (1:30 EU)

- Low Commission from 3$/1 Lot

- High liquidity and fast execution

- TradingView, MT4/5, cTrader

FCA (+ SCB, BACEN & CVM, CMVM)

- No Minimum Deposit

- Spreads from 0.5 Pips

- Leverage up to 1:400

- Low Commissions from $1 per side on Shares

- MT4, MT5, ActivTrader

FCA (+ ASIC, BaFin, DFSA, JFSA)

- No Minimum Deposit

- Spreads from 0.6 Pips

- Access to 17,000+ Markets

- Leverage up to 1:200

- Low Commissions from $3 per trade

FCA (+ CySEC, FSCA, SCB, FSA)

- No Minimum Deposit

- Spreads from 0.0 Pips

- Leverage up to 1:500

- Low Commissions from $4/1 Lot

- MetaTrader 4/5, cTrader, FxPro Edge

FCA (+ CySEC, FSC, KNF, Comisión Nacional del Mercado de Valores)

- Spreads from 0.0 Pips

- Leverage up to 1:200

- Commission from 0% per lot

- 2,100+ tradable assets

- xStation 5, xStation Mobile

#1 Pepperstone

Pepperstone is renowned for its competitive spreads and advanced trading platforms. At WR Trading, we have found Pepperstone to be an excellent choice for traders seeking low-cost trading with high-speed execution.

The broker offers MetaTrader 4, MetaTrader 5, and cTrader platforms, providing a variety of tools and features for both novice and experienced traders.

Pepperstone is regulated by the FCA, ensuring that clients’ funds are protected in segregated accounts and that the broker complies with stringent regulatory standards. We particularly appreciated their comprehensive customer support and the ease of managing deposits and withdrawals.

Key Facts about Pepperstone:

| Feature | Information |

|---|---|

| Min. Deposit | $0 |

| FCA Regulation? | Yes |

| Regulated By | CySEC, FCA, ASIC, DFSA, CMA, BAFIN |

| Max. Leverage | 30:1 (FCA) |

| Spreads | From 0.0pips |

| Commission | $3.5 per 100k traded |

| Copy Trading | Available |

| Platforms | MT4, MT5, cTrader, TradingView |

| Payment Methods | Bank Transfer, Credit/Debit Card, Bpay, PayPal, Skrill, Neteller |

| Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices, Metals |

#2 ActivTrades

ActivTrades is well-regarded for its commitment to innovation and client security. At WR Trading, we value ActivTrades for its wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies.

The broker offers the ActivTrader, MetaTrader 4, and MetaTrader 5 platforms, each designed to enhance the trading experience with advanced tools and indicators.

As an FCA-regulated broker, ActivTrades provides a high level of transparency and security, with client funds held in segregated accounts and protected by the Financial Services Compensation Scheme (FSCS).

We were impressed by their educational resources, which help traders of all levels improve their skills and knowledge.

Key Facts about ActiveTrades:

| Feature | Information |

|---|---|

| Min. Deposit | $0 |

| FCA Regulation? | Yes |

| Regulated By | FCA, SCB, BACEN & CVM, CMVM |

| Max. Leverage | 30:1 (FCA) |

| Spreads | 0.5 pips for major currency pairs |

| Commission | No commissions |

| Copy Trading | Not available |

| Platforms | MT4, MT5, ActivTrader, TradingView |

| Payment Methods | Wire Transfer, Credit/Debit Card, Neteller, PayPal, Skrill, and Sofort |

| Instruments | Currencies Crypto Indices Metals Energies Softs Stocks Bonds ETFs |

#3 IG

IG is one of the largest and most established brokers in the industry, known for its extensive range of trading instruments and robust platform offerings.

At WR Trading, we recognize IG for its strong regulatory framework under the FCA, which provides clients with peace of mind knowing their funds are secure. IG offers its proprietary trading platform, along with MetaTrader 4 and ProRealTime, each equipped with powerful analytical tools and features.

We found IG’s research and analysis tools particularly helpful, offering insights and data that assist traders in making informed decisions. Additionally, IG’s comprehensive educational resources make it an excellent choice for both new and experienced traders.

Key Facts about IG:

| Feature | Information |

|---|---|

| Min. Deposit | $0 |

| FCA Regulation? | Yes |

| Regulated By | FCA, ASIC, BaFin, DFSA, JFSA |

| Max. Leverage | 30:1 (FCA) |

| Spreads | From 0.1 pips |

| Commission | Varying overnight charges, but 0.5% currency conversion charges apply. |

| Copy Trading | Not available |

| Platforms | MT4, L2 Dealer, ProRealTime, Mobile App |

| Payment Method | Funding Wise, Credit Cards, and Bank Transfers |

| Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

#4 FxPro

FxPro stands out for its diverse trading platforms and excellent customer service. At WR Trading, we appreciate FxPro’s commitment to providing a seamless trading experience with platforms including MetaTrader 4, MetaTrader 5, cTrader, and their proprietary FxPro Edge.

As an FCA-regulated broker, FxPro ensures a high level of client fund security with segregated accounts and protection under the FSCA. It is also regulated under CySEC, FSCA, SCB, and FSA.

We were impressed by their low spreads, especially on major currency pairs, and their reliable execution speeds. FxPro’s multilingual support and comprehensive market analysis tools make it a top choice for traders globally.

Key Facts about FxPro:

| Feature | Information |

|---|---|

| Min. Deposit | $100 |

| FCA Regulation? | Yes |

| Regulated By | FCA, CySEC, FSCA, SCB, FSA |

| Max. Leverage | 30:1 (FCA) |

| Spreads | From 0.0 pips |

| Commissions | Max 3.5 USD per lot per side |

| Copy Trading | Available |

| Platforms | MT4, MT5, cTrader, FxPro Trading Platform |

| Payment Methods | Bank Transfers, Credit/Debit Cards, Neteller, PayPal, Skrill |

| Instruments | Cryptocurrencies, Energies, Stock CFDs, Forex, Futures, Indices, Metals |

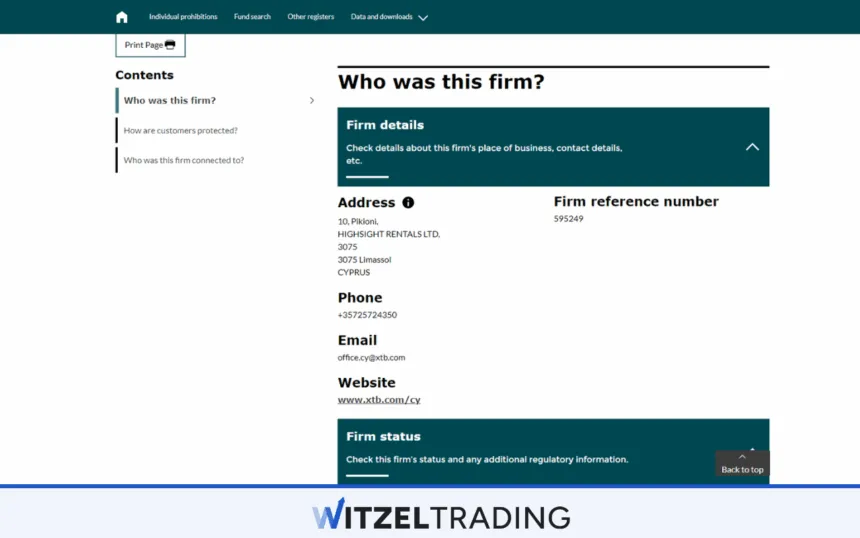

#5 XTB

XTB is known for its award-winning trading platform and exceptional customer support. At WR Trading, we have found XTB to be an excellent choice for traders looking for a user-friendly yet powerful trading platform.

XTB offers its proprietary xStation 5 platform, along with MetaTrader 4, both of which provide a range of advanced tools and features. The broker is regulated by the FCA and CySEC, ensuring that client funds are protected and regulatory standards are met.

We particularly appreciated XTB’s educational resources, including webinars and tutorials, which are invaluable for traders at all levels. Their competitive spreads and fast execution speeds further enhance the trading experience.

Key Facts about XTB:

| Feature | Information |

|---|---|

| Min. Deposit | $0 |

| FCA Regulation? | Yes |

| Regulated By | CySEC, FSC, KNF, FCA, and Comisión Nacional del Mercado de Valores |

| Max. Leverage | 30:1 (FCA) |

| Spreads | From 0.1 pips for PRO and 0.5 pips for Standard |

| Commission | 0.5% currency conversion fee on Investments |

| Copy Trading | Not Available |

| Platforms | xStation5, Mobile App |

| Payment Methods | Skrill, Neteller, PayPal, Bank Cards, Bank Transfer |

| Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

How We Tested the Best FCA-Regulated Forex Brokers

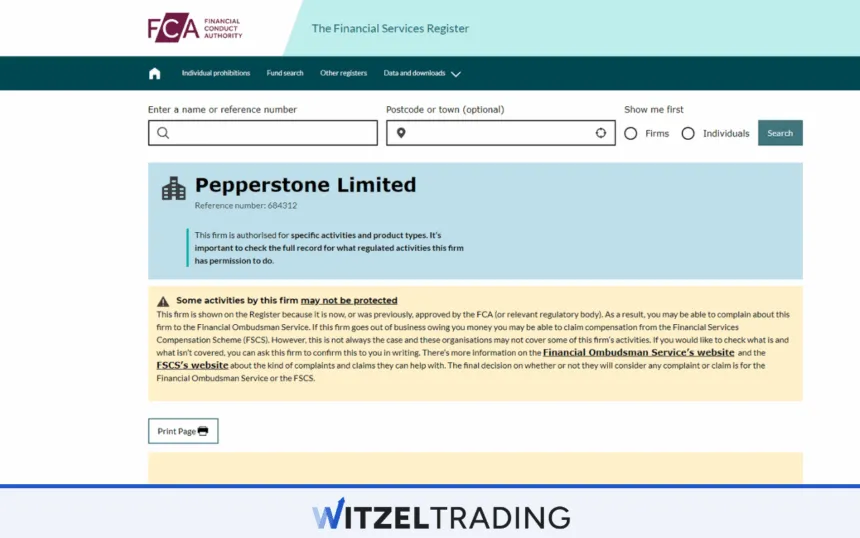

At WR Trading, our testing process for finding the best FCA-regulated forex brokers is rigorous and comprehensive. We begin by examining the broker’s regulatory status with the FCA, ensuring that each broker we recommend is fully licensed and compliant with all FCA requirements. This involves checking the broker’s registration number against the FCA’s official register to confirm their legitimacy.

Next, we evaluate the trading platforms offered by each broker. We test these platforms for usability, functionality, and the range of tools available to traders. This includes assessing the quality of the charting tools, the availability of automated trading options, and the overall user experience. Brokers that provide a seamless and efficient trading experience score higher in our evaluations.

Additionally, we scrutinize the broker’s trading conditions, including spreads, commissions, and leverage options. We place trades in different market conditions to gauge the broker’s execution speed and reliability. Customer support is another critical area we test extensively. We interact with support teams through various channels, such as live chat, email, and phone, to ensure they provide prompt and helpful assistance.

Finally, we consider the overall reputation of the broker, including reviews from other traders and any past regulatory issues. At WR Trading, we believe that transparency and trustworthiness are paramount, so brokers with a clean track record and positive feedback are given preference. Our goal is to recommend brokers that offer not only competitive trading conditions but also a safe and reliable trading environment.

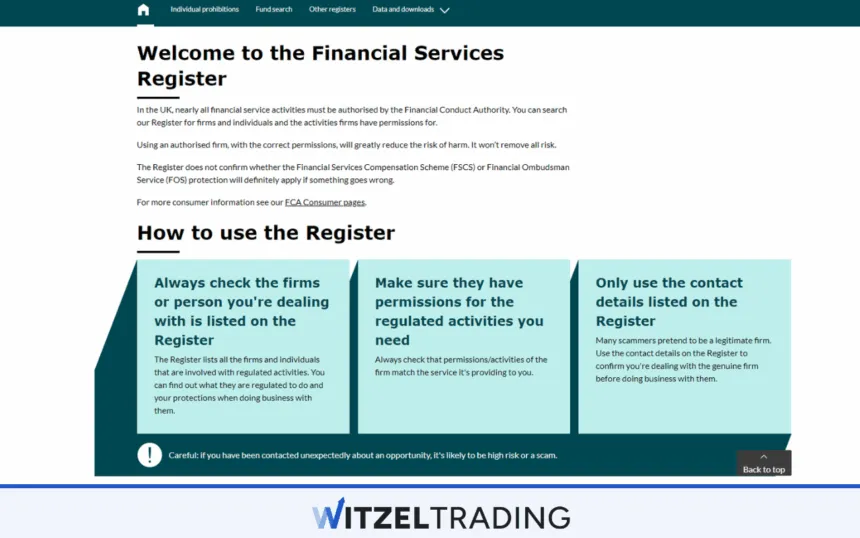

How to Find Out if Your Broker is FCA Regulated

Verifying whether your broker is FCA-regulated is crucial for ensuring your funds are secure and you are trading in a protected environment. At WR Trading, we advise starting with the FCA’s official website. The FCA maintains a comprehensive register of all licensed financial institutions, which can be accessed online. Simply enter the broker’s name or their unique registration number to check their regulatory status.

Additionally, reputable brokers often display their FCA registration numbers prominently on their websites. You can cross-check this number with the FCA register to ensure it matches. Be wary of brokers who do not provide this information or seem hesitant to disclose their regulatory status. Legitimate brokers will always be transparent about their FCA registration and are proud to highlight their compliance with regulatory standards.

It’s also beneficial to read reviews and feedback from other traders. Often, the trading community can provide insights into a broker’s regulatory compliance and overall reliability. At WR Trading, we make it a point to gather and analyze such feedback to guide our recommendations.

By following these steps, you can ensure that your broker is indeed FCA-regulated and operating under the strict guidelines set by the Financial Conduct Authority.

Protection For Customers Who Trade Under the FCA Regulator

| Feature | Information |

|---|---|

| Regulator | Financial Conduct Authority (FCA) |

| Protection | Up to £85,000 per client |

| Eligibility | Individuals, businesses, charities, and trusts |

| Covered Products | Investments, insurance, and financial services |

| Not Covered | Cryptocurrencies, physical goods, and services |

| Compensation | Paid if FCA-regulated firm fails or goes bankrupt |

| FSCS Protection | The Financial Services Compensation Scheme (FSCS) provides protection |

| FCA Role | Regulates and supervises financial firms, sets rules and standards |

| Customer Protections | Segregation of client assets, regular audits, and compliance checks |

Pros and Cons of FCA Regulated Brokers

When it comes to forex trading, choosing an FCA-regulated broker offers numerous benefits, but it’s also important to be aware of some potential drawbacks. At WR Trading, we’ve identified several key pros and cons to help you make an informed decision.

Pros

- Security and Trust

- Client Fund Protection

- Financial Services Compensation Scheme (FSCS)

- Regulatory Oversight

- Transparency

Cons

- Stricter Requirements

- Limited Leverage

- Market Restrictions

- Lengthy Processes

Pros

When you choose a broker regulated by the Financial Conduct Authority (FCA), you can enjoy numerous benefits, they include:

- One of the biggest advantages of trading with an FCA-regulated broker is the high level of security and trust. The FCA is known for its stringent regulatory standards, ensuring that brokers operate with transparency and integrity. This means your funds are safer, and the risk of fraudulent activities is minimized.

- FCA-regulated brokers are required to keep client funds in segregated accounts, separate from the broker’s operational funds. This protects your money in the event of the broker’s insolvency.

- Traders benefit from the FSCS, which provides compensation of up to £85,000 per person if a broker fails. This additional layer of protection can be a significant reassurance for investors.

- FCA-regulated brokers must comply with rigorous reporting and compliance standards. This oversight ensures that brokers maintain high ethical standards and follow best practices, contributing to a fairer trading environment.

- The FCA mandates that brokers provide clear and accurate information about their services, fees, and the risks involved in trading. This level of transparency helps traders make informed decisions and understand the true costs of trading.

Cons

While FCA-regulated brokers offer numerous benefits, there are also some potential drawbacks to consider:

- While stringent regulations are a benefit, they can also be a downside. Some brokers may pass on the costs associated with compliance to their clients, potentially resulting in higher fees or spreads.

- The FCA imposes leverage limits to protect retail traders from excessive risk. While this is generally a positive measure, experienced traders seeking higher leverage might find this restrictive.

- FCA regulations may also limit the availability of certain trading instruments or markets. For instance, crypto-related derivates like financial spread bets and CFDs are restricted. Traders looking for a wider range of exotic options might need to consider that limitation.

- The regulatory processes and requirements can sometimes slow down the speed at which brokers can implement new features or updates. This might affect traders who are looking for the latest trading technologies or innovations.

Criticisms of the FCA Regulation

While the FCA is widely respected for its robust regulatory framework, it is not without criticism. At WR Trading, we believe it’s important to consider both the strengths and areas for improvement within the FCA’s regulatory approach.

One of the primary criticisms is the perceived overregulation that some brokers and traders feel stifles innovation and flexibility. The stringent rules, while designed to protect investors, can also limit the types of trading instruments available and the leverage ratios brokers can offer. This can be particularly frustrating for experienced traders looking for higher leverage or more exotic trading opportunities.

Another point of contention is the cost of compliance. The rigorous requirements set by the FCA often translate into higher operational costs for brokers, which can be passed on to clients in the form of higher fees or less favorable trading conditions.

Some argue that these costs can make trading less accessible, particularly for smaller retail traders.

Additionally, the FCA’s focus on protecting retail traders sometimes leads to a one-size-fits-all approach, which might not be suitable for all types of traders. Professional and institutional traders often seek more tailored regulatory environments that better align with their advanced trading strategies and risk profiles.

Lastly, the FCA has faced criticism for its handling of certain high-profile cases where regulatory action was perceived as slow or inadequate. These instances have led some to question the regulator’s efficiency and responsiveness in protecting traders from misconduct or broker failures.

Conclusion: Pepperstone Is The Best FCA Regulated FX Broker

At WR Trading, we firmly believe that FCA regulation provides a solid foundation for a secure and trustworthy trading environment. The benefits of trading with an FCA-regulated broker, such as enhanced security, client fund protection, and regulatory oversight, far outweigh the potential drawbacks.

While there are areas where the FCA could improve, particularly in balancing regulation with innovation and flexibility, the overall framework offers significant protections that are crucial for retail traders.

By choosing an FCA-regulated broker, you ensure that your trading activities are backed by one of the most respected financial regulatory bodies in the world. At WR Trading, we continuously monitor and evaluate FCA-regulated brokers to ensure that we provide our clients with the best possible recommendations.

Once again, here is our list of the 5 Best FCA Regulated Forex Brokers:

- Pepperstone: Competitive spreads

- ActivTrades: Wide range of trading instruments

- IG: Extensive research tools and educational resources

- FxPro: Diverse trading platforms

- XTB: User-friendly platform with award-winning customer support

Frequently Asked Questions:

What Does It Mean For A Broker To Be FCA Regulated?

When a broker is FCA regulated, it means that they comply with the stringent rules and regulations set forth by the Financial Conduct Authority in the UK. This includes maintaining segregated client funds, adhering to transparency requirements, and participating in the Financial Services Compensation Scheme (FSCS).

How Can I Verify If A Broker Is FCA Regulated?

You can verify a broker’s FCA regulation by checking their registration number on the FCA’s official website. Reputable brokers will also display their FCA registration numbers on their websites.

What Protections Do FCA Regulated Brokers Offer?

FCA-regulated brokers offer several protections, including the segregation of client funds, participation in the FSCS for compensation up to £85,000 per person, and adherence to strict conduct rules that ensure transparency and fair treatment of clients.

Are There Any Drawbacks To Trading With An FCA-Regulated Broker?

While FCA regulation offers significant benefits, some drawbacks include higher operational costs for brokers, which can lead to higher fees for clients, limited leverage options, and potential restrictions on certain trading instruments.

Why Is The FCA Considered One Of The Top Regulators?

The FCA is considered one of the top regulators due to its rigorous regulatory standards, comprehensive oversight, and commitment to protecting retail traders. The FCA’s focus on transparency, security, and fair trading practices makes it a trusted authority in the financial industry.

What Should I Do If I Have A Complaint Against An FCA Regulated Broker?

If you have a complaint against an FCA-regulated broker, first contact the broker’s customer service. If the issue is not resolved, you can escalate it to the Financial Ombudsman Service (FOS) for independent dispute resolution.

For other regulators check these comparisons: